How to Disrupt Metamask: 4 Ways the Crypto Giant is Being Unbundled

How ERC-4337 Challenges the Wallet Giant's Dominance, or Not

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Crypto wallets have long been a subject of debate due to their inherent security risks and poor UX. However, the recent introduction of ERC-4337 this year has caused excitement among developers and users alike, renewing conversations around account abstraction and its implications for the industry.

This article explores the influence of ERC-4337 on the crypto wallet ecosystem and its potential to challenge Metamask's dominance. It covers the following topics:

The problem of poor UX and fragmentation in the crypto wallet landscape

Introduction to ERC-4337 and account abstraction

Overview of the conventional and smart contract wallet landscape

Impact of ERC-4337 on crypto wallets and UX

Will Metamask lose its crown? An examination of Snaps as Metamask's response to smart wallet competition.

The Problem

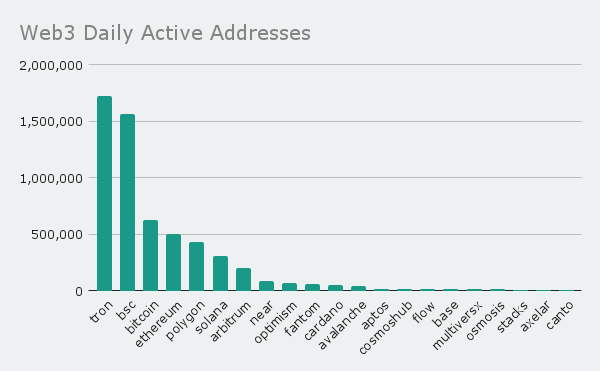

Despite seeing advancements and an increase in adoption since the inception of Bitcoin, the Web3 space is still massively behind the TradFi world. There are currently fewer than 6 million daily active addresses across 21 of the top blockchain networks (data as of 28 March, 2023). Assuming the average user has at least two wallets, that’s less than 3 million actual users. If you consider that a user will have wallets on multiple chains, you’ll realize this number is still grossly optimistic.

Whatever the number, it pales in comparison to the number of banked users in TradFi. A study by the World Bank found that around 76% of the global population is banked (has an account with a bank). As much as crypto natives like to joke about “TardFi”, DeFi still has a long way to go to reach similar penetration.

After more than a decade of groundbreaking innovation in the blockchain space, poor onboarding UX remains one of the largest barriers to mass adoption of crypto (regulatory concerns aside). The complexity of managing private keys, the risk of losing funds through human error and hacks, and the lack of user-friendly interfaces have hindered more users from entering the space and more importantly, staying in the space. Even crypto OGs are losing their funds to exploits, as we most recently saw with this wallet draining operation that @tayvano_ uncovered:

Moreover, fragmentation – the need for different wallets for different chains – adds another layer of complexity, making it harder for users to manage their assets seamlessly across various blockchain networks and further impeding mass adoption of crypto and Web3 technologies.

The current state of crypto wallets, which are the gateway to Web3, has no doubt played a part in preventing the industry from achieving its full potential. Addressing these issues and improving the UX of crypto wallets is crucial for the widespread adoption of cryptocurrencies and the growth of the Web3 ecosystem.

The Solution (Or is it)?

Enter ERC-4337, an ERC standard deployed and announced at ETHDenver in March this year, putting account abstraction and its benefits back into focus. An Ethereum Request for Comments (ERC) is a finalized document originating from an Ethereum Improvement Proposal (EIP) that outlines standards for the Ethereum network.

Before we dive into the details of ERC-4337, we must understand a few key concepts.

Firstly, Ethereum currently has two types of accounts:

Externally owned accounts (EOAs) – the default account that most of us use, controlled by private keys

Smart contract accounts – “smart wallets” controlled by code

An EOA is a type of account that users own through a cryptographic key pair. The public key is used to derive the EOA address, and the private key is used to sign transactions. The private key is crucial for truly owning your assets, as if someone else gains access to it, your assets are no longer secure.

Next, let’s understand what account abstraction is – it enables smart contracts to serve as primary accounts, creating "smart wallets" that offer advanced functionalities such as executing functions directly, intelligent transaction fee management, enhanced security features, and decentralized account recovery. The term "abstraction" refers to creating solutions that can modify the relationship between a public key and a specific account. By creating this abstraction through the use of smart contracts, greater flexibility is enabled in managing assets and ensuring their security.

While account abstraction has been talked about for years, its implementation at the protocol level is a long way off as it requires consensus-layer changes. Thus, ERC-4337 was proposed to accomplish the following (among others) in the meantime:

Enable users to use smart contract wallets with arbitrary verification logic (customizable rules to validate transactions) as primary accounts, removing the need for Externally Owned Accounts (EOAs).

Ensure decentralization by allowing any bundler to participate in including account-abstracted user operations.

Require no Ethereum consensus changes for faster adoption, as Ethereum's current focus is on scalability of the network.

Support various use cases, including privacy-preserving applications, atomic multi-operations, and EIP-3074-like sponsored transactions.

Enable users to pay transaction fees with ERC-20 tokens and developers to pay fees for their users.

Read the full ERC-4337 proposal here.

To summarize, ERC-4337 achieves the key goal of account abstraction which is to allow users to use smart contract wallets containing arbitrary verification logic instead of EOAs as their primary account, without consensus-level changes.

The big question is, will ERC-4337 revolutionize the way users interact with the blockchain and boost the adoption rate of crypto? Does it have the potential to derail Metamask's dominance in the wallet space?

The Impact of ERC-4337 on Crypto Wallets and UX

While smart wallets have been able to implement the features talked about above before ERC-4337, they faced challenges due to the limitations imposed by the Ethereum protocol, such as increased gas costs, complexity, and reliance on centralized relay systems.

The new standard introduces a high-level, pseudo-transaction object called a UserOperation. Users submit these UserOperations to a separate mempool and special actors, known as bundlers (block builders), which collect a group of these UserOperations and create a transaction that interacts with a dedicated contract. This bundled transaction is then included in a block, simplifying the overall process, potentially reducing the amount of gas required, and decentralizing the relay process.

Simply put, ERC-4337 introduces a more efficient way for teams building smart wallets to implement features previously limited by the Ethereum protocol.

The Crypto Wallet Landscape

For a bird’s eye view of the constantly evolving crypto wallet landscape, we can break it down into three main categories:

Conventional Wallets

Software or Hot Wallets

Hardware or Cold Wallets

Smart Contract Wallets

General Smart Contract Wallets

Multi-Signature (Multi-sig) Wallets

Multi-party Computation (MPC) Wallets

These wallet types fall under the broader category of non-custodial wallets. Non-custodial wallets are wallet solutions where users have full control over their private keys, ensuring they are the sole custodians of their crypto assets. On the other hand, custodial wallets are services where a third-party company (e.g. centralized exchanges) holds and manages the users' private keys, essentially taking custody of their cryptocurrency assets.

Lastly, it's essential to mention the emerging infrastructure category, in which teams are developing solutions and primitives that enable other developers to create and customize their own wallets for end-users, streamlining the wallet creation process.

Metamask: The Undisputed King

Developed by Consensys in 2016, Metamask was one of the earliest crypto wallets developed for Ethereum and was launched as a desktop browser extension. Its user-friendly interface and the accessibility that it gave users to DeFi applications at the time helped establish it as the undisputed king of crypto wallets today. Metamask has since evolved to include a mobile app, in-wallet swaps, as well as a portfolio dashboard.

Let’s take a look at the numbers.

User & Revenue Growth

Consensys only reports its monthly active users (MAU) milestones and as of April 2022 it had achieved more than 30 million MAU on Metamask, a 500% increase from the previous year. However, in a recent interview with The Defiant, Dan Finlay, co-founder of Metamask, mentioned that it has since dropped by about 50% and has stayed there throughout the bear market.

Metamask's in-wallet swap feature has been successful, with revenue from swaps on the Ethereum network alone reaching almost $500 million since launching in Q4 of 2020, perhaps helped in part by constant rumours of an upcoming token airdrop to swap users.

Although Consensys’ revenue figures have not been disclosed, they reportedly earned more than $100 million in 2021. Onchain data shows Metamask’s Swaps feature generating more than $267 million that year, which suggests that it makes up most of Consensys’ revenue.

Consensys raised $725 million in total from four funding rounds since 2019 and the most recent round raised $450 million, valuing the company at $7 billion. With $267 million in revenue from Swaps in 2021, this values Consensys at around 26x P/E based solely on its Swap revenue.

Swap

Metamask's in-wallet swaps function acts as a meta aggregator, sourcing liquidity from various providers, including other DEX aggregators. Although it competes directly with Coinbase in this area, it also faces competition from other meta aggregators such as Matcha and Defillama. Data from 0x reveals that Metamask falls behind Matcha ($627.8 million), DefiLlama ($350.5 million), and Coinbase ($111.4 million) in terms of trading volume over the past 30 days, with only $101.1 million traded. However, Metamask still has an edge in terms of user numbers (203,372) and total number of trades (434,430) made in the same period, more than any of its competitors combined!

The average trade value on Metamask is only $233, over 3 times smaller than its closest competitor, Coinbase. While this suggests that Metamask is primarily used by smaller accounts, it's more likely that this is due to Metamask’s 0.875% swap fees. Thus, users may prefer to conduct smaller swaps on Metamask due to its convenience, while preferring other meta aggregators for larger swaps – neither Coinbase nor any of the other aggregators charge a fee.

Downloads

A huge roadblock to being able to make any sort of meaningful comparison between wallet competitors is the fact that download metrics aren’t publicly available. Google’s Chrome Web Store and Play Store only show milestone figures, while Apple has elected not to show any download metrics at all. Furthermore, each wallet does not make user metrics publicly available nor are we able to check onchain data, since these wallets are just frontends and do not leave traces on the blockchain.

The table above includes wallets that I consider to be direct competitors of Metamask, including conventional wallets that support Ethereum and its L2s, as well as other EVM chains like BSC and Avalanche. Note that this list is inevitably not exhaustive nor does it constitute an endorsement of any particular wallet.

Based on the limited data available, it is evident that Metamask continues to dominate the EVM-based crypto wallet market, commanding a market share of over 54%. Trust Wallet (27.2%) and Coinbase Wallet (15.8%) come in second and third respectively. Notably, Metamask holds a considerable 88.2% share of the desktop market but only 38.8% of the mobile market. This suggests that its competitors may have conceded the desktop race to Metamask, focusing instead on capturing the mobile market. This idea is supported by the fact that newer wallets such as Zerion, 1Inch, and more recently, Uniswap, have only released mobile wallets.

Metamask Snaps

Earlier we saw that Metamask has maintained its market dominance, with over 54% market share of EVM-based crypto wallets. However, it has lost significant ground in the mobile wallet sector, having only 38.8% market share. With the introduction of ERC-4337, more wallet apps will trend towards being a Web2-like app. Familiar features like social login, programmable recovery, and multi-key security (2FA, 3FA, etc), among others, will become the minimum standard. Users will not even need to know what a seed phrase is, nor will they have to worry about keeping it somewhere safe. This is a major UX unlock and could be the key to onboarding the next billion users to Web3 as well as keeping its existing users.

In response to ERC-4337 and the rise of smart wallets, Dan Finlay has said that although they are excited about the future of smart contract wallets, they believe that we are “not yet at the endgame” of crypto wallets and thus Metamask are continuing to invest in research and development of wallet infrastructure.

Enter Snaps.

Snaps is a system designed to enable developers to create customized user experiences on the MetaMask wallet. Snaps are essentially untrusted JavaScript programs that operate safely inside the MetaMask application, giving developers the flexibility to add new APIs, support various blockchain protocols, and modify the existing functionality using internal APIs. Similar to how browser extensions can enhance and customize browsing experiences, Snaps extends the capabilities of the MetaMask wallet. Currently features live on the development version of Metamask include custom confirmation screens, notifications, encrypted local data storage and management, non-EVM accounts and assets support, and more. There are Snaps now live that extend support to non-EVM networks like Bitcoin, Starknet, and Filecoin.

Thus, Snaps appears to be Metamask's response to smart wallet competition. In fact, at ETH India, a Snap was developed that allows smart accounts which won "Best ERC-4337 Tool."

Smart Contract Wallets

A quick note on smart contracts here.

What most don’t realize is that smart wallets have existed long before ERC-4337’s introduction. Smart wallets such as Argent have been at the forefront of smart contract wallet development and have implemented features such as social login & recovery, multi-sig support, daily spend limits, emergency account freezing, among others. In fact, Julien Niset, co-founder of Argent, said that from a user’s point of view, both Argent and ERC-4337 are essentially equivalent in terms of functionality. Thus, the introduction of ERC-4336 is not necessarily groundbreaking nor does it change things for smart wallets like Argent. What it does instead is to level the playing field for developers looking to build smart wallets, which hopefully leads to improved UX throughout the space as these features become the minimum standard.

However, smart wallets have some drawbacks – higher fees, contract auditing, and having a higher surface area for potential vulnerabilities are just some of them. Another drawback to consider is that users lose control over their wallets in the sense that they are not able to move between different wallet providers as they could with an EOA. Conventional wallets like Metamask, Rabby, etc. are essentially frontend clients that users can use and switch between, depending on their preferences. With smart contract wallets, users are generally tied to a specific implementation or provider, as the wallet's functionality is embedded within the smart contract itself. This can limit users' flexibility and autonomy, which may be a concern for some. Lastly, because ERC-4337 is not a protocol level change, it may take time before dApps offer full support for smart wallets by default. In fact, this is one of the main reasons why Argent is supporting zkSync and Starknet, two L2s that support account abstraction natively.

Competitive Landscape

Evaluating the wallet & asset management landscape is challenging because the crucial metric of monthly active users (MAU) is not transparently published nor can it be reliably tracked. Let’s take a look at companies with liquid tokens or recent funding valuations alongside the number of downloads.

Note: Number of downloads is overly conservative due Chrome’s app and extension stores only reporting milestone numbers, App Store not showing any download numbers, and certain wallets and products not requiring a download to use.

Consensys, the parent company of Metamask, has a $7 billion valuation – 5.6 times larger than Safe’s $1.25 billion valuation. Argent, Coin98 (C98), Debank, and Instadapp (INST) all have similar valuations of around $200 million based on FDV or their most recent funding valuations. XDEFI, on the other hand, stands out as the outlier with its token XDEFI valued at an FDV of only $26 million.

Will Metamask Lose its Crown?

As more mobile wallet options emerge, Metamask's market position may not be threatened by one single competitor, but by multiple competitors who offer similar or superior features that were once exclusive to Metamask. Here are four examples of how this is or could be happening:

1. Mobile Support

As we saw earlier, Metamask has already lost ground in this area, with only 39.5% market share of the mobile wallet market. Why’s that? I spent a day using Metamask, 1inch, Zerion, and Argent on my phone and here’s a few key points as to why I think other mobile wallets are gaining traction:

Security

While Zerion and 1Inch are conventional wallets and are similar to Metamask in terms of security features (FaceID, passcode locks, etc), Argent is a smart contract wallet and has additional security features such as:

Seedless onboarding

Social recovery – add devices or even people to further secure your account

Time-limited sessions

These additional security features may be a deal breakers for some or even just better overall UX for users who don’t want to deal with the hassle of seed phrase management.

Excellent Onboarding Experience

Metamasks’s onboarding experience felt nearly identical to that of its browser extension, with the exception being that you could add FaceID to secure your app and sign transactions. This may be okay for seasoned crypto natives but for new users it may not be ideal.

I found Zerion to have the best onboarding experience, taking the user through every single step with clear instructions. It did not feel foreign at all and aside from the part where you are prompted to backup your seed phrase, it felt just like a well-designed Web2 app.

DeFi Portal

Whilst Metamask’s app has a browser feature that allows you to access and interact with most DeFi applications out there, Argent and Zerion both have what I’ll call a DeFi Portal, where users can directly interact with certain dApps from within the wallet itself. This feels infinitely better and very familiar if you’re a user used to interacting with banking or finance apps.

2. Security

Security has always been an issue when it comes to using a crypto wallet. Whether its seed phrase management, getting phished, approving malicious transactions, users have to navigate a sea of potential security risks.

Metamask recently introduced an anti-phishing feature that warns users trying to connect to a website that may be a phishing scam. While this is a step in the right direction, my opinion is that it still falls short as coverage will always be limited due to dependence on various services to maintain a database of malicious websites.

There are a number of new tools such as Pocket Universe (50,000+ downloads), Fire (40,000+ downloads), and Blowfish (1,000+ downloads), that introduce a new security primitive called transaction simulation. These tools come in the form of browser extensions that work alongside your wallet extension to simulate a transaction on a fork of the network in order to help users determine if a transaction they are about to sign is safe. Here’s a demo showing how it’s done via Fire.

Blowfish, which was incubated by Phantom, takes it one step further and provides an API for wallet providers to integrate the feature within the wallet extension itself. I believe Phantom is the only major wallet that has integrated transaction simulation so far.

3. Portfolio Management

The portfolio tracker sector was first dominated by Apeboard, which was later acquired by Nansen. Wallets like Metamask, XDEFI, and Coin98 (among others) soon began to offer similar features whereby users would be able to view their entire portfolio across multiple networks and wallets from one control centre.

Popular portfolio trackers include Debank, Nansen, Zerion, and Zapper. Of these four, both Debank and Zerion have wallets products as well. Debank recently grew in popularity due to traders and Twitter influencers launching public wallets for their followers to track and copy, drawing over 4 million website views in March 2023 alone.

While Metamask’s portfolio tracker does a good job of tracking assets across multiple networks and wallets, it lacks support for LP and staking positions across DeFi. This is where trackers like Debank and Nansen excel and also why we see these platforms being used and quoted across social media.

4. Institutional Support

Institutional support, while niche, is key as it involves not only the demographic (includes organizations and DAOs) with the most assets, but provides credibility and legitimacy to the overall crypto ecosystem. Safe alone has more than $30 billion assets under management (AUM), while other custodians like Fireblocks, Coinbase Custody, Copper, among others, manage billions of dollars between them.

While Metamask itself does not offer custodial services, its Metamask Institutional (MMI) wallet has integrated with 11 custodial services such as Safe, Copper, Qredo, HexTrust, and BitGo, among others. MMI allows institutions to use Metamask alongside their preferred custodian platform and charges fees based on AUM. Thus, instead of competing with these custodial providers Metamask aggregates their services by offering an additional layer of security and accessibility through its familiar interface.

It is not clear if MMI has met much adoption, but a check on the MMI Chrome web store shows only 154 downloads. This suggests that most institutions may be using custodial services like Safe and Fireblocks for their asset custody needs in isolation, rather than adopting a new platform like MMI. However, the integration of MMI with various custodial services demonstrates Metamask's effort to cater to the institutional market and expand its reach beyond individual retail users.

How Could Metamask Generate More Revenue?

Metamask's primary revenue source is their in-wallet swap feature, which generates revenue through a 0.875% fee on each trade. However, to maintain sustainability, they need to diversify their revenue sources, especially since swap volumes decrease during bear market conditions.

In addition to their swap feature, Metamask also generates revenue through their new cross-chain bridge aggregator, which charges an 0.875% fee per transaction and has brought in over $800,000 in fees since launching in Q1 2023.

One area that Metamask could potentially explore is MEV, or Miner Extracted Value. MEV refers to the profits that miners can make by ordering transactions in a block to their advantage. Pre-Merge, MEV was controlled by a few large entities with exclusive access to private order flows. Post-Merge, with Proposer Builder Separation and Blinded Blocks, block builders can now enter the game of MEV and weaponize order flows. Check out our memo on Flashbots for a deeper look into MEV.

It is said that up to 70% of all transactions on Ethereum are made via Metamask. That is a whole lot of order flow and a potential golden goose for Metamask. Here are some ways this can be monetized:

Exclusivity agreements: Metamask could sell order flow directly to one or more builders. However, this approach risks centralizing the builder market, as potentially only the highest bidder(s) would have access to Metamask's order flow.

Order flow auctions: Another option for Metamask would be to offer an auction system to all builders, where they could bid on a time-bound stream of unsigned transactions. Metamask could take a small fee from these auctions and pass the rest back to the user for their specific transaction.

Gas discounts/token emissions: Instead of selling or auctioning order flow, Metamask could monetize their order flows by capturing MEV value directly and share a portion of revenue back to users via gas discounts, token emissions that represent a share of the value captured, etc.

It is probably inevitable that wallet providers enter the MEV game due to the amount of order flow they command. If Metamask doesn’t, other wallets will, so it's just a matter of time in my opinion.

Summary

The introduction of ERC-4337 has sparked excitement in the crypto community, renewing conversations around account abstraction and its potential to improve the overall user experience of crypto wallets.

While smart contract wallets have been at the forefront of this development for some time, the new standard has the potential to level the playing field and become the minimum standard for wallet functionality.

Metamask remains the dominant player in the EVM-based crypto wallet market, with a 55% market share. However, the rise of new wallet providers with unique features means that Metamask's crown may be threatened not by a single competitor, but by multiple players that offer similar or superior experiences.

Metamask's response to the smart wallet competition is Snaps, a system that enables developers to create customized user experiences on the wallet. Snaps are untrusted JavaScript programs that operate within the MetaMask application, allowing developers to add new APIs, support various blockchain protocols, and modify existing functionality.

While smart wallets offer many advantages, they also have drawbacks like higher fees, contract auditing, and potential vulnerabilities. Additionally, users cannot easily switch between wallet providers as they can with conventional wallets.

To maintain its market position, Metamask needs to diversify its revenue sources and continue to innovate. Some potential areas for growth include improving security and portfolio management features, and exploring MEV monetization strategies.

References

ERC-4337, Smart Wallets

MEV

Metamask

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about

Thanks IAN for writing and sharing it here. Loved the wallet segmentation across devices.

In parallel, I was looking into the business models of Crypto wallets. This is in principle to any product that delivers vale, what is the sustainable model around it

You shared about Metamask revenues around swaps and Bridges . This was an excellent break up. Also, you mentioned neither another aggregators charge these fees. Love to know how Matcha is generating revenues? Any table or content around business models of other wallets is helpful in this place.

. Thanks