Is Flashbots a Bad Business? The Flashy Elephant in the Room

A non-public good lens to analyze business models in MEV: Flashbots’ sustainability today & future paths to monetization, emerging MEV sectors, and predictions on future MEV directions

This guest post is for educational purposes only and not an inducement to invest in any asset. Guest posts are created independently of Blockcrunch and do not reflect the official opinion of Blockcrunch.

What to expect out of this article

The core question explored and researched in this article is how ancillary participants in MEV (defined as products and services performed by non-validator/proposer and non-searcher) can accrue value and how well they can do so. The epitome of such ancillary participants is Flashbots. In this article, I will use Flashbots as a case study and then expand to analyze business models in MEV.

The article is divided into four sections:

Section one: assess Flashbots' defensibility to sustain its market dominance

Section two: prognosticate the directions of Flashbots' future business model, monetization routes, and tradeoffs. It explores two options & their designs

turn on the fee switch

launch a token (SUAVE)

Section three: analyze growing trends and emerging sectors in MEV

Section four: conclude with predictions on how the MEV space will evolve

Overall, the TLDR of my view on the business viability of this space went from optimistic → pessimistic → euphoric.

Optimistic 1st look: MEV may be the sector with the shortest time horizon to monetize, as evidenced by the $1B revenue generated to date.

Pessimistic 2nd look: MEV has turned out to be a sector with mercenary participants and a Bertrand-style competition (undifferentiated goods and competition on price). The front-runner of the market today is a loss leader, with $700M in revenue generated for validators and searchers, but none accrued to Flashbots.

Euphoric 3rd look: MEV's future is a gold mine, with endless permutations of MEVs, EIP 4337, growing DeFi activities, fledgling cross-chain MEV, various types of Private Order Flows (POF), and creative amalgamation of MEV, cross-chain bridging, and DeFi primitives (DEX, lending, staking/LSD, etc.).

Let’s go.

Background

A brief overview of Flashbots’ amazing achievements since launch

~91% of blocks used MEV Boost (free, open-source software that helps validators maximize their block reward by selling blockspace to an open market of builders slot share) in the last 14 days

MEV Boost increased validator/proposer block rewards by ~60%, which translates to ~$250M in incremental gross profit for validators

~$450M in gross searcher profit from MEV, bringing a total of ~$700M in MEV revenue for searchers and validators combined.

However, there has been no revenue accrued to the Flashbots entity itself. For now, Flashbots is a feature of Ethereum, not a product on its own. The distinction is that a “product” is monetizable, while a “feature” can garner lots of usage traction but does not necessarily accrue value to sustain the business (more on product vs. feature here).

BUT this may not be the case going forward, and I will hypothesize how Flashbots might adapt their business model to achieve profitability later.

If you are not familiar with Flashbots, here’s a succinct primer of what you need to know: what it is, what it does, why it matters, and how it excels today. A glossary of key concepts discussed is at the bottom of this article.

Section One: Assess Flashbots’ Defensibility Against Competition

While MEV is a high-potential market, Flashbots’ defensibility to stay as the market leader is contingent on below three considerations

Attainable market against L2s + ETH native MEV-mitigating features

Retention of competitive edge

Emerging alternative approaches to address MEV

Consideration #1: Flashbots’ current addressable market is being squeezed by upcoming ETH native MEV features + L2 rollups

Below are three assumptions that need to stay true for Flashbots to maintain its clout:

1st Assumption: Ethereum’s dominance in defi will persist.

Likely true. Despite the rise of app-chain theses on Cosmos, new alt L1s such as SUI and Aptos, and other non-EVM defi chains such as Fantom, Ethereum's defi dominance is still likely to persist thank to its:

Continued network effect

Ardent community

Upcoming Shanghai upgrade that enables withdrawals and reduces gas fees

Introduction of shared security and re-staking via Eigenlayer to further scale the network.

2nd Assumption: Ethereum will continue to outsource MEV solutions to Flashbots

Question mark. As the Ethereum Foundation gradually incorporates MEV as part of its protocol features, it may render obsolete Flashbots' "Band-Aid" solutions such as MEV-Boost, which is an out-of-protocol implementation of Ethereum's upcoming PBS (Proposer/Builder Separation) feature.

There are many protocol-level proposals being explored and researched by the Ethereum Foundation to reduce malicious MEV, such as

PBS (Proposer/Builder Separation): the content of the bundle/transaction is hidden until the proposer/validator signs the proposal to prevent malicious proposers; In Stage 3 of PBS (enshrined), trusted relays will be obsolete

Protocol-enforced proposer commitments (PEPC): creates a mechanism for credible signaling in general by building a trustless, permissionless scheme for validators to enter into commitments with third parties. Eigenlayer is a good testing ground for PEPC.

crList, which basically forces builders to fill each block to its gas limit

Encryption for mempool privacy: shield content from block proposers until after the order of transactions order is already fixed

With that said, Flashbots has demonstrated impressive execution in capturing the first-mover advantage to rapidly evolve its product offerings and stay ahead of the competition from Ethereum natively. Over the long run, I’m curious to see how this "move fast and keep moving" strategy evolves.

3rd Assumption: Flashbots’ SUAVE blockchain can capture value from L2/rollups’ sequencing market

Question mark. This is one of the biggest and most precarious concerns for Flashbots. Currently, all transactions from MEV-Boost are on the Ethereum base layer. However, the future of DeFi is moving towards layer 2 solutions such as Optimism, Arbitrum, ZKsync, and Starknet.

L2s/rollups batch and execute transactions off-chain, and have their own sequencers for transaction ordering (currently centralized with plans to decentralize). Additionally, L2s have varying design philosophies regarding MEV. For example,

Optimism's founder invented MEV Auctions: the winner of the auction has the right to reorder submitted transactions and insert their own, as long as they do not delay any specific transaction by more than N blocks

Arbitrum deems MEV auction as harmful and instead chose Chainlink’s Fair Sequencing Services (FSS) to minimize malicious MEV, making the time-ordering of transactions fair and predictable for all users

zkSync plans to use time-locked encryption/a privacy approach to minimize MEV; additionally, it leverages propellerheads for MEV protection by recapturing the MEV otherwise lost to bots and miners, and returning it to protocols and users

Starkware (VeeDo) has publicly leaned towards time-locked encryption/VDFs

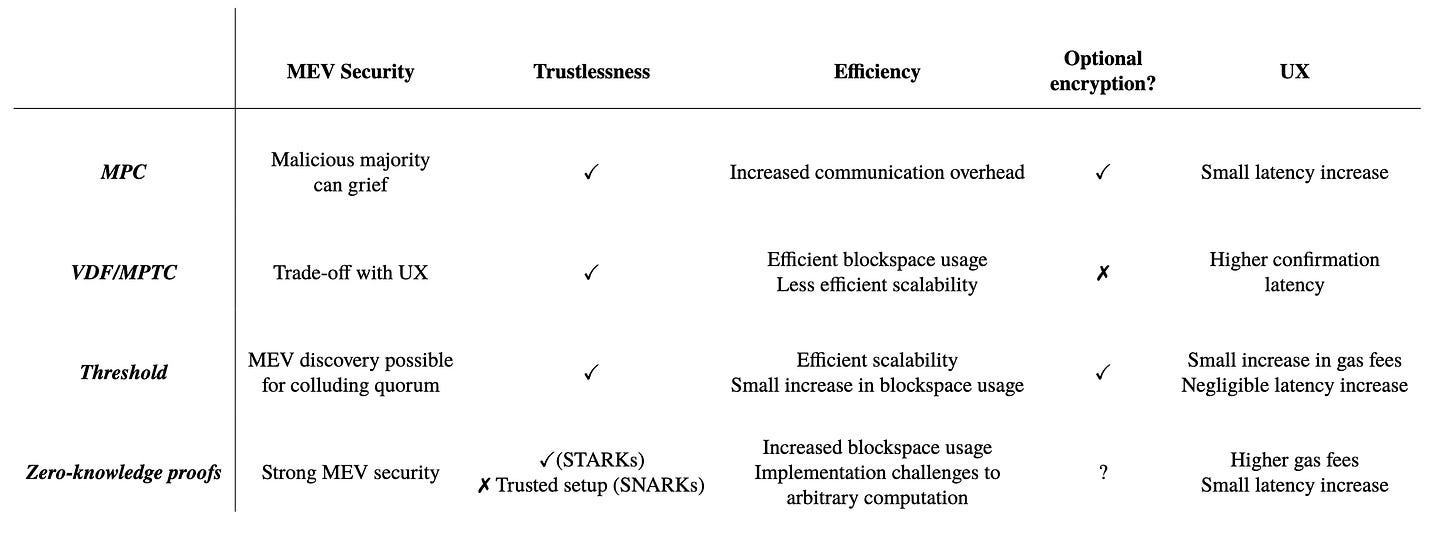

Additional design approaches & tradeoffs to address transaction privacy

Source: Flashbots.net

There is also a HIGH execution risk from this 3rd assumption

Flashbots SUAVE’s ambition is to be the mempool and decentralized block builder for all EVM blockchains, and such ambition comes with very high execution risks. The team at Flashbots will have to make a strong case to persuade L2s to outsource their sequencing to SUAVE, which is another blockchain. Three major humps to get over are

Customization: each L2 has different tolerance levels for & approaches to MEV. Can SUAVE be flexible & customizable enough to cater to each idiosyncratic design?

Incentive alignment on token value capture (assuming SUAVE will have its own token, more on this later) between L2 native token & SUAVE/Flashbots token. What would be the business case for Optimism to allow potential token value leakage to SUAVE token?

User friction: how much adoption friction will be introduced by making sequencers buy a token to participate vs. now merely a matter of adding a few lines of code? This depends on the design of the SUAVE token - if SUAVE turns out to be a pure governance token with little utility, this might not be an issue.

Consideration #2: MEV products tend to be non-sticky & Flashbots continuously gives away its competitive edge for the public good (for now)

To date, there are two market-related factors that contributed to Flashbots’ dominance:

1. Nascency of the market

2. Lack of competitive products

Using MEV-Boost only requires validators to add about a hundred lines of code, which is conducive for user-onramp but has the same effect on user-offramp: mercenary MEV participants have negligible switching costs to use a more profitable tool. With the MEV market turning from an esoteric topic to a major web3 sector, there might be increasing competitors with similar offerings to eat Flashbots’ lunch.

As of 3/7/2022, the market share of included blocks relayed by Flashbots is around 36% (past 24 hours) and 52% cumulatively. As shown above by the MEV Boost Transparency Report, the number of blocks proposed by MEV Boost Relays is declining (which the Flashbots team rightfully takes pride in).

One of Flashbots’ key competitive advantages today is its proprietary data when transactions get sent to Flashbots' private mempool. With such a bird's-eye view of order flow & tx data, Flashbots could continuously improve its algorithm to become the highest performing (e.g. high inclusion rate & speed) & “most profitable” block builder.

However, it is giving this rare “MOAT” away with SUAVE by decentralizing block builders, granting everyone access to the same data - which is laudable philosophically but may not be the soundest decision to retain competitive advantage based on its business model today.

Consideration #3: There is a plethora of new entrants & alternative solutions to MEV

MEV-prevention solutions: RFQ/Request for Quote (Hashflow), MEV-conscious DEX (CoW Swap), and new liquidation system (Maker, Euler)

Partial MEV boost with EigenLayer: allows proposers to attest to a chosen bid’s Merkle root but also construct a backup bundle to fill the block if the relay does not release the transaction of the chosen bid in time

Private RPC endpoints, including wallets, dapps, and MEV redistribution such as Blocknative’s Wallet Boost and Flashbots’ MEV Share. Infura, which according to some estimates (unable to find the origin of the stats but it was quoted in multiple Flashbots articles & EF talks) owns about 70% of RPC endpoints, has full oversight and sometimes discretion over transaction routing.

With such an advantageous stance, it wouldn’t be surprising if wallet providers enter the MEV game by “advertising itself as an ‘MEV-resistant wallet’ or a ‘gas-rebate wallet’ with its default RPC set to its private relay.”

Additionally, it’s worth pointing out the sleeping behemoth, Metamask, which according to some studies accounts for ~70% of ETH transactions. Imagine Metamask itself becoming a builder network to extract & share MEV by creating its own private mempool - speaking of centralizing force uh?

There will be a deep dive into trends & startups in POF (Private Order Flow) in the last section. “The Orderflow Auction Design Space” by Frontier.Tech is also an amazing read on the complexity of POF.

In summary, to remain a market leader, Flashbots needs to continuously innovate to stay ahead of competitors while adapting to L2 & other EVM MEV designs.

AND this could be the case - read on.

Section Two: Prognosticate the Directions of Flashbots’ Business Model and Monetization Routes

The above conclusion that Flashbots is a loss leader is based on a snapshot of the past. But what if this is part of Flashbots’ master plan to become an “aggregator” per the Aggregator Theory, which posits that in the Internet age, whoever aggregates users has the ultimate upper hand & business “MOAT?”

According to Ben Thompson (the author), there are three key characteristics of an aggregator:

✅ Direct relationship with their users, which in MEV’s case, are the validators, searchers, builders, etc. Flashbots’ impressive user traction from its suite of products from MEV-Boost, Relay, Protect, Protect, and more checks this box

✅ Negligible marginal costs for serving new users: check, because Flashbots produces software products with low costs per incremental user

✅ Demand-driven networks with decreasing acquisition costs: aka Network Effect. For example, the more relays that participate in MEV-Boost, the more validators use MEV-Boost, and the more likely additional relays will join

To continue this thought experiment, let’s hypothesize how the team would do it when the day comes.

Option One: Turn on the fee switch & accrue value to equity

Likely outcome: reduced market share, new entrants, market pattern trended toward NFT marketplaces (fee competition)

MEV is a commoditized space. Searchers, builders, and validators are profit-maximizing mercenaries with little loyalty to platforms. Although Flashbots has significant brand equity and trust among users and the Ethereum community, its public-minded practice of continuously encouraging and inviting new competitors precludes the feasibility of charging fees on its products. Turning on a fee switch will likely yield a similar undifferentiated competitive landscape, as seen in the proliferation of NFT marketplaces.

Option One NGMI.

Option Two: Launch a Flashbots/SUAVE Token

AKA the “web3” way and monetize off tokens. There are a couple of ways to tokenize for SUAVE, and different designs might lead to vastly different receptions.

Design 1: minimal disruption to user experience by launching SUAVE purely as a governance token.

Pros

It does not introduce user friction

Minimal disruption to user flow today

Good for BD with EVM & L2 chains because there’s no conflict of interest out of concern over value leakage from EVM/L2 chains to SUAVE token

Cons

Another governance token 🤷🏻♀️

Token performance is solely based on public perception (speculation) of Flashbots

Design 2: enforce utility into the SUAVE token by requiring MEV participants to purchase SUAVE for Flashbots products and services

Pros

Generate more demand for the SUAVE token

Create opportunities to turn on fee switch via token

Lay the foundation for future innovative defi<>MEV engineering tied to the token such as bridging, cross-chain MEV, and Flashloan for MEV arbitrage (e.g. Aave to provide flash loan to searchers/arbitrageurs)

There might be tokenomics benefits such as requiring block builders to lock up SUAVE tokens as collateral to join the SUAVE network to reduce the circulating supply

Cons

BD risks: such design makes it more challenging to onboard EVM chain partners due to their potential concerns about token value leakage

Per SUAVE’s website, it wants to be used by all chains. The incentive alignment for L2 & other EVM chains to outsource sequencers to Flashbots is challenging as is. Such fee token designs will toss another layer of complexity from negotiating revenue split & value accrual between the sequencer chain (SUAVE) and execution chain (L2s).

Adoption risks: added user friction because instead of just running the software, MEV participants will have to buy SUAVE tokens first

Currently, MEV-boost enjoys instant user traction because it only takes about a few lines of code and it’s free to use. The adoption curve might look drastically different when users need to purchase a token & pay a fee.

One mitigating approach is to airdrop SUAVE tokens to builders as a customer acquisition strategy to bootstrap usage & align network upside with that of builders. However, it still begs the question of whether the airdropped incentive is enough for builders to stay on the network long-term vs. see alternatives with less user friction (aka free service that doesn’t require builders to buy a token to use).

Of course, there are other design options such as a hybrid governance-utility token, platform token, profit-sharing token (barring Mr.Gary Gensler’s attention), etc. Would be fun to have a brainstorming workshop for this & see who guess it right!

Section Three: Analyze Growing Trends & Emerging Sectors in MEV

There is a lot of hype around the MEV space. To parse through the noise, two fundamental questions are

how much MEV will be there to begin with?

how much value can the ancillary service providers capture?

On 1, the growing defi landscape on ETH, L2s, alternative L1, EIP 4337, and cross-chain expands the total addressable market, but at the same time is counterbalanced by a multitude of MEV minimizing designs from

ETH protocol (PBS, crList, Mempool Encryption)

L2s (Fair Sequencing Services (FSS), Time-locked Encryption), and

Third parties (such as RFQ, MEV-minimizing DEX, new liquidation design, POF, etc.)

Net, the TAM (total addressable market) of MEV is indubiously growing.

On 2, the answer is your favorite “it depends.” While MEV startups today are mostly building public-good-like free features today without a clear path to monetization other than a “possible” token, the key to commercial sustainability is by introducing non-commoditized products to construct a moat.

Being public-minded & offering free service doesn’t necessarily mean you can’t monetize. Some examples of viable monetization approaches are

Skip Protocol (similar to MEV-Boost but for Cosmos) is free to use for validators, but it monetizes through a B2B business model to charge app chains for deployment. Additionally, it’s actively proposing to build a module for Osmosis to capture MEV revenue on-chain, redistribute back to the community, and take a small cut out of the net-new profits generated from the module (profit that would not have been possible without).

Blocknative operates a permissionless RPC endpoint for any searchers to submit bundles to Blocknative builders, and a permissioned (for now) relay. It profits from

Builder margin from lucrative blocks

A SaaS model to provide access to its underlying data infrastructure for builders and searchers to maximize profit.

So…What’s the Alpha? Trends to Watch

Cross-chain MEV

Flash loan to provide liquidity for cross-chain arbitrage (imagine Aave partners with SUAVE or similar block-building services to provide flash loan for cross-chain MEVs)

Cosmos Interchain scheduler to bring MEV on-chain via blockspace auctioning

CEX - DEX arbitrage tools

Potentially add-on services to existing or new bridges that monitor & alert complex cross-domain arbitrage opportunities. Professional traders will likely customize this for themselves but maybe there are more templated modules for amateur, but profit-seeking traders

MEV escrow service that ensures smart contracts get executed across chains (since there’s no atomicity of cross-chain MEV execution)

Cross-chain MEV will not have Atomic (single-transaction) arbitrage, which currently accounts for 80%+ arbitrage on ETH. I can see lots of demand here to bridge the gap from non-atomic execution.

EIP 4337 (Account Abstraction), which introduces a new user intent layer into the mix that will further complicate the combinatorial game of MEV permutations. It splits the role of the current EOA (External Owned Account) wallet into Alt-Mempool, Bundler, and PayMaster (which to me looks like an order book for user intent).

Below are two helpful charts from Blocknative research on MEV supply chain under EIP4337.

Source: Blocknative’s Tweet MEV Facilitators on Alt L1s

Jito Labs: MEV infra on Solana to reduce network spam

Skip.Money: MEV boost & explorer ("Satellite") on Cosmos (already portco)

Mekatek: MEV on Cosmos

Fastlane Finance: compensate participating validators, reduce transaction spam on Polygon

EigenLayer’s partial-block MEV-boost

SDK for MEV-minimization through encryption & enabling transaction privacy (varying degree of commercial viability)

Astria: Shared sequencer network

Shutter Network: threshold cryptography-based distributed key generation (DKG) protocol

ZeroMev: MEV explorer

0xPropeller: MEV keeper & MEV protection (used by zkSync)

Primev: Data layer to maximize builder success, accepted into a16z accelerator

FairBlock: Pre-execution privacy

Reputation market: as Matt Cutler of Blocknative pointed out on the On the Brink Podcast, today there’s a degree of trust from searchers to believe that builders will not front-run their MEV bundle, and such relationships are largely formed off-chain with centralization risks. A reputation marketplace of builders could be interesting for searchers or even POF to choose whom to send transactions to

Private Order Flow (POF): POF is becoming a big topic and will likely warrant its own deep dive. My biggest observation is that in POF, the role of searchers and builders are getting increasingly merged due to intertwined incentives to extract value from transactions in private mempool. There can be endless permutations of POF from different sources and to different endpoints (drawn below)

Upstream

Wallets: Metamask, Rainbow, etc.

Searchers (bots) bundles

Centralized RPC

User intent layer from EIP4337 (which can germinate new sub-market for user tx intent auctioning and matching)

Dapps that control tx flow (some Dapps even quote MEV as a major revenue source, which could have interesting long-term regulatory implications)

Relays

Permissionless relay

Private or permissioned relays

Builder-owned relays

End Points (Block Space)

Directly to validators/proposers

To wholesalers (market makers who own pre-bid slots)

To block space auction

See appendix for POF startups

Section Four: Concluding Predictions on the Future of MEV

Flashbots will tokenize SUAVE and monetize through brand equity to

operate public-good features like MEV-boost (infrastructural features that don’t make money & are cumbersome to maintain, but someone has to do it)

fund additional R&D for new features

SUAVE will play a big role in cross-chain MEV by potentially providing a combination of

bridging and flash-loan for arbitrageurs (since arbitrageurs need liquidity on both chains - would be interesting if Aave partners with SUAVE)

transaction escrow & insurance to bridge the lack of atomicity for cross-chain MEV

And more add-on & bespoke services based on types of MEV users

(I can see Flashbots monetize further from the above services by turning on the fee switch through the SUAVE token)

Cross-chain MEV will proliferate, engendering more partnerships & collaborations among defi-protocols like lending, AMM, staking/LSD, aggregators, bridges, and MEV startups

EIP 4337 (Account Abstraction) will create a mechanism for order books of user intent (the intent layer), further fragmenting the transactions to Alt-mempool in addition to POF and public mempool. Expect EIP 4337 to create new categories of MEV actors & compound the permutations of MEV routes

MEV startups will seek monetization from POF. Expect increasing involvements in MEV from upstream (Wallet, DEX) and downstream (market makers buying block space wholesale style & block space auction marketplaces in addition to existing proposers/validators).

MEV might become one of the few monetization levers for wallets, until one day policymakers outlaw it

Over the long run, expect increasing new entrants into the blockspace market, turning it into a Bertrand competition. Blockspace equilibrium price will emerge, and the invisible hand will take care of MEV smoothing

About Author

Crypto research is my hobby. You can see what else I do on LinkedIn

More theses & research on my Substack blog

Shoutout to below SMEs and friends for reviewing my draft & providing valuable feedback: Alex W of FastLane Labs; Ankit Chiplunkar & Stephane (Thegostep) of Frontier.tech, Arnav Pagidyala of Hashkey Capital; Bert Miller of Flashbots; Carl Hua of Shima Capital, Chunda McCain & Jun Kim of ION Protocol; Jiawei of IOSG; Luke Xiao of Arbitrum; Mads Mathiesen of Maven 11 Capital; Magmar of Skip.Money; Matt Cutler of Blocknative; Michael Ng of StakeWith.Us; Murat Akdeniz of Primev; Nikhil Saraf of Struck Crypto; Sam Peurifoy of Hivemind Capital & Playground Labs; Tom Schmidt of Dragonfly; Varun of Hashflow; Young Ling of LSE

MEV Library

This article stems from a month-long binge on MEV. Along the process, I’ve compiled a master list of great articles and dashboards under the “MEV” section of this repository, if you want to dig into any of the aforementioned sectors.

This article stems from a month-long binge on MEV. Along the process, I’ve compiled a master list of great articles and dashboards under the “MEV” section of this repository if you want to dig into any of the aforementioned sectors.

Some startups in the POF space

Manifold Finance: Private Order Flow w/ Sushiswap partnership

Blocknative: Private order flow & builder relay network, but also has a SaaS model

Duality: Cosmos Dex that gives MEV profits to LPs

Rook: Open MEV marketplace for Ethereum & redistribution

Eden Network: RPC, Relay, and Bundles

WallChain: Web3 Cashback & DEX Efficiency

POF Auction marketplace - though I can see this sector getting pretty competitive soon

Glossary

Builder: Block builders are highly specialized actors who construct blocks from transaction orderflow (public transactions, bundles, private transactions, etc). Profits to builder = Gas fees from public Mempool transactions + bids from private Searcher Bundles - block bid paid to the proposer

Relay: Trusted marketplace-like data availability layer to connect builders and proposers, from which proposers choose the highest bids. It's worth noting that relay is where censorship can happen (Flashbots is OFAC compliant) & has opacity around data. Flashbots is also the only relay that's permissionless (hence the high market share), whereas other relays need to be whitelisted by each validator

Relays move pre-built blocks around but do not modify them. Relays today also have no in-line mechanism to make profits as they do not have access to transactions, AKA not a very sustainable business. Relays will be displaced by PBS stage 3 implementation

Searcher: Arbitrage seekers who send transactions to block builders through public or private peer-to-peer transaction pools

Validator/Proposer: a block proposer is a validator that has been pseudorandomly selected to propose a block for a given slot in an epoch (there are 32 slots per epoch). By using MEV-Boost, proposers can only see the bid and block headers before signing a block to prevent frontrunning. Profits = block reward from network + winning bid from MEV-Boost (~91% of all blocks) OR optional self-block building (priority fee + any MEV)

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about

favorite post!