Why BendDAO Poses a Threat to NFT Collectors

Growing pains in the world of NFT Finance

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, valuation models and exclusive AMAs.

On 18th August, unbeknownst to many, the biggest risk the NFT market has ever faced emerged: the possible liquidation of 32,200 ETH ($58 million) worth of NFTs that were collateralized on lending platform BendDAO.

The falling NFT floor prices due to the lack of demand and the sudden increase in NFT supply from liquidations seemed to herald a potential death spiral for supposed NFT “blue-chips”.

Will NFT lending markets widespread systemic risk similar to Luna’s implosion? What happened with BendDAO, and what does it teach us about the nascent NFT lending space?

In this week’s Blockcrunch VIP, our research team breaks down the BendDAO liquidity scare in simple terms, and propose alternative solutions in the market today. As a disclaimer, Jason is a small angel investor in NFT.fi, a company building in the same vertical as BendDAO.

Contents:

How does BendDAO work?

What is BendDAO

Liquidations on BendDAO

Panic at the BendDAO

Latest update

Peer-to-Pool vs. Peer-to-Peer Models

Comparison of Upcoming Novel Alternatives

Subscribers - join our new Telegram channel here for exclusive AMAs and receive alerts for our episodes and newsletters!

How Does BendDAO work?

(For a comprehensive breakdown of NFT lending, please refer to our previous piece on NFTFi here)

BendDAO is an NFT lending platform where NFT owners post their NFTs as collateral to borrow ETH. The platform is particularly useful for collectors who may not want to give up their NFTs, but also want access to liquidity for short-term needs (e.g. speculation, paying bills).

Much like what DeFi users are familiar with on crypto lending platforms like Aave, BendDAO has a peer-to-pool lending mechanism where loans are permissionless. Lenders deposit ETH into a pool to earn interest, and NFT owners can collateralize their NFTs from whitelisted collections and take out an instant loan against the pool.

Specifically, on BendDAO,

For simplicity, all NFTs from the same collection are treated as fungible and are valued at the floor price (i.e. rarity of NFTs is ignored)

Depending on the collection, borrowers can borrow 30-40% up to of the NFT’s collateral value, meaning each loan is overcollateralized

This means that regardless of rarity, if the Bored Ape Yacht Club (BAYC) NFT collection has a floor price of 100 ETH, a BAYC owner can borrow up to 40 ETH by collateralizing his NFT.

For savvy readers, the natural next question you’re probably asking is - if a collateral NFT’s floor price drops precipitously, how does BendDAO service the orderly liquidation of collateral to prevent bad debt?

Liquidations on BendDAO

First, let’s examine how loan health is calculated. On BendDAO, a borrower’s margin of safety on his NFT-backed loan is represented by a “health factor” and calculated with the following formula:

Health Factor

= (Floor Price of NFT * Liquidation Threshold) / (Debt + Accrued Interest)BendDAO pulls its floor price data from OpenSea and LooksRare’s price feeds. When a NFT’s floor value drops, the health factor drops. Once the health factor of the NFT-backed loan falls below 1, the liquidation process is automatically triggered.

The liquidation sequence is a 48-hour auction in which the borrower can repay the loan (at least 50% to exit auction) plus a fine of at least 0.2 ETH (maximum 5% of the debt) to the first bidder and avoid losing the collateral. If the borrower fails to repay the loan, the collateral goes to the highest bidder at the end of the auction.

For the bid to be eligible, it has to be

Greater than the total debt;

More than 95% of the collections’ floor price; and

Higher than the previous bid plus 1% debt

Panic at the BendDAO

NFTs did not escape the recent market weakness across risk assets. The falling floor prices placed many loans, particularly Bored Ape Yacht Club (BAYC) -backed loans, on the brink of liquidation.

This was particularly concerning to the BAYC community as BendDAO’s collateral pool was the largest BAYC holder with 264 BAYCs used as collateral, which was more than 2x the next largest holder and represented 2.64% of the total BAYC supply, introducing a possible systemic risk.

Suppose floor prices were to continue falling and liquidations were successfully triggered - two scenarios could play out:

We could see the sudden influx of NFT supply into marketplaces, causing a further decline in floor prices – effectively starting a negative spiral as more liquidations are triggered one after another. Should demand fail to materialize as holders lose confidence in the NFT’s ability to retain value, this could ultimately lead to a UST-style demise for blue chip projects

Should borrowers fail to repay their loans and liquidators fail to show up (driven by lack of financial incentive amid a death spiral), the system risks incurring bad debt, leading to loss of funds for lenders. Liquidity providers could have lost a significant portion of their deposits, if not all, until pool liquidity is replenished via repayments, successful liquidations, or new lenders’ deposits.

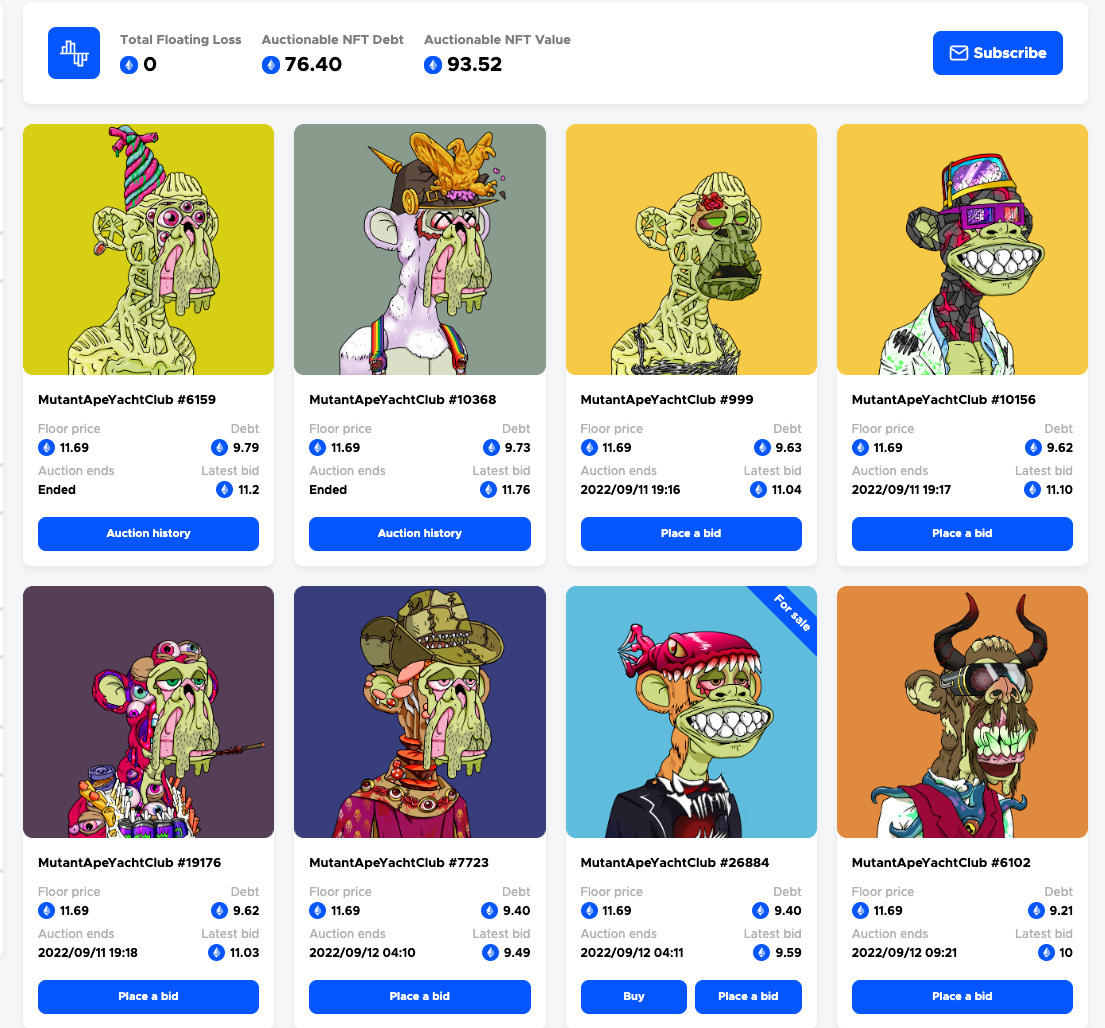

Situation as of 27th August

Fortunately for an already battered crypto market, the BendDAO situation resulted in some loan liquidations, but not a wides-read liquidation cascade. While we did experience a bank run on BendDAO, it has been averted for now.

In terms of liquidations:

Liquidators bid and repaid 781 ETH over 44 loans

NFTs liquidated included 13 Doodles, 13 Mutant Ape Yacht Clubs, 8 CloneXs, 6 Bored Ape Yacht Clubs, and 4 Azukis

As of today, there are no more outstanding liquidations

In terms of pool liquidity:

From 17th to 22nd August, there was a net outflow of $32 million as lenders panicked and withdrew capital

BendDAO’s reserve fell so low that the utilization rate was at 100% for nearly 48 hours i.e. there was no liquidity available for withdrawals nor new borrows

Borrowers repaid 6,000 ETH on their loans since 18th August, leaving 14,400 ETH worth of outstanding loans

Bend Reserve pools at 38,000 ETH – 5,500 ETH greater than pre-fiasco levels

Given that pool reserve levels are back at healthier levels (utilization ratio currently at 37% as of September 11th, 2022) and the absence of outstanding liquidations, BendDAO seem to have gotten out of the danger zone of a liquidation cascade and a complete bank run. Perhaps NFT collectors coordinated behind the scenes to prevent a market-wide cascade, or luck is simply on BendDAO’s side - the general NFT markets seem to have rebounded in the few days following the initial panic, which avoided triggering more liquidations. We believe that had floor prices continued to fall, the situation would not be as rosy as it is now.

BendDAO’s quick call to action

BendDAO’s team responded quickly to the situation and put together emergency proposals (BIP 9 and 10) to save the platform. They proposed increasing the base interest rate from 10% to 20% to encourage borrowers to repay their loans since borrowing has become costlier. The increase in base rates also attracted new lenders to deposit liquidity into the pool.

They also improved their liquidation mechanism to make liquidation more attractive for bidders. One of the problems liquidators faced was the lack of incentive / insufficient buffer to take on liquidation risk, as a bid had to be at least 95% of the collection’s floor price. Given that the auction process was 48 hours, a liquidator could be unprofitable / lose capital if the floor price continued to fall during the process. Furthermore, NFTs are generally more illiquid and have no guarantee of a sale.

Therefore, they made the following changes:

While the changes successfully incentivised loan repayment, new liquidity and participation in liquidation, we worry that they could potentially disincentivize borrowing. This is because not only is it more expensive to borrow now, but more importantly, borrowers have to constantly monitor the health of the loan since the pressure of liquidation is more significant with the decrease in liquidation threshold, and they have less time to react with the shorter auction period.

Could a peer-to-peer mechanism have avoided this situation?

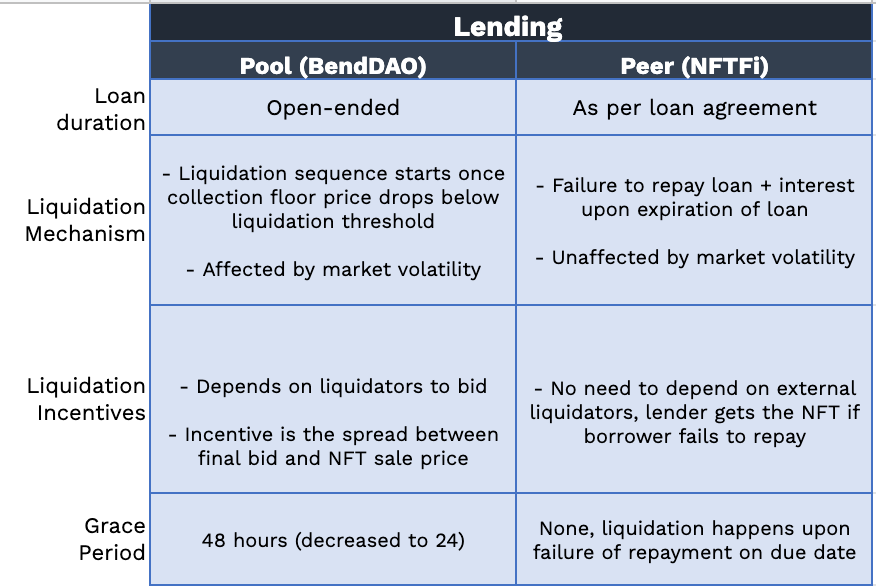

This BendDAO situation again sparked the debate of whether peer-to-pool (P2Pool) or peer-to-peer (P2Peer) lending is better suited for NFT-backed loans.

For the uninitiated, peer-to-peer lending is an alternate lending mechanism where a loan only begins when the borrower and lender agree on the terms. The loan terms are customized according to the rarity/valuation and loan duration, as opposed to valuing the NFT by the collection’s floor price and having an open-end loan term.

NFTFi, which utilizes the P2Peer lending mechanism, is currently the largest NFT lending platform and facilitated $252.6 million over 17,000 loans (read our analysis of them here).

While we applaud the speed and efficacy with which the BendDAO team responded to their crisis, we believe the risks that caused the initial situation continue to exist. It is our hypothesis that the P2Pool model poses a systemic threat to NFT markets that are averted by P2Peer model. Below, we summarize the major points of differentiation:

First, a liquidation cascade is impossible on P2Peer platforms as the loan liquidations are triggered by loan expiration, not NFT prices. Therefore, there is no risk of a supply-side crisis that could crater the entire NFT market. In addition, this is also more inline with user behavior for NFT collectors: while fungible tokens can easily be bought back, non fungible assets can be forever lost should a new owner refuses to sell after obtaining an NFT via a liquidation auction that took place during temporary market volatility. Doing away with automated liquidation removes this risk for collectors.

Furthermore, P2Peer lenders manage risk by staggering loan maturity dates, so even if there were liquidations from failure of timely repayment, the NFT markets could likely absorb the selling volume of the day without affecting floor prices significantly.

Secondly, a bank run technically can’t happen on P2Peer protocols as there is no excess capital for withdrawal with the absence of liquidity pools. This is to say a death spiral need not happen, as there is no situation wherein lenders who rush to exit first get away unscathed, leaving late exits stranded and waiting for liquidators and new lenders. Nevertheless, it is still possible for lenders to experience capital loss if the NFT collateral fetches a lower price than the loan amount after liquidation.

Is P2Peer superior to P2Pool?

While P2Pool makes for an easy experience for depositors, we believe this is a skeuomorphic idea carried over from DeFi and should not be applied to non-fungible tokens.

To be objective, P2Peer models are also not perfect. In exchange for lower platform risk for users and higher loan-to-value and peace of mind for borrowers, P2Peer lending protocols do not offer instantaneous loans. They also limit the type of lenders as a certain level of expertise is required to assess the viability of lending and manage its risks.

However, sophisticated lenders like Metastreet and Goblin Sax (disclaimer: Jason is an investor) help circumvent these disadvantages. They are working on algorithms that could automatically underwrite NFT loans and provide borrowers instantaneous credit. Metastreet recently launched capital vaults that offer yields to depositors with no expertise in underwriting loans but would still want passive exposure to lending yield, with Goblin Sax planning for the same.

On the other hand, P2Pool platforms are also not all bad. They have immediate liquidity and composability with other protocols (such as offering flash loans for NFT purchases and recently buy-now-pay-later schemes) but disregards the NFT’s rarity as well as expose themselves to lower risks of liquidation cascade and bank runs. The most significant issue P2Pool platforms face is the reliance on external liquidators - if no bidders are willing to step in to liquidate the collaterals, lenders are left with bad debt and illiquid NFT collaterals. A possible solution enabled by the P2Pool platform’s composability is the integration with NFT marketplaces like SudoAMM that allows instant liquidation of the NFTs (selling into the AMM pool). However, the existence of AMM integrations does not guarantee the emergence of liquidity, and similar death spirals described above may yet occur.

Ultimately, it’ll be a race of who can overcome their weaknesses first, and at the moment, P2Peer platforms (NFTFi) seem to be leading the race.

Other NFT Lending platforms to check out

While BendDAO (P2Pool) and NFTFi (P2Peer) are the current market leaders in NFT collateralized loans, here’s a few interesting up-and-coming protocols that offer a unique approach to NFT lending and may compete for market share.

JPEG’d

Akin to the MakerDAO of NFT lending. On JPEG’d, NFT owners collateralize their NFTs to mint PUSD, the platform’s stablecoin similar to Maker’s DAI. Like P2Pool lending, the NFTs are valued at their collection floor price and NFT owners can mint up to 32% of the collateral’s value. However, NFT owners are unlikely to utilize the full 32% as liquidation will occur if the debt/collateral ratio is 33% or higher.

Unlike P2Pool and P2Peer lending, there is no need for lenders to provide liquidity since new PUSd is minted from the protocol. This means that while no lenders are exposed to lending risks, holders of PUSd may rush to exit in the event of any bad debt. However, given that the protocol is very conservative on the loan-to-value and liquidation ratio, bad debt is unlikely to happen as liquidators are incentivized to step in.

Currently, most of the $6m PUSd minted are staked in a curve pool earning 23% - 35% APY yields - which is the primary use case of PUSd now. It will be interesting to watch if JPEG’d can build out more utility and composability with other DeFi protocols for PUSd.

Sodium

A hybrid platform that utilizes both P2Pool and P2Peer lending mechanisms. Like P2Peer lending, borrowers submit loan requests stating their desired loan amount, duration and interest rate. Similarly, loans are not liquidated by price movements but by failure to repay at the end of the loan term – providing more peace of mind for borrowers and avoiding the possibility of a liquidation cascade.

However, unlike P2Peer lending which solely depends on a counter-party to fulfill the loan, borrowers on Sodium get access to instant liquidity as a portion of the loan request will be fulfilled by lenders that deposited in a lending pool. Individual lenders that wish to take on more risk may fund the remaining loan amount.

Overall, Sodium built a novel solution that captures the benefits of both lending mechanisms while reducing their disadvantages. Therefore, the likelihood of facing a BendDAO situation is theoretically lower. We will be monitoring Sodium’s performance after the protocol is live.

Elixir

Elixir is an all-in-one NFT financialization platform built on Solana by the BridgeSplit team. Not only does it allow you to buy and sell NFT in whole and fractions, it also features NFT-collateralized loans.

Like BendDAO, Elixir utilizes a P2Pool lending mechanism. However, it features a dynamic collateralization ratio that controls the total borrowable for a particular collection instead of a fixed LTV ratio. While this may affect the total amount of loans on the platform, it helps to control the platform’s risk exposure to a particular NFT collection which would help prevent a catastrophic liquidation cascade.

The integration of NFT AMM-pool trading (similar to SudoAMM), which features instant liquidity by selling NFTs into the AMM pool, makes it more convenient for liquidators to liquidate an unhealthy debt. Therefore the protocol is less likely to experience bad debt and consequently lower chances of a bank run.

Elixir is only accessible for beta-testers now but will soon provide more details and access to the public and eventually be available on networks other than Solana.

Closing Statement

NFT-collateralized loans are necessary to unlock the liquidity of the otherwise illiquid NFTs – or else, more than $22.5 billion could be sitting idly in collectors’ wallets. The recent BendDAO situation highlighted the weaknesses that P2Pool platforms face and once again sparked the debate of whether P2Peer platforms are more suited for NFT-collateralized loans and P2Pool platforms are simply a case of skeuomorphism at work.

Admittedly, P2Pool platforms are exposed to the risk of liquidation cascades and bank runs. However, we believe these risks can be mitigated with better protocol settings. The features supported by its composability are also gaining traction – already facilitated 658 ETH in trading volume (approximately 10% of lending volume over the same period) since starting less than a month ago.

P2Peer platforms like NFTFi currently lead the space in terms of lending volumes. However, we would like to point out that BendDAO is quickly capturing market share as they did 27,517 ETH in lending volume from May to July, which is 65% of the lending volume NFTFi did over the same period.

In all, it will be a race of who is quicker to circumvent its disadvantages while competing with other upcoming protocols with novel mechanisms.

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

Another great read.

Check out FloorDAO as well.