SudoAMM: The 0-to-1 Moment for NFTs

Breaking down the upcoming SudoAMM launch

Blockcrunch VIP subscribers receive weekly research briefs for the price of 2 coffees a week. Prices go up every week until June but subscribers lock in their rate forever. This research memo is for educational purposes only and not an inducement to invest in any asset.

This week: SudoAMM

When Uniswap first launched, it breathed life into DeFi.

Say goodbye to opaque market-making deals with trading firms - anyone can have instant liquidity to their own token by setting up a Uniswap pool.

SudoAMM wants to bring that to NFTs.

Built by the team behind NFT trading protocol Sudoswap, SudoAMM went live quietly to a select community with the first ever NFT automated market making (AMM) pool of its kind, and is expected to go live soon.

Below we explain how SudoAMM works, why we think it’s the superior AMM for NFTs, and present our subjective view for where its upcoming token would likely be valued at.

Full interview:

YouTube: https://bit.ly/3FZwaFH

Apple: https://apple.co/39lxGFv

Spotify: https://spoti.fi/3lboJ4A

Overview

SudoAMM facilitates the trading of NFTs and tokens via on-chain liquidity pools, similar to Uniswap.

SudoAMM’s contracts have already been audited and are deployed on the mainnet but currently only available for 0xmons NFT holders. They are working on a simplified listing mode before opening up the frontend to the public.

Team

The initial development team of SudoAMM consists of 0xmons, boredGenius and 0xhamachi. Even though they are all anonymous, they have built projects together that are still live such as:

0xmons - an NFT collection with a floor price of 9.5 ETH

Sudoswap - p2p exchange NFTs that has facilitated a cumulative swap volume of $125 million

boredGenius is also building several other notable projects like 88mph and Timeless Finance. The team is advised by notable anonymous Web 3 contributors such as statelayer and mewny on mechanism design.

What is SudoAMM

To the end user, SudoAMM provides a similar shopping experience to Opensea and LooksRare: buyers browse through the list of NFTs put up for sale by sellers, and are able to sort NFTs by price, filter for characteristics and put up bids.

However, instead of a buy or sell order stored off-chain waiting to be matched, orders are matched and executed via multiple AMM pools.

How it works and Why It Matters

Under the hood, liquidity providers can create 3 types of pools on SudoAMM:

Buy-only: ETH-only pool that only buys NFTs i.e other sellers can just deposit their NFTs in the pool in return for the owner’s ETH

Sell-only: NFT-only pool that only sells NFTs i.e other buyers can just deposit their ETH into the pool in exchange the owner’s NFTs

Both: ETH and NFT pool that buys and sells NFTs i.e buyers and sellers can trade against this pool

Different types of pools taken from 0xmon’s blog

The 0-to-1 feature here is instant liquidity.

Instead of needing to set a bid/ask on marketplaces like Opensea, AMM pools allow buyers and sellers to instantly get liquidity for their NFT (or instantly purchase an NFT).

While whales can attempt to purchase large amounts of NFTs in one transaction via aggregators like Gem or Genie, this is still equivalent to a market order, which gives minimal flexibility in average entry price. Selling large amounts of NFTs is also a laborious process.

A liquidity provider on SudoAMM can set a sell-side pool with its own pricing formula (e.g. 1st NFT for 1 ETH, 2nd NFT for 1.5ETH etc.) to gradually DCA out of a position; conversely, they can also use the same function to DCA into a position

How to Price NFTs

The original version of Uniswap uses the now famous x*y=k invariant formula to price all tokens - but this is not applicable to NFTs!

By treating NFTs as fungible tokens, an AMM built around the x*y=k formula causes traders to suffer from high slippage and liquidity providers from poor capital efficiency. In fact, this issue exists on the original Uniswap as well for fungible tokens, which prompted the development of the now updated model, Uniswap v3.

For maximum customizability, SudoAMM allows liquidity providers to specify any arbitrary function that determines the pricing of the pool. At the start, 2 simple pricing functions will be available:

Linear curve: pool’s pricing shifted by a fixed amount after every trade

E.g for each NFT sold, price increases by 0.1 ETH incrementExponential curve: pool’s pricing multiplied by a fixed amount after every trade e.g for each NFT sold, price increases by a factor of 0.1

Here’s an example showing buy and sell prices of typical AMM and SudoAMM, with a pool starting with 5 NFTs and 5 ETH with an initial price of 1 ETH

As a consequence of lesser slippage, the tighter price range also gets better average prices for both buyers and sellers

Market Assessment

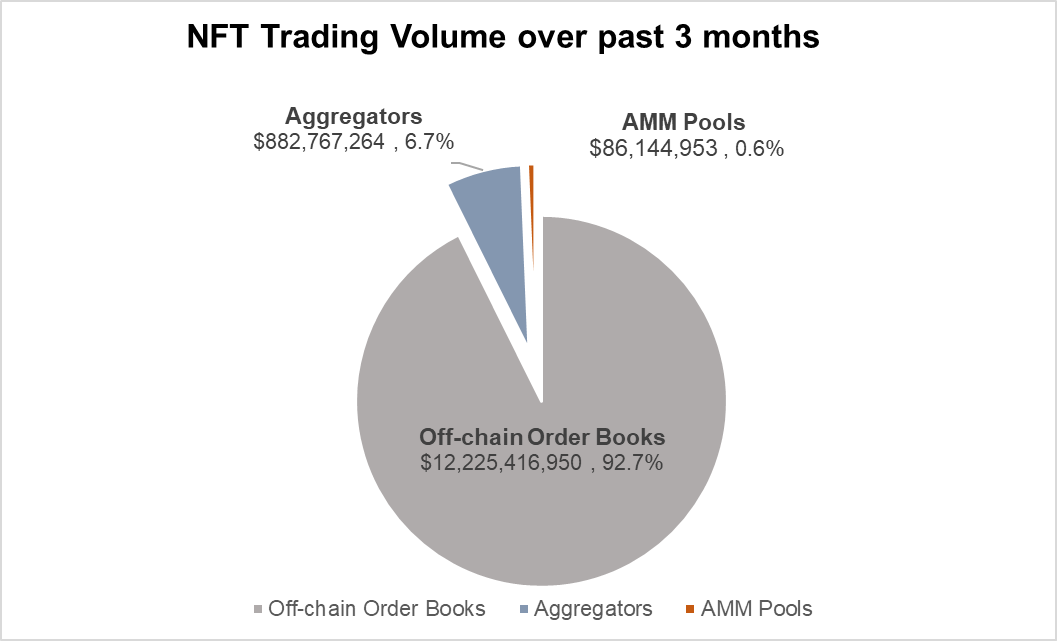

Over the past 3 months, ~$13.2 billion* of NFTs were traded across the 3 main archetypes of NFT marketplaces - off-chain order books (Opensea, LooksRare, X2Y2), aggregators (Gem, Genie) and AMM pools (NFTX)

Off-chain order books are the go-to marketplace for NFT trading, making up 92.7% of volume traded, followed by aggregators with 6.7% and lastly, AMM pools with a negligible volume of 0.6%.

As it stands, Opensea remains the dominating NFT marketplace, processing $11.7 billion or 89% (including those traded on aggregators) of the total volume traded over the past 3 months. The 2nd largest NFT marketplace, LooksRare, only processed 7.53% (excluding wash-trading) of Opensea’s volume.

We can also draw parallels to centralized cryptocurrency exchanges vs decentralized exchanges e.g Binance vs Uniswap which uses AMM pools. Over the past 3 months, approximately $2500 billion of spot cryptocurrency has been traded - centralized exchanges processed $2,253.7 billion / 90% and decentralized ones processed $245.9 billion / 10%.

If we assume the CEX vs AMM/DEX breakdown is comparable in NFT-land, then the implication is that projects such as SudoAMM and NFTX can capture up to 10% of the total volume traded i.e $1.32 billion over 3 months or $5.28 billion annualized, which is a 14.3x growth from here.

We will explore the likelihood of this below.

*Wash-trading has been excluded from LooksRare and X2Y2 volume data. Since aggregators route the buy order through off-chain order book marketplaces, the volume has been deducted to avoid double counting.

Competitive Landscape

General

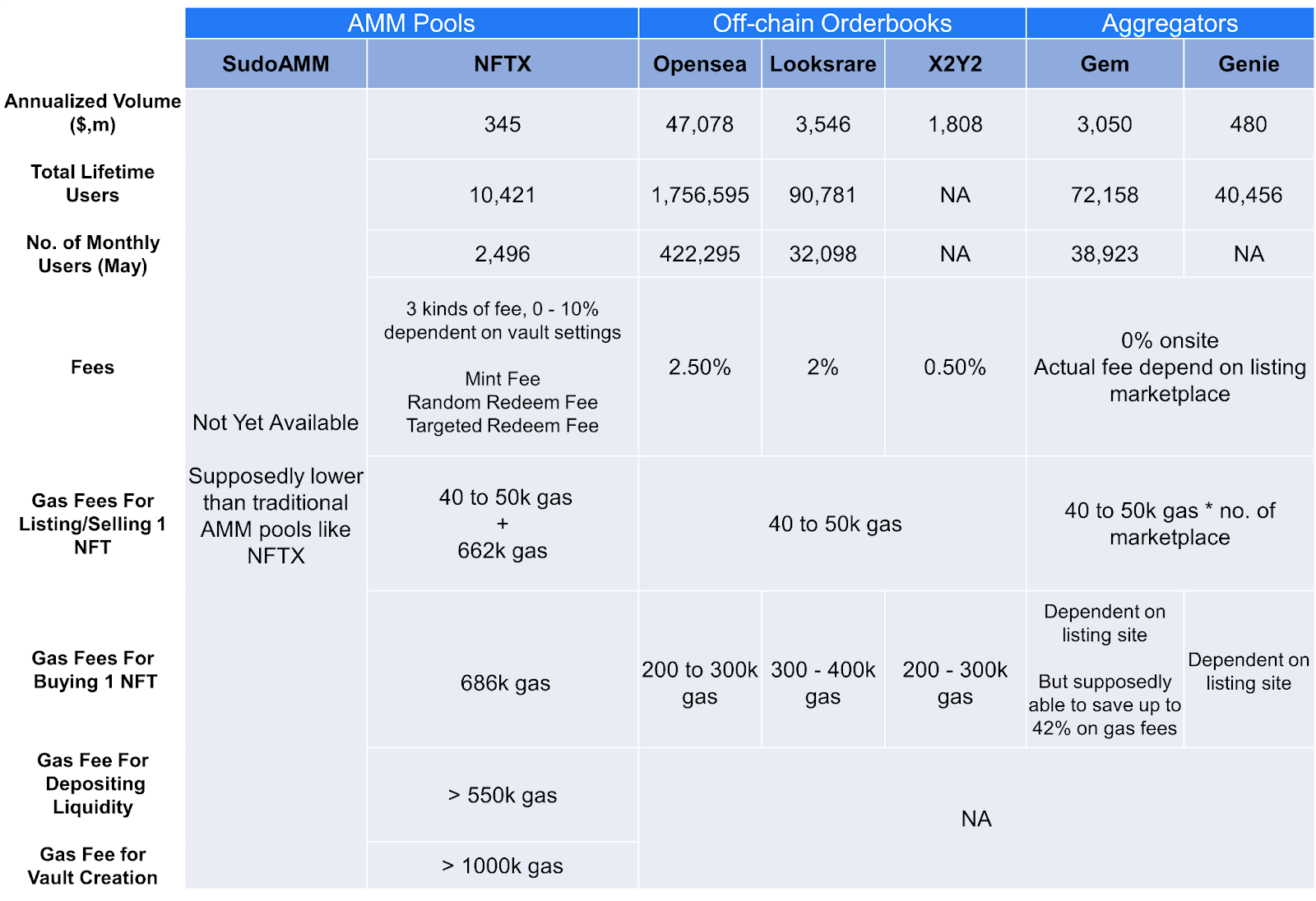

*Above information gathered from various Dune dashboards, website documents, actual testing and Etherscan transactions

When assessing the competitive landscape for NFT trading, the dominance of Opensea is undisputed. To put it into perspective, compared to LooksRare who has the 2nd highest volume, Opensea has ~18x more lifetime users and ~12x more monthly users.

Interestingly, NFTX, the only other live NFT AMM in the market today, has less than 1/10th of the volume of LooksRare and 0.7% of Opensea’s volumes. This underperformance is likely due to its extremely high fees compared to other types of marketplaces. On NFTX, sellers and buyers pay up to ~16x and ~2.5x more gas respectively, per NFT.

This is important to note as while SudoAMM also uses AMM pools, they have been optimized to not require extra conversion overheads, which means that gas fees are lower than NFTX’s. However, since the protocol is not yet live to public, we’re unsure how it’ll compare to Opensea and others.

In our view, despite potentially lower fees and instant liquidity, Opensea will likely remain the go-to marketplace for NFT trading for most retails in the near to medium term. The number of listings, liquidity and familiarity with the interface have generated provable user retention, and fee savings have to be substantial for users to incur switching cost.

Versus Off-chain Order Book Marketplaces

As evidenced by volume numbers, difficulty for new entrants to dethrone Opensea remains high and will likely remain the case.

We are skeptical that SudoAMM will be able to meaningfully steal volume from order-book based competitors like Opensea and Looksrare due to the following reasons:

Instant liquidity for sellers as a feature is replicable: While this feature is useful and unique to SudoAMM, other marketplaces like LooksRare have a similar feature and it’s possible for other marketplaces to add this in the future

Ease of bulk listing & price management strategies appeals to only a small group of NFT owners: NFT owners have to own multiple NFTs of the same value, from the same collection to find this feature useful. In most other cases and the majority of the NFT owners, this feature is not necessary

Potentially higher overall fees (gas, slippage and platform fee): The additional features aren’t sufficient to justify the potentially higher fees for those trading singular NFTs. While there is a possible of earning yield, it may not be attractive enough to offset the fees paid

Versus AMM models

However, we are confident that SudoAMM can be the dominant NFT AMM trading venue.

We view the model employed by the key AMM NFT competitor, NFTX, as an inferior design. Currently, NFTX requires users to deposit their NFTs into a NFTX vault, mint a fungible ERC20 token (vToken) that represents a claim on a random asset from within the vault. This negates the non-fungible aspect of NFTs and also incurs addition costs for the multiple conversions required to enter and exit a trade.

Solely from the perspective of NFT trading facilitation, SudoAMM is more efficient and suitable than the typical AMM model. However, SudoAMM might lose out on yield potential and composability of the typical AMM - hence we will be tracking if the potential savings from gas and protocol fees are significant enough to offset the lack of DeFi composability and potentially lower yields

Valuation Analysis

Below we present the core performances of the NFT marketplaces (Genie has been left out since we do not have information on its valuation) and the possible scenarios/sensitivity analysis for SudoAMM’s fully diluted valuation.

Note that the following represents a summary of currently available data only and does not constitute inducement to invest in any asset.

Given its superior design to NFTX, we view NFTX’s current FDV ($25M) as a conservative base valuation should SudoAMM issue its own token.

As a side note, using the median multiple on annualized revenues across multiple NFT trading volume and the median annualized revenue from our comps (NFTX), we can see that the market is currently pricing the median NFT trading venue at ~$117M fully diluted valuation.

However, do note that the above valuations are based on current market conditions and limited documents on SudoAMM’s value propositions. We should be able to get a more accurate analysis of SudoAMM once the protocol is live.

Resources

SudoAMM

NFT marketplace data

Others

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

This is great. Lots to dig into. Thanks