Why Are Crypto Investors Excited About "RWAs"? Analyzing Maker and Frax

Are RWAs the next iteration of DeFi?

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Real world assets (RWAs) have been a hot topic of late, and was one of the main points of discussion at Token 2049.

Both Maker and Frax have been exploring and utilizing RWAs in the form of cash-equivalent assets as collateral for DAI and FRAX. While Maker has amassed approximately $3.5 billion in RWA collateral, Frax recently entered the fray with the establishment of FinresPBC and the introduction of sFRAX. This move to RWA-backed collateral seems to be a growing trend amongst stablecoin protocols that aim to offer a more diversified, less volatile asset base while channeling yield from yield-bearing assets like U.S. Treasury bills back to end-users.

Is this pivot a forward-thinking move towards DeFi's future, or a tactical maneuver to solidify their foothold in a fiercely competitive landscape? Is this the key to making Maker and Frax even more sustainable businesses moving forward?

In this week’s report, we will dissect this and more as we dive deeper into Maker and Frax.

Introduction

Maker and Frax are key players in the stablecoin sector in the DeFi space, each taking a different path to ensure peg stability. Maker, an early trailblazer, launched in 2017 and is governed by MKR. Frax, which launched in 2020, was the first protocol to combine both the collateralized and algorithmic stablecoin models — a fractional-algorithmic model, hence the name. Both protocols are now expanding their horizons by incorporating Real World Assets (RWAs) as collateral, a move that has the potential to bridge the gap between traditional and decentralized finance.

Maker Overview

The Maker protocol is built on the Ethereum blockchain and revolves around the DAI stablecoin. Governed by the MKR token, Maker's governance model allows for a decentralized approach to building and managing all aspects of the protocol. Maker recently announced SubDAOs, which are semi-independent DAOs incubated directly by MakerDAO, in order to segregate complexity and alleviate overall load on core governance.

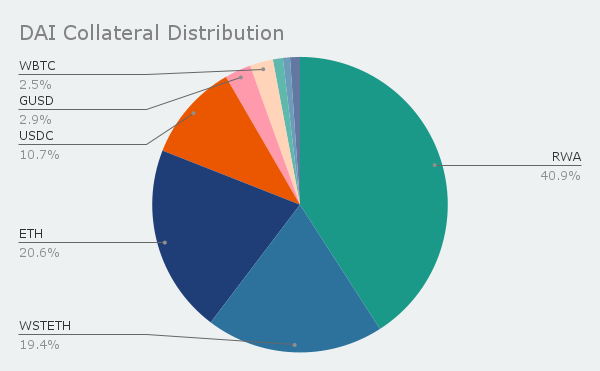

DAI is a stablecoin collateralized by a diverse range of assets approved by governance. As of the time of writing, these include ERC20 tokens such as ETH, rETH, wstETH, and WBTC, as well as a range of ERC20 LP tokens and RWAs.

To mint DAI, users create what is known as a collateralized debt position (CDP) by locking up approved ERC20 assets and generating DAI as debt, paying a stability fee in DAI. This fee acts as a revenue stream for the protocol and is essential for its long-term sustainability.

As of the time of writing, DAI has a total supply of 5.36 billion and has $8.59 billion in collateral backing it. This gives DAI a collateral ratio (CR) of 160.3%.

Of the $8.59 billion in collateral, RWA collateral accounts for about $3.5 billion (40.9%), of which $2.53 billion (72.1%) are in short-term bonds, AAA structured credit, and money market funds.

Frax Overview

Frax launched in 2020, pioneering the fractional-algorithmic stablecoin model. In Frax v1, its stablecoin FRAX had a backing of USDC and its native governance token, FXS, maintained at a specific collateral ratio (CR). For example, a CR of 85% meant that 1 FRAX was backed by $0.85 in USDC and $0.15 in FXS. In addition to this collateralization, an algorithmic mechanism was in place that would mint or sell FXS to realign FRAX with its peg. As of February 2023, Frax governance voted through FIP-188 which increased the target CR to 100% — this means that the protocol is retiring the algorithmic backing of FRAX (via FXS) and aims to fully collateralize FRAX without the use of FXS over time.

In Frax v2, Frax pioneered and introduced algorithmic market operations (AMOs) as part of its fractional-algorithmic stability mechanism. These AMOs perform market operations throughout DeFi in order to earn yield for the protocol, stabilize the peg, and dynamically adjust to market demand for its stablecoin — akin to the Fed and its open market operations (OMOs) that regulate money supply to maintain economic stability.

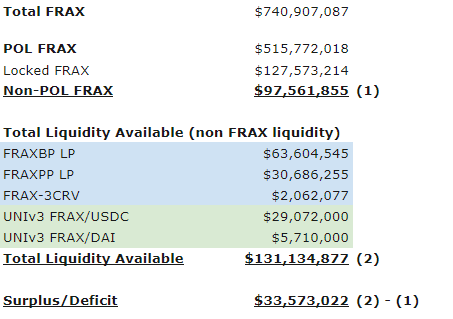

As of the time of writing, FRAX boasts a total supply of 741 million. The formula to calculate FRAX’s CR is:

Thus:

The CR of 91.73% and the synergistic influence of Frax's AMOs and on-chain liquidity are fundamental to maintaining the FRAX peg. Therefore, it's crucial to take into account the surplus or deficit of on-chain liquidity available for redeeming all non-protocol-owned FRAX. This method is detailed by Ouroboros Capital in their analysis here.

Using the same method and based on data at the time of writing, a surplus of $33.5 million is arrived at by deducting the total on-chain liquidity available to absorb non-POL circulating FRAX from the total supply of circulating non-POL and unlocked FRAX. Note that for a conservative estimate, this calculation does not include other assets paired with FRAXBP on Curve. This means that should a run on FRAX occur, there is more than enough liquidity to absorb the sale of all non-POL circulating FRAX.

This comes after the Curve Protocol hack, which caused Frax to remove all their POL from the FRAX3CRV, FRAXUSDC (FRAXBP), and FRAXUSDP (FRAXPP) pools on Curve. As of the time of writing, POL has been added back to the FRAXBP and FRAXPP pools.

Check out our Definitive Guide to the Next Big DeFi Stablecoins report for a deeper dive into Maker and Frax.

Real World Assets

RWAs have consistently been a central topic of discussion, regarded as a sector with the potential to propel cryptocurrency into mainstream adoption by serving as a bridge between decentralized finance (DeFi) and traditional finance (TradFi). This potential is underpinned by the concept of tokenization — the process that enables the digital representation of physical assets on the blockchain.

Tokenization converts a wide array of traditionally illiquid assets — spanning real estate, fine art, precious metals, securities, debt instruments, and bonds — into digital tokens. This enables fractional ownership, enhanced liquidity, and broader accessibility, effectively eliminating barriers to entry that have historically limited retail participation in traditional asset markets.

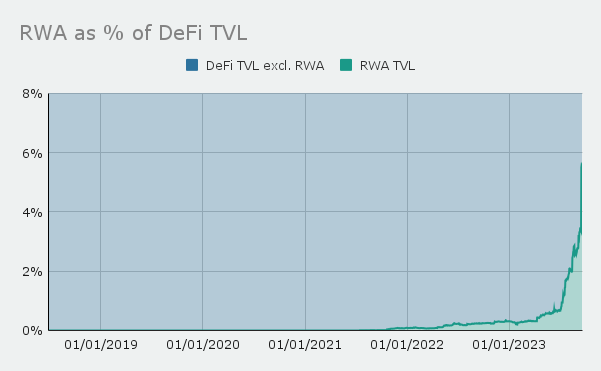

Until recently, RWA saw lukewarm adoption compared to the rest of DeFi and remained flat throughout 2022. As the risk-free rate of U.S. Treasury bills began to trump onchain “risk-free” yields, the exodus of onchain liquidity continued, leading to declining TVL across DeFi.

As shown in the chart above, U.S. 3-Month Treasury Bill yields have averaged 5% since the beginning of the year. In contrast, USDC deposit rates on Aave, which are often considered the DeFi equivalent of the risk-free rate, have ranged between 2-2.5%.

This macroeconomic shift has driven the development and growing interest in the subset of RWAs that focuses on tokenized treasuries. As a result, the TVL in RWAs has surged since the beginning of the year, growing to more than 5% of all DeFi TVL. These products enable users to access various short-term U.S. Treasury yields simply by holding the tokens representing these underlying assets.

Stablecoins: Unlocking Treasury Yields

As U.S. Treasury yields rose in response to aggressive rate hikes by the Fed, another utilization of Real World Assets (RWAs) came to the forefront. Stablecoin issuers began allocating a larger portion of their reserves to short-term U.S. Treasury bills, often with maturities of less than 90 days. It's worth noting that while Tether and Circle may not explicitly refer to these reserves as backed by RWAs, Maker, as an example, has been actively exploring and implementing this approach as part of its collateralization strategy and have classified these reserves as RWA-backed collateral.

While U.S. Treasury bills are not directly tokenized in this model, their use as collateral for stablecoins represents a form of tokenization, since holders of the stablecoins effectively hold a claim to a value represented by those Treasury bills.

Let’s explore this below.

Tether: USDT

Tether, the company behind the largest stablecoin, USDT, with a market cap of $83.168 billion as of the time of writing, 64.5% of its reserves in U.S. Treasury bills and 10.28% in overnight reverse U.S. Treasury Repos, as indicated in the latest auditor's report. This represents a significant increase from the 28.1% allocation reported in September 2021, a period when U.S. 3-Month Treasury bills were only yielding approximately 0.05%.

Circle: USDC

A similar trend can be observed with Circle, the issuer of USDC, the second-largest stablecoin with a market cap of $25.4 billion as of the time of writing. In July 2022, according to an attestation report (the earliest report showing a detailed breakdown of its reserves), Circle held 77.6% of its reserves in U.S. Treasury bills. This allocation was made during a period when U.S. 3-Month Treasury bills were yielding between 1.6% and 2.5%. In the most recent report from July 2023, Circle has further increased its exposure to U.S. Treasuries to 88.3% (65.89% in overnight Treasury Repos and 22.49% in short-dated Treasury bills). It's worth noting that Circle's reserves are managed by BlackRock under the Circle Reserve Fund.

Maker: DAI

In 2021, Maker embarked on a partnership with Centrifuge and New Silver to introduce Real World Assets (RWA) to the DeFi space, initially focusing on securitized real estate loans. However, it wasn't until late 2022 that Maker's RWA assets saw substantial growth. This surge in RWA TVL can be attributed to the implementation of MIP-65, which introduced a $500 million RWA vault. This vault utilized USDC acquired through Maker's peg stability module (PSM) to pursue investments in liquid bond strategies.

Initially, MIP-65 allocated its funds to a combination of U.S. short-term Treasuries and corporate bonds. However, it later shifted its holdings to include a mix of short and medium-term U.S. Treasury Bonds. Capitalizing on the improved yield environment in 2023, the vault's debt ceiling was later raised from $500 million to $1.25 billion, enabling the acquisition of U.S. Treasuries with 6-month maturities, offering a yield of 5.5% as of the time of writing.

Today, Maker's exposure to U.S. Treasuries extends beyond MIP-65. Firstly through the MIP-81 vault, which is custodied via Coinbase Custody, encompassing a $500 million vault of USDC. Additionally, Project Andromeda, with a vault debt ceiling of $1.28 billion, contributes to Maker's substantial exposure to U.S. Treasuries. In total, these initiatives represent a combined exposure of just over $3 billion to U.S. Treasuries.

Spark Protocol

On May 8, 2023, MakerDAO introduced Spark Protocol, a friendly fork of the Aave lending marketplace. This development extended the Maker protocol’s offerings to encompass lending and borrowing services for various assets, including ETH, rETH, wstETH, and DAI, among others.

One noteworthy feature was the introduction of sDAI, which represents DAI tokens locked into the Dai Savings Rate (DSR) module of Maker. The yield generated from the DSR module is derived from stability fees paid by borrowers and yield from the protocol's Real World Asset (RWA) vaults.

As of the time of writing, the DSR is set at 5%, and the supply of sDAI has reached 1.66 billion tokens. With the total DAI supply amounting to 5.55 billion, this means that around 30% of all DAI is locked within the DSR, highlighting the demand for yields rivaling that of U.S. Treasuries within DeFi.

Frax: FRAX

On August 15, 2023, a proposal (FIP-277) was approved, marking the onboarding of Financial Reserves and Asset Exploration Inc (FinresPBC), a public benefit corporation, as the facilitator for Frax v3’s RWA asset strategy. This pivotal development allows the protocol to hold cash deposits and low-risk cash-equivalent assets like U.S. Treasury bills and reverse repo contracts.

In a manner similar to previous approaches by stablecoin issuers, this strategy does not involve the direct tokenization of U.S. Treasuries. Instead, it allows the protocol to generate yield on its reserves, offering the possibility of distributing this yield to holders or stakers of its stablecoins. Notably, Sam Kazemian, the founder of Frax, has indicated the potential introduction of tokenized treasuries in the upcoming Frax v3 release.

sFRAX

On September 17, 2023, FIP-285 was passed — this proposal introduces staked FRAX (sFRAX), and builds on the infrastructure laid out in FIP-277. Users will be able to stake their FRAX into a smart contract vault and earn interest denominated in FRAX on their holdings. sFRAX is a receipt for their deposited FRAX and its accrued FRAX earnings and can be freely traded or utilized in other DeFi protocols for enhanced yield and capital efficiency.

As outlined in the proposal, the source of yield for sFRAX will be derived from balance sheet deployments into AMO and RWA strategies. The specific target yield for sFRAX is set to align with the Federal Reserve's Interest on Reserve Deposit Balances rate (IORB), which currently stands at 5.40% as of the time of writing.

The IORB rate represents the interest rate paid by the Federal Reserve to depository institutions, including banks and credit unions, on their required reserve balances and any excess reserve balances held at the Federal Reserve.

While sFRAX is not yet live, the protocol has already begun depositing USDC into the FinresPBC Circle Deposit address, with a total deposit of $1.2 million made to date.

RWA Reserves Comparison

While Tether and Circle have been denominating a majority of their reserves in strategies with direct or indirect exposure to U.S. Treasuries, DeFi-native stablecoin protocols like Maker and Frax are only beginning to scratch the surface and reap the benefits of doing so.

Treasury Yields as a Source of Revenue

Tether recently reported more than $1 billion in operational profit for the second quarter after record-breaking first quarter net profits of $1.48 billion. This comes as USDT’s supply continued to reach all-time highs in July this year. This growth in profits directly correlates with both the increase in Tether supply and growing proportion of its reserves in U.S. Treasuries. Tether are now one of the top purchasers of U.S. Treasuries globally after completely removing exposure to commercial paper (unsecured loans). This arguably makes Tether a more sustainable business, as it diversifies its revenue sources and reduces reliance on deposit and withdrawal fees during low-volume market environments.

Maker is perhaps the best example to illustrate the influential role of U.S. Treasuries as revenue generators in the current yield environment.

Its revenues are nearly back to record highs despite current market conditions, completely filling in the gap caused by declining demand for ETH and WBTC borrowing.

Another great example is Coinbase, which has derived a substantial portion of its recent revenues from U.S. Treasuries.

This chart above shows the revenue distribution of Coinbase from its latest 10-Q report. Notice how 28.2% of its revenue came from interest income alone — this interest income comes from:

USDC yield-sharing agreement with Circle (from U.S. Treasuries)

Loans issued to consumers and institutional users

Custodied customer funds in cash and cash equivalents (U.S. Treasuries)

This emphasizes again that U.S. Treasury yields can play a pivotal role in offsetting revenue declines during bear cycles.

What This Means for Maker

Maker’s recent implementation of the Smart Burn Engine (SBE) means that every time the protocol has a surplus buffer above $50 million, the SBE is activated and acquires MKR from the DAI/MKR pool on Uni v2. The process looks like this:

If surplus buffer > $50 million:

Use DAI to purchase MKR from DAI/MKR market

Match acquired MKR with additional DAI

Supply MKR & DAI tokens to DAI/MKR market

Transfer acquired LP token to protocol address

This effectively “burns” MKR tokens by removing the MKR from circulation whilst increasing DAI/MKR liquidity.

Impact of RWA on MKR “Burn”

Since the turn of the year, Maker’s estimated annualized profits grew threefold from approximately $20 million to around $65 million as of the time of writing. This directly correlates to the growth of their U.S. Treasury RWA vaults.

Since the implementation of the SBE, revenue from RWAs has consistently accounted for approximately 50% to 65% of the protocol's total revenue. Over the past 90 days, the protocol has repurchased 10,452 MKR tokens, pairing them with 15.5 million DAI in the DAI/MKR Uni v2 pool. This translates to an annualized buyback rate of 42,389 MKR, equivalent to approximately 4.2% of its maximum supply.

Buybacks have been occurring when the surplus buffer exceeds $50 million. Since the implementation of the SBE, the surplus buffer has remained above the minimum surplus requirement for approximately 75% of the time, indicating an efficiency rate of 75%. Assuming this efficiency continues throughout the year, the maximum annual buyback amount would be $75 million DAI. Based on the SBE parameters, the maximum buyback amount at 100% efficiency would be $100 million DAI.

Notice the chart above shows a gradual depletion of the surplus buffer as sDAI utilization, represented by the DSR vault balance, has risen. This is because the Enhanced DSR (EDSR) is presently set at 5% when sDAI utilization falls within the range of 0-35% (current sDAI utilization is at 27% of total DAI supply). Consequently, the protocol is obligated to distribute a considerably higher yield to sDAI holders as the sDAI TVL continues to expand, eating into the surplus buffer.

Nonetheless, as the Enhanced DSR (EDSR) is slated to decrease to approximately 3.67% when sDAI utilization falls within the range of 35% to 50%, there is an expectation that the surplus buffer will gradually replenish. Additionally, if utilization surpasses the 50% threshold for more than 24 hours, the EDSR ceases to apply, and the standard DSR of 3.19% is reinstated, contributing to potential surplus buffer recovery.

Given the above, a sensitivity analysis can be conducted to estimate the annualized MKR buyback and "burn" — the most likely scenarios, based on available data, are highlighted in green.

What This Means For Frax

Similar to Maker, Frax adopted a different strategy to generate yield in the DeFi space before yields started to decline due to decreasing demand for leverage and risk appetite, along with rising traditional finance risk-free rates. In Frax v2, the protocol heavily relied on its AMOs to maintain the stability of FRAX while generating yield through CRV and CVX rewards and other strategies.

However, unlike Maker's pivot towards U.S. Treasuries and the introduction of the EDSR in August this year, Frax has been slower to adapt, resulting in a drop in FRAX demand as DAI gained popularity.

Frax v3 is on the horizon and is set to introduce sFRAX and FXB (FRAX Bonds), which could potentially reignite demand for FRAX by offering users various yield strategies matching the IORB rate. Currently, only $1.2 million USDC has been deposited into the FinresPBC Circle deposit address, which is a relatively small amount. While the full extent of Frax's plans remains uncertain, some simple assumptions can be made.

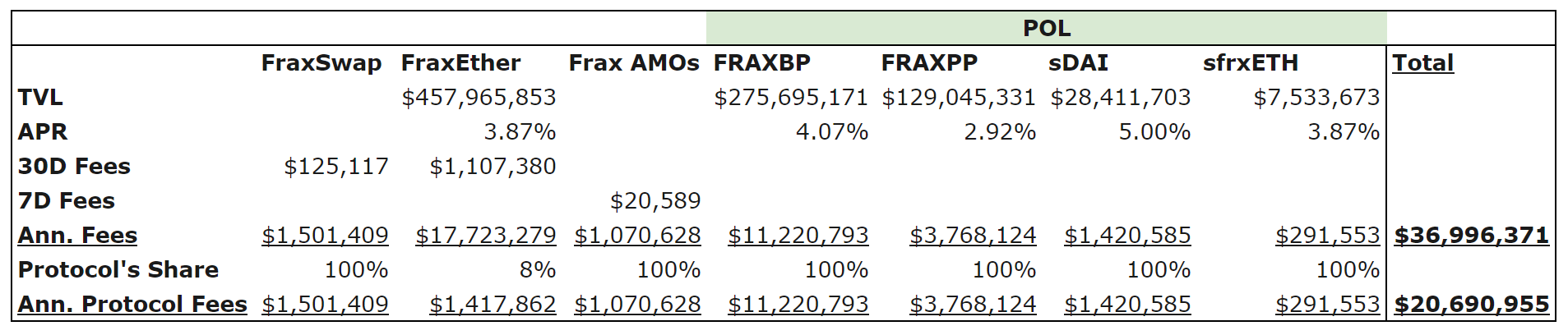

The Frax protocol generates revenue from various sources, including FraxSwap, FraxEther, FraxLend AMOs, and its substantial POL holdings used in on-chain strategies. Collectively, these products contribute approximately $20.7 million in annualized revenue to the protocol.

Considering the 20% increase in Maker’s DAI supply after the implementation of sDAI and the EDSR, we can project Frax’s potential revenue growth with a 20% increase in sFRAX POL holdings. Assuming a 5.3% yield on sFRAX, the conservative estimate (bear case) results in a revenue increase of $1.78 million, while the optimistic scenario (bull case) forecasts an annualized revenue boost of $7.1 million for the protocol.

What is the End Goal?

The convergence of business models within legacy DeFi protocols is an interesting one. Aave and Curve built up demand for lending and liquidity before introducing their own stablecoins to enhance and their existing business and revenue potential. Meanwhile, Maker and Frax originated as stablecoin-focused protocols before broadening their scope to include lending and liquidity solutions.

A noticeable trend is taking shape as Maker and Frax delve into the realm of RWA collateral, aiming to secure their long-term sustainability by diversifying their services and implementing collateral hedging strategies to weather changing yield environments.

With RWAs set for increased growth in the coming months due to lightening regulatory environments, vastly improved infrastructure, and elevated yields, using RWAs as a hedge against bear market cycles looks to be a solid strategy for stablecoin protocols and even other DeFi protocols with the means to do so to adopt.

Further to this point, both Maker and Frax seem moving in the same direction, both announcing their intentions to launch their own chain in the future. While a Maker chain is still 3 years away, Fraxchain is set to launch by early 2024. This expansion into their own blockchain ecosystems reflects a strategic move to gain more independence, enhance scalability, and further diversify their offerings, ultimately aiming to improve sustainability of their respective protocols.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about

What is POL?