Your Guide to the Next Big DeFi Stablecoins

Breaking down DAI, LUSD, FRAX, GHO, crvUSD, GYD, UXD and much more...

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Introduction

With the recent depeg of the $40 BILLION stablecoin USDC, decentralized stablecoins are retaking the spotlight.

The focus is once again shifting towards stablecoins that are not reliant on a single entity and are backed by decentralized assets instead of traditional fiat currencies.

The winning protocol that successfully scales a trustless stablecoin will likely become one of the most valuable protocols in all of crypto based on the sheer scale of the proven, addressable market. As such, understanding the current decentralized stablecoin design space is paramount for any investor.

In this week’s Blockcrunch VIP memo, we provide an overview of the decentralized stablecoin landscape. We investigate key questions such as: (1) Can DAI, LUSD, and FRAX maintain their dominance? (2) What new features do Aave and Curve bring to the table? (3) Do novel stablecoin designs (non-CDP) have a chance against established giants? (4) What are the key factors that determine success in the decentralized stablecoin market? (5) What exactly are stablecoins competing for?

A stablecoin taxonomy that matters

The Incumbents

I. Maker DAO (DAI)

II. Liquity (LUSD)

III. Frax (FRAX)

The Challengers

IV. AAVE (GHO)

V. Curve (crvUSD)

The Pioneers

VI. Gyroscope (GYD)

VII. UXD Protocol (UXD)

Conclusion – what are stablecoins competing for?

A Stablecoin Taxonomy that Matters

Prior to the collapse of Luna, the stablecoin market was often categorized into three main types: (1) fiat-backed, (2) crypto asset-backed, and (3) algorithmic. However, following the death of UST, it became clear to many that purely algorithmic stablecoins are based on a sort of "recursive social belief" and do not offer a reliable solution for stability. This realization has redirected attention back towards stablecoins that rely on collateralization.

Collateralization is the backbone of stablecoins. In fact, the concept of a stablecoin has existed long before blockchain, with examples like the fixed exchange rate system and currency board arrangement. Under a currency board, a central bank or monetary authority is required to back all units of domestic currency in circulation with foreign currency. The Hong Kong dollar is one such ‘stablecoin’ pegged to the USD at a rate between 1 USD to 7.75 to 7.85 HKD. The central bank of Hong Kong ensures that the entire monetary base (M0) is fully backed by highly liquid US dollar-denominated assets.

The point here is that the core mechanism for ensuring stability against a reference asset is simply collateralization, and history has told us that there’s likely no way around it.

While stablecoins are casually classified into two categories - Centralized and Decentralized, a more meaningful and nuanced categorization for stablecoins is on-chain vs off-chain collateralization. On-chain stablecoins are issued based on crypto assets already existing on the blockchain as collateral, while off-chain stablecoins like USDT rely on fiat currency. This categorization offers a more nuanced approach to understanding the evolving landscape of stablecoins.

This memo provides an overview on the on-chain stablecoins.

The Incumbents

I. MakerDAO ($DAI)

Mechanism Overview

Put simply, MakerDAO allows users to borrow the stablecoin DAI by using other cryptocurrencies as collateral. For example, users can deposit their ETH into a Collateral Debt Position (CDP) referred to as vaults.

To get DAI, borrowers lock up collateral above a collateral ratio prescribed by the protocol. The ratio is different for each type of collateral and can be adjusted by Maker governance. For example, if the collateral ratio is 150%, the value of the ETH in the vault must be at least 1.5 times the amount of DAI borrowed. In other words, depositing $1500 worth of ETH allows you to borrow a maximum of $1000 DAI.

MakerDAO charges a stability fee to users who take out loans to finance governance and development. The fee depends on the amount of DAI borrowed and the loan time and must be paid by the vault owner when returning the DAI and unlocking the collateral.

Maker Vaults require a Liquidation Ratio or Minimum Collateralization Ratio. This is the ratio between the USD value of your collateral and the amount of DAI minted. If the ratio falls below the required amount, your Vault will be liquidated.

During a liquidation event, collateral is sold to cover outstanding debt and a Penalty Fee. Any remaining collateral is available for withdrawal, and DAI used to cover debt is destroyed to keep the system balanced.

Maker Vaults Today – Finding stability in diversity

Since 2017, MakerDAO has evolved from a protocol that simply allows users to deposit ETH to mint DAI. New modules are added and today there are largely 5 types of vaults:

Regular Vaults: these are regular vaults mostly made up of volatile crypto assets such as ETH, stETH, wBTC, etc.

Peg Stability Module (PSM): this module allows direct 1 to 1 conversion of centralized stablecoin USDC to DAI and vice versa.

Real World Asset (RWA): traditional finance players taking out loans through MakerDAO with off-chain assets as collateral.

Uniswap LP tokens (G-UNI) – stablecoin LP tokens from Uniswap v2 & v3 including DAI-USDC pair or USDC-ETH pair (wrapped through Gelato Finance).

Direct Deposit Module (D3M) - D3M is a Vault in MakerDAO that allows to mint DAI directly to lending protocols like Aave and Compound and hold DAI as a collateral in the D3M Vault.

From SCD (Single Collateral DAI or SAI) to MCD (Multi-collateral DAI) to RWA vaults, the expansion of MakerDAO beyond regular vaults has fuelled its dominance as the largest DAO-governed stablecoin on-chain. However, this pursuit of growth and expansion is often accompanied with controversy and involves trade-offs on decentralization.

Does PSM make DAI ‘wrapped USDC’?

MakerDAO uses the Peg-Stability Module (PSM) to maintain a tight control of its peg and facilitate arbitrage by allowing redemption of DAI for USDC and vice-versa at a 1:1 ratio. When the value of DAI is above peg, it is profitable to use USDC to mint DAI and swap it for USDC in the open market. Conversely, when DAI is below $1, the PSM gets used in the opposite direction – you get DAI in open market under $1 and redeem it for 1 USDC.

A PSM, at its core, functions as a wrapper contract that encloses a privileged vault type within the Maker Protocol. All of the parameters that pertain to vault types similarly pertain to a PSM. Nonetheless, a stablecoin PSM must maintain a Stability Fee of 0% and a Liquidation Ratio of 100%.

This large amount of DAI created through PSM has long been controversial due to regulatory crackdowns on other stablecoins. Many have criticized DAI for being just a wrapped USDC token, and the fact that all USDC is stored in a few contract addresses that could be easily censored or influenced by authorities.

Currently, the PSM comprises of $2 billion in USDC, $440 million in Paxos USDP, and $477 million in Gemini's GUSD. While it ensures DAI's 1:1 USD backing, it comes at the cost of complete decentralization and censorship resistance. With Tornado Cash facing OFAC sanctions and Circle's compliance coming under scrutiny, there are concerns over DAI's dependence on centralized stablecoins. Additionally, a major drawback of relying heavily on stablecoins as DAI collateral is that they do not generate any yield by default.

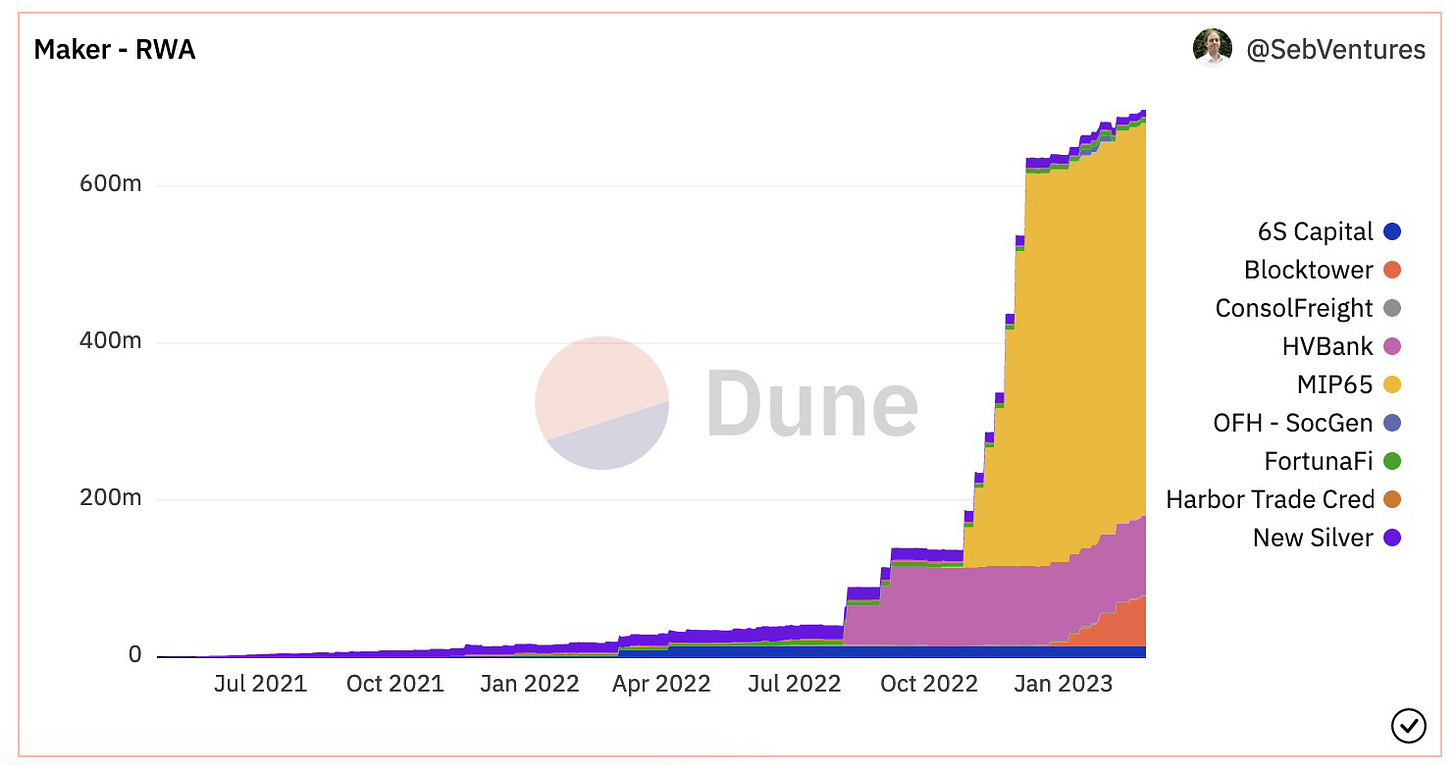

Real World Assets Vaults – The Rainmaker

Maker’s RWA balance continued to grow over 2022, reaching over $640mm DAI. These DAI are generated through individual deals with external parties. For instance, The Monetalis Clydesdale deal (MIP 65, the largest RWA vault) is a $500M Dai vault backed by short-term US Treasury ETFs. The collateral is split between IB01 (BlackRock’s iShares Dollar Treasury Bond 0-1yr UCITS ETF), holding treasuries with a maturity less than one year, and IBTA, holding treasuries with a maturity between one and three years. The vault started buying these ETFs in October 2022 and has since deployed all DAI up to the debt ceiling.

Although RWA vaults only represent 13% of total outstanding DAI, they’re generating more than 55% of the protocol’s revenue. Though this lucrative business comes at a cost. While liquidating crypto-collateral is straightforward on-chain, off-chain collateral liquidation poses uncertainty. RWA vaults may rely on third-party services, and their ability to fulfill obligations of securing and collecting payments related to RWA vaults for the DAO is so far untested.

The risk of government enforcement or seizure also remains a concern for MakerDAO. If off-chain collateral is seized by the government, it could negatively impact the protocol's integrity and DAI’s ability to track the dollar. Although governance has taken steps to ensure that all off-chain collateral is protected in accordance with relevant legislation, the idiosyncratic risk involved with multiple entities still remains.

Direct Deposit Module (D3M) – just like…FRAX?

The Direct Deposit DAI (D3M) is a way for the Maker Protocol to interact with third party lending protocols by adding additional liquidity to balance out periods of high demand, and remove liquidity in periods of low demand. The implementation of the D3M will allow users of third party lending protocols to benefit from more predictable and stable interest rates. This is operationally similar to the Algorithmic Market Operation (AMO) used by FRAX, as we will see later.

Traditionally on a lending protocol like AAVE, users can only borrow what is already deposited by other users. But with D3M, Maker can mint fresh DAI into AAVE for users to borrow. The minting action is constrained by a target borrowing rate (say 4%): If too much DAI is minted, and interest rate is <4% then D3M contracts supply to target 4%. If rate >4% then DAI supply expands.

Uniswap LP tokens (G-UNI) – Using DAI to mint DAI?

LP token is another more controversial type of collateral for DAI that has raised some eyebrows recently. About 8% of Maker’s collateral is made up of LP tokens in Uniswap. Most LP collaterals are from Uniswap V3’s DAI-USDC concentrated liquidity pool. Since Uniswap v3 LP tokens are technically NFTs with specific price range they cannot be used as collateral in vaults by default, MakerDAO utilizes G-UNI token, which is essentially wrapped Uniswap v3 position in the form of ERC-20 token, powered by Gelato network.

On Oasis (a MakerDAO frontend), we can see the option allowing users to leverage up to 50x by accepting Uni $DAI/$USDC LP tokens as collateral to mint $DAI. This means that $DAI minted can be redeposited in the pair to obtain more LP tokens, which can be used to mint even more $DAI. So in a sense, a portion of DAI created in this module is backed by non-other than DAI itself. The risk here is that in a potential DAI depeg, this module could see massive unwinding and liquidations of leveraged positions, leading to severe knock-on effects. Though such a scenario would be rather unlikely given the over-collateralized backing from other modules currently.

Spark Lend – Vertical integration into money markets

One way to gauge a stablecoin’s success is to look at its use cases. DAI is oldest, largest and most adopted decentralized stablecoin in DeFi. Stablecoins fight to gain acceptance in DeFi apps, including DEXs and money markets.

To further expand its utility, MakerDAO has announced Spark Lend, which is a borrowing and lending platform that is a direct fork of AAVE. Such a vertical integration of a money market protocol allows Maker to have more control over DAI’s usage and incentivize usage of its own stablecoin.

Intuitively, Spark Lend will integrate with the D3M module, allowing Maker to directly mint DAI into the market when users want to borrow. MakerDAO can then directly monitor and regulate the supply of DAI in the Spark Lend market to manage DAI fluctuations (initial debt ceiling set at $200M DAI). It is expected the module will set the borrowing rate at the Dai Savings Rate (DSR) of 1%, which will be the cheapest credit rate in DeFi and spur its further supply growth. Another down integration down-the-road is to offer a market on Spark Lend for Element Finance’s fixed rate lending offering.

Using MKR to mint DAI – Pulling a DoKwon?

In response to the Tornado Cash sanctions last year, Maker’s co-founder Rune Christensen promised the Endgame plan, which is an ambitious scheme to make the protocol more censorship resistant. Under this plan, MKR token is proposed to be allowed as collateral to create DAI. The community is quick to draw similarities between this mechanism to Luna and UST, the infamous algorithmic stablecoin that collapsed in May 2022.

Collaterals to back a protocol’s stablecoin can also be classified into endogenous vs. exogenous assets.

Endogenous assets in this case refers to a token that is meaningfully tied to the protocol itself as a form of equity or governance token (just like LUNA to UST and FXS to FRAX). ETH would be considered an exogenous asset that is more preferable as a collateral since its value has no direct linkage to the protocol’s development and survival.

Though upon closer examination, the proposal poses no immediate risk to DAI. The approval and exact implementation is still unknown at this stage. And it is likely a debt ceiling will be imposed to limit DAI with MKR as collateral to prevent it from having outsized dominance versus other collateral assets.

After years of development, Maker DAO has become a complex and multifaceted platform that goes beyond just being a decentralized stablecoin. With both on and off-chain asset collateralization, it is perhaps more apt to describe it as a DAO-governed stablecoin more than anything else.

II. Liquity ($LUSD)

Liquity - The not-so-ambitious ‘lawful good’ stablecoin

Liquity is a protocol that offers interest-free loans in LUSD backed by ETH collateral. The protocol charges an issuance fee to users, and loans can be liquidated if the collateral ratio falls below 110%. Liquidations are supported by a stability pool of deposited LUSD.

LUSD is hard-pegged between $1 and $1.10 through arbitrage opportunities. LQTY stakers earn the issuance fee in ETH and a redemption fee in LUSD when arbitrageurs swap LUSD to maintain the peg. The protocol is intended to be immutable and governance-free.

Liquity’s founders has from the get-go intended for the protocol to be sort of a public infrastructure of DeFi. While other protocols seek to grow its footprint and spread its wings over the on-chain world, Liquity is not very ambitious at all on this front.

Part of it is due to the sober understanding of the inherent capital efficiency of ETH collateralization – LUSD supply can only exist as a portion of Ethereum’s market cap. The protocol also has NO governance or improvement proposals to change the code. The contract, once deployed, is intended to be truly immutable and never touched. Liquity also has no self-operated front ends, existing solely as an infrastructure layer.

It is precisely such a ‘decentralization maxi’ positioning that always causes Liquity to gain periodic spikes in attention whenever there are some bad things happening on the regulation front.

Stability Pool – Is stability a curse for growth?

The Stability Pool is a key component of maintaining solvency and providing liquidity to repay debt from liquidated Troves (Liquity’s language for vaults). Users deposit LUSD into the Stability Pool to facilitate liquidations. As a Trove is liquidated, remaining debt is burned, while the collateral from the Trove is transferred to the pool owners. As time passes, they lose a pro-rata share of their LUSD, but gain a pro-rata share of the liquidated collateral. Due to Troves often being liquidated just below a 110% collateral ratio, Stability Providers receive more collateral than the debt they pay off.

Almost two-thirds of LUSD in existence are deposited in stability pool to facilitate the protocols own liquidation in a recursive loop. However, when compared to FRAX and DAI, LUSD lacks external usability and has a relatively minuscule number of holders (6K on-chain holders). Despite the protocol's stability, LUSD falls short when measured against the characteristics of a currency, particularly in terms of widespread acceptance and exchange.

Lack of liquidity depth and depegging upwards

Many stablecoins de-peg below $1, but LUSD could actually trade above 1 dollar for prolonged period of time: during time of market stress, borrowers of LUSD rush to get LUSD on the market to repay their debt to avoid being liquidated, causing $LUSD curve pool imbalanced and a depeg to the upside.

This was also a problem for DAI in the early years until Maker introduced PSM to maintain a tight peg through arbitrage opportunities. The relatively high volatility band of LUSD also makes it less desirable as a medium of exchange.

Curve serves as an indicator of stablecoin prices in the DeFi space, and maintaining a deep curve pool is vital. However, LUSD falls short in this aspect and struggles to maintain a stable peg due to the lack of a deep pool for arbitrageurs. Additionally, as a leverage tool, $LUSD is not sufficiently liquid to support large-scale trades, rendering it a rather inefficient leveraging mechanism.

Chicken Bond’s ‘15 mins of fame’

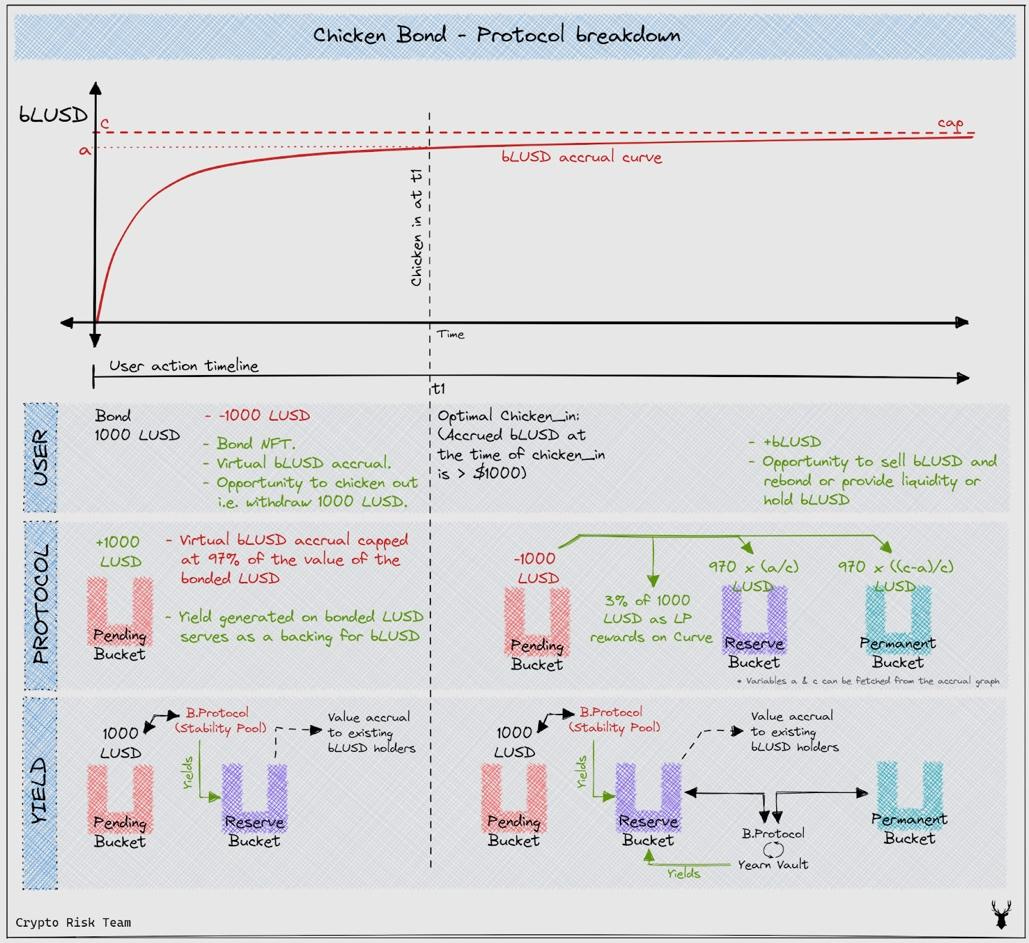

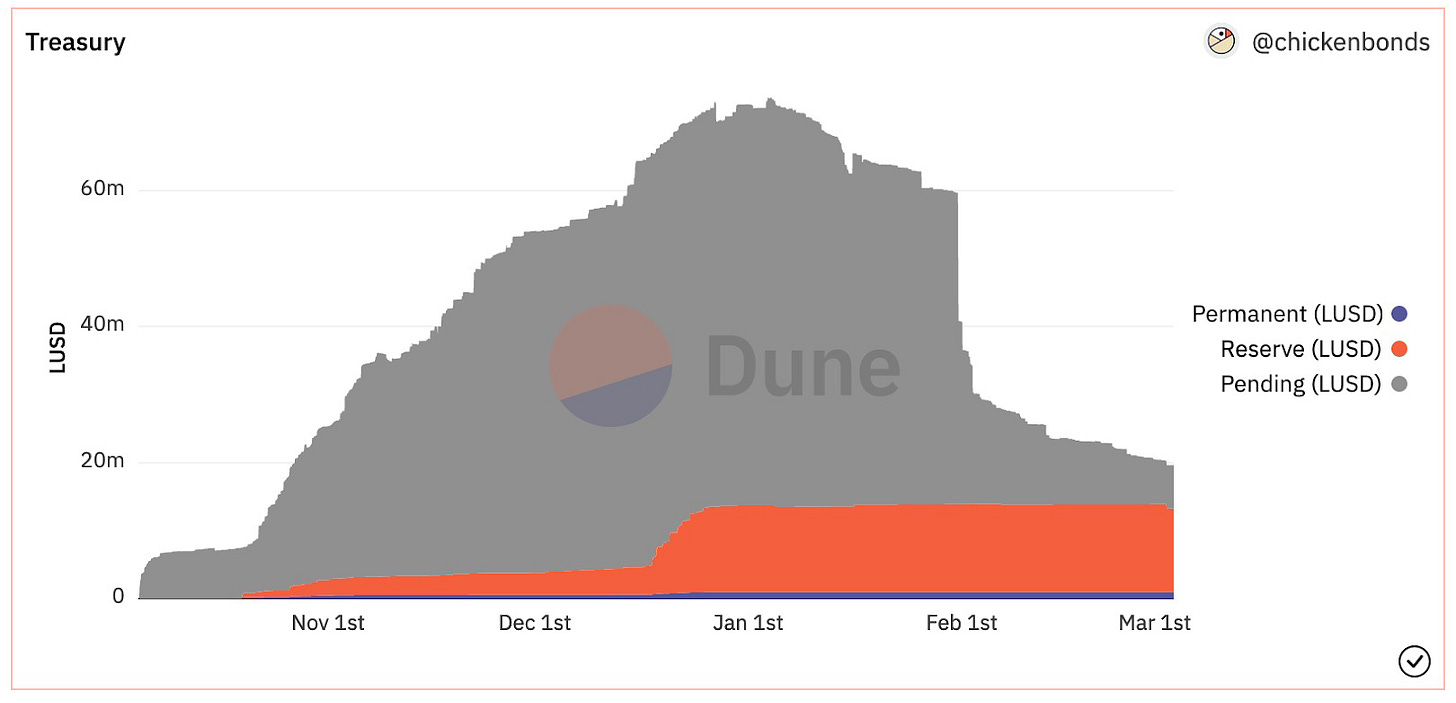

Chicken Bonds is a unique mechanism built on top of Liquity’s core contracts to bootstrap protocol-owned liquidity while increasing yield opportunities for users.

By depositing LUSD, users receive an accruing balance of bLUSD, with the option to either withdraw their principal and forfeit the accrued amount ("chicken out") or exchange it for the accrued bLUSD ("chicken in"). The system acquires a portion of the LUSD, which backs the bLUSD supply, and this amount depends on the timing of the chicken in event.

The protocol's Treasury consists of three distinct sections or "buckets":

Pending Bucket, controlled by the protocol, holds the LUSD of depositors who have yet to chicken in/out. These funds are invested into B.Protocol, which promptly deposits them into the Liquity Stability Pool.

Reserve Bucket, another protocol-controlled vault, stores a portion of the LUSD collected from the previous bondholders after a chicken in event. Yields generated from funds in each bucket are directed here to support bLUSD supply.

Permanent Bucket, owned by the protocol, houses the remaining portion of the LUSD acquired from former bondholders.

Investors who hold Chicken Bonds must be willing to sacrifice their short-term liquidity in order to obtain increased long-term yield. To accumulate Boosted Tokens, users bond tokens into the "Pending Bucket," which does not generate yield but does generate Boosted Tokens. Boosted Tokens signify ownership in the "Reserve Bucket," where the yield amplification occurs. The yield earned from tokens in the Pending Bucket, Boosted Tokens in the Reserve Bucket, and Tokens in the Permanent Bucket are all added to the Boosted Tokens. The below diagram depicts the movement of user deposits across the three buckets.

After an initial spike, the chicken bond treasury has dropped to sub $20M from a high of nearly $70M. The complex mechanism of chicken bonds essentially crates a liquidity game redistributing yields across the ‘bonders’ and different buckets. Nonetheless, without fresh liquidity coming into the system the flywheel never really took off.

Liquity as decentralized hedge against regulatory overreach

Liquity's primary advantage is its ability to withstand censorship and regulatory capture because it is solely an ETH collateral vault. This decision to only accept ETH as collateral indicates a high level of confidence in their approach.

Liquity's decentralized values and purity are commendable. Its presence may serve as a necessary safeguard against worst-case scenarios, such as the confiscation of USDC assets or the imposition of KYC requirements. In other instances, Liquity may attract increased attention during periods of regulatory uncertainty or fear. However, the total value of LUSD in circulation can only be a fraction of ETH's market capitalization.

III. FRAX ($FRAX)

FRAX, AMO, and DeFi’s Central Bank

Frax started as a partially-backed algorithmic stablecoin. The idea is that FRAX is always backed by a combination of a stable asset like USDC and its own protocol token FXS. A collateral ratio (CR) determines the split of the collateral. Say the ratio is at 90%, this means that to mint 1 FRAX, $0.9 USDC plus $0.1 worth of FXS tokens are required. Vice versa, a FRAX can always be redeemed back to 0.9 USDC and $0.1 worth of FXS.

Frax CR is a dynamic ratio that is subject to fluctuations based on market forces of supply and demand. This ratio is directly affected by the expansion or retraction of FRAX. When the demand for FRAX increases, the CR decreases, and a lower amount of collateral, as well as more FXS, are necessary to mint FRAX. Conversely, when demand for FRAX decreases, the CR increases, and more collateral is needed to maintain the stability of FRAX.

Nonetheless, this original mechanism has evolved significantly from what Frax is today. Frax v2 is an updated version that uses the concept of fractional-algorithmic stability. This version introduces the "Algorithmic Market Operations" (AMO), which is an autonomous contract that manages the supply and demand of FRAX. AMO controllers can perform open market operations algorithmically to maintain the FRAX price but cannot mint new FRAX arbitrarily.

There are 4 AMOs active on FRAX:

Curve AMO ($710M) - Move idle USDC collateral or mint new FRAX to the Curve pools. Tightens the peg and enhances liquidity for FRAX.

Investor AMO ($180M) - Moves Idle USDC to select DeFi protocols to earn yield

Liquidity AMO ($80M) - Deploy FRAX & USDC into DEXes to earn fees

Lending AMO ($80M) - Mint FRAX into money markets for over-collateralized borrowing

Let’s take Curve AMO as an example, there are 4 processes involved:

Decollateralize - The algorithm identifies excess collateral in the treasury beyond the required Collateral Ratio to back the total supply of FRAX.

Market operations - The AMO injects the idle USDC and FRAX into the Curve pool to increase liquidity and strengthen the dollar peg.

Recollateralize - The AMO removes liquidity from the Curve Pool and recollateralizes the protocol when the treasury gets too close to the collateral ratio.

Burn - Revenue from swap fees is used to mint new FRAX at the collateralization ratio and buyback FXS for burning.

FRAX is perhaps the hardest stablecoin to wrap one’s head around because its collateral backing cannot be cleanly segregated into vaults or troves like Maker and Liquity. There is no one wallet address that holds all the ETH collateral or all the USDC in PSM. With Maker and Liquity, a straightforward comparison between collateral value & debt outstanding gives users a quick view on the protocol’s solvency. With Frax however, there is no one single address that holds vanilla USDC & FXS that is used to back FRAX.

One way to understand this is that, with the introduction of AMOs in Frax V2, a majority of collateral has been deployed for FRAX-denominated LP tokens. This diversifies the overall collateral backing of FRAX, generates protocol revenue from trading fees, convex bribes, and CRV emissions. The protocol effectively ‘buys back’ outstanding FRAX as protocol-owned liquidity, and creates deep liquidity for secondary markets.

Frax has been described by some as the "central bank" of DeFi, and for good reason. Frax's founder, Sam Kazemian, has envisioned what he calls the holy trinity of DeFi - a stablecoin, an AMM+liquidity ecosystem, and a lending market to set interest rates. The Frax team's ultimate goal is to build towards this trifecta in a slow and methodical manner. They understand the importance of taking their time to ensure that each component of this holy trinity is built with care and precision. By doing so, they hope to create a protocol that will be both powerful and resilient, capable of withstanding the challenges of the DeFi landscape.

Moving towards 100% collateral backing

One major development for FRAX recently has to do with its proposal to fully collateralized its stablecoin FRAX, moving away from its original algorithmic backing approach. In FIP-188, the proposer believes that the benefits of the original approach now outweigh its costs, and a gradual shift towards a 100% collateral ratio (CR) is the best path forward for the protocol's long-term health and growth.

The proposed change aims to make FRAX a more attractive option for users as a long-term store of value, without incentives. The signal vote passed this week. The goal here is to enhance the "money" attributes of FRAX and establish it as a long-term store of value. CR reading 100% also means more collateral can be utilized through AMOs, generating revenue and liquidity for the protocol.

The Challengers

As alluded to earlier, the DeFi Trinity is an enviable position. While Maker and Frax have devised their own lending markets to facilitate the utilization of their stablecoins, other preeminent protocols are also vying for a slice of the stablecoin market.

In this regard, AAVE's GHO and Curve's crvUSD emerge as the most capable contenders in the race towards attaining the coveted 'Trinity' status.

IV. AAVE ($GHO)

On February 9th, 2023, GHO was successfully deployed onto the Goerli test network. GHO stands out for its commitment to decentralization, over-collateralization, and the use of Facilitators (GHO issuing entities). Moreover, AaveDAO plays a crucial role in determining the upper limit of GHO issuance and the discount rate.

The mechanism is essentially the same as MakerDAO here. The minting contract of GHO would allow users to provide crypto collateral, subject to governance-approved collateralization ratios, and receive a corresponding amount of GHO in their wallets. Any fees generated would be deposited into the DAO treasury. Upon repayment or liquidation, an equivalent amount of GHO would be burned.

Facilitators

The GHO protocol has been designed with the concept of "Facilitators" in mind, who would be authorized by Aave's governance to mint GHO. While the Aave protocol itself would serve as the first facilitator, subsequent facilitators may include other protocols or entities, thereby expanding the scope of GHO's design. We can see that such a set up most clearly resembles the structure of MakerDAO. A facilitator in Aave is very much similar to a module or ‘vault’ in Maker.

For instance, Centrifuge has proposed to become the first Real World Asset Facilitator for GHO. It has launched a Credit Group and facilitated a governance-integrated, and scalable on-chain RWA approach for Maker before. It is now preparing a draft facilitator proposal for GHO and is seeking early feedback. Moreover, Facilitators include Delta Neutral Positions and loans based on credit scores (undercollateralized lending).

Discount rate strategy creates additional utility for AAVE tokens

The integration of GHO into Aave allows for innovative features that provide greater utility for Governance and community participants. One such feature is the Discount Rate Strategy mechanism, which offers Safety Module participants a discount on the GHO borrowing rate. The discount rate is controlled by Aave Governance and can vary from 0% to 100%. Only stkAAVE is eligible for the borrowing discount.

When users stake AAVE into the Safety Module, they are taking a risk that in the case of bad debt arising in the Aave protocol, their staked assets may be slashed. To incentivize users to participate in staking and reward them for taking this risk, they can receive a discount on their interest rate. This design enhances the utility of AAVE tokens and may encourage more tokens being staked, which reduces circulating supply.

Demand sinks and cost of bootstrapping liquidity

Aave's launch of GHO stablecoin will require a deep liquidity pool and incentives to attract sufficient liquidity to pair with it, which will likely cost more than the revenue generated by GHO in the short term. While MakerDAO's stablecoin DAI has gained real use and legitimacy due to its decentralization and being first to market, new up-and-coming stablecoins like GHO may struggle to create real demand sinks.

Maker’s launch of Spark Lend and AAVE’s launch of GHO has pitched the two protocols in a direct course of collision. Aave's launch of GHO signals competition with MakerDAO to be the next central bank in crypto, potentially cannibalizing fees MKR holders would have earned from DAI utilization. Though the success of GHO will heavily depend on Aave's ability to offer incentives for borrowers to choose it over DAI.

V. Curve ($crvUSD)

Curve is set to enter the fray of monetary expansion with its latest offering, the crvUSD stablecoin. crvUSD will be overcollateralized and will feature innovative mechanisms such as LLAMMA, which allows for continuous liquidation of debt positions to prevent losses during market volatility. Additionally, it will accept collateral in the form of $ETH and LPs, potentially from pools like tricrypto2 and 3pool.

LLAMMA - Automated Self-Liquidation

The core innovation of crvUSD is its proposed self-liquidating mechanism. In a traditional CDP vault like Maker or Liquity, if the value of your token decreases, your loan becomes much riskier and is more likely to be liquidated immediately.

Traditional CDPs have a liquidation price, which leads to sudden liquidations if the collateral price falls below it. In contrast, LLAMMA (Lending-Liquidating AMM Algorithm) constantly rebalances the collateral, swapping it for what was borrowed if its price dips. This allows for a gradual "liquidation" of collateral, ensuring that it covers the debt as the loan approaches the liquidation price.

For example, as collateral approaches the liquidation zone, Curve will use its pool liquidity to gradually liquidate/deliquidate the collateral without penalty fees. When collateral loses value, the platform will convert $ETH to other stablecoins like $USDC to maintain a safe distance from the liquidation price.

LLAMMA uses a system of “liquidity bands'' under the hood to manage the liquidation of collateral in a more gradual and predictable manner. This means that instead of depositing collateral at a specific liquidation price, users deposit it over a range of liquidation prices. As the price drops, the contract tracks which band is "active" and in the process of being liquidated.

To use LLAMMA, liquidity must be added to at least five bands, up to a maximum of 50. The larger the range of bands, the sooner the position begins liquidating, but more gradually. In contrast, a smaller range means the liquidation process can be sudden. This approach is similar to Uniswap v3's liquidity ranges but is more useful as it provides a passive LP solution.

The addition of crvUSD as a new collateral type on Curve's liquidity pools could attract more liquidity providers seeking greater capital efficiency with their funds. The reduced risk of liquidations with LLAMMA may also entice risk-averse users looking to incorporate leverage into their DeFi strategy.

LLAMMA's constant rebalancing of users' collateral can generate more trading volume in Curve's pools, resulting in increased fees for the protocol and veCRV token holders. Additionally, crvUSD loans are expected to incur borrowing fees, creating a new revenue stream for the protocol.

Incumbents & Contenders Compared

Below is a quick comparison of the five protocols we discussed. Apart from qualitative aspects, I have highlighted the velocity of the stablecoins by looking at the on-chain volume versus its market cap. The velocity of stablecoins is important because it can provide insight into the adoption and usage of the stablecoin as a means of exchange within the broader cryptocurrency ecosystem.

The velocity of stablecoins can also have an impact on their stability. A stablecoin with a low velocity may be more vulnerable to market fluctuations, as a sudden increase in demand or decrease in supply could lead to significant price swings.

The Pioneers

VI. Gyroscope Protocol ($GYD)

Gyroscope is another new stablecoin GYD soon to launch on Ethereum. Gyroscope seeks to innovate at different levels, starting with the collateral type. Gyroscope accepts Balancer pool tokens as collateral, which are made up of various token assets and stablecoins. These assets are divided into separate vaults, which are designed to minimize the risks of contagion and composability.

The design of Gyroscope's vaults is such that even if one of them fails, the other vaults remain unaffected, and there is no spill over effect on the system. This means that if the stablecoin becomes undercollateralized due to a vault failure, the autonomous fallback mechanism kicks in to support the stablecoin’s price. This fallback mechanism uses the reserves and yield generated from the remaining unaffected vaults to support the price of the stablecoin, ensuring that it remains stable at $1.

At the heart of Gyroscope innovation is its Dynamic Stability Mechanism, which can be seen as an improved version of Maker’s PSM. In the event that the available funds are not enough to cover all the stablecoins outstanding, Gyroscope's autonomous price quotes come into play, stabilizing the stablecoin market price and creating disincentives for speculators to run on the reserves. This means that speculators have a rationale to expect a full system recovery, leading them to ‘arbitrage’ the stablecoin price.

Why would this element be important at all?

Let us consider an example where a stablecoin, which is backed entirely by reserves, suffers a sudden shock and the value of its reserves falls below the value of the outstanding stablecoins. In this scenario, if there are 100 units of stablecoin in circulation and only $80 worth of assets in reserve, the first 80 units redeemed can be exchanged at a desirable 1-to-1 peg. However, the remaining 20 units will be left with no recourse, as the liquidity has been depleted. This characteristic is what gives rise to a 'bank run' scenario, where everyone seeks to redeem their stablecoins first, resulting in the last 20 units becoming worthless and a burden for their holders."

We can see that this system may not be the most durable and sustainable model, particularly when contemplating a scenario in which the protocol undergoes a brief period of under-collateralization. For instance, suppose something bad happens to the collateral, resulting in a situation where there are only $98 worth of assets supporting 100 stablecoins that are currently in circulation. While the $2 worth of collateral could be fairly easily recuperated via protocol revenue or other mechanisms in the medium term, rational market participants may still rush to redeem their stablecoins due to the fear of being left with worthless assets once all the collateral has been depleted. This reaction could trigger a run on the stablecoin, exacerbating the problem.

Here's how Gyroscope's DSM mechanism would handle redemption even when the collateral falls below 100%. When the number of redemption surges and reaches the circuit-breaker phase, the redemption rate decreases, and the bonding curve of the redemption market offers diminishing redemption quotes as a circuit breaker. This mechanism discourages runs and attacks on the currency peg, while still permitting users to exit.

Furthermore, Gyroscope provides rational incentives to bet on the stablecoin returning to its target price, as the redemption price autonomously rebounds back to the stablecoin's target price once the circuit breaker phase concludes. Interestingly, this design proposal has sparked discussions in MakerDAO to enhance their own PSM.

UXD Protocol ($UXD)

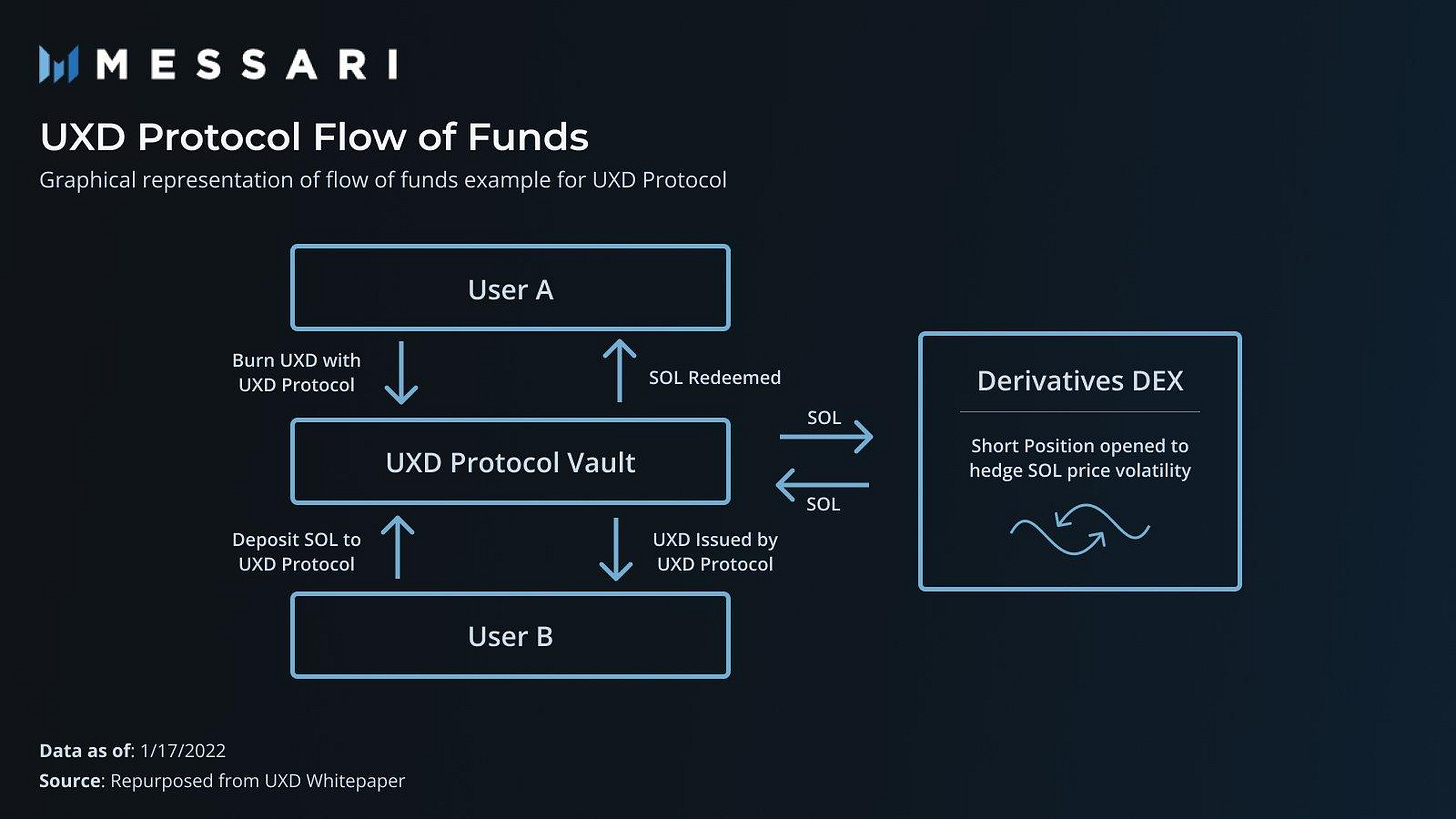

The UXD protocol is a new stablecoin protocol that was first launched on Solana that seeks to use delta-neutral position to back the UXD stablecoin.

To achieve this, users deposit crypto collateral and receive newly minted UXD tokens in return. The protocol then shorts the equivalent amount of collateral to achieve a perfectly hedged position, meaning that the price of the underlying collateral does not change. This means that if the price of collateral falls by -10%, the deposited asset would lose -10% of USD value, but at the same time, the short position would gain +10% of USD value, resulting in a net 0% move of UXD's collateral in USD terms.

The UXD protocol relies on arbitrageurs to maintain the perfect peg to the USD. If the price of UXD deviates from $1.00, traders can deposit or redeem UXD for collateral and earn a risk-free profit by arbitraging the token back to the peg. This unique algorithmic design enables the protocol to simulate stable assets as collateral while using volatile assets to back each UXD token 1:1 with decentralized assets.

When a user wishes to redeem UXD for collateral, they burn UXD tokens with the protocol and receive the exact USD amount in the collateral token of their choice. The protocol then closes the short position on the collateral exchange for the exact dollar amount of UXD burned, and the freed up collateral is withdrawn to the UXD protocol and returned to the user.

In contrast to CDP stablecoins, the UXD protocol could allow for faster and more efficient scaling of its supply because it only requires stable-like assets as collateral, rather than a corresponding amount of USD value. This feature allows UXD to maintain stability while also being decentralized and resistant to censorship.

Conclusion – what are stablecoins competing for?

In the crypto ecosystem, money-printing is a coveted role, and stablecoin projects are vying for position to become the predominant medium of settlement for DeFi liquidity. So, what exactly are these stablecoins competing for?

Two approaches emerge: Acting as an intermediary to pool together yield-generating assets and issue a non-yielding asset, which can be seen in centralized stablecoins like Circle, Paxos and on-chain stablecoins such as FRAX and Maker’s RWA vaults.

The second approach entails the credit creation approach, which involves the collection of interest from users seeking leverage, primarily through the offering of loans as seen in DAI, LUSD and GHO.

The demand for stable stores of value is expected to continue growing in the crypto ecosystem, and the competition for dominance is well underway. We are currently witnessing the "free banking" era of DeFi, where multiple money-issuers are vying for supremacy. Whether the Contenders can gain significant traction against the established Titans, or if the pioneers can meteorically rise to the top, remains to be seen.

References

https://tokenterminal.com/terminal/projects/makerdao/financial-statement

makerburn.com | Dai Stats | MakerDAO - by Michael Nadeau - The DeFi Report

https://forum.makerdao.com/t/alm-framework-for-makerdao/12994

FRAX Finance: From Monetary System to DeFi Matrix - Mint Ventures

Frax: Every Decentralized Stablecoin Will Become a Central Bank

[FIP - 188] Increase CR to 100% - Governance Proposals | How Frax beats the Rest

Can on-chain stablecoins break through a fiat-dominated market

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.