What ATOM 2.0 means for Cosmos: Bullish & Bearish Takes

Deep dive on the biggest proposal for $ATOM

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

To call Cosmos an “ecosystem” is at times controversial.

Yes, Cosmos is probably the most diverse ecosystem in crypto today, after Ethereum.

It was where the novel concept of liquid staking was first explored, where the largest exchange has chosen to build its chain, where one of the earliest DAO projects has decided to set foot, and also where the $60B disaster that was Terra Luna decided to build prior to its collapse.

But unlike on Ethereum, where applications deploy smart contracts onto the mainchain, most projects building “in Cosmos” are simply utilizing its open source “blockchain-in-a-box” SDK and consensus mechanism, Tendermint. As with most public goods, Cosmos Hub - the central hub where people can stake $ATOM tokens to earn block rewards - does not capture much value from the activity within this loosely organized universe of blockchains.

In other words, Cosmos has created a lot of value in crypto (~$13B, to be exact), but has to date captured little of it.

So, Cosmos announced its ATOM 2.0 plans to change that.

This week, we prepared a 30-page report for Blockcrunch VIPs to do a critical deep dive. We will cover:

Part 1: Cosmos Recap

“The Cosmos Stack”: Cosmos SDK, Tendermint, IBC

Cosmos Hub: What is it Good For?

ATOM: “Cursed Coin” or Untapped Value?

Part 2: ATOM 2.0

Part-by-part ATOM 2.0 Breakdown

Why liquid staking helps reduce issuance

Interchain security and the rise of minimum viable app chains

Cosmos’ unique MEV problems

Interchain Allocator

Part 3: The Bull & Bear Cases for ATOM 2.0

3 Bullish Developments

2 Bearish Trade offs

Cosmos - The NATO of Crypto

The defining trait of the Cosmos ecosystem is sovereignty.

For those of you who have suffered me since 2019, you may recall my (stolen borrowed) analogy of Cosmos being crypto’s NATO: a somewhat loose alliance of blockchains with their individual sovereignties, monetary policies and use cases, united under a brand.

Positioned as the Internet of Blockchains, Cosmos is distinct from monolithic chains like Ethereum, where different blockchain verticals (DeFi, NFTs etc) compete for block space. Cosmos chains are interoperable chains that are individually optimized to cater for the different activities, allowing for high-speed transactions with fees as low as $0.01.

CoinGecko estimates there are 13,000+ unique assets in Cosmos. While not all of these are individual blockchains, Cosmos is the indisputable destination for developers who want to create their own blockchains quickly and with a high degree of customizability.

This is all thanks to the Interchain Foundation, which developed the “Cosmos Stack”: Cosmos SDK, Tendermint, IBC (personally, I prefer the Cosmos Trinity, but it’s a bit grandiose).

According to Electric Capital’s report, Cosmos was the 3rd most popular chain for developers in 2021 and its token, ATOM is the 13th largest blockchain in market cap.

IBC - Trading Within NATO

While giants like Binance Smart Chain (market cap: $46.8B; fully diluted valuation: $57.3B) are considered by the Cosmos team to be part of the Cosmos Network, they are not necessarily inter-connected with other chains in the Cosmos Network.

To complete our NATO analogy, sovereign chains within Cosmos need to set up trade routes before they can be interoperable with each other. This comes into the form of IBC (Inter-blockchain Communications), an interoperability protocol that allows messages to pass securely between sovereign chains. We covered the design and security implications of IBC in an earlier memo here.

Being IBC-enabled allows chains to form secure connections with each other without relying on third-party built bridges, which we learnt in the past years have been massive honeypots for hackers.

Cosmos Hub: What is it Good For?

For every chain to be connected to each other in Cosmos, every single one of them must run light clients of every other chain in the ecosystem.

While this is highly secure, and running light clients is less intensive than running full nodes, it isn’t exactly as simple as sending a friend request on Facebook either (assuming any of you still use it). It can get unwieldy once we get to hundreds - even thousands - of app chains!

This is where Cosmos Hub comes into the picture.

The Cosmos Hub is Proof-of-Stake chain, secured by its token $ATOM, and functions as the central Schelling Point for all Cosmos app chains. Instead of needing to connect to every chain in the ecosystem individually, every app chain technically only needs to connect to the Hub and will be one hop away from every other chain.

With ~$2B staked value securing the chain, Cosmos Hub is also the most secure chain in Cosmos for users to store their Cosmos ecosystem assets.

Despite the compelling proposition for chains, IBC transactions into and out of Cosmos Hub are dwarfed by Osmosis - the 5th largest app chain on Cosmos today by market capitalization. This is likely due to the fact that Osmosis is home to the most liquid venue to trade most Cosmos ecosystem assets, and as such setting up direct connections between app chains and Osmosis itself is the most efficient solution to interoperability.

Extending this logic further: if the ascendancy of Cosmos Hub is threatened by popular app chains in the future, just what good is the Cosmos Hub?

By extension…what good is the $ATOM token?

Let’s get into it, shall we.

$ATOM - A “Cursed Coin” or Untapped Value?

$ATOM is perhaps a sound a rebuttal to the fat protocol thesis - an asset which doesn’t seem to benefit much from the burgeoning growth of activity on protocols built on top of it.

A dramatic example can be see in Binance’s $44 billion BNB chain, which is built using the Cosmos Stack. In comparison, ATOM commands a market capitalization of less than 1/10th that.

While an imperfect metric, $ATOM’s weak value accrual is best exemplified when comparing it to quotient of a Layer 1’s market capitalization and the aggregate market capitalization of assets in their respective ecosystems, as seen in the table below.

A primary reason for this phenomenon is the lack of fee accrual to Cosmos Hub. Currently, only assets that route through Cosmos Hub when traveling to other chains accrue fees to Cosmos Hub. Given the ease (and incentive to capture maximum value) of spinning up app chains on Cosmos, it is unlikely for there to be more applications built natively on the Cosmos Hub, than for there to be app chains. (in fact, this was a matter of contention when Osmosis was first started - some community members wanted it to be an application on Cosmos Hub, the team wanted it to be its own app chain!).

As Cosmos Hub does not capture intra-chain transactions, i.e. transactions within the sovereign chains, the only way for $ATOM to capture significant value from the Cosmos ecosystem is if significant value is transferred between app chains via the Hub.

To draw an analogy, consider the Cosmos ecosystem as a nation with sovereign city-states (app chains), connected by a large highway (Cosmos Hub), and many other smaller highways (IBC connections). The nation’s GDP can grow substantial from increasing activity within the city-states without the highway toll booth earning a single dollar, if no cross-city commerce occurs!

Even cross-city commerce does occur, it is unlikely for this to rival the activity that happens within a city-state (e.g. simply contrast the fees earned by L1s and the fees earned by bridges between them…).

In short, the value captured by the highway likely scales sub-linearly with the growth of the nation’s output as a whole.

Furthermore, other sovereign chains like Osmosis can also act as hubs and facilitate inter-chain transactions, bypassing Cosmos Hub. As noted above, today, Cosmos Hub has fewer connections compared to Osmosis (41 vs 47), and facilitates approximately 50% of inter-chain volume compared to Osmosis.

Besides fundamental value accrual, $ATOM is also hampered by a highest-in class inflation schedule that could lead to constant sell-pressure (assuming validators sell at least partial rewards to recoup fiat-denominated fees).

Today, Cosmos Hub uses $ATOM emissions to supplement the yield from interchain transaction fee capture to incentivise staking. This is because the yield from interchain transaction fee alone would not be attractive enough to achieve the optimal staking rate for security, where 2/3 of ATOM’s supply are staked.

Furthermore, having 2/3 of $ATOM supply staked leads to significant capital inefficiencies and hinders growth and composability, and as such Cosmos favors a high inflation rate to ensure a consistently high float for its liquid token.

Breaking Down ATOM 2.0

To address the above and help $ATOM break from its “good project, horrible token” curse, ATOM 2.0 was born.

As an ambitious, multi-year plan put forward by core members of the community, $ATOM 2.0 seeks to do a few things:

Renew Cosmos Hub’s purpose as a provider of infrastructure services whose utility scales well with the growth of the interchain network

Unlocking liquidity of $ATOM while reducing inflation

Introduce new revenue streams for better value capture on Cosmos Hub

This is done via the following features. Let’s get the simple ones out of the way first - as each of the features fees into the next!

Liquid Staking: Promote $ATOM Liquidity

Currently, there are 200 million ATOMs staked on Cosmos Hub. As of writing, this amounts to $2.44 billion of liquidity locked in to secure Cosmos Hub. ATOM 2.0 plans to introduce in-protocol liquid staking primitives, where liquid staking systems can be safely built to unlock the liquidity of the otherwise illiquid staked ATOMs.

Before liquid staking, ATOM holders had to choose between staking with Cosmos Hub or using it for DeFi activities on other chains. This either/or situation is highly inefficient because:

Both Cosmos Hub or DeFi applications have to end up paying more (through emissions) to attract liquidity

Creates unnecessary competition between securing the network and the growth of the ecosystem

With liquid staking, users can now stake their $ATOMs to earn yield while securing Cosmos Hub, and simultaneously participate in other DeFi activities such as providing liquidity for AMM pools on Osmosis.

$ATOM holders can finally have their cake and eat it too.

Both Cosmos Hub and protocols in the Cosmos network can reduce their dependence on token issuance while achieving higher security and activity levels respectively.

Reducing $ATOM’s Issuance: Reduces Selling Pressure

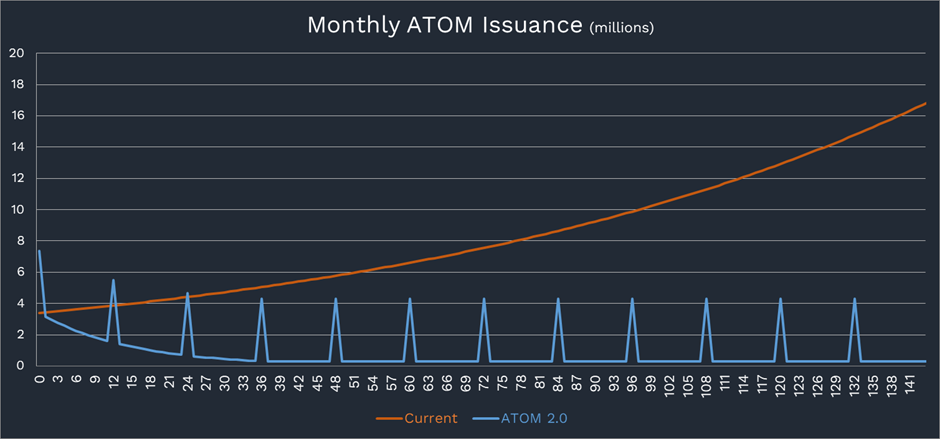

With liquid staking reducing Cosmos Hub’s reliance on emissions to balance its security level versus network liquidity, $ATOM’s high inflation can now be resolved. $ATOM 2.0 proposes a new monetary policy that reduces $ATOM’s emissions over 2 phases:

The first phase is a 36-month-long transition period whereby $ATOM emissions will decrease by 6.5% monthly until it reaches 300,000 $ATOM per month.

The gradual decrease over 36 months allows sufficient time for consumer chains (the new term for app chains) to join the Interchain Security program, which would further reduce Cosmos Hub’s reliance on issuance to subsidize security (more in a later segment).

In this period, the Cosmos community can also develop the social infrastructure capable of effectively managing Cosmos’ sizeable treasury.Following the 36-month transition period is a steady state, where the 300,000 ATOM monthly issuance will continue indefinitely.

The more contentious part of the proposed issuance is the funding of Cosmos Hub’s Treasury, which the proposers have since revised. Under the revised plans, the treasury will instead receive 12 tranches of 4 million $ATOMs for 48 million $ATOMs in total. The treasury will receive the 1st tranche upon initiation of the transition phase, with the remaining issued at any time upon $ATOM holder’s vote.

Readers must note that even accounting for issuance to the treasury, cumulative issuance and inflation under this new proposed model is significantly slower than the current state. Effectively, the new model has shifted the growth of total $ATOM supply from exponential to linear growth.

Interchain Security: Tapping into Cosmos Hub’s Economic Security

Despite the general inability of the Cosmos Hub to effectively capture value, it is undeniable that 200 million staked $ATOMs - worth $2.44 billion - is a massive asset. Interchain Security is a proposed feature that will put this security to the forefront of Cosmos Hub’s value proposition.

While the Cosmos Stack has already made it comparatively easier for the enterprising Joe/Jane to spin up their own blockchain, there remains one last significant barrier for developers to spin up their app chain - incentivizing and maintaining their own set of validators to secure their app chain!

Instead of concerning themselves with bootstrapping network security, Interchain Security allows app chains to tap into Cosmos Hub’s well-established set of validators.

Cosmos Hub’s validators earn a share of the transaction fees and app chain’s token issuance in return for producing blocks and securing any app chain’s network.

By renting security from established provider chains, developers on consumer chains can focus more on building great products rather than stressing about courting validators and maintaining network security: i.e. focusing more on the app part, rather than the chain part, of app chains.

For provider chains like Cosmos Hub, the additional revenue helps to reduce the reliance on issuance subsidies, making it possible to reduce inflation (as detailed in the above segment) while maintaining high levels of security.

In addition, it allows $ATOM better accrue value that is in line with Cosmos’ growth, since $ATOM stakers earn a portion of the consumer chain’s token issuance on top of the transaction fees.

Interchain Scheduler: Tokenizing MEV Negotiations On-chain

Assuming Interchain Security gives rise to a whole new wave of app chains, the volume for cross-chain transactions likely increases within Cosmos - and with it the ability for savvy traders and bots to extract MEV.

For clarity, Maximum Extractable Value (MEV) refers to the maximum value available for extraction from block production by including, excluding, and rearranging transactions in a block.

MEV emerges on the blockchain in 3 primary ways:

Arbitrage MEV – profiting from the price difference of the same token on different decentralized exchanges in a single atomic transaction

Liquidation MEV – competing to be the first or even creating the opportunity to earn liquidation fees for repaying liquidated loans on lending protocols.

Sandwich trading MEV – front-running a large buy trade on a decentralized exchange, forcing the trader to take maximum slippage on their transaction and then selling immediately after at a higher price caused by the large order

With the exception of sandwich trading, arbitrage and liquidation MEV are arguably necessary to maintain DeFi protocols’ robustness. However, at the network layer, the gas wars that all MEV operators compete in leads to network congestion and high gas prices for everyone else trying to submit regular transactions.

Since MEV is a highly profitable business (Flashbots estimates at least $675 million has been extracted on Ethereum since 2020), it is unavoidable and inherent in all public blockchains – Cosmos is no exception.

In fact, MEV is a more significant issue for Cosmos.

In many Cosmos chains such as Juno and Osmosis, transactions are ordered on a first-come-first-serve basis. This means those who monitor the chains for arbitrage opportunities (“searchers”) are incentivized to co-locate their arbitrage bots near validators and to spam validators with as many transactions as possible to call dibs on block space.

The transaction spamming leads to many obvious problems that impact end users: since there’s no way to prioritize “more important” transactions via a fee market, there’s no way to execute crucial transactions first - which occurred during the Terra depeg event.

In addition, spamming of transactions leads to wasted block space, and the co-location requirement means validators are actually incentivized to run these searcher bots themselves, centralizing the ecosystem further. While MEV on Cosmos is still relatively nascent (Skip Protocol estimates $7 million has been extracted on Osmosis, the most active Cosmos chain), Cosmos’ inter-chain capabilities present significant MEV opportunities as network activities scale up.

$ATOM 2.0 proposes the Interchain Scheduler to tackle potential problems associated with MEV.

In short, it is a secure block space marketplace that brings the otherwise off-chain MEV negotiations on-chain.

It lets validators sell future block space, in the form of NFTs, to whoever wants to buy them - mostly other protocols.

This is a wild idea, but if it works out would ideally achieves a few things:

Allow MEV operators to guarantee block space and cross-chain executions, thereby reducing the need for them to spam the network and in turn, reducing network congestions and issues associated with network spam

Bring MEV negotiations to the protocol level, allowing app chains and token holders to benefit from MEV rather than just validators alone

On-chain MEV negotiations also reduce the centralization of ecosystems

Increase demand for $ATOM by using it as the settlement asset

How it works is also deceptively simple:

An app chain commits to sell a portion of their block space e.g. one block every minute

Future block regions to be sold are represented as NFTs

The NFTs are periodically auctioned to buyers (and may even be traded on the secondary markets)

The NFT is then redeemed

Owners of the tokenized block space hold the exclusive right to order transactions for the specific block space, guaranteeing the execution of their transactions and inter-chain atomicity

Upon successful block execution, a split of proceeds from the Scheduler auction are sent back to the partner chain and Cosmos Hub Treasury

A simplistic example would be an arbitrage opportunity between two app chains.

Say Coin X is listed on Chain A at $10, and on Chain B at $9 because of a massive liquidation that just occurred on Chain B. The savvy arbitrageur would want to purchase the asset on Chain B, and sell the asset on Chain A, until the price converges back to $10. To guarantee atomic execution, the arbitrageur will pay (up to the amount of the expected profit, $1 net fees), to reserve the block space on Chain A and B for this transaction to occur and not be front-run.

The ability to tokenize block space is made possible by Tendermint’s latest ABCI++ upgrade. The Scheduler also allows novel mechanisms, such as enabling chains to designate block space for other partnered chains, analogous to a free trade agreement, specify allowable MEV or become the substrate layer for service providers to create novel, MEV-native applications. VCs, listen up!

Readers should also note that the Interchain Scheduler will only be available to Interchain Security consumer chains at the start and only made available for other app chains in the future.

Interchain Allocator: Managing Cosmos Hub’s Treasury

The final piece of the puzzle - the Allocator.

When the above proposed changes are executed and things goes well as planned, Cosmos Hub’s Treasury is set to receive a sizable amount of funds, specifically the:

Up-front tranche of 4 million ATOMs/$48.8 million, followed by 11 other tranches for a total of 48 million ATOMs/$585.6 million (dollar value calculated using current ATOM price)

Revenue share from Interchain Allocator (actual percentage yet to be decided)

These funds, if managed properly and put to good use, can be highly beneficial for the entire Cosmos ecosystem and $ATOM holders.

The Allocator is a collection of tools to effectively manage this treasury in a decentralized way. For example, the Cosmos Hub treasury could be used to fund a new consumer chain’s treasury with $ATOMs in exchange for their chain token for an agreed lockup period. This way, the incentives for both parties are aligned – new projects receive the funding necessary to kickstart their project and network effect as an Allocator recipient. At the same time, the Cosmos Hub treasury benefits from potential token price appreciation and a more robust interchain economy.

The Hub’s treasury funds could also be used to bootstrap liquidity for AMM pools, act as a delegate to participate in other chain’s governance, and be used as collateral for an ATOM-backed stablecoin – essentially anything that credibly aids in achieving the Allocator’s mandate of:

Increasing the velocity of new Cosmos project creation

Accelerating project growth and sustainability

Expanding the economy for cross-chain block space

Aligning incentives between new projects and the Cosmos Hub

Making $ATOM the most desirable, widely deployed reserve asset in the interchain

For clarity, the Allocator won’t be alone in allocating the Hub’s treasury. It will also fund sub-DAOs with various focuses and strategies, such as other Allocator DAOs with differentiated theses for diversity, DAOs that focus on liquidity provision or DAOs that provide consumer chains with uncollateralized loans.

The $ATOM community and $ATOM holders can form/join these sub-DAOs and bond their liquid $ATOM stake for varying durations to get greater voting power within the DAO. Cosmos Hub may grant these DAOs a recurring funding fee and performance-dependent bonus in exchange for their service and putting their capital at risk.

In essence, the Allocator provides the necessary tooling to turn the Hub’s treasury into an on-chain fund, which will fund other sub-DAOs that will utilize the funds to grow the Cosmos network with Cosmos Hub and $ATOM at the center.

What To Expect

Before you get too excited, the proposed changes/upgrades are still subjected to changes and will be rolled out in phases over the next 1 – 3 years.

As for immediate next steps, we can expect the following:

First, the ATOM 2.0 proposal must pass the on-chain community voting on 31st October 2022. The community has mostly signaled their intent to support the proposal – except for ATOM’s issuance. Since then, the proposers have already incorporated the feedback of the ATOM community and reworked ATOM’s issuance schedule (which we used for the segment above); the proposal likely is approved on voting day.

The roll-out of liquid staking and Interchain Security is scheduled to launch in Q1 2023. The change in ATOM issuance will likely launch after liquid staking and Interchain Security has proven to be stable and sufficient to replace the hefty issuance subsidy to avoid risk security issues.

The proposers are already working on building the Interchain Allocator and should launch around the time that the treasury receives the 1st tranche of ATOMs (together with the change in issuance). It is unclear at this point when the Interchain Scheduler will be launched, but given the complexities, the community should expect it 2 – 3 years out.

Bull & Bear’s Case for ATOM 2.0

Disclaimer: The following segment does not constitute financial advice nor inducement to purchase any assets. Blockcrunch is not licensed to provide financial advice, and the following model is presented purely for educational purposes and does not represent Blockcrunch’s investment view.

And now - for the part you all came here for - our assessment of $ATOM 2.0.

Below, we’ll outline a few key developments that we view as bullish for $ATOM, and others that are questionable at best in terms of driving value to $ATOM.

Bull’s Take

Interchain Security Drives Significant Value to $ATOM

The obvious benefit that positioning Cosmos Hub as the primary provider of security has is that it captures the value of any new app chain that opts into interchain security.

If there’s one thing crypto development has taught us, however, is that as long as Fat Protocols continues to hold true, the allure of verticalizing into the infrastructure layer for popular applications is a difficult one to resist (e.g. StepN creating its own dex, dYdX/Compound/Binance/Bored Ape Yacht Club their own respective chains).

While most chains over time may seek to capture more value by relying less on Cosmos Hub and more on their own validator set as they mature, ATOM likely still stands to gain the most value as the primary outsourced security provider for large protocols or companies who:

Are looking for a reliable way to expand their business offering into Cosmos;

Don’t expect to have a majority portion of their business on Cosmos and as such;

Are less likely to want to incur additional operational and financial risks in order to capture maximum value via bootstrapping their own validator set

One notable example is Circle, the issuer of the USDC stablecoin. Last week, Circle announced that they will be launching on Cosmos via a generic asset issuance consumer chain secured by Interchain Security. Other chains like Quicksilver have also signaled their intention to participate in Interchain Security, and more are likely on their way.

Interchain Scheduler Removes Reliance on Centralized MEV Mitigation

MEV is1 becoming an increasingly important priority for developers in crypto. While it is a deeply explored topic on Ethereum, MEV on Cosmos is relatively new. One of the key incumbents and potential competitors to the Interchain Scheduler is Skip Protocol, which allows validators to boost their staking rewards similar to how Flashbots’ MEV Boost, which we explained in layman terms in a memo last memo.

Similar to Flashbots, Skip currently uses a centralized relay, effectively operating an off-chain market between searchers and validators. In short, searchers get to pocket arbitrage profits without clogging up the chains, and validators get to earn more from the tips arbitrageurs pay to prioritize their transactions. Win-win!

However, the centralized nature of the relay and the increasing relevance of MEV (e.g. 90%+ of validators on Ethereum are plugged into Flashbot’s centralized relay) has real-world implications. For instance, post-OFAC sanctions, Flashbots has committed to censoring transactions that go through their relayer, which can very likely impact Skip should it remain reliant on a centralized server in the long term.

The Interchain Scheduler effectively creates an on-chain market for block space, creating an important alternative to limit Cosmos’ reliance on centralized vectors of censorship and further bolstering ATOM’s use case should it become the preferred currency of settlement for the Scheduler.

Long Term Inflation is Significantly Reduced for $ATOM

While much chagrin has been expressed by the general Crypto Twitter crowd on $ATOM’s supposed massive increase in short-term inflation post $ATOM 2.0, it is worth noting that the annual inflation on a marginal basis will still be lower than what came before, especially after the third year, where inflation will taper off further.

In addition, a significant part of the new inflation will also be dedicated to the Treasury, which is unlikely to hit the market in the short-term. That being said, in the first 2 months of the new monetary policy being in place, inflation will be higher (on a monthly basis) compared to the original emissions scheme.

All in all, we see the change in inflation as having minimal impact on $ATOM’s outlook - it is the long term implications of this reduction that will bear much more significant impact, which we will examine below. (Update: as of publishing, new proposals are being put forth to further change the emissions schedule of $ATOM)

Bear’s Take

Cosmos Hub Faces Cannibalization From Other App Chains

Previously, we discussed how app chains like Osmosis already have more IBC volumes transacting in and out of it compared to Cosmos Hub, likely due to the liquidity on its AMM. Besides the economic leverage Osmosis has, a new mechanism is being proposed that could further threaten the dominance of Cosmos Hub as the Schelling point for app chains seeking to utilize IBC.

In the recent Cosmosverse event, Sunny Aggarwal, co-founder of Osmosis, laid out his vision for a concept known as “mesh security”. The concept was simple: if we can allow $ATOM stakers on Cosmos Hub to validate transactions for other Cosmos app chains, why not allow all app chains to validate to all other app chains via IBC?

This is actually a more evolved version of an idea proposed in the last Cosmosverse (2021) called Superfluid staking, whereby liquid derivatives of staked assets can be sent across chains to be staked and used as validating stake on the destination chain.

The savvy reader might be quick to catch on to the fact that this could lead to centralization quickly - for instance, what if Binance puts the full weight of their BNB stake to validate for every single new app chain that spins up? Does the entire Cosmos ecosystem effectively become the Binance ecosystem?

To counter this, Sunny proposes a few mechanisms, namely:

Cross-staking (staking on one app chain to validate for another - e.g. staking $OSMO on Osmosis to validate for Juno transactions) must be kept at sub 1:1 voting power, such that the best way to gain exposure and influence governance on specific app chain is still to stake natively on said chain

A cap will be maintained for an app chain’s total stake that comes from another chain (e.g. no more than 10% of the total stake securing Osmosis must be coming from $JUNO)

From app chains’ perspective, given that most of Cosmos based assets likely have liquidity pools on Osmosis’ decentralized exchange, they are economically incentivized to ensure Osmosis remains secure. Likewise, by validating for other chains, Osmosis also increases value for its token $OSMO.

While proponents of this idea may argue that Interchain Security (relying on Cosmos Hub for “outsourced” validation) is a subset of Mesh Security, it is also easy to see how the promotion of the latter could weaken the value proposition of $ATOM as the sole asset that offers universal, cross-chain security.

In addition, a Cosmos ecosystem that fully runs on Mesh Security and without a dominant Hub may lead to coordination complexity should things go awry. While we expect the Osmosis team to fully push ahead for a Mesh Security future, we also foresee some pushback from $ATOM stakers and validators, especially if Osmosis leverages its economic significance to projects and becomes the dominant hub, over Cosmos Hub.

Further, in light of $ATOM validation rewards being reduced dramatically under ATOM 2.0, should app chains like Osmosis continue to generate significant fees for their stakers and should stakers still be able to have partial exposure to Cosmos Hub by staking on Osmosis, the incentive to stake directly on Cosmos Hub can be gravely diminished.

Limited Incentive to Use Interchain Scheduler

With the Interchain Scheduler, validators can commit to auctioning off blocks at fixed intervals to potential buyers on a market place, which itself is another app chain / consumer chain.

While the specifics of implementation are still being ironed out, it is likely that installing an on-chain marketplace will be extremely complex considering the nascency of MEV, let alone cross-chain MEV. It also perhaps conflicts with the existence of the off-chain marketplace that is Skip. Core members of the Cosmos community also seem to have doubts that the Interchain Scheduler will become a meaningful part of Cosmos’ economic activity as teams such as Osmosis do not seem to offload a core part of their economic activity to another chain.

On the bright side, in our conversations with the Skip and Cosmos teams, it seems there is a genuine intention to collaborate, and Skip has indicated that the their solution can be made to work with the Scheduler.

Perhaps more pertinently, app chains that do not opt in to Interchain Security likely don’t have a strong incentive to actually use the Scheduler due to two reasons:

From a value accrual perspective, it makes little sense for an app chain to leak value to $ATOM, rather than capture it natively, by incorporating the Scheduler.

Assuming our hypothesis that most app chains in Cosmos will likely seek to capture more value by relying more on their own token to secure their network (as opposed to relying on Cosmos Hub), it follows that in the long term the case for most app chains to adopt the Scheduler is a tough one to make.Currently, the floor price for block space drops severely with any additional latency, so a fully onchain marketplace likely faces an uphill battle relative to faster, more centralized relays. In addition, the marketplace potentially privileges actors with low cost of capital who can buy block space ahead of time just to hold inventory.

Final Words

All in all, we view the community’s push for a total revamp of ATOM 2.0 as a positive step forward in addressing one of the longstanding issues with ATOM - its inability to capture value.

While ideas like the Interchain Scheduler are highly experimental and in no way guaranteed successes, Interchain Security is highly intuitive and a logical step for ATOM to take.

In the long term, balancing Cosmos’ philosophy of chain sovereignty while increasing Cosmos Hub’s significance as a central source of security will be a delicate balance to make. In the near term, we will be monitoring the following developments which we view as key to ATOM’s ability to retain value:

Community support for Mesh Security vs. a Cosmos Hub-centric future

Further considerations on emissions schedule and response from validator community

Development of MEV projects such as Skip and their interoperability with the Interchain Scheduler

Resources

ATOM

Whitepaper (v1.1, the one we used for this memo)

Inflation details

ALGORAND’s here

Others

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.