The Merge: 13 Questions You Were Too Embarrassed to Ask

Layman's guide to the most important crypto event this year

This research memo is for educational purposes only and not an inducement to invest in any asset. This is a free sample - subscribe to Blockcrunch VIP to receive members-only in-depth project analysis, valuation models and exclusive AMAs.

With the Merge just days away, many readers are scrambling to find out if there’s anything they can do to prepare themselves.

The Blockcrunch team has scoured dozens of pages of blogs, forums, and interviewed industry experts (one of which is now public on our podcast) to prepare an accessible, layman-friendly list of FAQs below as a community resources. No technical knowledge required!

Special thanks to Anthony Sassano of the Daily Gwei, Eylon Aviv of Collider VC for their help.

What is the Merge?

The Merge is the most significant update in Ethereum to date which will transition the blockchain fully to Proof of Stake.

If you’ve used any application on Ethereum (e.g. buying NFTs on Looksrare, trading on Uniswap, sent a USDC transaction on Ethereum), you’ve been interacting with the Proof of Work chain. This is the chain that has been processing transactions since 2015.

Since December 2020, there is a separate blockchain running in parallel to the Proof of Work chain, called the Beacon Chain. Short of processing actual transactions, the Beacon Chain has pretty much been live for almost 2 years.

The upcoming Merge “merges” the Proof of Work’s chain history since inception with the Beacon Chain, after which the Beacon Chain will become the main consensus engine for Ethereum. This will happen through two upgrades - namely Bellatrix (which prepares the Beacon Chain to be Merge ready), and Paris (which changes ETH’s consensus engine from Proof of Work to Proof of Stake).

However, users don’t really need to care about any of these!

So why is this important?

The Ethereum blockchain currently uses Proof of Work, which relies on computation-intensive miners and mining pools. Its goal since as early as 2016 was to transition to Proof of Stake, where instead of miners, we have validators.

Instead of spending on mining hardware, validators lock up, or “stake”, their ETH to run validating nodes, which are about 99.95% less energy-intensive than mining. Non-technical ETH holders can also delegate their ETH holdings to validating services or exchanges.

By obviating the need to use elite hardware to secure the network, Proof of Stake will lower the barrier to entry for validators. In other words, the network will become more decentralized and more energy efficient.

Is it safe?

The Merge is a technically complex update for a network that is live - akin to swapping out the engine of a plane that is mid-flight! However, the process has been extensively reviewed and tested.

The Beacon Chain has already been running live since December 2020, proving its reliability and security, whereas the merge process itself has been done three times on Ethereum’s testnets - Ropstein, Sepolia, and most recently Goerli (on August 10th, 2022).

There were a few minor hiccups in the most recent Goeli testnet, namely:

There were 2 terminal blocks instead of 1, so nodes were confused as to which block was the right one

Validator participation dropped throughout the upgrade, which caused chain finalization to delay for more than 30 minutes. Part of the issue was attributed to faulty configurations by some client teams

It’s impossible to guarantee minor hiccups will not occur on mainnet, but it’s reassuring that the above hiccups were not remotely near existential and were mostly considered minor inconveniences.

When is it happening?

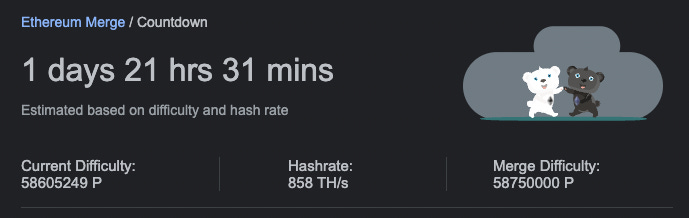

There is no firm, pre-set time for the Merge as the update is supposed to kick in at a specific total terminal difficulty (TTD) - or the difficulty required to mine the final ETH block.

The threshold set is at 58750000000000000000000, which in human terms is estimated to be in 20 hours (as of the time of this writing) and in lizard terms is about hissss hissss HISSSSSSS 🦎.

You can now view at the live estimated time simply by Googling “the Merge”!

Who will it affect?

If the Merge goes through smoothly, end users should not feel any change except for transaction times, which are estimated to reduce from 13 seconds to 12 seconds.

Staking on the Beacon chain has been live for a long time and existing stakers will not be affected except for some required updates. However, compliance may become a consideration as we will explore later.

Miners are most affected as they will become obsolete (more later).

Is there a risk of a contentious fork?

Because miners will effectively lose out on all their mining rewards, there has been some discussion on social media regarding whether there will be a contentious fork - as in miners continuing to validate for a Proof of Work based Ethereum as validators spin up the Proof of Stake Ethereum, both containing the exact history of transactions up to the point of the fork.

In reality, as the two largest stablecoin issuers Tether (USDT) and Circle (USDC) have signaled support for PoS Ethereum only, and many applications are dependent on either and/or both, the likelihood for a contentious fork gaining material organic adoption is low.

In addition, given the Merge is telegraphed years in advance, with ample social coordination, it is unlikely any contentious fork garners sufficient community support outside of a few select and opportunistic miners.

What was the recent OFAC ruling?

Recently, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, the privacy-focused DeFi application. In other words, all property or interests in Tornado Cash within the US are now blocked by the US and are required to be reported.

Because the associated penalties of violating a OFAC sanction are high, exchanges, centralized frontends for applications (e.g. Aave, Oasis), staking service providers, validators, validating service providers are all wary and have begun to censor certain addresses that interacted with Tornado Cash.

As a potential act of protest, small amounts of ETH were sent by an anonymous individual/ team from Tornado Cash to a variety of Ethereum addresses in an act known as “dusting”, including those held by high-profile accounts, resulting in Aave blocking access from those addresses to their frontend. This has since been lifted.

As an important caveat, there is no way to censor transactions at the contract level - Aave (and other dapps) can only censor addresses via their frontends. Tech-savvy users can still access smart contracts directly via alternative means.

How do OFAC sanctions affect Ethereum?

While the sanctions are a big deal, they became doubly complex because of the implications at the blockchain level. The sanctions don’t just affect applications frontends built on top of Ethereum, but also whether validators decide to process certain transactions.

For instance, if a validator based in the US processes a transaction that contains a Tornado Cash user, it is unclear whether they will be considered complicit with sanctioned activities.

This extends to staking providers, exchanges that provide staking services, and similar entities. Note that the official OFAC statement makes no mention of whether processing transactions from addresses that interacted with Tornado Cash constitute a violation of OFAC rules; however, considering the severe penalty, service providers seem to be erring on the side of caution.

Would staying as Proof of Work prevent this issue?

Unlike staking providers (e.g. Bison Trails, Staked, Coinbase Staking), many of whom are registered entities with public-facing brands in the United States, miners and mining pools are relatively less visible, so some make the argument that Proof of Work Ethereum may be more defensive towards this type of transaction-level censorship as they are less likely to be targeted by prosecutors.

However, with Proof of Work, social slashing (more later) cannot be implemented, and as such there is one less level of defense against transaction level censorship. In addition, the Ethermine mining pool has already begun censoring Tornado Cash transactions on Ethereum.

What is Flashbots and why do people think it will lead to censorship?

Flashbots is a research and development organization working on programs that make Ethereum more effective and efficient (mostly by mitigating MEV - more information here for those interested, but it is not strictly necessary for the purposes of this post).

Flashbots is the creator of MEV-Boost - a software for validators that allows them to boost their staking rewards up to 60%. MEV Boost is an implementation of the so-called “proposer-builder” separation in Proof of Stake Ethereum, wherein validators can sell block space to specialized third parties, called block builders, who collect and sequence the transactions to create a block.

The specifics of this are out of scope here, though the takeaway is this: given the reward boost that validators get by running MEV-Boost, any economically rational actor would incorporate it. As such, most validators have incorporated MEV-Boost.

However, Flashbots have publicly stated that their version of MEV-Boost will be OFAC-compliant, meaning any validator running it will be automatically censoring transactions that violate OFAC sanctioned.

So does that mean Proof of Stake Ethereum is censored from day 1?

An analogy for the censorship that is taking place currently: imagine if Ethereum is a restaurant. The restaurant’s tables are open to all, but it does have one rule. While most hungry visitors can be assigned to the first available table, only one seat is set aside specifically for patrons who have interacted with Tornado Cash before. While the wait time is unaffected for most patrons, those who have used Tornado Cash before likely end up having to wait in line longer.

Bringing this back to the blockchain world - even if majority of validators do censor certain transactions, non-OFAC compliant transactions will still get included into the blockchain by validators that do not censor. In other words, even if an address is deemed to have interacted with Tornado Cash before, it is highly likely that their transactions will still be processed, albeit with a bit of delay.

In fact, Flashbots has open-sourced their MEV-Boost codebase so others may create implementations that do not actively censor transactions. In addition, some have called for “social slashing” as a way to counter potential censorship (more later).

How are staking providers responding?

Currently, it seems that over 66% of the beacon chain validators will be adhering to OFAC regulations, including Lido Finance, Coinbase, Kraken and others.

In particular, Brian Armstrong, CEO of Coinbase has stated that should Coinbase be pressured to comply by censoring transactions, they will more likely shut down the business instead. It remains to be seen how staking providers will respond post-Merge.

What is social slashing and how is it related?

In light of recent censorship concerns, some have proposed social slashing as a solution. In short, ETH holders can vote to slash validators who actively censor. This creates a social-layer for Ethereum external to the codified rules of the network, which is understandably controversial to some.

Vitalik Buterin has signaled his support for such a mechanism on an informal Twitter poll as well, but development of social slashing remains to be seen.

There you go - 13 of the most commonly asked questions in the past few weeks as we head into the merge in about a day’s time. For those who want an even more in-depth breakdown, check out our interview below:

DISCLAIMER

This document and the information contained herein is not a recommendation or endorsement of any digital asset, protocol, network, or project. The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement. The risk of loss in cryptocurrency, including staking, can be substantial and nothing herein is intended to be a guarantee against the possibility of loss.This document and the content contained herein are based on information which is believed to be reliable and has been obtained from sources believed to be reliable, but Blockcrunch makes no representation or warranty, express, or implied, as to the fairness, accuracy, adequacy, reasonableness, or completeness of such information, and, without limiting the foregoing or anything else in this disclaimer, all information provided herein is subject to modification by the underlying protocol network.