Understanding the $40 Billion Luna Implosion: A Play-by-play

Breakdown of the Luna UST Crash

Blockcrunch VIP subscribers receive weekly research briefs for the price of 2 coffees a week. Prices go up every week until June but subscribers lock in their rate forever.

Last week, roughly $18B of value in the algorithmic stablecoin UST and $40B in the cryptoasset Luna were effectively wiped, with its impact rippling across the entire crypto asset class.

Many in the crypto space - let alone those outside - are still trying to put the pieces together to examine just how we managed to destroy an entire ecosystem over the course of a week.

We scoured the internet and put together what we think is a definitive timeline of major events below for Blockcrunch VIP subscribers.

We also spoke to Galois Capital - the hedge fund that sounded the alarm on Luna as early as January - on how they executed their Luna and UST short.

That conversation is available for free for all subscribers here.

How UST Collapsed: An Executive Summary

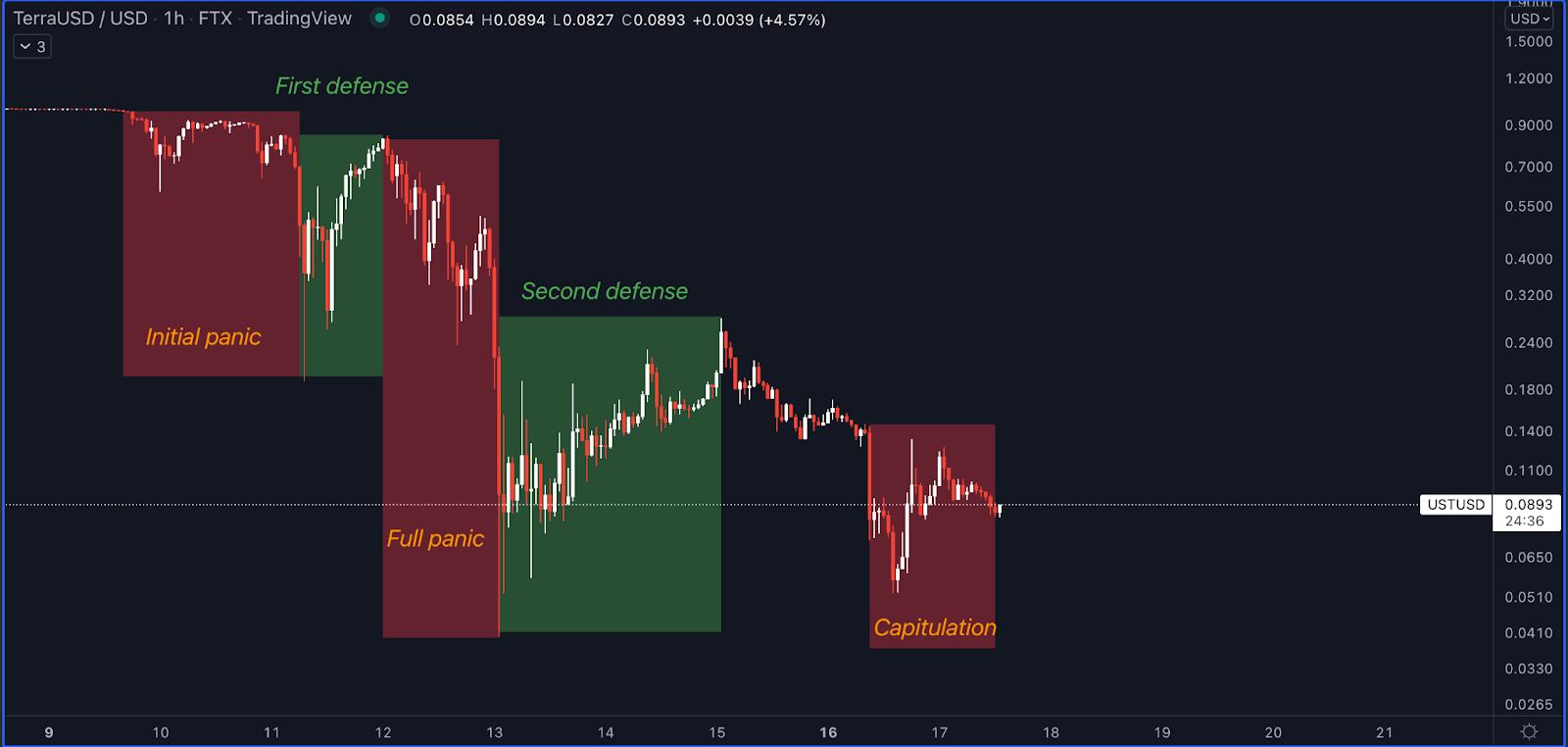

UST’s collapse played out from May 10th, reaching a historic low of ~$0.013 on May 13th from a high of $1. The collapse was noticed by savvy traders who began to exit and/or short UST and Luna from the initial de-peg.

The Luna Foundation Guard (LFG) stepped in with an almost-successful defense on May 11th, but was promptly overwhelmed by a market-wide panic on May 12th that crashed UST price to its historic lows.

A second defense was mounted, with market pricing in either a bailout distressed financing round or a complete restructuring, before it was revealed that the LFG only had ~$84M in reserves (against a circulating supply of 11.3B UST).

At that point, UST enters capitulation, revisiting ~$0.05 before a subsequent revival proposal was put forth by Do Kwon.

A Play-by-play Recap

The Set Up

12/28/2021:

UST crosses 10B in market cap for the first time.

Its algorithmic model - whereby arbitrageurs can burn $1 worth of Luna (Terra’s governance token) to mint 1 UST when UST trades >$1, and buy 1 UST and redeem it for $1 worth of Luna when the opposite is true - has worked…

so far.

2/22/2022:

Luna Foundation Guard (LFG) is a non-profit entity in Singapore overseen by Do Kwon and 5 other members. Its main purpose is operating a reserve capital pool backing UST.

In February, LFG has closed a $1B token sale to build a forex reserve denominated in BTC. This helps UST lower its reliance on Luna. LFG has also subsequently purchased $100M of AVAX to achieve the same goal.

4/2/2022:

Terraform Labs (TFL) is the main entity, chaired by Do Kwon, that supports the development of Terra Luna, recently securing $50M in funding from Arrington Capital, SkyVision Capital, among others.

In April, TFL proposed the 4pool, a stablecoin liquidity pool on decentralized exchange Curve that allows users to pool four stablecoins: UST, FRAX, USDC and USDT. The pool enables competing decentralized stablecoins UST and FRAX to share liquidity, rather than compete against each other in paying Curve liquidity incentives.

The 4pool will be launched to replace 3pool - which was the previous liquidity pool consisting only of USDC, USDT and UST.

The transition from 3pool to 4pool proved to be an opportune time for those who were preying on Luna’s downfall later.

Whether it was one big malicious actor, an honest mistake that triggered cascading panic, we are yet unsure.

4/19/2022

UST surpasses BUSD (Binance’s stablecoin) and becomes 3rd largest stablecoin.

The Trigger

5/8/2022:

In anticipation of transitioning from 3pool to 4pool, LFG removes $150M in liquidity from the pool, followed by another $100M withdrawal later on.

5/8/2022, 5:57 SGT:

First large, notable sell occurred for UST in the form of a $85M UST to USDC swap on curve, making 3-pool off-balance and bringing peg ~0.60% under.

The withdrawal seemed to have spooked holders, triggering $300K to $3M clips to be sold on Curve. Total sales of UST into the 3pool amounted to ~$350M of UST.

But the full panic has not begun yet.

The Panic

5/8/2022, ~10:00 SGT:

Massive withdrawals, totaling $2B, began to occur on Anchor, the most popular destination for UST depositors whereby users are enticed by a 20% yield.

At the same time, Do Kwon falsely reports that 62% of withdrawals are from 1 wallet, which seemed to have somewhat quelled very warranted fears.

General response from market at the time was “big players will repeg stablecoin and UST remained somewhat stable despite never fully recovering peg”.

This will soon change.

5/9/2022, 15:00 SGT:

UST peg was never fully restored (highest price was ~$0.9981 based on FTX perp). Large sells occurred on exchanges with relatively thin liquidity, exacerbating downward spiral of UST price.

5/10/2022, 1:00 SGT:

UST reaches a low of $0.60

First Defense

5/09/2022, 13:17 SGT:

Do Kwon announces the LFG council will deploy $1.5B in capital to fight the depegging ($750M in BTC, $750M in UST)

The resultant selling plus market panic drove BTC price from $34,000 on 5/10/2022 to a low of $25,500 on 5/12/2022, increasing the amount of BTC that needed to be sold to re-peg UST and draining LFG’s reserve

5/10/2022, 14:00 SGT:

LFG deposits UST into Curve pool to rebalance, UST rallies ~50% to regain ~$0.93.

Somewhere between the first de-peg and capitulation, LFG spent approximately $3B in defending the peg, based on the delta of their treasury pre- and post-depeg announced on 5/16/2022.

5/10/2022, 18:15 SGT:

Jump, an investor in TFL, deposited $639M in largely stablecoins into the off-balance Curve pool.

~70% of the transactions were in single-sided USDC deposits (as the balance of USDC relative to UST was already low). Using the minted LP tokens, JUMP withdrew UST to drain Curve balances in an attempt to bring the peg back. JUMP deposited into ~589M UST into Wormhole to transfer to Terra, and began to swap UST for LUNA.

This did not work as the panic proved too overwhelming and UST holders exited the market in droves.

Full Panic

5/10/2022, 22:00 SGT:

UST breaks peg again; Do Kwon teases a recovery plan for UST and assures holders to “hang tight” on Twitter.

Second Defense

5/11/2022, 7:09 SGT:

Do Kwon assures holders a recovery plan will be live soon.

5/11/2022, 18:10 SGT:

Do Kwon announces a new plan, allowing the Terra Luna protocol to 4x its LUNA minting capacity. UST was already trading up in the hours preceding, likely from those with access to upcoming new plan details speculating on a positive outcome.

Market soon prices in the inflation of LUNA, trading down from $2.18 (already down from a recent high of $5.77) to ~$0.00000064 with little reprieve, effectively a 100% loss in the expanse of 3 days.

5/12/2022, 3:00 SGT:

UST reaches a high of ~$0.84 amidst hope of a potential recovery. Communications regarding LFG’s reserves remain opaque; some speculate that should LFG still have ~$1-2B in reserves, which would imply roughly $0.1-$0.2 in reserve value per UST

5/13/2022, 2;00 SGT:

A rumor allegedly circulating on 4Chan, amplified by Cardano founder Charles Hoskinson on Twitter posits that Citadel and Blackstone were instigators of the Luna and UST short, enabled by a large loan from Gemini.

All three parties have denied involvement.

There is also a reasonable refutation made by Max Boonen, founder of B2C2 here, who while mistaken Blackstone for Blackrock as the named asset manager in the rumor, still made convincing arguments around why Blackstone and Citadel are very unlikely to be the attackers given their size, mandate restrictions, and risk parameters.

At this time, UST reaches a historic low of ~$0.04 (it has since appreciated by 250% to $0.14 at the time of this writing on 5/16/2022, 16:00).

Capitulation

5/16/2022, 17:05 SGT:

LFG finally releases details on its reserves, and it’s not good…

Excluding UST and LUNA, they only had ~$84M left, far from the $1B+ that some were expecting.

Should every UST be bailed out using this reserve, that would still imply -90% lower a reserve value compared to UST market price at the time.

Expectedly, UST crashes in price, bottoming temporarily at ~$0.05.

Path to recovery

Multiple plans are being discussed in the Terra forum on agora, with the latest being an attempt to revive Terra as “Terra 2.0” - a layer 1 blockchain without UST.

The plan proposes to distribute a new Terra token as follows:

25% for community

35% for pre-attack Luna holders

10% for pre-attack aUST (UST on anchor) holders

10% for post-attack Luna holders

20% for post-attack UST holders

The distribution posts “whale cap”, which limits the bailout for smaller retailer holders vs. institutions.

The above are the major events so far in the Luna saga; however, note that the above situation is still developing, and new updates may be made any time from the writing of this post to its publishing.

DISCLAIMER

The Blockcrunch Podcast is an educational podcast and newsletter for informational purposes only. The authors invest in cryptoassets actively and may hold assets discussed in the newsletter or podcast. All content contained within this email is intended for educational purposes only and should not be construed as any form of financial advice. The Blockcrunch Podcast, its associates and affiliates are not liable for any decisions third parties choose to make.