The Open Network (TON): Unlocking Web3 Mass Adoption through Telegram Integration

Exploring TON's scalable architecture, thriving dApp ecosystem, and potential for bringing crypto to the masses.

This article is brought to you by Yield Guild Games (YGG). YGG is a web3 guild protocol that enables players and gaming guilds to find their community, discover games and level up together. Find out more at: https://investors.yieldguild.io/

The rise of cryptocurrencies and Web3 Apps has been one of the most significant technological developments in recent years. However, despite the rapid growth of the crypto ecosystem, mass adoption has remained a challenge due to the complexity and learning curve associated with these technologies.

For many users, the process of setting up a crypto wallet, navigating exchanges, and interacting with dApps can be daunting, creating a barrier to entry that hinders widespread adoption. Many users simply use crypto as a means to speculate on memecoins despite the risks involved, missing out on many benefits that Web3 has to offer.

Enter The Open Network (TON), a blockchain with the potential to bring Web3 mainstream. TON's unique selling point is being Telegram native, becoming the first mainstream messaging app with almost a billion users to integrate Web3 natively into its platform. This invites millions of potential users to try Web3 with just a few taps within Telegram, offering a more cohesive Web3 experience. Telegram’s large user base and native Web3 integration are also the primary reason why Pantera Capital, a top crypto VC, invested in TON.

The TON blockchain is also highly scalable, reaching a staggering speed of 104,715 transactions per second in a public performance test. TON is now focused on attracting developers to build on their ecosystem by introducing grants. A scalable blockchain with millions of potential users and a developer grant program is a potent combination to attract developers, like offering free pizza to college students—it's practically irresistible.

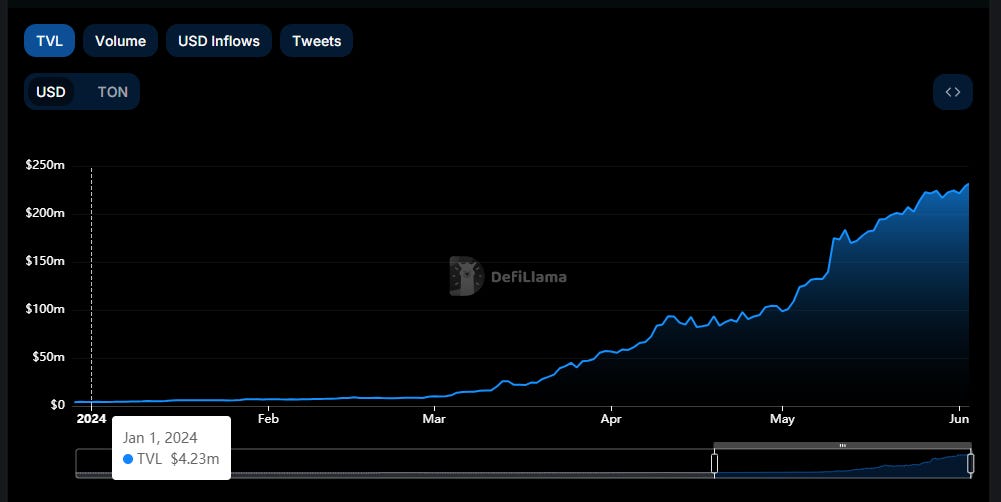

This resulted in TON’s TVL achieving a phenomenal growth of 22x since the start of the year, from $15 million to $330 million. They now have an established DeFi ecosystem with the core pillars available such as DEXs, Lending, Liquid Staking, and more. Their GameFi ecosystem is also expanding fast with $NOT coin being the first TON GameFi project being listed on Binance and having over 35 million users. We will explore more about the TON ecosystem later.

In our previous article, we explored the foundations of the TON blockchain and its ecosystem. If you haven't read it yet, I highly recommend checking it out here to gain a better understanding of the platform's underlying technology and vision.

Building upon that knowledge, this article will focus more on the dApps that have been built on TON and how they could drive mass crypto adoption.

In this article we explore the below topics:

The TON Thesis

How TON dApps differ from Web3 dApps

Popular TON dApps and Their Potential for Mass Adoption

Challenges and Limitations

Future Outlook and Opportunities

The TON Thesis

Scalable Architecture to Onboard the Masses

In order to achieve mainstream adoption, a blockchain needs to be able to handle millions of users. The TON Blockchain is specifically engineered for high performance and scalability with its own proprietary "blockchain of blockchains" architecture. This design allows for unparalleled scalability and flexibility, making it an ideal foundation for the development of a dApp ecosystem catered to the masses.

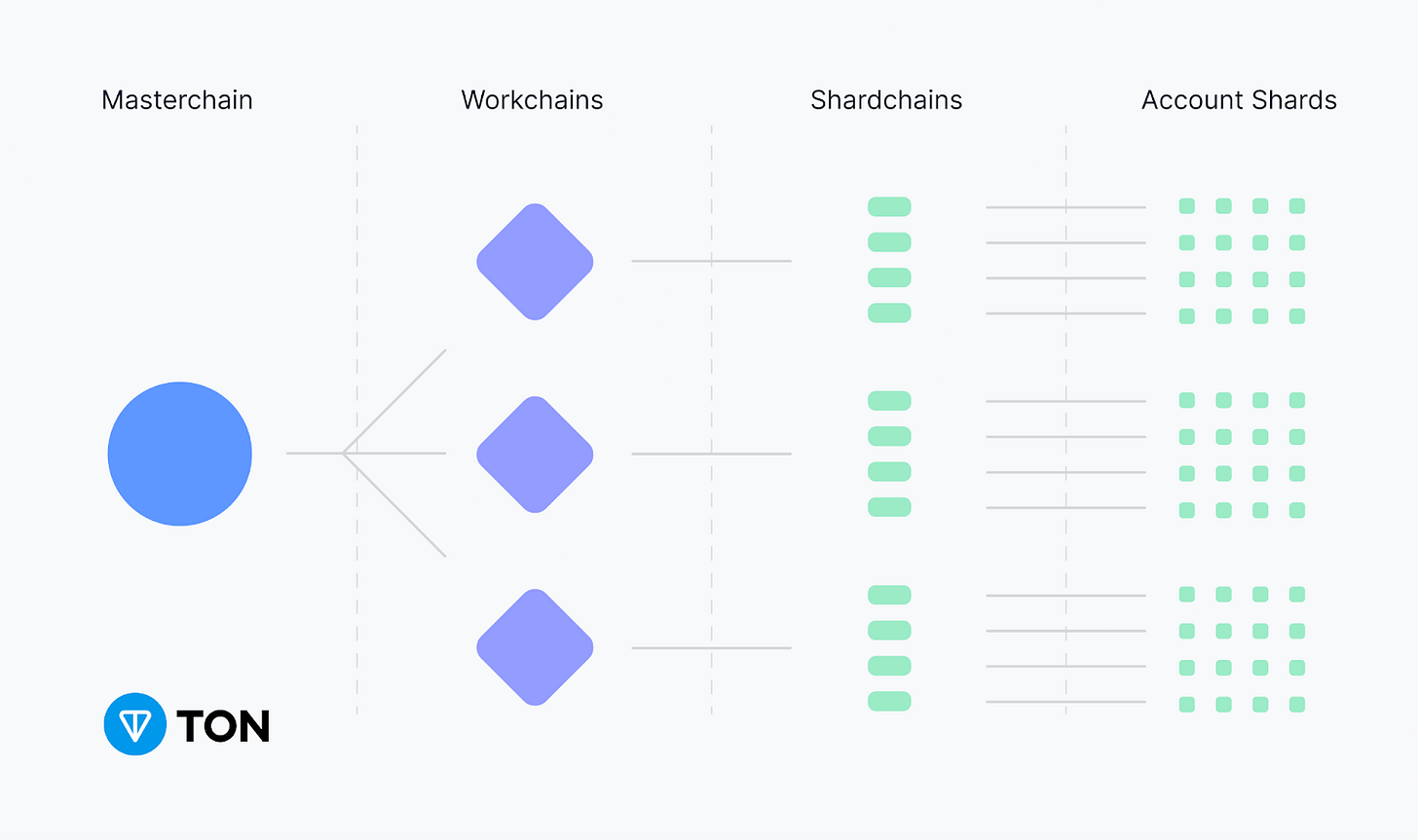

At its core, smart contracts (accounts or actors) form the building blocks of the ecosystem. Transactions involving these contracts are grouped into blocks, creating AccountChains specific to each account. To ensure scalability and efficient processing, AccountChains are aggregated into ShardChains, which can be dynamically split or merged based on transaction volume. This allows for optimal load balancing and resource allocation.

TON takes this a step further with Workchains, enabling developers to create custom blockchains with tailored rulesets. This flexibility opens up endless possibilities for innovation and adaptation to specific use cases. To maintain synchronization and consensus across all chains, the MasterChain acts as a central reference point, containing information about the state of the entire TON ecosystem.

This WorkChain and MasterChain setup is similar to Avalanche’s subnets or Polygon’s supernets. These architectures are designed to provide flexibility and scalable by allowing multiple blockchains to operate in parallel, with the main network providing security and communication between them. However unlike subnets or supernets, each TON Workchain still has dynamic sharding, which allows for further scalability and load balancing, as well as being integrated with Telegram.

Ultimately, this architectural design allows the network to manage millions of transactions per second and adapt efficiently as the number of users increases. Such scalability makes TON an excellent choice for developers looking to deploy applications to hundreds of millions of users without sacrificing speed or security. Making TON poised to attract a wide range of developers and users, fostering the growth of a thriving dApp ecosystem.

Native Tether Integration

Imagine you are chatting with your friends on Telegram and can seamlessly send and receive USDT, the world's most popular stablecoin, without ever leaving the app. No more juggling multiple wallets or scratching your head over complicated blockchain addresses.

That is now reality thanks to a partnership between Tether and Telegram, the first stablecoin integration with a mainstream messaging platform. By bringing USDT payments to Telegram's massive user base of over 900 million people, this integration has the potential to be a game-changer for crypto's mass adoption.

Tether dominates the stablecoin sector by having over 70% of the stablecoin market cap. They've also launched Tether Gold (XAUT) on TON, expanding their presence to a whopping 15 blockchains.

TON also launched a ‘Wallet Earn’ campaign to provide 11 million TON tokens (~$66 million) as incentives to reward users for participating in TON, from providing liquidity to depositing USDT for 25% APY.

The Right User Base to Bring Web3 Mainstream

Telegram currently has a user base of close to a billion spread across the globe, with significant presence in emerging markets like Russia, India, Indonesia, and Brazil with a skew towards the younger generation consisting of millennials and Gen Z.

These age groups are more likely to embrace new technologies such as Web3, and are more open to the idea of decentralized systems as an alternative to their existing centralized system.

Additionally, their traditional financial systems may be less developed or simply ‘not working for them’, and the need for alternative financial solutions is more pressing.

These factors prime them to look for a financial application and Telegram is an ideal platform for driving crypto adoption among a diverse and globally distributed user base. TON continues to grow rapidly in users as well.

Although it’s banned, Telegram is the most downloaded Android wallet app in China. With native USDT payments, we could see a crypto boom in a country where it was once thought impossible.

"Access to Telegram requires a VPN in China, but Chinese people are smart, they like Telegram and find a way to use it," - Pavel Durov, billionaire founder and CEO of Telegram.

Telegram Native Integration with TON Mini Apps

One of the key advantages of TON is the built-in wallet inside Telegram which allows users to set-up, store, send, receive cryptocurrencies, and use Web3 dApps in just a few taps.

Users who may have been hesitant or too lazy to explore Web3 can now do so in a more accessible manner. This makes it easy for users to integrate Web3 into their daily usage as it lowers the barrier to entry for crypto adoption.

TON Web3 dApps are officially called TON Mini Apps (TMA) and they turn Telegram into a Superapp for Web3. TMAs are built using standard web technologies like HTML, CSS, and JavaScript, making them accessible to a wide range of developers. Many TON apps also allow users to connect by opening the TON Wallet in Telegram.

They also allow developers to have easy monetization within the TMA as well as seamless integration with Telegram’s TON Wallet. TMAs also focus on mobile-first experiences, ensuring that users can access and interact with dApps on the go, compared to their Web3 counterparts.

With their seamless integration, user-friendly design, mobile-first approach, and potential for mass adoption, TON dApps are poised to change the game for crypto and dApp adoption.

Now let's dive into some of the hottest TON dApps that are making waves in the ecosystem.

Exploring the TON Ecosystem

TON Foundation Support Programs

The TON Foundation is focused on growing their ecosystem of dapps by incentivizing users and developers through their support programs. Let’s go through them to understand how TON is attracting users and developers at an exponential rate.

The Open League

The TON Ecosystem features a Telegram app center where users can explore a wide variety of apps built on Telegram, from games to Web3. To bring more attention to their app ecosystem, TON has an incentive program called The Open League which aims to increase the number of users on TON.

Each season features a different theme and prize quantum, distributing TON to participants. Season 2 which is happening now is distributing a total of 30,000,000 TON (about $180 million) to users who participate in liquidity provisioning on DeFi apps built on TON. Check it out here!

Memelandia

The TON Foundation also understands the importance of building a strong community and memes and created TON Memelandia, a hub for memecoins and community tokens. It allows users to mint, launch, and airdrop memecoins in a safe way. Memecoins can also compete in the The Open League for prizes and benefit from increased visibility by being featured in TON official channels all while being natively integrated in Telegram.

TON Foundation Grant

One of the reasons for a vibrant TON Ecosystem was due to the TON Foundation grant. In September of 2023, the TON Foundation announced a Web3 Grant program to provide financial support, technical resources, and mentorship. This has played a pivotal role in attracting talented developers to build innovative dApps on the TON blockchain and fostered a vibrant community of builders who are pushing the boundaries of the TON ecosystem.

As mentioned, the total value locked (TVL) in TON-based projects has skyrocketed from a modest $15 million at the beginning of 2024 to an astonishing $330 million, demonstrating the growing confidence and interest in the platform's potential.

There are four grant categories to ensure efficient and equitable distribution of funds:

Type A – Initial Deployment

Targets initial deployments or proof of concept applications on the Telegram Web Apps platform, including Web3 infrastructure based on the TON blockchain (e.g., @wallet, Wallet Pay, and TON Connect) by providing up to $10,000 in TON.

Type B – Live TON-based Projects with Existing User Base

Supports live projects on the TON blockchain that have not yet integrated with Telegram by providing up to $10,000 in TON.

Type C – Live Non-TON-based Projects with Community

For projects live on other blockchains looking to expand or migrate to the TON blockchain and Telegram. Telegram will provide between $20,000 and $50,000 in TON, based on milestones such as user numbers, transactions, and Total Value Locked (TVL).

Type D – Projects Seeking Venture Funding

The grant program doesn't provide venture funding but can facilitate connections with VC funds and offers guidance for evaluation through TONcoin.Fund.

This comprehensive grant program aims to support a wide range of projects, from early-stage developments to those seeking venture capital, fostering growth within the Telegram Web3 ecosystem.

Decentralized Finance (DeFi)

The TON ecosystem has seen a surge in DeFi activity, largely due to the native integration of Tether and TON Foundation Grants. Let's take a closer look at some of the key players in various DeFi categories.

This section highlights the key protocols within each DeFi vertical:

DEXs

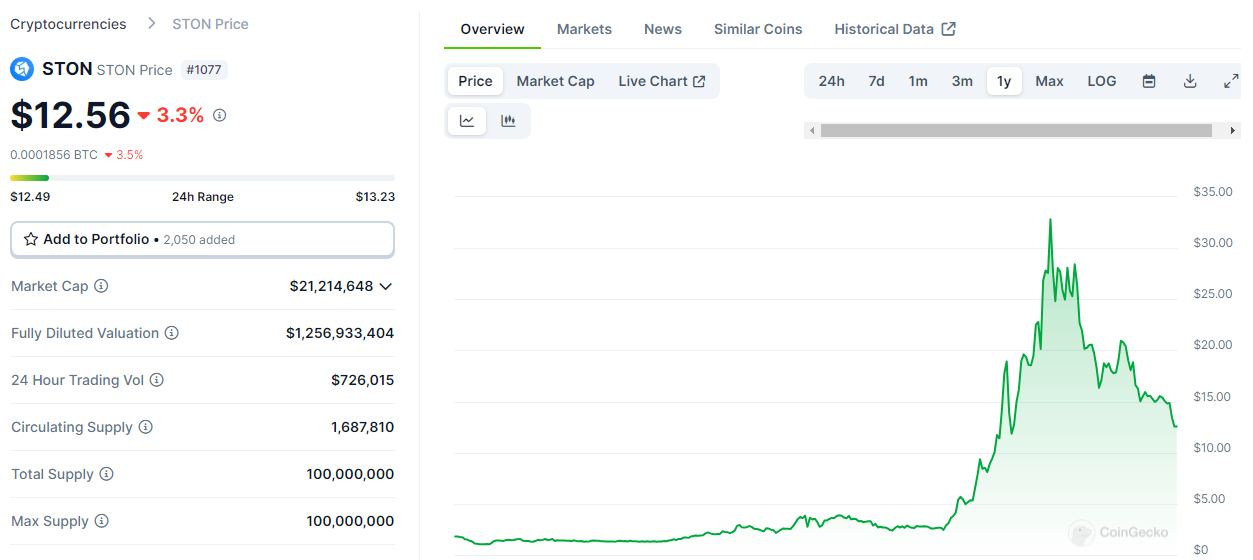

STON.fi: STON.fi is the main DEX and it leads the pack with an impressive $230 million in total value locked (TVL), an increase of 50x since the start of the year with just $4 million in TVL. It also has its own token called STON which is used for governance voting. It partners with various tokens to offer an attractive APR for certain promotional liquidity pools.

DeDust: DeDust follows closely with $83.12 million, offering an all-in-one AMM DEX complete with portfolio tracking and bridging capabilities.

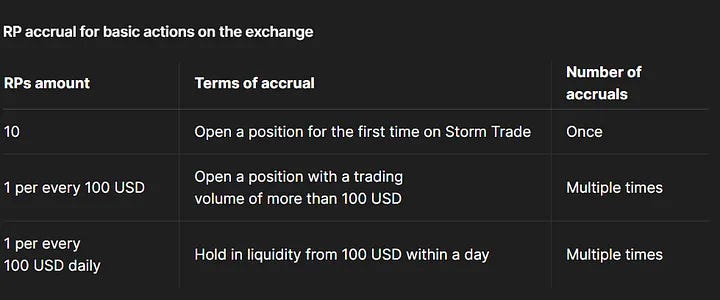

Storm Trade: For those seeking leveraged trading, Storm Trade offers perpetual futures with up to 100x leverage across a range of assets including cryptocurrencies, stocks, forex, and commodities. They also have vaults to provide counterparty liquidity, earning 70% of protocol fees.

It is backed by Cointelegraph, Tonstarter, etc and currently has no token but will be doing an IDO on Magic Square. It also has a Reward Points system that can be exchanged for Storm Trade tokens after its TGE.

Liquid Staking

Tonstakers: Liquid staking has also gained traction on TON, with Tonstakers boasting over $220 million in TVL and more than 60,000 stakers. Their TON LSDs are called tsTON.

Bemo: Another notable liquid staking protocol, Bemo has $67 million in TVL and offers liquid staking through a Telegram mini-app, focusing on DeFi integrations to enhance yields, and currently has a reward program where users are earning stXP for a potential airdrop. Their TON LSDs are called stTON.

Lending & Borrowing

In the lending and borrowing market, EVAA is the only available platform, with $10 million in TVL. It supports stablecoins, TON, and TON LSTs. They currently have an EVAA XP program where you can earn XP based on your activity on EVAA in exchange for the EVAA token upon TGE.

GameFi

GameFi has found a home on TON, with numerous games seamlessly integrated into Telegram.

Notcoin:

A TON-based memecoin that is built as a tap-2-earn Telegram mini-game, allowing users to mint Notcoin by simply tapping on the phone.

The game reached 4.1 million players within a week, a growth rate more rapid compared to StepN or Axie Infinity. This could have been attributed to the seamless onboarding through Telegram and strong support from noticeable firms like DWF Labs.

Notcoin also had a squad system integrated, alongside a referral program that further contributed to its virality, and also informs users that their Notcoin has been burnt due to inactivity. It has over 35 million users worldwide but has since ended its tap-to-earn mining phase and is planning its next phase to build a sustainable ecosystem revolving around the NOT token.

The NOT token has launched and is available to claim by users by June 16 and is listed on top exchanges like Binance and Bybit.

Yescoin:

Yescoin is a swipe-based game compared to Notcoin’s tap-based game. It has attracted over 2.5 million users in a month.

Catizen:

Ranked top in the TON Open League for 2 seasons, Citizen is a semi-AFK coin mining game with over 12.1 million users and 1.6 million daily users that is available on both TON and Mantle ecosystem and has surpassed $10 million in revenue.

Users generate cats that will distribute coins automatically. Two equal level cats can be merged into a higher level cat, which will distribute a larger amount of coins.

The game is highly pay-to-win focused as users can purchase higher level cats with $TON instead of spending time and effort to generate the cats. The process of cat merging can also be automated when users pay with $TON as well. As clubs compete with each other, it is easy to see this competition fuelling the desire to use $TON to pay for powerups to one-up the competition for more potential $CATI rewards when they TGE.

Recently the project also accepts $NOT coin as payment, showing partnerships within TON’s GameFi ecosystem.

The project is expected to airdrop 35% of their governance token, however the TGE date is not known yet.

Phase 2 of Catizen sees the launch of their mining pool, where users can stake their in-game cats to mine $wCATI points. The team has hinted that the Catizen governance token will have an airdrop in the future, and a portion of that will be allocated to $wCATI holders.

The Pixels:

A social-driven multiplayer game where users compete with one another in a squad to gain the most amount of territory on a canvas, done by coloring a pixel on the canvas every 7 seconds. Based on the territory gained, users will be rewarded with $PXL tokens, which can be used to purchase boosts to allow multiple pixels to be coloured at once (accelerating the pace of territory gain).

The game has over 2.3 million players and sees 37,000 daily active users and is only supported on mobile at the moment.

Community Apps:

Telegram allows channel admins to create an in-Telegram quest platform for channel subscribers to complete tasks and earn rewards straight into their wallet.

NFTs

Telegram sticker NFTs:

Telegram has previously experimented with tokenizing its user namespace, successfully generating $350 million in sales. Their next venture involves creating Telegram sticker NFTs, allowing creators to monetize their stickers and receive payments directly into their TON wallets. With over 730 billion stickers used, this initiative could significantly increase user adoption, especially among those unfamiliar with traditional web3 NFT marketplaces.

GetGEMS:

GetGEMS is the largest NFT marketplace on the TON blockchain, boasting over 4,000 NFT collections. It allows users to launch their own NFT projects with gas fees under 10 cents. Currently, more than 80% of NFTs on TON are traded on GetGEMS, with the platform generating over $200,000 in monthly trading volume.

TON Diamonds:

TON Diamonds is a curated marketplace for renowned digital artists to launch their NFT collections. It is the first auction house to sell unique, one-of-a-kind NFT art pieces. As NFTs on this platform are denominated in $TON, TON Diamonds has integrated a DEX aggregator to simplify acquiring $TON for payments.

Fragment marketplace:

Fragment is a marketplace for trading virtual phone numbers and custom Telegram usernames, with sales exceeding $350 million. By facilitating the proxying of virtual phone numbers for business use, Fragment is poised to capture a portion of the business phone market which is projected to reach $6.4 billion by 2028.

Infrastructure

Wallet:

The default self-custodial wallet for TON, integrated with Telegram, eliminates the need for users to remember seed phrases and supports social recovery through email and Telegram accounts. Users can purchase cryptocurrencies (TON, USDT, BTC) directly with a credit card, with funds deposited straight into their TON wallet, simplifying wallet interactions.

Additionally, the TON wallet functions as an encrypted text messenger, allowing users to send end-to-end encrypted messages with their transactions, readable only by the sender and recipient.

TON Space:

After you set up your TON Wallet, you will see a TON Space Beta. This is another non-custodial wallet but unlike the TON Wallet which is mainly for holding assets, TON Space is a complete wallet, supporting NFTs, called by Web3 applications and Telegram’s built-in mini-apps. You can think of it as a Metamask that is embedded in Telegram.

HumanCode:

An AI company focused on enhancing digital identity verification within the TON ecosystem through palm scanning as proof-of-humanity. With a $5 million incentive program in collaboration with TON Society, HumanCode aims to provide Telegram users with secure digital identities, establishing a new standard for digital identity verification.

Tonviewer:

The primary block explorer for the TON ecosystem, Tonviewer offers dashboards and APIs for comprehensive data querying and analysis.

Tonstarter:

Tonstarter is the first launchpad on TON, designed to help TON-native applications raise funds. To encourage participation, Tonstarter runs a Community Incentives Program, rewarding users with points.

Tokenova:

Tokenova is a self-launch platform that allows users to create tokens on TON without writing code. This service is akin to pump.fun, a memecoin launchpad that has recently gained traction, demonstrating product-market fit within this niche.

Challenges and Limitations

Buggy Experience for TON’s DeFi Apps

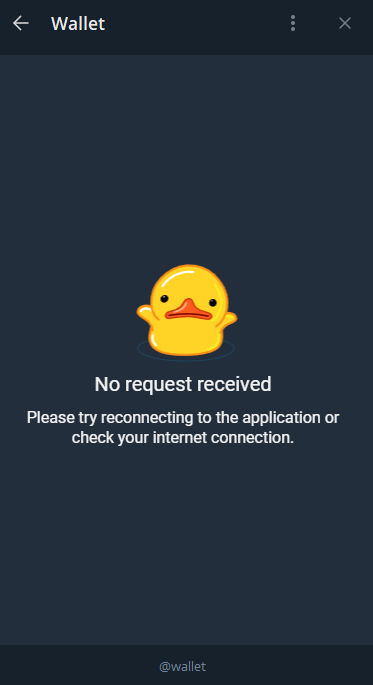

While TON boasts a seamless integration with Telegram, many dApps still require users to access them through a web browser pop-up within the Telegram app, rather than being truly native to the platform. This hybrid approach can lead to confusion and frustration for users, as they may expect a more streamlined, in-app experience.

Additionally, the experience itself can be quite buggy. For example, connecting a user's TON wallet to a dApp can sometimes require multiple attempts, transaction messages may not always appear, or transactions themselves going through. These can further detract from the overall user experience.

These usability issues can create barriers to entry for new users and hinder the adoption of TON dApps, especially among those who are less technically savvy or familiar with blockchain technology. To address these concerns, TON developers must focus on creating more intuitive, user-friendly interfaces and ensuring stable wallet connections.

By prioritizing the user experience and working to eliminate bugs and inconsistencies, TON can create a more welcoming environment for mainstream adoption, making it easier for Telegram's vast user base to explore and engage with the growing ecosystem of TON dApps.

Regulatory Concerns

TON have had their fair share of run-ins with the authorities which could impact its growth and adoption. The most notable challenge is the SEC lawsuit against Telegram, alleging that the sale of Gram tokens constituted an unregistered securities offering. This legal battle led to a preliminary injunction, halting the launch of the TON blockchain and raising concerns about the project's future.

Eventually Telegram integrated with TON after the network was relaunched and run separately by independent developers with its own community of validators.

Additionally, TON's integration with Tether, the largest stablecoin, presents potential regulatory risks. Tether has faced its own controversies and regulatory scrutiny, including allegations of misrepresenting its fiat currency reserves. The association with Tether could draw additional regulatory attention to TON, raising concerns about money laundering, fraud, or other illicit activities.

Moreover, the evolving regulatory landscape surrounding stablecoins could have knock-on effects for TON. Any changes in the regulatory status of stablecoins could impact TON's ecosystem and its ability to leverage Tether's liquidity and user base.

To navigate these challenges, TON must engage proactively with regulators, implement robust compliance measures, and maintain transparency around its operations and governance.

Different Programing Language

While the TON ecosystem offers unique benefits to developers, it uses the FunC and Fift programming language for developing dApps and smart contracts, which have a smaller developer community and a limited number of resources and tutorials available. This can make it more challenging for developers to find solutions to problems they encounter or to learn best practices for working with these languages.

Another potential limitation is the lack of interoperability with other blockchain ecosystems. While TON's programming languages are designed to work seamlessly within the TON ecosystem, they may not be easily compatible with other blockchains or dApp platforms. This could limit the potential for cross-chain collaboration and the ability to leverage existing tools and libraries from other ecosystems.

Furthermore, the simplicity of FunC, while beneficial for newcomers, may also be a drawback for more advanced developers who require greater flexibility and control over their smart contracts. The language's focus on simplicity may limit the ability to implement complex logic or advanced features that are possible in more feature-rich languages like Solidity.

Fift, being a low-level language, presents its own set of challenges. Working with Fift requires a deeper understanding of the TON Virtual Machine and its inner workings, which may have a steeper learning curve for developers who are not familiar with stack-based languages or low-level programming concepts.

The long-term viability and support for TON's FunC and Fift programming languages are uncertain. The two main programming languages now are Solidity and Rust, and if a blockchain uses another language, it may have a reduced developer interest resulting in a slower pace of innovation within the TON ecosystem. An example of this is the Zilliqa blockchain which designed its own programming language called Scilla that was unable to achieve sufficient developer adoption.

To address these challenges, the TON community will need to focus on expanding educational resources, fostering a stronger developer community, and encouraging the development of tools and libraries that make it easier to work with FunC and Fift. For example, there is an existing open-source project called ‘sol2tvm’ that is a solidity to FunC transpiler, making it easier to migrate existing solidity projects to TON.

Outlook: TON's Potential for Mass Adoption

The Open Network (TON) is well-positioned for future growth and mainstream adoption, thanks to its scalable architecture, integration with Telegram, and thriving dApp ecosystem. As more users discover TON through Telegram, network effects are likely to drive a virtuous cycle of adoption and growth.

TON's trajectory shares similarities with Solana's early growth stage. Both platforms are non-EVM that focus on security and scalability, attracting developers through grants and incentives, and building diverse ecosystems spanning DeFi, NFTs, and gaming. Solana's success in onboarding millions of users and achieving rapid TVL growth suggests that TON, with its Telegram integration, could follow a similar path to mainstream adoption.

Looking ahead, TON has ample opportunities for expansion and innovation. The TON Foundation's grants program has already played a crucial role in fostering the development of a vibrant dApp ecosystem which grew its TVL by 50x and this growth is expected to continue. As more developers are attracted to the platform, we can anticipate an influx of new and exciting projects spanning various sectors, from DeFi and NFTs to gaming and beyond.

However, challenges remain, including regulatory uncertainties, competition, and the need for ongoing improvement of its developer tools and resources. Despite these obstacles, TON's strong foundation, growing community, and backing from Telegram position it for significant growth and adoption in the coming years.

As the world increasingly embraces decentralized technologies, TON stands ready to provide a user-friendly gateway to the world of crypto and Web3. With its unique blend of scalability, accessibility, and mainstream appeal, TON has the potential to shape the future of decentralized applications and bring the benefits of blockchain to a global audience.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about