The Open Network ($TON) - Could Telegram’s Integration Bring about Web3 Mass Adoption?

Telegram has more users than the entire crypto ecosystem. Can $TON tap into this value?

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Introduction

Today's blockchains, while boasting low transaction fees, fast processing, and scalability, have yet to reach the mainstream audience. This has led to the key question - how can we bridge between current internet ecosystems and the emerging decentralized landscape?

The transition from web2 to web3’s technology landscape is a complicated endeavor for many users, often leading to a preference for the familiarity of existing solutions. Despite significant investments aimed at bridging this gap, the chasm between Web2 and Web3 remains significant.

Telegram (TG) is a cloud based mobile messaging app boasting 700M monthly active users. Specifically TG serves as an important communication tool in the crypto industry, appealing to a broad range of users and developers from the blockchain sector while hosting crypto-centric channels and groups.

Originally developed by the Telegram team, The Open Network (formerly known as the Telegram Open Network) operates as a decentralized computing network based on blockchain. Could Telegram’s integration of its core services with TON effectively channel users to the decentralized network? In this article we explore the below topics:

Introduction to The Open Network (TON)

Overview of TON’s ecosystem and service offerings

Network Growth of TON

Toncoin’s token economics

Comparison with other blockchains

Catalysts and risks

What is The Open Network (TON)?

Telegram’s The Open Network (TON) is a layer 1 Proof-of-Stake blockchain founded in 2018. The project was initially developed by Telegram’s team. However the messaging app shelved TON in 2020 after being blocked by the US SEC. TON is now a community-driven blockchain supported by the TON Foundation.

Toncoin ($TON) is the principal cryptocurrency of the chain and is primarily used for transaction fees and as deposits for validators to secure the network. TON can authenticate and handle an enormous number of transactions per second by accommodating dynamic sharding and work chains. In other words, TON's versatile design enables it to increase without limit while preserving its speed.

On TON, smart contracts deployed need to pay rent. This aspect is a major differentiation from traditional blockchain like Ethereum. The fee model of Ethereum is inspired from that of a bank. For instance, if someone wants transfer tokens, the person pays the bank a transaction fee. In other words, the initiator is always responsible for the cost. This cost is paid only once, but if data on the blockchain is everlasting, miners will have to keep paying system expenses to keep this data for a long time into the future.

TON’s fee model is inspired by web applications rather than a bank. In this case the app developer is bearing the costs. Therefore it is up to them to recoup these costs and finance itself. As such, on TON, dApps need to pay for their own resource costs. Every smart contract holds a TON token balance and uses this balance to pay rent. The developer can fund the contract with TON tokens out of their own pocket and subsidize its users. Alternatively, they can demand gas from users for different actions and keep this gas in its balance for future rent payments.

TON Ecosystem

TON Domain Name System (DNS)

TON DNS is a core service of the TON blockchain and is integrated with the underlying networking protocol. It is a service for assigning human-readable names to accounts, smart contracts, services, and network nodes on the TON Network.

It works similar to traditional domain name services but with added security, privacy, and decentralization features. TON DNS eliminates intermediaries such as for-profit corporations and uses smart contracts to manage domains, promising fair and equal access. It also allows for the labelling of anonymous Abstract Datagram Network Layer (ADNL) addresses. ADNL protocol enables transfer of data using only ADNL addresses, where IP Addresses and Ports are hidden. Such a feature makes it suitable for entities such as WikiLeaks that require anonymity to resist censorship and avoid prosecution.

In July 2022, TON launched the DNS sale and sold over 2,000 ‘.ton’ domains. The sale totalled 2.39 million Toncoin, which at the time is worth approximately $3 million. The highest grossing name in the sale was ‘wallet.ton’, which sold for 215,250 Toncoin. The runner-up domain names, ‘casino.ton’ and ‘bank.ton’, sold for 200,000 and 157,500 Toncoin, respectively.

Fragment Marketplace

In Oct 2022, Telegram (TG) launched the marketplace Fragment on the TON blockchain for auctions of premium TG usernames. The launch follows the successful auctions of TON domains. The auction enabled Telegram handles (both usernames and channels) to be bought and sold using Toncoin. Telegram began with auctions of four-and five-letter handles, which is the first time these shorter handles were made available to all users.

The minimum price for a four-character handle was set at 10,000 Toncoin. With Fragment, individual Telegram users had the ability to auction off their own usernames. Users were able to log into the site using Telegram, the Tonkeeper app, or other TON-based wallets. Some top TG username sales include @news, bought on November 18th for 994,000 TON (approx. $2 million) @auto, sold at 900,000 TON and @bank at 850,000 TON.

Apart from TG usernames, Fragment also added support to purchase numbers. NOrmally, using Telegram requires a phone number for signup, which is an identifier that inherently prevents full anonymity of the users. With Fragment, users can purchase an anonymous number that starts with “+888” that is not tied to a SIM card.

TON Payments

TON Payment is a platform for micropayments and a micropayment channel network that utilizes Payment Channel Technology (similar to Lightning Network). This technology enables large numbers of transactions between two parties off the blockchain, with only a network fee being paid upon opening and closing the payments channel. This allows for lightning-fast transaction speeds, making it suitable as payments for internet data, streaming, games, etc.

TON Payment differs from other micropayment solutions (e.g. Venmo, Cash App) in its integration with the TON Network, which means transactions are on-chain and secured. The TON Payments SDK also documents the ability to join payment channels together in a network off-chain, enabling participation from more than two parties, which provides more flexibility and scalability in the micropayments ecosystem.

TON Storage

TON Storage was presented by the TON Foundation on 29th Dec, 2022, for reliably storing data of any size on the decentralized network. It allows individual users and services to store their public and private files. The technology behind TON Storage is similar to BitTorrent’s, where users download files directly from one another’s devices without using centralized servers or data centers.

Any user can upload a file onto The Open Network and make it available for download. The next user who downloads the file will automatically become a storage node and join in seeding, while the following person will download from the first two nodes (users) simultaneously. This way, file copies will be stored in various locations worldwide. Anyone can become a storage node on the TON network and receive Toncoin directly from users for storing files and data.

TON Storage differs from other services like Filecoin in its approach to data management and allocation, as well as the roles and responsibilities of nodes and miners. Filecoin is a decentralized storage network that operates through a system of proof-of-storage, with three types of miners responsible for different aspects of data handling (deep dive of Filecoin here):

Storage miners store files and data on the network.

Retrieval miners provide quick retrieval of files.

Repair miners will be responsible for resolving glitches in data processing.

In contrast, TON Storage uses a different system design. Instead of designating multiple roles to miners, TON Storage has node operators who interact directly with the client. This simplifies the system architecture and roles compared to Filecoin.

Another key difference between TON Storage and Filecoin is their approach to on-chain and off-chain data management. TON Storage's core data is stored off-chain, with the hash to access it stored on-chain. This means that the actual data is stored in a decentralized manner on various devices, while the record (hash) of the data is stored on the blockchain.

On the other hand, Filecoin's approach is the opposite. Filecoin's storage market is built on-chain, while its retrieval market is off-chain. This means that the contracts and deals for storage are made on the blockchain, but the retrieval of the data (the act of accessing and downloading it) happens off-chain.

TON Sites, WWW, Proxy

TON Sites is a feature that enables the launch of web servers on the TON Network. It uses built-in cryptography for mandatory encryption and data authenticity verification, eliminating the need for certification authorities. Users can also create their own domain names, eliminating the need for centralized domain name registries.

TON WWW is a decentralized version of the World Wide Web that is accessible through the TON Network. It allows for browsing and accessing websites on the TON Network without the need for a domain name.

TON Proxy is a network layer that facilitates the anonymization of TON nodes. Similar to I2P (Invisible Internet Project), this layer can be used to create decentralized VPN services and blockchain-based TOR alternatives to achieve anonymity and protect online privacy. When used in conjunction with the TON P2P Network and TON DNS, TON Proxy can make services, including Telegram, resistant to censorship.

TON Mobile

TONMobile is a service that provides secure global mobile connectivity without any restrictions. It allows users to purchase an eSIM from anywhere and use it instantly alongside a regular SIM card of any cellular service provider. TON Mobile provides an international number for dealing with international institutions and allows users to pay as they wish with any bank card or with Toncoin. Users can stay connected in 70+ countries and regions around the world. The service provides a smarter and more convenient way to stay connected by allowing users to download data packs directly to their phone

Telegram Wallet Bot

The Telegram ‘@wallet’ Bot was released in April 2022. It allows users to purchase TON/BTC and transfer them inside the chat function of Telegram. Moreover, the bot also supports purchase of cryptocurrencies with credit card or conduct peer-to-peer trades.

In March this year, Telegram released its support for USDT stablecoin in Telegram’s wallet bot. Previously users can only send and receive $TON tokens, which is not ideal for micropayments due to its volatility. The wallet bot is a powerful feature which essentially gives each of the 700 million Telegram users a crypto wallet by default. Supporting a major stable coin could lead to a strong pick up in wallet bot’s penetration among Telegram users as people discover the convenience of it for micropayments.

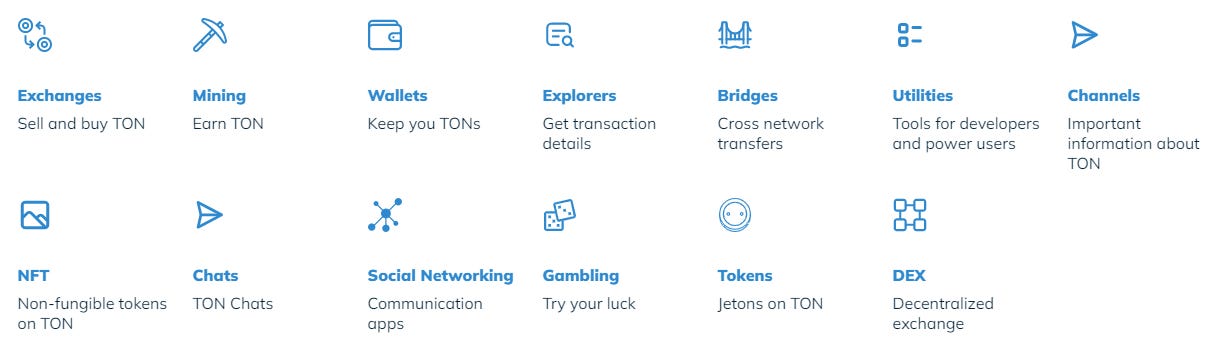

DApp Ecosystem

The TON blockchain is also home to an ecosystem of dApps and services that utilize smart contracts. TON Services enables developers to create new applications on the blockchain. Users can access these third-party apps with a user-friendly interface.

For instance, STON.fi is an AMM DEX on the TON, offering low fees, low slippage, a simple interface, and direct integration with the TON wallet. Ston.fi currently offers the basic trading and liquidity provisioning features of the DEX (TVL approx. $540,000).

TON Diamonds is a major NFT marketplace on TON. Typically, customers pay a 5% platform fee to trade NFTs at TON Diamonds. But customers can receive a reduction in fees by acquiring official diamond NFTs of different levels (Small Diamond — 2% Fee, Medium Diamond — 1% Fee, Big Diamond – 0% fee, access to airdrops and NFT priority sales etc.).

Network Growth

User Growth – As of June 18th 2023, The TON network has 2.8 million accounts which has grown almost 130% since the beginning of the year (1.2 million in Jan 2023). The Open Network is currently secured by ~300 validators, with a total stake amount of about 210 million Toncoin (approx. $300 million).

Project Treasury & Ecosystem Funding

In 2018, Telegram raised $1.7b in a private sale of TON tokens (then called Grams) in one of the largest cryptocurrency offerings ever. There are currently two ecosystem funds with a combined assets of $340mn. TONcoin Fund is a $250M fund that supports teams building TON-native products, integrations with Telegram, and cross-chain projects that bring users, liquidity and value to the TON ecosystem. TON Alpha-Vista Incubation (TAV) is a $90M incubator with a narrower mandate that is dedicated solely to fostering new projects on the TON chain and promoting usage of the native utility token Toncoin. In addition, market maker DWF Labs injected $10mn to support the ecosystem in November last year.

Token Economics

Demand for TON tokens mainly comes from:

Gas Fees: Gas fee for transactions on smart contracts

Staking: Validator stakes required to maintain the blockchain

Governance: TON is used as governance for the chain

Payment currency for services:

TON Mobile

Domain names (DNS)

TON Proxy

TON Storage

Telegram Premium Subscriptions

Token Statistics (as of 18 June 2023, from CoinMarketCap):

Total Supply: 5,087,893,492 (0.6% annual inflation rate)

Circulating Supply: 3,431,892,087 or 67%

Market Cap: $4.8 billion

FDV: $7.07 billion

Token Circulating Supply

Due to TON’s unique history and transition from PoW to PoS, there was considerable confusion among the community regarding the accuracy of its circulating supply.

The initial supply of TON was distributed through PoW mining among thousands of miners. The TON project did not hold any private token sale. On Dec 17th, 2022, TON Foundation proposed a community-wide effort to determine what the community should consider dormant, inactive or uncirculating supply going forward. It is requested that these owners make a transaction before a set time to prove its activeness. In the end, the total number of inactive mining addresses was determined to be 171, totalling 1.08 Billion TON. These tokens were then decided to be locked for 4 years.

Leading market data providers such as CoinMarketCap (CMC) previously displayed TON’s circulating supply at around 1.2 TON. However, on June 15th 2023, an announcement was made that TON’s circulating supply was updated on CMC to be 3.43Bn instead, effectively making it the 14th largest coin in terms of market cap. Despite this sudden “supply shock” of Toncoin’s circulation supply, the price of TON had seen minimal reaction.

Token Distribution

The TON project began on November 15, 2019, when Telegram launched “testnet2”, now known as the mainnet. However, Telegram suspended its active involvement in May 2020 due to conflicts with the U.S. Securities and Exchange Commission. To keep the project moving, Telegram commenced a token mining process in July 2020 to distribute test GRAM tokens (later renamed to TON). In May 2021, testnet2 officially became the Mainnet, and Telegram transferred the rights to ton.org and the related GitHub account to an independent development team.

During July and August 2020, 96% of the TON supply was distributed to miners. Notably, at least 85.8% of the supply was mined by a few connected miner groups affiliated with TON Foundation. These funds are utilized by network validators who control 2/3 of the TON blockchain PoS consensus.

Competitor Analysis

Catalysts & Risks

Catalyst - Toncoin transaction fee burning

The TON Foundation initiated a significant change on June 1st, 2023, when it proposed a vote to implement the burning of 50% of all network fees. The community voiced their approval of the initiative. The network validator vote followed on June 15, attracting a similarly strong support of 98%. Validators on the TON network earn their staking rewards from two sources - transaction fees paid by users and new coins issued per processed block. This newly introduced deflationary mechanism will impact the transaction and storage fees.

With the implementation of this deflationary measure, validators will receive only half of the transaction fees. The remaining 50% will be redirected to a “black hole” address. Based on current network activity, an estimated 350-400 TON will be burnt daily, which represents half of the daily fees of 700-800 TON. Over time, this reduced supply could potentially favor TON holders.

Catalyst - User facing products being built on top of TON Storage

At the end of 2022, TON Foundation announced TON Storage. The distributed file-storage technology accessible through the TON P2P Network could present itself as a worthy competitor to existing storage networks such as Arweave and Filecoin. TON Foundation hopes to invite developers to build products based on TON Storage that could resemble convenient front end apps similar to Dropbox. There were examples of ‘tonstorage-dapp’ frontend being teased to become a ‘unified dapp’ that allow users to interact with all storage providers. Growth in adoption of TON’s storage solutions will further enhance its utility and increase demand for its token.

Risk - Centralized token distribution

As mentioned previously about 85.8% of the TON’s token supply is held by potentially interconnected mining groups. These entities possess a strategic hold over TON token release, resulting in controlled supply and consequent low liquidity that could impact the token price dramatically. While the groups managing these addresses are unidentified, they are believed to have affiliations with the TON Foundation.

Evidence of this collaboration surfaces through several transactions. For instance, according to the on-chain analysis from Whiterabbit, a crypto research and consulting company, tens of millions of TON tokens have been dispatched to provide liquidity on centralized exchanges - a process managed by the TON Foundation. Significant token transfers from these groups to core community members of TON and test transactions between these groups, the TON Foundation, exchanges, and other services are further indicators of this cooperation.

The recent move to freeze particular addresses attempted to address the centralization concerns and the control of a small number of "whales" over the token supply. However, the issue persists, with a handful of mining groups still maintaining the majority of token supply. During the token distribution process, these mining groups transfer a portion of their tokens to the TON Foundation (found at address 1 and address 2), currently holding 570 million TON. To mitigate these centralization concerns, the TON Foundation may need to more actively distribute tokens to the community and ecosystem projects.

Resources

Commissions on TON: https://telegra.ph/Commissions-on-TON-07-22

DTON explorer: https://dton.io/

TON Validators: https://tonvalidators.org/

Top TG handles: https://tinyurl.com/2u6vtc5w

TON Stake: https://www.tonstake.com/#/

TON ICO Whitepaper: https://tinyurl.com/2amcs3ka

TON Governance Votes To Freeze 20% of TON Supply - Blockworks

The Open Network (TON) Roadmap: 8 key features to expect in 2023 – Cryptopolitan

TON blockchain: a group of related whales mined 85% of TON supply | by Whiterabbit

https://medium.com/ton-community/what-is-ton-storage-7f3571cd451e

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about