SPEC, OLAS, PRIME, PROMPT: Unveiling The Agent Economy

Build your own AI agent with just a few line of text

This article is brought to you by Yield Guild Games (YGG). YGG is a web3 guild protocol that enables players and gaming guilds to find their community, discover games and level up together. Find out more at: https://investors.yieldguild.io/

AI has been moving rapidly - GPT-4o, Rabbit R1, Devin AI - all sorts of tools to help us improve our lives by enlightening us with answers. This is what AI agents, which are sophisticated software with remarkable problem-solving and task execution abilities, and human-like interaction skills, are capable of.

With billions of dollars being poured into the web2 AI landscape, e.g. Scale AI $1 billion Series F, within the web3 space, we see a similar cambrian explosion in AI projects:

In particular, AI agents and adjacent projects have begun to receive significant funding in the range of millions. With so much attention being attracted to this market, this report delves into

What are 'AI agents’?

Significance of blockchain technology in advancing AI agents

Understanding web3 AI agent creation frameworks - Spectral, Autonolas, Wayfinder

Exploring the limitations and potential of web3 AI agents

Decoding AI Agents - What Are They?

First off, elephant in the room, what are AI agents? AI agents are software programs that are designed to perform tasks autonomously with little to no external human input. This is achievable as the AI agent can analyse data in its environment and change its course of actions accordingly to reach a certain goal.

Definitive Characteristics of AI Agents

These are the key characteristics an AI agent has:

Autonomy: Operate independently without external human intervention

Reactivity: Ability to assess the environment and analyze data

Decision Making: Process information and make decisions to achieve goals

Learning: Improve performance over time through a suite of techniques, including deep learning, reinforcement learning, and others

We have all interacted with various kinds of AI agents in our day-to-day lives. Whether it be Notion AI tidying up data, or Fireflies.ai helping to take meeting notes, these AI agents differ in the level of autonomy they possess.

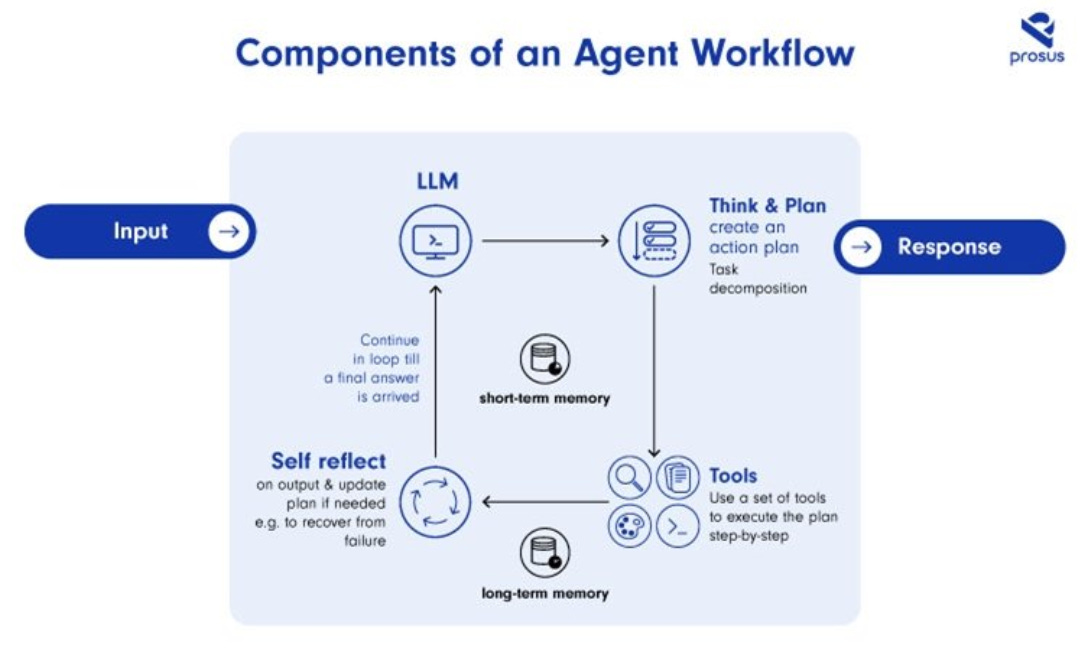

Modularized AI Agent Workflow

The early AI agents were relatively siloed in their working process, where the responses generated are based simply off a single large-language model (LLM). This often resulted in subpar answers as the agents have limited knowledge and no built-in mechanisms to improve on their responses.

Since then, AI agents have evolved to become modularized, utilizing an iterative workflow comprising the following phases:

LLM: Processes inputs received by the AI agent to identify the primary goal

Think & Plan: Break down the task into smaller sub-tasks and craft a plan for sequential sub-task execution

Tools: Identifies tooling for sub-task execution, which can include data querying and more

Self-reflect: Automated assessment of whether task execution has achieved the goal. Mistakes are identified and the plan is modified accordingly

With a better understanding of AI agents, the next section highlights prominent web3 AI agents and dives into the value proposition of blockchain technology in enhancing AI agents.

The Cambrian Explosion of AI Agents in Web3

The AI agent ecosystem within the web3 landscape is becoming increasingly robust, with AI agents being built in a variety of categories:

AI Companion: MyShell

AI Game Avatar: Virtual Protocol

DeFi AI Agent: Mozaic, frenrug, Dawn Wallet

Art-Collection AI Agent: Botto

This heavy proliferation of AI agents within the Web3 space is not without reason.

What Can The Blockchain Offer AI Agents?

Infrastructure Access at Low Cost - Compute & Payment Rails

Building AI agents on blockchain infrastructure reduces the barrier to access to fundamental resources required, in particular GPUs for compute and payment rail integration.

Web3 AI agents can tap into decentralized compute marketplaces like io.net and Akash for low-cost compute, choose to store their history in decentralized storage solutions like Arweave or Filecoin based on their needs. This approach breaks away from the high costs which are often imposed by centralized cloud providers. According to Akash’s website, as shown below, it is able to offer compute at a price that’s less than half that of traditional providers. Note: The differences in prices vary based on the GPU model chosen.

To truly propel the capabilities of AI agents, they need to have access to capital, which can be used to carry out tasks for humans, and to transact with other agents. On-chain payment rails present themselves as a more accessible solution as compared to traditional bank accounts, which may be difficult to access due to regulations, financial or social status, and other reasons. This is evident, with 5% of the world currently unbanked.

The ease of access to on-chain wallets can be seen from this demo, where a GPT is given access to a Safe multisig wallet on Base, and is able to autonomously manage the USDC within the wallet. A higher level of customizability is also granted when it comes to determining the level of autonomy given to AI agents in managing these wallets, making it possible to specify which particular scenarios warrant the need for human intervention, e.g. when the sum to be transacted passes a certain threshold.

With these synergistic infrastructure integrations, AI agents are able to be more productive and operate more efficiently when built on blockchain infrastructure.

Transparency & Censorship Resistance

Utilizing the blockchain for AI agent creation offers unparalleled transparency and censorship resistance, which are significant challenges associated with web2 solutions.

By building the AI agent on-chain, users are able to gain insights into the creation process, including the integrity of data included in the training and development phases, which are stored on a distributed ledger. With this visible and verifiable data trail, users can be reassured of the AI agent’s quality based on the data sources and the rigor of the training process. In scenarios where an AI agent is required to break down tasks into smaller components to be routed to other models, the transparent process ensures that AI agents are performing as per training, maintaining a high quality of response.

A single point of control typically equates to a single point of failure. Take the example of Akihiko Kondo, who married a virtual singer, Hatsune Miku in 2018. This marriage was made possible by Gatebox, the company that developed the holographic ‘wife’. In 2022, due to the shutdown of Gatebox’s service, Kondo had to bid goodbye to his wife (not a divorce), whose hologram could no longer be hosted. By creating AI agents on the blockchain, this situation can be avoided since there is no central authority that can unilaterally decide to shut down an AI agent hosting service. This is especially crucial, given the amount of data held by AI agents from day-to-day learning and the critical role it plays in improving the user’s workflow and day-to-day life.

Strong Coordination Layer & Incentivization Mechanism

One of the greatest value propositions of the blockchain is its ability to offer a coordination layer and an incentivization mechanism through the use of a token.

Data is often referred to as ‘king’ in AI, given that it is fundamentally required for training AI models. Data monopolies like Google, Meta, and Amazon are best positioned to develop superior AI models, given their access to exponential amounts of user data. Nonetheless, users are not rewarded even if their data contributed to model development, as all of the data is owned by centralised entities, known as the walled garden challenge.

Blockchain breaks down the wall to offer an open garden, facilitated by a token economy which aligns various stakeholders, ultimately creating a community-owned verifiable knowledge graph:

Developers who create AI agents gets rewarded whenever the agent is used

Users pay to access a variety of AI agents and are also rewarded when they contribute data to training of models

Verifiers are rewarded for verifying the output of AI agents, maintaining accuracy and integrity of agent response

More importantly, the token also serves as a disincentivization mechanism for any malicious behavior. More on this in later sections when exploring AI agent creation frameworks.

Web3 AI Agent Creation Frameworks

Spectral Labs SPEC

Spectral aims to create the web3 inference economy, which allows for the creation of a network of interconnected on-chain agents known as the Inferchain. The Inferchain aims to be the bridge between blockchain and the AI and ML industries, providing users with verifiable inferences. This transparent provenance layer serves to tackle the problem of traditional inferences coming from centralized entities, requiring users to trust without knowing the source.

Spectral Labs Architecture

There are 3 distinct components of Spectral’s architecture:

Spectral Syntax

Co-pilot software for the creation of on-chain agents using natural language input, which is used to generate functional code with the help of LLMs.

Spectral Nova

Decentralized network of ML models for smart contracts to access verifiable inference. Spectral Nova serves as an incentivization layer for data scientists and ML engineers to build ML models.

Inferchain

Communication layer for on-chain agents built on Spectral.

Spectral Labs AI Agent Creation Workflow

There are 4 stakeholders involved in Spectral’s inference network:

Creator: Post relevant ML challenge, performance benchmarks and establishes rewards to be earned by Solvers

Solvers: Build ML models for challenges created by Creators

Validators: Verify integrity and quality of models created by Solvers

Consumers: Pay to access models that have been created and verified

The detailed workflow, including these stakeholders, is as follows:

Creator stakes SPEC to create a challenge which is made available to the Solver community

Solvers stake and commit their highest-performing model (Model M) for the challenge

Validators will issue a challenge dataset to the Solver

Solver computes test inferences against the challenge dataset and submits their inferences + zkML proofs to Validators

Validators evaluate Solver’s submitted inferences and proofs against challenge’s performance benchmarks. Upon passing the validator’s evaluation, a Solver’s model is ranked against other Solver’s models. The top 10 highest-performing models will be available for Consumers

Consumers can infer finalized models through Spectral’s inference feed

A Consumer’s request is routed to the top Solver

Inference is provided to the Consumer

SPEC Tokenomics

The SPEC token is used for governance, where holders get to vote on aspects including platform upgrades, model parameter adjustments, fee structure and challenge rules.

In Spectral Syntax, staking SPEC will allow users to create on-chain agents at a lower fee. In addition, they might also be prioritized when it comes to processing of transactions received from on-chain agents. Staking SPEC also allows users to monetize their on-chain agents, where rewards are proportional to the amount of SPEC being staked.

The figure below depicts the use of SPEC within Spectral Nova:

Solvers can stake SPEC to participate in challenges by Creators. Should the models be found to be malicious, Solver’s SPEC will be slashed. This ensures that models used by on-chain agents within Spectral’s inference network are of high quality. Should a Solver have insufficient SPEC, they can choose to crowd-source SPEC to kick-start their participation.

Validators are required to put up a stake in SPEC to participate in Solver model verification, in return for a reward, which comes from fees paid by Consumers. Should a Validator fail to validate the submission within the required time window or make an incorrect verification, their stake will be slashed.

Consumers can stake SPEC to access the ML models at a discount.

Autonolas OLAS

Autonolas is a platform that allows building of autonomous services that allow for inclusion of multiple agents.

Autonolas Architecture

Autonolas utilizes ‘Open Autonomy’, a software framework designed for the creation of agent services. This modular framework consists of multiple components.

Multi-Agent Systems (MAS) Architecture

This serves as the blueprint for building services that are able to tap on MAS, which is a group of agents. Autonolas utilizes the open-aea framework, which has a library to allow developers to build agents that come equipped with the ability to communicate with each other, as well as interact with blockchains and smart contracts.

State-Minimized Consensus Gadgets for Agents

Agents built using the Open Autonomy framework tap onto a shared state to receive information, and come to consensus on actions to take to reach a collective goal. This creates a distributed system where a distributed ledger can be used as the settlement layer.

Consensus mechanisms are the key to a distributed system functioning efficiently. Autonolas leverages the Tendermint BFT (byzantine-fault tolerance) as their choice of consensus. Each agent created runs a corresponding Tendermint node, Each agent generates an output based on the intermediate values of the local state and uses Tendermint BFT to reach consensus. The output is then recorded on-chain, finalising the state.

This is known as state-minimized, as agents are not required to permanently keep the history of the state. Once the state is no longer useful, it can be deleted, making it less resource intensive for agents. In some sense, this bears resemblance to blobs on rollups.

Architecture of Off-chain Agent Services

Agents within the Autonolas ecosystem are off-chain to minimize cost and latency. The flow of computing user’s intent is as follows:

A user enters their intent (desired action) into agent interface

Nodes receive client calls from agents detailing the output desired

Intent is executed and consensus is reached on-chain

ABCI callbacks are forwarded back to the agent

This concludes the round and the next intent can be executed

Given that the agents are off-chain, Autuonolas implements an Incentive Compatibility Module (ICM) to detect misbehavior. If agent A detects a fault committed by agent B, agent A can put a stake in raising a fault proof. Upon consensus that agent B had misbehaved, a portion of agent B’s staked capital is slashed and given to agent A and the rest of the agents that participated in consensus to reward honesty.

Autonolas AI Agent Creation Workflow

There are 2 paths to creating an agent

Developer build an agent of their own choice

A service owner publishes specifications of their desired agent, which is subsequently built by a developer

agent is registered as an NFT and functions off-chain

Metadata stored within the agent is matched with an IPFS hash, which can be called to retrieve data

A multisig is initiated, which then belongs to the agent’s on-chain address

OLAS Tokenomics

OLAS has a total supply of 1 billion tokens, with a maximum token inflation per year capped at 2%.

The distribution of OLAS is as follows:

32.65%: Founding members

10%: Valory AG which is in charge of running the protocol

10%: Autonolas DAO

47.35%: Incentives for agent creation

It can be observed that a sizable amount of OLAS has been set aside to developers for agent creation. A system known as direct contribution measure (DCM) is used to evaluate the number of times and profits generated by a particular agent. Given that the rewards are based on the quantity of agent usage, rewards are only distributed when a user pays for usage of the agent. This balance in demand and supply could potentially limit the selling pressure for OLAS.

OLAS Utility

The Autonolas economy functions efficiently while being maintained by OLAS, which is used in these areas:

Bonding

Users holding OLAS can provide liquidity into third-party DEXs (decentralized exchanges) and receive a LP (liquidity provider) token in return.

The LP token can be sold for OLAS at a discounted price. This serves as a form of fundraising for Autonolas and maintains liquidity for the token in DEXs.

Locking

OLAS can be locked for veOLAS (vote-escrow OLAS), a virtualized, non-tradable, and non-delegatable governance token.

Opting for a longer lock-up period will entitle users to higher multiplier boosts, giving them more governance rights.

Wayfinder PRIME / PROMPT

Wayfinder is an AI tool designed to help users navigate the blockchain with ease. This is achieved by building smart maps, a layer that unifies all ecosystems. Users interact with applications through Shells, which are AI agents with access to web3 wallets and smart maps, to carry out their desired actions. This abstracts away the complexities of interacting with an application, creating a much smoother and more efficient user experience (UX).

An analogy would be to think of Wayfinder as Google Maps:

Smart maps: Google Street View car that maps out how roads are built and connected

Interacting with Shells: Indicating your starting point and destination in Google Maps, and clicking on ‘directions’ to know where to go

Wayfinding paths: Algorithms that determine the routes that can be taken

Check out the Wayfinder demo here for some magical UX.

Wayfinder Architecture

Wayfinder aims to create the underlying infrastructure that allows AI agents to interact with blockchains in a robust manner - being able to access smart contracts, oracles, bridges, and more. This translates to a higher level of AI agent capacity to execute on-chain transactions efficiently. Core components of Wayfinder’s architecture include Shells and Wayfinding Paths.

Wayfinder has been proposed to be built on the Solana blockchain, as the low latency allows Shells to execute at high speed. Nonetheless, the chain of choice is subject to changes based on governance approvals.

Now, diving into the details of the architecture.

Wayfinder Shells

What are Shells?

Shells are user-facing AI agents that execute users' diverse requirements, and can be customized to various use cases by leveraging different open-source LLMs. Nonetheless, Shells are able to transact with each other as they share the same knowledge library - similar to the concept of speaking the same language. For folks that are familiar with DeFi, Shells share some resemblance to solvers within the intent vertical, highlighted in this Blockcrunch article.

Shell Creation Workflow

Shell creation is purposefully made simple, even for non-coding users, and can be broken down into 3 steps:

Shell Minting

A user pays PROMPT to create a new Shell.

Skill Acquisition

The Shell owner can then choose from a variety of LLMs, and tune their Shell to become more specialised through a graphical user interface (GUI). This interface allows Shell training to be done through natural language, making the process very user-friendly.

Each Shell comes equipped with the Wayfinder’s shared knowledge base, which will constantly expand based on community contributions - more on this in the ‘Wayfinding Paths’ section.

Seeding an Identity

Everytime the Shell is utilized, it learns the logic of that particular instance and stores the data, allowing the Shell to self-improve over time.

Properties of Shells

Customisable

A Shell owner has autonomy over its memories and can make various changes:

Memory Curation: Pinning specific memories

Memory Deletion: Shell Reboot

Memory Expansion: Increasing the amount of memories stored with a fee

Memory Wiping: Shell Reset

This is similar to the concept of playing a game and customizing your character. If a gamer chooses to be a swordsman, they will equip themselves with a sword even if they pick up a bow (memory curation). If the gamer now decides to be a mage, they can clear their inventory of swords, and start waving wands instead (memory wiping).

Highly Secure

The private key associated with the web3 wallet assigned to a Shell can only be accessed by the Shell and the owner.

Despite this feature being implemented to ensure that funds are not accessed by malicious actors, it does not take away the potential risk of Shells being exploited, which ultimately will still give the exploiter control over the assets.

Expansive Functionality

Shell's execution capabilities are significantly improved through obtaining contextual data through Wayfinder’s extensive suite of integrated infrastructure, e.g. LangChain, Llama Index, and more. A Shell is also equipped with the API keys necessary to query for data.

Wayfinding Paths

What are Wayfinding Paths?

Wayfinding Paths are a detailed sequence of actions that Shells use to navigate the blockchain and execute the user's needs. Drawing back to the earlier analogy, Google Maps help users figure out the route they have to take to get to their destination, as well as instructions on each step along the way - which bus to take, which train station to get on. Similarly, Paths give Shells a route to follow, and identify the necessary smart contracts they have to interact with.

Creation of Wayfinding Paths

Wayfinder uses a crowd-sourcing approach to populate the directory of Wayfinding Paths, where the community drives its creation, verification, and maintenance.

The end-to-end workflow of a Path is broken down into 3 phases:

Creation: A user stakes PROMPT to submit a Path

Verification: New Paths are verified by Verification Agents and human reviewers for execution accuracy and safety. If deemed to be incorrect, the creator’s staked PROMPT will be slashed and distributed to Verification Agents

Finalization: Verified Paths are added to the shared library and will be accessible by all Shells.

Creators have to maintain their PROMPT stake while the Path is active. This is to prevent malicious or incorrect Paths from being created. Should the amount of PROMPT staked be less than the required quantum (expected to be one-third of the Path’s daily transaction value), fees received from Path usage will be added to the stake before being rewarded to the creator.

Private Paths can also be created, which can be made exclusive to Shells by either having higher usage fees, or necessitating a licence for use. This will likely be designed by creators who might have exclusive insights on certain mechanisms, or have thought of specific algorithms that might yield good returns. It should, however, be noted that private Paths are not verified, requiring users to exercise their own discretion.

PROMPT Tokenomics

PROMPT Utility

Here’s a depiction of the utility of PROMPT within the Wayfinder ecosystem:

There is no indication of whether Verification Agents will be required to put a stake.

PROMPT Distribution

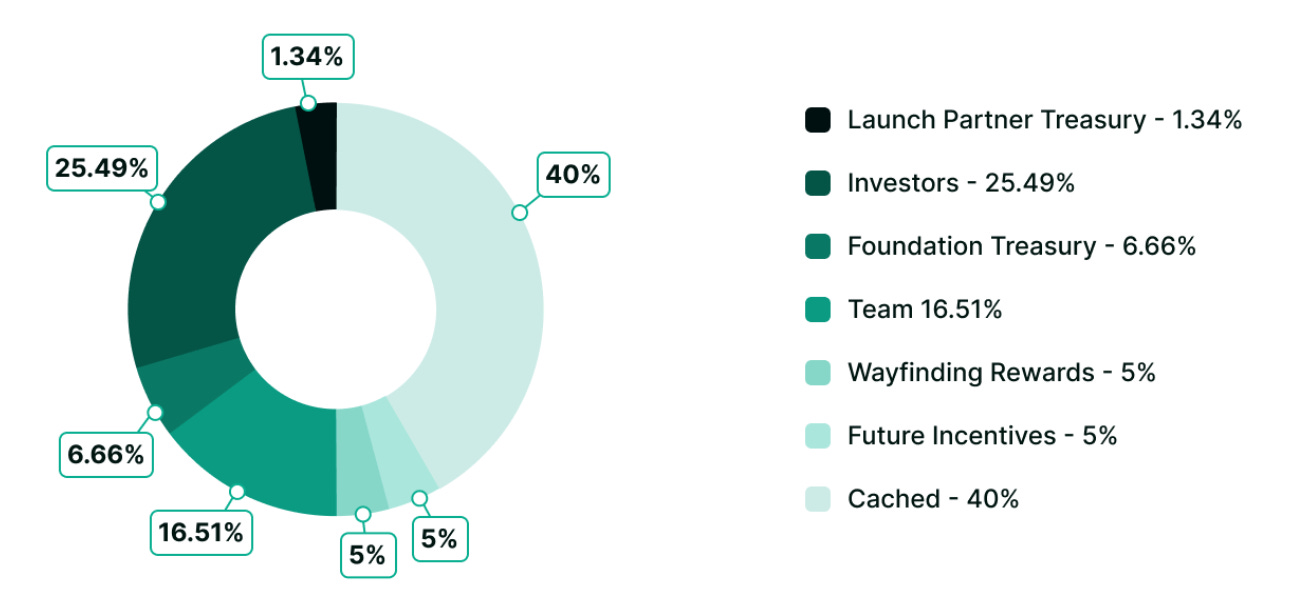

Note: Tokenomics have yet to be finalized and are subjected to changes based on governance.

Wayfinder is targeting a total supply of 1 billion tokens. A total of 42% of total token supply is issued to investors and the team. Despite this being a relatively high percentage, it can be observed from the token supply chart below that there is likely no sudden unlocks, which could result in significantly higher selling pressure:

1.34% is allocated to ‘Launch Partner Treasury’, which refers to potential games that partners or integrate with Wayfinder will receive PROMPT token upon caching their own ecosystem token for 3 years, where the tokens are locked and will be unlocked in a monthly fashion.

Caching is similar to the concept of staking, where tokens are locked up for a period of time before they are being distributed back with a yield.

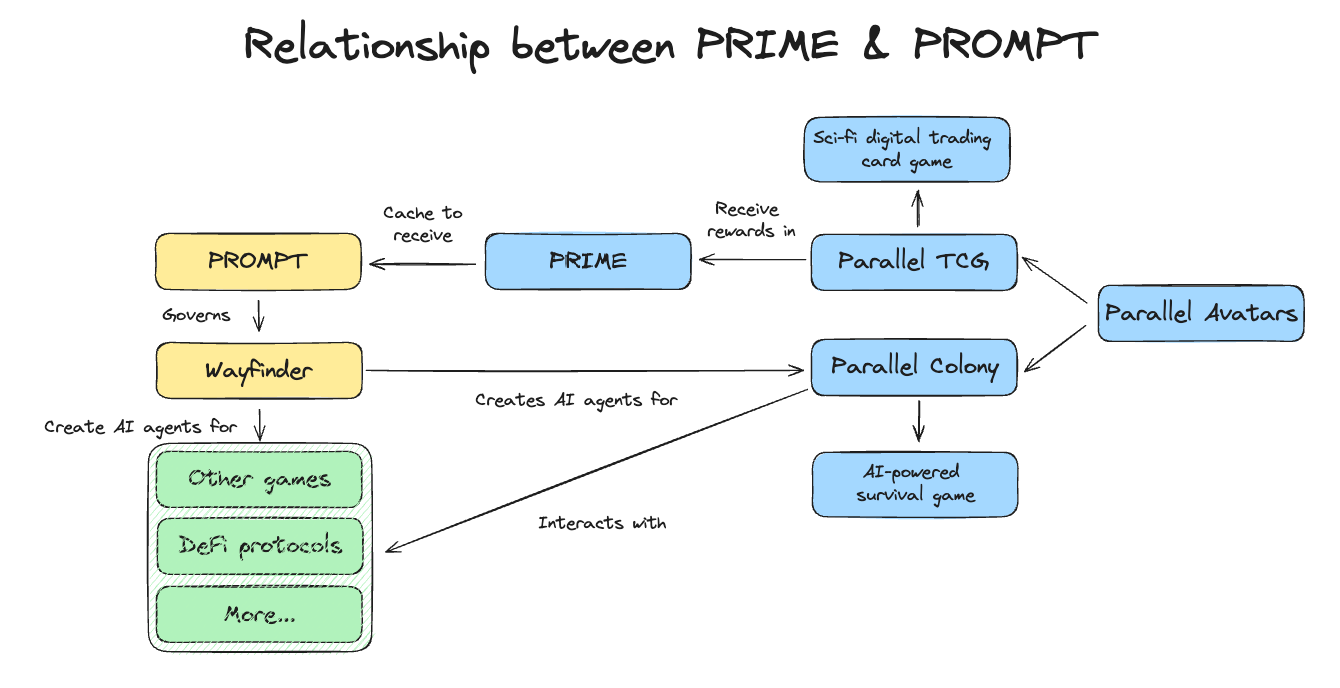

Wayfinder aims to allocate 40% of PROMPT to PRIME holders. A similar arrangement applies for PRIME holders who chose to cache to receive PROMPT tokens. The next section elaborates on the relationship between PRIME and PROMPT, and evaluates the potential reason for the huge allocation of 40%.

Caching PRIME for PROMPT

Wayfinder is built by Parallel Studio, a gaming studio known for its sci-fi based digital trading card game - Parallel TCG. Users are required to purchase Parallel Avatars (a collection of 11,000 unique NFTs) using the PRIME token to boost their game rewards, which comes in the form of PRIME.

Thereafter, Parallel Studio proceeded to launch their second game: Parallel Colony. This is an AI-powered survival game, where game characters, which are AI agents, have to collaborate to reach a common goal in order to earn PRIME. The creation of such AI agents within Colony leverages Wayfinder's infrastructure. In the future, these AI agents within Colony can potentially be used in other games that are built using Wayfinder.

Given the existing traction that Parallel TCG has obtained, a successful launch of Colony will bring significant activity onto Wayfinder with more AI agents being developed. This is coupled by the community’s excitement, with PRIME’s price rising to all time high with the announcement of Colony.

By making a choice to cache PRIME, it is likely that a user is confident in the success of Colony, which will increase the demand for PRIME tokens, driving its price up. Users will then benefit from both increased PRIME value, as well as rewards in the form of PROMPT.

If you would like to cache PRIME to receive PROMPT, here’s a guide.

Wayfinder: A Catalyst for Web3 Gaming?

Wayfinder provides the framework to design a variety of AI agents, including NFT minting assistants, smart trading bots, etc. Since Colony utilizes Wayfinder’s architecture for the creation of in-game AI agents, this report will focus on the impact that Wayfinder can have for web3 gaming.

Exponential Growth in Fun Gaming Content

Have you ever watched the movie ‘Free Guy’ by Ryan Reynolds? In this movie, Reynolds plays a non-playable character (NPC), Guy. What’s an NPC supposed to do - nothing, they are meant to carry out actions as per their code. However, upon seeing a female game character, Millie, Guy no longer acts like a NPC, but begins to cater his game actions to court Millie. This change was induced by an LLM embedded within the game, allowing NPCs to develop their own characteristics.

This may have been a fictional movie, but depicts the potential of AI agent-based game characters that can expand the gameplay without any intervention. No more waiting for years for game developers to release an upgraded version of Grand Theft Auto (GTA) - which might not even be that much more fun. Instead, leave it up to the game characters to create new game scenes. This lack of predictability has the potential to make the game more sticky, increasing player retention over time.

Limitations of Web3 AI Agents

Despite the benefits of decentralized AI agent creation frameworks, there are several limitations that need to be addressed to ensure their effectiveness and reliability.

Lack of Universal Standard

From examining Spectral Labs, Autonolas, and Wayfinder, it's clear that each AI agent creation framework has its own unique process. Notably, there's no common standard for verifying the output of these AI agents. Even if these agents become composable and work across different blockchains in the future, the lack of standardization creates complexities when they interact with on-chain protocols. This is similar to the current name domain landscape, as well as rebasing liquid staking tokens, both of which lack a unified standard.

Security Concerns

First and foremost, the security of AI agents is still unknown. Even with web3 wallets today that are managed by humans, exploits are rampant. A hacker that is capable of exploiting AI agents not only gains access to the assets held, but also the blockchain data it possesses. With this high level of connectivity, the impact of an exploit could spread beyond a single protocol or wallet. In addition, when an AI agent becomes popular and experiences high daily transactional volume, it could potentially become the target of exploiters.

Sensitivity of Private Data Collection

Another limitation is the privacy concerns related to the data collection process. AI agents operate based on the data they collect from transactions. Should these frameworks extend beyond blockchain into sectors like financial markets and healthcare, the potential leakage and misuse of data is a significant risk. This ties in with the next limitation of regulation: stringency.

Regulation Difficulties

The regulatory landscapes within both the AI and web3 sector are subjected to unexpected changes at times. Ensuring that AI agents created comply with all applicable laws might prove to be a challenge in the future. This holds the potential of reducing AI agent functionality, which ultimately impedes the goal of creating a seamless environment for users to interact with the blockchain.

Questions for Web3 AI Agent Creation Frameworks

Given the rather heavy data storage required in Wayfinder, it could be interesting for the community to consider AO by Arweave as a potential chain to build on. Given that AO’s infrastructure integrates Arweave’s permanent storage, this could be a solution to the scalability of Wayfinder. To learn more about AO, check out this interview with AO founder, Sam Williams.

Other questions that pop up while considering AI agent creation frameworks’ future development include:

For agents that become highly utilised, is there a possibility that developers limit access and make it private in an attempt to earn higher fees?

Since AI agents might be similar in their offerings, what are the chances of a commoditized market, where similar agents are created, and compete purely based on lower fees?

How will the AI agent creation process evolve over time to improve the developer experience?

The Future of Web3 AI Agents - Where Are We Headed?

Data can be considered ‘king’ when it comes to AI, as it serves as the foundation for learning. Based on the data ingested, AI agents are able to identify trends, improve their accuracy, and eventually deliver higher quality output. Web3 AI agents have the autonomy to carry out transactions even without an input, allowing them to collect data and learn at an exponential rate. in comparison to existing AI agents, the likes of GPT-4o require explicit user input, and thus the growth in data collection is capped by the amount of user interaction.

With the above phenomenon, web3 AI agents will become the source of data for many more use cases. For example, AI coprocessor networks, such as Ritual, could potentially integrate Wayfinder to have access to data from its army of Shells. With more infrastructure built to track data provenance, users within the Wayfinder ecosystem have the opportunity to earn more over time, generating a flywheel effect to grow the ecosystem further.

With the current limitations in blockchain infrastructure, AI agents typically execute off-chain, before verifying the output on-chain to be cost- and speed-efficient. Nonetheless, verification solutions like opML (optimistic machine learning) or zkML (zero-knowledge machine learning) are still novel, and require more development time to become efficient and sufficiently low cost. It will be interesting to see alternative solutions in the industry, such as chains that might be optimized for AI workloads, with an example being Blockless.

Wayfinder is a glimpse into the future of how AI and blockchain can harmonize to create an advanced digital landscape. With AI agents being able to navigate and execute across complex blockchain networks, the average UX stands to become automated and seamless.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about