CoW, 1inch, Uniswap: Intents and the Future of DeFi Exchanges

A look at the key players in the Intent-Centric Future

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

Since that report on intent-centric architectures by Paradigm, which introduced the concept of “intents” and its related applications, we've witnessed significant advancements by both established and emerging protocols in this often misunderstood direction. DeFi leaders like Uniswap, 1Inch, and CoW Protocol are at the forefront, innovating with intent-centric liquidity protocols that are reshaping on-chain trading dynamics.

In the past, decentralized exchanges (DEXs) have been pivotal in shaping the decentralized finance (DeFi) space, revolutionizing the way assets are traded. By allowing users to seamlessly exchange assets without the need for a centralized intermediary, these platforms have unlocked unprecedented levels of autonomy and flexibility in asset management. DEXs, led by pioneers Uniswap, have facilitated a staggering $3.76 trillion in all time swap volume (across 10 EVM chains tracked by Dune) — a testament to their product-market fit and importance within DeFi.

However, as the DeFi space matures, the typical DEX, once the core of any new ecosystem, will gradually play a supporting role to the market leaders evolving into intent-centric protocols — the key to the future of onchain trading.

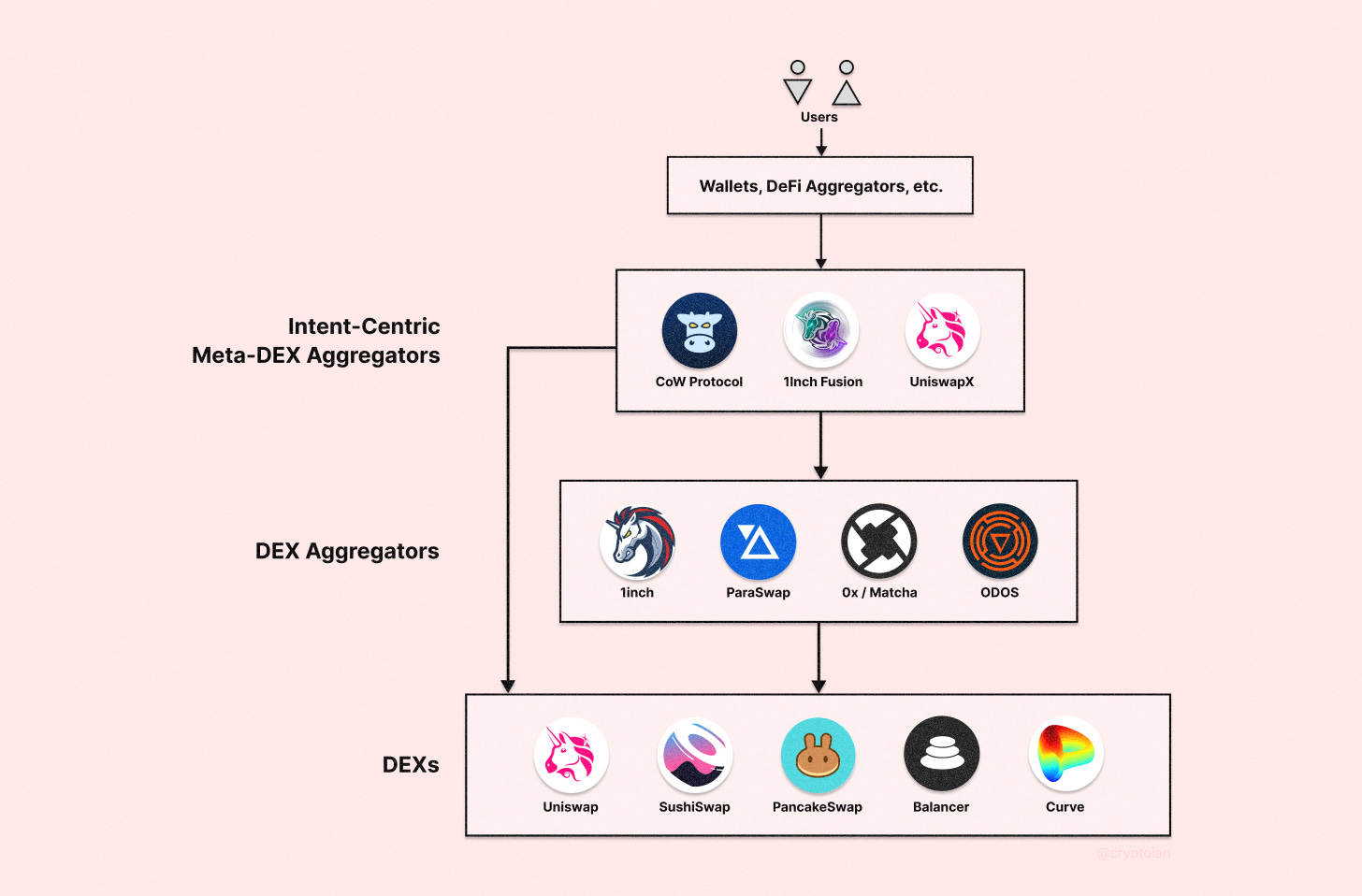

User-facing interfaces like wallets and DeFi aggregators abstract away the difficulty of navigating various DEX aggregators, which in turn aggregate fragmented liquidity across different DEXs, CEXs, and chains. At the core of this new paradigm are intent-centric protocols, effectively functioning as meta-DEX aggregators.

This report aims to provide an in-depth analysis of the protocols that are increasingly dominating on-chain order flow, with a particular focus on their innovative approaches to enhancing user experience through intent-centric models.

Note: While the report acknowledges cross-chain liquidity aggregators, the focus will be on select Ethereum-based intent-centric protocols based on the author’s discretion. As a disclaimer, the editor is a venture investor in CoW Protocol, but the author of the post has no personal exposure.

Setting The Scene

On-chain Order Flow

DEXs serve as the foundational layer for on-chain asset swaps, representing the initial tier of on-chain swap order flow. Their efficiency, however, is inherently tied to the liquidity available within the protocol. This dependency means that when liquidity for a particular token is scarce, users may face higher slippage, impacting the cost-effectiveness of their trades.

Enter DEX aggregators. These platforms pool liquidity from multiple DEXs, offering users more optimized trading routes. Through pathfinding algorithms capable of executing 'order splitting' or 'multi-hop' swaps:

Order Splitting: This means that a user's trade is divided into smaller parts and executed across different liquidity pools or exchanges. For the user, this often results in better prices and lower slippage, especially for large orders.

Multi-Hop: This involves routing a user's trade through multiple token pairs to achieve the best possible rate. For example, if a user wants to swap Token A for Token C, the trade might go through Token B as an intermediate step (A → B → C) if this path offers a better rate than a direct swap. For the user, this means potentially getting more of the desired token for the same initial investment.

However, the efficiency of these aggregators is bound by the prowess of their individual pathfinding algorithms, which varies from one aggregator to another.

This is where Meta-DEX aggregators come in. Effectively “aggregators of DEX aggregators”, meta aggregators carry out swaps from various DEX aggregators in order to take advantage of the most favorable swap rates available across the DeFi ecosystem.

As the DeFi landscape progresses, we're witnessing the rise of intent-centric protocols, representing the next evolution in this hierarchy. These advanced platforms not only aggregate liquidity but also intelligently anticipate and fulfill user intents via the use of resolvers/solvers/fillers, thereby offering a more nuanced, efficient, and user-tailored trading experience, transcending the capabilities of traditional DEXs and even meta-DEX aggregators.

The Intent-Centric Future

WTF Are Intents?

As defined by Anoma in their whitepaper, an intent is an expression of a user's objective when interacting with a protocol. Something as simple as "transfer X from A to B" or as specific as "trade X for Y."

Unlike conventional transactions that are complete and self-contained, intents are like puzzle pieces of a transaction, needing other parts to form a complete, balanced transaction that meets all users' constraints.

Imagine you're at a restaurant and you're craving a specific type of meal, say, a vegetarian dish. In a traditional transaction (like ordering from a menu), you would specify exactly what you want - perhaps a specific type of salad or a pasta dish. This is akin to a traditional transaction in the blockchain world, where you dictate every detail of the transaction.

Now, consider an intent in this restaurant scenario. Instead of specifying a particular dish, you simply inform your waiter that you want a vegetarian meal under $15. The waiter, who knows the menu well, then goes to the kitchen and finds the best vegetarian option available, considering variety, ingredients, and your preferences to give you the best value for your money. The meal is then prepared by the chef and his team of sous chefs.

In this intent-driven model, the role of third parties, to which we will henceforth refer to as solvers, becomes pivotal. A solver operates much like the waiter or the culinary experts in the restaurant scenario, where a user's intent is akin to the diner's preference for a specific type of meal.

Since most on-chain activity revolves around trading, it makes sense that most intent-centric protocols today focus on improving trading experience for users.

Here are some examples of different expressions of an on-chain intent:

Limit Orders — one of the most common expressions of an “intent”. Users submit an order to buy or sell a token at a specific price or better. The order is executed only if the conditions are met.

Batched Orders — similar to limit orders, but batched orders rely on a network of solvers or an algorithm to match a combination of orders together to maximize efficiency and price.

Cross-Chain Aggregators — these protocols aggregate liquidity across multiple chains and liquidity sources, giving users the most optimal price given a swap order along with a source and destination chain.

Automated Trading — advanced strategy protocols handle automated trading such as dollar cost averaging (DCA), grid trading, and other trading strategies without any manual input from the user other than the initial parameters.

Solvers, Fillers, & Resolvers

A solver is a specialized node within a network that observes and interprets user intents. The main function of a solver is to compute solutions for a set or subset of intents. It does this by running various solver algorithms, which are designed to figure out the most efficient and beneficial way to fulfill these intents.

A key characteristic of solvers is that they operate in a permissionless environment, meaning anyone with the necessary skills and resources can become a solver. This open nature fosters a competitive landscape where multiple solvers work to find the best solutions to the intents presented. More importantly, unlike searchers specializing in maximal extractable value (MEV), solvers processing intents are incentivized to return the best solution for the user instead of prioritizing for as much profit as they can for themselves.

Maximal Extractable Value (MEV) refers to the maximum value that can be extracted from blockchain transaction reordering or insertion by miners or validators. DEX arbitrage is the most common source of MEV, and includes front-running, back-running, and sandwich attacks.

Front-running occurs when someone sees your pending transaction and quickly places a similar one that gets executed before yours. This can lead to your transaction failing while the front-runner profits.

Back-running is a tactic where someone spots your large trade (which causes a price impact) and makes their own trade right after yours. This creates an opportunity for them to profit from the price impact. Unlike front-running, back-running doesn't usually affect the success of your transaction but exploits the market movement it causes.

Sandwich attacks are a combination of front-running and back-running. Here, the attacker first increases the price you pay for a trade by placing their order before yours. After your trade goes through and affects the market price, they make another trade to profit from this price change.

Intent Example

Let’s walk through a step-by-step example to further understand what an intent is:

User's Objective: A user wants to execute a dollar-cost averaging strategy for buying a token, say ETH, without manually entering orders each time. They set an intent to purchase $200 worth of ETH every Monday at the best available price.

Solver's Role:

Observation: A solver, acting as an algorithmic expert, monitors the blockchain for such intents.

Matching the Intent: On Monday, the solver observes the user's intent and begins to search for the best possible execution.

Execution Strategy: The solver analyses various liquidity pools and trading paths to find where $200 can get the most ETH at that specific time.

Creating the Transaction: Once the optimal trade is found, the solver creates a transaction that executes the user's intent – buying ETH with the set amount.

Completion: The transaction is executed on the blockchain, and the user's portfolio is updated with the newly purchased ETH.

For the purposes of this report, we will discuss the following intent-centric protocols:

UniswapX

1inch Fusion

CoW Protocol

Intent-Centric Protocols

UniswapX

UniswapX is a new intent-centric Dutch-auction based protocol integrated into Uniswap, creating a marketplace for liquidity discovery. Unlike with regular trades made on Uniswap V1-V4 where trades are routed through its liquidity pools via its routing API, UniswapX delegates routing to a permissionless, open market of what it calls “fillers”, or solvers.

UniswapX simplifies trading through these steps:

Approval: Users (swappers) approve the Permit2 contract for token transactions.

Order Signing: Users sign orders detailing their trade preferences, including tokens, amounts, and conditions, without directly submitting transactions.

Order Pickup: MEV searchers, market makers, or other on-chain agents, known as solvers, pick up these orders for execution.

Execution and Gas Fees: Fillers execute orders on-chain, covering the gas fees, which are included in the trade's execution cost.

Asset Transfer and Verification: The Reactor Contract interacts with fillers for asset transfer, ensuring trade conditions match user expectations.

Liquidity Sourcing Flexibility: Fillers can source liquidity from a mix of on-chain and off-chain venues, bundling multiple orders for efficient execution.

Orders on UniswapX are in the form of Dutch auctions. Unlike typical limit orders, Dutch auctions have a decreasing execution price based on timing. When swappers submit their orders via UniswapX, the order starts with a price slightly better than the current market rate.

For instance, if 1 ETH equals 1,000 USDC, a Dutch order to sell ETH might begin at 1,050 USDC. Over time, this price gradually decreases to the lowest price the seller is willing to accept, say 995 USDC. This mechanic motivates solvers to act quickly for a profitable deal. Delaying could mean another filler might step in and accept a lower profit, thus taking the order.

Other benefits UniswapX brings:

Aggregated Liquidity: ensures superior pricing for users by pooling liquidity from various sources, addressing the limitations of fragmented liquidity pools.

Gas-Free Swapping: users can now execute trades without bearing the cost of gas, as fillers cover these expenses, integrating them into the swap price.

MEV Protection: combats one of the prevalent challenges in on-chain swapping — MEV. By redirecting potential MEV to improve trade prices, it shields users from adverse pricing impacts.

No Cost for Failed Transactions: ensures users aren't charged for unsuccessful transactions.

Cross-Chain Swapping: in the future, UniswapX will introduce seamless cross-chain swapping, merging the functionalities of swapping and bridging, thus streamlining the trading process across different blockchain networks.

Uniswap: Business Model

On October 17, 2023, Uniswap Labs announced the implementation of a 0.15% swap fee that would apply to token pairs traded through Uniswap Labs frontends, including the following tokens: ETH, WETH, USDC, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, XSGD. This frontend fee applies to trades going through UniswapX and its regular router API, which routes through V2 and V3 pools.

This is the first time Uniswap has implemented any swap fees that specifically accrue to Uniswap Labs, in addition to liquidity provider fees. Liquidity provider fees of 0.01%, 0.05%, 0.3%, and 1% accrue back to liquidity providers, depending on the pool.

Note that governance can vote to implement a fee specifically for UniswapX swaps, up to 0.05%. Governance can also vote on a fee switch that distributes a percentage of liquidity provider fees to the Uniswap Foundation. Both of these are yet to be implemented as of the time of writing.

While many were dismayed at the introduction of these fees, this move aims to enable the Uniswap Labs team to continue developing the protocol for the foreseeable future.

To-date, Uniswap Labs has generated approximately $1.2 million from the newly introduced swap fee, amounting to an annualized revenue of about $15.09 million. This revenue is a direct outcome of roughly $800 million in swap volume processed since the fee inclusion through Uniswap Labs' trading interfaces, including the Uniswap mobile app.

Despite the fee implementation, user engagement with Labs-maintained frontends remains stable. This consistency in user numbers underscores Uniswap's strong product-market fit and reaffirms its position as a leading venue for DEX trades.

In terms of supply-side swap fees, Uniswap has generated over $56 million in the last 30 days or an annualized $675 million, all of which goes to liquidity providers. While UNI governance have discussed implementing a fee switch to redirect a share of revenue to the protocol, this discussion has been shutdown due to concerns around legal and tax implications. Furthermore, with the implementation of the 0.15% frontend fees as discussed above, it is unlikely that a fee switch is implemented any time soon.

1Inch Fusion

1Inch Fusion is an intent-centric protocol by 1Inch, the most widely-used DEX aggregator in the space today. Like UniswapX, Fusion utilizes a Dutch auction that constantly decreases the swapper’s order price until it’s filled by a “resolver”, or solver.

Effectively a limit order with a variable (decreasing) exchange rate, solvers may partially fill orders until the end of the auction, leading to an optimized and favourable result for the swapper.

Solvers on Fusion are crucial for executing swaps, and consist of a backend server app to select orders, a whitelisted account funded by staking $1INCH, and workers that perform the swaps. To be eligible, solvers must be among the top 10 in unicorn power, a metric obtained by staking $1INCH. This power can be increased through additional staking or attracting delegators. Order-filling priority is based on total unicorn power held. The list of whitelisted resolvers is dynamic, changing with unicorn power distribution. This system ensures only credible and adequately funded resolvers participate in swap execution.

As with UniswapX, solvers on Fusion pay for gas fees so swappers don’t have to bear any network fees for placing an order, even if the transaction fails due to failed or expired swaps. Fusion also provides MEV protection, most likely via MEV Blocker, of which 1inch is a launch partner.

Business Model

The larger 1Inch protocol generates revenue from positive slippage from its v5 swap router. The revenue comes from the swap surplus resulting from the difference between the swap price at time of quote and time that the transaction is actually mined. However, in June 2023, 1inch governance voted to discontinue swap surplus collection and instead redirect all positive slippage back to the user, due to the inconsistent (and frankly, negligible) nature of the revenue.

With its primary source of revenue removed, 1inch DAO and its token does not accrue any value from the protocol as of the time of writing. However, Fusion could be a potential source of revenue should the DAO decide on its monetization strategy.

CoW Protocol

CoW Protocol distinguishes itself with its unique batch auctions and the Coincidence of Wants (CoWs) mechanism. CoWs match orders with similar prices in a batch, leading to better deals and lower costs for users. CoW Swap, built on this protocol, acts as a Meta-DEX aggregator, ensuring users get the best rates from different liquidity sources.

The protocol uses solvers — parties rewarded for finding the best ways to settle trades. These solvers, who must be approved by the CoW DAO and place a bond, compete to offer the most efficient trade settlements. This system, coupled with off-chain trade signing, not only removes transaction fees (users still pay a settlement fee) but also protects users from MEV exposure by keeping their intents private.

MEV Blocker

MEV Blocker is a free RPC endpoint that protects users from MEV across the DeFi space, and was a joint venture between CoW Protocol, Beaver Build, and Agnostic Relay. MEV Blocker routes all transactions through a decentralized network of searchers that block MEV such as front-running, back-running, and sandwich attacks.

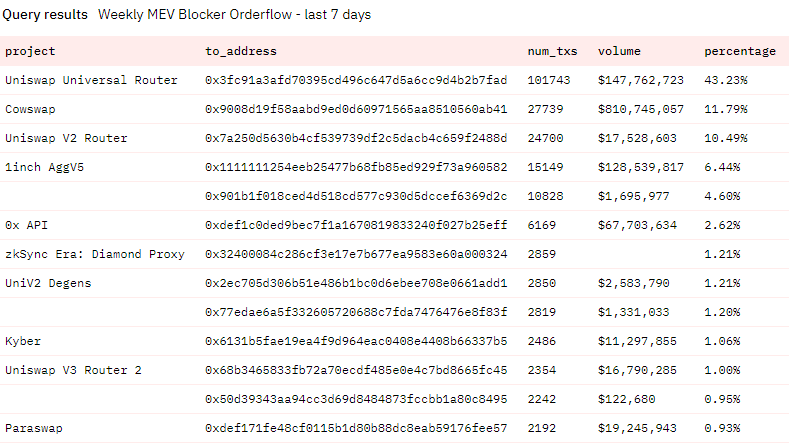

MEV Blocker currently sees between 2.5-4% of all EVM transactions on Ethereum. The table above shows the order flow passing through MEV Blocker over the last 7 days, with a majority of it coming from Uniswap, CoW Swap, 1Inch, and 0x Protocol.

Business Model

In its current state, CoW Protocol does not explicitly have a fee switch that redirects revenue from the protocol to CoW DAO. Instead, any “revenue” is a result of over-collection of gas fees, which is neither intentional or desirable.

As such, the DAO recently tabled a proposal to trial various fee models for a 6-month period. This includes, but is not limited to:

Surplus fees — fees are charged on the surplus; amount received - quoted amount.

Volume-based fees — fees are charged on the total trade amount of certain token pairs.

Fixed fees — fees are charged as a fixed amount for every trade.

As of the time of writing, the protocol has generated $6.2 million in surplus from swaps over the last 12 months. The chart above shows a proposed 50% take rate, leading to $3.1 million in annualized revenue for the protocol if this was implemented from the beginning.

It has also been discussed that CoW Protocol begin to accrue revenue from MEV Blocker. This year, validators earned 14,594 ETH, or around $29.4 million — $51.6 million annualized. Assuming a take rate of 10% is decided, this would be an additional $5.2 million in annualized revenue to the protocol.

COW: Hidden Gem?

Of the three tokens, COW appears to be lagging behind its peers in terms of valuation. Notably, while UNI, 1INCH, and COW do not accrue any value from protocol revenue as of today, CoW Protocol is the closest in terms of implementing a fee switch based on governance discussions.

Tokenomics

Token Distribution

COW has a total supply of 1 billion tokens, with just under 780 million tokens fully vested as of the time of writing. Assuming Team, Gnosis DAO, and DAO Treasury tokens are removed from the circulating supply, we arrive at around 451 million tokens circulating.

Given the hypothesized take rates from Swap Surpluses (50% of ~$10 million) and MEV Blocker validator fees (10% of $51.6 million), CoW Protocol would be raking in an annualized $10.2 million, which would see it trading at around 13.3x earnings at current valuations.

Catalysts

CoW Protocol: Strong User Retention & Growing Order Flow Market Share

CoW Protocol boasts impressive monthly retention rates of around 30%, with 50-60% of its monthly active users being returning users. This shows that the protocol has garnered significant adoption among its users.

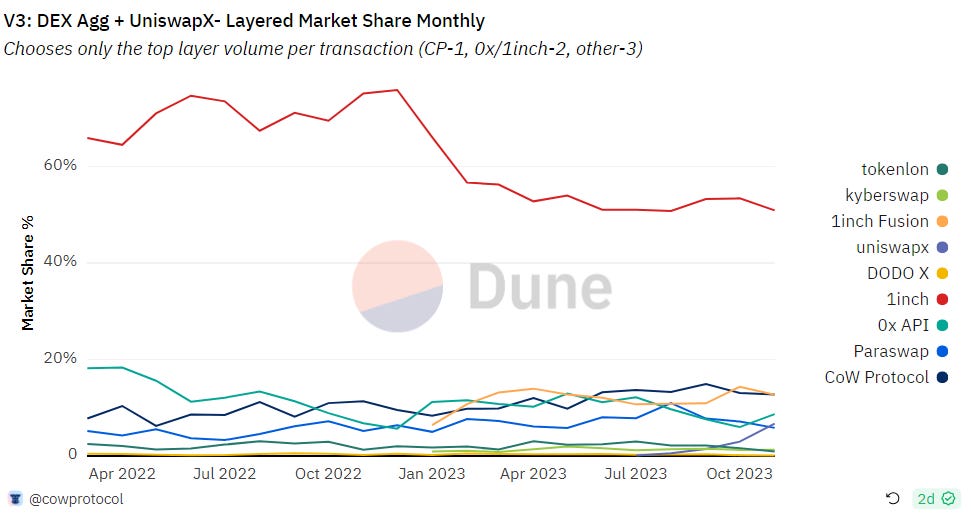

Furthermore, since the turn of the year, CoW Protocol has grown it’s share of DEX aggregator order flow market share by 54% from 8.3% to 12.8%. In contrast, market leaders 1Inch went from 66.1% to 50.9%. UniswapX launched in July 2023 and has since gained 6.7% market share, and will be one to watch given its dominance in the DEX space.

Going Cross-Chain

The CoW Protocol team has hinted that cross-chain trades could be in the works, and UniswapX has cross-chain swaps on its roadmap. Thus, we can also assume that deployment of these intent-centric protocols on various L2s prior to cross-chain functionality implementation could be prioritized in the near future. This significantly increases the total addressable market of both UniswapX and CoW Protocol to grow their respective market share.

While this move would place them in direct competition with cross-chain bridging solutions like Across and Li.Fi, cross integrations between these protocols are likely and serve as a net positive for the sector as a whole.

New Integrations

On-chain trading is evolving to become more user-friendly, with much of the complexity abstracted away by frontends such as wallets, trading terminals, DeFi aggregators, and cross-chain liquidity aggregators. The development of proprietary wallet solutions by major players like Uniswap and 1Inch exemplifies this trend.

Intent-centric meta-DEX aggregators like UniswapX, 1Inch Fusion, and CoW Protocol will continue to be integrated into these user-facing protocols, thereby increasing its reach and share of on-chain order flow.

CoW Protocol: Turning on the Fee Switch

CoW Protocol is the closest of the trio to “turning on the fee switch”, with discussions for a testing period of various fee models and revenue redistribution from MEV Blocker underway.

MEV Blocker (CoW Protocol): The Dark Horse

Since coming online, the MEV Blocker RPC has seen between 4.0% - 5.7% share of all transactions on Ethereum, or an average of around 1.5 million transactions each month. As of the time of writing, 90% of profit from back-running opportunity goes back to the user, with the remaining 10% kept by the searchers.

Potential catalysts for MEV Blocker include:

New integrations with various user frontends such as wallets and trading terminals as the default RPC will significantly increase order flow share

A ~57% growth in 30-day daily active users (DAU) since its launch in April 2023. This is likely to continue to grow along with onchain trading volumes.

This bodes well for CoW Protocol should revenue sharing be implemented.

Headwinds

Lack of Value Accrual

As of the time of writing, UNI, 1INCH, and COW do not redirect a share of protocol revenue to the treasury, token holders, or token stakers. This leads to poor value accrual for the respective tokens, meaning that demand relies solely on speculation and utility.

Uniswap are unlikely to implement any fee sharing in the near future, given the recent implementation of the 0.15% frontend fee and governance concerns around tax and legal obligations should a fee switch be implemented.

Similarly, 1Inch would need to monetize Fusion before any discussion of a fee switch can be had.

High Competition: Aggregation Layers

The liquidity aggregation market is intensely competitive, with numerous layers of aggregation fostering a race-to-the-bottom scenario for both protocols and their associated solver networks.

The solver networks are also highly competitive — we are seeing the power law play out here. For instance, on UniswapX, the top three solvers handle 90% of the trading volume, a trend mirrored in 1Inch Fusion where the top four solvers account for a similar volume share. where the top 3 solvers account for 90% of volume on UniswapX. This effect is similarly observed in the 1Inch Fusion solver network, where the top 4 solvers account for 90% of volume on Fusion. CoW Protocol exhibits a slightly more distributed pattern, with 30% of its solvers managing around 80% of batch share.

Despite this intense competition, a state of equilibrium is likely to be reached. Users may increasingly be prepared to pay higher fees for intent fulfillment, which could offset the competitive pressures and sustain solver network participation.

References

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about