Pandora: The First Truly Fractionalized NFT Ownership

Breaking down ERC 404 - the new "ERC" standard

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

How important is fractional ownership? Imagine if Bitcoin did not allow for decimal places, thus anyone interested in BTC had to buy one full BTC at least, do you think it would have been able to reach the same level of acceptance today? I think not.

This is why most cryptocurrencies we know today are ERC20 that offers fungibility. But ERC721 are non-fungible tokens (NFTs) and although they offer uniqueness and ownership, they lack native fractionalization, which is hurting the NFT ecosystem.

Here’s another example that we are all too familiar with. Let’s say you bought an NFT from a collection a while back, like a year ago, and when you bought it, it was hot. But right now the project is dead, a very common occurrence for NFT projects. If there are no bids, you will not be able to sell your NFTs at all, and your losses are an astronomical 100%.

What if NFTs could be as fungible and liquid as ERC20 tokens? Instead of listing an NFT and waiting for a buyer, holders can sell the tokens at any time. .

That’s what a project called Emerald was attempting to do by merging ERC20 tokens with NFTs to tackle NFT liquidity issues. However, it was exploited due to the reliance on ChatGPT. Despite this, three pseudonymous developers, ctrl, Acme, and Searn, saw the potential of what the project was trying to achieve, and thus the Pandora team was formed.

Pandora is an NFT collection with a maximum supply of 10,000 tokens, and it uses a new unofficial token standard they created called ERC404. It combines the fungibility of the ERC20 token standards with the uniqueness of the ERC721 token standards. By mixing the two standards, they simplify the relationship between tokens and NFTs, allowing for native features like partial ownership, enhanced liquidity for an NFT collection, and more. The benefits don’t stop there, and extend to many other applications and possibilities.

Note: The ERC404 is a wordplay on the famous 404 ‘not found’ error, sigalling that the ERC404 is not an official standard yet, but the team is working on getting it recognized.

This initiative marks a pivotal moment for crypto as it’s the first time that an NFT is able to easily achieve the liquidity of ERC20 tokens with the uniqueness of ERC721 NFTs. By doing so, Pandora not only addresses the NFT market's liquidity issues but also pioneers the first truly fractionalized NFT ownership where each token is inextricably linked to an NFT. In a sense, the team has opened Pandora’s box, and hopefully, unlike the myth, this time it unleashes a treasure trove of opportunities for NFT ownership and liquidity.

In the following sections, we will explain what ERC404 is, the problems that ERC404 is solving, compare Pandora with existing NFT solutions, explore possible future use cases and risks that Pandora faces, and the prospects of the token.

Explaining The First ERC404 - Pandora

ERC404 is a hybrid token that blends the features of ERC721 (non-fungible tokens) with the fungibility of ERC20 tokens, allowing for fractional ownership of NFTs while maintaining individual token identities. These ERC404 tokens are also known as ‘Replicants’.

Properties of ERC404:

Native fractionalization: The replicant can be held as parts instead of whole numbers

NFT protocol interoperability: The replicant can be used in NFT protocols

Native liquidity: The replicant can be used as liquidity easily, making it tradeable

ERC20 protocol interoperability: The replicant can be used in DeFi protocols

Non-fungible properties: The replicant can have traits, rarities, etc, similar to an NFT

Source: https://www.pandora.build

Puzzle Maker Analogy

Let’s try explaining this with an analogy. Imagine ERC404 as a magical puzzle creator. It can transform each unique artwork in a gallery, which is akin to traditional ERC721 NFTs that are owned by a single person, into a puzzle set that is divisible into infinite puzzle pieces, akin to fractionalizing an NFT into more accessible segments.

These puzzle pieces are like shares of the artwork; owning a piece is similar to holding an ERC20 token, representing a portion of the value. Just as you can trade puzzle pieces with others, ERC404 tokens can be easily traded, enhancing liquidity and making ownership more accessible.

Assembling a complete puzzle set doesn’t require complex procedures, illustrating ERC404’s streamlined approach to consolidating fractional shares without the need for additional layers. This analogy underscores how ERC404 democratizes the ownership of valuable digital assets, making it feasible for more people to invest in and appreciate unique digital art through partial, more accessible shares.

Hopefully the above analogy helps you to visualize how ERC404 works, now let’s move into a more technical explanation.

How does ERC404 work?

ERC404 works by having two main innovations, native fractionalization without using wrappers, and allowing the NFT to be used in liquidity pool easily due to native fungibility.

Imagine buying a token, but for each whole number that you own, you also get a unique, collectible item like an ERC721 NFT. This makes every whole purchase a bit like opening a mystery box—you get the standard token and a surprise NFT, which could be anything from common to super rare.

That’s how it works for the PANDORA ERC404 token, when you buy 1 PANDORA token, you're not just getting a token; you're also getting a unique NFT. If you decide to sell your token, the NFT gets burnt automatically.

If you only buy a part of a PANDORA token, you don't get the NFT until you have a whole one. And if you have more than one token, thus having multiple NFTs, you can choose which NFT to keep by trading the token it's tied to.

This means tokens can be fractionally traded and transferred, with the system automatically managing the complexities of whole and fractional token balances. By having fungibility baked into the NFT collection, it makes it much easier for users to provide liquidity to the NFT collection.

I made a quick summary of how ERC404 work:

Update: Transferring 1 full ERC20 token no longer burns and mints a new NFT.

The main benefits that ERC404 brings are:

More liquidity: Ease of providing liquidity without wrappers means more liquidity

Less volatility: More liquidity often results in less volatile prices

More adoption: Less volatile prices encourage more adoption, especially with DeFi

With this in mind, let’s explore some new use cases that can be derived from these benefits.

New Use Cases for NFTs due to ERC404

1. Better liquidity means more use in DeFi Integrations:

As ERC404 tokens are supposedly more liquid, it also means more reliable and less volatile pricing. Let’s take an example for a trending NFT collection like Moonbirds. Buying 30 of them, or spending 50.7 ETH (about $147k as of this writing), will move the floor price from 1.63 ETH to 1.7312 ETH, or about 6%.

On the other hand, buying 50.7 ETH of PANDORA will only result in a price impact of 1.45%. Although this isn’t the best example since Moonbirds market cap is about 2.5x smaller than Pandora, it gives you an idea of how liquid ERC404 tokens can be.

Ironically, the Pandora NFT itself isn’t liquid. If we purchase Pandora NFTs with approximately 50 ETH, it results in a 50% increase in NFT prices.

Additionally, it is easier to fetch the price of an ERC20 token compared to an ERC721 which involves much more complex formulas.

If an oracle can provide a reliable price feed for an ERC404 token, it allows the ERC404 NFTs to be used for more DeFi integrations.

This includes, but is not limited to:

Using fractional NFTs as collateral in a money market

Using fractional NFTs as margin for trading

Using fractional NFTs in options contracts

Incentivizing LPs to provide liquidity by rewarding them with fractional NFTs

Creating a perp market of that NFT

Bridging the NFT over to other networks

The more utility an NFT has, the greater the staying power and demand that it will have, which will benefit that NFT community. Imagine a world where an NFT has so much utility and is accepted everywhere, it could even be as good as money.

2. Improved Governance for NFT Communities

ERC404 can help improve the governance process for NFT communities by leveraging its unique attributes of fractional ownership. Here's how it can help:

1. Fractional Ownership for Wider Governance Participation:

ERC404's fractional ownership democratizes access to governance by allowing more community members to hold stakes in valuable NFTs. This broadens participation in decision-making processes, making governance more inclusive compared to ERC721, where typically only full owners can participate.

2. Dynamic Governance Models such as veNFTs:

ERC404's similarities to ERC20 means that it can leverage many of its features, such as vote escrow popularized by Curve protocol. For example, communities can implement mechanisms where NFT holders lock up their NFTs to increase voting power, rewarding long-term holders and contributors with greater influence in governance decisions.

3. Reward Active Governance:

For instance, governance participation itself could be incentivized through the distribution of additional ERC404 tokens, aligning community members' interests with the long-term success and health of the project.

4. Bootstrap Demand, Liquidity and Community:

ERC404 tokens can be issued out as staking or LP rewards which can serve as a powerful mechanism to bootstrap demand and liquidity for new ERC404 tokens. By rewarding early adopters and liquidity providers with additional tokens, projects can stimulate interest and investment, driving up both demand and value.

By leveraging ERC404, NFT communities can foster more inclusive, equitable, and dynamic governance models, ultimately leading to stronger, more engaged, and resilient ecosystems.

3. Using Uniswap v3 to Mint NFTs

ERC404 introduces a transformative approach to NFT minting by leveraging Uniswap V3 for not just the exchange feature but also using it as a bonding curve for minting. By doing so, it facilitates a dynamic price discovery process, enabling projects to avoid setting mint prices too low or too high, which can hinder price discovery or stifle the project entirely.

Utilizing Uniswap V3's capabilities, ERC404 projects can achieve deep liquidity, support active speculation, and improve royalty earnings with lower fees for users, all while mitigating issues like botting and unfair release strategies.

This also helps to address traditional challenges faced by ERC721 projects such as slow price discovery, illiquidity, and the inefficacies of bonding curves.

4. Using ERC404 in Games

ERC404 could also be used as an innovative gaming mechanism.

For example in trading card games, purchasing a booster pack could yield you multiple ERC404 cards, with the distribution based on predefined probabilities, and if you want to obtain a higher rarity card, you could reroll it, a mechanism that burns the NFT and mints a fresh one, adding a certain strategic layer to a game’s economy.

Another example could be, an RPG game could feature ERC404 equipment, where the number of tokens held for a particular NFT could represent durability or stats; or gathering shards of an artefact like a health jar to receive a health boost, similar to games like Zelda.

How ERC404 solves current problems with NFTs

In November 2017, CryptoKitties launched as the first ERC721 NFT, introducing unique elements such as traits, ID numbers, rarities, etc, that were not in ERC20 tokens.

Source: https://guide.cryptokitties.co/guide/cat-features

Since then, the NFT ecosystem has evolved to have more utility and grown into a multibillion industry. However, it is still grappling with several significant challenges.

Let’s explore some of these problems and how Pandora and ERC404 can help solve them.

1. Unsellable Dead NFT Projects:

As mentioned above, a considerable problem for NFTs was how common it was for projects to lose momentum or fail to capture continued interest, leading to a situation where holders of these NFTs were unable to sell their assets due to having zero buyers and incurring a total loss on their investment.

If you have been an avid NFT investor in the past cycle, and you look at your NFT portfolio, you’ll see that most of them do not have any volume and are unsellable. Even with NFT AMMs, less popular collections were not always available on platforms like Sudoswap. This highlights the need for a way to preserve some value even as projects lose popularity.

With ERC404, the NFTs can be pooled on DEXs like Uniswap and take advantage of its AMM features. This means that for a ‘dead’ project, Uniswap constant product liquidity pools can still guarantee some liquidity at any price, from $0 to infinity, so that the losses, however severe, are not a 100% loss.

2. Exclusion Due to High Prices in Successful Projects:

Conversely, NFT projects that experienced significant success and skyrocketing valuations created an unintended barrier to entry for less wealthy retail investors. As prices for these coveted NFTs soared, they became inaccessible to a broader audience, stymieing community growth and limiting the democratization of ownership.

Source: https://opensea.io/collection/pudgypenguins

For example, Pudgy Penguins used to be less than 2 ETH and have since skyrocketed to 22 ETH, which is around $60k, or around the average US salary according to Forbes. This means it can be harder for the collecsotion to gain new holders as they are priced out.

Additionally, the maximum number of holders a 10K collection can have is well... 10K. And that’s the very maximum.

With ERC404, users who cannot afford an entire NFT can still buy partial amounts, and can eventually DCA their way onto a full NFT, allowing the NFT community to be more accessible and continue to grow way past 10K holders.

3. Airdrops using NFT Wrappers could be exploited or unfair

During the ApeCoin airdrop to BAYC holders, an individual successfully claimed $1.1 million in ApeCoin by temporarily acquiring Bored Ape NFTs that had not yet claimed their airdrops. The exploit hinged on the airdrop's design, which allowed the claim to be based on current rather than past ownership, enabling the claimant to briefly hold the NFTs, claim the airdrop, and then return the NFTs. This maneuver involved utilizing a flash loan to gain temporary ownership of the NFTs from an NFTX vault without the need to permanently purchase them, exploiting the airdrop mechanism for profit.

ERC404 could mitigate such vulnerabilities through its design by eliminating the need for wrappers and allowing airdrops to be prorated among ERC404 token holders. Any form of airdrop to the holders of an ERC404 NFT collection can be done in a prorated way by airdropping ERC404 tokens which could represent gov tokens or fractional NFTs itself.

In essence, ERC404's structure could enable a more equitable distribution of rewards by considering the duration of token ownership or fractional stakes in an NFT, rather than the binary state of ownership at the time of the airdrop.

Source: https://www.theblock.co/post/138410/someone-borrowed-5-bored-apes-to-claim-1-1-million-of-ape-tokens

4. Inability to Realize Partial Profits:

Traditional NFT ownership models presented a binary choice: hold or sell. For NFT holders owning a singular asset, this meant they could not realize partial profits on their investment without selling the entire NFT. This all-or-nothing approach to liquidity posed a significant limitation, especially for those who wished to diversify their investments or needed to access funds without relinquishing their stake in a potentially appreciating asset.

This resulted in many users buying 2 NFTs at a minimum so that they can take profit while still being exposed to the NFT, increasing their capital allocation and therefore downside risk as a result.

With ERC404, token holders can sell any portion of their NFTs that they want, allowing them to purchase lesser NFTs in the first place, such as 1.5 of an NFT, where the 0.5 portion of the NFT is meant to be sold as the NFT goes up in price.

5. Volatility in NFT Pricing:

As NFTs floor prices are based on offers and can often have wide gaps between offers, creating huge price swings in floor prices. This volatility complicates their integration into decentralized finance (DeFi) protocols that require a more stable price such as using NFTs as collateral. NFT prices need to move in a smoother and more stable manner in order to be more suitable for DeFi integration.

As ERC404 allows NFTs to be easily added into a Uniswap’s liquidity pool as concentrated liquidity, it helps to deepen liquidity and reduce the volatility of NFT prices, smoothing out the price chart, allowing the NFT to be practically used in more avenues.

6. Complexity of bridging:

Bridging NFTs is complex and there is often not much utility outside of its native chain as well. Thus, NFTs rarely get adopted to other ecosystems, limiting the potential reach of its community.

Since ERC404 tokens are similar to ERC20 tokens, it is easier to be bridged compared to ERC721 tokens. This ensures that ERC404 tokens can be easily wrapped or transferred across chains with minimal adjustments to the bridging mechanisms, enhancing their compatibility with a wide range of ecosystems, allowing for more partnership with protocols and community growth.

Top ERC404 Projects Explored

Pandora

Source: Opensea

Pandora started with a team of 2 developers and have expanded to 4 co-founders. Three of the co-founders are developers: Acme, ctrl, and Searn. Acme was an engineer at Coinbase; ctrl, is recognized as an investor in Syndicate and manages a Web3-focused community; Searn, has a lower profile with minimal information available publicly; and the last co-founder has not been revealed but was hinted to be a renowned figure in Crypto.

The Pandora team is in charge of both the Pandora NFT, which was the first ERC404 collection, as well as maintaining the ERC404 standard for it to gain more adoption.

Features

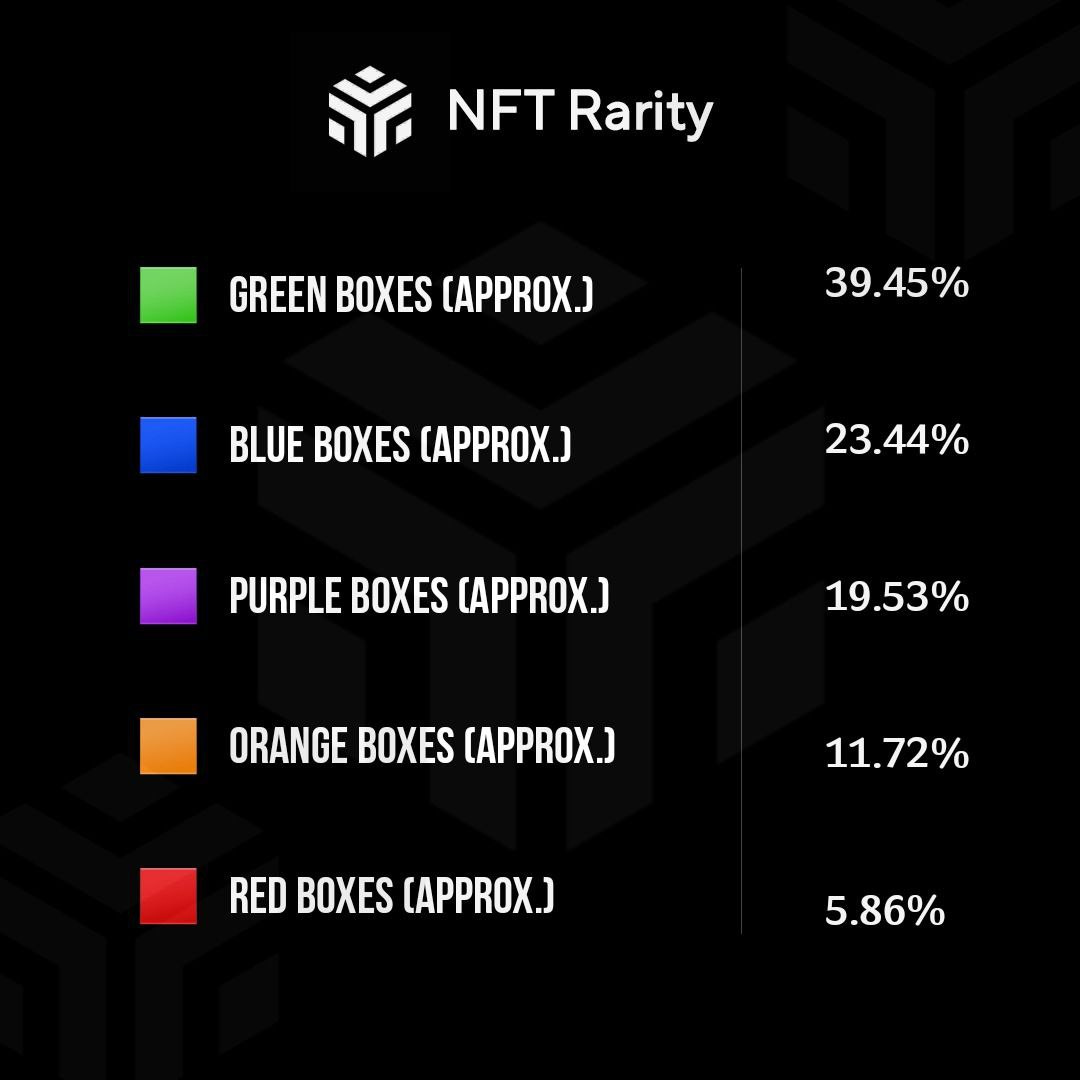

As mentioned, Pandora is a 10K collection of boxes which cannot be opened at the moment. These pandora boxes have rarities attached to them, from green, blue, purple, orange, and red, in order of increasing rarity and probability. It is unknown what these rarities at the moment but it is speculated that the higher rarity results in better rewards when the Pandora boxes can be opened.

Below is an image of their rarities:

Due to a ‘rerolling’ feature, it is important to note that these percentages are not a representation of their cap or distribution, they are the percentage probability of getting a specific box.

Pandora introduced the concept of rerolling where a user can transfer their tokens between wallets, resulting in a new NFT being minted each time. This means that it is possible for there to have more blue boxes than green boxes even though blue boxes are rarer.

What makes gaming this rerolling mechanism hard is:

The unknown number of times you might have to reroll

The gas cost for rerolling is high due to the minting cost involved with each transfer

However, a PANDORA contributor called mathdroid has made a website that calculates the color of the next 10 mints, removing some uncertainty from the rerolling process.

Source: https://pandora-stream.vercel.app

Tokenomics

Source: Pandora Telegram Group, sent by ctrl, co-founder of Pandora

In terms of the tokenomics and distribution, the team holds 7% of the supply that is being linearly vested within 30 days, a relatively quick period of time. As of 7th February 2024, the team has not sold.

There were some allocations given to KOLs that had a 2 weeks linear vesting and are over as of this writing. Much of the selling pressure was speculated to have come from the KOLs.

Partnerships

In a short span of time, Pandora has achieved multiple partnerships:

Listed on Blur NFT marketplace and having one of the top volume

Collaboration with Aevo using ERC404 mechanisms to farm AEVO points

Listing on centralized exchanges such as Bitget and Ascendex

Inspired by ERC404, Mubi is experimenting with BRC404 as well

Seed.Photo, an NFT marketplace exclusively to photographers said that it is integrating the ERC-404 standard

They are also collaborating with Palette, a profile picture NFT collection by CFW which is the first ERC404 Art project built in collaboration with Pandora Labs. More details here.

Roadmap

At the moment there is no official roadmap, however, the team has been hiring more and are focused on turning ERC404 into an official standard that is recognized by the Ethereum Foundation, as well as announcing more CEX listings and partnerships.

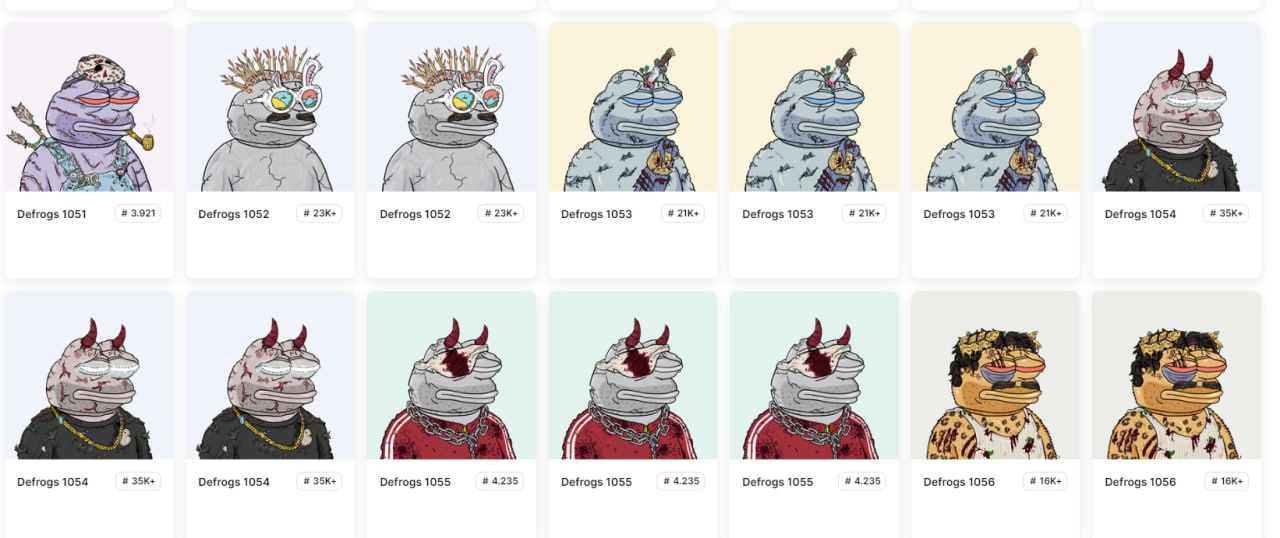

DeFrogs

Source: Opensea

DeFrogs is a 10K collection of a profile picture (PFP) NFT that mixes Pepe the Frog with the style of the Degods NFT collection, hence the term DeFrogs. It was the first 10K PFP collection that used the new experimental ERC404 standard.

However, there were issues of duplicates, where NFTs had the same traits and were identical. This duplicate issue will be fixed in the next version.

DeFrogs was delisted from Opensea, making it difficult for it to be traded, causing the price to drop significantly. However, as of 20 Feb 2024, they have been relisted.

Comparing ERC404 with Existing Solutions

To understand why ERC404 is a huge improvement, it is important to understand and compare with the solutions that came before it.

They are mainly NFT AMMs, Fractionalized NFTs and ERC1155 and I will be using Sudoswap, NFTx and Enjin respectively, to better explain them.

NFT AMM: Sudoswap

Sudoswap is a decentralized exchange (DEX) that allows NFTs to be traded through automated market maker (AMM) models, It enables users to trade NFTs directly with liquidity pools instead of other users, offering instant liquidity without needing a buyer-seller match. This is similar to how users can use Uniswap to swap tokens. This model allows for the creation of pools where NFT holders can deposit their NFTs and traders can buy from these pools at set prices.

However, it failed to generate sustained traction, and its volume and users have dropped significantly these days.

Source: https://dune.com/0xRob/sudoamm

Advantages:

Immediate liquidity: When liquidity is available, it offers immediate liquidity to traders

Dynamic pricing: LPs have the ability to set dynamic pricing through AMM algorithms

Lower Fees: Trading on Sudoswap can incur lower fees compared to traditional NFT marketplaces, which often charge higher transaction and listing fees as well as royalty fees.

Disadvantages:

Impermanent Loss: Risk of impermanent loss for liquidity providers

Arbitrage: Less control over specific NFT pricing due to the automated nature of pricing resulting in arbitrage

Lack of royalty fees: Unlike OpenSea which usually pay 5% to NFT creators on secondary sales as royalty fees, Sudoswap do not give NFT creators royalties, losing the support of many NFT artists

Fractional NFTs: NFTx

NFTx, on the other hand, is a platform that focuses on creating a liquidity infrastructure for NFTs by allowing users to mint fungible tokens against their NFTs by locking it up, effectively creating NFT-backed tokens that can be traded on DEXs. This method turns NFTs into fractionalized, fungible assets that can be bought, sold, and speculated on more easily than individual NFTs. The NFTs can be redeemed by burning whole numbers of ERC20 tokens.

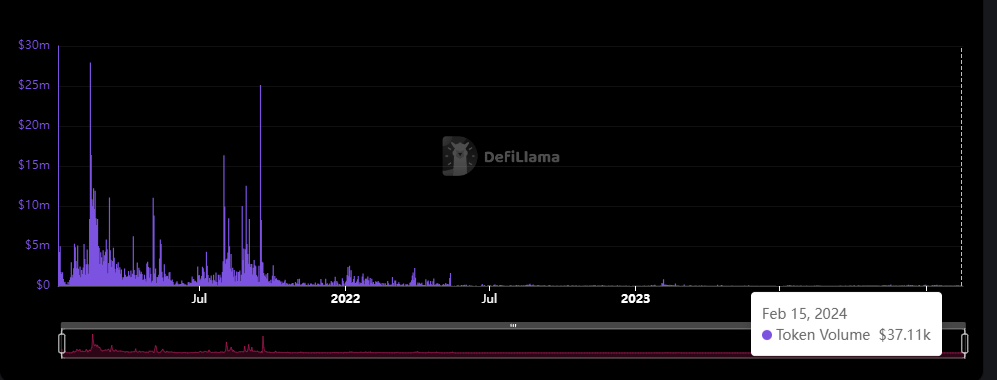

Source: https://defillama.com/protocol/nftx

Advantages:

Fractional ownership: Allows users to own a piece of a high-value NFT that they otherwise couldn’t afford, democratizing access and increasing participation for NFTs

Increased liquidity: By allowing NFT owners to turn their NFT into ERC20 tokens representing shares of an NFT, it increases the liquidity of NFTs

Integration with DeFi: By converting NFTs into ERC20 tokens, they can be used in existing DeFi protocols such as liquidity farming, using it as collateral, etc.

Disadvantages:

Fragmentation: As multiple protocols were trying to do something similar, different protocols had different ERC20 tokens which were not fungible.

Complex: Locking and redeeming the original NFTs felt complex and NFT owners could lose their original NFT as it could be redeemed by someone else.

Liquidity and demand issues: It failed to generate demand for the underlying NFT, resulting in low liquidity and reintroducing the problems with NFTs.

Similar to SudoSwap, NFTx failed to generate sustained traction, and its volume and users have dropped significantly.

EIP1155: Enjin Protocol

Before ERC404 was ERC1155, which was also an upgrade of ERC721 as it was a multi-token standard, meaning it could create fungible tokens, NFTs and even semi-fungible tokens (items that can be both unique and interchangeable, similar to ERC404).

It was created by the CTO of Enjin, a blockchain platform that focus on gaming and digital collectibles. By utilizing ERC-1155, Enjin allows for a scalable creation of a vast array of digital assets, from in-game items and currencies to unique collectibles, all within a unified ecosystem and token standard.

ERC1155 enabled batch transfers and other properties, which drastically reduced gas costs and the complexity involved with interacting with different token types, making it particularly suitable for gaming, where item types and currencies need to be managed simultaneously.

It is used in many popular games, from The SandBox, Axie Infinity, to games like Illuvium which use the ERC1155 standard to allow their NFTs to be mintable up to a certain number of copies and easily sold.

Read more about our Illuvium research here.

Another benefit of ERC1155 is the safe transfer function, which allows ERC1155 tokens to only be sent to addresses that can handle them, making it difficult to accidentally send the tokens to a wrong address, protecting users.

However, ERC404 does not have this feature.

Catalysts for ERC404

Comparisons with BRC20:

As a potentially new token standard that has taken the crypto world by storm, ERC404 is being compared to BRC20 and people have been comparing PANDORA’s price movement with BRC20 tokens like MUBI.

Pandora and MUBI side by side, source: https://www.tradingview.com/x/4ynCzHgv/

ETH ETF:

With the ETH ETF on the horizon, NFTs which are often seen as ETH beta plays will likely catch a bid, and ERC404 token being a new ERC20 and NFT hybrid can potentially be the new hot NFTs.

CEX Listings:

Pandora and other ERC404 tokens have not been listed on any centralized exchanges yet.

$ORDI was the most successful BRC20 token which exploded at launch and went down 90% from its peak over 162 days. In anticipation of the BTC ETF, and after Binance listed ORDI, ORDI went up 2000% within 122 days from the bottom after being listed on Binance and peaked at 1.75B market cap and is slowly climbing back up to ATHs.. It is possible that Pandora can achieve a similar impact when it is finally live on Binance.

Source: https://www.tradingview.com/x/9Zne6vzc/

Official Token Standard:

The team is working hard to get ERC404 into a proper standard recognized by the Ethereum Foundation via an EIP. If and when this passes, we can expect bullish momentum for ERC404 tokens.

Challenges with ERC404

Rerolling Rarity:

NFTs using ERC404 can have their rarity ‘rerolled’ by transferring the tokens between different wallets as it burns and mints a new random NFT in order to obtain an NFT with a higher rarity, making rarity less meaningful. This is especially true if ERC404 moves onto ETH L2s where gas fees are even cheaper.

Arbitrage:

There remains a constant arbitrage opportunity for ERC404 tokens where the price of 1 PANDORA token and 1 Pandora NFT can be far apart. This is due to users buying up the ERC404 tokens and rerolling it until it becomes rare and then selling it on NFT marketplaces at a higher price.

Higher Gas Fees:

Transferring more than 1 Pandora token results in an NFT burn and mint which can result in a poorer user experience.

Source: https://dune.com/chocolate_chungus/pandora-gas-usage

However, ERC404 has a unique feature known as the "Exemption List," which allows specific addresses to bypass the standard ERC721 logic during transfers, leading to significant gas savings. Exemptions include providing liquidity to DeFi protocols like Uniswap V3 pools, other smart contracts, or even transfers to CEXs.

Fewer NFTs than the max supply:

Due to the fractional nature of ERC404, it is expected that the number of NFTs will be far lesser than the maximum supply. Looking at Pandora itself, although the total number of NFTs are 5,623, the number of available NFTs will always be less due to most of them being in liquidity pools or existing as less than a whole number.

Not Fully Composable:

One of the biggest risks is that ERC404 tokens are not as composable as ERC20 or ERC721 tokens. This means that they may not be compatible with all of the existing DeFi tools and services which is one of its biggest use cases.

Another risk is that ERC404 tokens are more complex than ERC20 or ERC721 tokens. This complexity could make it more difficult to develop and audit smart contracts that use ERC404 tokens. This could lead to security vulnerabilities that could be exploited by attackers.

Because of this, alternative approaches have appeared, such as DN404 (divisible NFTs) which aims to improve upon ERC-404’s code to be more efficient and prevent potential exploits.

Conclusion

ERC404, introduced by the Pandora project, innovates the non-fungible token (NFT) landscape by blending the uniqueness of ERC721 NFTs with the liquidity and divisibility of ERC20 tokens.

This hybrid standard facilitates fractional ownership of NFTs, making high-value digital assets more accessible and enhancing market liquidity. ERC404 addresses key issues in the NFT space, such as the inability to sell NFTs from inactive projects and the exclusion of potential investors due to high asset prices, by allowing partial ownership and trading, and opens up new opportunities in integrating ERC404 NFTs into gaming as well.

Key benefits of ERC404 include increased liquidity, potential for broader adoption, and the introduction of novel applications in DeFi and digital collectibles. However, challenges like the manipulation of rarity through rerolling, arbitrage opportunities, and increased transaction complexity need to be addressed and the team is working on it.

"ctrl" and "Acme" intends for ERC-404 to extend beyond mere technological advancement; they desire for it to become an official EIP404 standard in order to further bring confidence to both developers and users to explore new possibilities and fully unleash the potential of ERC404, and I can’t wait to see what creative use cases there will be.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about