Dissecting Illuvium ($ILV): The Economics Behind the First Crypto AAA Game

Is the anticipated Web 3 game living up to its hype?

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

Digital entertainment is a huge part of our lives, and gaming is a cornerstone of that as well. In fact, about 65% of USA and 40% of the world play games, so when the GameFi narrative started in 2021 it sparked a craze amongst investors. Now, 2 years later, many Web3 games have launched, and one of the most anticipated Web3 games is Illuvium (ILV).

Funded by Framework Ventures, Delphi Digital, Yield Guild Games, and other prominent VCs, Illuvium has raised over $20 million in private funding and NFT sales combined. It brands itself as the first AAA Web3 game and is one of the first attempts at pioneering Web3 gaming to bring ownership of in-game assets over to users.

Since its public beta launch on November 28, Illuvium has seen considerable engagement, with 23,199 downloads and a growing active player base of around 3,800. This traction in the Web3 gaming world sets the stage for Illuvium to potentially redefine gaming norms and attract both gamers and investors.

This week, let's delve into the world of Illuvium and explore its mechanics, market potential, and the role of ILV and see if it has what it takes to shape the future of Web3 gaming.

What is Illuvium? - A Universe of Games

Illuvium is a complex game currently encompassing four distinct games within its universe. Each game offers a unique gaming experience while having some elements interconnected.

Let’s briefly explain how the core gameplay loop works and where the value exchanges are to understand the Illuvium economy and tokenomics better.

Illuvium Overworld: Exploring a Beautiful World

Most players will start in Illuvium Overworld, an open-world resource collection game. They play as a futuristic hunter starting with basic equipment, which are also NFTs. They gather resources in the Overworld which they can to sell to other players or use it to upgrade their own equipment to gather resources faster. Higher rarity equipment can improve resource yield by multiple times.

Players are free to visit Stage 0 regions that have Tier 0 illuvials. To find higher-tier illuvials and resources, they need to go to a higher stage which requires resources that are only obtainable in Illuvium Zero.

When a player explores a region, they will be able to encounter Illuvials and need to win them in an auto-battle to capture them.

Auto battles mean the fighting is automated and users can’t interfere once the battle has started. The player’s hunter is also participating in the battle, and its equipment plays a core part. Thus, the gameplay is more focused on tactical decision-making before each round starts. Players also require shards (similar to Pokeballs) to capture Illuvials.

Once they capture Illuvials, they can sell them, or use them to form their team and participate in the Illuvium Arena, a PvP game mode with a competitive ranking system.

However, until they sell enough resources to buy higher-tier resources or Illuvials, they will be limited to the lower-tier Illuvials and will be disadvantaged against players with higher-tier Illuvials in Illuvium Arena.

Thus, pay-to-win competitive players can shortcut their Illuvium Arena experience by buying the highest-tier Illuvials and equipment right from the IlluviDex by spending ETH.

Players can evolve their Illuvials by fusing 3 Illuvials of a similar type, enhancing their abilities in a process that burns 3 NFTs and creates an upgraded Illuvial NFT.

Illuvium Arena: Pokemon meets Auto-battler

In Illuvium Arena, a PvP strategy game, players engage in auto-battles, either against bots or other players using their Illuvials and items.

Once a player can form a team that consists of a maximum of 28 items between augments, weapons, armour, and Illuvials, they can battle in the Illuvium Arena. Each item is expected to be NFTs as well.

Having the best items increases their chance of winning more battles in the Illuvium Arena. Being the best in this game mode allows you to compete in competitions and giveaways to earn prizes.

Illuvials have their own unique abilities and traits, fitting into various classes and elemental affinities. There are currently 21 affinities and 21 classes. This aspect is similar to "Pokémon" as certain affinities have advantages and disadvantages against other affinities.

Players can participate in ranked games to climb the ranks, and top-ranked players can participate in tournaments that likely offer prizes in the future.

Auto battlers are increasingly popular as the fun comes in strategizing the team composition, and by letting the game handle the hectic fighting for you automatically, it makes the game more approachable and provides a fun and casual gaming experience that many can enjoy. It is essentially easy to play but hard to master, which will appeal to many.

Illuvium Zero: City-builder resource generator

Illuvium Zero is a city-building game available on both mobile and desktop platforms. Players create different buildings to produce resources which is needed in other Illuvium games. It's akin to the land components seen in metaverse like Decentraland or Sandbox.

This game can be played for free without an Illuvium Land NFT, however, the NFT is required to mine resources and search for blueprints (skins), which they can sell on the IlluviDex for revenue.

Examples of resources produced are fuel, which is needed for Overworld players to travel, cure shards (Pokeballs), etc. Fuel will be used in new Illuvium games as well.

Illuvium Beyond: Collectible card game

Illuvium Beyond will be a customizable collectible card game, and potentially a A PvP card game with approval from the Illuvium DAO.

It features Illuvitars that are similar to avatars but can be customized with accessories, backgrounds, finishes, and competitive aspects such as power ratings.

Illuvitars can be acquired by purchasing D1sks on the IlluviDex which contains random Illuvitars and accessories, similar to buying trading card booster packs.

Interoperable Blockchain Gaming

The three games in the Illuvium universe are interoperable and connected in several ways:

1. Illuvials Across Games: The Illuvials captured in the Overworld can be used in the Illuvium Arena. This creates a cohesive experience where players can leverage their progress and achievements from one game into another, enhancing the strategic and competitive aspects of the Arena.

2. Resource Integration: Resources and items gathered in Illuvium Zero can be utilized in the Overworld and other games for upgrades. This integration ensures that time and effort invested in one part of the Illuvium universe have tangible benefits in other areas, creating a unified ecosystem.

3. Economic Connectivity: The IlluviDex marketplace allows for the trading of Illuvials, items, and resources across the games, connecting the economy of all the games. This shared economy enhances the sense of a unified world and adds depth to the player's strategic options. More on this in the next section.

IlluviDex: The Illuvium Dex Marketplace

The IlluviDex serves as the native online marketplace within Illuvium. It is similar ‘OpenSea, enabling players to trade NFT assets such as Illuvials, equipment, and other in-game items for ETH.

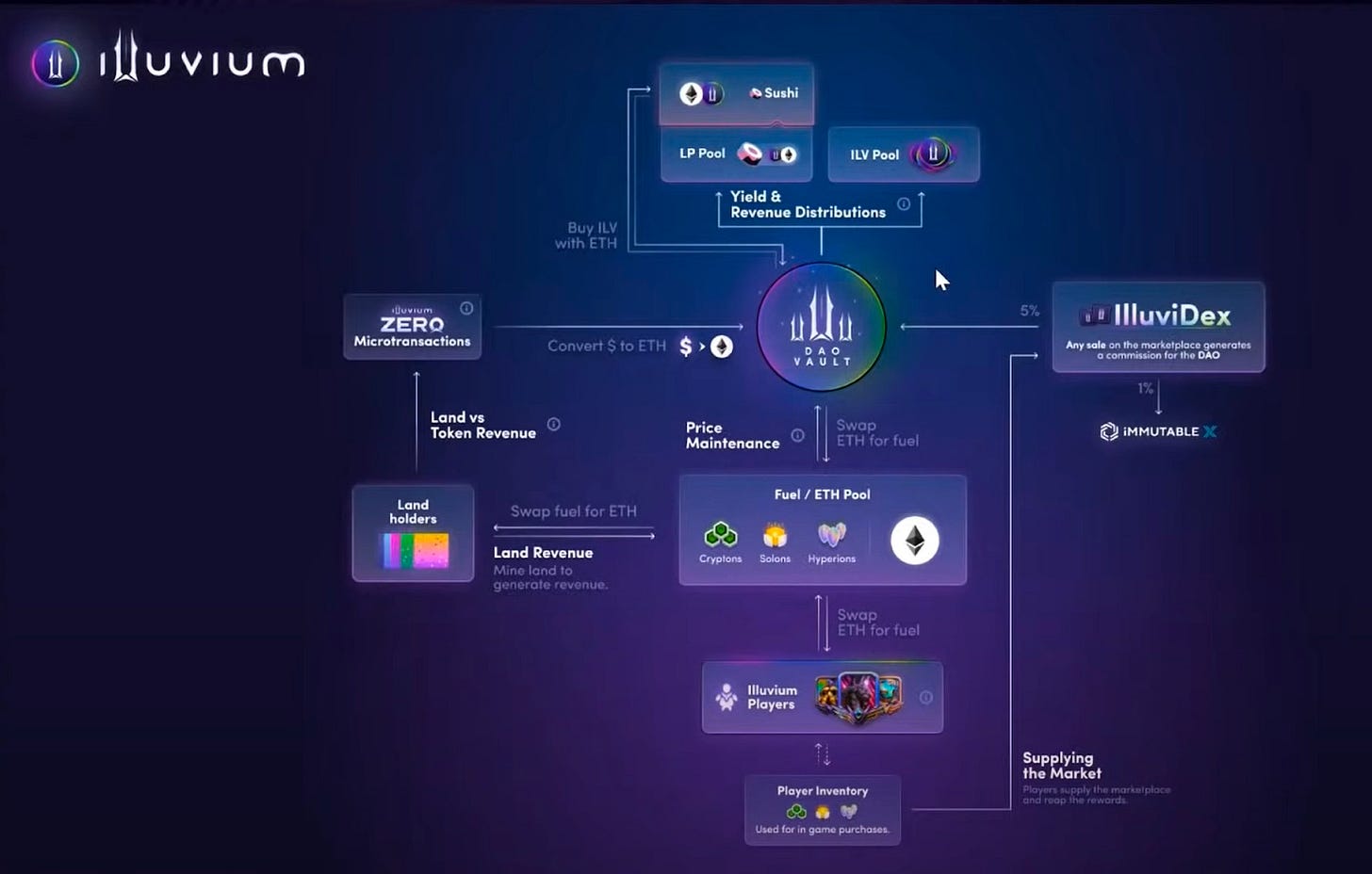

The IlluviDex places an additional 5% fee on top of listings, of which 3% is distributed to the ILV stakers reward pool and 2% is paid to IMX. The fee and marketplace is managed by the Illuvium DAO, this marketplace is central to the game's economy.

Illuvium DAO: A Community-Driven Approach

The Illuvium game is overseen by the Illuvium DAO (Decentralized Autonomous Organization), allowing ILV token holders to participate in Illuvium’s decision-making processes by creating and voting on governance proposals.

This approach empowers the community, allowing players and investors to shape the game's development and future direction.

Tokenomics - Currencies in Illuvium

Now that we have covered some of the core gameplay elements and the IlluviDex platform, let’s explore how tokenomics work in Illuvium.

Currencies and Utility

There are three main currencies, ETH, ILV, and sILV2.

ETH

ETH is the primary payment currency for all transactions. It is used to purchase land, in-game assets, fuel, elements, other Illuvium NFTs, and even speed up the time it takes to complete buildings in Illuvium Zero.

ILV

The ILV token powers the Illuvium universe. It’s an ERC-20 token native to Ethereum and is used in the governance of the IlluviumDAO, and voting in members to the Illuvium DAO.

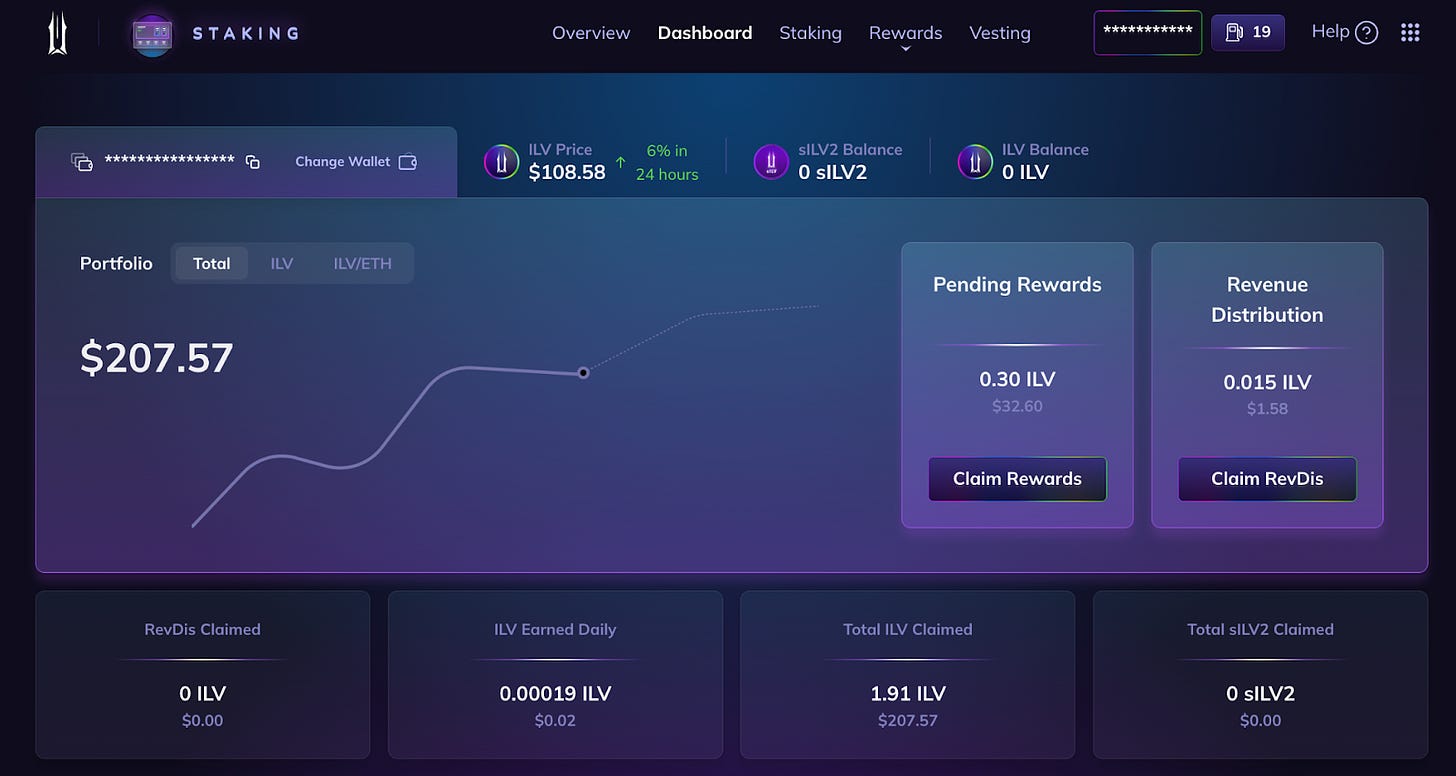

The key aspect of the ILV is the revenue distribution (revdis) that it rewards to stakers. All revenue earned by the Illuvium DAO is returned to staked ILV holders. This creates a positive network effect as users feel like the investment they spend is going back to them rather than a centralized entity.

Revenue sources include IlluviDex marketplace fees, player purchases of Fuel, Shards, Crafting, etc, and all future Illuvium games, movies, and other products.

ILV can also be earned from ILV staking, and ILV-ETH LP farming, or as in-game rewards, such as winning competitions and giveaways. However, it cannot be used as an in-game currency. For in-game usage, sILV2 is needed.

sILV2

The synthetic-ILV2 token is an in-game currency valued at the price of ILV that functions as the secondary payment currency for all transactions in the Illuvium ecosystem.

It is obtained by burning ILV and ILV-ETH LP staking rewards into sILV2 as an alternative to waiting 12 months to vest escrowed ILV staking rewards into liquid ILV. This means that the max supply of ILV is actually lower than 10 million.

It’s called sILV2 as the sILV1 contract was exploited and was migrated into sILV2. This token is also available to be traded on Uniswap albeit with low liquidity and usually has a 20-30% discount to the native ILV token as yield farmers convert their ILV rewards to sILV2 to sell, and it can only be used as in-game currency and not partake in revenue distribution.

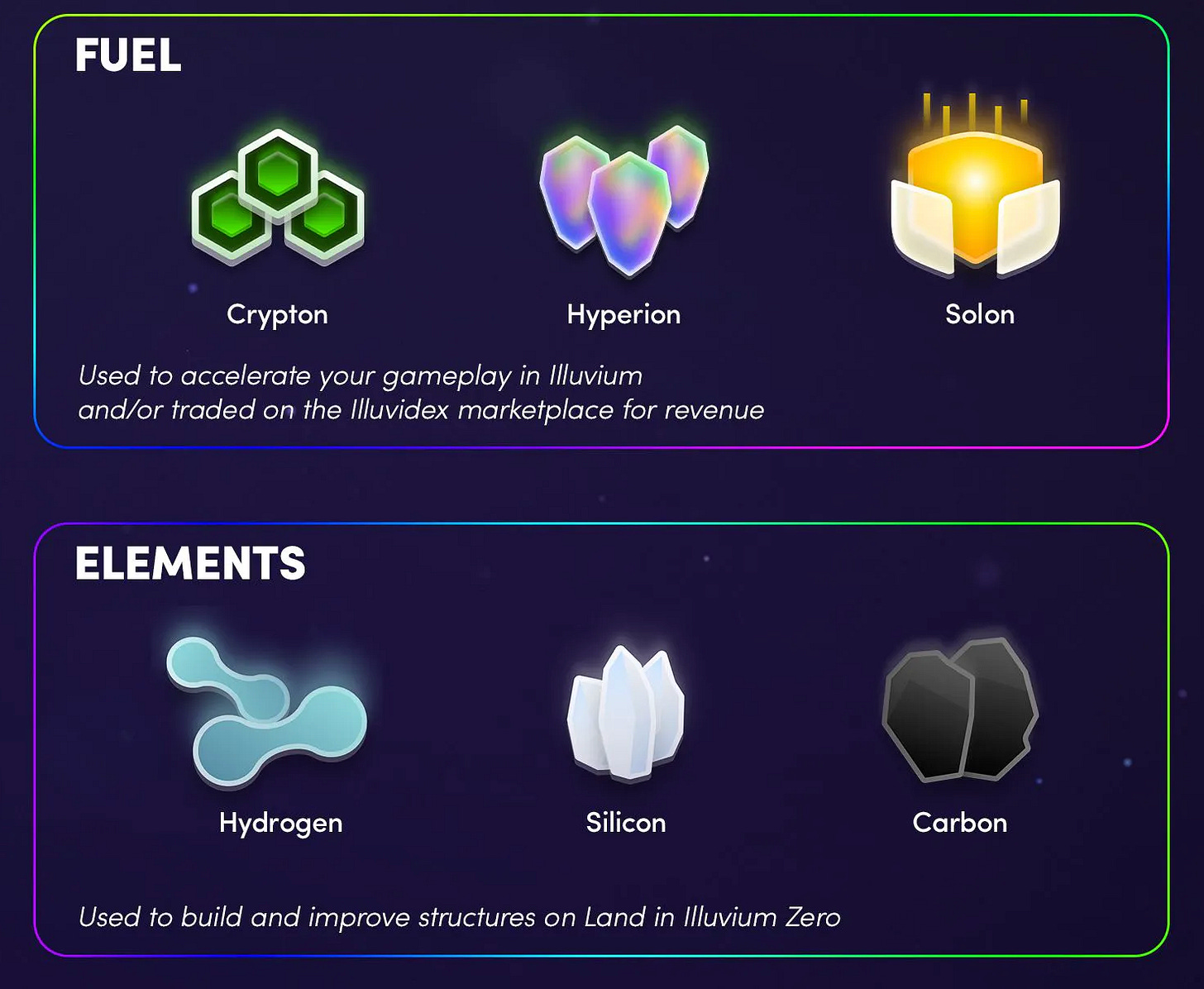

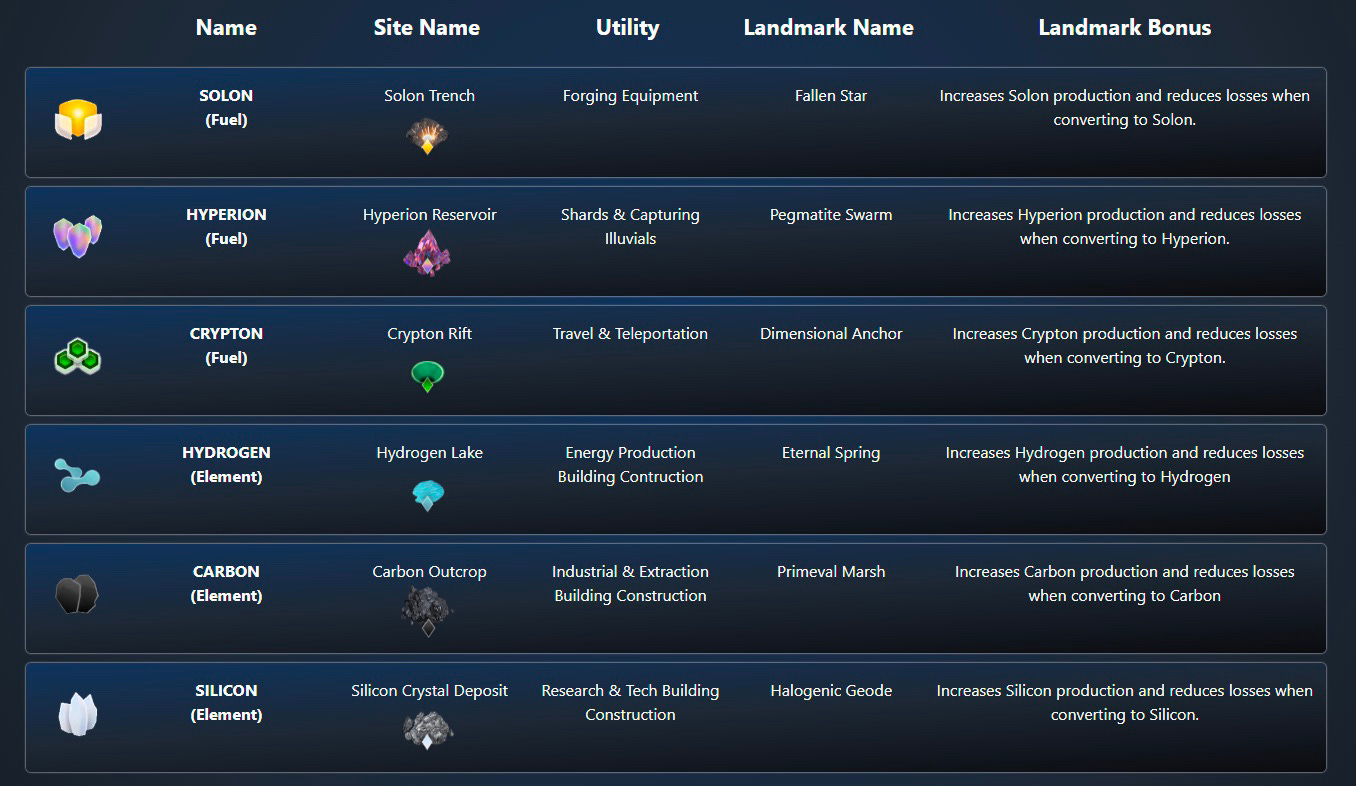

Fuel

There are other resources in the game but fuel is one of the most important resources as it can only be generated from Illuvium Land.

Illuvium Land generates the fuel for the game ecosystem. Land owners are due 5% of the total in-game revenue, distributed pro-rata to land owners based on how much fuel they produced.

Illuvium DAO generates 19x the fuel generated by land owners and thus is able to sell 95% of the total fuel that exists to generate revenue and faciliate RevDis.

Token Distribution

The initial max supply of the token is 10 million. Below is the updated token distribution table I curated factoring in allocation changes overtime.

Source: Illuvium

Token schedule excluding in-game rewards and treasury which makes up 28.5% of the supply.

Source: Illuvium Moderator

Private rounds:

In 2021, the pre-seed round was purchased for $1 per token, while the seed round was purchased for $3.33 per token, generating a total of $5.5 million for Illuvium for 20% allocation.

In 2023, another round was raised with Framework Ventures for an additional $10 million for an undisclosed allocation.

Team:

The upper management team’s vesting schedule is 3 years and will fully vest by Feb 28, 2025. The rest of the team’s vesting schedule is 1 year and have fully vested.

IlluviumDAO treasury:

The treasury is fully owned by the Illuvium DAO and is thus controlled by ILV stakers. It’s fully vested as of this writing.

Public sale:

The launchpad, which is the public sale, was purchased at $58 per token for a total of $38 million, making the total raised $43.5 million. It was fully vested at TGE. Only 650k tokens were sold instead of the full 1m allocated, and the rest was added into the treasury.

Yield Farming:

The yield farming is to reward ILV stakers and ILV-ETH LP over a 3-year timeframe. 20% goes to ILV stakers while 80% goes to ILV-ETH LPs. As mentioned above, the ILV rewards are escrowed for 1 year but has the option to be converted into sILV2 immediately to be spent in-game instead.

As the yield farming portion makes up 30% of the total supply, the minimum total supply of ILV is 7 million if all 3 million yield farming rewards are burnt, but realistically not all would be burnt. At the moment about 0.4 million ILV tokens have been burnt into sILV2.

The Economy of Illuvium

To understand the economy of a GameFi project, we should understand these 2 aspects:

Value creation and value sink - how resources are supplied and controlled

Value distribution - how is the value created shared amongst different stakeholders

Value creation and value sink

Going back to economics 101, this can be thought of as demand and supply.

Illuvium Zero and Illuvium Overworld can be thought of as supply games, as they generate value in the form of resources being procued. The supply games will just be Illuvium Zero and Overworld, while the team works on creating more demand games.

Illuvium’s demand games are currently Illuvium Arena and Illuvium Beyond as they consume resources to participate and continuously improve.

A balance of players playing supply and demand games will create a more sustainable economy in Illuvium economy. To achieve this, the game is designed to be able to respond dynamically to fluctuations in supply and demand to keep the game economy stable.

For example, if demand is low, there will be no new supply of Illuvium Land which limits the amount of resources that can be produced. When the demand is high and more fuel is purchased and used than generated, the IlluviumDAO can open up more land plots to be sold (with a total max of 100,000 lands), and Illuvials will be harder to encounter. The game can continue to introduce new features and mechanics to further stabilize the economy.

As the game is still in private beta, the quantitative aspects such as the rate of production and the resources required are not yet confirmed.

Example of resources from Illuvium Zero:

Example of resources from Illuvium Overworld:

The resources gathered, together with other gameplay mechanics, help to generate value when they are traded on the IlluviDex. Here’s a table of some of value creation and value sink activities.

Outside of the game, revenue to the IlluviumDAO can also generated from movie deals, esports, sponsorships, partnerships, merchandise, and others.

Value distribution

All fees from the Illuvium ecosystem go into the IlluviumDAO vault as part of revenue distribution. For example, all transactions on the IlluviDex give 5% to the vault.

The fees collected will be used to periodically but randomly (to prevent front-running) buy ILV off the market and distribute it.

The ILV distribution is done in this ratio:

95% to staked ILV and ILV-ETH LP (you gain revdis on the ILV portion of the LP)

5% to Land NFT owners

As mentioned, the ILV distributed has a 1 year escrow or can be immediately burnt into sILV2 to be spent as in-game currency instead of using ETH. This helps to increase the value of all existing ILV holders as it reduces the max supply of ILV.

Example of staking rewards:

Revenue, Projections and Comparisons

Let’s explore the current and projected revenue of Illuvium, and compare them with other games.

Current Revenue:

Illuvium generated an estimated about $8.4 million of revenue till date. Let’s explore how this was made.

Illuvium Land Sale:

In 2022, Illuvium Land was fully sold, raising $72 million. However, only $7.25 million, or about 10%, was paid in ETH, while the remaining $64.75 million was paid in sILV2 which I did not count as revenue.

Source: Illuvium Twitter

Illuvium Beyond D1sks Sale:

The same can be said for Illuvium Beyond D1SKs where $4m was sold, and I assume 90% was in sILV2 and only 10% of it was in ETH, similar to the land sale.

Source: Polemos

IlluviDex commission revenue:

The remaining $760k of revenue was calculated by taking the total sale volume in ETH from the Land, D1Sks, Illuvitars, and Accessories, and multiply it with the 3% royalty fee of the IlluviDex.

Source: IlluviDex

Projected Revenue:

Although the game is out on the Epic Games store, it’s still a beta and the two Illuvium demand games, Overworld and Arena, are not available for trading on the IlluviDex yet.

As they are expected to make up most of the royalty fees, let’s estimate how much trading activity and revenue there could be, and explore a few scenarios.

Base scenario:

Illuvium Arena number of active players:

According to League of Legend’s Teamfight Tactics statistics, there are about 33 million monthly active users (MAU) in 2019. It is unknown how many players are there now, but if we assume 1% of those players decide to play Illuvium Arena due to its similar nature, that would be 330,000 MAU.

Illuvium Arena annualized value of transactions:

According to Statista, the average gamer spends about $24 a month or $0.80 a day. As NFT purchases can be resold, players may feel that it is okay to spend more or even partake in speculation with the belief that they can even make money while using their purchases. To account for this potential increase in spending, I will 10x the spend due to speculative activities to $8 on average a day. This generates an annual revenue of about $29 million a year captured by the IlluviumDAO.

Illuvium Overworld number of active players:

Currently, Axie Infinity has about 350,000 MAU according to Activeplayer.io, let’s assume they will play Illuvium Overworld as well since it’s free-to-play.

Illuvium Overworld annualized value of transactions:

As the Overworld figures are not finalized yet, I will take a ground up approach based on the minimum salary in Philippines of around $330 a month or $11 a day, and assuming each player will be earning minimally this, which means $330 of resources sold on the IlluviDex. Based on this, the IlluviumDAO gets an annual revenue of about $42 million.

Based on the above projections for Illuvium, the projected annualized market place revenue without including sales figure is about $71 million, and at the current FDV of $1 billion, Illuvium’s projected P/S ratio would be around 15.

Bullish scenario:

Let’s explore the projected revenue if the game achieves the level of success similar to the peak of Axie Infinity where there were 2.8 million daily active users, and they are able to attract 10% of the players from Teamfight Tactics. That would give an annual DAO revenue of $627 million.

Illuvium Land or ILV tokens?

After crunching some numbers, as of the current price of land now, the average ROI for Land owners is less than ILV stakers, making ILV tokens the better investment. However, this does not factor in the revenue generated from rare blueprints that a Land may have.

Financial Health

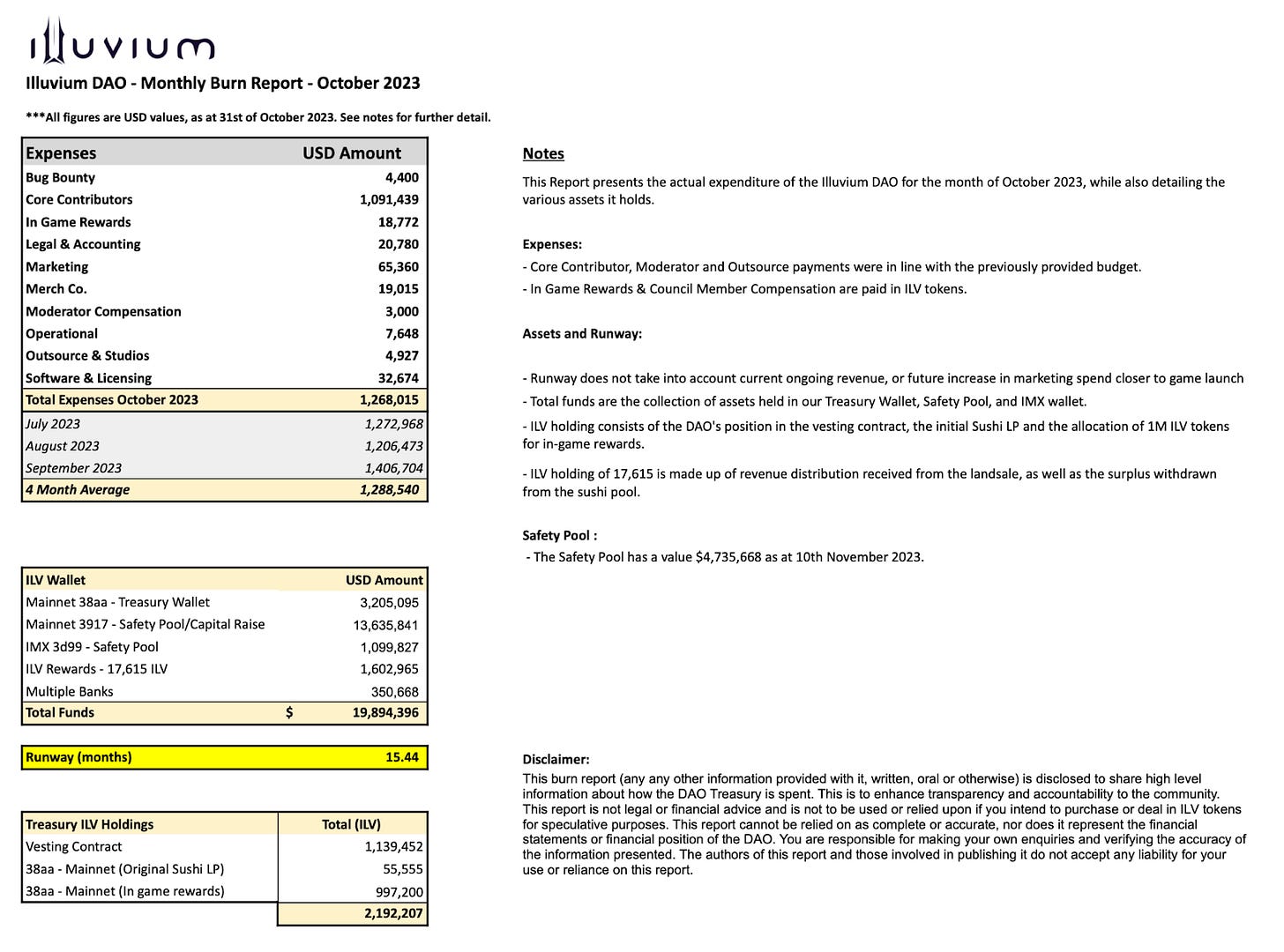

As games cost millions and years to make and polish, it is important that Illuvium's financials are healthy. In the spirit of transparency, Illuvium DAO produces monthly financial reports.

Source: Illuvium Discord

Key takeaways of Illuvium Financials as of 31 October 2023:

Total Funds Left: $19,894,396

Monthly Average Expense: $1,288,540

Runway: About 15 months or until 31 January 2025

The ILV treasury has about $120 million worth of $ILV with about $60 million of liquidity in the ILV-ETH LP pool as of this writing

At the moment the financial health of Illuvium looks like it only has about 1 year of runway left, however, the founder did say that they can raise more rounds if necessary.

With an annualize expense of roughly $15 million, and a 20% ownership of the amount of staked ILV, the team will need the Illuvium DAO to earn an annual revenue of $75 million in order to breakeven, or about $2.5 billion of IlluviDex yearly volume, attributed to the 3% commission.

Wallets:

Here are additional information on Illuvium related wallets if you would like to do further digging.

Treasury:

https://etherscan.io/address/0x58C37A622cdf8aCe54d8b25c58223f61d0d738aA

Safety Pool:

https://etherscan.io/address/0xba085e0a14801c8c7a919a90304e75cabb7e3917

IMX:

https://immutascan.io/address/0x9989818ae063f715a857925e419ba4b65b793d99

REVDIS:

https://etherscan.io/address/0xaa2e727ba59b4fea24d0db4e49a392fdc3e8e778#internaltx

Competitive Analysis

How big is Web3 Gaming?

To understand how big Illuvium can be, let’s take a look at the existing gaming industry.

With roughly 40% of the world as gamers, billions of gamers worldwide are spending tens of billions of dollars in digital worlds, and this spending is expected to grow at a compounded annual growth rate (CAGR) of 13.4% from 2023 to 2030.

According to futuremarketinsights, the web3 gaming market size is projected to be worth $23 billion in 2023 with a CAGR of 18.7%.

Let’s compare Illuvium with some other popular games.

Pokemon

Pokemon is a decades-old game that was launched in 1996 and was played by millions of people worldwide. Pokemon generated $11.6 billion in revenue in 2022 and is valued at $92 billion according to some sources.

Pokemon are similar to Illuvial as they share similar affinities like fire, air, water, etc, and have different evolutions.

There are also several games made by Pokemon, from Pokemon console games, to trading card games, and even mobile games. However, all the revenue goes back to the parent companies and players do not have any option to receive any of these revenues despite helping to generate the revenue.

Illuvium is looking to deploy a similar strategy where they have multiple games built on top of Illuvials, and also allow players to own a part of the revenue stream by staking ILV.

Axie Infinity

Axie Infinity is a popular web3 game where players use NFTs called Axies that have different affinities, stats, and abilities to battle one another. Axie Infinity is expected to generate around $1.6 million to $3 million in revenue in 2023 and is currently valued at $1.8 billion. Axie Infinity is similar to Illuvial however there are some differences.

Axie Infinity had an economic problem that relied on new players or investors coming in and buying Smooth Love Potion (SLP) to keep the price of SLP up. However, players are rewarded with SLP for playing, which meant that the game’s economy was unsustainable. Once new players stopped coming in, the continuous supply of SLP resulted in the price of SLP dropping to the point where the game is no longer economically viable and players and investors left.

Some of the economic problems include having an infinite number of Axies that can be bred and an infinite amount of SLP that can be generated from players playing the game.

In Illuvium, the number of Illuvials per set is capped, and there’s a bonding curve meaning that the more Illuvials are captured, the rarer it is to find more in the Overworld, and players have to buy them off the IlluviDex market place. Additionally, three illuvials can be merged into one illuvial of the next evolution stage, reducing the supply of Illuvials. Resource production in Illuvium are also controlled by limiting the number of land supply which can only be increased once there’s a consistent demand of resources compared to supply.

Similar to Axie Infinity, there is a way to manage scholars. Wealthier players can become managers as they will loan out Illuvials to other players known as scholars who can’t afford Illuvials. In return, managers get a percentage of the scholar’s earnings.

However, it remains to be seen how effective Illuvium is in having a balanced economy until the game is out.

Teamfight Tactics

Teamfight Tactics (TFT) is a free-to-play auto-battler strategy game and it’s a spinoff game from the popular League of Legends MOBA game.

Although both games are autobattlers, there is a huge difference in gameplay. TFT is more a free-for-all 8 player battle royale where the last one standing is the winner, teams are assembled within the game and the champions and items to select are randomized.

In Illuvium Arena, PvP is done as a 1v1 battle and teams and items are pre-selected before the start of the game, making Illuvium Arena rely more on pre-game planning while TFT is based on your ability to make the best strategy of the random champions and items that are given to you.

Champions and items are also free, making the competitive edge is equal in TFT, whereas in Illuvium Arena although higher-tier Illuvials and items can be obtained by free-to-play players, it requires extensive grinding and selling resources to purchase them. This creates an unfair advantage for wealthier players who are willing to invest money in purchasing higher-tier items instead of grinding for them. It remains to be seen how players will react to this seemingly pay-to-win element.

The main monetization of TFT comes in the form of skins and cosmetics. Illuvium also has skins but Illivium’s skins are managed by a blueprint which originates in Illuvium Zero. Blueprint holders are able to determine the quantity of the skin that is minted, allowing them to make a skin rare or common, and on top of that, the blueprint itself even be sold. This aspect makes skins in Illuvium very interesting from an economic standpoint.

Web3 Gaming Land Comparisons

For players looking to be digital landlords, they can consider buying Illuvium Land which is a limited asset. As Illuvium Land resource production is not finalized yet, we can only compare surface level metrics with land NFTs from other Web3 gaming protocols.

Comparing Illuvium Land’s market cap to its token market cap shows that it’s on the lower end relative to other games. Although Illuvium has a high Land total supply, they will only come into circulation when the demand for resources is more than what is being generated, which is a good problem to have.

Additionally, the purpose, utility and value accrual for Illuvium Land owners are clear compared to the other Web3 games.

Catalysts

Let’s explore some of the catalysts that will help Illuvium’s traction.

Team: Founded by the Warwick Brothers

The game was conceived by the Warwick brothers: Kieran, Aaron, and Grant.

Their venture into blockchain gaming was inspired by their older brother, Kain Warwick, founder of the Synthetix Protocol. This family connection to blockchain technology, the crypto space, and decentralized finance (DeFi) laid a strong foundation for Illuvium's development.

Gaming Trend: Empowering the Players

The philosophy behind the game was to give ownership and power back to stakers and players of the game instead of having one centralized entity that receives all the revenue and dictates all the rules.

A case in point was when Call of Duty: Modern Warfare 2 was launched, skins from Call of Duty: Modern Warfare 1 were not transferable which led to

By giving the players as much empowerment and participation as possible, it makes players and stakers become a part of the game, and want it to succeed. This creates a powerful network effect and positive flywheel that can help the game to become more popular.

They aimed for a fair launch and fair economy to create an organic and sustainable game. This means there are no pre-launch powerful NFTs that are sold to whales directly. Nobody gets an economic advantage at the start, and everyone has to earn their progress, at least in the beginning.

Additionally, if the Bitcoin ETF gets approved, it helps further open up crypto to the mainstream, and web3 crypto games like Illuvium may ride the wave up as well.

Partnership with Epic Games

Illuvium launched on Epic Games, a platform that's seen phenomenal growth. According to backlinko, Epic Games store have 31.3 million daily active users in 2023, exposing Illuvium to a huge potential player base from day 1.

Unreal Engine is also built on Epic Games’s gaming engine called Unreal Engine which features cutting-edge technology such as Lumen and Nanite which will help to futureproof Illuvium’s graphics.

This partnership with Epic Games signifies Illuvium's commitment to not just joining the ranks of major gaming titles but also revolutionizing how value and ownership are perceived in the digital gaming world.

Built on Immutable X

Instead of launching Illuvium on their own network which can take up significant resources, they chose to build on Immutable X, a Layer 2 scaling solution for Ethereum. By leveraging its technological advancements, it brings a host of benefits to Illuvium.

1. Scalability and Efficiency: Immutable X is known for its scalability, which is crucial for gaming platforms that require fast and efficient transactions. It addresses Ethereum's challenges with high gas fees and slow transaction times, making it an ideal solution for a game like Illuvium that involves numerous in-game transactions and NFT trades.

2. Zero Gas Fees for Users: One of the standout features of Immutable X is its ability to execute transactions with zero gas fees. This is particularly beneficial for Illuvium players, as it allows them to engage in frequent trading and transactions of NFTs without incurring the usual costs associated with blockchain transactions.

3. Security and Decentralization: Despite being a Layer 2 solution, Immutable X maintains the robust security and decentralization of the Ethereum blockchain. This ensures that Illuvium’s in-game assets and player transactions are secure and tamper-proof.

4. Environmentally Friendly: Immutable X also addresses environmental concerns associated with blockchain technology, as it utilizes a more energy-efficient approach to transaction verification. This makes Illuvium a more sustainable option in the world of blockchain gaming.

5. Marketplace Integration: The integration with Immutable X facilitates a seamless user experience in Illuvium's marketplace, IlluviDex, where players can trade their NFTs with ease and efficiency.

The use of Immutable X for Illuvium represents a strategic decision to leverage advanced blockchain technology to enhance the gaming experience, ensuring scalability, security, and user-friendliness, while also being mindful of environmental impact.

Risks

1. Market Volatility: The value of ILV tokens and NFTs within Illuvium is subject to the volatility of the cryptocurrency market. This can lead to significant fluctuations in value, affecting both the in-game economy and player investments.

2. Technology Risks: Being built on blockchain technology, particularly on the Immutable X platform, Illuvium faces risks related to technical glitches, scalability issues, and potential security vulnerabilities inherent in blockchain-based systems.

3. Adoption and Player Base: The success of Illuvium heavily depends on the number of players it can get. Changing gamer preferences, competition from other blockchain games, and the overall adoption of NFTs in gaming are crucial factors in determining whether Illuvium will be able to attract and retain a stable and growing player base.

4. Imbalance Economy: By having a pay-to-win element where wealthier players could buy higher-tier items without grinding, it could result in less wealthy players feeling that the game is unfair and leaving. The economy has to be balanced intricately to ensure harmony amongst the players.

5. Regulatory Risks: The regulatory landscape for cryptocurrencies and NFTs is evolving. Potential regulatory changes or legal challenges could impact the GameFi sector, affecting Illuvium's operations, especially concerning token issuance, public sale, NFT and in-game asset trading, as well as their revenue model which allows anyone who stake ILV to become ‘investors’ in the project.

6. Development and Execution: As games are highly complicated, as with any complex software project, there are risks associated with the development and execution of the game. Delays, technical shortcomings, or failure to meet player expectations can adversely affect the game's reception and success.

These risks highlight the need for thorough due diligence and continuous monitoring for anyone considering investing in or analyzing Illuvium and similar blockchain gaming projects.

Analyst’s Take: Redefining The Gaming Economy

Illuvium is not just another game. Illuvium is a paradigm shift in the gaming industry by integrating blockchain and decentralized finance with traditional gaming mechanics.

This unique fusion creates an ecosystem where players are not just consumers but also stakeholders, with real ownership of in-game assets and participation in the game's economic success. This model challenges the norms of the gaming industry, offering a new perspective on digital asset ownership and value creation. If web3 games can capture a similar number of players as traditional games, the revenue that can be generated will offer great and sustainable returns to existing token holders.

However, as much as I am excited about the future potential of web3 gaming, I remain skeptical of the long-term success and mass adoption of such games. I believe that games are meant to be an escape of our stressful lives to give us enjoyment when played. By incorporating money into a game, it adds stress to it, making it seem like another job which is what we wanted to escape from in the first place. Initially, most people might come for the allure of making money, but once the money they earn inevitably starts to drop due to demand and supply imbalance, it can psychologically make the game ‘less fun’ even if the game did not change, causing players to leave. This can result in games never hitting the ‘critical mass’ needed for the game to become sustainable and balanced.

Ultimately, Illuvium's venture into redefining the gaming economy is a double-edged sword. It presents an opportunity to revolutionize player engagement and ownership in gaming, but it also risks altering the fundamental nature of gaming as a source of stress-free enjoyment. The success of Illuvium and the broader web3 gaming sector may hinge on their ability to balance these contrasting aspects, shaping the future of gaming in this web3 era.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about