Friend.Tech: Blueprint of a Good Airdrop Program

Deep-dive into Friend.Tech and Blur's Point-Based airdrop program

This research memo is for educational purposes only and not an inducement to invest in any asset. The following is an unsponsored guest post. Guest contributors’ views are their own. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Airdrop: the favorite word of every crypto-native

At its core, an airdrop involves distributing tokens to eligible wallet addresses, primarily as a promotional or incentivization tactic for specific projects or protocols. Some of the most iconic airdrop examples include those by Uniswap, ENS, and Arbitrum.

Nowadays, airdrop campaigns are so prevalent that they're almost indispensable for drawing user attention. However, it's not just about launching an airdrop; it needs to be meticulously crafted to onboard users and keep them engaged

But what makes an effective airdrop model? Is it more effective to adopt a retroactive approach like Uniswap and Arbitrum, or should it be announced in advance, as seen with FriendTech and Blur? What are some other critical criteria?

In this analysis, I'll dive deep into FriendTech’s airdrop model to explore these questions and explain why I think FriendTech’s model is set to become the industry standard.

What is FriendTech?

FriendTech is the latest social platform where users, by holding onto a creator's keys, can gain exclusive access to the creator's chatroom and content

Capturing attention on FriendTech is the ability to speculate on the creator’s key values through trading against a bonding curve. This not only brings a financial incentive but, due to the exclusivity of these chatrooms, provides opportunities for users to connect with otherwise inaccessible individuals.

Contrasting other Web 3 platforms that have historically faced challenges in user acquisition and revenue generation, FriendTech has achieved impressive numbers in the short month that it has launched:

Onboarded 200K users

Facilitated $237M trading volume, equivalent to 60% of NFT trading volume

Generated $23M in protocol fees, ranking it the 6th highest fee-generating platform over the past 30 days

30% of users retained on the app after 30 days, which a16z categorizes as great retention performance

FriendTech's meteoric rise can be attributed to a myriad of factors, many of which I've discussed in depth in my previous article. Yet, among these, their airdrop model particularly caught my attention and stands out as a significant driver of their success

Golden Standard for Airdrop

FriendTech's airdrop model will set a benchmark that many in the Web 3 industry will refer to. Here are the specifics of their announcement:

Every Friday for a span of six months, 100,000,000 points, or approximately 3.45 million points every week, are distributed to users

These points, accumulated off-chain during the beta phase, will have a “special purpose” when the app enters official release status – strongly hinting at a token airdrop

Point allocation criteria change weekly

The Points Airdrop Model

Contrary to retroactive airdrops or those that instantly disburse tokens, upcoming airdrops should be structured around a points-based model.

A points-based model uses points to quantify a user’s participation and contribution to a project. Eventually, the points are converted to tokens to reward users.

Beyond the perks of gamification and micro-rewards, which I'll delve into in the following segment, the most significant advantage of this points model is that it delays the token distribution, akin to a cliff mechanism.

In this setup, while users remain actively engaged throughout the program, it simultaneously allows protocols to collect valuable user feedback and accumulate significant usage metrics prior to the official token launch. Consequently, when the token does launch, it does so with several advantages: a more mature product, an elevated valuation, and an additional catalyst to propel its lifecycle forward.

*See appendix for more discussion on this

Motivational Elements

FriendTech's airdrop model fulfills the criteria of several motivational and effective goal-setting theories, such as the esteemed Locke and Latham research, which has also been embraced to varying degrees by global giants like Coca-Cola, Nike, and Intel. By integrating these tried-and-true motivational elements, the airdrop program can then drive consistent and heightened user engagement and motivation

Clear Goals

FT clearly states the airdrop duration at 6 months – contrasting the unannounced (Uniswap and Arbitrum) or ambiguous programs (Sei and many others) that do not have a clear timeline. Knowing the finish line, users remain motivated while anticipating for their rewards

Announcing a distribution of a total of 100 million points offers users insight into potential point value, sparking intrigue and speculation (more on this later)

Research indicates that habits typically solidify within a span of 2 to 3 months. Given the 6-month duration, there's ample time for users to integrate their interactions with FT into their daily routines, reinforcing consistent engagement

Gamification and Competition

A fixed pool of 100 million points spurs healthy competition as users vie for top positions and points as higher points means a larger airdrop

FT’s model requires users to adapt to changing weekly requirements. This dynamism parallels game metas that evolve with every new update, keeping user interest piqued

Proper Feedback

Continuous feedback is a cornerstone of motivation. FT’s weekly distribution acts as a “micro-reward”, giving users tangible markers of their progress and a weekly dopamine hit

Platforms like Twitter become stages where users proudly parade their achievements, providing free publicity for FT

Worthwhile Rewards

Arguably the most important aspect. Users need to believe that their efforts will culminate in a worthy payoff to remain engaged

This is where the Paradigm investment played a huge role, adding significant weight and trust to their brand, as evidenced by the spike in activity post-announcement

With existing metrics such as Total Value Locked and generated fees, users can make educated guesses on the potential worth of their points – with some users estimating $0.20 to $1 per point earned – making FT one of the most profitable “yield farms” in this market

In summary, airdrop programs with clear timelines, include gamification features to engage participants, induce a healthy level of challenge, offer consistent feedback through micro-rewards, and suggest substantial profitability are poised to set the next industry standard for airdrops.

Assessing FriendTech, which has been live for only a month and is still in progress, may not be enough to advocate for the efficacy of such an airdrop model. To build a more compelling argument, let's examine a similiar airdrop strategy deployed by Blur, another venture supported by Paradigm.

Blur’s Airdrop Program and Performance

Despite a disgruntled NFT community, OpenSea’s supremacy in the NFT marketplace is hard to dispute, boasting a staggering 94% market share at its peak and still commanding 60% even after the emergence of decentralized rivals such as LooksRare and X2Y2.

However, none of the marketplaces were much of a threat, much less had a shot at dethroning OpenSea - that is, until the launch of Blur on 19th October 2022.

Season 1 Airdrop

Right off the bat, Blur caught the attention of NFT traders by unveiling its Airdrop 1 campaign. This campaign rewarded those who traded NFTs over the past 6 months before Blur’s launch with “Care Packages” of distinct rarity, which will contain varying quantities of $BLUR tokens.

Now that Blur has gotten the NFT community’s attention, Blur still had to incentivize both demand (bidding) and supply (listing) participants, leading to the highly effective Airdrop 2 and 3

The airdrop design was meticulously crafted for NFT marketplaces and had the necessary characteristics of a successful airdrop program that I’ve identified above:

Clear goals: Participants were informed that they’d receive their rewards in January 2023, with guidance on optimizing their airdrop benefits

Gamification and competition: Though the criteria were more transparent than FriendTech’s program and did not vary each week, there were still elements of challenge as users had to figure out the most optimal strategy to accrue points. A leaderboard was updated every 24 hours, fueling competition with attractive bonuses for the top 100 participants. Rewards are also gamified with different tiers containing different amounts of $BLUR tokens

Proper feedback: Performance metrics were refreshed daily, giving insights into strategy efficacy and facilitating bragging rights on platforms like Twitter

Worthwhile rewards: With each announcement, Blur stated that it would be bigger than the previous airdrop. Since LooksRare and X2Y2’s tokens were trading at an average of $100 million FDV in December 2022, and Blur was doing 1.5x to 22x more their daily trading volume, users could deduce that $BLUR was highly likely to trade at a higher valuation than both, which meant that the airdrop program could be worth approximately $10 million or more (assuming 10% of $BLUR was allocated for the airdrop)

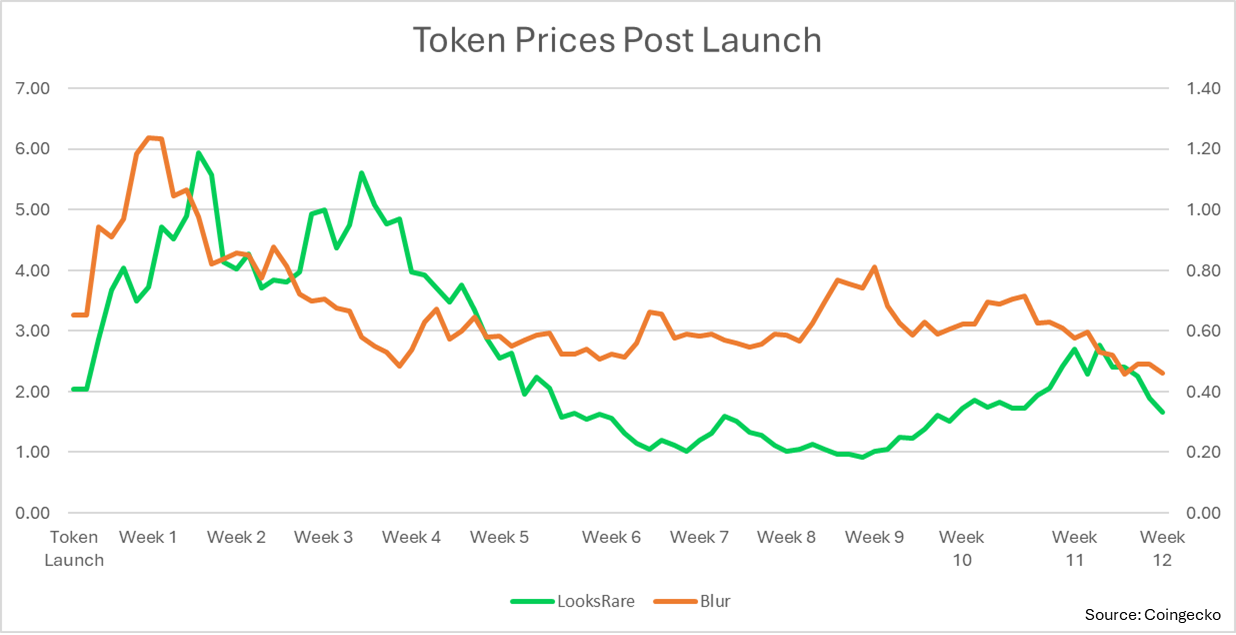

On 14th February, though slightly delayed from the initial plan, $BLUR tokens were available for claiming and started trading at $0.65, which translated to an astonishing $2 billion FDV. This meant an impressive $234 million was distributed to participants from the Season 1 airdrop

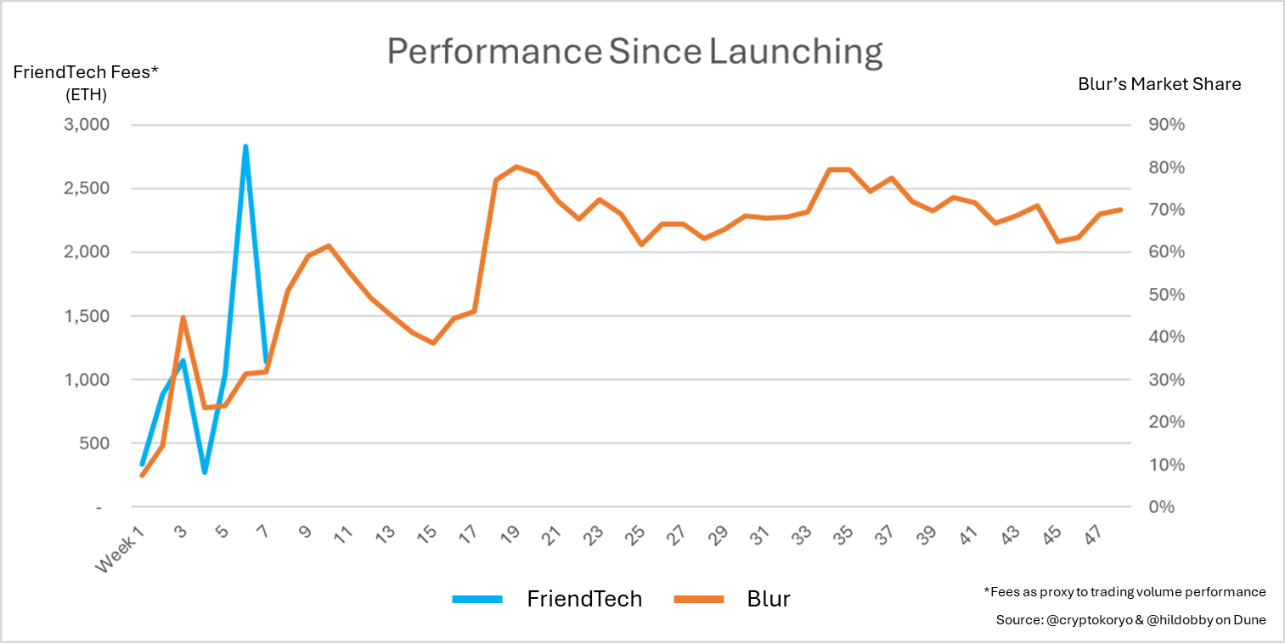

Since December, Blur has consistently outperformed OpenSea with the exception of a few weeks – a feat that many have attempted but failed to achieve and own more than 70% of the market share at this pont – supporting the claim that Blur’s Season 1 airdrop being a success.

Season 2 Airdrop

Alongside Season 1’s conclusion and success, Blur unveiled Season 2, promising to distribute an additional 300+ million $BLUR tokens. This time, the duration was unannounced, but the lucrative prospects of the previous season ensured a surge in activity on Blur, resulting in an 80% market share at its peak.

On 1st May 2023, the Blur team also released Blend, a peer-to-peer lending protocol accepting NFTs as collateral. Now, lending activities also accrued points toward Season 2 airdrop.

There was some community backlash, as challenging market conditions paired with Blend hyper-financialization of NFTs caused some liquidation cascades. This was largely due to borrowers over-leveraging on their NFTs and lenders underwriting loans at slender APY margins to accumulate points for the Season 2 airdrop.

However, Blur’s program proved to be a resounding success, as Blend also dethroned the NFTFi and became the number 1 NFT lending platform

Today, both Blur and Blend stand as unparalleled leaders in their respective sectors, commanding market shares of over 60% and 95%. Without question, Blur's team has demonstrated excellence in crafting top-tier products for NFT traders with professional trading user interface and doing away with trading fees. This isn't to overshadow their efforts but rather to highlight the pivotal role their airdrop program played, which I firmly believe significantly propelled Blur and Blend's meteoric rise

Ultimately, airdrop programs aren't magical panaceas for mediocre products, nor able to ensure long-term user retention post-airdrop. But, they serve as a powerful catalyst supporting exceptional products, amplifying their visibility and equipping them with a competitive edge to seize and maintain market share.

Final Verdict Of A Successful Airdrop Blueprint

Through FriendTech’s airdrop program, I laid the case for essential attributes of a successful airdrop program and substantied it with the success of Blur, which had a similar airdrop program that was pivotal in helping them dethrone OpenSea and NFTFi

Analyzing Blur's program also highlighted the value of dividing the entire airdrop allocation into several smaller drops to maintain user engagement. This was evident in the surge of user activity with every new airdrop announcement.

In summary, for the builders that are designing their airdrop model, here are the final design considerations for a successful airdrop program:

Point-based model: Effective at onboarding users, incentivizing activity and collecting feedback for product improvement before launching a token

4 key motivational characteristics: Clear timelines, include gamification features to engage participants and induce a healthy level of challenge, offer consistent feedback through micro-rewards, and suggest substantial profitability

Micro-airdrops: Rather than disbursing the entire budget in a single lump-sum airdrop, consider structuring the airdrop into smaller, more frequent disbursements to keep users engaged. Provides the flexibility to modify each drop according to user feedback and performance.

Future Studies

Continue monitoring FriendTech and Blur

Both Blur and FriendTech are amidst their airdrop programs, and outcomes are still unfolding.

Blur's challenge is maintaining its significant market share after the Season 2 airdrop concludes. The next phase will be an exciting opportunity for them to demonstrate sustained growth and long-term momentum in the market.

Compared to Blur, FriendTech's airdrop program is in its infancy, running for just a month – but has shown it’s effectiveness in attracting users. However, following the point reveal on 15th September, there was a noticeable dip in activity and a subsequent sell-off. While such fluctuations are not unusual, as evidenced by Blur's past, FriendTech's success hinges on promptly addressing user feedback and consistently enhancing their airdrop program to maintain engagement, while also focusing on refining their core product to seamlessly integrate into a user's daily social media habits, ensuring lasting user loyalty beyond just the allure of the airdrop.

The points-based model is also gaining traction in Solana’s DeFi ecosystem. Following up on their progress will also be good.

Comprehensive quantitative analysis

Without diving into the unit economics, Blur’s and FriendTech’s airdrop program are considerably successful at onboarding users. This is particularly true for Blur Season 1 airdrop, which, despite its hefty $234 million price tag, played a pivotal role in dethroning OpenSea and securing Blur a commanding 75% market share.

On the other hand, LooksRare, even with its substantial $207 million airdrop program, reached a peak market share of only 11% (Blur and LooksRare data are presented without wash trading).

Eventually, a more granular quantitative study to uncover customer acquisition cost, lifetime value, retention rate, and more is necessary to determine the cost-effectiveness of their programs. A study on percentage allocated to airdrop programs can also be conducted.

This is because airdrop programs still come with inherent costs even though they bypass the need for companies to offer upfront cash. Specifically, these programs involve offering project equity in the form of tokens to the community, and therefore crucial for projects to view such opportunity costs in the same light as traditional customer acquisition costs (CAC).

For example, Kerman's analysis of LooksRare revealed a CAC of $2,500 and an LTV/CAC ratio of 0.34, figures that are less than ideal by traditional standards.

Introducing vesting of airdropped tokens

When most airdropped tokens are immediately unlocked, as was the case with LooksRare, they create the potential for significant selling pressure on the token. For example, LooksRare faced the possibility of $207 million, or roughly 10% of their total token supply, being abruptly sold in the marketplace upon launch.

In the worst-case scenario, such intense selling pressure could spell the end for the protocol, as mercenary capital and users rotate to the next shiny new thing. Granted, there are ways to reduce selling pressure, such as LooksRare incentivizing holders to stake $LOOKS with their platform to earn a share of the trading fees. However, that only bought them less than a month of extra time, as token prices are “down-only: from then on and over 80% down from their all-time high by the end of the 2nd month of going live.

Even though Blur’s point-based airdrop model afforded them 4 additional months before their token launch – of which I discussed it’s effectiveness in the segments above – their tokens unlocked on day 1 and were also unable to escape a similar “down-only” fate after token prices peaked 1 week post-token launch, and over 60% down from their all-time high by the end of the 1st month of going live.

On top of token utility to encourage holding, some sort of vesting mechanism could be introduced to reduce the selling pressure of tokens post-airdrop e.g. 20% unlock at the start, with remaining unlocking over the next 6 months. The challenge would be to balance between introducing a reasonable vesting schedule that does not affect the perceived value of the airdrop, so as to not affect the engagement rate of the program.

Effectiveness in Different Scenarios:

FriendTech and Blur's Season 1 airdrop highlight the efficacy of a point-based model in driving activity pre-token launch, while Blur's Season 2 demonstrates its post-launch advantages.

Yet, several questions linger:

Can platforms like Layer 1s, DePIN networks, or DeFi platforms adopt a point-based airdrop approach?

Is it compatible with traditional liquidity mining programs that typically necessitate immediate reward distribution?

In what situations might a point-based model fall short?

A thorough examination of diverse airdrop models, encompassing a wider array of projects like Arbitrum and Optimism (Layer 1), dYdX and Paraswap (DeFi) and others is essential to uncover these insights.

Let us know if you think we should continue this series!

About Author

Javier is a Research Analyst with Blockcrunch. If you’re launching an airdrop soon and want to jam on some design ideas, feel free to reach out on Twitter!

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about