Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day

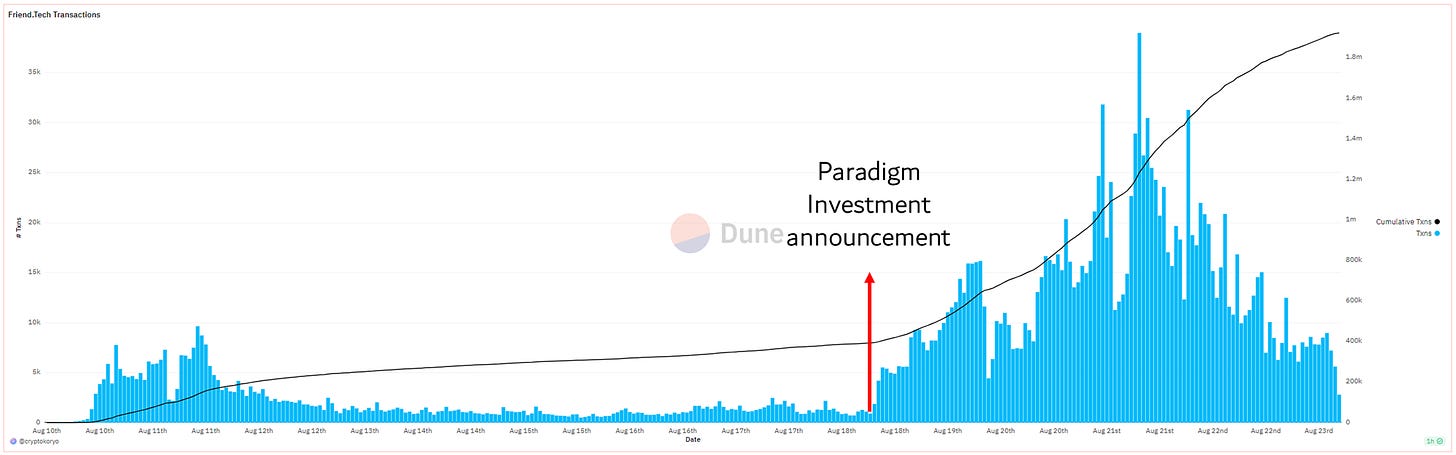

Launched on 10th August 2023, Friend.Tech (FT) is a social-fi platform deployed on Base from the makers of Stealcam, another social-fi project on Arbitrum.

Within a mere 12 days, FT has done impressive numbers:

Onboarded nearly 100,000 users, resulting in an inflow of 36,300 ETH / $62.2 million

Facilitated over 36,500 ETH / $62.4 million trading volume across 1 million trades

Generated close to 2,000 ETH / $3.3 million in protocol fees and was the 2nd highest fee-generating platform on 22nd August, only behind Ethereum.

With such a buzz surrounding FT on Twitter and the backing of investors like Paradigm, it beckons the question:

What exactly is FT, and could it potentially shape the future of decentralized social media?

What is Friend.Tech

FT is a social platform that allows users to buy and sell shares of creators. Holding these shares unlocks access to the creator’s content and a direct line of interaction. In its current iteration, FT can perhaps be understood as OnlyFans, though currently limited to only text features for now.

Driving the buzz around FT is the ability to speculate on the creator’s share prices. On FT, share prices are determined by a bonding curve, wherein prices are dynamically adjusted based on shares in circulation. Consequently, every new share purchase raises the price, while each sale brings it down

The bonding curve on FT naturally generates excitement. By favoring early investors with better terms, it motivates users to join and buy shares quickly. Since share prices rise with increased participation, early adopters are incentivized to promote the platform, amplifying its growth. This dynamic creates a self-sustaining cycle of enthusiasm and expansion, positioning FT as a focal point of attention for crypto-native folks.

Moreover, the creators earn a 5% fee on each transaction and are thereby incentivized to promote and convince users to buy into their shares. They often entice users with offers of exclusive alpha, community calls, and even a stake in the fee revenue.

Friend.Tech’s Playbook

Skeptics might argue that FT’s offerings aren’t particularly novel, as its social functionalities mirror those found on established social media platforms such as Twitter’s Subscriptions, OnlyFans, and many more. Moreover, past endeavors at the financialization of social networks, like Steemit, Roll, and BitClout, have historically fizzled out after brief stints of prominence.

There’s merit in their skepticism.

Yet, sparking debates about whether FT could chart a different path than its predecessors is its remarkable feat of acquiring 100K users and handling $62 million in transactions in a mere 12 days. This is noteworthy, especially when other decentralized social networks have traditionally struggled with user acquisition, with many sunsetting before even hitting the spotlight

FT’s outstanding performance thus far can be attributed to the successful execution of the following:

Inducing FOMO:

Limited access: An access code is needed to sign up with FT, which could be obtained from existing members. The sense of exclusivity had everyone camping for access codes on Twitter.

Shares priced with bonding curve: As highlighted earlier, the bonding curve favors early adopters, creating a competitive rush among users to secure shares ahead of others

Airdrop mechanics: Over a 6-month period, app testers are granted a collective 100 million points, which are promised to serve a "special purpose" upon the app's official launch, suggesting they could potentially be redeemed for FT tokens. As users accrue points based on their in-app activity and the number of referrals they bring in via access codes, they are naturally incentivized to both use and promote FT. This clever strategy not only spurs users to actively engage with the platform but also, given the campaign's extended duration, subtly encourages the formation of consistent usage habits, enhancing long-term user retention

Relatively good user experience

While the necessity of owning ETH and bridging it to the Base chain might remain perplexing and pose an obstacle for the non-crypto natives to get on board with FT, the platform has commendably ensured a smooth user experience for its crypto users.

Smooth onboarding experience with Privy: Unlike many dapps that necessitate users to connect to their wallets or set up a new in-app wallet – often accompanied by the cumbersome task of recording a 12-word keyphrase – working with Privy offers a more streamlined approach. New users can simply log in using their Google or Apple accounts and fund the automatically generated wallet. This effectively reduces onboarding barriers as it assuages users' concerns about potential hacks to their original wallets and obviates the need for the 12-word keyphrase. Additionally, Privy does away with the necessity for signatures on each FT transaction, enhancing the overall user experience.

Use of Progressive Web Apps: Approximately 83% of social media usage occurs on mobile devices. However, it's typically challenging for crypto apps to be listed on Apple or Android App stores. Addressing this challenge, FT ingeniously launched as a Progressive Web App, which functions like a native mobile app where users can “download” directly from the FT site. This approach not only sidesteps traditional app store limitations but also ensures a seamless user experience aligned with prevalent mobile usage trends. However, FT should still allow browser-based access on desktops/laptops. This is likely in the works, though a workaround is available now.

Truly Different This Time?

Here comes the answer to the question everyone is waiting for:

In my opinion, no, it is unlikely to be different this time.

Personally, I don’t think FT is as revolutionary as everyone is touting it to be – it’s just the euphoria from the “up-only share prices” speaking for now. Importantly, it isn’t sustainable, and FT likely falls off in the coming months due to the following reasons.

Lack of long-term, sustainable incentives to use FT

Key stakeholders on FT can primarily be classified into 3 categories:

The creators: those actively managing their channels and encouraging users to buy their shares. Primarily driven by the trading fees earned

The consumers: those buying shares to access a creator’s channel. Primarily driven by the desire to consume the creator’s content or gain exclusivity to the creator

The speculators: those buying shares and flipping them. Primarily driven by the capital gains on shares

Amongst the 3, speculators are likely the first to leave. The nature of speculation means that early adopters often see the most significant benefits. However, as the platform evolves and the initial buzz diminishes, speculative activities tend to decrease, given that active trading becomes less lucrative. This is especially true in FT’s case due to its aggressive bonding curve. FT’s share pricing curve is supply squared, making its growth more exponential than a typical bonding curve. As shares become progressively more expensive, attracting new users to invest becomes an even greater challenge.

For example, at just 202 shares, Racer’s shares are worth 2.55 ETH or approximately $4,000 – which also means that the next shareholder would have to pay > $4,000 to be part of the Racer’s club. Using 0xCygaar’s formula, the cost for the 400th entrant soars to 10 ETH or $16,000

The escalating cost of content on FT starkly differs from the prevalent models of other content-driven social platforms. For instance, platforms like Twitter and TikTok offer free content, while Twitter Subscriptions and OnlyFans provide exclusive content for a consistent monthly fee.

This pricing strategy implies that on FT, good content is reserved for those with deeper pockets. Consequently, many users might find themselves with limited or lower-quality content, leading to reduced engagement on FT and making them the next potential group to depart.

As speculators and consumers sell their shares when they leave the platform, this likely creates a downward spiral in share prices. While this downward trajectory might generate short-term fees for creators, there is unlikely sufficient buying demand to present a sustainable incentive for them in the long run. As engagement dips and content creation dwindles, the exodus of both speculators and consumers could accelerate, further dissuading creators. This cascading effect could be the harbinger of FT’s decline as the platform’s value proposition wanes for all its stakeholders.

Conflicting monetization scheme and business model

Diving deeper into the long-term incentives for creators, the monetization scheme and business models are also at odds.

On traditional content platforms, the primary revenue driver for creators is sustained engagement and user retention. However, FT presents an unconventional model: creators earn from trading activities, specifically the buying and selling of the shares that grant access to their content. Rather than incentivizing stable, enduring relationships, this model oddly appears to celebrate user turnover.

Such a model could create misaligned incentives between creators and their audiences. Instead of fostering deep and lasting connections, creators might be driven to capitalize on short-term trading spikes.

Even though creators benefit when consumers purchase shares, the exponential growth in share prices inherently restricts the buyer pool, effectively installing a ceiling on the group size. Coupled with the fact that creators only receive a one-off payment instead of continuous revenue, the sustainability of this model comes into question.

In sum, FT’s unconventional monetization model, which emphasizes short-term trading over sustained user engagement, risks misaligning creator incentives and threatens the platform’s long-term sustainability

Lack of sustainable dopamine generation

At the core of it, the success of social media platforms hinges on their ability to trigger dopamine releases in users, thereby keeping them hooked and coming back for more. While FT’s speculative nature and rising share prices effectively stimulate dopamine, drawing users in initially, such engagement loops risk being short-lived and unsustainable for the aforementioned reasons. Moreover, FT’s underlying social chat features don’t seem poised to offer meaningful dopamine-driven incentives for users that are not already available on other platforms.

That being said, crafting an innovative, compelling, AND enduring dopamine loop is a challenging endeavor. Numerous platforms once heralded as the “next Facebook,” such as ClubHouse and Be Real, or those anticipated to pioneer the “decentralized social network era” such as Steemit, Roll and Bitclout mentioned above, have since faded into obscurity or ceased operations entirely after making their way into the fleeting spotlight.

Potential Updates

However, to be fair, FT has only been live for 12 days, with more functions likely to come.

Now that FT has done what most other obscure platforms have failed at – onboarding users – its next challenge is retaining as many of them as possible.

Below I offer some potential updates that could help in doing so.

Enhancing communication and interaction dynamics:

Present situation:

Currently, it appears as though creators are conversing with themselves, given that shareholders cannot view messages from other shareholders. Moreover, communication is restricted to text.

Suggested enhancements:

Differentiate between a shareholders’ chatroom and private direct messaging with the creator. Implement a “creator-only” message toggle within the shareholders’ chatroom.

Expand communication methods to include images, videos, and live-streaming capabilities.

Introduce advanced financial features, such as sharing trading fees with shareholders, establishing DAOs, and integrating governance tools. However, these could carry potential legal repercussions.

Improving the sustainability of the monetization model

Current model:

As highlighted earlier, FT’s steep bonding curve, combined with their current monetization strategy of levying 5% fee on trading volume, may not prove to be sustainable in the long run as they potentially limit the number of prospective users, and wrongly incentivizes churn instead of retention

0xCygaar claims that FT’s smart contracts are non-upgradeable, restricting modifications mainly to protocol/subject fees and protocol destination fee. However, there may be potential workarounds to address these limitations

Suggested enhancements:

Tone down the aggressiveness of the pricing curve by transitioning to a linear or even square root curve. Though this may temper the immediate thrill from skyrocketing share prices, it promotes broader participation and sustainability in the long term

Introduce a tiered membership with a monthly subscription model for basic content access. Shareholders, however, should enjoy premium privileges and benefits. This could include exclusive messaging rights with creators or a percentage of the creator's earnings, encompassing both trading fees and subscription revenues

Introducing vesting mechanisms can enhance sustainability, especially if implemented using an inverse curve: early buyers face longer vesting periods than later entrants. This approach not only rewards patience and long-term commitment but also stabilizes the platform, deterring speculative short-term behaviors and promoting consistent growth for FT

Enhancing discoverability of profiles:

Present discovery methods:

A feed displaying shares purchased by friends (with “friends” being those whose shares you own)

A feed indicating when another user acquires shares of your friend

Browsing through the platform’s leaderboard that ranks users by their share price

User’s post on Twitter

Suggested enhancements:

Introduce a feed that highlights when your Twitter followers or those you follow join FT or are already members

Showcase trending profiles from the last 24 hours

Profile suggestions based on previous purchases

Allow profile owners to create a bio page on what type of content they’d be offering shareholders (most creators are promoting on Twitter right now instead of FT)

Introduce a 24-hour access pass to creator content for a nominal fee. Allows users to take a sneak peek before committing to share ownership, simultaneously diversifying revenue streams for creators

Disclaimer: Consider the above suggestions as casual musings. I'll revisit in a few months to see how many of these suggestions FT might have picked up on!

Ideology alone doesn’t onboard users

Regardless of FT’s eventual outcome, its recent performance offers a significant insight for Web 3 builders and investors: while the ideals of decentralization and ownership are commendable, they alone are not the key to drive adoption or success.

While the crypto community ardently champions decentralized, on-chain protocols, the lack of contention over FT's choice – be it the absence of on-chain posts akin to Lens or Farcaster, or the decision to sidestep conventional ERC-20 tokens or NFTs in favor of internal tracking via its smart contract – is telling

When it comes to user-centric crypto applications, satisfying the speculative appetite and harnessing the allure of the "number goes up" strategy often proves to be a potent catalyst for initial engagement, while ideology can operate in the background and roll-out progressively

Ultimately, long-term success demands more than just fleeting adoption or ideologies. It's anchored in sustainable strategies that genuinely address user needs and improve lives. To achieve lasting impact, builders must ultimately prioritize genuine value and solutions.

Useful Resources:

Dune dashboards: CryptoKoryo’s FT dashboard, CyberConnect, SixDegree’s Lens dasboard

0xCygaar’s thread on FT’s share pricing formula and deep-dive into FT’s architecture

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about