What's the noise around Bittensor? $TAO

We deep dive into Bittensor and try to understand it better and also propose a few solutions

This article is brought to you by Yield Guild Games (YGG). YGG is a web3 guild protocol that enables players and gaming guilds to find their community, discover games and level up together. Find out more at: https://investors.yieldguild.io/

Bittensor has definitely been one of the hottest and I’ll say most active projects in the Crypto x AI space.

In this deep dive, I'll explore the network, aim to highlight both its relative strengths and weaknesses, aiming to provide an unbiased and open perspective.

Feedback and discussion are always welcome.

Current Problems

Starting with the basics:

Researchers have been working on AI since the 1930s, but recent advances in data, compute, and algorithms, especially in generative AI, have accelerated progress. A major breakthrough came in 2017 with the development of the transformer model by Google Brain, initially for language translation but later powering large language models (LLMs) like OpenAI's GPT-4.

Training these AI models requires vast data and substantial processing power, mainly accessible to large corporations. Training costs can millions of dollars and on top of that limiting the opportunities amongst a few major players, results in centralised, permissioned and siloed models creation process that limits the development and functionality

Siloed models can't learn from each other, lacking the compounding effect seen in open research.

Third-party integrations need permissions, limiting functionality and value

Creating large language models involves three stages:

training

fine-tuning

in-context learning

Training is resource-intensive, often beyond the reach of startups and solo developers, leading many to use pre-trained models from platforms like Hugging Face.

Fine-tuning for specific tasks requires extensive data and expertise

In-context learning guides models toward desirable outputs but needs ongoing inference

Open-source models also face several challenges. A significant issue is the lack of incentives for contributors, which leads to lower participation and slower development. Even if that’s done, top platforms like Hugging Face who encourage contribution of models, datasets, and applications also face the issue where their LLM Leaderboard encounters problems with performance metrics, where models are optimized for benchmark scores rather than practical advancements.

Community biases and favoritism can skew results

Manipulated leaderboard rankings undermine credibility

Incentives for open-source contributors are still needed for meaningful progress

To unlock the potential of open-source AI and address centralized problems, we need to tackle coordination and incentive issues.

What is Bittensor?

A potential solution lies in leveraging decentralized, trust-minimized digital money principles, like Bitcoin. This approach combines the capital formation of closed-source systems with the collaborative nature of open-source projects.

Inspired by Bitcoin’s principles, is Bittensor - imagine it to be a system that effectively coordinates efforts in a transparent manner and provides tangible incentives for contributors.

A more formal definition 👇

Bittensor is an open-source protocol aiming to advance the process AI development through a blockchain-driven incentive mechanism, focusing on providing $TAO 0.00%↑as a reward for contributors. It operates as a mining network where numerous nodes host machine learning models, analyzing text data, extracting semantic meanings, and generating insights across various domains.

Let’s understand it better.

It transforms ‘machine intelligence’ into a tradable asset via 'subnetworks‘. The incentive system continuously evaluates miner performance, ensuring the network remains efficient and responsive.

By commoditising machine intelligence and incentivising high-performing models training, Bittensor aims to create a decentralized, transparent, rewarding and competitive AI ecosystem.

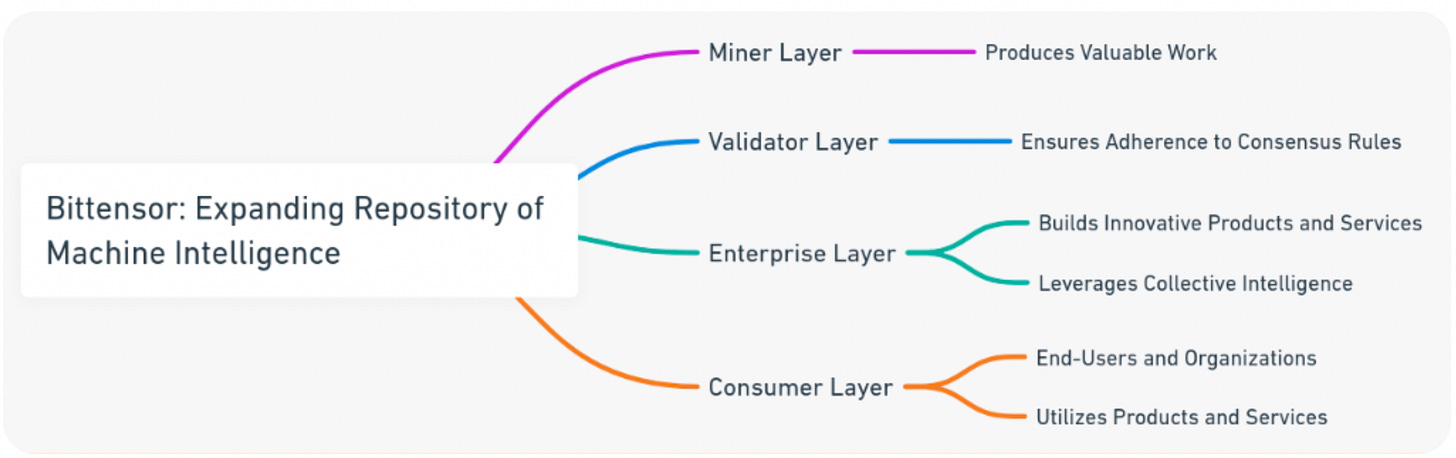

Bittensor’s architecture involves miners and validators.

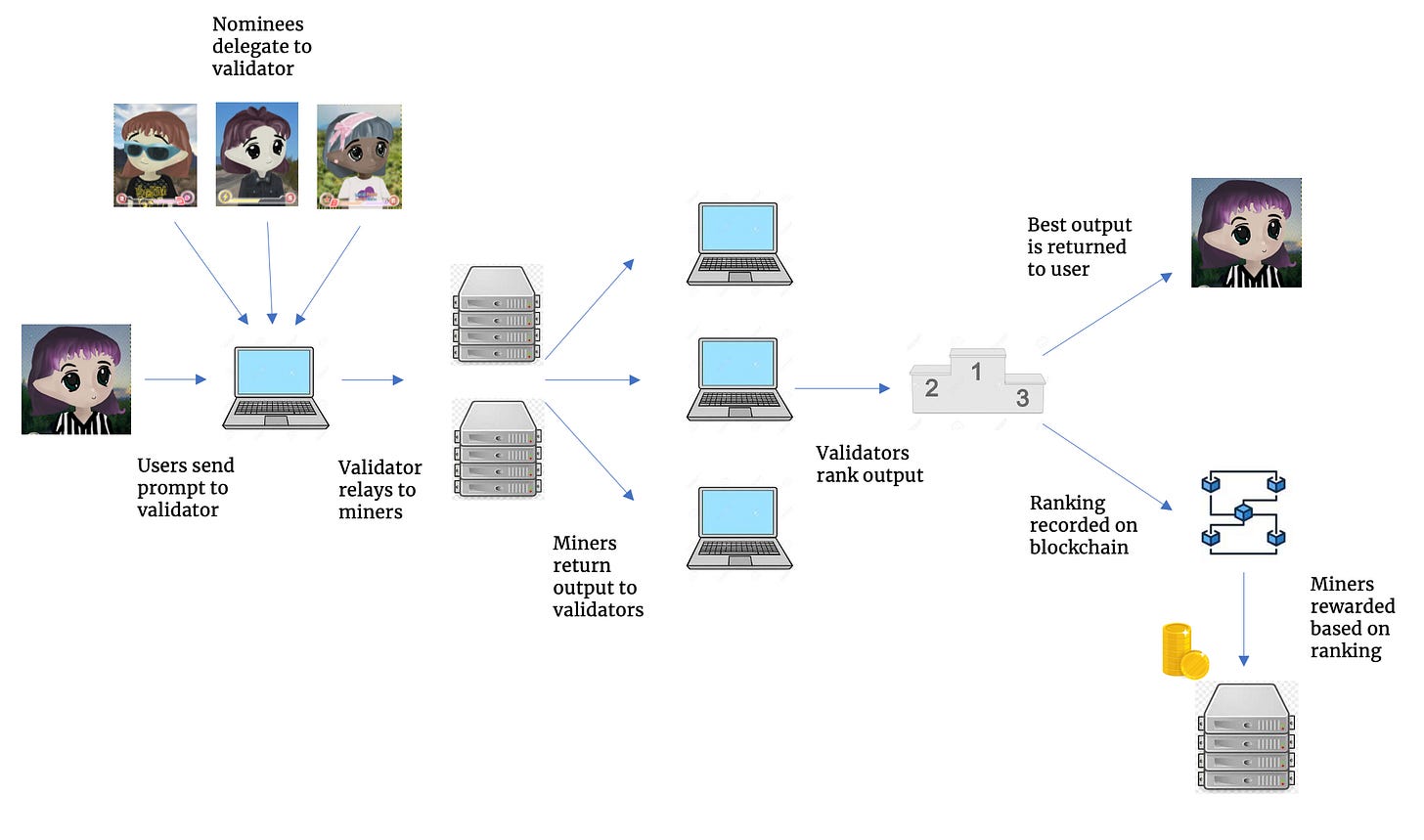

Miners submit pre-trained models for rewards, while validators confirm the validity of these models’ outputs.

For example, a user requesting an AI chatbot answer would have validators propagate the query to miners, rank the outputs, and return the best ones to the user.

A common misconception is that Bittensor supports ML training; it actually supports inference. Training involves teaching a model with a labeled dataset, while inference uses a trained model to make predictions on new data.

Bittensor acts like an on-chain oracle or network of validators for off-chain ML nodes (miners).

Creates a decentralized mixture-of-experts (MoE) network, combining multiple optimized models for a robust overall model.

Validators evaluate models using a specific dataset, scoring based on timestamp and loss. Loss functions measure the error between predicted and actual values, ensuring miners are judged on model quality and accuracy.

A common misconception is that Bittensor supports ML training; it actually supports inference. Training involves teaching a model with a labeled dataset, while inference uses a trained model to make predictions on new data.

Bittensor acts like an on-chain oracle or network of validators for off-chain ML nodes (miners).

Creates a decentralized mixture-of-experts (MoE) network, combining multiple optimized models for a robust overall model.

Similar to a genetic algorithm, Bittensor’s incentive system continuously evaluates miner performance, selecting or recycling miners over time. This ensures the network remains efficient and responsive to AI development.

In the network, value accrual follows a dual approach:

High-performing AI models hosted by miners (contributors) are rewarded with $TAO tokens.

Validators, who assess and utilize the intelligence, also receive $TAO tokens.

Importantly, Bittensor doesn’t only reward raw performance but emphasizes generating the most valuable "signal."

It’s also worth noting that instead of taking on any direct competition, Bittensor actually helps encourage collaboration and integration across the AI stack like compute, data, model. For eg: an inference request on Bittensor, can leverage say a Akash for compute requirements and Gensyn for model training.

It extends beyond typical subnets meant like web scraping, data storage, and cloud computing. It supports specialized tasks, including AI model development, refining open-source LLMs, and producing 3D content, images, and trade signals. This flexibility has led to two key applications: outsourcing technological innovation and serving as an incentivization layer for independent networks.

Teams can use the network to outsource technology development. Instead of maintaining one’s own R&D, projects can simply create competition markets as subnets, encouraging contributors to come solve specific problems. Examples include MyShell and Kaito, which put out specific requirements and the miners are offered $TAO 0.00%↑as rewards by the netowrk

Tldr;

Helps run competition markets as subnets

Contributors solve specific problems

TAO rewards

It can also serves as an incentivization layer, helping new networks build their supply-side. One good example is of, Inference Labs who uses Bittensor to attract zk provers and model inferencers for their AI on-chain protocol. This help leverage Bittensor's infrastructure and reward system to attract contributors.

Tldr;

Functions as an incentivization layer.

Helps build supply-side.

For instance, Inference Labs attracts zk provers and model inferencers.

Here’s how it is for different user profiles:

Developers can build on top of validators

Nominees can delegate $TAO tokens to support validators

Consumers can get (hopefully) accurate and valuable AI responses

Core working of the network

The major players in the ecosystem include:

Subnet owners create subnets, set the reward mechanisms and delegate responsibilities

Subnet miners contribute models and in turn are rewarded

Subnet validators ensure model and subnet integrity

Blockchain operators work on managing the chain itself

Bittensor uses a unique subnetwork model, ‘Mixture of Experts’ (MoE), where multiple models are queried on a semi-random basis. This decentralized approach enhances AI predictions. If you’d like to learn more about MoE, check this blog by Hugging face..

The blockchain layer consists of two components:

Subtensor: built on the Substrate framework, handles consensus, block production, and rewards without smart contract functionality.

Bittensor core: facilitates communication between nodes, using neurons, synapses, axons, dendrites, and the metagraph [all terms native to Bittensor, for more check out the docs].

At the heart of the network is ‘Yuma Consensus’ that powers Bittensor, which reduce the load on the system and actually help off-chain mining and validation. It combines proof-of-work (PoW) and proof-of-stake (PoS) elements in an unique manner, distributing computational resources across nodes for scalable AI tasks. You can learn more about it here.

By integrating decentralized MoE and Yuma Consensus, Bittensor aims to create a scalable, secure network.

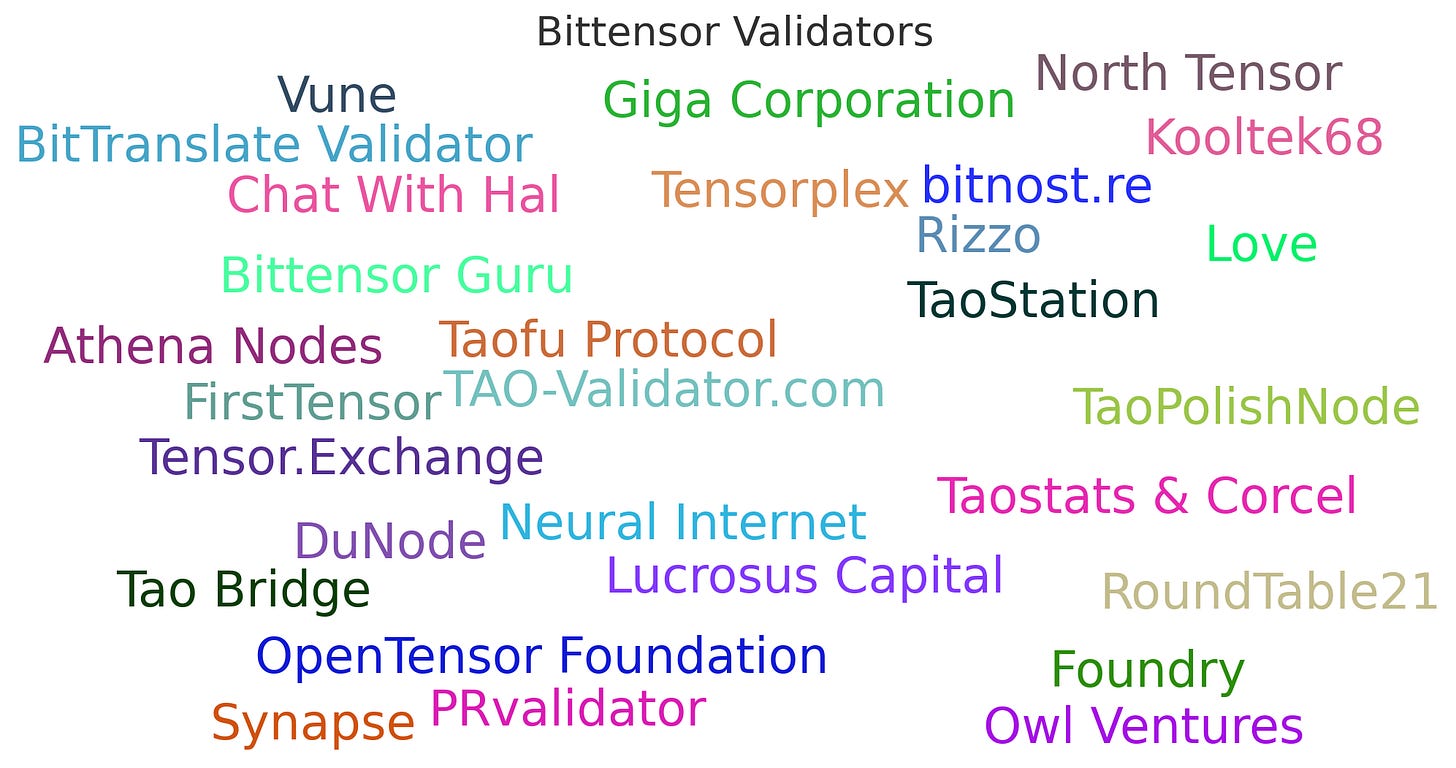

Here’s a list of top validators that I’ve pulled up.

Tokenomics & Platform Economics

Bittensor emits 7,200 TAO tokens daily, distributed among network participants. The top 64 validators currently allocate emissions based on service value, transitioning soon to a market-based mechanism via dTAO (more on that below)

TAO allocation in subnets:

Subnet Owners: 18%

Subnet Miners: 41%

Subnet Validators: 41%

Here’s a very good explainer 👇

Example: If subnet 19 receives 7.9% of emissions, the allocation would be:

Subnet owner: 102.24 TAO daily

Miners: 232.56 TAO daily

Validators: 232.56 TAO daily

Bittensor's tokenomics mirror Bitcoin's supply and vesting model:

Maximum supply: 21 million TAO

Halving every 10.5 million blocks

Current supply: ~6,977,281 TAO (33.23% of total)

Market cap: ~$1.94 billion (current price: $278)

Vesting of over 45years+

The platform economics is designed in such that way that it aims to encourage competition among miners, promoting higher-quality models and better user experience. However, decreasing rewards from halvings might reduce competition over time, it’ll be concern to monitor.

As miners become more specialized in providing their commodity, they move to the right on the x-axis and earn more TAO. The cost to register nodes in the subnet should remain stable and low, ensuring that the reward system is well-designed. This allows miners to operate at full capacity without needing multiple UIDs.

If registration costs are high, it means the reward formula isn't properly incentivizing miners to provide their full output, or they aren't being adequately rewarded for improving the quantity or quality of their commodity

TAO serves as both reward and access token:

Holders can stake, participate in governance, or access applications.

Every 12 seconds, 1 TAO is minted and equally distributed between miners and validators.

Despite potential concerns, TAO's tokenomics are robust, promoting decentralization and fair distribution. They can only be obtained by actually contributing to the network.

Value Accrual Mechanism

The value of $TAO 0.00%↑is tied deeply to the bittensor ecosystem. As these services become more impactful, the demand for $TAO would increases.

Intrinsic Value and Ecosystem Role

Holding $TAO grants access to data, bandwidth, and intelligence generated by the network

Economic Principles: Supply and Demand

Price of $TAO is governed by supply and demand

Increased demand raises the price, while decreased demand lowers it

Demand Drivers

Validators need $TAO for registration

Users purchase $TAO for governance and voting

$TAO is used for payments within the network

Users stake and delegate $TAO to earn rewards

Rising interest in the crypto x ai ecosystem

Network effects → leading to more developers joining in

Supply Drivers

Inflationary emissions aim to reach 21 million total supply

Miners and validators may sell $TAO to cover expenses

Value Capture and Staking

Validators attract stakes from token holders.

OpenTensor Foundation controls 22.36% of network ownership

Validators distribute 82% of rewards to delegates as $TAO, offering staking rewards

Risk/Reward and Long-Term Considerations

$TAO doesn’t yield USD but rewards in token emissions, which can be staked for APY

Similar to Bitcoin with a 21 million max supply and long halving events

Over 65%+ of $TAO is unissued, raising decentralization and scarcity concerns

The Subnet Ecosystem

Bittensor subnets are specialized networks within the ecosystem, each defined by unique incentive mechanisms. They enable decentralized, competitive, and incentivized environments for AI development and deployment.

They underpin Bittensor's technological utility, allowing specialization and division of labor.

Bittensor operates as a sparse mixture model, attracting specific AI models to solve larger problems. The ecosystem has evolved with significant updates like the Synapse Update, which opened Bittensor to external requests, and the Revolution Upgrade, which enabled specialized subnets. These updates allow validators to independently define problems and create new revenue streams.

With the Revolution upgrade, anyone can create a subnetwork specializing in specific applications. For example, Subnet 4 uses JEPA (Joint Embedding Predicted Architecture) to handle various inputs and outputs, such as video, images, and audio. Another development is the BTLM-3B-8K model, which enables high-performance AI on mobile devices.

Types of Subnets:

Public Good Subnets: Aim to accelerate open-source AI by allowing researchers to monetize their work

Subnet 3 (Text-to-Speech): Incentivizes advances in open-source text-to-speech technology

Subnet 9 (Pre-trained Models): Rewards the creation of high-quality pre-trained models

Validator Service Subnets: Create monetizable products and services using existing AI models and infrastructure

Subnet 8 (Proprietary Trading Network): Incentivizes miners to provide profitable trading strategies

Subnet 5 (Decentralized Search Engine): Enhances data retrieval and analysis capabilities

Unique Features:

Incentive Mechanisms: Each subnet's unique incentive mechanism ensures continuous improvement and innovation. For instance, Subnet 9 uses a competitive performance-based incentive mechanism, while Subnet 18 focuses on uptime and availability for text and image responses.

Collaboration: Subnets can reference and intersect the work of others. For example, Subnet 6 leverages synthetic data from Subnet 18 for real-time data synthesis, ensuring models can't overfit benchmarks.

Decentralization: Validators and miners work together to maintain a transparent and open ecosystem for AI model training and validation. This approach prevents cheating and promotes a fair competitive environment.

You can think of bittensor as a launchpad for AI applications and infrastructure services, similar to how say ETH supports smart contracts. The unique incentive architecture of these subnets enables the creation and monetization of specialized services.

These subnets enhance the network by focusing on specific tasks, from image processing to financial predictions and decentralized storage. Here are some subnets with the highest and lowest emissions, highlighting their contributions [as of Jun, 2024]. Let’s check them out.

Highest Emission Subnets:

Subnet 19 - Vision (7.90%): Focuses on image processing, rewarding miners for quick and efficient image recognition and object detection

Subnet 18 - Cortex.t (7.84%): Supports synthetic data generation, providing high-quality text and image responses

Subnet 9 - Pre Training (5.87%): Facilitates the pre-training of AI models on large-scale generic datasets, improving model efficiency and effectiveness

Subnet 8 - Taoshi (4.64%): Provides advanced trading signals across various asset classes using decentralized AI and machine learning

Subnet 1 - Text Prompting (4.08%): Incentivizes the development of conversational intelligence, encouraging innovation in AI communication technologies

Lowest Emission Subnets:

Subnet 34 - Healthi (0.03%): Focuses on predictive diagnostics in preventive medicine using AI, leveraging electronic health records

Subnet 16 - BitAds (0.01%): Creates a decentralized, incentivized advertising environment to enhance transparency and reduce costs

Subnet 36 - HIP (0.10%): Provides human intelligence services for evaluation, testing, and feedback to improve data quality

Subnet 25 - Folding (0.21%): Facilitates protein folding for academic research, supporting world-class studies

Subnet 29 - Fractal Research (0.48%): Optimizes text-to-video inference with minimal latency through a decentralized node grid

The TAO token is essential in Bittensor's network, particularly in allocating emissions to subnets. Currently, validators decide which subnets receive TAO emissions, guided by a delegated staking system where delegators stake their TAO to validators who vote on their behalf. Although validators are trusted to act in the network’s best interest, there's a risk they could exploit their position if they lose confidence in the network's future.

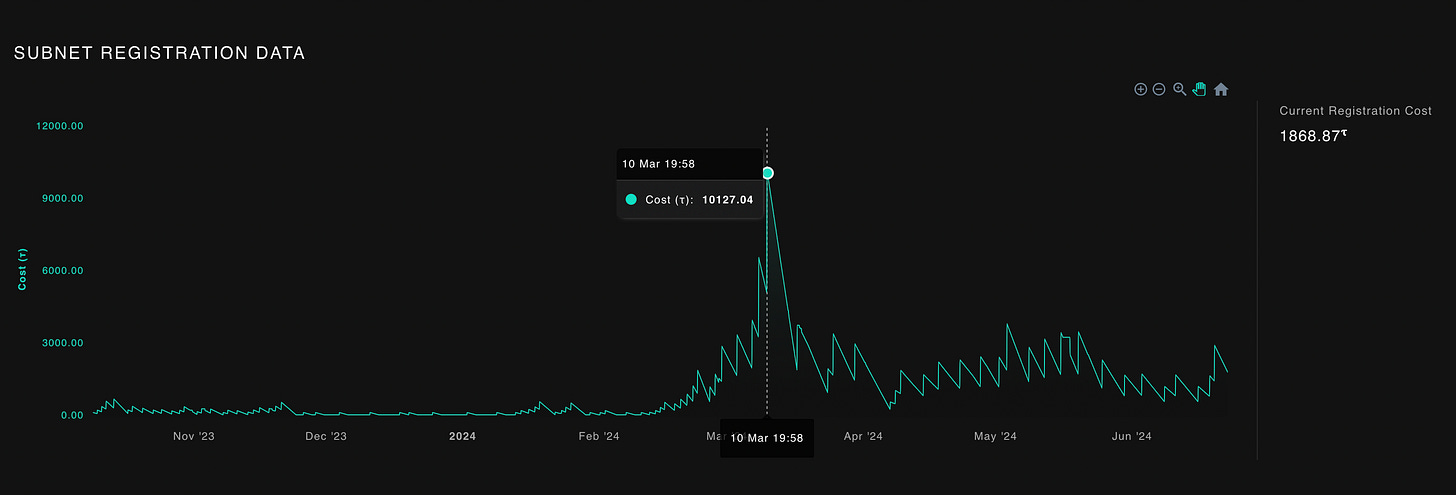

When new subnet owners register and the subnet cap (currently 36) is reached, the subnet with the lowest emissions is automatically deregistered. This process helps eliminate low-quality projects and allows new talent to compete for emissions. The system algorithmically determines the required TAO lock for registration based on past subnet data, striving to balance accessibility and existing subnet ownership. In the recent time, the registration lock cost reached over 10,000 TAO, highlighting the strong demand to build on the network

TAO token is critical for allocating emissions to subnets

Validators use delegated staking to decide emissions

Risk of validators exploiting their power if network confidence wanes

Subnets with the lowest emissions are deregistered once the cap is reached

TAO lock for registration is determined algorithmically

High demand recently pushed registration costs to 10,000 TAO

Need for Dynamic TAO

From the above section, you might have got a fair understanding of what are subnets and few of the different subnets too, but what’s crucial is to understand the underlying challenges with them and the need for dyanmic TAO.

Current Challenges

First off, let’s talk about the current setup. Bittensor’s Root Network is governed by 64 validators who decide how emissions are distributed. Sounds fair, right? Well, not quite. The top 5-6 validators control over 60% of the token supply, giving them excessive power. Such centralization can skew decisions, risking choices that don’t benefit the network as a whole.

Additionally, as the network grows, manually setting emissions for each subnet becomes not scalable. Validators are required to manage emissions for dozens or even hundreds of subnets, an enormous task as the network scales.

These challenges highlight why Bittensor needs a more dynamic and scalable solution.

Why We Need Dynamic TAO

So, what’s with Dynamic TAO? The main idea is to shift from a manual, centralized process to a more decentralized and market-driven approach. This spreads decision-making power to more participants, reducing the influence of a few and automating the process for efficient management of growing subnets.

The Dynamic TAO Proposal

The Dynamic TAO proposal introduces several key changes. Instead of a few validators (64) making decisions, emissions would be determined by the market price of subnet tokens. Each subnet would have its own token and liquidity pool, making the process more dynamic and fair.

Validators stake TAO into these pools to acquire subnet tokens, incentivizing investment in promising subnets. The success of a subnet ties directly to its market value, creating a more efficient resource allocation.

The emission schedule allocates 50% of tokens to the subnet’s liquidity pool, with the remaining 50% shared among miners and validators. This ensures a balanced distribution of rewards, encouraging both validation and mining activities.

Implications

Validators will need to be strategic, evaluating each subnet’s potential to maximize returns. This adds a new layer of strategy and competition. Miners will earn the subnet token, increasing competition and incentive. Delegators must research and pick the best subnets to maximize returns.

This model drives up demand for TAO as it becomes essential for engaging in subnet economies. It mirrors real-world economies, making Bittensor more resilient and adaptable, improving overall network efficiency.

Comparison with Helium

Let's look at how this stacks up against other ecosystems. Take Helium, for example. They moved to a multi-token system, which led to some issues with liquidity competition (for eg: $mobile). In Helium’s case, the introduction of multiple tokens created challenges in maintaining a balanced and integrated ecosystem.

Bittensor plans to avoid this by making subnet tokens non-transferable outside the system, keeping a strong link to TAO. This ensures that the demand for TAO remains strong and that subnet tokens are closely tied to the health of the overall network. By keeping subnet tokens within the system, Bittensor can work to maintain a more cohesive and stable ecosystem.

The Dynamic TAO proposal aims to decentralize control, enhance scalability, and introduce market dynamics into Bittensor’s emission allocation process.

It’s a bold move that could significantly improve the network’s efficiency and fairness. Let's see how this evolves and continues to shape the future of the network.

Major Positives of Bittensor

Let’s spend sometime to explore into what makes the network interesting.

One of its main advantages is that it avoids training models in isolation. Instead, Bittensor promotes the cross-usage of models across the network or ‘Knowledge Compounding‘. This collaborative approach ensures that models are more useful and efficient, benefiting from shared knowledge and improvements.

The network also benefits from an automated coordination layer that streamlines operations. This layer helps manage the complex interactions between various subnets and participants, making the system more robust and easier to navigate.

In just a year, Bittensor has got almost nearly 36 subnets registered now and has seen a good demand from projects to register ($2m+), each tackling different types of problems. This rapid growth demonstrates the network's versatility and capacity for addressing a wide range of problems.

A strong focus is on model inferencing and actually being able to drive usage and real-world impact on these apps.

Bittensor also provides an incentivization mechanism for open-source initiatives. This encourages broader participation and contribution from the community, fasttracking the development of high-quality, open-source AI models.

The Yuma Consensus mechanism is another crucial aspect of the stack. It incentivizes validators to rank miners consistently, ensuring reliable evaluation of outputs. This consistency is vital for maintaining the network's integrity and trustworthiness.

Its unique approach to model training, automated coordination, rapid subnet growth, strong development focus, open-source support, and reliable evaluation mechanisms set it apart as a one of leading projects in the Crypto x AI space currently.

Major concerns or what can be done better

Bittensor faces several critical challenges that hinder its development and effectiveness.

One primary issue is the reliance on validators to determine the best computational tasks, which can be problematic, especially for specialized AI applications where validators may lack the necessary expertise. Additionally, the scalability of subnets, which manage different use cases, is a significant concern. As the number of AI apps grows, the subnet model may struggle to accommodate this diversity effectively.

The economic model of Bittensor has flaws, particularly in the horizontal competition between subnets for inflation rewards. It is challenging to compare the economic value of different subnets, such as a text-to-speech model versus a pre-training model. Subnets may also struggle to compete with established open-source AI projects in image and text generation.

High operational costs are another major problem for Bittensor. Running the network requires substantial funding, primarily from speculators, with a daily inflation rate of 7,200 TAO (~$2mn per day), raising questions about the sustainability of such expenses.

Moreover, model training and weights transparency issues further complicate the situation since Bittensor is not fully open-sourced, limiting understanding of how the models have adapted themselves purely to earn rewards.

The user experience is another area that needs improvement. The current UX is complex and not intuitive, primarily accessible to developers with backend knowledge. This complexity makes it difficult for businesses and users to engage with the network, creating a "chicken-and-egg" problem where low rewards reduce incentives for miners to join new subnets. Effective marketing and education are crucial for communicating Bittensor’s value to developers, businesses, and end-users. Preventing gaming of economic incentives and ensuring fair competition requires ongoing adjustments to address exploitative practices.

The sustainability of the TAO token is also in question, given its reliance on speculative demand and potential dilution of incentives as the network grows.

Bittensor struggles to match the standards of open-source models like Llama-3, raising doubts about its ability to achieve high-quality inference at scale.

Developer adoption is critical for Bittensor’s success, requiring strong community engagement and decentralized decision-making. Competing with established AI players like OpenAI and Google, which have significant resources and data access, presents another challenge, especially given the data divide problem.

Decentralized AI is promising but still very much in the speculative stage and carries risks. Many decentralized platforms face durability issues and rely heavily on developers to maintain operations. Limited access to extensive data banks and cutting-edge AI hardware compared to larger tech corporations also poses significant risks.

Heavy token issuance (over 2 million annually until the next halving) is another concern, with no robust mechanism to track how effective subnets are in earning tokens as rewards, raising concerns about whether models are providing the correct outputs or working to their full potential.

Overall, Bittensor must address these challenges to achieve high-quality inference at scale, attract users and high-quality applications, and balance cryptographic technologies with AI development. Sustaining user growth and activity, maintaining competition and innovation among miners, and effectively utilizing large language models are critical for its long-term success.

Proposed solutions

The current network design of Bittensor presents several challenges, but with strategic changes, it can potentially overcome these obstacles.

Firstly, closed models in different domains may plateau in performance. As open-source models reach GPT-4 level performance on modest hardware, the market could become highly competitive, driving a race to the bottom in terms of price and performance. In such a scenario, pseudo-anonymity and efficient operations could become key differentiators for Bittensor.

One solution could be for Bittensor to focus purely on the model inferencing part for now and move out of fundamental operations like storage on subnets. Instead, using Polkadot or any other blockchain substrate to bridge to dedicated networks that are fit for purpose could alleviate many deficiencies of the subnets.

Redesigning Tao to ensure model provenance, execution, and weights are public, coupled with a user-friendly API for distributed training based on advanced sharding techniques, could position Tao as the standard platform running large model training and inferencing on distributed hardware.

Subnetwork design, being fiat-based rather than product-market fit-driven, makes the organic emergence of subnets costly and unlikely. This design suggests that the primary factor for subnet success is staking, driven by high net worth investor stakes and ongoing popularity via stake delegation. As a result, social promotion and memetic activity dominate, appealing more to the masses than to ML or crypto professionals.

Validators could likely form cabals, monopolizing traffic and reducing the entry of new validators. They may copy each other’s answers through timing attacks or off-chain coordination, as validation work reduces profitability. This should be something which is ensured is not done, in a decentralised manner - for these again better incentive and transparency mechanisms should be in place.

A more focused approach, aligning subnets towards specific sectors like genomic research or finance, could foster greater synergy and economic cohesion. Bittensor's economic model, in its current state, may best serve niche AI areas that do not attract widespread attention but could benefit from targeted incentives. This could include crypto-specific tasks, such as predicting token prices, where the unique capabilities of Bittensor can be effectively utilized.

Focusing on defining better comparative metrics for comparing between subnetworks (I think Dynamic TAO is a good way ahead) is crucial. However, I believe models should be judged based on the output they provide rather than the liquidity part of it, as that can be gamed and is not an AI problem itself. Model performance is the pure AI element of this stack.

Next, the "onboarding cost" to the subnets is very high. There could be an opportunity where empty subnets or a new section can be "rented out" for small ad-hoc tasks and one-off requirements, similar to Kaggle competitions. This might open up opportunities for small projects to join the network and participate, as currently, the stakes are too high for small projects to join.

I also feel that instead of requiring multiple models to sit and train and optimize for the same output, it would be better to combine the qualities and performance from all of them together in a collaborative way.

Incorporating privacy preserving techniques like zkML techniques could significantly enhance the Bittensor network. By using zkML, validators could verify the correctness and integrity of the models and their outputs in a privacy-preserving manner. This would allow validators to understand how miners are modeling without revealing sensitive information. Such a system would ensure that miners who genuinely contribute high-quality models are rewarded appropriately, while those who attempt to game the network could be accurately identified and penalized. This approach would foster a fairer and more efficient ecosystem, encouraging genuine contributions and maintaining network integrity.

The overall reward mechanism currently seems to be easily able to be gamed. There should be certain performance metrics on the AI side, like the number of inferences generated by the network or model performance, to a stricter evaluation process for these subnets - their miners & validators.

By addressing these issues, Bittensor can become more robust, scalable, and attractive to a broader range of participants, from small projects to large enterprises. This approach can enhance its long-term viability and success.

Closing Thoughts

Thank you for reading! I hope you enjoyed this exploration of the Bittensor ecosystem. I've aimed to explain the problems in the space, the current state, and my thought process on how I imagine the network could grow. Your thoughts and feedback are always welcome on anything, honestly.

Overall, I do feel that Bittensor can be a revolutionary technology, but in its current state, it’s more like a poker game where you know your cards but they are not visible to everyone (models) and even the dealer (validator) can easily be bribed. Scalability issues always exist, and with almost $2 million worth of TAO being unlocked daily, that's around $750 million worth of TAO coming into the market over the next year—who is going to buy this?

Ensuring that rewards are given based on the actual value the subnetwork provides is crucial. Instead of immediate reward distribution, we could consider a system where earnings for miners or validators are vested, similar to a credit period. Rewards would vest slowly, and if miners or validators want to redeem their rewards immediately, they would need to burn a portion, say 10% of their earnings. This could encourage holding for the long term and stabilize the market.

By addressing these issues, Bittensor has the potential to evolve into a more robust and sustainable ecosystem. These changes could help balance the rewards mechanism, improve scalability, and ensure that the value generated by the network is fairly distributed.

Thank you again for taking the time to read through this, and I look forward to any feedback or discussion on these ideas.

References: some amazing material

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about