Uniswap: Everything you need to know about V4, Unichain, and more

How V4 Hooks and Unichain Position Uniswap for the Next Phase of DeFi Infrastructure"

This post was brought to you by the Aptos Foundation, an organization dedicated to supporting the growth and development of the Aptos protocol and developer ecosystem. Aptos is the secure, scalable, and feature-rich L1 blockchain of choice for both developers and users—delivering the best performance, the highest throughput, and lowest latency.

Uniswap stands as DeFi's flagship protocol, being both the largest decentralized exchange (DEX) and one of the first platforms for users to buy tokens on-chain. Since its launch in 2018, the protocol has processed over $2.36 trillion in trading volume, has over 25 million unique addresses, with almost half a billion trades.

Today it commands approximately 37% of the total DEX market share, with daily active users consistently around 70 thousand, and is deployed on 12 networks including Ethereum, Arbitrum, Optimism, and Base.

Founded by Hayden Adams, Uniswap received substantial backing from leading venture capital firms including Paradigm, Andreessen Horowitz, Polychain Capital, and more:

Seed Round (2019): $1.8M led by Paradigm

Series A (2020): $11M led by Andreessen Horowitz

Series B (2021): $165M led by Polychain Capital, valuing the company at $1.66B

The team has consistently demonstrated its ability to execute, with each version of the protocol introducing features that become industry standards.

When V1 launched in 2018, it featured the groundbreaking concept of AMM using the constant product formula (x * y = k), enabling permissionless token swaps without traditional order books. In 2020, V2 added any-to-any token liquidity pools and swaps, flash swaps, and price oracles. In 2021, V3 launched concentrated liquidity, allowing liquidity providers to focus their capital within specific price ranges for greater capital efficiency.

V3 has generated over $2.4 billion in fees for liquidity providers since launch. Notably, the protocol itself has not taken any cut of these fees - all revenue has gone to liquidity providers. The protocol has the ability to enable up to a 10% protocol fee on all trading volume through the "fee switch," which, based on current volumes, could generate substantial protocol revenue if activated by governance.

In October 2023, Uniswap Labs (the core development team driving protocol innovation) introduced a frontend fee where users interacting via its website UI will incur a fee of 0.25% (was increased to 0.25% from the initial 0.15%), generating over $83 million in fees.

Now, with V4, Uniswap is pushing the boundaries further by introducing a hooks system that enables customizable pool logic, enabling more possibilities to create sophisticated DeFi applications by builders. We will deep dive into V4 and especially hooks later in this article.

On 10 October 2024, Uniswap also launched Unichain on testnet, a Superchain L2 which aims to address key challenges in DeFi, promising significantly reduced gas fees and block times, unifying cross-chain liquidity, and more.

In this report, we will explore Uniswap's latest developments and their implications for the future of DeFi, covering the following key topics:

What is Uniswap v4: Singleton design, hooks and use cases, and more

What is special about Unichain?

Competitive Landscape

Investment considerations

Thesis

Uniswap V4: Revolutionizing DeFi Infrastructure

Uniswap V4 represents a fundamental reimagining of decentralized exchange architecture. Think of it as upgrading from a basic calculator to a programmable scientific calculator – same core function, but with vastly more capabilities.

This major upgrade focuses on four key innovations: Hooks, Singleton Design, Dynamic Fees, and Flash Accounting, collectively positioning Uniswap as a more versatile and efficient DeFi primitive. Let’s explore these key innovations.

1. Hooks: Customizable Pool Logic

Hooks are V4's most transformative feature, enabling custom logic to interact with a pool during its lifecycle.

Let’s first understand the lifecycle of a uniswap pool:

Uniswap pool is created with a fee tier

Liquidity is added, removed, or readjusted

Tokens are swapped in the pool

Hooks allow an action, such as calling any solidity code, to take place at anypoint of the pool's lifecycle, such as before or after a swap, or before or after adding or removing liquidity. For example, a hook can adjust fees before a swap happens, or reward liquidity providers directly with incentives upon adding liquidity. Here is a full list of the available functions so you get a better idea:

Before and after pool initialization (only invoked once during intialization)

Before and after adding liquidity to a pool

Before and after removing liquidity to a pool

Before and after executing a swap

Before and after donating to a pool

Let’s understand some of the key characteristics of hooks:

External smart contracts: Hooks are external smart contracts attached to a Uniswap V4 liquidity pool, and they can be attached during creation or after

Pool-specific: Each liquidity pool in Uniswap v4 can specify which hook contract to attach during pool creation, but it can only be attached to one hook

Reuseable: While one pool can only have one hook, a hook can be attached to an unlimited number of Uniswap v4 pools, making it scalable

Modular: Hooks extend the functionality of a liquidity pool without changing Uniswap v4’s core logic, saving on audit costs

Hooks open up all kinds of use cases and opportunities. Here are some examples:

Custom Trading Logic:

On-chain limit orders that fill at specific prices

Time-Weighted Average Market Making (TWAMM) for large order execution

Volatility-based dynamic fee strategies

Whitelisted address exclusivity for compliance

Custom oracle implementations replacing default TWAP

Advanced Liquidity Management:

Automated position adjustments

Yield optimization strategies without separate staking contracts

MEV protection mechanisms benefiting liquidity providers

Dynamic fee adjustment based on market conditions

Integration Capabilities:

Direct connection with other DeFi protocols

Automatic deployment of out-of-range liquidity to lending protocols

Cross-protocol yield optimization

Custom oracle feeds for external protocols

Note: While hooks offer powerful customization options, users should exercise caution and verify the hooks used in pools they interact with, as malicious hooks could potentially be deployed.

Now that we have a better understanding of hooks, let’s go through a sample scenario of how a dynamic fee hook would work:

Hook Creation:

Developer creates hook that tracks hourly volume

Implements fee tier table (e.g. <$1M = 0.1%, $1M-$5M = 0.2%, >$5M = 0.3%)

Includes logic to calculate rolling volume

Hook Attachment:

Attaches to his own pool during creation

Sets initial parameters and fee bounds

Hook Execution:

Hook triggers before a swap takes place to check current volume

Calculates appropriate fee tier

Applies new fee to current swap

Hooks are the future of DeFi and there are already hackathons (or hookathons) focused on helping developers to launch hooks, supported by Uniswap Foundation’s grant.

In other words, hooks are like an app store. Imagine Uniswap V3 as a smartphone with only pre-installed apps, in V4, developers can create Hooks to customize how you interact with Uniswap, similar to downloading apps to customize your phone's functionality.

We will explore some example use cases of Uniswap hooks in a later section.

2. Singleton Design: Unified Pool Management

Uniswap V4 introduces a singleton design, where all pool state and operations are solely managed by the PoolManager.sol contract. This helps to facilitates:

Centralized Pool Operations: All liquidity pools are managed by a single contract

Reduced Deployment Costs: New pools are contract states rather than entirely new contracts, which makes pool creation cheaper as it is not a contract deployment

Improved Gas Efficiency: Optimizes multi-hop swaps and pool interactions

Simplified Protocol Management: Streamlines upgrades and maintenance

This design choice reflects a mature understanding of blockchain's constraints and opportunities, optimizing for both performance and scalability.

3. Dynamic Fees: Market-Responsive Pricing

V4's dynamic fee system introduces market-responsive fee pricing mechanisms managed through hooks:

Adaptive Fee Structure: Unlike the static fee tiers in Uniswap V3, V4 allow fees to be any number and be adjusted real-time based on market conditions and volatility

Frequent Updates: Fee updates can occur on swaps, blocks, or a scheduled interval

Optimized Efficiency: Better yield for LPs during different market conditions can attract more LPs which allows traders to have less slippage as well

Enhanced Capital Efficiency: More precise fee capture during high-volatility periods

This feature represents a significant improvement over V3's fixed fee tiers, allowing pools to optimize for both liquidity depth and trading volume, opening many use cases, such as:

Volume-based fees: Higher fees during low-volume periods to compensate LPs

Time-based fees: Different fees during off-peak hours based on historical data

Arbitrage Penalty: Increase fees when arbitrage potential detected to discourage it

Momentum: Analyze price momentum and adjust fees based on trade direction

Note that Uniswap V4 pools determine their dynamic fee capability at pool creation and is immutable. For more info, read Uniswap V4’s dynamic fees here.

4. Flash Accounting: Gas Optimization

In Uniswap V3, token swaps required tokens to be transferred between pool contracts for intermediate steps via external calls, which was gas intensive (expensive). This was because each pool was its own contract and token transfers were needed for accounting.

In Uniswap V4, it uses the singleton design where all pools are managed by a single contract, allowing it to leverage EIP-1153’s Transient Storage feature, aka Flash Accounting. This allows swaps and liquidity changes to update a single internal balance, resulting in only one set of token transfers once the final balance changes, optimizing transaction efficiency.

This results in the following benefits:

Balance Netting: Consolidates multiple token transfers into single, net settlements

Optimized Multi-Hop Swaps: More efficient execution of complex trading routes

Reduced Gas Costs: Significantly lower fees for complex operations

Example of a swap between V3 and V4:

Uniswap v3: Swapping ETH to DAI

ETH is transferred to ETH/USDC pool contract

USDC is withdrawn from ETH/USDC contract and transferred to USDC/DAI contract

DAI is withdrawn from USDC/DAI contract and transferred to the user

Now on v4: Swapping ETH to DAI

Call swap() on ETH/USDC

Call swap() on USDC/DAI, with the credit of USDC from above as the input amount

User pays ETH and receives DAI, without calling the transfer function, saving gas

More use cases of Uniswap v4 Hooks

To emphasize how big of a gamechanger hooks can be, let’s explore some use cases to further illuminate the potential massive impact of hooks.

Yield Optimization for LPs:

Current problem: Uniswap v3 concentrated positions regularly go out of range, not earning yield until the user withdraws the liquidity and creates a new concentrated liquidity position, turning the impermanent loss permanent, or until the price returns back to the range.

Solution: Hooks could automatically deposit out-of-range concentrated liquidity positions into other protocols to earn yield, such as AAVE, Yearn vault, or even dynamically fetch the highest-yielding protocols that is whitelisted and deposit it there.

It would also automatically withdraw back to uniswap once it detects that a swap has moved the price within the range again.

This optimizes the yield that a user could earn while providing concentrated liquidity.

Fixed-Rate Orderbook Lending:

Current problem: DeFi lending protocols like Aave and Compound rely on variable rates based on utilization, leading to unpredictable yields for lenders and borrowers. Fixed-rate lending markets exist but often suffer from fragmented liquidity and complex implementations.

Solution: Uniswap v4 hooks, combined with dedicated lending contracts, could enable fixed-rate lending markets that leverage Uniswap's liquidity infrastructure. The core lending mechanics (collateral management, liquidations, loan tracking) would live in external contracts, while hooks facilitate the trading of zero-coupon tokens representing future claims on assets.

In this design, the hook's role would be focused and specific:

Enable trading between current and future token versions (e.g., USDC and future USDC which act as zero coupon bonds)

Direct trading fees to the lending protocol

Validate trade parameters against lending contract conditions

Enforce maturity and settlement rules during swaps

The external lending contracts would handle the heavy lifting:

Manage collateral deposits and requirements

Track loan positions and maturities

Handle liquidations and settlement

Mint and burn zero-coupon tokens

This hybrid approach could offer unique benefits by combining Uniswap's efficient price discovery and deep liquidity with fixed-rate lending functionality. However, the success would depend on careful economic design and gas-efficient integration between hooks and the lending contracts.

In conclusion, Uniswap V4 hooks' application to lending markets demonstrates the potential for DeFi infrastructure to evolve beyond simple token swaps. By enabling order book-based lending, these innovations could significantly improve the efficiency and sophistication of DeFi lending markets, potentially bridging the gap between DeFi and traditional finance.

ve(3,3) Implementation via Hooks:

Current problem: The success of Aerodrome demonstrates the effectiveness of ve(3,3) tokenomics in attracting sustainable liquidity through aligned incentives. However, protocols must currently choose between implementing a complete ve(3,3) DEX from scratch (high development cost, fragmented liquidity) or using Uniswap's established infrastructure (deeper liquidity, better capital efficiency, but less aligned incentives).

Solution: Uniswap v4 hooks could offer a hybrid approach. Rather than implementing complex ve(3,3) mechanics directly in hooks, the core ve(3,3) system (token locking, voting, bribes) would live in external contracts, while hooks provide a simple but powerful integration layer. The hook's primary role would be directing a portion of trading fees to the ve system, while external contracts handle the heavier computation of reward distribution and voting outcomes in separate processes.

This design could potentially offer unique benefits over traditional ve(3,3) DEXs - combining Uniswap V4’s dynamic fee capabilities with ve(3,3)'s aligned incentives. For example, LPs could benefit from both vote-directed rewards and dynamic fees that adjust to market conditions, while maintaining access to Uniswap's deeper liquidity and established integrations.

If successfully implemented, such a system could attract liquidity from existing ve(3,3) DEXs back to Uniswap, as it would offer LPs the best of both worlds: ve(3,3)'s sustainable incentives and Uniswap's capital-efficient infrastructure. However, the success of this approach would ultimately depend on the technical execution and whether the added complexity of coordinating between hooks and external contracts provides enough benefits to overcome the simplicity of dedicated ve(3,3) protocols.

What is Unichain: Uniswap's L2 Solution

Launched by Uniswap, Unichain is an L2 built on Optimism’s Superchain, which is a unified network of Ethereum L2s built using the OP Stack, which is a modular and open-source software stack built by Optmism and is also used by chains such as Base and Mode.

As a quick refresher of an ETH L2, it is essentially a chain that regularly takes all the transaction data from the L2 blocks and posts them onto Ethereum L1, so that all the data needed to verify the L2’s state is available on L1, for anyone to verify and detect if there are any malicious behavior.

However, Unichain would not be a generic purpose L2 as it is purpose-built is to enhance DeFi and cross-chain liquidity capabilities while maintaining Ethereum's decentralization principles.

It is already live on testnet but there is no timeline for a mainnet launch yet, although it is expected to be within the next few months. Let’s explore its key features.

Significant Cost Reduction

Unichain achieves a 95% reduction in transaction costs compared to Ethereum L1 by moving execution to a Layer 2 solution as part of Ethereum's scaling roadmap. As an optimistic rollup built on the OP Stack, it inherits the general cost benefits of L2 scaling solutions while maintaining the security guarantees of Ethereum. The whitepaper indicates that these cost savings are expected to increase even further over time as the system evolves.

Key benefits:

95% reduction in transaction costs compared to L1

Potential for further cost reductions over time

Maintained security through L1

Makes DeFi more accessible to broader range of users

Unichain Validation Network (UVN)

Similar to most other L2s, Unichain will be running with a single sequencer for improved efficiency. Sequencers act as the primary transaction processor for the L2, responsible for accepting transactions from users and ordering them into blocks and posts the data to Ethereum L1, in exchange sequencer fees.

To mitigate the centralization issue of having a single sequencer, Unichain is implementing the Unichain Validation Network (UVN), a decentralized network of node operators that independently validate the latest blockchain state.

Node operators that stake UNI as collateral (to incentivize their honesty) can become validators. While node operators are parties that maintain a copy of the chain for data availability, validators have an additional role.

Validators have to sign block hashes and publish attestations once per epoch, basically to verify that blocks are not malicious (i.e. double spending, transaction reordering, posting incorrect data to the L1, etc). In exchange for posting valid attestations, they receive validation fees based on their stake-weight.

The UVN specifically addresses two major risks in single-sequencer rollups that affect cross-chain settlement speed:

Block Equivocation Risk: The possibility of a sequencer proposing multiple conflicting blocks at the same height, creating uncertainty about which block will be finalized

Invalid Block Risk: The risk of a sequencer posting an invalid block, leading to chain reversion when fault proofs are submitted

Key benefits of the validation network:

Enable node operators to independently verify that blocks produced by the sequencer follow protocol rules

Faster economically secure finality for cross-chain settlement

Provide an additional security layer by catching any malicious activity from the sequencer

Create economic incentives (validation fees) for decentralized verification of the network

Trusted Execution Environment (TEE)

Unichain has partnered with Flashbots to develop a "Verifiable Block Builder" that uses a TEE.

A TEE is like a secure, locked room inside a computer's processor that runs code in complete isolation from the rest of the system and no one can view or tamper with what's happening inside. It is a way of proving to others that the code running inside hasn't been modified. The entire code execution can be verified and attested to publicly, and the block builder's code is open source, allowing anyone to verify what rules are being enforced.

This technology provides several critical protections for Unichain users:

Fair transaction ordering to prevent front-running and back-running attempts by malicious actors

Improved transparency in transaction execution through verifiable block building

Limited ability for validators to manipulate transaction order for profit

Effective mitigation of toxic flows through a dedicated validator set

Traditionally, sequencers on an L2 have full control over block building and can manipulate transaction ordering. Unichain separates these roles - block building happens in the TEE, while the sequencer's role is limited to broadcasting these pre-built blocks. Through execution attestations posted publicly, users can verify blocks were built inside the TEE according to stated policies.

Here's how blocks are built on Unichain:

Transactions are streamed to the TEE builder

The TEE creates "Flashblocks" - which are block pre-confirmations and each block is split into 4 Flashblocks, enabling effective block times of 200-250ms

The sequencer then broadcasts these Flashblocks as pending blocks

These protections are particularly significant given that trading volume worth approximately $83B has been exposed to MEV activities like sandwich attacks on Ethereum alone, resulting in roughly $300 million (0.34%) being extracted by MEV searchers.

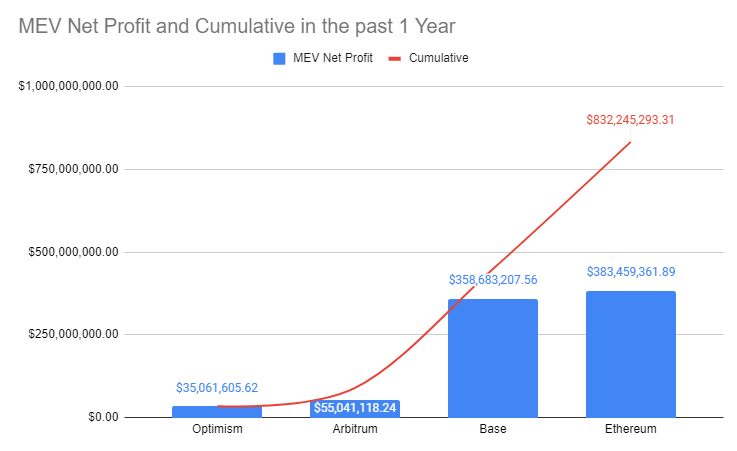

Additionally, in the past year alone, MEV net profits reached approximately $832 million cumulatively across major chains, with Ethereum accounting for $383 million, Base $359 million, Arbitrum $55 million, and Optimism $35 million. This demonstrates that MEV extraction remains a significant concern across the DeFi ecosystem, not just on Ethereum.

Uniswap’s Unichain with TEE and verifiable block building could protect users from such value extractive activities like sandwich attacks or liquidation frontrunning, or captured this value within their ecosystem, potentially saving hundreds of millions in MEV losses annually, instead of letting it go to external MEV searchers and validators.

Key benefits of the TEE:

Verifiable Execution: Through attestations, users can verify blocks were built according to stated rules

Revert Protection: Simulates transactions during block building and removes any that would fail, reducing wasted gas fees

Framework for Improvement: Provides foundation for future features like:

Encrypted mempool for pre-transaction privacy

Scheduled transactions

Private, verifiable computation through TEE coprocessor

MEV Protection: Unichain's advanced block production system enhances market efficiency and mitigates MEV concerns to:

Prevent predatory MEV extraction

Capture legitimate MEV opportunities

Redistribute the captured value to benefit users or the protocol

Create a more efficient and equitable trading environment

This is particularly important as it provides a transparent and verifiable block building process, enabling applications to capture and redistribute MEV to benefit users rather than having it extracted arbitrarily.

It also gives institutional players a strong guarantee that their large trades won't be manipulated by the sequencer.

Optimism Superchain Integration

Unichain leverages its position within the Optimism Superchain which ensures consistent message processing and verification across all participating superchains, to deliver unique cross-chain capabilities. For chains outside the Superchain, interoperability initiatives like ERC-7683 are being developed to improve cross-chain communication.

The integration enables the following core features.

Native Message Passing

This enables cross-chain message passing between any superchain where messages can be passed atomically and verified within the same block, significantly reducing cross-chain transaction times.

It also allows for communication between smart contracts on different rollups, meaning smart contracts can track and verify cross-chain state changes in real-time, enabling complex cross-chain applications.

Key benefits:

Instant cross-chain message verification

Smart contract interoperability

Real-time state tracking across chains

Optimized Liquidity Flow

Unichain is specifically designed to eliminate liquidity fragmentation across different superchains through shared infrastructure and optimized message passing.

By aggregating demand from multiple superchains, it allows LPs to deploy their liquidity solely on Unichain resulting in deeper liquidity instead of fragmenting it.

Key benefits:

Reduced liquidity fragmentation

Lower cross-chain transaction costs

Deeper, unified liquidity pools

Seamless multi-chain accessibility

Universal Compatibility through ERC-7683

Expanding beyond the Superchain ecosystem, this standard creates a unified protocol for cross-chain trade execution, enabling developers to build cross-chain applications through an intents-based bridge functionality.

Rather than specifying exact execution paths, users can indicate desired outcomes, while the system handles the complexity of cross-chain routing and settlement.

The implementation supports atomic settlement of cross-chain trades, reducing counterparty risk and improving efficiency, while providing a framework for complex operations like multi-hop trades or cross-chain liquidity provision that can be adopted by any blockchain network.

Key benefits:

Standardized cross-chain interface

Intents-based trade execution

Atomic settlement guarantees

Complex operation support

Benefits and Considerations

Unichain's introduction, alongside Uniswap v4's innovations, represents a transformative development that will likely reshape DeFi market dynamics. Let's analyze the key impacts across institutional and ecosystem participants.

Institutional Benefits

Unichain's architecture directly addresses two critical barriers to institutional DeFi adoption: trading infrastructure and risk management.

The combination of cost reduction, execution speed, and customizable environments through hooks creates an institutional-grade trading infrastructure previously unavailable in DeFi. Large players can now deploy sophisticated strategies that were previously impractical due to high gas costs and execution uncertainty.

Traditional finance firms have historically been hesitant to engage with DeFi due to uncertainty around transaction ordering and MEV exposure. The TEE-based block builder provides the transparency and predictability these institutions require, while the validation network and verifiable execution provide the assurances needed for significant capital deployment.

Moreover, the ability to customize trading environments through hooks enables institutions to implement their specific compliance and risk management requirements directly at the protocol level - a critical feature for regulated entities looking to participate in DeFi markets.

Key institutional benefits:

Institutional-grade infrastructure with reduced costs and improved execution

Enhanced transparency and predictability through TEE-based block building

Customizable compliance and risk management through hooks

Robust security guarantees via the validation network

DeFi Ecosystem Effects

Similar to how Uniswap V3 set a new standard for the DEX space, Uniswap V4 and Unichain are poised to create even more significant ripple effects across the DeFi ecosystem by extending beyond token swaps and liquidity provision.

The protocol's enhanced efficiency through Flash Accounting and Singleton Design substantially reduces transaction costs, which should attract higher trading volumes. Hooks enable Uniswap to offer specialized trading needs, such as address exclusivity, that were previously not possible, while dynamic fees allow pools to optimize revenue generation based on real-time market conditions.

The most immediate ecosystem impact will be on market efficiency through liquidity consolidation. Rather than being fragmented across multiple chains, liquidity can be concentrated on Unichain while remaining accessible to users across the Superchain. This consolidation should lead to better price discovery and reduced arbitrage opportunities between chains.

Market makers and liquidity providers benefit from this consolidation through reduced capital requirements and operational overhead. The ability to serve multiple chains from a single liquidity pool improves capital efficiency and potentially enables better yields for liquidity providers.

From a developer perspective, hooks represent a paradigm shift in how developers can interact with the protocol, enabling the creation of new DeFi primitives without the need for complex forking or external contracts. This significantly reduces barriers to innovation, allowing developers to implement sophisticated trading strategies and custom pool logic while earning a cut for providing the hook.

For end users, Unichain simplifies the increasingly complex DeFi landscape. Cross-chain operations become more straightforward, and users benefit from better execution prices due to deeper liquidity. The reduction in failed transactions and faster finality creates a more reliable trading environment that more closely resembles traditional finance platforms.

Key ecosystem impacts:

Enhanced market efficiency through liquidity consolidation

Reduced barriers to innovation through the hooks system

Improved capital efficiency for market makers and LPs

Better user experience with simplified cross-chain operations

Creation of new DeFi primitives through extensible architecture

By bridging traditional finance requirements with DeFi innovation, Unichain could accelerate the maturation of the entire DeFi market while fostering a new wave of ecosystem growth through its extensible architecture.

Considerations

While Unichain and Uniswap v4 offer significant improvements, historical patterns suggest adoption may follow a gradual path. When Uniswap v3 launched, Uniswap v2 retained substantial TVL for an extended period due to its simplicity and lower gas costs for basic swaps. A similar pattern might emerge with v4, particularly given the added complexity of hooks and the learning curve for developers.

In the L2 landscape, new networks have historically faced challenges in gaining immediate traction despite technical advantages. Base, zkSync, and other recent L2s demonstrated that building significant liquidity and user adoption takes time, even with strong technical foundations. Unichain may face similar initial headwinds despite its unique value proposition.

Key considerations for market participants:

Potential for gradual migration from v3 to v4 as the hooks ecosystem matures

Initial period of liquidity fragmentation across versions and L2s

Time needed for developer ecosystem to build and optimize hook implementations

Importance of monitoring early adoption metrics and liquidity trends

These considerations don't detract from Unichain and v4's long-term potential but suggest market participants should maintain realistic expectations about adoption timelines.

Another crucial factor to consider is the competitive landscape, particularly as protocols like Raydium, Balancer, and ve(3,3) DEXs like Aerodrome develop their own innovative features to capture market share. The next section will analyze how Uniswap's latest innovations position it against these key competitors.

Competitive landscape

Let’s explore how Uniswap stacks up against other popular DEXs.

Uniswap vs Raydium

Raydium combines AMM with order book functionality for hybrid trading and has emerged as a significant competitor in the DEX space being the premiere DEX on Solana. It’s TVL has surpassed $1.40b and it currently generates roughly $1 billion of volume and $3m in fees daily.

The protocol has seen remarkable growth recently, largely driven by the success of Solana and pump.fun’s popularity and resulting trading activity. As a result, RAY token price has increased over 3x in the past month. It also significantly outperformed UNI so far this year with a 2.5x against UNI since September.

Key Similarities:

Both utilize concentrated liquidity for efficient capital deployment

Similar base pool mechanics (AMM-based)

Multiple fee tiers for different trading pairs

Protocol fees that can be directed to value accrual

Key Differences:

Raydium implements automatic RAY buybacks (12% of all trading fees) and its treasury directly receives 4% of fees from certain pool types, while Uniswap has a 0.25% interface fee on selected token pairs through Uniswap Labs interfaces, plus potential protocol fee switch (up to 10%, currently inactive)

Uniswap's upcoming V4 introduces hooks for customizable pool logic

Raydium capitalizes on retail momentum through user-friendly interfaces and is the AMM DEX for pump.fun tokens while Uniswap focuses on institutional adoption through cross-chain infrastructure and customizable trading environments

The protocols' divergent approaches highlight different visions for DEX evolution - Raydium optimizing for retail user experience and token value accrual, while Uniswap builds extensible infrastructure for institutional and sophisticated DeFi use cases.

Uniswap vs Aerodrome

Aerodrome has quickly established itself as a leading DEX on Base, with its TVL reaching $1.3b and generating around $800 million in volume and $500k in fees daily. Originally known as Velodrome on Optimism, the protocol is a fork of Solidly, which was created by Andre Cronje, often referred to as the 'godfather of DeFi', on Fantom chain.

While Velodrome saw moderate success on Optimism, Aerodrome's launch coincided with Base's meteoric rise to become the fastest-growing and now largest L2, surpassing even Arbitrum in TVL.

This explosive ecosystem growth, combined with Aerodrome's ve(3,3) tokenomics model, created a powerful flywheel effect. The model allows $AERO token voters to earn significant yield through bribes, which in turn incentivizes deeper liquidity and higher trading volume, helping Aerodrome overtake Uniswap as the dominant DEX on Base.

As a result, AERO token price has nearly 3x since the bottom in September. It also significantly outperformed UNI so far this year with a 2x since September.

Key Similarities:

Both operate as decentralized exchanges with liquidity pools

Support for permissionless pool creation

Fee generation for liquidity providers

Cross-chain aspirations (Unichain for Uniswap, upcoming Aerodrome expansions)

Key Differences:

Aerodrome implements a ve(3,3) tokenomics model where $AERO holders can lock tokens for voting rights and direct liquidity incentives, while Uniswap maintains a simpler fee structure with potential protocol fee switch

Uniswap V4 introduces hooks for customizable pool logic, while Aerodrome focuses on optimizing the ve(3,3) system

Aerodrome targets sustainable liquidity through vote-directed emissions, whereas Uniswap relies on organic market dynamics and capital efficiency

Aerodrome's primary focus is Base chain optimization and Coinbase ecosystem integration, while Uniswap aims for broader institutional adoption across multiple chains

The contrast in approaches reflects different strategies for DEX evolution - Aerodrome leveraging proven ve(3,3) mechanics for sustainable growth and aligned incentives, while Uniswap develops novel infrastructure through hooks and cross-chain capabilities for more sophisticated use cases.

Uniswap vs Balancer v3

Balancer, another leading DEX protocol, currently holds $845.89M in TVL and averages around $65M in daily trading volume and generates approximately $19K in daily fees. Like Uniswap v4, Balancer v3 is expected to launch later this year with hooks being a key feature, and they have also conducted hookathons and maintain an open source hooks repo.

$BAL has underperformed $UNI by approximately 50% year-to-date. This underperformance can be attributed to several factors: unlike Raydium on Solana or Aerodrome on Base, Balancer wasn't positioned to capture the explosive growth of an emerging ecosystem. Additionally, despite its technical innovations, Balancer faces the challenge of competing directly with Uniswap in mature markets where network effects and liquidity advantages heavily favor the incumbent.

Without a clear differentiating catalyst or new market opportunity to drive growth, Balancer has struggled to expand beyond its core user base, who already have access to deeper liquidity and lower slippage on Uniswap for most common trading pairs.

Architectural Approaches:

Balancer v3 adopts a modular architecture with distinct components (Vault, Routers, and Pools) where hooks are one part of a larger extensibility system

Uniswap v4 uses a singleton design where hooks are the primary method of customization, with all functionality running through a single contract

Looking at the current Balancer v3 testnet hooks and hackathon projects, both Uniswap v4 and Balancer v3 developers are building a diverse range of applications that shows that both protocols enable similar end-user functionality, but through different technical approaches:

Fee Management

Balancer: Built-in pool creator fees and structured fee hierarchy

Uniswap: Fee customization through hook logic

Integration Complexity

Balancer: More structured but requires understanding multiple components

Uniswap: Potentially simpler due to consolidated design

Customization Methods

Balancer: Multiple customization points (Hooks, Routers, Rate Providers)

Uniswap: Primary customization through powerful hook system

For developers and users, both protocols will likely enable similar functionalities despite their architectural differences. The choice between them may come down to development preferences and specific use case requirements rather than capability limitations.

Uniswap vs Camelot

Camelot has established itself as the dominant DEX on Arbitrum and Orbit chains, processing over $30 billion in trading volume and securing partnerships with more than 75 protocols. Starting in 2022 through community bootstrapping, Camelot has become the largest protocol exclusive to Arbitrum and has evolved into the first Orbital Liquidity Network, expanding its infrastructure across multiple Arbitrum Orbit chains.

While Uniswap maintains its position as the largest DEX across all chains, Camelot's focus on Arbitrum and its Orbit ecosystem has allowed it to capture significant market share in this specific L2 ecosystem. Camelot's strategic positioning as an Orbital Liquidity Network, connecting different Arbitrum Orbit chains, provides a unique value proposition in the growing L2 landscape. The protocol has already deployed on 8 Orbit chains, creating a unified liquidity infrastructure for the broader Arbitrum ecosystem.

Key Similarities:

Both operate as permissionless decentralized exchanges

Focus on building cross-chain liquidity infrastructure

Strong emphasis on ecosystem development and project support

Commitment to decentralized governance and community ownership

Key Differences:

Camelot exclusively focuses on Arbitrum and its Orbit ecosystem, while Uniswap operates across multiple L1s and L2s

Camelot's Orbital Liquidity Network creates network effects between Arbitrum Orbit chains, whereas Uniswap's Unichain aims for broader cross-chain interoperability

Camelot prioritizes real yield and sustainable tokenomics through GRAIL, while Uniswap maintains potential for protocol fee switch activation

Camelot serves as a dedicated launch platform for Arbitrum projects, having helped over 10 protocols launch, while Uniswap focuses on providing universal liquidity infrastructure through hooks and customizable pools

The upcoming Uniswap v4 emphasizes technical innovation through hooks, while Camelot focuses on ecosystem alignment and cross-Orbit chain connectivity

The contrast in approaches highlights different strategies for DEX evolution - Camelot optimizing for deep integration within the Arbitrum ecosystem and creating network effects across Orbit chains, while Uniswap develops generalized infrastructure that can be deployed across any EVM-compatible chain. Camelot's focused approach has allowed it to become a central hub for Arbitrum's DeFi activity, while Uniswap's broader scope positions it as a universal liquidity layer for the entire blockchain landscape.

Quantitative Comparison

Despite being the market leader with a $5.65B market cap, Uniswap is actually underperforming in several key metrics:

Raydium generates 72% higher fees ($982.6M vs $571.5M annually) with lower volume

Raydium has 5x more daily active users (3.78M vs 711K)

Both Aerodrome and Camelot show significantly higher volume per user ($12.3M and $6.24M respectively vs Uniswap's $827K)

Worth noting is Camelot's unique position:

Highest fee per user ($5,991) after Aerodrome ($7,935), far exceeding Uniswap ($804)

Most conservative market cap to TVL ratio (0.16) suggesting potential undervaluation

Tightest supply with only 23.73% float vs industry average of ~50%

Interestingly, Aerodrome stands out for efficiency:

Shows strong capital efficiency with $12.3M volume per user

Maintains healthy market ratios despite being a newer entrant

These metrics suggest that while Uniswap maintains market leadership by size, newer competitors are showing superior efficiency metrics and user engagement.

Investment Considerations

Short-term Catalysts

Unichain: The upcoming launch of Unichain mainnet represents a potential watershed moment for cross-chain trading efficiency. With its innovative 200-250ms Flashblocks and verifiable block building system, Unichain could fundamentally reshape how cross-chain transactions are executed and verified.

Uniswap v4: The deployment of Uniswap V4 stands as another significant near-term catalyst. Its introduction of hooks technology will enable developers to create customizable pool logic, potentially sparking a new wave of DeFi innovation. If the hooks system becomes a success, it effectively creates a new developer ecosystem around Uniswap, functioning similarly to an "app store" for DeFi applications. Combined with Unichain's unified infrastructure, this positions Uniswap to potentially become the default liquidity layer across multiple blockchain networks. Key metrics to monitor during the initial rollout include hook deployment rates, the variety of new use cases being built by developers, and the pace of liquidity migration from V3 to V4 pools.

Long-term Value Drivers

Unifying Liquidity: Uniswap's V4 hooks architecture presents a compelling solution to the persistent challenge of fragmented liquidity. By enabling ve(3,3) and Unichain’s unified liquidity with the Superchain ecosystem, the protocol could become increasingly attractive to both liquidity providers and traders.

Fee Switch: Uniswap has already generated significant revenue through its 0.25% interface fee in 1 year, placing it as a top 20 protocol for year-to-date revenue at over $60 million, and over $2.4 billion in fees for liquidity providers. The protocol fee switch could enable up to 10% of trading fees to accrue to the protocol, which would significantly increase revenue stream, making Uniswap the top DEX by revenue. However, this fee switch requires careful consideration of its potential market share.

Regulatory support: Uniswap stands to be a prime beneficiary of Trump's pro-crypto presidency. His pledges to make the U.S. the "crypto capital of the planet," remove SEC Chair Gensler, and provide regulatory clarity align perfectly with Uniswap's upcoming V4, Unichain launch, and fee switch. With its institutional-grade infrastructure, Uniswap is also ideally positioned to capture the wave of institutional capital that could flow into DeFi under Trump's crypto-friendly administration.

Uniswap Wallet: The protocol's growing mobile presence, evidenced by over 500,000 wallet downloads, provides a direct channel for user acquisition and engagement. They could develop more features to tap on this large mobile userbase, such as having a debit card to make spending their on-chain money more easily.

Market Positioning Considerations: While Uniswap's position as the largest DEX by market capitalization might suggest limited upside potential compared to smaller competitors, recent underperformance relative to other DEXs could present an attractive catch-up opportunity for investors. This dynamic creates an interesting risk-reward profile for potential investors considering entry points in the current market environment.

Thesis: Uniswap is positioned for a DeFi bull run

Uniswap stands at a pivotal moment in its evolution, with V4 and Unichain representing not just technical upgrades but a fundamental reimagining of DeFi infrastructure. These innovations address three critical challenges that have historically hindered DeFi adoption: liquidity fragmentation, execution inefficiency, and limited customization.

The protocol's strategic advantages emerge from several key dimensions. First, its technical innovation and infrastructure development set new standards for the industry. V4's hooks system creates an extensible platform that could become the "app store" of DeFi, fostering a rich ecosystem of customized applications. Complementing this, Unichain's 200-250ms Flashblocks and TEE-based block building provide institutional-grade execution quality. Through Superchain integration, the unified liquidity approach positions Uniswap to become the default cross-chain liquidity layer.

From a market leadership perspective, Uniswap has demonstrated strong revenue potential, generating over $60 million in interface fees within just one year. The potential activation of the protocol fee switch could capture up to 10% of $2.4 billion in trading fees, significantly enhancing value accrual. Furthermore, its growing mobile presence, with over 500,000 wallet downloads, provides a direct channel for user acquisition and engagement.

A particularly significant catalyst on the horizon is the potential shift in the U.S. regulatory landscape. Trump's campaign promises to make the U.S. the "crypto capital of the planet," remove SEC Chair Gensler, and provide regulatory clarity align perfectly with Uniswap's trajectory. As the largest DEX with institutional-grade infrastructure, Uniswap is ideally positioned to capture the wave of institutional capital that could flow into DeFi under a more crypto-friendly administration. This regulatory tailwind, combined with Uniswap's technical innovations in V4 and Unichain, could accelerate institutional adoption significantly.

Institutional readiness forms another cornerstone of Uniswap's positioning. Enhanced transparency and predictability through TEE-based block building, coupled with customizable compliance and risk management through hooks, create an environment suited for institutional participation. The robust security guarantees via the validation network further strengthen its appeal to traditional finance players seeking to enter the DeFi space.

However, several factors warrant careful consideration. Historical patterns suggest adoption may follow a gradual path, with migration from V3 to V4 likely to occur over an extended period as the developer ecosystem matures around hooks. The protocol also faces competition from specialized platforms like Raydium and Aerodrome, which have carved out successful niches in specific markets.

Market dynamics present both challenges and opportunities. While current underperformance relative to smaller competitors might concern some observers, it could also present attractive entry points for investors. The protocol's success ultimately depends on broader DeFi market growth and institutional adoption, with regulatory developments potentially playing a crucial role in determining the pace of expansion.

Looking ahead, Uniswap's combination of technical innovation, market leadership, and institutional readiness positions it uniquely in the DeFi landscape. While near-term catalysts like V4 and Unichain launches could drive growth, the protocol's long-term value proposition lies in its potential to become the fundamental infrastructure layer for decentralized finance, particularly as the regulatory environment becomes more supportive.

As the industry matures and institutional participation increases, potentially accelerated by a more favorable regulatory environment, Uniswap's strategic positioning and continuous innovation make it a compelling force in shaping the future of decentralized finance.

The protocol's evolution from a simple token swap platform to a comprehensive DeFi infrastructure provider demonstrates its ability to innovate while maintaining security and decentralization. This balanced approach to growth, combined with its strong technical foundation, market position, and potential regulatory tailwinds, suggests Uniswap is well-positioned to lead the next phase of DeFi evolution.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about

Share