TRON: Slow and Steady Wins The Race

Find out more about TRON and how it outperformed the market during this cycle.

This post was brought to you by the Aptos Foundation, an organization dedicated to supporting the growth and development of the Aptos protocol and developer ecosystem. Aptos is the secure, scalable, and feature-rich L1 blockchain of choice for both developers and users—delivering the best performance, the highest throughput, and lowest latency.

This cycle we have seen most established Layer 1 (L1) chains stumble while new L1 chains failed to continue the hype after mainnet and fade into obscurity. However, one chain has been silently defying market trends by having a steady upclimb through the downturn.

I am talking about TRON (TRX), the brainchild of controversial crypto mogul Justin Sun. It has not just survived the recent market turbulence – it's thrived. Since the start of the crypto downturn this year in April, the crypto market has plummeted with big names like POL and AVAX down over 40%, while TRON has actually climbed 30% back to its 2021 all-time-high, outperforming all major L1s from April to now. This leaves both supporters and critics wondering: what fueled TRON's resilience this cycle?

TRON was founded in 2017 by a Singapore non-profit called TRON Foundation and its governance and gas token is TRONix (TRX). The token was launched through an Initial Coin Offering (ICO) that took place from August 31 to September 2, 2017. The ICO was a mega success, raising 15,200 BTC, roughly $70 million at the time, or around $1 billion at today’s price if they kept the BTC. TRX is currently showing an ROI of 83x against the US dollar, making it top 15 in terms of ICO ROI.

This funding allowed TRON network into the successful ecosystem today. Its goal was to decentralize the web and revolutionize the entertainment industry by creating a global, free content entertainment system that aims to decentralize content creation and distribution.

As I am sure most of us do not think of decentralized entertainment when thinking of TRON, I can confidently say that its success in that domain has been limited. Instead, TRON has found unexpected success in other areas. The platform's true strengths have emerged in the realms of decentralized finance (DeFi) and, most notably, in facilitating stablecoin transfers. Today, TRON stands as a formidable player in DeFi, challenging even Ethereum in terms of transaction volume and network revenue.

As TRON has solidified its position as a top performer in the cryptocurrency market, particularly among Layer 1 platforms, let’s explore some of its key stats:

Market Capitalization: TRON’s market cap exceeds $10 billion, ranking in the top 15 cryptocurrencies, representing a significant increase from its position in early 2023.

Price Performance: While many cryptocurrencies have struggled to regain their all-time highs, TRX has maintained a price level near its historical peak, showing remarkable stability and growth in a volatile market.

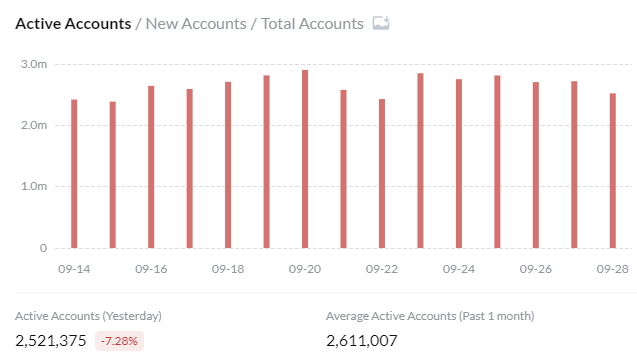

Active wallets: The TRON network has over 2.5 million active users, while Ethereum has around 400 thousand active users, a testament to TRON’s widespread adoption.

Trading Volume: Daily trading volume for TRX consistently exceeds $300 million, making it a top 20 cryptocurrency by volume, indicating high liquidity and active market participation.

Network Activity: TRON blockchain processes over 3 million transactions daily, surpassing many of its Layer 1 competitors in terms of network usage, including Ethereum which only has around 1 million transactions daily.

Source: TRONscan

Total Value Locked (TVL): TRON has seen substantial growth in DeFi, with TVL in TRON-based protocols exceeding $7 billion, placing it as the second largest chain by TVL, behind just Ethereum.

Source: DefiLlama

USDT Dominance: TRON has become the preferred network for USDT transactions, handling over 70% of all Tether transfers, surpassing Ethereum in this regard.

Source: Dune

Revenue: In August, TRON has already generated approximately $435 million in fees, outpacing Ethereum's $364 million. This represents a substantial 50% lead over Ethereum in monthly protocol revenue. However in terms of year-to-date Ethereum is still leading at $1.55 billion in fees while TRON is catching up at $1.34 billion. If TRON maintains its pace, it will be the first time that Ethereum is dethroned in terms of blockchain revenue.

Source: Cryptorank

As TRON has performed admirably this year, it’s time to understand why. In this article, I will delve deep into the TRON ecosystem, exploring its technology, key partnerships, and the factors driving its impressive market performance. Read on to discover why TRON is not just surviving but thriving in the competitive world of cryptocurrencies.

TRON’s Background

TRON's Historical Milestones

Key Milestones in TRON's History:

September 2017: TRON Foundation established and TRX’s ICO completed, existing as an ERC-20 token on the Ethereum Network

May 2018: TRON Mainnet launched, marking independence from Ethereum

June 2018: TRON Virtual Machine (TVM) goes live, enabling smart contracts

July 2018: TRON acquires BitTorrent, expanding its decentralized ecosystem

December 2021: TRON becomes TRON DAO, with over $1 billion in assets, while Justin Sun steps down as CEO of the TRON Foundation, transitioning to a TRON DAO ambassador

2021: Expansion into DeFi with the launch of JustSwap (later rebranded as SunSwap) and other DeFi protocols.

2023: TRON's DeFi ecosystem experiences significant growth, with Total Value Locked (TVL) reaching new highs

May 2024: TRON is the second non-EVM chain to integrate with LayerZero to connect with other ecosystems

April 2024: TRON introduces Stake 2.0, introducing TRON LSTs

Justin Sun's Leadership and Influence

TRON was founded by Justin Sun, who was born in 1990 in China.

He has been the key figure in TRON's development and promotion. His background and achievements have played a crucial role in shaping TRON's trajectory:

Early Career: Before founding TRON, Sun joined Ripple Labs from 2013 to 2016 as chief representative and adviser, gaining valuable experience in the blockchain industry. Justin Sun had previously gained recognition as the founder of Peiwo, a popular audio content aiming to become China's equivalent of Snapchat, which has matched over 4 billion chats. He was also personally mentored by Jack Ma, the co-founder of Alibaba Group. He eventually founded TRON and the TRX token in 2017.

Strategic Acquisitions: In 2018, Sun acquired BitTorrent, Inc. for $140 million, later launching the BTT token on the BitTorrent network. He also acquired the crypto exchange Poloniex, though this acquisition has been associated with controversy, including allegations of mishandling user funds.

Other Ventures and Investments: As of February 2023, Sun was reported to be the largest individual staked ether holder, with a balance of $500 million. In August 2024, he launched SunPump, a platform allowing users to create their own cryptocurrency tokens.

Ongoing Influence: Despite stepping back from direct TRON operations in December 2021, Sun remains a significant figure in the crypto space, advising for exchanges like HTX (formerly Huobi) and continually launching new projects.

Ecosystem and Key Partnerships

TRON's ecosystem has shown remarkable growth and resilience, contributing significantly to the token's strong performance. This section delves into the key components of the TRON ecosystem and their impact on TRX's market position.

DeFi Landscape on TRON

The decentralized finance (DeFi) sector on TRON has experienced substantial expansion, becoming a major driver of the network's growth. As of September 2024, TRON's Total Value Locked (TVL) stands at an impressive $8 billion which is primarily in DeFi. Let’s explore some of these DeFi protocols.

JustLend

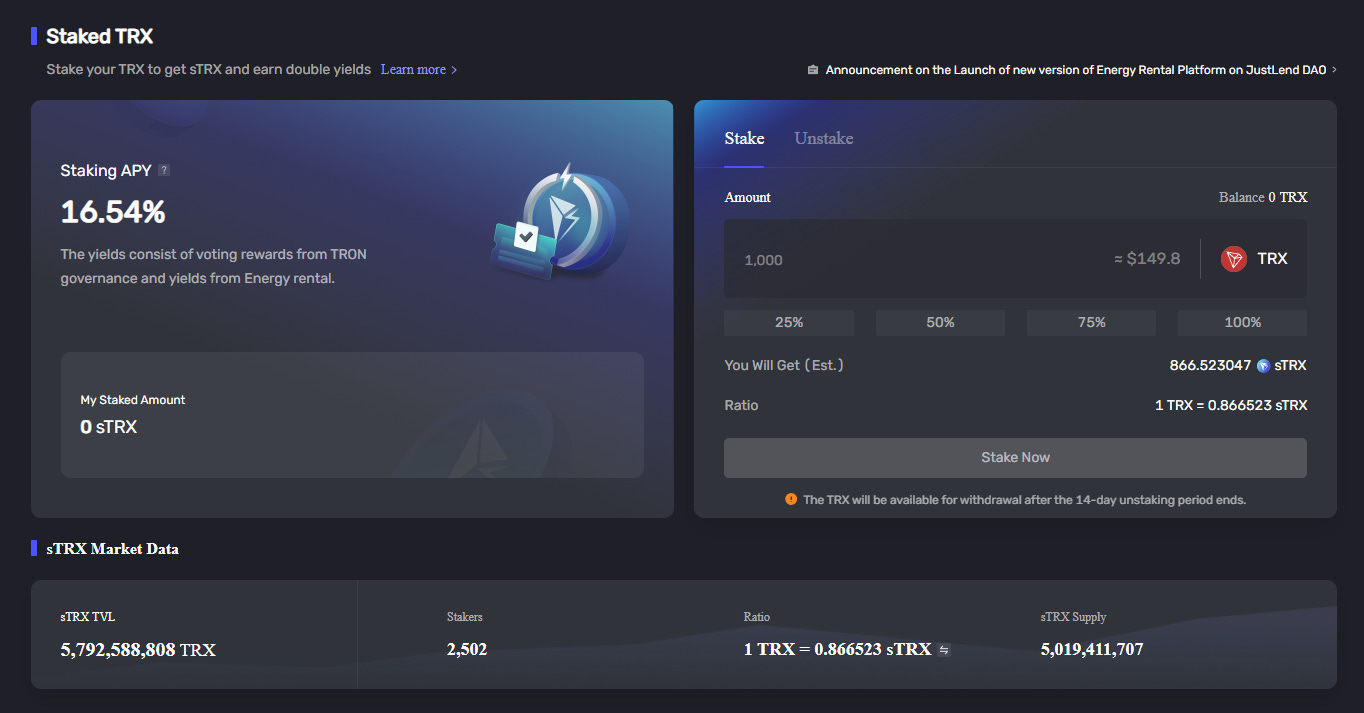

JustLend is TRON’s leading protocol that has several DeFi features and currently accounts for over 60% of the network's TVL.

Its primary application is a lending market similar to AAVE where users can lend, supply collateral, and borrow all major assets on TRON. Source: Justlend

It also a liquid staking feature where users can deposit TRX and mint stTRX which is a liquid staked token of TRX, earning 16% APY and can be further used in other DeFi applications, such as lending directly on JustLend itself. The unstaking period for TRON is 14 days.

TRON uses a unique resource system called Energy which we will dive deeper into later. Energy can be obtained via TRX staking or burning, which can be cumbersome to procure, which is why Justlend created an Energy Rental feature where you can just borrow Energy (no pun intended). This service aims to address the high costs and lengthy procedures of obtaining Energy through by allowing users to rent Energy at significantly lower prices, aiming to make Energy more accessible and cost-effective for users.

SunSwap & SunPump

As TRON's primary decentralized exchange (DEX), SunSwap has seen its daily trading volume surpass $500 million, a 200% increase from the previous year. The platform's low fees and high liquidity have made it a preferred choice for traders within the TRON ecosystem.

On 13 August 2024, SunSwap launched SunPump, a fairlaunch memecoin generator platform that is inspired by the popular Pump.fun on Solana.

SunPump offers a user-friendly, efficient, and cost-effective way to launch meme coins on the TRON network. Here's how it works:

Token Creation: Issuers pay a nominal fee of 20 TRX (approximately $3) to create a token. The process is straightforward, requiring basic token details such as name, ticker, description, and logo.

Fair Launch System: All tokens must adhere to a fair launch protocol, prohibiting team allocations and presale rounds. This system aims to create a level playing field for all participants.

Security Measures: The platform offers options to prevent automated bot purchases, enhancing the security of the launch process.

Trading Mechanism: Users can easily browse, evaluate, and purchase meme coins through SunPump's interface. A 1% transaction fee applies to all trades.

Bonding Curve: Newly created tokens utilize a bonding curve mechanism, designed to potentially increase token value as more purchases occur.

Integration: SunPump is fully integrated with the TRON network and SunSwap, facilitating seamless buy and sell operations.

Within just over a week of its debut, the platform reached a remarkable milestone of over 7,500 daily token launches on August 21, 2024. This rapid ascent allowed SunPump to surpass its main competitor, the Solana-based Pump.fun, in terms of both daily token launches and revenue. It has achieved a revenue of over $30 million in about a month since launch.

Despite a slight cooling off in early September 2024, SunPump has maintained its position as a leading meme coin crypto platform, generating more than $20,000 a day. By September 16, 2024, it had facilitated the launch of more than 80,000 tokens, cementing its status in the burgeoning meme coin ecosystem.

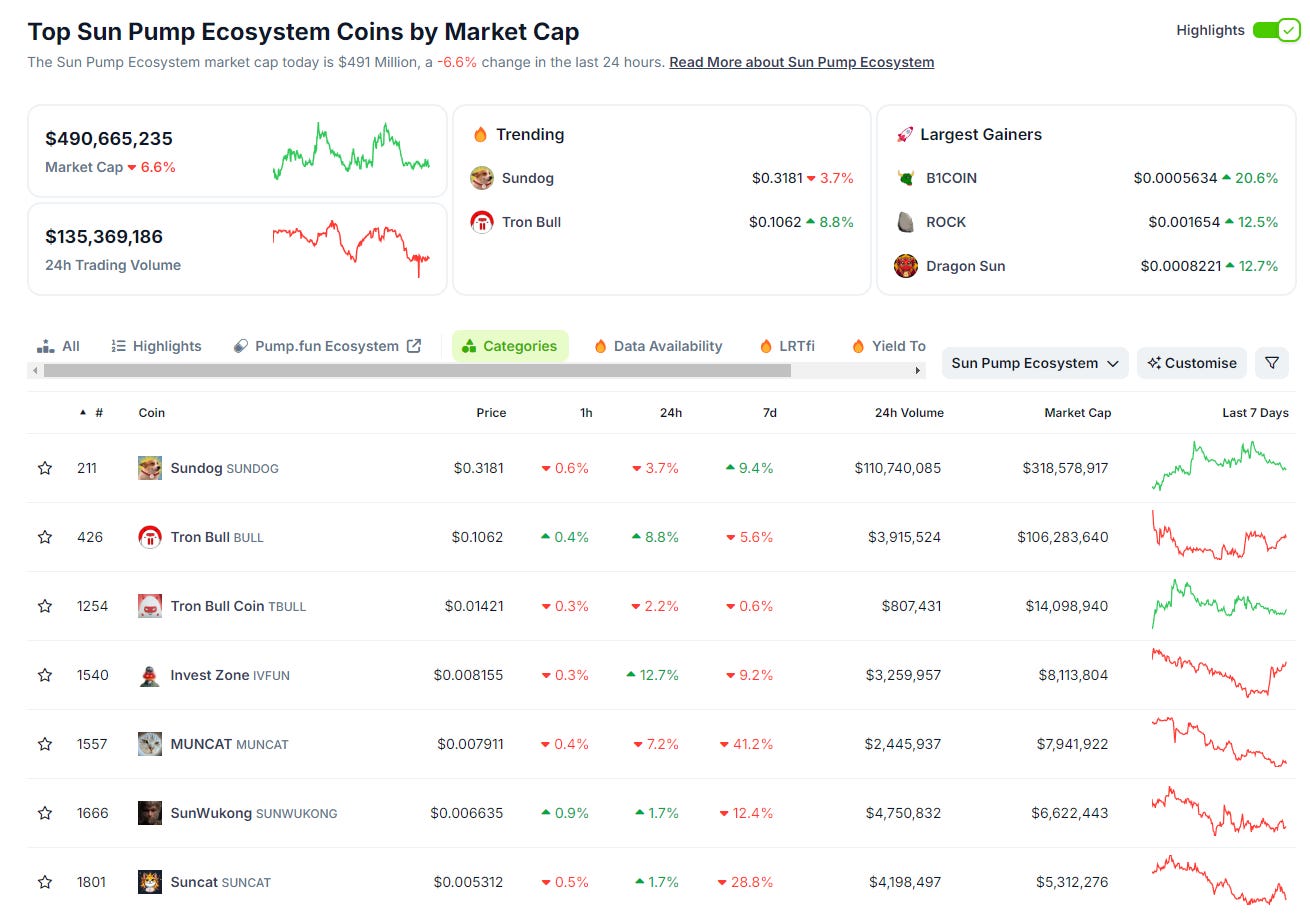

As of September 30, 2024, several SunPump meme coins have achieved significant market capitalizations:

Sundog (SUNDOG): The current market leader that has performed token buybacks

TRON Bull (BULL): The only other coin to surpass $100 million in market cap

Various other coins with market caps ranging from $5 million to $20 million

The prevalence of "Sun"-themed coins on the platform reflects the influence of TRON founder Justin Sun within the ecosystem.

The introduction of SunPump further boosted SunSwap’s activity and revenue. The platform’s dual-token mining and governance features have attracted more users and liquidity providers, enhancing its overall liquidity and trading efficiency. SunSwap remains a vital component of TRON’s DeFi infrastructure, continually evolving with new features and community-driven initiatives.

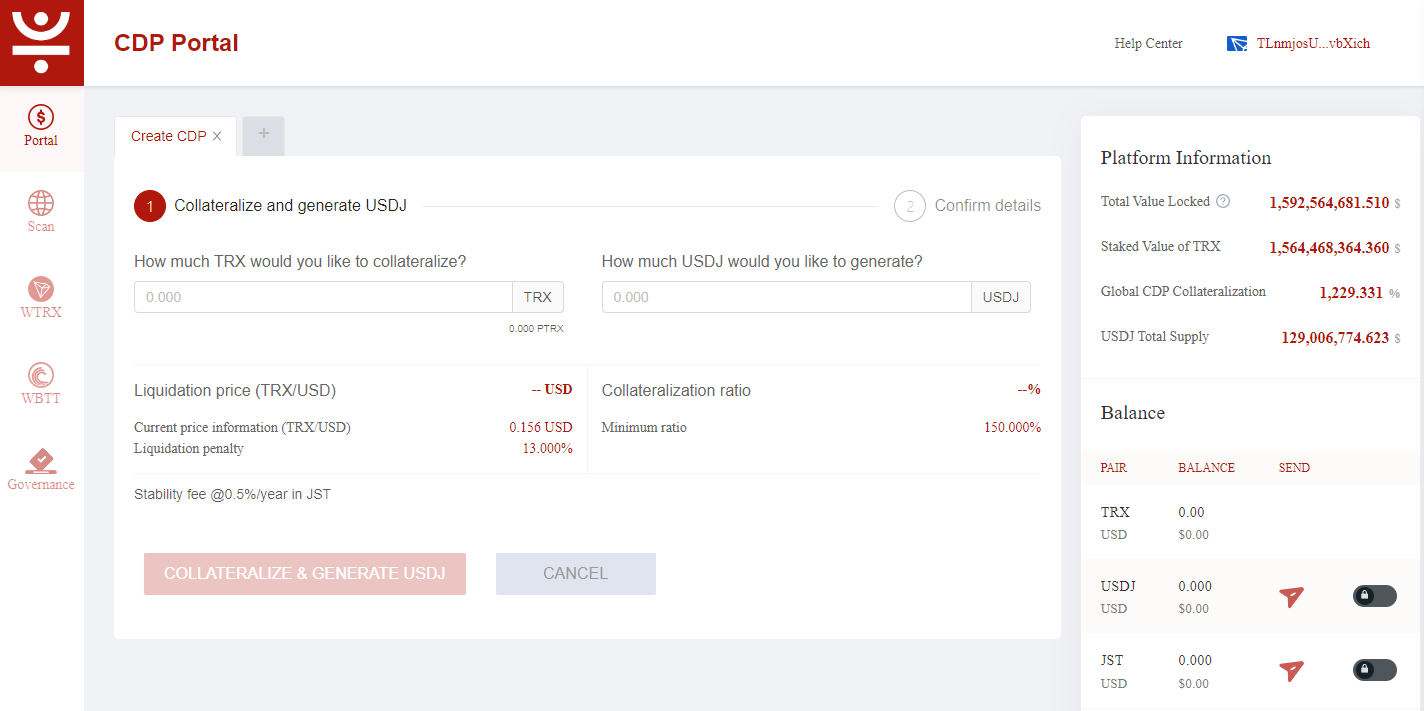

JustStable

Juststable is a CDP protocol and is crucial in TRON's DeFi landscape, with over $1 billion in collateralized debt positions (CDPs) and $129 million USDJ minted. It allows users to collateralize TRX to mint USDJ, the JUST stablecoin that is pegged to the dollar through algorithmic mechanisms.

However the price of USDJ often deviates from a dollar and overpegging instead, making it unreliable to be used as a stablecoin. When USDJ spikes up, it can cause liquidations to TRX or other collateral as the borrow value of USDJ goes up, resulting in health factors decreasing.

Staked USDT (stUSDT)

Staked USDT (stUSDT) is a Real World Asset (RWA) protocol on TRON, allowing users to stake USDT and gain exposure to yield from real-world assets like U.S. Treasury bonds, offering an annual yield of around 4.2%. It has over $250 million in Total Value Locked (TVL) with over 350,000 stakers. It operates through smart contracts and have both a rebase and yield-bearing version. However, it has also faced scrutiny over its governance structure, associations with Justin Sun, lack of credible attestations, smart contract audits, and clarity of reserves. Despite these challenges, stUSDT's success demonstrates TRON's ability to host sophisticated financial products, attracting both crypto enthusiasts and traditional finance participants.

Infrastructure on TRON

TRONLink: Most Popular Wallet

Officially endorsed by TRON, TRONLink is the most popular wallet on TRON. It boasts a user-friendly interface and is available as both a mobile app and a browser extension. It allows users to securely store, send, and receive TRX, along with various TRC-standard tokens. TRONLink also features built-in support for decentralized applications (dApps) and staking, enhancing its utility within the TRON ecosystem.

WINkLink: Main Oracle Network

WINkLink, launched in 2021, serves as the primary oracle network for TRON. It provides smart contracts with secure access to off-chain data to DeFi applications with features like decentratized price feeds and Verifiable Random Function (VRF) capability. While relatively basic compared to some oracles on other chains, WINkLink plays a crucial role in TRON's growing DeFi landscape by providing essential price feeds and other off-chain data to protocols like JustLend, SUN.io, and stUSDT.

BitTorrent File System (BTFS): Decentralized File System

BTFS is a crucial component of the TRON ecosystem, enhancing its capabilities in decentralized storage and file sharing. Following TRON's acquisition of BitTorrent in 2018, BTFS was integrated into TRON's blockchain infrastructure, leveraging TRON's high-throughput network and smart contract capabilities. This integration allows BTFS to offer scalable, cost-effective storage solutions that complement TRON's focus on decentralized applications (DApps) and digital content distribution.

BTFS utilizes the BitTorrent Token (BTT), which runs natively on the TRON blockchain, to incentivize users for sharing storage space and bandwidth. This tokenomics model aligns with TRON's broader vision of creating a decentralized internet infrastructure. By incorporating BTFS, TRON expanded its ecosystem beyond financial transactions and smart contracts, positioning itself as a more comprehensive blockchain platform capable of handling diverse decentralized services, including file storage, content delivery, and data management.

Key Partnerships

USDT

The partnership between Tron and Tether has been transformative for the Tron ecosystem. As of August 2024, the total market capitalization of USDT on Tron reached $58.5 billion, with more than 99% of stablecoins on the platform being USDT tokens. This dominance in the stablecoin space has made Tron a key player in global cryptocurrency transactions.

In fact in USDT settlement volume has grown rapidly, and in the most recent quarter USDT on TRON made around one-third of Visa’s annual settlement volume of around $1.25 trillion per quarter.

With such massive volume, security becomes increasingly important, which is why TRON has recently collaborated with USDT and TRM to launch the T3 (TRON, Tether, TRM) Financial Crime Unit initiative. This initiative aims to enhance security for users but also raises considerations about privacy and asset control. With approximately 254.8 million unique addresses and over 2.1 million daily active users on the Tron blockchain, the impact of this partnership on the broader cryptocurrency ecosystem is substantial.

LayerZero

On May 28, 2024, Tron DAO announced support for LayerZero, marking a significant milestone in blockchain interoperability. This integration makes Tron the second non-EVM chain to be incorporated into LayerZero's cross-chain protocol. The partnership enables Tron developers to seamlessly expand their applications across more than 70 networks supported by LayerZero.

This could enhance the versatility of TRON-based applications and open up new avenues for cross-chain interactions. However, despite the high potential, at the moment there are no actual deployments using LayerZero, so it remains to be seen how this partnership would impact TRON.

Poloniex Acquisition

Tron's acquisition of Poloniex, a well-established cryptocurrency exchange, has significantly bolstered its market presence and liquidity. This strategic move has provided Tron with a direct gateway to the crypto trading market, enhancing the visibility and accessibility of TRX and other Tron-based tokens.

The acquisition has enabled preferential listing of Tron ecosystem projects, facilitating easier access to capital and users for Tron-based initiatives. Moreover, it has strengthened Tron's position in the broader cryptocurrency market by providing valuable insights into trading patterns and user behavior, which can inform future development and strategic decisions.

Future Roadmap

TRON zkEVM

In April 2023, Justin Sun announced that TRON is exploring ways to integrate zkEVM to enhance TRON’s capabilities, potentially offering improved privacy, security, scalability, and interoperability with other blockchain platforms.

The exploration of zkEVM technology aligns with the growing momentum in Zero-knowledge proof development across the blockchain industry. Recent mainnet launches by projects like Matters Lab and Polygon zkEVM underscore the increasing importance of this technology in addressing scalability and privacy challenges faced by many blockchain networks.

However, TRON has not launch much developments about TRON’s zkEVM solution since this annoucement.

TRON Bitcoin L2 Solution

In February 20, 2024, TRON DAO has unveiled that it is developing a Bitcoin Layer 2 solution, aiming to enhance blockchain interoperability and expand stablecoin usage in the Bitcoin ecosystem.

The plan involves: (1) introducing TRON ecosystem tokens to the Bitcoin network using cross-chain technology, (2) forming partnerships with Bitcoin Layer 2 protocols such as its partnership with Merlin, and encouraging TRON users to participate in re-staking initiatives, and (3) launching a unified Layer 2 solution that combines TRON, BTTC, and Bitcoin networks.

This solution aims to incorporate the low fees of Proof of Stake systems with the security of Proof of Work and UTXO systems. Additionally, TRON plans to venture into Ordinals, develop a user-friendly wallet, and create tools for BRC-20 tokens, all to enhance blockchain usability, scalability, and interoperability.

However, similar to the zkEVM announcement, TRON has not launch much developments about TRON’s Bitcoin L2 solution since this annoucement.

TRX Tokenomics

Let's delve into the key aspects of TRX tokenomics:

Initial Total Supply: 100 billion TRX

40% (40 billion TRX): ICO investors

34% (34 billion TRX): TRON Foundation

10% (10 billion TRX): Private sale investors

16% (16 billion TRX): TRON open source project and ecosystem development

Staking and Governance:

TRX can be staked to vote for Super Representatives

Staking earns rewards, aligning incentives with network security

Token Utility:

Transaction fees

Content creation incentives

Data sharing rewards

Governance (staking and voting)

DeFi applications

In-app payments

Token Burning:

1% of TRX is burned in various scenarios (account creation, token issuance, etc.)

Circulating Supply: Approximately 86.66 billion TRX (as of writing)

Over 14.3 billion TRX (>10% of total supply) burned as of September 2024

Current deflation rate of 2.52% per year

Justin Sun currently holds over 2% of TRX tokens, or around 2.3 billion TRX tokens, making him the top verifiable individual holder of TRX.

TRX is not just one of the few deflationary L1s, it is also generating immense revenue as shared previously. In fact, in terms of fully diluted P/S ratio, TRON ranks first amongst L1 at 5.5x. For comparison, Ethereum is at 415x and Solana is at 715x and TON is at 878x, and the rest of the L1s is over 1,000x.

TRON’s Technology Explained

Consensus Mechanism: Delegated Proof-of-Stake (DPoS)

TRON utilizes a Delegated Proof-of-Stake (DPoS) consensus mechanism.

How TRON's DPoS works:

TRX token holders stake their tokens and vote for super representatives.

The top 27 candidates become super representatives, elected every six hours.

Super representatives validate blocks and receive rewards, which are shared with voters.

TRON’s DPoS shares similarities with Solana's Proof-of-Stake variant, while differing from Ethereum's pure Proof-of-Stake (PoS). Each approach offers unique characteristics:

Validator Selection:

TRON's DPoS: TRX holders vote for 27 "super representatives" to validate transactions.

Solana: Uses a variant called Proof-of-Stake with History (PoH), where validators are selected based on stake weight and a verifiable delay function.

Ethereum's PoS: Allows any participant with 32 ETH to become a validator, potentially leading to greater decentralization with over a hundred thousand validator.

Transaction Speed and Throughput:

TRON's DPoS: Achieves fast block creation and high throughput (reportedly up to 2,000 TPS).

Solana: Known for extremely high throughput (theoretically up to 65,000 TPS) due to its unique PoH mechanism.

Ethereum's PoS: Improved speed post-merge, but still slower than TRON and Solana (currently around 15-30 TPS on the base layer).

Centralization Concerns:

TRON's 27 super representatives set have raised some centralization concerns.

Solana’s validators require powerful hardware requirements which can be costly posing a financial barrier to entry and have also raised some centralization concerns.

Ethereum's larger validator set aims for greater decentralization.

Unique Resource Model

One unique feature of TRON is its resource management system that uses bandwidth and energy to govern how network resources are allocated and consumed. This model is crucial for maintaining network efficiency and preventing abuse.

The three primary resources in the TRON network are:

Voting Rights (TRON Power - TP)

Obtained by staking TRX

Used to vote for super representatives

1 TRX staked = 1 TP

Bandwidth

Required for all types of transactions

Each account gets 600 free bandwidth points daily

Additional bandwidth obtained by staking TRX

When insufficient, TRX is burned to pay for bandwidth (1000 sun per TRX)

Energy

Consumed by smart contract operations

Obtained only by staking TRX

When insufficient, TRX is burned to pay for energy (210 sun per unit)

Note: 1 TRX = 1,000,000 SUN

There are additional features that TRON has to maintain healthy network operations.

Staking Mechanism: Users can stake TRX to obtain both bandwidth and energy

Resource Recovery: Consumed bandwidth and energy recover gradually over 24 hours

Dynamic Energy Model: Adjusts energy consumption based on contract popularity to prevent resource concentration

Flexible Resource Allocation: Users can choose to allocate their staked TRX towards bandwidth or energy based on their needs

Although TRON's unique resource model offers innovative solutions for network management, it creates additional complexities in developer experience, which will be discussed in more detail in later sections of this analysis.

Three-Layer Architecture

TRON employs a three-layer architecture designed to optimize performance, scalability, and flexibility. However, it is similar to older blockchains such as Ethereum and it is not particularly groundbreaking when considering the more innovative blockchains nowadays.

The three-layers include the storage layer using LevelDB, the application layer running the TRON virtual machine, and the network layer managing consensus. These are standard components in the blockchain space.

Although this three-layer structure is similar to what Ethereum does, in fact there are key disadvantages for TRON when compared to Ethereum which we will explore next.

TRON Virtual Machine (TVM) vs EVM

While TRON's TVM is designed to be compatible with Ethereum's EVM, it is not 100% identical. There are several key differences between TVM and EVM which results in migration from EVM to require hefty adjustments. This could be one of the reason why TRON’s ecosystem is less vibrant than Ethereum.

Here are the main differences between TVM and EVM.

Network Performance Comparison

TRON's network design prioritizes high throughput and quick transaction finality in exchange for a higher degree of centralization. Here's a breakdown of its key performance metrics while comparing with Ethereum and Solana.

Challenges and Criticisms

Despite its early headstart compared to other blockchain networks and strong market performance, TRON has faced some criticisms.

Centralization Concerns:

TRON's centralization issues have been a significant point of contention within the cryptocurrency community. The network's Delegated Proof-of-Stake (DPoS) system, which relies on 27 Super Representatives to validate transactions, has been criticized for concentrating power in the hands of a few.

This centralization is exacerbated by allegations that Justin Sun, TRON's founder, exerts undue influence over many of these Super Representatives. More controversially, there have been accusations that Sun uses TRON’s lending protocols as a personal "piggy bank." These claims stem from instances where large amounts of TRX tokens were moved from TRON's reserves to addresses allegedly controlled by Sun or his associates.

Technological Stagnation:

TRON's technological framework is outdated in the rapidly evolving blockchain landscape. While TRON boasts high transaction speeds and low fees, it has struggled to keep pace with the technological advancements offered by newer blockchain platforms like Solana and Sui.

It has no plans to introduce newer blockchain techniques like parallelization that can significantly outperform TRON's transaction processing capabilities, or enshrined liquidity similar to what Berachain or Initia is looking to achieve.

TRON's reliance on a modified version of Ethereum's technology stack, while initially advantageous for compatibility, is now severely lagging behind and hampers its ability to implement cutting-edge features such as zero-knowledge proofs or more sophisticated sharding solutions.

The platform's slow pace of core protocol upgrades and lack of significant innovations in areas like interoperability and developer tooling further highlight its technological inertia. This stagnation poses a serious threat to TRON's long-term competitiveness and relevance in the blockchain ecosystem, particularly as developers and users increasingly gravitate towards more technologically advanced platforms that offer superior performance and functionality.

TVM Hampers DeFi Migration:

As described previously, the differences between TVM and EVM makes the migration of complex DeFi applications to TRON significantly more challenging.

The process requires substantial refactoring efforts due to TRON's unique address handling, resource models, and ecosystem tools, often necessitating a complete overhaul of smart contracts and supporting infrastructure.

This technical adaptation triggers a cascade of additional requirements, including comprehensive retesting and frequently, re-auditing of contracts - a process both time-consuming and financially burdensome.

TRON's ecosystem limitations further complicate matters, with the absence of battle-tested oracle solutions and other critical DeFi infrastructure posing major roadblocks for sophisticated applications. Even after overcoming these technical hurdles, DeFi protocols face the daunting task of building liquidity and a user base on TRON, which lacks the DeFi-centric community prevalent on platforms like Ethereum.

Thesis

During the recent market downturn from April, TRON’s USDT stablecoin activity continued to climb. With its low fees and high transaction speeds, it became a preferred choice for these stablecoin transfers. This increased activity is clearly visible in the steadily rising USDT volume on the TRON network throughout 2023 and into 2024. Consequently, this surge in stablecoin transactions generated a consistent stream of fees for the TRON network, providing a steady revenue source even as other cryptocurrencies struggled. This unique positioning allowed TRX to maintain its value and even grow, bucking the overall bearish trend in the crypto market.

However, the long-term sustainability of this growth may be challenged by technological limitations and centralization concerns. For TRON to maintain its competitive edge, it must address these challenges head-on. Innovating its core technology to keep pace with emerging blockchain solutions will be crucial. Equally important is addressing centralization concerns to build trust within the broader crypto community. Improving developer tools and EVM compatibility will be essential to attract a more diverse range of applications and users, further enriching the TRON ecosystem.

While TRON has shown impressive resilience and growth in the current market conditions, its future success will depend on its ability to evolve technologically, maintain its strong market position in stablecoins and DeFi, and address the critical concerns surrounding centralization and technological stagnation. As the blockchain landscape continues to evolve, TRON's adaptability and strategic decision-making will be crucial in determining its long-term position in the cryptocurrency ecosystem. The coming years will be pivotal for TRON as it navigates these challenges and opportunities in its quest to remain a leading force in the blockchain space.

In the end, TRON’s future rests on its ability to adapt. Can it maintain its stablecoin and DeFi stronghold while pushing technological boundaries? So far, TRON’s adaptability is questionable. Despite announcing ambitious technological roadmaps like Bitcoin L2 solutions and zkEVM integration when these concepts were trending, Tron has consistently failed to deliver on these promises. These announcements often seem to coincide with market hype, only to be quietly abandoned once public interest wanes. This pattern of chasing trends without meaningful follow-through raises serious concerns about TRON’s commitment to genuine innovation and its ability to evolve in a rapidly changing blockchain landscape.

As the crypto ecosystem continues to advance, TRON’s resilience will be put to the test. Its success will depend not just on maintaining its current strengths, but on actually delivering the cutting-edge technologies it promises. The crypto community watches with a mix of curiosity and skepticism, wondering: can TRON break its cycle of unfulfilled promises and truly innovate, or will it continue to rely on its existing advantages in a tech landscape that waits for no one?

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about