The Definitive Guide to Consumer Crypto

A deep dive Analysis of the Most Prominent Projects and Their Impact on the Market.

This post was brought to you by the Aptos Foundation, an organization dedicated to supporting the growth and development of the Aptos protocol and developer ecosystem. Join the Aptos ecosystem next month at The Aptos Experience - and take an immersive journey into the heart and soul of Web3.

Just for Blockcrunch listeners: Use code [BLOCKCRUNCH] at checkout for 50% off your ticket. Limited supplies: get your ticket today.

Introduction

Over the last decade, crypto has primarily focused on infrastructure and tooling. However, with much of this infrastructure now in a "ready to use" condition, there's a significant opportunity for consumer apps to gain traction and run experimentations with.

Despite this potential, consumer apps in the crypto space have struggled to achieve the scale they anticipated. A few, such as Notcoin, KaiKai launched this year, have managed to reach more than 1mn+ users already.

Notion has been particularly successful, being able to reach a massive global audience and having a community-led ecosystem built with the underlying game mechanics being super simple. Meanwhile, other categories, like social, prediction markets and betting, are now seeing a rise of apps going off the roof (polymarket) and new apps being developed as well.

The main metric for any consumer app is retention, which hinges on delivering an enhanced user experience that is not only engaging and interesting but also rewarding and entertaining.

However, retention and user loyalty remain significant challenges. Many new users are drawn to speculative event-based applications, with recent consumer interest driven partly by external factors, such as elections being one of the hot topics of discussions.

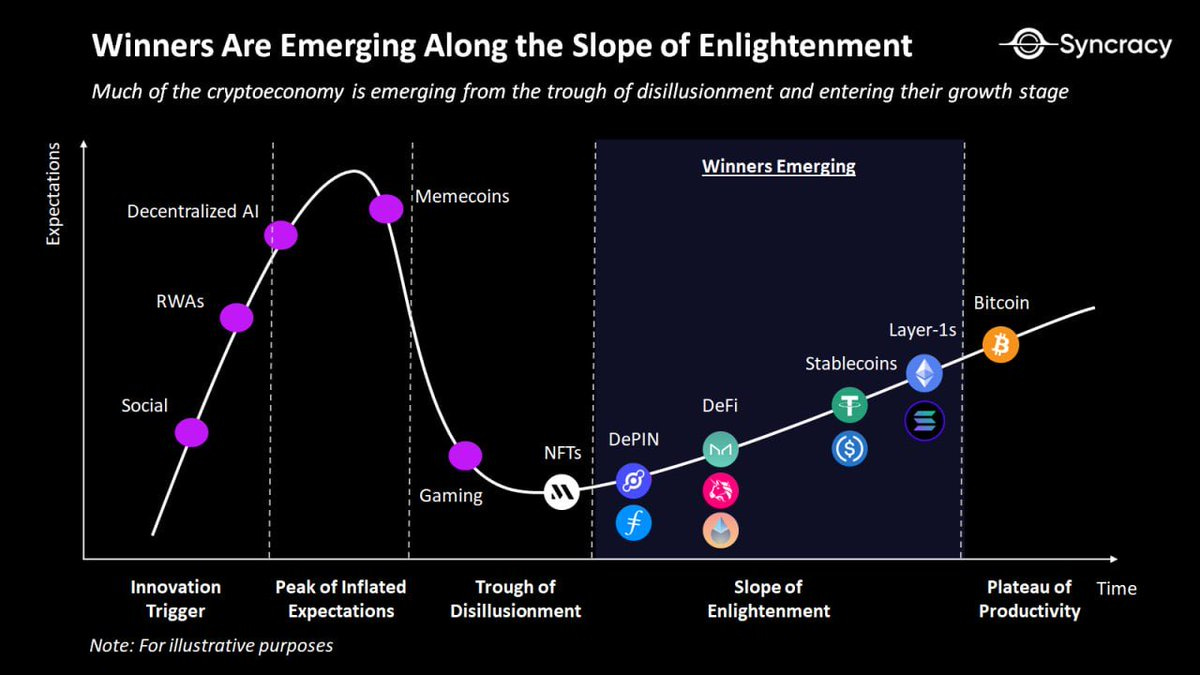

It's interesting to see that there have been various use cases have already been emerged in the crypto, including social apps, RWA, web3 gaming, and DeFi.

However, the standout use case for blockchain technology hasn't been fully nailed down yet. The areas where it’s likely to make the biggest impact include applications that:

bring together a global audience

facilitate seamless cross-border payments

enable product-led rewards distribution

ensure transparency

It will be interesting to see how these areas evolve as the crypto ecosystem continues to develop.

Challenges in building social apps

It's a well-known fact that building successful social applications is challenging, even outside the web3 ecosystem. Acquiring the first thousand users is difficult, and scaling to the next ten thousand is even more complicated. Once a user base is established, the focus shifts to identifying the best features, creating effective notification strategies, and ultimately driving retention and loyalty.

Even after these elements are figured out, making the business sustainable requires developing a strong business model. Interestingly, out of every 1000 applications, only about 4-5 are actually able to achieve lasting success in the market. This highlights just how tough and competitive the landscape is.

Some of the existing challenges in web3 first consumer apps are:

→ User experience and onboarding challenges

In web3, the challenges are compounded by constraints such as

inadequate onboarding processes

broken user experiences

a lack of personalization

These factors make it difficult for users to become daily active users of a product, presenting a significant hurdle for Web3 applications.

→ Token dynamics and it’s impact

Another major challenge for web3 products is managing the token along with the app. Balancing the token to prevent it from being sustainable while still driving project relevance and supporting operations is difficult. A well-managed product-led token can help fund the project and demonstrate long-term user interest rather than just attracting users seeking short-term gains like airdrops.

→ The Issue of incentive-driven engagement

Unfortunately, many current crypto applications fall into the category where a small set of users continuously try out different applications, not out of genuine interest but because of high incentives associated with them. A recent study by 6thman ventures supports this, showing that many "lurkers"—users who don't fit the core audience—are often rewarded, which can gather traction and eyeballs but doesn't lead to genuine engagement.

This remains a persistent challenge in the market, where products must navigate between attracting a wide audience and ensuring that core engagement is meaningful and long-lasting.

Infra vs Apps

Generally speaking, there’s a well-established cycle between building infrastructure and developing applications. This cycle was illustrated effectively by Union Square Ventures showing how, after each wave of infrastructure development, the focus naturally shifts to building apps. Once the potential of these applications has been explored and exhausted, the cycle returns to addressing new infrastructure challenges, before eventually moving back to applications again.

Currently, we find ourselves at a similar inflection point in this web3 cycle. The infrastructure that has been built over recent years is now decently ready - though not entirely complete - to start testing how it performs at scale. This phase is crucial because it allows us to experiment with the existing infrastructure, determining whether it truly works and meets the needs of the current audience. One of the best ways to conduct this testing is through building consumer apps and actually interacting with the users, which can serve as a proving ground for the broader crypto ecosystem.

What makes this moment particularly exciting is the potential for breakthrough applications. My prediction is that we might be on the verge of seeing a purely crypto-based product that can attract and retain over 10 million users. Achieving this milestone would be a significant success for the consumer crypto ecosystem and could mark a turning point in how crypto is perceived and utilized by the broader public.

However, the success metric shouldn’t just be about user acquisition; but about retention and engagement. For an app to truly make an impact, it must not only draw users in but also keep them coming back as daily/ weekly active users who are genuinely interested in the product. A high number of DAUs will be a key indicator of an app’s success.

Looking ahead, certain categories seem particularly ripe for this kind of growth. Social applications, socialfi , gamefi, and rewards-based apps are all promising areas where we might see these breakthrough products emerge. These sectors are likely to play a significant role as the current cycle continues to unfold and could lead to the next big leap in mass crypto adoption.

What’s hot in the space?

The space is ripe with many experiments being run by builders who are trying to create entertaining and interesting products.

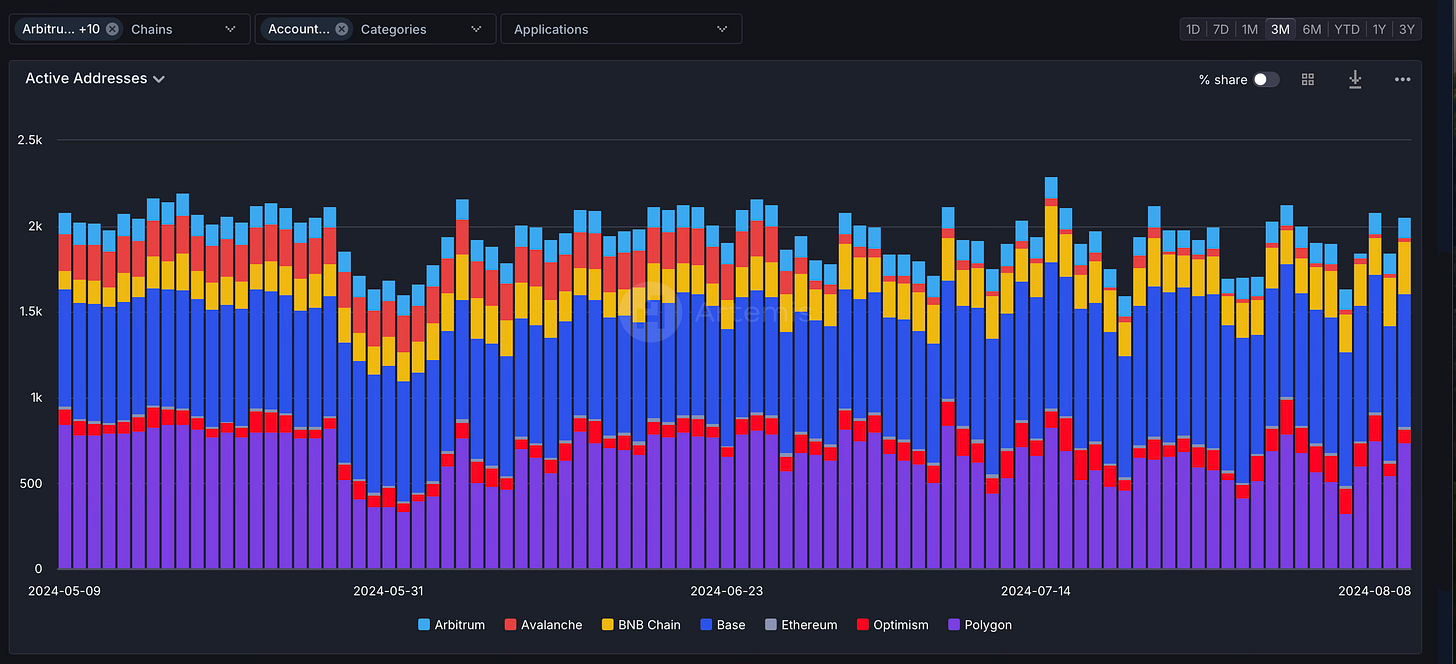

It’s interesting to compare different blockchain ecosystems, especially when looking at the number of active addresses on various chains like Near, Solana, BNB, Polygon, Ethereum, and Base. These chains are showing a lot of activity, and it's intriguing to see how they stack up against each other in terms of user engagement.

But it's not just about counting active addresses; it's also about understanding how transactions are happening across these chains and what kinds of use cases are emerging. Some key areas to watch include:

Memecoin trading

Social products

Gaming

P2P payments

Bridging

NFTs

In this report, we’ll take a closer look at some of the projects that have been getting a lot of attention recently. The focus will be on projects that are “investible,” meaning they have a live token, product, or asset that you can acquire and start using right away. I’m particularly interested in projects that stand out for their unique approaches or innovative methods.

So, let’s dive into some of the interesting categories, trends, and products currently in the ecosystem.

Prediction markets

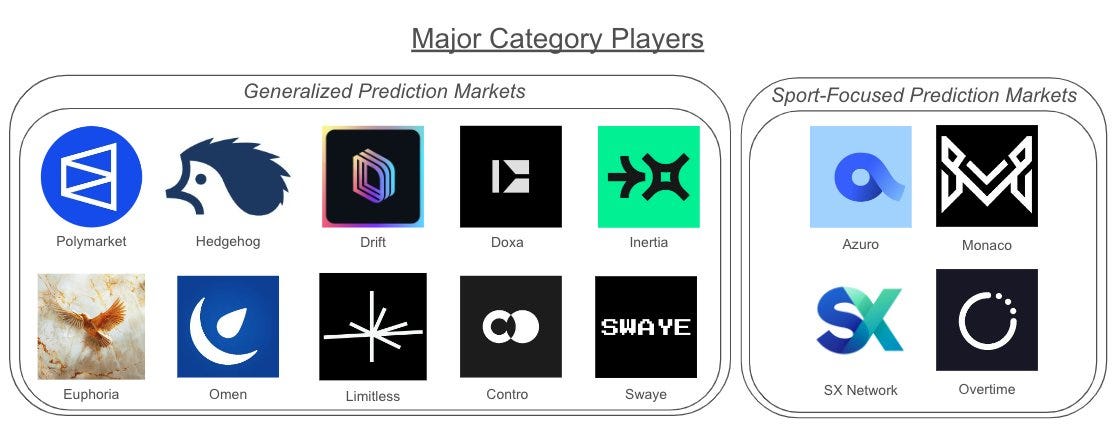

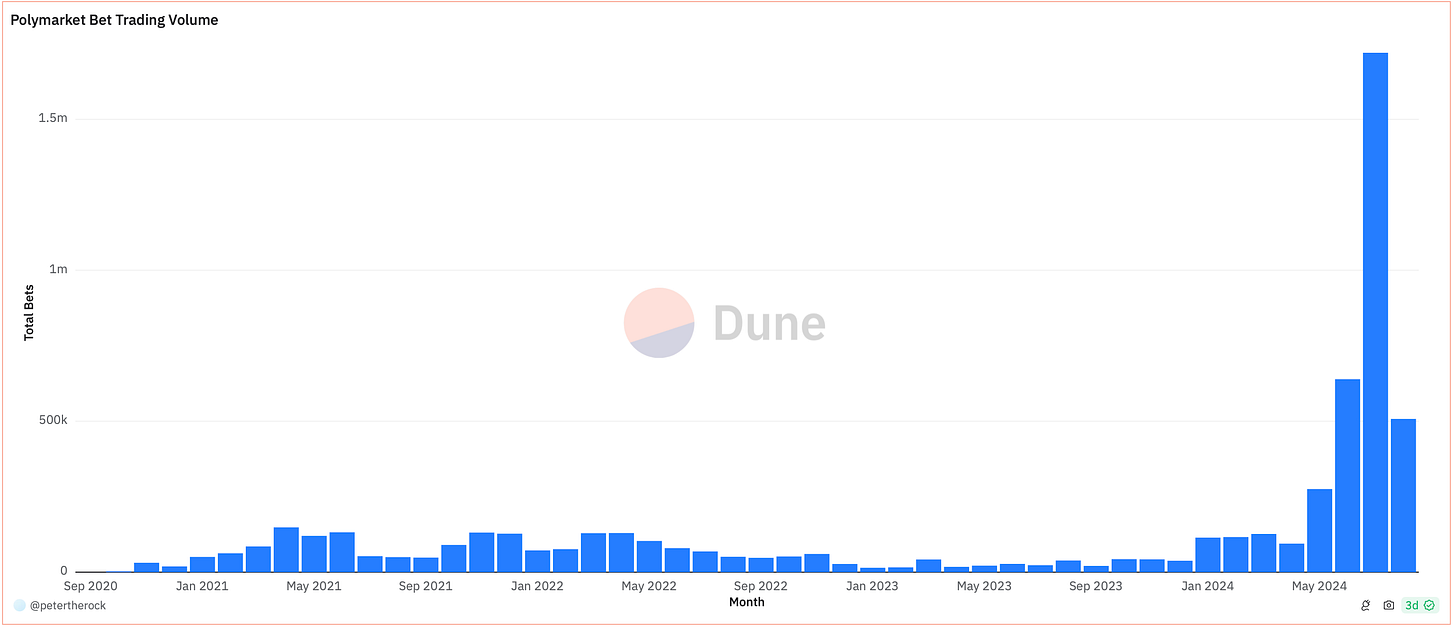

Prediction markets have shown some fascinating use cases, particularly in political forecasting currently. Platforms like Polymarket have demonstrated how community-based interactions really help with finding out patterns and providing early insights against speculation. For instance, Polymarket accurately predicted that Biden might drop out of the 2024 election race well before mainstream media outlets began discussing it. This example underscores the potential of these markets to provide valuable foresight.

However, the success of prediction markets often hinges on specific events, like elections, which are inherently seasonal. The real challenge lies in sustaining activity during periods when such events aren't taking place.

Polymarket has emerged as a leader in this space, some key highlights are:

recently integrating with Perplexity

registering highest volume in 100+ years of prediction market history

making headlines by being one of the first to predict Biden’s potential exit from the 2024 race

This success has spurred the emergence of several competitors, especially on Solana, as others aim to capture a share of this growing market.

The diversity of active prediction markets on Polymarket is impressive, covering everything from political events to cryptocurrency ETFs and public figures. Notably, the market predicting Biden’s potential withdrawal from the presidential race has seen the highest engagement, with over $20 million in bet volume and more than 14,000 bets placed. This variety highlights the wide-ranging appeal of these platforms and their potential to become a more integral part of the speculative landscape.

While political forecasting has been a strong focus so far, the potential for these platforms to expand into other areas is significant, especially with the development of verticalized prediction markets for specific use cases. There’s a lot of untapped potential in areas like sports, entertainment, and other speculative environments. Imagine using these markets to predict outcomes in horse racing, Formula 1, football, and more—these could become new and exciting segments for prediction markets.

Hyper-financialized Apps

Hyper-financialized social apps like Pump.fun, Friend.tech, and Fantasy Top often feel like amusement park rides—thrilling at first, but quickly losing their appeal after a few uses. They’re similar to TikTok’s short-form content, offering a quick burst of entertainment without much staying power.

The real challenge for these apps lies in user retention. To keep users engaged, these platforms need a constant stream of fresh, diverse content that keeps people coming back for more. Without this, users might lose interest just as quickly as they were drawn in.

However, if we view these apps as early-stage experiments in a new content genre, there’s significant potential for future innovation. These platforms could evolve into something more sustainable and engaging, offering experiences that are not only exciting at the start but also retain their appeal over time. The key will be finding the right balance between financial incentives and genuine user engagement, potentially leading to the creation of a new class of social apps that combine the best of both worlds.

Pump.fun

Launched earlier this year, Pump.fun has quickly emerged as one of the most revolutionary consumer products in the market. This rapid success can be attributed to two key factors. First, the platform has expertly tapped into the booming meme coin category, which has dominated consumer interest over the past 6 to 12 months. By positioning itself at the intersection of meme coins and speculation, Pump.fun has become a hotspot for users eager to capitalize on the latest trends.

One of the platform's most exciting features is its role as a launchpad for new, buzzworthy tokens. There’s always hype around which tokens to jump into and which ones might hold their value over time, driving significant user engagement. This speculative element makes Pump.fun a go-to platform for those looking to stay ahead in the ever-evolving crypto space.

Additionally, Pump.fun has made it easier than ever to launch a token, lowering the barrier to entry and attracting a diverse range of users. This accessibility has been a major contributor to the platform’s rapid growth. Financially, Pump.fun has been nothing short of impressive, generating over $85 million in revenue—an achievement that sets it apart as a major player in the market.

What’s even more impressive is that Pump.fun has, at times, surpassed major platforms like Solana, Ethereum, and Tron in 24-hour daily revenue volume. This milestone underscores the platform’s significant impact and highlights the positive trajectory it is on.

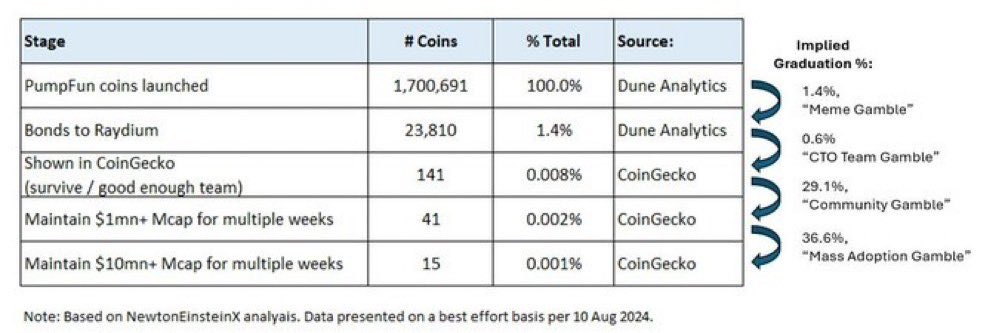

While Pump.fun has seen significant success, it's important to acknowledge that not everything is as promising as it seems. Since its launch, nearly 1.7 million tokens have been created on the platform. However, the success rate of these tokens is extremely low, with only about 0.5% to 1% achieving any notable success.

For example, out of the nearly 1.7 million tokens launched on Pump.fun, only 15 have managed to maintain a market cap of over $10 million—a strikingly small number. Similarly, just 41 tokens have crossed the $1 million market cap threshold. These figures highlight a critical issue: while it’s relatively easy to launch tokens on Pump.fun, the real challenge lies in sustaining their relevance and value in such a competitive market.

The main issue is that most tokens fail to build lasting utility or a strong community. While meme coins often thrive on cult-like followings, the majority of tokens launched on Pump.fun haven’t been able to establish a culture or vibe that can sustain them over time. This lack of retention is a significant concern, as it suggests that many tokens may only enjoy brief success before fading into obscurity.

This short-term focus is one of the biggest challenges for Pump.fun, as it tries to balance the thrill of new launches with the need for lasting value and utility.

Fantasy Top

Fantasy Top is a social crypto app that combines daily fantasy sports with the influence of popular Twitter accounts. Players purchase NFT "cards" of Twitter personalities, known as "heroes," and enter competitive tournaments where they score points based on the engagement and interactions these accounts generate on Twitter. The more attention a "hero" receives, the more valuable their card becomes, with players competing for prizes.

When Fantasy Top launched, it quickly gained attention, recording one of the highest trading volumes, with nearly 22,000 ETH traded in the first three months. The innovative use of Twitter influencers and the appeal of daily fantasy tournaments attracted a significant number of users.

However, maintaining that initial momentum has been a challenge. In the following five months, trading volume dropped significantly, with only about 3,000 ETH traded in total. This decline highlights a key issue for Fantasy Top: keeping users engaged over the long term. While the initial excitement around speculation and competition brought users in, their interest faded as the novelty wore off.

The game’s reliance on continuous Twitter engagement to drive value may have contributed to this drop-off, as users moved on once the initial buzz subsided. Like many other apps, Fantasy Top has struggled to keep players interested and engaged over time

Despite these challenges, the Fantasy Top team has been actively working on new initiatives to improve user retention. One of their most successful efforts has been the voting system, which has been well-received and frequently used by the community. This feature, along with a solid overall product experience, has helped maintain impressive D1 retention rates, averaging between 35% and 40% over the past 5 to 6 months. However, the real challenge emerges by D30, where retention rates drop off significantly. This drop-off is a key reason why apps like Fantasy Top struggle to achieve long-term sustainability, as keeping users engaged beyond the initial excitement remains a difficult hurdle to overcome.

Maintaining long-term user engagement is a significant challenge for Fantasy Top, especially in the fast-paced world of Web3, where users expect constant innovation and fresh content. This high standard can be tough for any app to consistently meet.

Fantasy Top has been trying to find its “equilibrium” in the ecosystem, particularly through its tournament offerings. However, the platform has faced some hurdles.

Some key stats of the current tournaments and the progress of the game (h/t 0xBreadGuy):

Since May, Fantasy Top has seen a steady decline in the number of holders, losing about 30 holders per day on average. Although this decline is beginning to level off, the platform has yet to experience a day of positive growth in holder numbers.

Despite the drop in holders, tournament participation has remained relatively stable, with around 18,000 decks submitted each week. However, participation in higher leagues like Gold and Elite has fluctuated, with some weeks seeing fewer entries even as more cards are upgraded.

On the supply side, the circulating supply of cards reached a low of 168,000 cards 30 days ago but has since risen by 5,500 cards, marking a 3% increase. This uptick is largely due to the net growth in card supply outpacing the burn rate during weekly tournaments.

In terms of market activity, card trading volumes are averaging about 40 ETH per day outside major tournaments. The number of card listings tends to peak at around 5,000 outside of tournament periods, dropping to about 2,400 during tournaments.

The team’s treasury currently holds approximately 3,600 ETH, which is sufficient to sustain weekly games for about 1.5 years at the current reward pace. To ensure long-term sustainability, the team is focusing on converting tactics users into full-ecosystem participants and carefully managing card dilution, especially at the higher levels.

Friend tech ($friend)

Friend.tech emerged as one of the most notable breakout applications in the crypto social ecosystem, backed by Paradigm and supported by some of the most influential figures on crypto Twitter. The platform quickly generated a lot of hype when it first launched, with prominent influencers creating their own channels, trading keys, and inviting users into exclusive groups. This activity created a sense of community and excitement, driving keys to trade for as much as 10 ETH or more.

However, the platform’s early success was heavily fueled by an incentive-based loop, where the promise of future airdrops and rewards attracted users. This led to a spike in engagement, but much of it was driven by anticipation of these incentives rather than genuine interest in the platform. As the initial excitement waned, the team struggled to maintain long-term engagement and failed to reinvent the platform in a way that could keep users interested over time.

Another major challenge was the delay and lack of clear communication around the token launch. The absence of a defined roadmap and ongoing updates created uncertainty and frustration among users, further eroding trust in the platform. Despite these challenges, Friend.tech offered a relatively seamless experience for web3-native users, especially as a mobile-first platform. The ease of installing the app, setting up wallets, and participating in the ecosystem was a key factor in its early adoption and success.

However, the delayed token launch, lack of new product updates / innovation including many other reasons led to a sharp decline in the platform’s . What was once a highly anticipated token, boasting a FDV of over $350 million, has now plummeted to just $10 million. This dramatic drop not only underscores their struggle to sustain its initial momentum but also highlights the difficulty in maintaining user interest over the long term.

Farcaster Ecosystem Tokens

Farcaster has established itself as a builder-first ecosystem, focusing on fostering a community where creators and developers thrive. This collaborative environment encourages people to come together, interact, and support each other in building new products, features, and services that enhance the platform. This approach has been particularly effective in keeping users engaged, entertained, and motivated to return regularly.

One of the standout features within the Farcaster ecosystem is Frames. Since its launch, Frames quickly became one of the most engaging and entertaining aspects of the platform. Integrated natively within the Farcaster mobile app, Warpcast, Frames is easily accessible and seamlessly fits into the user experience. Its success has set a high standard for other applications in the ecosystem, with new developments like Wildcard also adding further value and diversity to the Farcaster community.

Farcaster has built a user base of around 50,000 daily active users (DAUs), which can be divided into three main groups:

Builders: These are the active creators and developers who drive innovation on the protocol, continuously building new features and products.

Lurkers or “Degens”: Engaging more passively, this group is always on the lookout for the next “shiny” token or trend within the ecosystem, often driving speculative interest.

Marketers or BDs: Focused on creating and managing engagement for their projects, these users leverage “channels” to connect with the broader community and promote their initiatives.

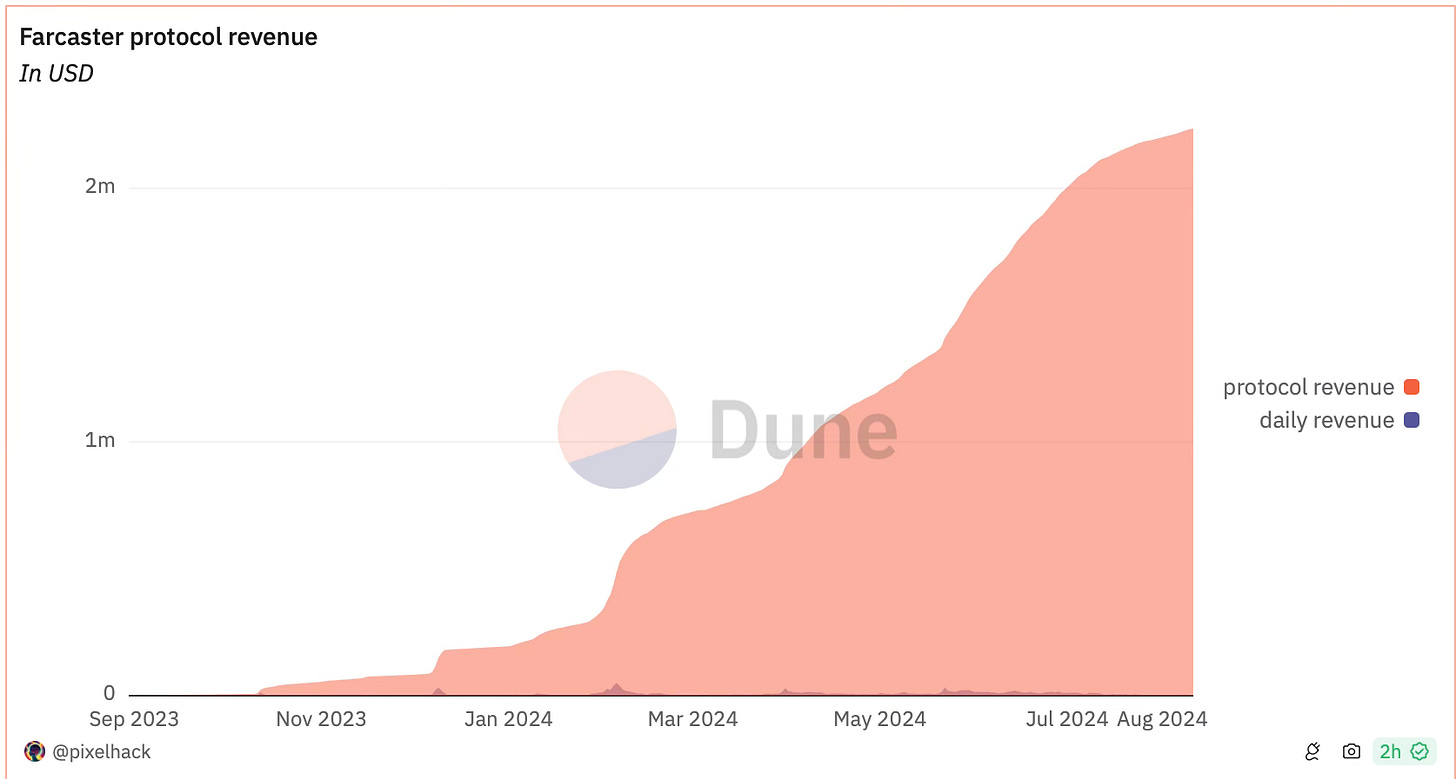

Since its inception, the Farcaster protocol has generated approximately $2 million in revenue. This revenue reflects the platform's ability to monetize its growing user base, driven by the diverse activities of these user groups.

A significant portion of Farcaster’s “adoption“ success can also be attributed to the rise of specific tokens within the ecosystem, particularly $degen and $higher. These tokens have not only driven user engagement but have also played a crucial role in expanding the Farcaster user base.

Let’s take a closer look at them to understand how they have contributed to the ecosystem and how they have evolved over time.

Degen L3 ($degen)

$degen is an intriguing case within the Farcaster ecosystem, as it started not as a serious project, but as a simple meme coin. Over time, it has evolved into an L3 chain, expanding beyond the Farcaster ecosystem. Initially, $degen gained traction as a way for users to tip others, rewarding valuable content or insights shared within the community. These tips, awarded in $degen, allowed users to support one another, which helped the token gain popularity.

At its peak, $degen was distributed over 200,000 times in a single day, and currently, almost 4 million $degen tokens have been tipped out.

A major airdrop also took place, targeting OG users of Farcaster who were early adopters and actively contributed to the community. This airdrop rewarded these users for their support, further solidifying $degen’s role in the ecosystem.

The token’s significance was further boosted when One Confirmation, a prominent venture capital firm, invested $1 million to support $degen. This investment sparked a rally, transitioning $degen from a simple meme coin to a utility token within the Farcaster ecosystem, with tipping increasingly done in $degen.

Since then, $degen has expanded into a full-fledged L3 chain, supporting various features and functionalities typical of a blockchain, including bridging, an explorer, and a name service for $degen. It has essentially become an end-to-end ecosystem on its own, with several applications being built on top of it. What’s particularly interesting is how $degen, initially rooted in meme coin culture, has evolved into a valuable asset within the Farcaster ecosystem. This has driven increased participation in challenges and communities, with $degen being leveraged to bootstrap channels and enhance community engagement on Farcaster.

Higher ($higher)

$higher followed a trajectory similar to $degen, quickly gaining popularity with its simple yet powerful concept that users should always aim higher in life. The token resonated strongly within the Farcaster ecosystem, maintaining a robust presence in the market for a significant period. At its peak, $higher saw daily trading volumes exceed $20 million, showcasing the substantial demand for Farcaster-native tokens.

However, like many hype-driven projects, $higher eventually experienced a decline as the initial excitement began to fade. Despite this, $higher's early success highlights how early movers can shape a strong narrative and build a dedicated following, helping a token gain significant traction, even in a developing ecosystem.

Gaming

Gaming has emerged as one of the most significant categories where tokens have found substantial value, far beyond the meme coin culture. In gaming, tokens serve a variety of important functions, such as purchasing NFTs, buying in-game items, unlocking skins or characters, and enabling extra moves or abilities based on the game's offerings. This range of utility makes gaming one of the key areas where tokens have demonstrated their true potential.

In this section, we'll delve into some of the most intriguing gaming applications that have successfully integrated tokens. We'll explore what makes these examples stand out, and consider how their success might guide future developments at the intersection of gaming and crypto.

Pirate Nations by Proof of Play ($pirate)

The first token in the gaming ecosystem worth discussing is $Pirate, which plays a central role in Pirate Nations, a game developed by Proof of Play. Pirate Nations has quickly become one of the most widely adopted on-chain games, boasting an impressive 40,000 to 50,000 daily active users (DAUs). Even amid broader market challenges, the floor price of the game's NFTs has remained strong at around 1.18 ETH, a clear indicator of the game’s solid market performance and strong community support.

What sets Pirate Nations apart is its community-driven development approach. The team actively engages with users, prioritizing features and services that resonate with their player base. By incorporating feedback and insights directly from the community, they have maintained a highly engaged and loyal user base that keeps returning to the ecosystem.

The team behind Pirate Nations is also noteworthy. It is led by the former founder of FarmVille, a well-known and successful social game. The team’s credibility was further reinforced when they secured $33 million in a seed funding round led by a16zcrypto.

The game’s economic model is also noteworthy, with approximately 30% of the total token supply currently circulating—higher than many other gaming tokens launched around the same time, which tend to have less liquidity.

One of the key takeaways from Pirate Nations is the effective balance the team has struck between the token economy and product-led growth. They have ensured that $Pirate token holders are genuinely invested in the game’s development and long-term potential, rather than merely speculating. This careful management has helped preserve the integrity and value of $Pirate within the ecosystem, contributing to the game’s continued success.

Currently, Pirate Nations is available only on desktop, but the team is actively working on expanding to mobile platforms. This move is expected to introduce the game to a broader audience, potentially driving significant user engagement and growth.

One of the most impressive aspects of Pirate Nations is its Day 7 retention rate, which stands at over 65%—an exceptional figure, especially when compared to other hyper-casual games. However, it’s worth noting that the current user base is still relatively small. As the game scales to new geographies, user types, and devices, maintaining this high retention rate could become more challenging. How the team navigates this will be crucial to sustaining growth.

Despite its successes, Pirate Nations faces notable challenges. The total addressable market for on-chain games remains extremely small, with limited adoption even within the Web3 ecosystem. This presents a significant hurdle that Pirate Nations will need to overcome to achieve broader success.

However, given its strong foundation, Pirate Nations has the potential to lead and expand this emerging category. The key will be in how the team drives adoption and sustains engagement in what is currently a niche market. It will be fascinating to see how Pirate Nations tackles these challenges and whether it can solidify its position as a leader in the on-chain gaming space.

Echelon & the Parallel Ecosystem

Next up is $Prime, a key token developed by the Echelon Prime Foundation, has become a significant player in the Web3 gaming ecosystem, particularly within the Parallel economy. As one of the biggest breakout successes of 2023 and 2024, $Prime's rise can be attributed to the team’s focus on product-led growth, integrating the token natively within the game’s economy for purchasing NFTs, trading cards, and other in-game items.

What’s particularly noteworthy is how the team has successfully attracted key opinion leaders and investors, further boosting $Prime's traction. Since its inception, $Prime has facilitated over $10 million in NFT sales, underscoring its strong market presence. The token performed exceptionally well over the past few months, positioning itself as a potential market leader in the Web3 gaming space.

However, the introduction of AI Wayfinder and its associated token, $Prompt, has complicated the landscape. The challenge of balancing a two-token economy has raised questions about which token—$Prime or $Prompt—will hold more value in the future. This shift has been particularly challenging, as $Prime was previously the cornerstone of the gaming economy. The introduction of $Prompt has sparked speculation and led to a significant decline in $Prime’s market value, with a drop of around 60-65% in the last four months.

One of the key challenges now is ensuring that $Prime remains relevant and valuable as the ecosystem evolves. The speculation surrounding $Prompt has made the situation more complex, especially as the team works on projects serving different markets. The market’s mixed reaction to the tiered staking system for $Prime, with concerns about the locking mechanism, has further contributed to the token’s decline.

Despite these challenges, the Echelon team is well-connected and appears to have a solid strategy moving forward. They are expanding into the Southeast Asian market, aiming to capture a broader audience. Recently, they launched a staking program where $Prime holders can stake their tokens and earn rewards in $Prompt, set to launch within the next 6 to 12 months. This staking program includes multipliers based on the staking duration, ranging from 0 to 3 years. Impressively, about 40% of the $Prime token supply has already been staked, with a significant portion locked in for the maximum duration of three years. This has effectively created a supply shock, reducing the circulating supply of $Prime and potentially boosting its value.

However, there are significant concerns about how the $Prompt launch will be managed. It’s crucial that the team avoids a scenario where 100% of the $Prompt supply is unlocked at once, as this could trigger a massive sell-off and destabilize the market. This is a critical point that the team must handle with caution.

On the positive side, strong support from big players like OSS Capital, which has staked around $30 million worth of $Prime for the maximum duration of 1,095 days, underscores confidence in the long-term potential of $Prime and the broader ecosystem. This bullish stance reflects a strong belief in the project's future, particularly as the team works to integrate AI into the gaming economy.

Overall, $Prime has made a significant impact in the Web3 gaming space, but the introduction of $Prompt adds a new layer of complexity that the team will need to navigate carefully. The future success of $Prime will hinge on how effectively the team can manage these challenges while continuing to innovate and expand the ecosystem.

It's very interesting to look at the collections or NFTs held by those who own Parallel Avatars, the native NFTs of the Parallel ecosystem. Many of these holders boast portfolios filled with blue-chip NFTs, including Bored Apes, Azukis, Art Blocks, and Pudgy Penguins. But what’s even more intriguing is that these holders aren’t just focused on a single asset within the Parallel ecosystem. Collectively, they have invested nearly $60 million into various other assets within the ecosystem, with Parallel Alpha being the most significant holding.

This level of investment demonstrates that the Parallel ecosystem has successfully created an experience where holders are not only incentivized but are also genuinely excited to be part of the economy. Their eagerness to invest heavily across multiple assets within the ecosystem showcases a deep commitment and interest. This kind of engagement from the community is a strong indicator of the ecosystem’s strength and the value it provides to its users.

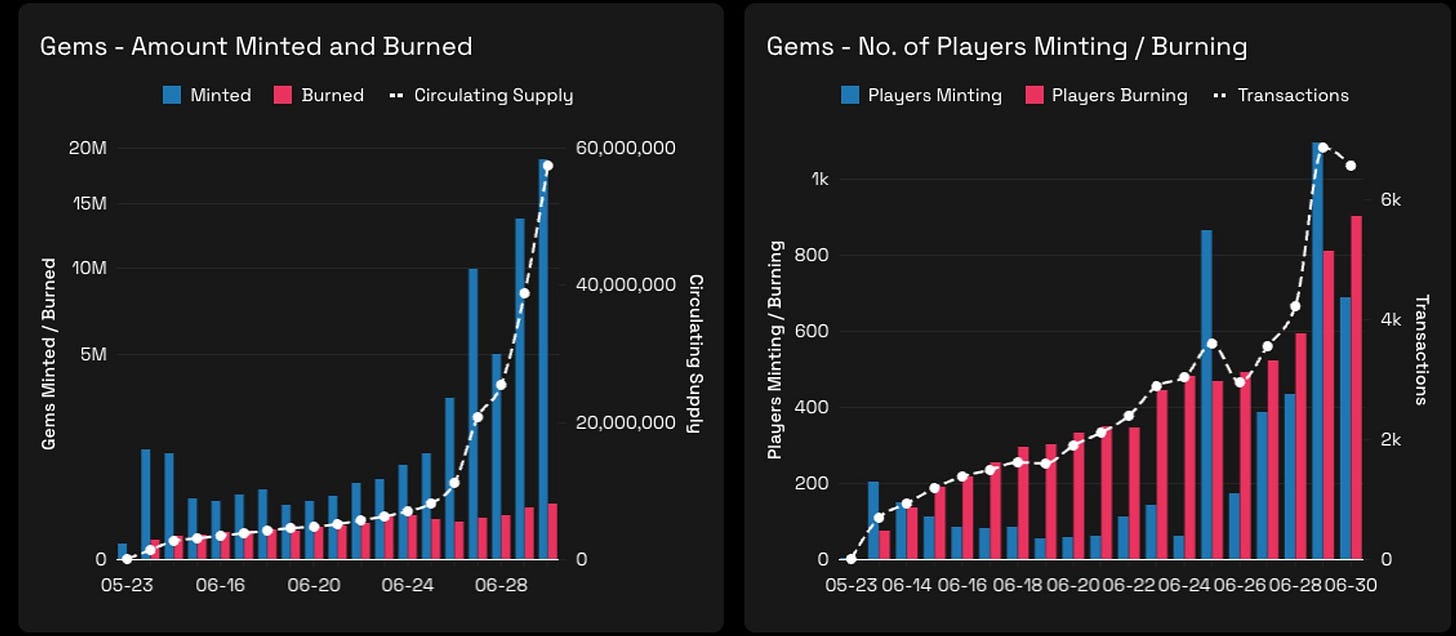

Pixels ($pixel)

Lastly, let’s take a look at $pixel, which has carved out a unique space among games operating at scale. It has emerged as one of the breakout games on the Ronin ecosystem, particularly excelling in targeting different markets, especially the Southeast Asian market. The game has attracted a significant number of users who are genuinely interested in playing, rather than just engaging for incentives. This genuine interest in gameplay has been a key driver behind it’s product-led growth.

A major factor behind the initial hype and rapid user base growth was its play-to-earn model, which created an ecosystem where players were incentivized through token rewards, driving high levels of engagement. While the token launched at a strong valuation, the past few months have seen a noticeable drop in activity. Despite this, there are signs of recovery, with activity gradually picking up again—an encouraging development for the ecosystem.

Here’s a look at the amazing stats and numbers the game has been able to have over the last few months

The game’s simplicity has been a major advantage, making it easy for new users to adopt and start playing, unlike some other games that can be more complex and harder to get into. As the product continues to evolve, it will be interesting to see how $ixel adapts and maintains its audience’s engagement in the coming months. The way the game and its ecosystem develop will be crucial in determining its long-term success.

Music NFTs

Music NFTs have been one of the slower sectors to gain momentum in the broader NFT landscape. While other categories, like gaming NFTs, have rapidly grown and captured significant market share, music NFTs haven’t yet reached the same level of adoption.

One significant reason for this slower adoption is the speculative nature of the current NFT user base. Many users are drawn to NFTs that offer clear incentives, such as access to exclusive communities, in-game utility, or potential future rewards. Music NFTs, however, often lack this speculative element, making them less appealing to those looking for immediate or tangible benefits. Unless the artist tied to the NFT achieves significant success, the potential for future earnings is uncertain, which doesn’t align well with the speculative mindset that drives much of the NFT market today.

Another challenge is the uncertainty surrounding the actual ownership and utility of music NFTs, particularly regarding their financial benefits. While supporting an artist holds cultural value, many potential buyers are unclear about the tangible benefits of owning a music NFT. This uncertainty contributes to the slower adoption rate, as the current NFT community has yet to fully embrace the idea of long-term investment in an artist’s career through NFTs.

The lack of top-tier artists in the music NFT space is another major barrier to broader adoption. Without prominent musicians launching their work as NFTs, the appeal remains limited to a niche audience. If more well-known artists were to enter the space, it could drive much higher engagement and interest. Additionally, once a music NFT is purchased, it often remains in the buyer’s wallet with little activity on the secondary market. This lack of trading is also probably due to the absence of a speculative market around music NFTs, resulting in lower overall trading volumes and visibility within the broader NFT ecosystem.

To boost adoption, music NFTs might need to be tied to more tangible and desirable utilities, such as access to exclusive artist events, concerts, or other unique experiences. However, implementing this approach presents its own challenges, especially when trying to cater to a global audience with diverse preferences. Building a global network of artists and events to support such utilities requires significant coordination and buy-in from the music industry.

Recently, a few projects have attempted to change this dynamic. For instance, Crate achieved about $300,000 in trading volume shortly after its launch, but it still struggled to “really take off” compared to other more established genres in the NFT space. This highlights the ongoing challenges faced by platforms trying to bridge the gap between music and NFTs, particularly in terms of attracting high-quality and diverse artists.

Despite these challenges, the potential for music NFTs remains exciting. The space offers a unique intersection of art, culture, and technology that could see wider adoption as the market matures. As someone who has always been passionate about music, I’m particularly interested in seeing how this space evolves and whether it can go mainstream in the coming years. The idea of music NFTs becoming a significant part of the broader NFT ecosystem is compelling, especially if the right strategies and innovations are implemented to overcome the current barriers.

Chain abstraction

Chain abstraction is likely one of the biggest opportunities in the consumer crypto market, holding immense potential for the future. The core idea is to create a user experience where blockchain technology operates entirely behind the scenes, invisible to the end user. This mirrors how the internet functions today—users engage with applications for search, discovery, or entertainment without worrying about the technical complexities that run underneath.

In the same way, chain abstraction seeks to hide the complexities of blockchain technology beneath the application layer. This approach could greatly expand blockchain use cases, especially in mobile-first ecosystems where user experience can be more nuanced and challenging. By abstracting the blockchain layer, developers can create applications that are far more user-friendly, eliminating the need for users to understand or interact with the underlying technology.

As the consumer crypto space grows, chain abstraction may shift from being an optional feature to a fundamental requirement. The goal isn’t just to make blockchain technology more accessible, but to make it so seamless that users don’t even realize they’re interacting with a blockchain. This could lead to broader adoption and more innovative use cases, particularly in environments where ease of use is crucial. Chain abstraction has the potential to revolutionize how blockchain technology is integrated into everyday applications, making it a key part of the infrastructure for future developments in the crypto space.

It’s interesting to see how different chains are already gaining traction in chain abstraction. For example, Polygon has been a major player, with platforms like Polymarket enabling transactions that hide the complexity of the underlying blockchain. Similarly, Base has become the backbone for apps like Friend.tech and Farcaster, where all transactions occur on the Base chain. What’s notable is that these transactions happen without users needing to be aware of the blockchain layer at all.

This level of abstraction allows users to interact with these applications without thinking about the technology powering them. It’s not about removing the blockchain entirely, but about making it invisible so users can focus on the functionality and experience rather than the underlying tech. This approach improves user experience and lowers barriers to entry, making it easier for new users to get involved without needing to understand complex blockchain technology.

Kai Kai: a prime example of chain abstraction

Kai Kai stands out as a project that exemplifies what ideal chain abstraction looks like in practice. This application has gained significant traction, boasting nearly 1,000,000 daily active users, all while operating on the NEAR blockchain. What’s fascinating is how Kai Kai leverages blockchain technology without making it visible to the user.

Initially, Kai Kai partnered with Stripe, a traditional Web2 payment provider, which charged a 2.7% transaction fee. To reduce costs, they transitioned to NEAR, a move that not only proved to be cost-effective but also fueled massive growth for both Kai Kai and the NEAR ecosystem. This shift has led to nearly 1 million wallets being used daily and a significant increase in daily active users on NEAR.

Here’s how Kai Kai works: whenever a user makes a purchase on the platform—a Web2 commerce shopping app—they are rewarded with a native token that operates on NEAR. All transactions are logged and recorded on the NEAR blockchain, yet the user experience remains seamless. Despite over 1 billion transactions being processed, users interact with the app just as they would with any Web2 platform, without needing to be aware of the underlying blockchain technology. This makes Kai Kai a prime example of effective chain abstraction in action.

Ton x Telegram

Ton x Telegram has emerged as one of the most hottest ecosystems & narrative the consumer crypto space, with several applications coming out of it. While not all these apps have been massive hits, the ecosystem has proven to be a robust launchpad for new projects and tokens. With integrated wallets, products, and features, Telegram provides a ready-made distribution network, allowing users to interact with mini-apps directly within the interface, without the need to download external wallets. This ease of access has significantly contributed to the ecosystem’s rapid growth.

However, one of the key challenges facing this ecosystem is that many applications have yet to offer strong value accrual for their tokens. Despite the high user numbers, the quality and value these users bring to the broader economy are sometimes lacking. This issue could impact the long-term sustainability and success of tokens within this space. There’s a need to find ways to ensure these tokens can deliver tangible value to a larger audience over time.

While I’ll not dive deep into all the mini apps on Telegram, you could actually check out them in our previous coverages, I will like to pick projects as case studies that stand point, especially those who have a live token. Notcoin and BananaGun have both managed to capture significant traction and volume within the ecosystem. These apps have effectively leveraged the Ton x Telegram infrastructure, drawing considerable attention and activity to their respective protocols. Their success offers valuable insights into how other projects might achieve similar results in this rapidly evolving space.

Notcoin ($not)

Notcoin was among the first free-to-play games to launch on Telegram within the TON ecosystem, quickly becoming one of the most notable success stories in the global crypto landscape. The game has achieved remarkable growth, with over 11.5 million holders—far surpassing other prominent projects like zkSync, which has 695,000 users, and LayerZero with 1.28 million users. At its peak, the Notcoin airdrop was valued at an astonishing $2.5 billion, making it larger than the combined airdrops of zkSync and LayerZero, which were valued at $954 million and $323 million, respectively.

This success can be largely attributed to the game’s broad reach and effective user engagement strategies within the Telegram ecosystem. Nearly 30% of all Telegram Premium users participated, driven by a referral system that rewarded users for inviting others, especially those who subscribed to Telegram Premium. This model not only fueled adoption but also ensured wide distribution of rewards. For instance, one top referrer brought in 200,000 users but earned only 0.2% of the total airdrop, reflecting the highly distributed nature of token allocation due to the vast number of participants.

Initially a simple play-to-earn app, Notcoin quickly evolved into a full-fledged project with a dedicated team focused on expanding its ecosystem and adding value for its users. The game’s success has been further enhanced by its social features, allowing users to form squads and compete on leaderboards, either as part of a team or individually. Influencers within Telegram communities played a crucial role in its spread, with some inviting thousands of participants to join.

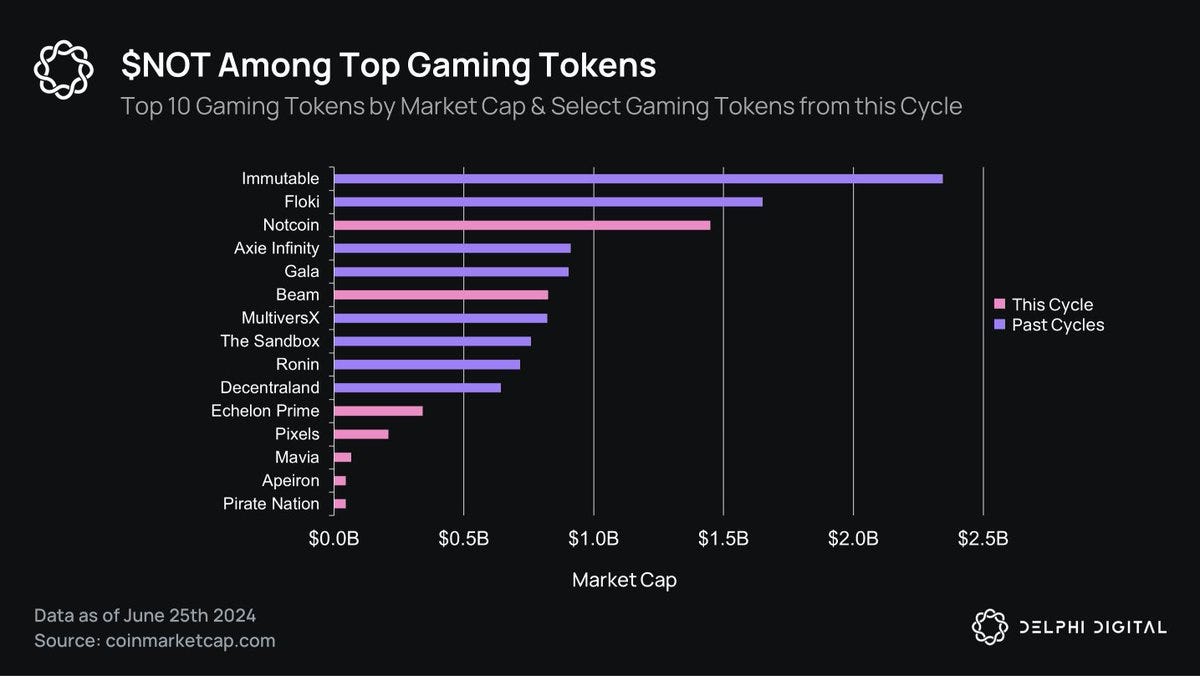

Beyond its impressive user growth, Notcoin has been recognized in the broader crypto space. A recent report by Delphi Digital ranked it among the top 10 tokens in the web gaming ecosystem, highlighting its rapid ascent. The game's user base is also geographically diverse, with participants spread across the globe, further strengthening its position.

The success of Notcoin underscores the importance of being an early mover in a strong narrative. Its early entry allowed it to capture significant attention and maintain momentum, something many other tap-to-earn and click-to-play games have struggled to achieve. While these other games face challenges in sustaining their ecosystems, Notcoin continues to thrive, demonstrating that early adoption and widespread engagement are critical to long-term success in the rapidly evolving crypto space.

Banana Gun Trading Bot

The Banana Gun bot, which began as a simple trading tool on Telegram, has quickly become one of the most talked-about tokens in the ecosystem. Its recent listing on Binance has only amplified its relevance and visibility. With a lifetime trading volume of approximately $5.7 billion, the bot has attracted around 230,000 users and facilitated over 10 million trades. On average, it sees nearly $15 billion in daily trading volume—remarkable figures that underscore the significant impact Banana Gun has made in the space.

One of the standout features of the Banana Gun bot is its seamless integration within the Telegram ecosystem. Users can execute trades directly within the app, without needing to switch platforms. This convenience has been a key factor in its popularity, making it easy for users to stay engaged and actively manage their trades or investments. The bot’s user-friendly experience has contributed to its widespread adoption and success.

Beyond its trading capabilities, the success of the Banana Gun bot highlights a broader trend in the ecosystem: the rise of integrated financial services within Telegram. This trend is not limited to trading; it also parallels the potential for P2P payments to become a major feature in the future. The ability to conduct trades, manage investments, and potentially make peer-to-peer payments all within the Telegram platform points to a growing movement where users can handle various financial activities without leaving their preferred messaging app.

Let’s also check out a few fun apps that have recently launched.

Time fun

Time.fun is a fascinating example of how Web3 is tackling traditional Web2 problems by reinventing the concept of time as a tradable asset. Instead of individuals setting their own hourly consultancy rates, Time.fun allows the community to determine the value of a person’s time through a speculative market. This flips the traditional model on its head, turning time into a dynamic asset that can be bought and traded by those who see potential value in it. I call it the calendly of web3.

What makes Time.fun particularly intriguing is its ability to create a market where the “time” of influential individuals can be bought, held, and traded. Someone might purchase the time of a high-profile individual, either because it’s valuable to them personally or because they believe they can resell it at a higher price. The market collectively decides the worth of a person’s time, adding a strong speculative element that makes it a fluid and potentially lucrative asset.

The platform gained early traction, with adoption from top influencers like Ansem, Mert, Nikita Bier, which boosted its visibility. However, like many speculative-driven products, Time.fun struggled to maintain momentum over the long term. The initial surge in trading activity quickly plateaued, with volumes flattening out over time. This highlights a recurring challenge for Web3 projects: generating significant early excitement is one thing, but translating that into sustained user engagement and retention is another.

While Time.fun is innovative, it faces the challenge of turning initial traction into sustainable growth. The speculative nature that drives early adoption doesn’t always lead to lasting user loyalty, which is something Time.fun will need to address moving forward. It will be interesting to see how the platform evolves and whether it can find ways to keep users engaged beyond the initial novelty of trading time.

Elements Fun

Elements.fun introduces a simple yet engaging gaming concept where players combine different elements to create new ones. Built on on-chain economics, the game allows players to either purchase new elements or acquire them from the secondary market, such as OpenSea. The core mechanic revolves around discovering new elements, with a unique reward system tied to these discoveries.

What makes Elements.fun particularly interesting is its communal reward system. Whenever a new user buys or discovers an element, existing players in the ecosystem are rewarded based on the number of successful combinations made within the game. Essentially, the more you play and explore, the more everyone in the ecosystem benefits. This approach brings a collaborative aspect to the gameplay, encouraging players to participate and contribute to the game’s growth.

Although Elements.fun is still in its early stages and hasn’t yet gained significant traction, its innovative concept has the potential to evolve in exciting ways. The game’s unique approach to rewarding players for their contributions could help build a strong and engaged community if it gains the right momentum. It will be interesting to see how this concept develops and whether it can capture the attention of a broader audience in the future.

Closing thoughts

The consumer crypto space is incredibly exciting yet still in its early stages. With advancements, investments, and ongoing research and development across various products, features, teams, ecosystems, and narratives, the potential in this space is vast. Opportunities are particularly ripe in areas like integrating or creating NFT-based communities, entertainment experiences, and driving user engagement.

However, significant challenges remain, particularly in scaling the infrastructure to serve a broader audience. The need for infrastructure that can handle mass adoption is critical, and this is something that projects like KaiKai and $Sweat are beginning to experiment with by abstracting the underlying chain and focusing on seamless user experiences.

Chain abstraction remains a challenge, and achieving seamless interactions across different chains will likely become a priority over time. For instance, while users may prefer Ethereum for its security, they might also want faster, smaller transactions to be handled by chains like Solana. Protocols like Solana, Polygon and Base are already making progress in this area, creating applications that are more accessible and functional for everyday users without exposing them to the complexities of blockchain tech.

Another major challenge is figuring out how these applications can become more cash flow positive. Many projects, like Crate place and Time.fun, are still in the early stages and aren't yet generating significant revenue. This is where the role of tokens becomes crucial. Mechanisms that enhance token value accrual, such as $Prime's staking programs, will be important in keeping the user excited about the project in the long run.

One ongoing issue in the space is the speculative nature of many projects. Speculation often drives hype, which in turn fuels narratives and user engagement. However, as the space matures, there's a need to shift from a purely speculative focus to one that emphasizes real-world utility and fundamental value. Notcoin serves as a prime example of how early movers in a strong narrative can succeed, but the long-term success of such projects will depend on their ability to provide genuine value beyond initial hype.

Retention and user loyalty are among the most pressing issues in consumer crypto today. Projects like Friend tech, Pump.fun and Fantasy Top have demonstrated that while it’s easy to attract users initially, keeping them engaged over the long term is much harder. Moving away from short-term incentives like airdrops to more sustainable models will be crucial. The goal should be to create applications that users are motivated to use because they offer real value, not just because they might earn a quick profit.

Overall, I’m extremely excited about the potential of the consumer crypto space and eager to see how it evolves. The future will likely bring a wave of new applications and innovations that push the boundaries of what’s possible, and I look forward to seeing what emerges as the space continues to grow.

Of course, there are many more projects out there that are also doing great work. I’m eager to learn about them and explore those that are already live.

Thank you for reading through this report on some of the most interesting projects in consumer crypto across different categories.

References

https://6thman.ventures/writing/airdrops-an-analysis-of-over-2000000-events/

https://www.usv.com/writing/2018/10/the-myth-of-the-infrastructure-phase/

https://x.com/perplexity_ai/status/1823029449534615705

https://x.com/NTmoney/status/1821244373243449590

https://x.com/Polymarket/status/1815102945291276676

https://x.com/pet3rpan_/status/1800904223120613721

https://x.com/0xBreadguy/status/1820817140309541125

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about