RON, IMX, BEAM: Beyond Play-to-Earn

An In-Depth Analysis of Crypto Gaming's Evolution and Its Major Players

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

In an era where the fusion of gaming and finance (GameFi) is a reality, the sector emerged seemingly at the forefront of a technological revolution. Axie Infinity, the pioneer of GameFi, exemplified this boom with over 2.8 million daily active users (DAU) and a fully diluted valuation of over $44 billion at its peak between November 2021 and January 2022.

However, the sustainability of Axie Infinity’s model soon came into question. Its in-game token SLP became excessively inflationary due to a disproportionate mint-to-burn ratio, driven largely by speculative activity. This imbalance led to a significant downturn in its in-game economy and token value.

This trend was not isolated to Axie Infinity. Many GameFi projects, attempting to replicate its success, encountered similar challenges. The fundamental premise of GameFi began to show cracks, and since the 2021 peak, which saw over $2.3 billion raised, the sector has struggled to meet its initial promise.

Amidst these challenges, the past year has seen a notable shift. Major players in the crypto gaming space are reorienting their strategies. Rather than solely focusing on the 'GameFi' aspect, they are investing in comprehensive game development, forming alliances with traditional gaming giants, and building robust infrastructures, including marketplaces for gaming and in-game content, and social platforms. Central to this resurgence are three networks: Ronin Network (RON), ImmutableX (IMX), and Merit Circle (MC).

This report delves into the evolving landscape of crypto gaming, guided by the developments in these three networks. It examines their technological advancements, development trends, and critically assesses the sustainability and future potential of the sector.

Disclosure: The author is long RON and BEAM.

Ronin Network (RON)

Background

Ronin Network, the home of Axie Infinity, launched in April 2021 by Sky Mavis as a Proof-of-Authority (PoA) Ethereum sidechain. Ronin Network’s goal was to scale Axie Infinity, which previously lived on Ethereum mainnet, along with any future dApps and games that launched in the ecosystem. They soon outgrew Ethereum however, when gas fees began to become a huge barrier for users looking to play the game.

Architecture

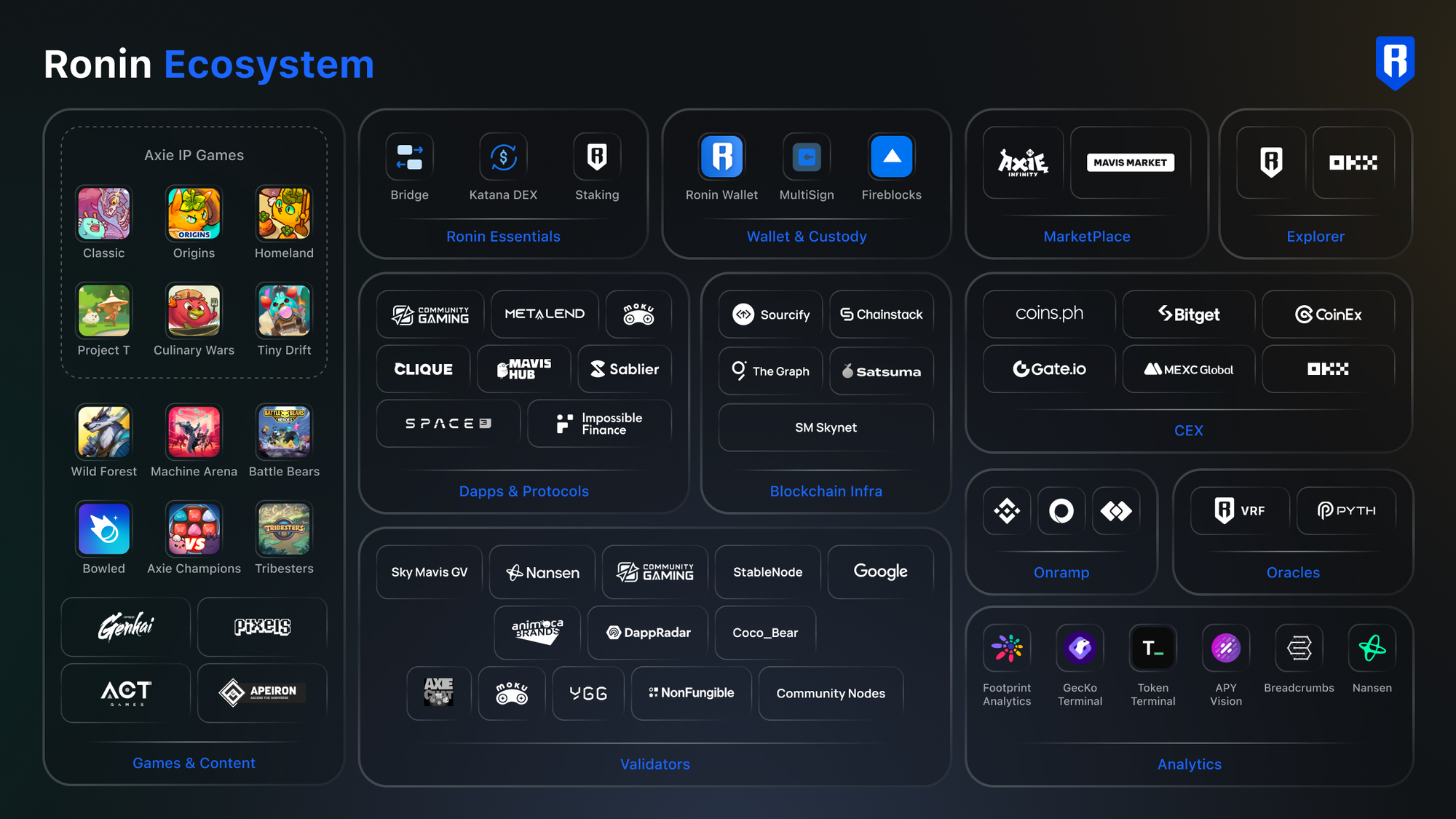

In March 2023, Ronin Network transitioned its consensus mechanism from PoA to Delegated-Proof-of-Stake (DPoS). This allowed anyone to stake their RON tokens to a pool of 22 validators. This makes the Ronin Network an EVM Layer 1 chain, as opposed to an Ethereum sidechain.

Of the 22 validators, 12 validators are "Governing Validators” handpicked by the team with the goal of picking trusted entities to prevent a 51% attack on the network — an attacker with more than 51% stake of the network can conduct a hostile takeover of the blockchain via malicious governance proposals. The remaining 10 validators are automatically chosen among “Validator Candidates” — validators run by anyone outside of the Governing Validator group — by highest staked amount.

Ecosystem Overview

Axie Infinity

Axie Infinity is the flagship game and metaverse brand of Sky Mavis. The game launched it’s alpha in December 2019 before gaining momentum in the summer of 2021. Gameplay revolves around Axies, which are represented by non-fungible tokens (NFTs) which players can purchase or breed.

Players then take part in player versus player (PvP) or player vs environment (PvE) battles in return for rewards in the form of Axie Infinity Shards (AXS), the game’s utility and governance token, and Smooth Love Potions (SLP), an in-game currency. This type of incentive system in crypto gaming has come to be known as play-to-earn (P2E), first pioneered and popularized by CryptoKitties.

At its peak, Axie Infinity saw over 2.8 million DAU on its network, spurred on by viral stories of players in third-world economies such as the Philippines and Venezuela earning a living wage just by playing the game.

However, the sustainability of Axie Infinity’s model soon came into question as its in-game token SLP became excessively inflationary due to a disproportionate mint-to-burn ratio, driven largely by speculative activity. This imbalance led to a significant downturn in its in-game economy and token value, which in turn led to a decrease in players.

It was clear that Sky Mavis could no longer depend on one game in the long run. Throughout 2022, the team continued to work on the next iteration of the Ronin and the Axie ecosystem.

The Axie Infinity Metaverse

Sky Mavis continued to build out the Axie Infinity brand and IP, with the addition of five games in the Axie Infinity universe outside of the original game, now known as “Axie Classic”.

Two of the now six in total games were developed under the Builder’s Program, which allows for and incentivizes development of games within the Axie Infinity ecosystem, allowing the community and other third-party studios to take part in building out the brand.

Partner Games

In November 2022, Sky Mavis announced that they were beginning to partner with gaming studios to build out the gaming ecosystem on Ronin Network and Mavis Hub. In March 2023, the team revealed five game studio partnerships and their games; Directive Games, Tribes Studio, Bali Games, Bowled.io, and SkyVU (as of the latest update, Ronin has onboarded over ten studios to its ecosystem).

Jason dived into these partnerships in this thread.

On October 31st, Pixels migrated onto Ronin, bringing with it around 5000 DAU — this number increased to over 45000 DAU in the first week, and to 115,212 DAU after two weeks.

On November 8, 2023, Zoids Wild Arena by ACT Games migrated onto Ronin. The trading card game (TCG) is based around Zoids, a franchise founded in 1983 by TOMY.

On December 18, 2023, Apeiron, a P2E adventure game, migrated from Polygon to Ronin. The game immediately saw its DAU rise from less than 100 to more than 8,000 as of the time of writing.

Tokenomics

RON has a total supply of 1 billion tokens, with an initial distribution as follows:

25.00% — Staking Rewards

30.00% — Community

30.00% — Sky Mavis

15.00% — Ecosystem Fund

Considering that 29.5% of tokens have been vested, and 17.5% of tokens staked, RON has an effective circulating supply of 12%.

The remaining 169 million tokens allocated for Rewards are on a front-loaded inflation schedule for the next 8 years, with 30m to be emitted over the first three years, decreasing each year after.

Immutable (IMX)

Background

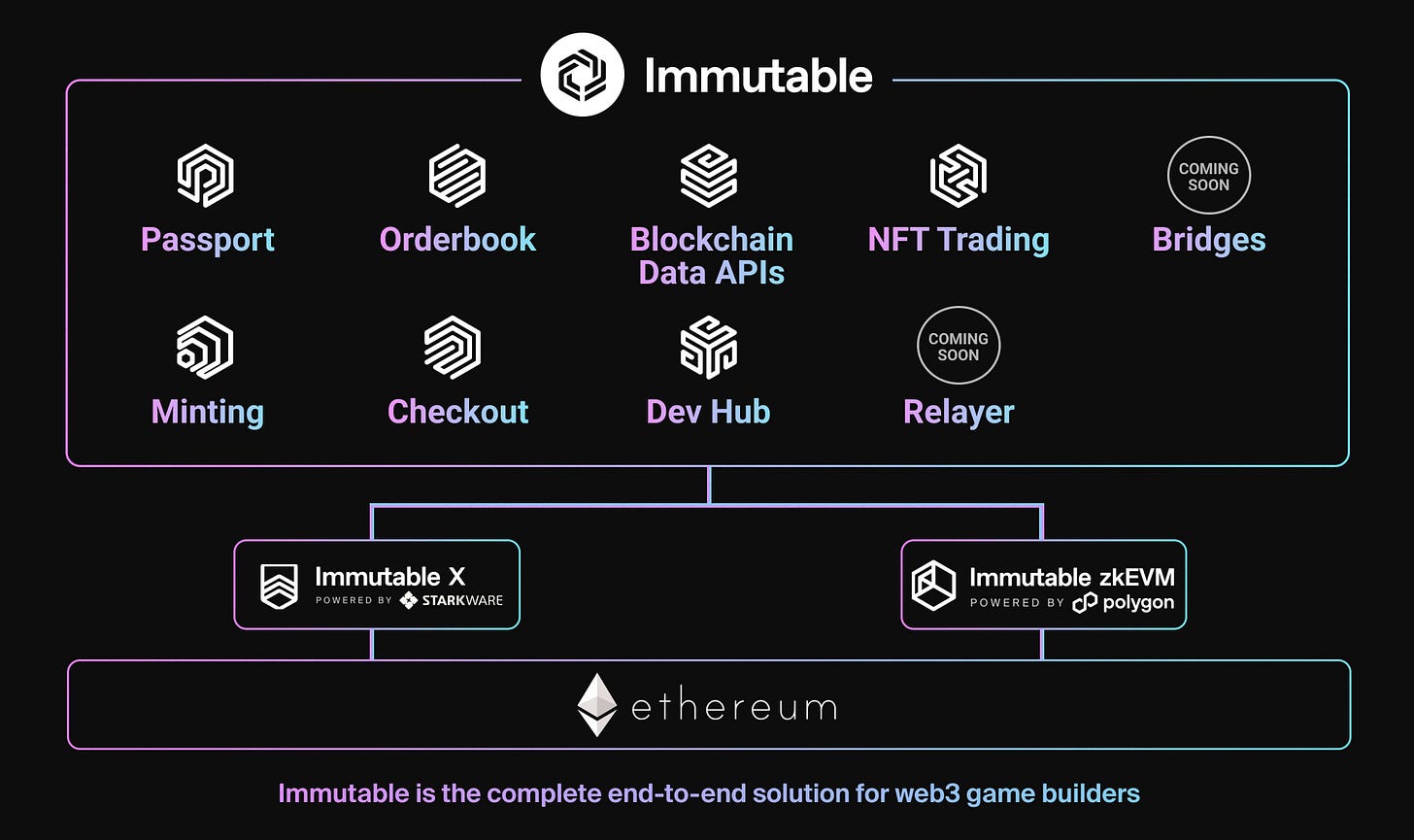

Immutable began as Fuel Games in 2018, creator of Gods Unchained, a card game on the Ethereum network, before their rebrand in 2019. Due to rising gas fees on Ethereum, Immutable launched ImmutableX in 2021, an Ethereum Layer 2 (L2) zk-rollup powered by StarkEX.

Refer to our deep dive on Aztec for a refresher on zk-rollups:

In March 2023, Immutable announced its partnership with Polygon to develop Immutable zkEVM, a EVM-compatible zk-rollup powered by the Polygon Chain Development Kit (CDK), a modular, open source toolkit that anyone can use to launch new L2 chains on Ethereum.

Architecture

The introduction of the Immutable zkEVM marks a significant expansion in the Immutable ecosystem, adding a second Layer 2 (L2) rollup on Ethereum. This development will expand the network’s capacity and form a robust foundation for Immutable’s suite of infrastructure, tools, and applications dedicated to its gaming ecosystem.

The Immutable zkEVM

The key distinction between Immutable zkEVM and Immutable X lies in their underlying technologies and intended use cases. While Immutable X, utilizing Starkware technology, focuses on high-performance NFT minting with efficiency and cost-effectiveness, the Immutable zkEVM, built on the Polygon CDK, offers full Ethereum Virtual Machine (EVM) compatibility. This compatibility enables developers to deploy custom smart contracts, facilitating more complex and sophisticated game mechanics. The Immutable zkEVM is currently in testnet.

Gas & Staking

The Immutable zkEVM will use IMX as its native gas token. At the same time, both IMX and MATIC are used in a dual staking model to secure the chain, utilizing a PoS-based mechanism. As an L2, the Immutable zkEVM utilizes Ethereum for settlement and data availability, leveraging its security & extensive liquidity.

Ecosystem Overview

The Immutable ecosystem includes both games and marketplaces. Its gaming ecosystem is dominated by Gods Unchained, its flagship card-based game.

On-chain data indicates that Gods Unchained is the most popular title by a large margin, with more than $300 million in trading volume since its launch.

Illuvium, which has yet to launch since its inception in late 2020, is in second place with around $16 million in trading volume of its Land NFTs.

NFTs in the Immutable ecosystem mainly trade on its native marketplace, as well as on three major partner marketplaces — AtomicHub, GameStop, and TokenTrove. Immutable NFTs also trade on other platforms like OKX, NFTrade, Rarible, among others.

Collectively, Immutable sees an average of $800,000 in daily trading volume — more on this later.

Tokenomics

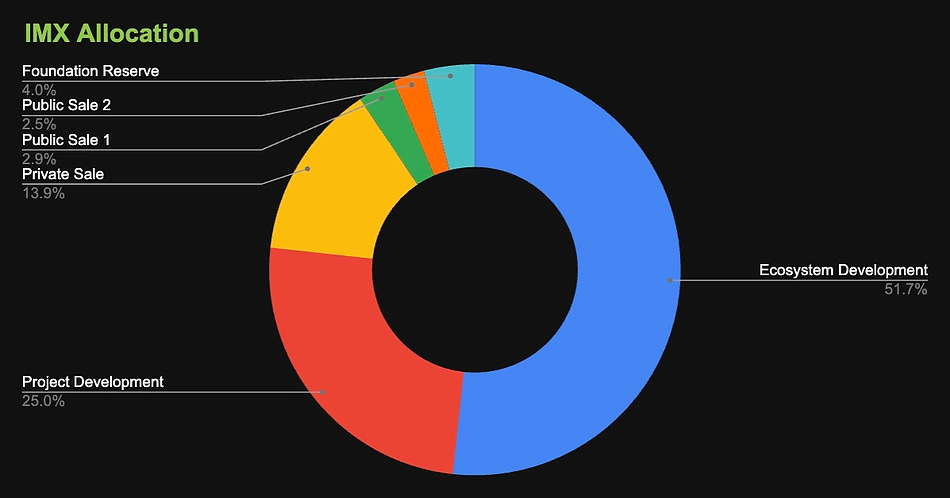

IMX has a total supply of 2 billion tokens, with a token distribution as follows:

51.72% — Ecosystem Development

25.00% — Project Development

13.86% — Private Sale

2.94% — Public Sale 1

2.48% — Public Sale 2

4.00% — Foundation Reserve

As of the time of writing, IMX has a circulating supply of 1.29 billion tokens (64.82%). With a further 31.88% of the supply in the Foundation’s Treasury, this results in an effective circulating supply of 32.94%.

While there is a “Staking Rewards” program, where users lock their tokens in return for rewards, with the Immutable zkEVM not yet live, there is no staking of IMX tokens yet to secure the chain. The soft-staking program currently pays out 25,000 IMX tokens every week. There is a also a Trading Rewards program which pays out 7,300 IMX tokens a day.

Merit Circle (BEAM)

Background

Merit Circle is a decentralized autonomous organization (DAO) formed in September 2021. Incubated by Flow Ventures, Merit Circle went on to raise more than $105 million from its Balancer Liquidity Bootstrapping Pool launch and more than $4.5m in subsequent seed rounds with investments from Spartan Labs, Defiance Capital, Maven11, Binance Labs, among others.

Before the formation of the DAO, the founders of Merit Circle created “420 Scholarships”, one of the earliest crypto gaming organizations and adopters of the “scholarship” system. The scholarship program continued at Merit Circle after it was formed. This model, initially popularized and utilized in Axie Infinity, involves renting out accounts with NFTs to new players under a profit-sharing arrangement. Within Merit Circle, selected scholars are granted access to play decentralized P2E games using NFTs owned by the Merit Circle DAO. Earnings generated by these players are split between the players and the DAO treasury, with a portion allocated for reinvestment in player development and support.

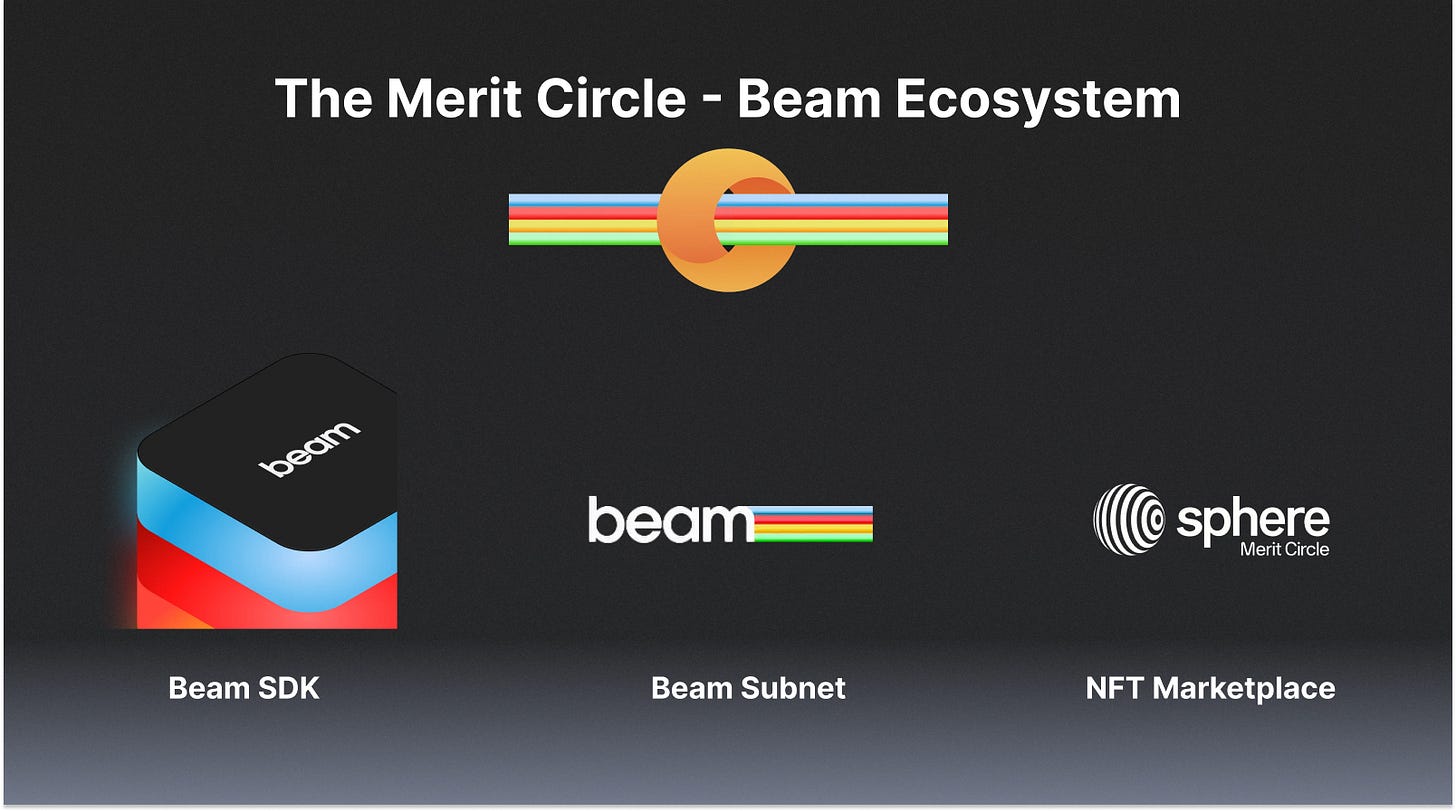

In April 2022, Merit Circle announced Beam, a gaming-focused blockchain as a subnet on the Avalanche network. The network is powered and governed by the Merit Circle DAO and its token, MC (since rebranded and migrated to BEAM).

Architecture

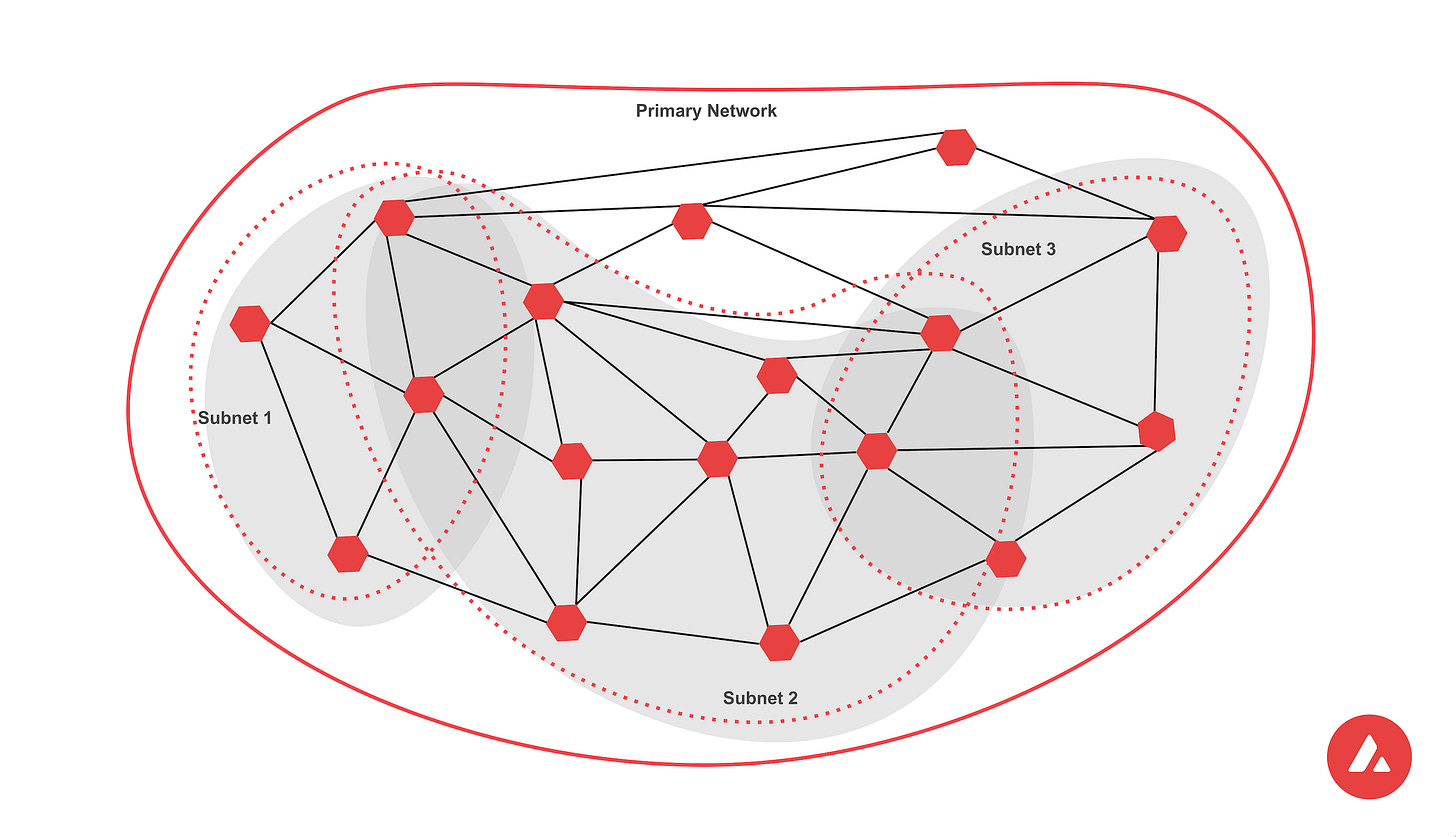

Beam is a subnet on the Avalanche network. Avalanche subnets are dynamic subsets of Avalanche validators forming sovereign networks, each defining its own rules, including membership and token economics, to achieve consensus on one or more blockchains.

Each blockchain is validated by exactly one subnet, but a subnet can validate multiple blockchains. The Beam subnet uses BEAM as its utility and governance token. Users and validators stake BEAM to secure the network and use BEAM to pay for gas fees. Most of the BEAM used as gas fees are used to reward validators, with the remainder of the gas fees burned.

In December 2023, Beam announced its partnership with Immutable and Polygon Labs, underscoring its plans to be chain-agnostic. The partnership adds the Immutable zkEVM — which we discussed above — to the Merit Circle ecosystem.

Ecosystem Overview

While the Merit Circle ecosystem is centered around the Beam subnet, its partnership with Immutable and Polygon Labs expands its reach beyond its native chain. The partnership sees the Beam SDK, beginning with Sphere, integrated into the Immutable and Polygon ecosystems.

For example, Sphere is integrating the Immutable zkEVM orderbook to become a venue for games and gaming assets across the Merit Circle, Immutable, and Polygon ecosystems. The partnership also sees the Immutable Passport, a passwordless sign-on and non-custodial wallet for the Immutable ecosystem, integrated into Sphere.

These integrations add to the Beam SDK’s account abstraction features, enabling easy onboarding via unified gaming profiles across the Merit Circle, Immutable, and Polygon ecosystems — an experience not unlike that found in Web2 gaming today.

The DAO further breaks down its ecosystem into four main pillars — Investments, Studios, Gaming, and Marketplace. It’s Investments Pillar is particularly interesting, as it has been outperforming the CCI30 (an index of the top 30 largest cryptocurrencies by market capitalization).

Tokenomics

The Merit Circle token (MC) was rebranded and is in the process of migrating to Beam (BEAM), at a conversion rate of 1:100. MC had an initial total supply of 1 billion tokens, with a token distribution as follows:

29.44% — Community Incentives

20.00% — Team & Advisors

18.40% — DAO Treasury

14.06% — Early Investors

10.00% — Liquidity Rewards

4.10% — Public Distribution

4.00% — Retroactive Rewards

Since the token migration is in progress, the effective total supply of tokens is the sum of MC and BEAM total supply — denominated in BEAM which has a 1:100 conversion rate from MC, the current total supply of tokens is 70.2 billion tokens.

Token Burn Mechanisms & Proposals

Merit Circle has implemented a number of burn mechanisms & proposals for its token, leading to deflationary tokenomics.

Treasury Investment Proceeds

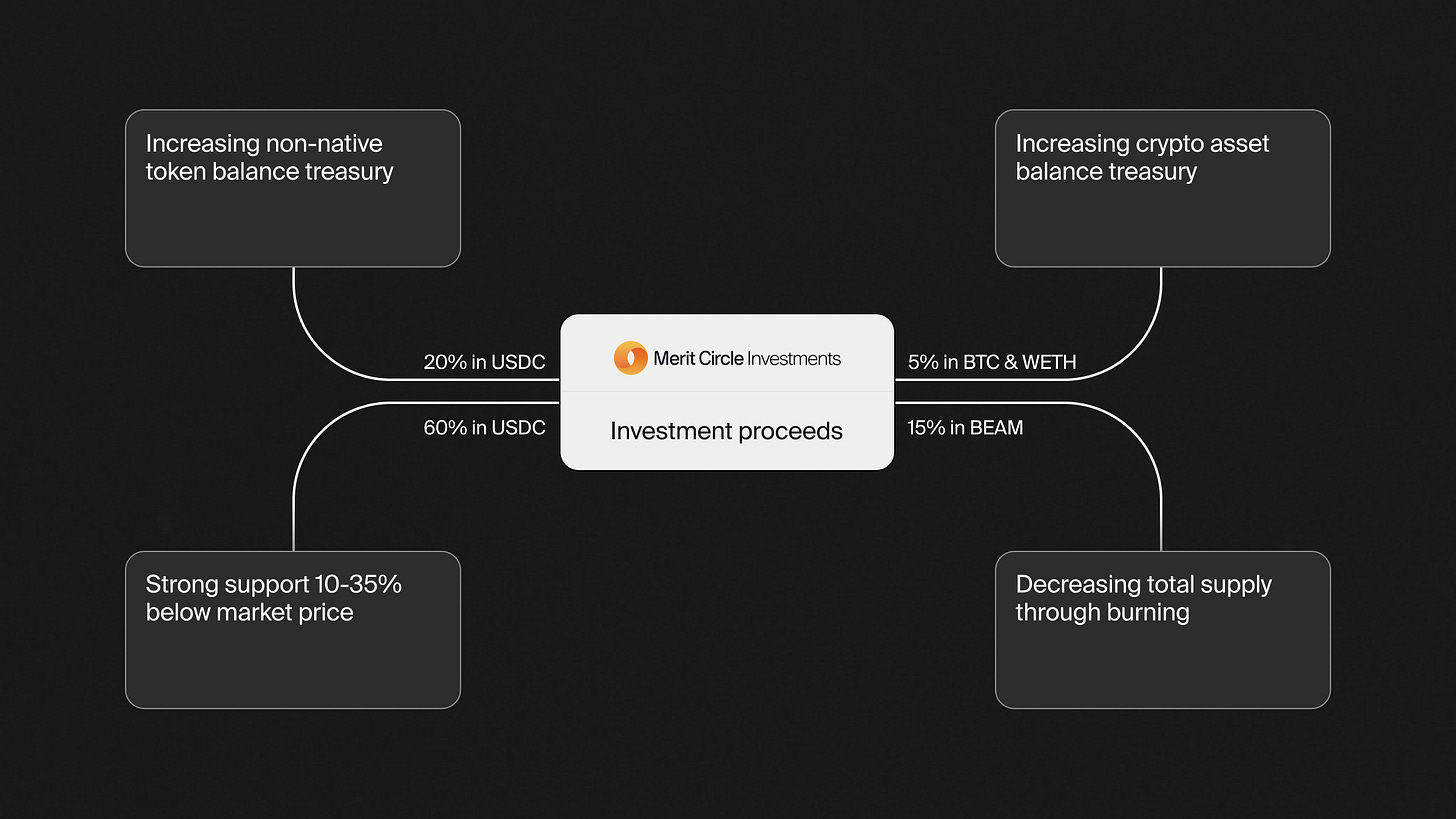

The introduction of MIP-7 sees between 15% and 75% of proceeds from its treasury investments used to purchase BEAM tokens off the market and burned.

According to MIP-7 in January 2022, proceeds (realized profits) from treasury profits are utilized as follows:

20% — converted to USDC

60% — used to purchase BEAM tokens 10-35% below market price, then either sold to strategic investors with a lockup or burned

5% — converted to BTC and ETH

15% — used to purchase BEAM and burned

Community Incentives

MIP-7 implented a burn of 75% of unused MC token incentives per month — this was later overriden by MIP-20 in October 2022, which burned 200m (20%) of the MC token supply.

MIP-26

MIP-26 proposed to cancel V2 and all future staking rewards programs. As such, 10 million MC tokens were burned in July 2023.

To-date, around 37% of the token supply has been burned, as a result of the aforementioned burn mechanisms and proposals.

Less the burn proposals which saw a total of 304 million MC tokens burned, the burn rate from treasury investment profits is around 3.27% annualized taken from the period since the launch of the MC token.

Competitive Comparison

Catalysts & Risks

Ronin Network

Game Launches, Migrations, and Partnerships.

The recent migration of Pixels was an overwhelming success, reaching more than 100,000 DAU within two weeks of migrating to Ronin and accounting for more than 87% of active users on Ronin according to on-chain data from Footprint Analytics.

The “Ronin Effect” — existing and new games alike will be observing and are likely to consider migrating or launching on Ronin to benefit from instant user acquisition of the network’s existing user base. There are already rumours circulating that Treeverse, a Web3 MMORPG in development might migrate to Ronin, after its founder posted that they had been talking to Ronin.

The more games launch on ronin, the larger the “sink” for the token. For example, Pixels introduced a VIP subscription that grants players with in-game perks. These subscriptions are priced in RON, creating additional demand for the token. Ronin reported over 190,000 RON was spent on these VIP passes within the first week.

Migrations and partnerships are a win-win for the network and potential games and its publishers, and will likely be a significant catalyst for Ronin Network moving forward.

Future CEX Listings

RON has a very low float, with less than 12% circulating. While it is listed on OKX, the majority of RON liquidity available for trading today resides on the Ronin Network itself, making it difficult to acquire. Given that Binance is an investor and already supports deposits and withdrawals for AXS, SLP, and USDC for the Ronin Network, the author is confident that a Binance listing for RON is likely in the future.

Future L2 Chain?

The team has mentioned in 2020 and again recently that their current L1 iteration of Ronin is not the end game and that they are looking to further scale the network in the future. Possible scaling solutions include Polygon zkEVM, Immutable zkEVM L3, OP Stack, and Arbitrum Orbit. Given the options, the author thinks a Polygon zkEVM chain is the most likely.

Strong Roadmap

Ronin recently published a “Year in Review” report which revealed a number of key items on their roadmap for 2024. Some notable ones are:

Multi-Party Computation (MPC) wallet

Reputation systems, airdrop programs, and partner token launches

Proposal to generate yield on bridged ETH

Immutable

Partnerships

Immutable’s recent partnerships with industry giants like Ubisoft, and collaborations with Merit Circle and Polygon, not only expand Immutable’s reach into diverse gaming ecosystems but also signal a growing industry recognition and validation of blockchain’s role in revolutionizing the gaming experience.

Immutable zkEVM and Gaming Launches

The Immutable zkEVM is currently in testnet, and is set to launch in Q1 next year. This will see the launch of not just the chain, but a number of games with it. The Immutable zkEVM will use the IMX token as its gas and staking token, which will result in additional utility and demand for the token.

Illuvium has been highly anticipated since it was founded in 2020, and is finally set to release its open beta in between Q1 and Q2 next year.

Sustainability

Immutable currently sees an average of $800,000 in daily trading volume across its marketplaces, which translates into $5.84 million in annualized fees. Assuming 7,300 IMX in daily trading rewards are being given out, this means that the protocol has been spending around $2.35 million this year on trading incentives.

With only around 2,141 daily active users trading its NFT collections, we can attribute some of this trading volume to wash trading as traders trade to farm IMX rewards. It will be interesting to see how long these incentives continue to be paid out and if the launch of the Immutable zkEVM mainnet and ecosystem games will be a sufficient catalyst to gain organic users and trading activity to reduce reliance on trading incentives.

Merit Circle

Partnerships

Merit Circle’s partnership with Immutable integrates Sphere, its NFT marketplace, with the upcoming Immutable zkEVM. Beam SDK products, of which Sphere is one, will impose a 2.5% fee on all transactions. Assuming Immutable’s current annualized volume of around $300 million continues and Sphere achieves 50% of marketshare, this represents an annualized $3.75 million in potential revenue to the Merit Circle DAO.

Game Launches

Gaming launches are coming in hot and Merit Circle is poised to benefit significantly due to its chain-agnostic nature. Multiple highly anticipated games are launching in Q1 2024, including Illuvium on Immutable and Oh Baby Game’s Oh Baby! Kart (of which Merit Circle is a seed investor).

Merit Circle Treasury

As we discussed above, the Merit Circle treasury has been conducting buyback and burns at a rate of 3.27% a year from its realized profits. Around 51% of its treasury is in illiquid venture investments, which looks set to increase in value as the bull market and crypto gaming sector heats up in the next year or so.

Final Thoughts

Sector Tailwinds

Overall, the gaming sector has a number of tailwinds in its favor. Years of development and the inherent benefits of the blockchain have resulted in a strong foundation of infrastructure that can facilitate the next generation of Web3 games:

Unified social logins and social graphs enable easy onboarding of users and increases network effects of various gaming ecosystems.

Provable and trackable on-chain transactions allow games to reward loyal and active users as well as incentivize community-led development of gaming IP and metaverses.

A number of top publishers and developers are actively looking to capitalize on Web3 gaming — such as Nexon, who are developing the MapleStory Universe on Polygon.

Chinese regulators recently drafted a document proposing new restrictions on online gaming. Among the restrictions proposed were restrictions on incentivizing daily logins and in-game revenue generating items and speculative assets. The Chinese market is a large one — CGIGC reports that the number of gamers in China grew to a record 668 million, more than the population of the entire United States. Despite a statement by the regulatory body showing a slight easing in its stance, these regulations pose a risk to game developers and publishers looking to enter the Chinese market, which may lead to a pivot to Web3 gaming to bypass these restrictions.

Regulatory Landscape

On the other hand, navigating the complex and evolving regulatory landscape becomes increasingly crucial. Governments and financial authorities worldwide are continue to scrutinize cryptocurrency and blockchain-based gaming, focusing on consumer protection, financial stability, and anti-money laundering measures.

This shifting regulatory environment poses potential challenges for the sector — just this month, Immutable’s Gods Unchained was removed from the Epic Games store due to its Adults Only (AO) rating given by the Entertainment Software Ratings Board (ESRB). The ESRB gives an AO rating to games that have crypto or NFT elements. Epic Games later reinstated the game by updating their content policy to allow for games that are rated AO solely due to the usage of blockchain or NFT technology.

Thus, understanding and proactively engaging with regulatory bodies and Web2 platforms can help shape policies that support Web3 innovation while ensuring a secure and fair gaming ecosystem.

Sustainability of Crypto Gaming

Questions about the long-term sustainability of the Web3 and crypto gaming sector persist. A key concern is whether developers will learn from the shortcomings of initial play-to-earn models and instead shifting focus towards creating games that leverage blockchain technology to enhance, rather than replace, the core gaming experience. The sector stands at a pivotal point: established players like Sky Mavis (Ronin), Immutable, and Merit Circle have accumulated valuable experience through years of experimentation — from developing flagship games to creating robust gaming infrastructures and ecosystems — while major Web2 gaming companies are now actively exploring Web3 integrations.

The probability of a future where leading entities from both Web2 and Web3 gaming sectors collaborate is not just a possibility but is increasingly materializing. Such alliances could harness the strengths of traditional gaming — engaging gameplay, storytelling, and player communities — with the innovative aspects of blockchain, such as decentralized ownership and native incentivization models. This synergy could be the key to addressing current challenges and unlocking the true potential of crypto gaming.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about