Rollbit (RLB): A House of Cards or Hitting the Jackpot?

A Deep Dive into the Most Profitable Company in Crypto

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

Since the beginning of the year, Rollbit (RLB) has experienced a meteoric rise, appreciating nearly 100-fold and capturing significant market attention. Its dramatic growth has galvanized the GambleFi sector, inspiring a wave of competitors and auxiliary tooling seeking to capitalize on its momentum.

Despite the market dominance of Stake, the dominant online casino with $2.6 billion in annualized revenue, Rollbit - which shares an almost identical layout and offerings - has carved out its own space with its notable performance. It recently reached an annualized reported revenue of around $500 million, and is conducting token buybacks and burns at a rate of up to 15% of its total supply per year.

However, Rollbit has not been without controversy, facing scrutiny for rumors of past unethical behavior by its team, regulatory risks, and questions about the legitimacy of its reported revenue.

Is Rollbit's meteoric rise backed by genuine performance, or is it a house of cards? This report delves into the hard numbers, scrutinizes the reported revenues, and unpacks the risks to give you a bigger picture.

What is Rollbit?

Rollbit launched in 2020 and has grown to be one of the largest crypto casinos, second only to Stake.com. Incorporated as Bull Gaming N.V. in March 2021 and licensed and authorized for gaming operations by the Government of Curaçao, Rollbit offers a diverse array of products and games. Its primary sources of revenue include casino games, perpetual futures trading, and sports betting — more on this later.

Little is known about the Rollbit team, which has maintained anonymity since the company's inception. Searches in corporate registries reveal that the company structure is layered with proxies, providing limited insight. The entities identified in these searches appear to be nominees, as they are also listed on the boards of other offshore companies. This lack of transparency adds an element of risk and complexity for potential investors and other stakeholders, which we will discuss.

Tokenomics

Rollbit Coin (RLB) was launched in November 2021. The entire supply was distributed on the Solana blockchain to users as rewards through various events, lotteries, and staking rewards. On June 28, 2023, Rollbit migrated the RLB token to the Ethereum blockchain.

Distribution

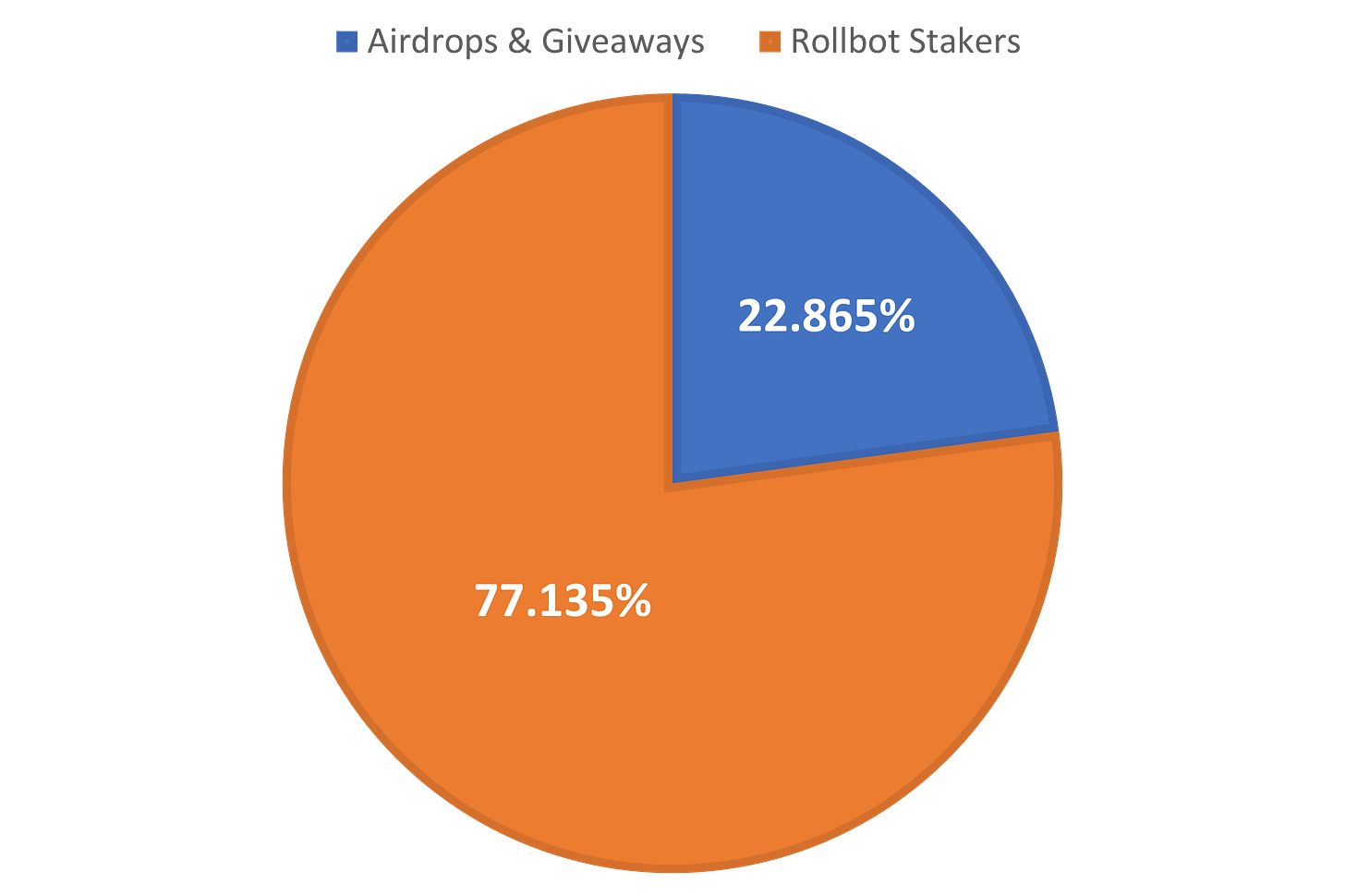

RLB has a maximum supply of 5 billion tokens, of which 22.87% of the supply was distributed via airdrops and giveaways, with the remaining 77.13% of the supply allocated to Rollbots v1 (the platform’s first NFT collection) stakers. Thus, we can consider the entire supply to be circulating.

Token Utility

RLB provides holders with a number of benefits on the Rollbit platform.

Increased Rakeback

In online gaming or gambling, 'house edge' describes the statistical advantage that the service provider, such as Rollbit, holds over the player. A 1% house edge implies that players are expected to lose an average of 1 cent for every dollar wagered.

'Rakeback' refers to a reward system where a certain percentage of the house's commission, or rake, is returned to the player. On Rollbit, a base rakeback of 5% is granted to all users, with the possibility of increasing this up to 15% depending on the quantity of RLB tokens held by a user.

To illustrate, consider Plinko, a popular casino game with a house edge of 1% on Rollbit. Take the example of a hypothetical user Daniel, who holds $100,000 in RLB, the rakeback is 13% (consisting of a 5% base rakeback and an additional 8%). The effective house edge for Daniel is calculated as follows: 1% (initial house edge) minus 0.13% (1% * 13% rakeback), resulting in an effective house edge of 0.87%.

Reduced Trading Fees

Rollbit’s crypto trading product allows users to trade tokens with up to 1,000x leverage with zero slippage. Users are able to choose from two fee structures when they trade: PnL Fee or Flat Fee.

In the PnL Fee mode, no fees are charged upon opening or closing a trade; instead, a portion of any profits is deducted upon trade closure.

When choosing Flat Fee, the trader pre-pays a fee that covers entry, exit, and slippage, receiving 100% of any profits thereafter. This is similar to the fee structure on conventional exchanges. The flat fee is determined as a percentage of the total position, calculated as the wager multiplied by the trade multiplier.

Traders with a specific amount of RLB holdings can qualify for trading fee reductions, the extent of which depends on the chosen fee structure and the volume of RLB held:

PnL Fee: A percentage discount is applied to the fee incurred upon closing a trade.

Flat Fee: Traders can opt to pay the fee using RLB tokens, which results in a percentage reduction in the total fee.

RLB Lottery

RLB holders can enter a lottery with cash prizes using RLB tokens as tickets. Lotteries run for roughly 15-20 hours based on Bitcoin block times, funded by a share of Rollbit's casino profits. Entry requires at least 10 RLB, and more RLB increases win chances. Lotteries start and end every 100 Bitcoin blocks.

At the end of each lottery, two draws occur: a regular lottery and a jackpot, both eligible for RLB stakers. The regular lottery pays out every 100 Bitcoin blocks, while the jackpot has a 10% chance of being won and a 0.1% chance for a full payout. Unwon jackpots roll over. Entry is open during the first 100 Bitcoin blocks of each round, with a UI countdown and prize details.

As of the time of writing, more than $2.1 billion RLB has been wagered on the RLB Lottery.

Buyback & Burn

Part of Rollbit’s revenue is used to buyback and burn RLB tokens. Before the migration to Ethereum, Rollbit carried out four separate buyback and burns, burning over 1.77 billion tokens at an average cost of $19.27 million, accounting for 35.51% of the maximum supply.

Since the migration to Ethereum, buyback and burns have been automated, occurring every hour. While these buybacks were initially carried out within the Rollbit platform’s liquidity pool with no way to verify on-chain, as of October 3, 2023, all buybacks are now conducted on-chain on Uniswap V2.

To-date, over 98 million RLB tokens have been bought back and burned on the Ethereum chain at an average cost of $14.4 million, accounting for 1.97% of the maximum supply.

Key Metrics

Unique Depositors

Rollbit claims to have had over a million registered users* on its platform, with over $40 million wagered per day. Looking at on-chain deposits to verify this, we see that more than 1.67 million unique addresses* have deposited on the platform across the Ethereum, Solana, and Bitcoin networks.

While new addresses depositing BTC, SOL, and erc20 tokens have either declined or plateaued in the last quarter, we can observe that new addresses onboarding via ETH have been on an uptrend.

*Note the distinction between users and addresses.

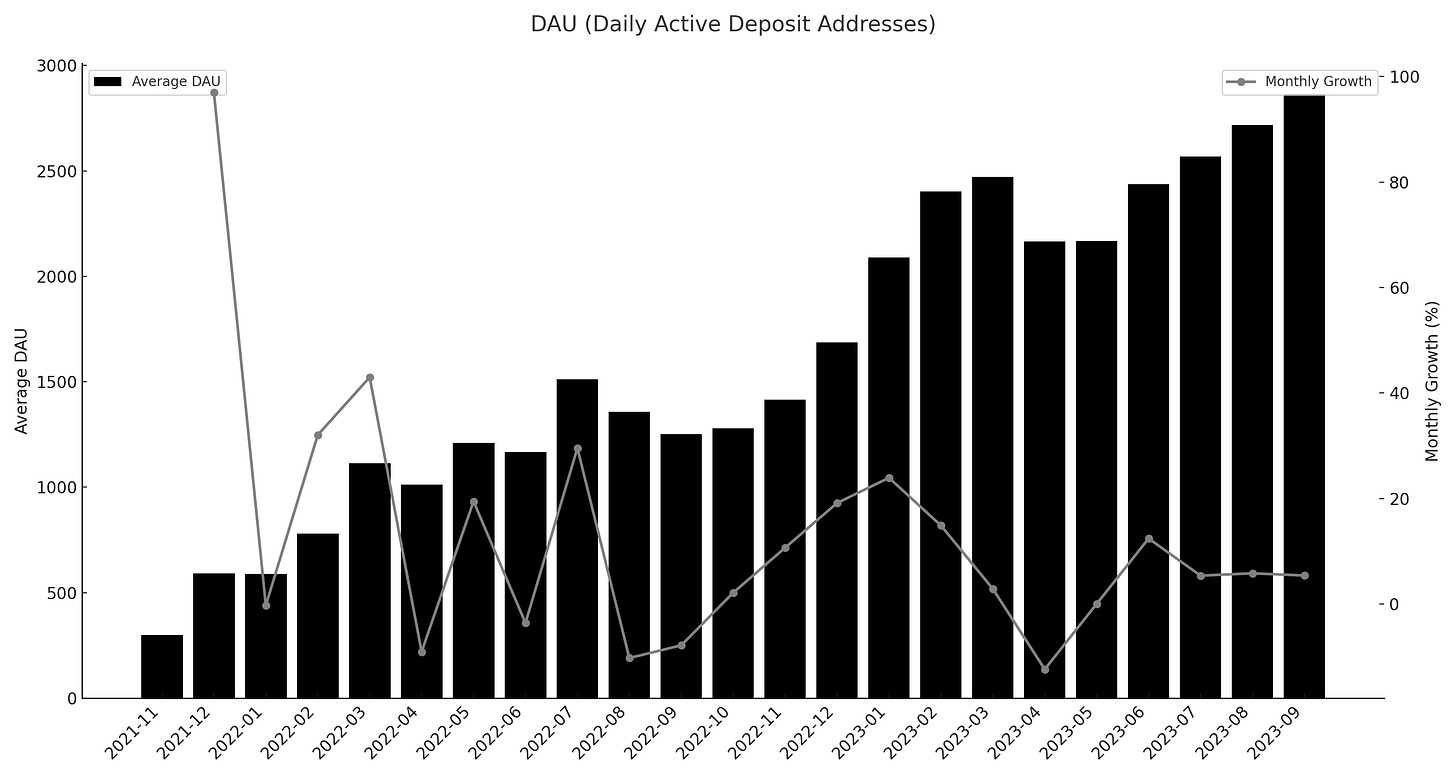

DAU & MAU

We define active users based on unique deposit addresses, utilizing on-chain data from Flipside. Across both ETH and SOL deposits, metrics for the month of September 2023 indicate a DAU of 2,865 and an MAU of 23,237, experiencing YoY growth rates of 128.9% and 134.08% respectively.

Utilizing available DAU and MAU data allows for the calculation of the DAU/MAU ratio, a key indicator of user engagement. Since the platform's inception in November 2021, the average DAU/MAU ratio has been 12.15%. A higher DAU/MAU ratio suggests strong user engagement, as it indicates a greater proportion of monthly users are active on a daily basis.

Revenue

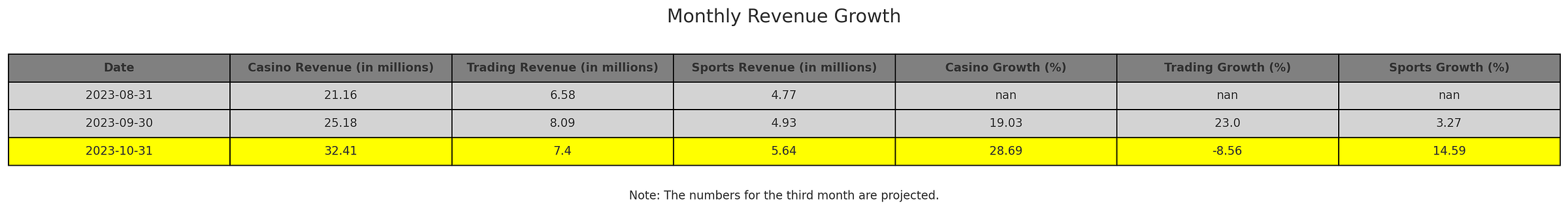

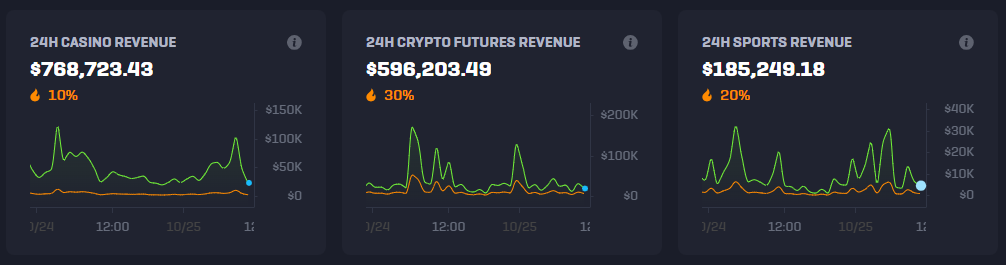

Revenue information for Rollbit is accessible via its public API, though data is available only from August 2023 and covers revenues from the platform’s Casino, Trading, and Sports products. The above chart, updated as of October 23, 2023, indicates a consistent annualized revenue of approximately $500 million, with a daily revenue exceeding $1 million over the past 30 days.

In September 2023, Rollbit's primary revenue source was its Casino product, contributing 65.9% of total revenue. This was followed by Trading at 21.2% and Sports at 12.9%.

Month-over-month growth rates from August to September 2023 were 19.03% for Casino and 23% for Trading, while Sports saw a modest growth of 3.27% despite the commencement of major football and soccer seasons.

As October nears its end, projections have been calculated by scaling the revenue data available for the month using a factor determined by the ratio of the total number of days in October to the number of days for which we have data. These scaled projections indicate robust growth for Casino at 28.69%, an increase for Sports at 14.59%, and a decline for Trading at -8.56%.

It's worth noting that with the recent surge in BTC to $35,000, trading volumes on Rollbit have increased dramatically since revenue data from the API was pulled, positively affecting Trading revenues.

Average Revenue Per User (ARPU)

Average Revenue Per User (ARPU), is a metric commonly used to measure the revenue generated from each active user on a platform over a specific time period, offering insights into user value and potential for monetization.

To benchmark Rollbit's ARPU against industry standards, we'll use the complete revenue data available for September 2023. Calculating ARPU involves dividing the month's total revenue of $38,203,516 by the MAU count of 23,237 for that same period, arriving at an ARPU of $1644 for September 2023.

The calculated ARPU for Rollbit in September 2023 appears notably high when compared to industry averages. According to Statista, the ARPU range for online casinos, lotteries, and sports betting in 2023 varies between $113.3 and $226.4.

This discrepancy could be due to high-rollers on the platform contributing significantly to the platform, the combination of three main products (casino, futures trading, and sports betting), and the fact that MAU in this analysis is defined as monthly unique deposit addresses which may not fully capture actual user activity, given the lack of more detailed data.

Buyback & Burn

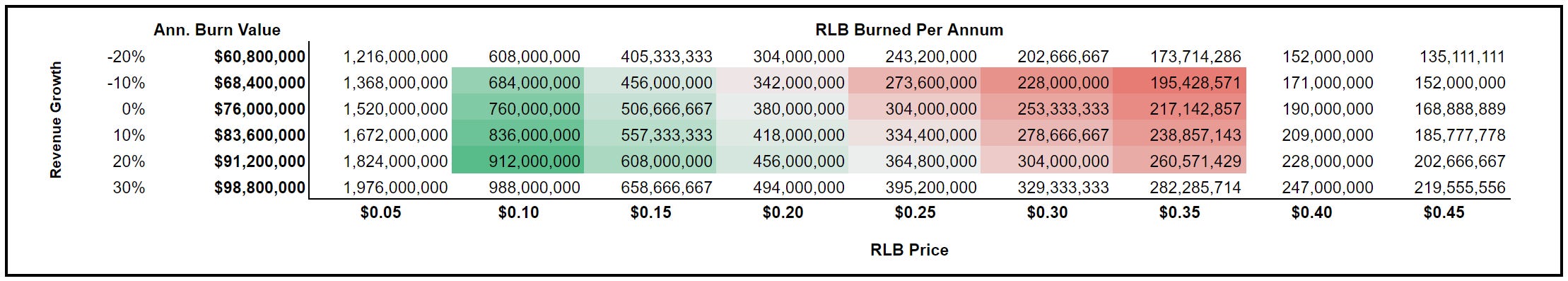

As previously noted, Rollbit allocates portions of its various revenue streams for the buyback and burning of RLB tokens. Specifically, 10% of casino, 30% of futures trading, and 20% of sports revenues are set aside for token holders.

From this allocation, 10% is distributed to holders of Rollbit v1 NFTs, while the remaining 90% is utilized to repurchase RLB tokens from the Uniswap V3 pool. These repurchased tokens are then sent to a designated burn address.

Over the past 30 days, Rollbit has been burning RLB tokens at a monthly rate of 1.34% of its outstanding supply of around 3.1 billion tokens, which translates to approximately 16.08% on an annual basis.

Projected Burn

Based on Rollbit's performance over the last 30 days, we can forecast the projected token burn for the upcoming year. Using an annualized burn value of $76 million — derived from a 30-day average to account for outliers — we incorporate assumptions around revenue growth rates and a specified range of RLB prices to create a sensitivity table, with the most likely scenarios (based on the author’s assumptions) colored below.

Legitimacy of Rollbit’s Revenues

The elephant in the room: how does one ensure the veracity of Rollbit’s reported revenues? Although on-chain deposits to the platform are traceable, the trail ends there. Similarly for withdrawals, transactions leaving the platform provide no insights into activities that occur within this ‘black box’.

Rollbit initially disclosed revenue data solely via its dashboard, leaving no method for verification or historical tracking. The company's newly released public API allows for tracking of revenue and burn numbers from the last month or so, but this does little to relieve concerns about the authenticity of these figures, as they could potentially be manipulated.

Thus, the only way to mitigate the risk of these numbers being manipulated is to remove as much doubt as possible through various analytical methods.

Comparing On-chain Buyback and Burns with Reported Revenues

While revenue data from the public API lacks on-chain verification due to the absence of transparent fee contracts, buybacks and burns can be checked on-chain.

API data (as seen above), starting from August 7, 2023, shows a cumulative 98.3 million RLB tokens burned as of the last complete day.

On-chain data, in contrast, indicates 106.8 million RLB tokens burned, leaving a discrepancy of around 8.5 million RLB. However, this gap can likely be attributed to additional RLB burned from the excess RLB on hand accumulated from the period between the last burn on Solana until the burns began on Ethereum.

This assumption is corroborated by a large, one-time burn of 11.7 million tokens recorded on August 10, 2023, when on-chain burns were initiated. The remaining difference is likely attributed to tokens stored in the rollbot.eth address, pending future burns.

Triangulation

Triangulation in this context refers to the process of validating the reported revenues of Rollbit by comparing its metrics with similar data points from other casino platforms, such as Stake. The idea is to establish a baseline or a range of plausible revenue figures based on industry averages, which can then be used to assess the reasonableness of Rollbit's reported revenues.

In this analysis, we use website traffic data and reported revenues to estimate Rollbit's revenues, drawing upon a similar approach taken by X-user gentlemanzhao in this thread. This method allows us to make an informed estimate of Rollbit's financial performance, using Stake — a leading crypto casino platform whose revenues have been independently verified by the Financial Times — as a benchmark

Using website traffic data obtained from Similarweb, and after filtering out single-page views to exclude less meaningful interactions, we found that Stake received approximately 11.16 million monthly visits in the last month, while Rollbit had around 2.07 million. Stake reported a revenue of $2.6 billion for the year 2022, yielding a revenue-per-visit ratio of 233x.

Applying this multiple to Rollbit's monthly visits suggests a projected annual revenue of approximately $483 million. This figure is consistent with Rollbit's annualized revenue of about $500 million, as calculated from the last 30 days of available data.

Catalysts

Deflationary Pressure — Rollbit has a monthly burn rate of approximately 1.34% of its outstanding supply of about 3.1 billion tokens. Annually, this translates to an estimated 16.08% of the total supply being burned. This rate of token burn exerts substantial deflationary pressure on the RLB token, serving as a mechanism for value preservation or even appreciation over time, should demand remain constant.

Sportsbook Revamp — Despite the soccer and football seasons re-starting in August and September this year, revenue from Rollbit’s sportsbook has been lackluster, accounting for only 12.9% of its revenues for the month of September and managing only a 3.27% growth from August. The sportsbook has also come under fire for its poor lines and spreads compared to Stake, which has been a popular platform for sports betting. However, the team has been teasing a revamp, possibly even building their own sportsbook, moving away from its current provider, Betsby.

The Duel Arena is a player-versus-player (PvP) casino game with a 0% house edge, inspired by the infamous Duel Arena of Runescape (since removed from the game). Players have the flexibility to set their own stakes, and released screenshots suggest the inclusion of NFTs and some form of currency available to be used as stakes. While a 0% house edge suggests no direct revenue generation for the platform, the Duel Arena could serve as a significant onboarding mechanism if it garners a level of popularity similar to its Runescape counterpart.

CEX Listing — As of the time of writing, the majority of RLB's liquidity is concentrated on the Rollbit platform, with the main on-chain liquidity pool residing on Uniswap v3. A listing on a centralized exchange (CEX) could significantly boost RLB's liquidity and trading volume, while also improving its accessibility. However, the regulatory risks (as we will cover below) associated with Rollbit as an online casino could also pose a barrier listing on centralized exchanges.

Risks

Regulatory Risk — Although Rollbit has secured a gaming license in Curaçao, the effectiveness of this license in providing a regulatory shield is questionable. Licenses are jurisdiction-specific; a Curaçao license does not grant permission to operate in the vast majority of other countries. Gambling regulations are generally stricter than even securities laws, with non-compliance often resulting in both fines and imprisonment. This level of risk differs markedly from centralized exchanges (CEXs), where regulatory grey areas might exist. Gambling is unequivocally regulated across jurisdictions, and operating without a local license is considered illegal. Enforcement actions by regulators tend to be a slow-moving process, but the long-term risks cannot be discounted. The absence of immediate action does not eliminate the risk of future enforcement.

Anonymous Team — The Rollbit team has chosen to remain anonymous since the company's foundation, a decision that adds a layer of complexity and risk for investors and other stakeholders. In the absence of a known team, the avenues for legal recourse and communication are constrained, making it difficult to assess the credibility and reliability of the platform. Anonymity, while sometimes considered a feature in the decentralized landscape, acts as a risk factor in this case, potentially undermining stakeholder confidence and inviting scrutiny from regulatory bodies.

Revenues Aren’t Real — Even with comprehensive attempts to validate the platform's revenues, there remains an inherent risk of revenue manipulation with the public API. Although on-chain metrics for buybacks and burns have increased the platform's transparency to some extent, they do not necessarily authenticate the source of these funds.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about