Render Network (RNDR): Bridging Megatrends in Tech

Can Render be the bridge between Web 3, AR, VR and AI?

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

As we approach the highly anticipated WWDC23, speculation is rife that Apple may finally reveal their long-awaited AR/VR headset. This development has prompted investors in the crypto space to consider assets that align with this narrative.

Among these, RNDR (Render Network) stands out due to its unique convergence of key narratives such as integrations with the Apple ecosystem, Metaverse involvement, artificial intelligence (AI) integration, and 3D rendering capabilities.

As demand for GPU computing power is expected to soar in fields like gaming, metaverse development, architecture, animation, product design, augmented reality (AR), and more recently, AI tooling, RNDR may present an accessible alternative to expensive computing equipment typically required for creating 3D graphics.

This week, we attempt to cut through the hype and analyze whether Render actually has applicability with the aforementioned technological trends.

Let’s dive in!

What Is Rendering?

Imagine you're a visual effects artist hired to work on the latest Marvel superhero blockbuster and you want to create a photorealistic scene. Since you’re likely not in possession of an actual Iron Man suit, you’ll have to draw out the character in your computer.

However, the sketch is far from photorealistic. You’ll need to consider the color of the scene, the lighting, how the light interacts with different materials of your character’s costume, and how the textures should look in different angles, how shading changes with the camera’s viewpoint, and so on. As a seasoned visual effects artist, you codify all of the above into algorithms - instructions on how each of the above should look in the final setting.

Now, the scene is ready to be rendered. This is where the rendering software calculates how every pixel of the final image should look, based on the models, textures, lights, and camera view that you have set up. This is a highly computationally intensive process that virtually every single CGI scene in any movie, video game and TV show employ today.

One company that has been creating tools to help movie studios and video game developers simplify the rendering process is OTOY Inc. OTOY’s most well-known product is OctaneRender, a rendering application with a fully GPU (Graphics Processing Unit)-based rendering engine.

Enter Render Network

In 2016, the CEO of OTOY - Jules Urbach - realized one thing: that if we somehow enabled anyone to offer their excess computing power at home to anyone who needed computational resources for rendering, they can vastly increase the scalability and efficiency of their offering.

With this understanding, Urbach launched Render Network, a decentralized peer-to-peer network on the Ethereum and Polygon blockchains that allows users to rent out GPU computing power. Today, it is integrated within the OTOY suite of services and is accessible to OctaneRender subscribers and creators.

The network is powered by the RNDR token, which is used to pay node operators for rendering services. Users can choose to purchase either RNDR tokens or RNDR Credits. Unlike RNDR tokens, which is a cryptocurrency, RNDR Credits offer an accessible entry point for new or non-crypto users on the Render Network, purchasable via PayPal or Stripe, and are backed by RNDR Tokens acquired by the Render Network Team on centralized exchanges (CEXs), ensuring node operators are always paid in RNDR tokens for their services.

The Render Network currently consists of two main layers: the off-chain rendering network and the blockchain layers.

The off-chain rendering network includes Creators, Node Operators, the Render Network itself, and rendering application layer vendors. The blockchain layers manage payments through RNDR and escrow contracts. Following the passing of RNP-002 (discussed below), Render will move from the Ethereum and Polygon networks to the Solana blockchain.

The Render ecosystem is comprised of two main types of users:

Node operators are users that lease their GPU(s) to the Render Network to be used by Creators.

Creators are users that make use of the Render Network’s GPUs to render high-quality images at higher speeds.

At this present time, the Render Network only supports render projects using the OctaneRender engine, which was acquired by OTOY in 2012. Render has also recently added support for Stable Diffusion, a popular AI text-to-image model released in 2022.

Node Operators

Anyone with GPUs to spare can be a node operator. Even a single GPU running idle can contribute to the Render Network and earn RNDR. To join the network, prospective node operators fill in a form before getting placed in an on-boarding queue. Once onboarded, node operators can begin earning. Like any node-running operation, there are hardware requirements to ensure the network is robust and reliable. There are currently two classes of node operators:

Centralized Node Operators — verified partners like AWS, Google, and Microsoft run commercial-grade GPUs that satisfy high-performance and security requirements for operation in Tier 1.

Decentralized Node Operators — individual node operators or render farms that have been onboarded operate within Tier 2 and Tier 3. Contains a wider range of hardware and reputation scores.

To keep network performance from degrading, node operators are required to maintain a reputation score. Excessive job failures will lead to a reduction of reputation and can result in potential quarantining of the node.

Creators

Creators are users who utilize Render Network’s decentralized network of GPUs to run rendering jobs. As of the time of writing, this includes both OctaneRender and Stable Diffusion jobs. Users must have an active OctaneRender license subscription to use the Render Network. Aside from the active subscription which costs between $20-25 a month, Render Network has a Multi-Tier Pricing (MTP) model:

Tier 1 (Enterprise): Most expensive tier, without any pricing discounts. It uses a dedicated and centralized pool of verified nodes and prioritizes jobs, offering access to GPUs with high VRAM for complex scenes. Verified partners include AWS’ Elastic Compute Cloud (EC2), Google Compute Engine (GCE), and Microsoft’s Azure Virtual Machines (VMs).

Tier 2 (Priority): This level offers the highest tier of decentralized rendering, providing access to high-performing and most parallel GPU nodes. Compared to Tier 1, Tier 2 offers a pricing discount multiplier between 2 to 4, depending on network conditions.

Tier 3 (Economy): This tier provides the greatest discount multiplier, typically ranging from 8 to 16, depending on network conditions. It aims to ensure job completion, but jobs may process slower and node hardware may not be as advanced as in Tier 2.

The MTP model can be dynamically adjusted based on supply and demand conditions, such as allowing for the introduction of specialized tiers, AI computing tiers, renewable energy source tiers, and other modifications to align with evolving user preferences.

Proof-of-RNDR

The system that ties the network together is called Proof-of-RNDR (PoR). Unlike the conventional Proof-of-Work (PoW) model that relies solely on cryptographic puzzle-solving, the RNDR network generates trust through the successful completion and validation of rendering tasks.

The network utilizes a reputation scoring system based on users' past performance and success rate to manage and incentivize network activity. Creators and Node Operators are rewarded or penalized based on their adherence to smart contract conditions, impacting their reputation score positively or negatively.

Reputation scores affect a user's productivity on the network. For Creators, a higher reputation score grants access to more concurrent mining nodes, enabling faster work processing. This encourages creators to meticulously check scenes before uploading, preventing network clogging from poorly-prepared work. Node Operators can only access higher-tier, more rewarding tasks by maintaining a high reputation score. This system incentivizes them to consistently deliver successful results.

The user ranking system also serves as a tie-breaker in situations of potential network congestion. For instance, if two users require a rendering job needing all available resources, the user with a better reputation score would take priority. This setup fosters consistent positive activity on the network and prevents sybil or distributed denial-of-service (DDoS) attacks.

ORBX File Format

The open ORBX file format and streaming framework was designed by OTOY as an umbrella for various open source sub-formats involved in rendering. It is an highly interoperable open format supported by most if not all mainstream 3D content creation tooling and is highly optimized for streaming and GPU processing.

The OBRX file format is a container format that contains scene data (assets) and an XML (extensible markup language) render graph which describes the semantics of a scene. Critically, OBRX enables assets to be abstracted from third-party software tools in order to be processed in parallel by multiple GPU nodes on the Render Network. This cuts down rendering time and enables efficient and software-agnostic rendering.

The Render Network is also able to break down each scene into individual assets in order to be hashed and end-to-end encrypted when uploading to the network. This ensures that the work of artists, be it individual creators or globally recognized studios, remain secure and private.

The Render Network Team

Render Network has been led by Jules Urbach, its founder and CEO, since its inception in 2016. Urbach has an extensive background in gaming and software development spanning three decades. Aside from also being the founder and CEO of OTOY since 2002, Urbach's achievements include creating the best-selling CD-ROM game Hell Cab and designing the first 3D video game using Macromedia Director software.

While Render has a 15-person dedicated team, the entirety of OTOY works to support and build the Render Network as well. Thus, Render Network is run by a dedicated group of people with decades of relevant industry experience behind them.

Competitive Analysis

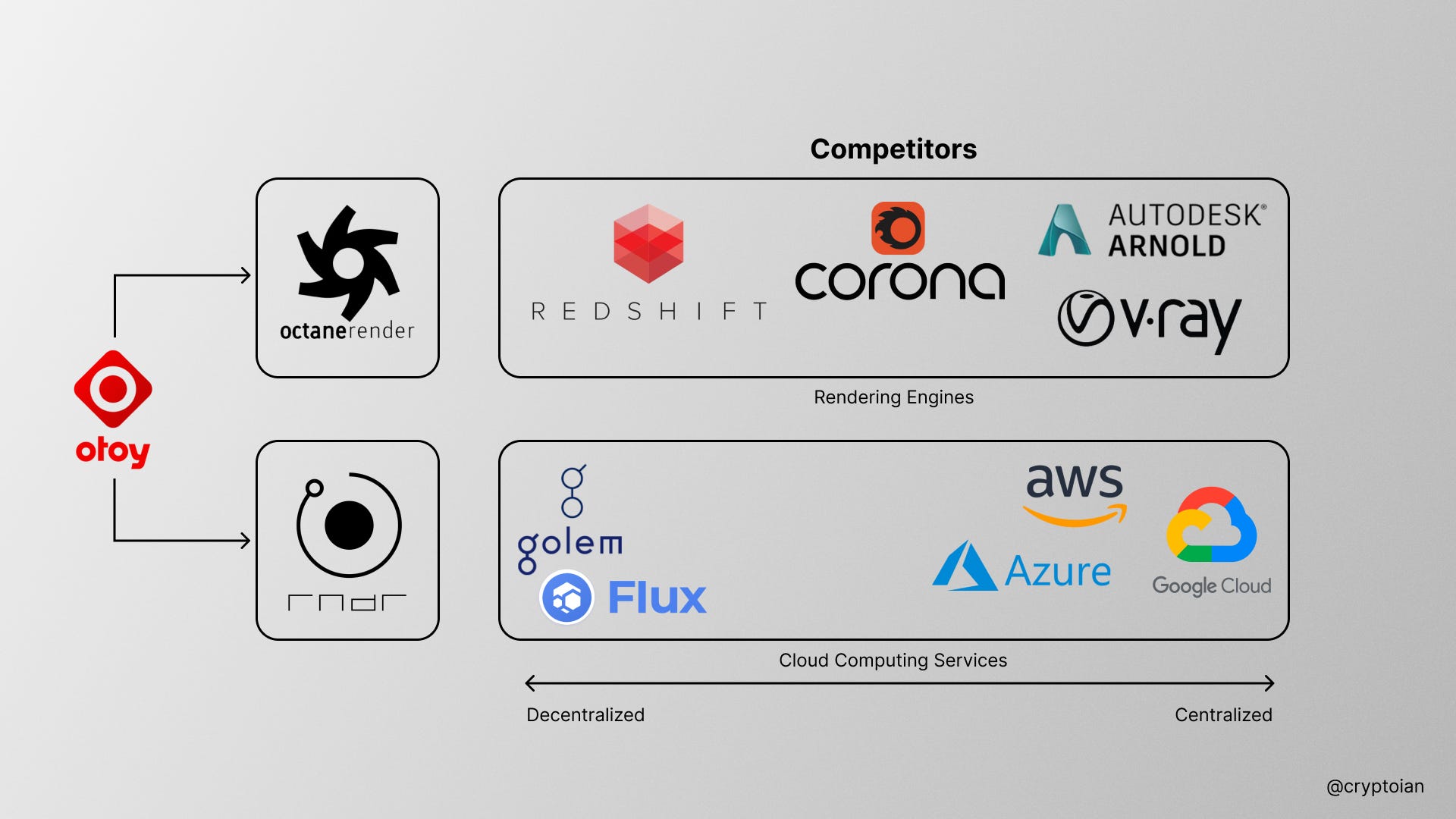

Render Network faces competition from a number of other companies. While not technically targeting the same market, Render’s most comparable projects are Golem Network, which, similar to Render Network, is a decentralized peer-to-peer (P2P) network of users who either provide or request computing resources, and Flux, a decentralized Web 3.0 cloud infrastructure service comprised of user-operated nodes.

Neither Golem nor Flux compete directly with RNDR to provide a decentralized GPU rendering service. Thus, despite existing in the same broader sphere of decentralized distributed computing networks, neither Golem nor Flux directly challenges Render Network in its niche of providing a peer-to-peer platform for GPU rendering tasks. It is worth noting however, that Golem has been experimenting with a GPU computing proof of concept (PoC) using Stable Diffusion as a use case.

In the cloud rendering services sector, RNDR’s competitors include cloud computing giants such as:

AWS Elastic Compute Cloud (EC2): AWS EC2 is a cloud computing platform that offers a variety of virtual computing instances, including GPU instances.

Google Compute Engine (GCE): GCE is a cloud computing platform that offers a variety of virtual computing instances, including GPU instances.

Microsoft Azure Virtual Machines (VMs): Azure VMs is a cloud computing platform that offers a variety of virtual computing instances, including GPU instances.

As discussed above, AWS, Google, and Microsoft are all partner node operators for the Render Network’s Tier 1 plan.

Competitive Advantages

In our view, Render Network has a number of competitive advantages, including:

Technological Ownership – Render Network’s parent company OTOY owns the render engine OctaneRender, leading to easy integration with the Render Network and convenient onboarding for existing customers.

Large Network – Render Network boasts a large network of node operators and creators within the 3D rendering industry. Aside from node operator partnerships with Google, AWS, and Azure, Render has been used by industry leaders for mainstream projects such as artists like Lil Nas X, productions for NASA, Hollywood films, among others.

On-Demand Services – Unlike AWS, GCE, and Azure, Render Network’s GPUs are on-demand instead of pre-reserved instances. This could allow Render Network to be competitively priced and to offer more specialized services. As mentioned ealier, AWS, GCE, and Azure are trusted partners and node providers for Render’s Tier 1 (Enterprise) service.

Market Leaders – Render Network is the largest decentralized provider of GPU computing power. Their ownership of the OctaneRender engine and extensive integrations with more than 20 industry-leading Digital Content Creation (DCC) tools (see below) makes it difficult for new entrants to match, creating significant barriers to entry.

Key Metrics

Render Network shares two main metrics with respect to tracking network usage: frames rendered and RNDR used. Frames rendered refers to the number of frames rendered from OctaneRender jobs, while RNDR used refers to the amount of RNDR tokens used to pay for those jobs.

Frames Rendered: In 2021, the network rendered approximately 5.95 million frames. This increased substantially in 2022, with about 9.42 million frames rendered, marking a growth of roughly 58.2%. In Q1 2023, the network continued to maintain high output, rendering over 2.11 million frames.

RNDR Used: In 2021, approximately 1.49 million RNDR were used, increasing to about 1.85 million in 2022, an increase of approximately 24.3%. In Q1 2023, around 500 thousand RNDR tokens were used, demonstrating continued demand for rendering services on the network.

While there was a slight decrease in demand during the first quarter of 2022 compared to the latter half of 2021 (see images below), the network has generally maintained a consistent growth trajectory since its inception in 2021.

Note that whilst the team has been sharing network utilization (percentage of nodes utilized) numbers, they have been vague and inconsistent and thus have been excluded from this section. However, the team has indicated that detailed dashboards will be built once the network has completed its move to Solana, so we can look forward to seeing more granularity in the future.

Tokenomics

RNDR is an ERC-20 token on the Ethereum and Polygon (bridged) networks. RNDR currently has a maximum supply of 536,870,912 tokens, 363,911,539 (~68%) of which are currently circulating. At launch, the token was distributed as follows:

25% – Public and Private sale in 2017 and 2018 (no vesting)

10% – RNDR Reserve; for marketing and user acquisition purposes

65% – Token Emissions; for “flowback into the network”, ie. token supply and demand management

As mentioned previously, RNDR tokens are used by creators to pay for usage of the Render network, which is paid out to node operators. While there exists a fee switch that can charge between 0.5-5% in transaction fees to pay for costs associated with running and maintaining the network, transaction fees are currently set to 0%. There is no staking utility nor burn mechanism implemented – thus, token holders can only anticipate potential value increases due to speculative market activity and not from inherent value accrual.

However, Render Network's token economics will undergo a significant change with the implementation of RNP-001. The proposal was designed to increase the supply of RNDR tokens by adjusting the emission schedule, which introduces a 20% increase in the total supply of RNDR tokens, changing the maximum supply from the original 536,870,912 to approximately 644,245,094 tokens.

This new schedule was adapted from Helium Network’s burn-and-mint model and aims to incentivize both Creators and Node Operators to participate in the Render Network by ensuring a consistent flow of tokens.

With the new emission schedule, the allocation of RNDR tokens changes as follows:

Creators: Under this new model, Creators receive a percentage of their spent RNDR back in the form of RNDR token rewards on a regular basis. This system aims to incentivize further network use and reward power users by enabling them to render more creations on the Render Network. Percentage returns could initially be as high as 100% of RNDR spent, and will gradually taper over time.

Node Operators: Node operators are rewarded in two distinct ways:

Coupon Token Rewards: Node operators receive incentives for completing jobs submitted to the network.

Availability Rewards: Node operators receive incentives for maintaining their availability or "liveness" on the network.

Liquidity Providers: Liquidity providers play a crucial role in the new Burn and Mint Equilibrium (BME) model. They are rewarded per epoch for contributing staked tokens to the liquidity pools on partnered exchanges, ensuring RNDR availability. The reward could be an additional percentage of the tokens staked during that epoch, as determined by the network.

Core Team: Supplementing RNP-001 is RNP-003, which proposes that 50% of Year 1’s emissions (4,563,402 RNDR) be sent to the RNDR Foundation for the purpose of core team expansions and grant programs.

The new emission schedule means that RNDR has the potential to be a deflationary asset, should demand outstrip the proposed emissions schedule. The emissions schedule can be supplemented with “recycling” of burnt tokens to reward fulfillers should incentives be insufficient through minting. Furthermore, treasury reserves or DAO contributions might be used to further supplement incentives.

Network Expansion

The Render community recently voted through RNP-002, which represents a significant shift for the Render Network. This core-technical proposal advocates for implementing the Burn and Mint Equilibrium (BME) model proposed in RNP-001 on the Solana blockchain to meet escalating technical demands.

Solana was chosen after thorough evaluation and consideration of factors such as community support, transaction throughput, fees, and programming language support. Notably, Solana outperforms Ethereum and Polygon in terms of transactions per second (TPS), a critical factor for Render Network's future scalability and on-chain data transparency. Solana has a TPS of around 4080, which is 290 times Ethereum’s ~14 TPS and over 140 times that of Polygon, which manages roughly 29 TPS.

Moreover, Solana's support for Rust and C++ enables high-performance code execution for GPU render work and smart contracts, providing a robust and flexible development environment. While Solana’s stability issues are acknowledged, the proposal expects the highly anticipated validator client update, Firedancer, to hugely improve the network’s reliability and scalability.

Strengths

Secular growth: unlike most crypto projects, Render Network’s usage is largely uncorrelated to crypto market conditions as it services multiple industries such as gaming, metaverse and AR/VR development, architecture, animation, interior design, product design, and AI tooling.

Expansion to AI: while Render Network’s newly added support for Stable Diffusion is currently running on centralized nodes, the potential for more AI-related integrations is huge. Demand for Large Language Model (LLM) tools such as ChatGPT has exploded recently (more than 13 million DAU reported), and Render has suggested these could be integrated in the future. LLMs require a significant amount of GPU processing power, as indicated by OpenAI partnering with Microsoft’s Azure for its GPU network.

Continual integrations: This is likely where Render’s ties to OTOY, a historic incumbent in the rendering space has a distinct advantage, as it likely expedited new integrations with other industry-leading render engines - particularly with Maxon’s Redshift and Autodesk Arnold impending. This increases the total addressable market (TAM) of the Render Network significantly by broadening the range of potential users that can take advantage of the network’s rendering services.

Octane X expansion to Apple M1 and M2 devices enables users from the Apple ecosystem to create works and be directly integrated with the Render Network to offload rendering workload to thousands of decentralized GPU nodes. This greatly expands Render Network’s addressable market to virtual production, Augmented Reality (AR), and mobile rendering.

The migration to Solana is significant, as it allows Render Network to scale further, due to Solana’s high throughput, lower fees, and the conducive development environment that Rust and C++ compatibility provides.

Risks

Weak value accrual — in its current state, there is no flow of revenue to the RNDR Foundation nor its token holders. However, this is being addressed with the upcoming BME model (RNP-002) and an imposed 5% network fee on all transactions. Some quick math: as of the time of writing, RNDR is trading at $2.3. Taking RNDR usage in 2022 of 1.85 million, 5% of this represents an annualized revenue of around $212,750. Note that this would be revenue to the RNDR Foundation and not to token holders. Token holders may benefit from RNDR being potentially deflationary due to the new BME model. Note that the Foundation is separate from OTOY, which earns revenue from OctaneRender subscriptions.

Competitive force: As mentioned earlier, Render has a strong foothold on the market due to its ownership of OctaneRender, its partnerships, and its extensive integrations with industry-leading 3D tooling. However, competition growth is always a possibility. We see this with Golem Network (GLM), who are currently in the early stages of testing a proof of concept GPU network for Stable Diffusion jobs. While still insignificant, time will tell if competition can pose a significant challenge to Render’s market dominance.

Technology Transition: the proposed transition to Solana might present technical and operational challenges. Although Solana offers potential benefits in terms of scalability and transaction costs, the network has previously experienced stability issues. Should Firedancer fail to address these stability issues or if the transition does not go as smoothly as anticipated, this could possibly impact the operation and growth of the Render Network.

Synthesis

All in all, Render Network represents a bold entry for Web 3 into other significant trends: from the graphics-heavy industries of AR and VR, to upcoming fields that may require increasingly scalable computation infrastructure such as AI.

While Render likely retains a strong competitive moat given its roots in OTOY and rapid integration pipeline, its upcoming technology transition to Solana may represent a risk in the short term, while longer term bears competitive risk from other Web 3 entrants.

References

RNPs

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about