PENDLE: Kickstarting LSDFi Summer?

Understanding PENDLE's 25x run this year

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

You may have heard of LSDs (liquid staking derivatives), but have you heard of LSDFi? Coined by unshETH back in January, LSDFi is a merge between two acronyms — LSD and DeFi (decentralized finance). Thus, LSDFi is the integration of Liquid Staking Derivatives with decentralized Finance.

LSDs are tokenized forms of otherwise locked staked assets, which makes them “liquid”, and takes advantage of their inherent yield to build the foundation for DeFi activities such as lending, borrowing, yield farming, leverage, etc. This approach of tokenization enhances the capital efficiency of staked assets, allowing for participation in dynamic DeFi ecosystems.

This week’s report takes a look at Pendle, an innovative LSDFi protocol on Ethereum and Arbitrum. Its token, PENDLE, has had an impressive run since the turn of the year, up almost 25x as of the time of writing.

What happened - and is Pendle poised for continued growth?

What is Pendle?

If you’ve been involved in the DeFi space long enough, you’ll know that it is difficult for users to predict and optimize yield from lending due to its highly fluctuating nature. Lending rates are volatile because general market trends, micro-factors and the inherent volatility of the crypto market affect the demand and supply dynamics for lending and borrowing. This uncertainty and lack of control can limit users’ ability to maximize earnings or hedge against downturns, potentially leaving significant value on the table. These challenges limit the potential for investors to fully harness the potential of their yield-bearing assets in an efficient and risk-managed way.

Enter, Pendle.

Pendle aims to solve this by introducing a permissionless yield-trading protocol that provides users complete control over their yield strategies. It does this through a three-fold approach, beginning with yield tokenization.

Tokenization of Yield Assets

Yield Assets: A Foundational Building Block

Before we dive into yield tokenization, let’s first take a look at yield assets.

The approach of utilizing yield assets as the foundation for DeFi products is not a new one. Terra’s multi-billion dollar ecosystem was built on top of UST, a stablecoin that had ~20% APY yield for most of its life before its ill-fated end.

Another example is GMX’s GLP, a yield-bearing token that is made up of an index of assets used for swaps and leverage trading on the GMX exchange. Due to its consistent yield, various protocols have been built on top of GLP, such as yield aggregator and optimizers, custom yield and leveraged strategies, among others.

We also see this in traditional finance (TradFi) markets where US Treasury Bills (T-Bills) form the foundation for various TradFi products and strategies such as money market funds, collateral for short-term loans, hedging strategies, etc., serving as the backbone of the financial ecosystem due to their consistent yield and liquidity. In fact, T-Bills have already been tokenized and this growing sector is already at more than $600M in TVL.

Yield Tokenization

Yield tokenization on Pendle involves wrapping yield-bearing tokens into Standardized Yield Tokens (SY), which in turn can be broken down into its two constituents.

Imagine you have a savings account that pays you interest over time — that interest is similar to what we call "yield" in crypto. Now, let's say you want to sell the future interest you're expected to earn without selling the money you initially put in, which we call "principal". This is typically difficult, if not impossible, with a traditional savings account.

Pendle does this by creating an onchain interest rate swap.

It does so by taking a token you own that has an underlying yield (e.g. your liquid staked ETH, stETH, that’s earning staking yield from Ethereum), and puts a wrapper around it to create what it calls a Standardized Yield token (SY).In other words, you stake your ETH on a liquid staking platform, obtain stETH, then you deposit the stETH into Pendle, and receive SY-stETH.

This in turn can then be split into principal token (PT) and yield token (YT) components. As their name suggests, the former represents the value of your principal, while the latter represents your future yield, stripped out as a tradable asset.

This means that the yield is tokenized into a separate asset - similar to a interest rate swap. There is a similar process in TradFi called bond stripping, where the principal and interest components of bonds are separated. Drawing a parallel, the PT in Pendle's system are similar to zero-coupon bonds, which are bonds that do not pay interest until maturity. Meanwhile, YT can be compared to the detached coupon payments, which are periodic interest payments that a bondholder receives from the bond issuer.

With their yield tokenization model, Pendle creates a more flexible way of trading your future interest or "yield", without having to touch the initial money or “principal” you put in. Savvy users can leverage on this to better manage and maximize their potential earnings.

Pendle AMM

Pendle introduces an Automated Market Maker (AMM) to facilitate trading of the Principal Token (PT) and Yield Token (YT) components. The AMM facilitates trading for each Standardized Yield token (SY) and its PT and YT components, via a single liquidity pool that contains ONLY the PT and SY tokens.

What about the YT component?

Because there’s only a PT/SY liquidity pool, a pseudo-AMM model makes use of a unique mechanism to enable the trading of YT components — this is made possible due to the unique relationship between PT and YT, where:

Principal Token (PT) + Yield Token (YT) = Standardized Yield Token (SY)

Let’s look at an example:

Buying YT

The buyer sends SY into the swap contract

Contract withdraws more SY from the PT/SY pool

Mint PT and YT from all the SY

Send all the YT to the buyer

All the PT is sold for SY and returned to the PT/SY pool

Selling YT

The seller sends YT into the swap contract

Contract borrows an equivalent amount of PT from the pool

The YT and PT are used to redeem SY

SY is sent to the seller

The remaining SY is sold to the pool for PT to be returned to the pool

This mechanism is called a flash swap, and allows for efficient trading of YTs via the singular PT/SY liquidity pool. Furthermore, because there’s only one pool for two different assets, this doubles the yield from LPing.

Tokenomics

PENDLE

The PENDLE token was launched in May 2021 with an initial supply of 188,700,000 tokens and was distributed as follows*:

29% – Team; 1-year cliff, 2-year vest, quarterly release**

21% – Investors & Advisors; 3-month cliff, 1-year vest, quarterly release**

24% – Ecosystem Fund; 50% no vest, 50% unlocked after 1 year

17% – Liquidity Incentives

9% – Liquidity Bootstrapping

*Note that articles from Pendle’s Documentation and Medium show a snapshot of token distribution about two years after launch. The above distribution by the author is based on onchain data of the initial mint and can be verified on etherscan.

**All team and investor tokens have been fully vested as of April 2023.

PENDLE utilizes a hybrid inflation model, which consists of three phases:

Phase 1 (Week 1-26) – Stable Inflation; 1.2M PENDLE a week

Phase 2 (Week 26-260) – Decaying Inflation; Starting from 1.2M PENDLE a week, inflation will begin to decay at a rate of 1% a week.

Phase 3 (Week 260-n) – Terminal Inflation; After 260 weeks, a stable inflation of 2% a year will be introduced based on the circulating token supply.

Based on the above, the weekly emission as of the time of writing would be around 450k PENDLE a week.

vePENDLE

Pendle utilizes the vote-escrowed model ve(3,3), an adaptation of the model pioneered by Curve, for its governance. When users stake (lock) their PENDLE tokens, they are given vote-escrowed PENDLE (vePENDLE). The amount of vePENDLE that users get is based on two factors: how much PENDLE they've locked and how long they've committed to lock it for, with the maximum lock period being two years. Over time, the value of this vePENDLE decreases and eventually drops to zero when the locked period is over. At that point, users can access their originally locked PENDLE tokens again.

vePENDLE is used to control incentives and direct rewards to different pools. Holders get to vote on how rewards are distributed, meaning the more vePENDLE a user holds, the more incentives they can direct. Votes are recorded at the start of each week and are used to adjust incentives for each pool.

Holders of vePENDLE also receive benefits from voting for a pool. They are entitled to 80% of the pool's collected swap fees, which are split evenly among all the voters. Additionally, Pendle takes a 3% fee from all yield accrued by Yield Tokens (YT), and currently distributes 100% of this fee to vePENDLE holders. Furthermore, a share of the yield from matured, unredeemed Perpetual Tokens (PTs) is also given to vePENDLE holders. All rewards are converted to USDC and distributed regularly.

The annual yield (APY) for vePENDLE consists of base APY (interests from YT and matured PT rewards) and Voter's APY (80% of swap fees from voted pools). The maximum potential rewards, or vePENDLE Max APY, are the sum of the Base APY and the highest possible Voter's APY.

Additionally, if a user is a liquidity provider (LP) in a pool and holds vePENDLE, their PENDLE rewards can be boosted by up to 250% based on their vePENDLE holdings. This boost rate is fixed when first applied and remains constant until the user changes their LP positions.

Protocol Revenue

As explained above, the protocol has 2 revenue sources:

Swap Fees – fees generated by all swaps on the Pendle AMM.

YT Fees – fees from all yield accrued by all YT in existence and yields from matured, unredeemed PTs, currently set at 3%

As of the time of writing, vePENDLE holders are earning a max APY of 7.6%: 0.096% APY from YT and matured PT interests, and a maximum of 7.51% APY if the vePENDLE holder also voted for the highest earning pool.

Given that there are ~28.4M vePENDLE and only ~19.5M vePENDLE was used to vote, the average return to vePENDLE can be calculated by taking a weighted average of the returns for non-voters and voters. Considering an APY of 0.096% for all holders and an additional APY for voters based on the weight of votes for each pool, this results in an average return of approximately 1.32% APY for vePENDLE.

As of the time of writing, ALL protocol revenue goes to vePENDLE holders and voters. While Pendle does not take a share of any protocol revenue at this point, a portion of protocol revenue may be redirected to the Pendle Treasury in the future, should it be approved via governance.

Key Competitors

In terms of competitors in the same sphere (yield tokenization and yield splitting) as Pendle, there is only one that meets the criteria of being live and having a token – APWine. Note that APWine recently announced its V2 protocol, which will be rebranded to Spectra. The V2 protocol will also involve yield-splitting, while APWine will progressively be phased out.

This section will also explore the broader sector of LSDFi since it is the sector that arguably revived Pendle and brought the protocol into the spotlight.

Yield-Splitting Protocols

Launched in 2020, APWine was one of the earliest DeFi protocols that split yield tokens into its principal and future yield components. APWine enabled the trading of principal tokens (PT) and future yield (FT) tokens, allowing users to long or short token APRs.

Prism Protocol, no longer live, is the largest yield-splitting protocol by TVL to ever exist in DeFi. At its peak, Prism Protocol had over $602M in TVL and was valued at $770M FDV before the Terra crash. Prism Protocol will soon be re-launching as an appchain on Cosmos.

Competitor Comparison

From the comparative analysis, we can see that Pendle is the top protocol by a large margin in the yield-splitting category, commanding a significant majority of the market share with a total value locked (TVL) of $134 million. This stands in stark contrast to its singular* live competitor, APWine, which only accounts for a modest $225,786 in TVL.

When evaluating against metrics from Prism Protocol at its peak, Pendle's FDV/TVL ratio is observed to be in a comparable range, suggesting similar market perception in terms of value relative to TVL.

*APWine is the only other yield-splitting competitor besides Pendle that is live with a token to the author’s knowledge. Element Finance has been rebranded and its token is not currently liquid.

LSDFi

Since the rise of ETH liquid-staking derivatives catapulted Pendle into the limelight, it is only fair to compare Pendle amongst protocols that are competing for LSD liquidity.

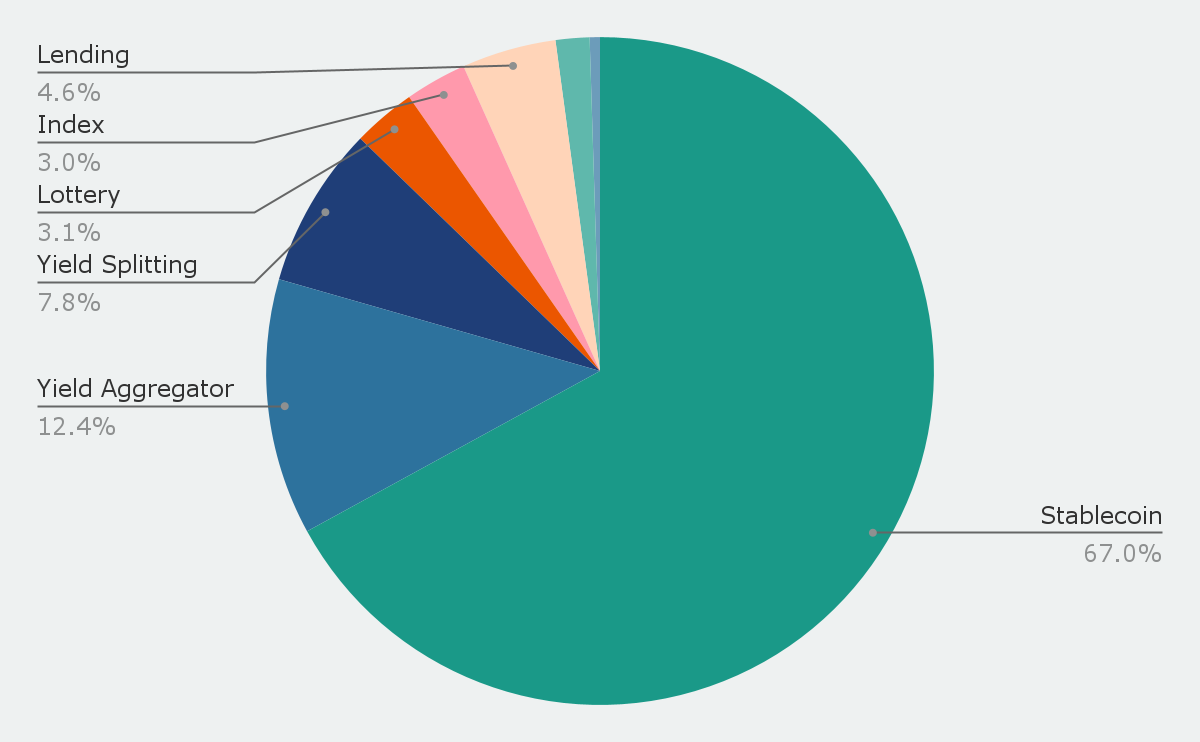

As of the time of writing, a total of $729M in LSD TVL is tracked on this Dune dashboard by defimochi. I have added Sommelier Finance’s $6.6M LSD TVL to the data, bringing the total LSD TVL to around $736M.

Of these protocols, Lybra Finance (LBR) is the largest protocol by TVL, having accumulated more than $344M in LSD liquidity, commanding a 46.9% market share. Pendle is the fourth largest protocol by TVL, with $57M in TVL and a market share of 7.8%.

Grouping these protocols together by category shows that Stablecoin protocols command the most TVL (67%), followed by Yield Aggregators (12.4%), Yield Splitting (7.8%). It is interesting to note that most of the TVL (84.5%) utilized in these LSDFi protocols involve some form of leverage, a phenomenon that seems to mirror that of the US Treasury bond markets.

LSDFi Competitor Comparison

Catalysts

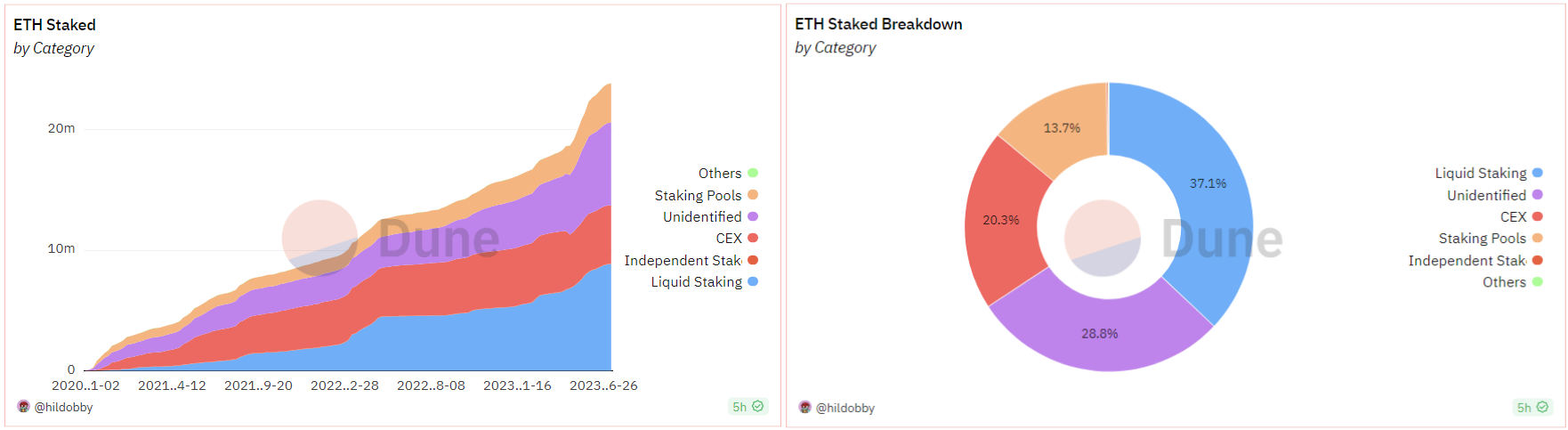

Growth of ETH staking and Liquid Staking — Since the Shapella upgrade, the amount of staked ETH has seen consistent growth, surpassing 20% staking ratio just recently. Concurrently, the proportion of ETH in liquid staking has expanded, now accounting for almost 40% of all staked ETH. The staking ratio for the top 10 Proof-of-Stake (PoS) chains, excluding Ethereum and Binance Smart Chain (BSC), is currently around 50%. This scenario indicates a potential for further growth in ETH staking. As this sector continues to flourish, it is anticipated that users will be inclined to optimize their staking yield by choosing LSDFi protocols that deliver the highest yield with the least perceived risk. Therefore, the ongoing growth in ETH staking and liquid staking can potentially translate into sustained benefits for Pendle.

Cross-chain Expansions — Pendle recently expanded to BSC, opening doors to new partnerships with an entire ecosystem of protocols and more importantly, a new LSD market, one that also has room to grow — BNB staking ratio is at 14.55%. Having found a successful formula, Pendle will be able to easily expand to new chains, reaching new users and liquidity sources with each expansion.

Pendle Wars — reminiscent of the Curve Wars, protocols like Penpie and Equilibria are now fighting for PENDLE liquidity. As of the time of writing, both protocols are neck and neck, controlling ~26% of vePENDLE supply respectively.

The growth of protocols built on Pendle lays a foundation for its ecosystem to thrive. This is largely due to the retention of liquidity and the network effects that incentivize liquidity for these protocols. As more users and protocols across various chains build on and interact with Pendle, its utility and value to the ecosystem increase, which in turn attracts more users and protocols. This positive feedback loop is a classic network effect and a significant growth driver for leading DeFi platforms today.

Pendle Earn — Pendle recently launched Earn, a fixed-rate product that lets users deposit supported assets to earn a consistent yield without any lockup period. This streamlined product simplifies the process of leveraging the fixed yield from Principal Tokens (PTs), derived from their inherent value appreciation as they near maturity. Simply put, the established Fixed Yield APY comes from the known end value of PT in relation to the underlying asset. Given the complex nature of yield splitting, having a fixed-rate product with plug-and-play capabilities makes onchain yield more accessible to a broader user base — retail, institutional, and even CEX integrations. For these reasons, it is likely that the Earn product will attract more TVL to the protocol in the near future.

Risks

Highly Competitive Sector — The liquid staking category is the largest in DeFi, at $22B TVL. Numerous protocols are already battling for a share of LSD liquidity, with more than $765M TVL locked in 13 tracked LSDFi protocols according to this Dune dashboard. Note that this is a conservative number due to the lack of complete coverage of the Dune dashboard. This race for a share of LSD liquidity likely means that liquidity may not be sticky and will flow to those offering the most attractive risk-reward balances and incentives.

Valuation — Pendle’s MC/TVL and FDV/TVL ratios are 0.58x and 1.38x, which, when compared alongside its competitors (see LSDFi Competitor Comparison above), appears to be already fairly valued. Taking its market cap of $86.3M and annualized fees generated of $472.6K, PENDLE is trading at 183x earnings — far above its competitors LBR (9.23x), ALCX (11.43x), and MAV (14.86x).

References

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about