Morpho Blue: A new DeFi bluechip in the making?

What makes Morpho Blue and its MORPHO token unique? Can Morpho Blue challenge the dominance of AAVE and position itself as the next bluechip in money market protocols?

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

Introduction

Lending protocols are among the core primitives of DeFi alongside decentralized exchanges. While DEXs have seen significant innovation in recent years, with developments such as Uniswap v3's concentrated liquidity, Trader Joe's liquidity book, Maverick's dynamic distribution AMM, and Uniswap v4's hooks, updates to lending protocols have been less exciting by comparison.

It's not to say that there hasn't been progress. For instance, Compound v3 introduces an upgrade that transforms the cross-asset market into a single borrowing market. In this model, the 'base asset' (USDC) can be borrowed using other assets as collateral. This iteration puts a strong emphasis on simplicity and security.

AAVE v3, on the other hand, introduces 'efficiency mode' (e-mode) that allows for a loan-to-value (LTV) ratio of more than 90% for correlated assets (e.g. stETH & ETH), enabling users to take advantage of it for lucrative leverage looping trades.

At present, Compound and AAVE are the most forked protocols aside from Uniswap, which speaks to the strength and soundness of their designs. However, this raises the question of whether or not this is the final form that lending markets will take. Is it possible that a new model will emerge to challenge their dominance?

Morpho Labs is a project that aims to enhance the efficiency of lending markets and address their shortcomings. Their initial product, Morpho Optimizer, is a peer-to-peer (P2P) matching layer built on top of existing lending pools. It utilizes a matching engine to connect borrowers and lenders, providing a better rate for both parties compared to the interest rates determined by the lending protocols. Earlier this year, Morpho Labs launched Morpho Blue, its own next-generation lending market that seeks to address the design inadequacies in traditional lending markets.

How does Morpho Blue's isolated lending market design differ from others? What is Metamorpho Vault? What is the adaptive curve interest rate model (AdaptiveCurveIRM)? How do non-transferable MORPHO token emissions work? And can Morpho Blue challenge the dominance of AAVE and present itself as the next bluechip in lending? These are the questions we explore in this memo.

Primer on Lending Protocols

1. Basic Mechanism

Let’s first go over the basics of a lending / money market protocol. Lending protocols automate the borrowing and lending of crypto assets. In doing so, they facilitate the allocation of capital within DeFi. Lending markets mostly operate in a peer-to-pool structure: borrowers interact with smart contracts that pool the liquidity supplied by various lenders. The interest rates in these money markets are set automatically, depending on the demand and for loans and the pool size, as well as other parameters decided by the governance.

When users deposit assets into Aave's liquidity pools, they receive platform-specific receipt tokens such as aTokens for AAVE or cToken for Compound. For instance, if a user deposits DAI in AAVE, they will receive aDAI. Each aToken corresponds to a specific asset, which enables users to earn interest passively. When the lender redeems, the aToken is burned and the lender receives the original token plus the interest accrued.

Several other group of stakeholders including borrowers, liquidators and governance participants collectively contribute to the functioning of money market protocols. The below illustration summarizes the core interactions these stakeholders have with the protocol.

2. Interest Rates Mechanism

Another key aspect to understand lending markets is how interest rates are determined. The variable interest rate mechanism employed by money market protocols are driven by the supply and demand of loans.

In these markets, interest rates are defined by a formula containing a multiplier (slope), a base rate (intercept) and the utilization rate.

Borrow Rate = A * Utilization Rate + B

Here, A represents the slope and B the intercept, with both parameters set by governance that takes into account the perceived risk associated with each asset. Utilization Rate represents the the ratio of borrowed loans out of the supplied assets (i.e. a percentage represented by a number between 0 to 1).

The supply rate is subsequently calculated as follows where the reserve rate represents the fee the protocol takes from the borrowers, essentially the Net Interest Margin (NIM).

Supply Rate = Borrow Rate * Utilization * (1- Reserve Rate)

Most rate models also feature a 'kink' function to assign an optimal utilization level for the token market—typically 60 to 80%. This function increases borrowing costs sharply beyond a certain threshold to discourage excessive borrowing and encourage repayment.

This aims to prevent scenarios where market utilization hits 100%, locking out lenders from withdrawing their assets. By implementing this 'kink' or target utilization, the model ensures liquidity remains available for lenders wishing to withdraw or recall their loans at all times.

However, there’s one downside. Such a design means that the bid-ask spread between the lending and borrowing rate is proportional to the slope of the curve and tends to grow with the utilization rate. The way the formula is set means there is no utilization level where the spread between borrowing and lending is zero. This results in sub-optimal levels of utilization and capital inefficiency.

Morpho P2P Optimizer

To address the issues of large spread between lending and borrowing rate, Morpho Labs’ first product is an optimizer layer on top of these lending pools that seek to match lenders and borrowers in a P2P manner to improve rate.

Initially, a supplier deposits a token (say ETH) into Morpho. In scenarios where there is no immediate borrowing demand, Morpho temporarily allocates this liquidity to the underlying lending pool (Compound or AAVE), receiving $cETH or aETH tokens. At this point, from a supplier's perspective, this is exactly the same as directly using Compound or Aave.

Now when a borrower seeks to take out a loan through Morpho, Morpho's system then initiates its matching engine to identify if a corresponding lender is available. Successful matches result in Morpho redeeming the appropriate $aTokens to then lend to the borrower in a P2P transaction directly. They key is that the borrower is no longer borrowing from the a pool of aggregated funds, but paired directly with a lender that seeks to offer the loan on the opposite side.

If a supplier wishes to exit while the borrower is still maintaining the loan, Morpho goes directly to the underlying protocol and borrows at a higher rate to settle with the supplier, transferring the borrower's loan back to the lending pool at the new rate.

In other words, If P2P matching is unsuccessful or incomplete, borrowers can access liquidity directly from the pool under the same conditions they would face before. By matching lenders and borrowers directly, Morpho can set rates that are more competitive, lying within the acceptable range of the base lending pool's rates. This reduces the spread between what lenders earn and borrowers pay, making DeFi lending more efficient and profitable.

As of now, Morpho Optimizer isn't earning revenue, although it has the ability to charge protocol fees in its code. The decision to activate these fees lies with the governance. If implemented, protocol fees would be derived from a portion of the enhanced peer-to-peer (P2P) APY. Specifically, this fee would come from the difference between the P2P APY and the standard supply rate for lenders, or the borrow rate for borrowers.

Morpho Blue

In 2024, Morpho Labs launched Morpho Blue, which is not an optimizer but a new protocol designed from the ground up. It seeks to be the base layer of lending markets with a trustless and permissionless design. Morpho Blue is built as a singleton contract, meaning every market lives in one single smart contract instead of each market having a different contract. This simplifies the protocol, reduces gas consumption and reduces surface area for exploits.

Instead of relying on governance to list assets and manage parameters, Morpho Blue is designed to leave choices up to the users, enabling them to create markets with any loan asset, collateral asset, risk parameters, or oracles. Different third party entities (e.g. MetaMorpho Vault managers) can handle risk management on behalf of the users, allowing them to deposit into lending vaults that supply directly on Morpho Blue according to different risk parameters.

In summary there are four main features of Morpho Blue:

(1) The Morpho Blue protocol consists of isolated pairs, which are individual markets with their own set of assets, collateral, and risk parameters. Each isolated pair operates autonomously without the need for manual intervention from the DAO to adjust risk parameters.

(2) Morpho Blue is a lending primitive with permissionless market creation. It enables the deployment of isolated lending markets by specifying one loan asset, one collateral asset, a liquidation LTV (LLTV), and an oracle.

(3) Through Morpho Blue, asset managers can create MetaMorpho Vaults, which are more specialized lending markets that can be curated for different risk profiles. For instance, a Leveraged ETH vault can choose to only deposit into Morpho Blue Markets with ETH LST as collaterals.

(4) Another innovation of Morpho Blue is AdaptiveCurveIRM (Interest rate model), it is a model that targets a 90% utilization and can dynamically shift the rate curve up or down as a whole depending on the current utilization vs. target utilization.

1. Isolated markets

A typical single cross-collateral pool, like those offered by AAVE and Compound, enables users to deposit supported assets as collateral and borrow all the other supported assets listed in the same pool. Although this arrangement brings convenience and efficiency, its structure is inherently risky. Specifically, sudden price fluctuations in a single asset can endanger all other assets within the pool.

This is why protocols must exercise caution when adding assets to cross-collateral pools. Carefully considering factors such as liquidity and reliable price oracles is crucial to mitigating potential risks.

In a traditional cross-collateral pool, where any asset can serve as collateral, the stability of the pool is only as robust as its weakest link—the asset with the lowest value or liquidity. A significant price drop or liquidity crisis in this asset could expose the entire pool to exploitation or undercollateralization.

This underscores the value of Morpho’s isolated markets, which consist of separate lending markets containing only two assets (one for collateral, one for borrowing). By setting unique parameters for each pair, these markets enable more precise risk management. Should any malfunction or exploitation occur, its impact remains confined to the affected pair, preventing a spill-over into the broader pool's assets.

Moreover, isolated pools promise users a greater degree of flexibility. With each pool supporting different parameters, users can select pools that best match their risk tolerance and asset preferences.

While isolated pools enhance user choice and security, they introduce certain compromises. One notable drawback is the potential for fragmented liquidity as assets disperse across multiple pools. However, Morpho's MetaMorpho Vault (discussed below) aims to address this challenge, promising a novel solution to unify and streamline liquidity across the ecosystem.

2. Permissionless market creation

Another key value proposition of Morpho Blue is the introduction of permissionless market creation. This feature represents a significant departure from traditional lending platforms such as Aave and Compound. In essence, it empowers users to independently create their own lending markets without requiring centralized approval. Each market incorporates five critical components:

Loan Asset: The type of asset that can be borrowed.

Collateral Asset: The type of asset used as security for the loan.

Liquidation Loan-To-Value (LLTV) Ratio: A threshold that, similar to collateral ratio, if exceeded, makes the loan eligible for liquidation.

Oracle: A trusted source for real-time price feeds

Interest Rate Model (IRM): The formula that determines the interest rates applicable to loans.

This framework is a notable pivot from the approach of traditional DeFi platforms, which typically require a centralized governance process to approve new asset listings and adjustments to market parameters, limiting flexibility and responsiveness to market changes.

Within Morpho Blue, once a market is created, its parameters are permanent and immutable. This means that the decisions made at the time of market creation regarding LLTV and IRM are final and cannot be altered, operating within a governance-approved range to ensure a basic level of oversight and security.

3. MetaMorpho Vaults

Morpho governance takes a hands-off approach when it comes to managing users' funds. Instead, the protocol empowers users by allowing them to create their own markets tailored to their preferences, including the choice of loan and collateral assets, risk parameters, and price oracles. This open-market approach introduces a challenge: liquidity fragmentation. Since lenders have to choose specific markets for investing their liquidity, the available funds can become spread too thin across many markets.

To address this challenge, Morpho Blue incorporates the Metemorpho Vault design that allows for the aggregation of lending markets into a unified, multi-asset lending pool. This system enables passive lenders, who may not wish to navigate the complexities of individual market selections, to deposit assets like wETH into a Metemorpho vault. This vault, in turn, employs the expertise of a risk manager to distribute the deposits across various Morpho Blue markets that accept WETH as a loan asset.

The risk manager (which is an external party specialized in vault management not controlled by Morpho) plays a critical role in simplifying the investment process for users. They carefully select markets based on their collateral quality, LLTV ratios, and oracles, ensuring that users' investments are placed in markets that align with their risk tolerance and return expectations.

For example, “Re7 WETH MetaMorpho vault” curated by Re7 Labs aims to outperform staked ETH yields by lending WETH against a diverse set of Liquid Staking and Liquid Restaking Token collateral markets.

This also means that Morpho Blue’s design is a more fundamental protocol layer of lending where a Metamorpho Vault manager can recreate a structure of cross-collateral landing pool like AAVE on top of the isolated lending pairs. Currently, the curator of these vaults include well-regarded risk analytics platforms such as Gauntlet, Steakhouse Financials and BlockAnalitica.

4. AdaptiveCurveIRM

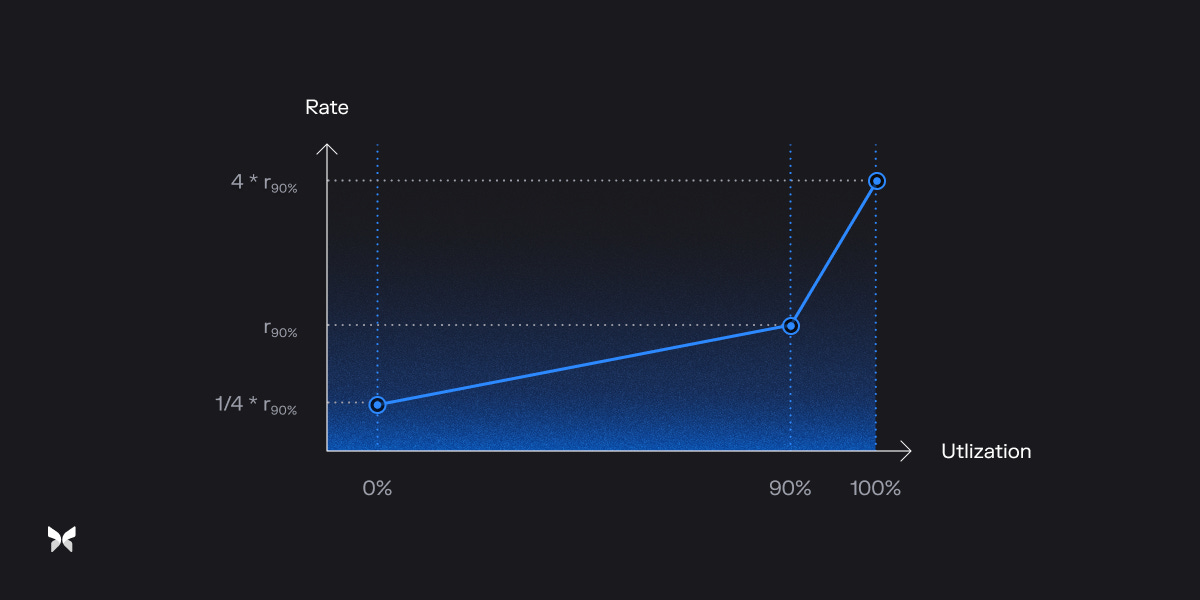

Morpho Blue also introduces the AdaptiveCurveIRM, an efficient Interest Rate Model (IRM). This IRM stands out for its ability to aim for a 90% capital utilization target, which is considerably higher than the typical rate set by traditional lending pools (except for e-mode). Its design incorporates two main mechanisms that work in tandem: the Curve mechanism and the Adaptive mechanism.

The Curve mechanism

This component of the IRM mirrors the traditional interest rate curves seen in conventional lending pools, employing a similar set of formulas with a kink model. As a reminder, the kink model is aimed to target a certain level of utilization rate of assets in the pool.

The Adaptive Mechanism

The Adaptive mechanism introduces another layer adjustment by fine-tuning the interest rates through modifications to the entire curve. These adjustments are contingent on the pool's utilization rate:

When utilization exceeds 90%, the curve shifts upward, increasing the interest rates. This is designed to discourage borrowing when the pool is nearing full utilization, thereby preventing liquidity shortages.

Conversely, when utilization falls below 90%, the curve shifts downward, reducing the interest rates. This encourages borrowing by making it more attractive, aiming to boost the pool's utilization back towards the target.

The rate at which these adjustments occur is directly proportional to the distance between the current utilization rate and the 90% target. This feature ensures that the interest rate adjustments are both responsive and proportional, allowing for a more nuanced and effective management of capital utilization within the pool.

Morpho Tokenomics

The Morpho token technically underwent a Token Generation Event (TGE) but remains non-tradable and non-transferable, therefore does not have a market price.

Token launches often face criticism for their centralized decision-making processes and the significant information asymmetry between founding teams/investors and potential buyers. Morpho's strategy of launching the MORPHO token as non-transferable directly confronts these issues. By granting the DAO the authority to initiate transferability, Morpho ensures that the decision to make tokens tradable is a decentralized one, reflecting the community's will.

The token has a maximum total supply of 1 billion MORPHO. 80% of the tokens were minted by the DAO, and the association minted 20% of the tokens and sold 19% of them to investors.

Unlike other protocols that schedule token emissions years in advance, Morpho has a flexible system that adjusts to changing needs. It's organized into ages, each lasting three months, with smaller periods called epochs for claiming rewards. A vote determines the token allotment for each age, providing a dynamic and adaptable reward system. There were 9 epochs in total so far:

Valuation of $MORPHO

Since the tokens are now non-transferable, there is no trading venue or market price for $MORPHO at the moment. This makes it difficult to determine the yield on incentives without a valuation and price. However, Morpho Blue is allowing users to custom input a fully diluted valuation (FDV) on their website to estimate the potential APY.

When considering the Morpho valuation from a fundamental perspective, one approach is to examine the potential revenue it can capture and use the price multiples of other lending protocols as a proxy.

AAVE is the clear leader in terms of TVL and annualized revenue. Across the board, lending protocols are trading at reasonable valuations (compared to infra chains) with a median multiple of 57x revenue.

Let’s now imagine if Morpho had a fee switch, how much revenue could be potentially captured with its current adoption?

Morpho P2P Optimizer - According to the website, there are currently $1.96 Bn worth of tokens supplied through Morpho Optimizers and $920 million borrowed. Of these, $600 million are matched in volume. With an average APY improvement of about 1%, and assuming Morpho takes a 15% cut (reserve factors of AAVE are 10-20%), this would translate to an annual revenue of $900k.

Morpho Blue - Morpho Blue’s revenue capture potential is larger as it is a base layer and its own protocol. Currently, the total supplied asset is around $550 million with total borrowing at $204 million. Looking at the top markets, we can estimate that the average 7D borrowing APY is around 16%. This means the borrowers are paying $32.6 million in interest to the suppliers annually. If we assume a 15% fee cut, this translates to $4.9 million generated per year. Overall, Morpho could be generating around $5.8 million in revenue per year. Using the multiples of top lending markets, the FDV of Morpho would be in the range of $334 million to $632 million.

However, it's important to note that this is a very crude model to value Morpho based solely on its current scale, TVL, and assumed fee. Multiple factors can change, such as the fee cut being higher than the assumed 15%, the borrowing rate increasing. The growth factor is another important aspect. Morpho has already amassed a TVL of $300 million in just 3 months with no signs of stopping. The markets would also price in a significant premium if the model is believed to represent a significant improvement over traditional lending models.

Other players in permissionless lending

Despite its impressive growth, Morpho is not without competition. Two other lending primitives that seek to unlock permissionless lending are worth noting, which are Anja Finance and Euler v2’s Ethereum Vault Connector (EVC).

Ajna is a peer-to-pool lending and borrowing platform that operates without requiring governance, similar to Morpho. However, Ajna goes a step further in that it does not require external price feeds or oracles to function. Instead, the protocol allows lenders to input the price at which they are willing to lend, with the price being the amount of quote token they are willing to lend per unit of collateral pledged by the borrower. For example, if a lender deposits at a price of 100, they are willing to lend 100 units of quote token per one unit of collateral. In other words, lenders are basically long term limit order buyers of the collateral that earn interest in the mean time.

Euler v2 is a modular lending platform with a feature called Ethereum Vault Connector (EVC). The EVC is a primitive that facilitates communication between ERC-4626 vaults and other smart contracts, providing access to unified liquidity and enabling protocols to accept deposits as collateral from vaults in the network. The EVC enables vault creators to connect their vaults, allowing for efficient information transfer and interaction between vaults, serving as base layer lending infrastructure.

A common characteristic of these protocols is their emphasis on establishing a unified foundational layer for lending with permissionless market creation. Among these, Ajna differentiates itself by being oracle-less, making it more well-suited for supporting niche, long-tail assets.

Tailwind and catalyst

When liquid staking tokens (LSTs) such as stETH were introduced on version 3 of the AAVE protocol in "e-mode," they enabled users to employ an aggressive 10x leverage strategy. This was achieved by repeatedly providing stETH and borrowing ETH, thanks to the high Loan-to-Value (LTV) ratio. This strategy significantly contributed to the volume in AAVE's borrowing. Currently, stETH is the most supplied asset on AAVE, while ETH is the most borrowed asset.

With the introduction of various liquid restaking tokens (LRTs), Morpho is poised to benefit from increased borrowing activities. With LRTs listed, a similar leverage looping strategy can be replicated. While traditional protocols like AAVE are still in the governance discussion on listing these new LRT assets, Morpho has already captured a significant portion of the market thanks to permissionless design. Today, we are already seeing sizable liquidity from StakeWise's osETH, EtherFi's weETH, Dinero's apxETH, and Renzo's ezETH. With the upcoming EigenLayer airdrop, the expansion of restaking and liquid staking sector will continue to fuel the growth of Morpho.

Conclusion - building genuine DeFi layer

Paul Frambot, the founder of Morpho Labs, distinguishes between two types of applications in DeFi when designing the Morpho protocol. Decentralized brokers and protocols.

Decentralized brokers are managed DeFi platforms that enable direct financial interactions between parties but require active human intervention to operate correctly. They have flexible, managed, and product-oriented code bases that incorporate various features and are maintained by multiple parties. Decentralized brokers rely on economic and statistical models for risk management.

On the other hand, protocols are trustless DeFi primitives that form the foundation for many more layers to be built on top. They do not require external interactions to operate correctly and do not rely on upgradability setters. Protocols are un-opinionated so that they enable a broader diversity of innovation on top of their primitive.

Historically, lending has gravitated toward the decentralized broker model. Morpho, however, aims to shift the landscape in a different direction, focusing on building "Genuine DeFi," the vision that DeFi should be organized in layers around trustless protocols. Morpho Blue's growing traction could spell a significant shift in the lending and borrowing landscape, potentially dethroning traditional protocols and establishing a new order.

References

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about