Mantle Network ($MNT): What Makes This Upcoming Layer 2 Unique

The modular scaling approach and what it means for Ethereum

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

The blockchain scalability issue has been a persistent one and has arguably been the driving force behind most developments in blockchain architecture. The quest for a highly scalable Ethereum network led to the rise of proof-of-stake (PoS) blockchains, sidechains (Polygon, Ronin), Layer 2 (L2) solutions such as optimistic rollups (Optimism, Arbitrum, zkSync, Polygon zkEVM), and other modular solutions (Celestia, Fuel, Nitro, Eclipse, EigenDA).

Other blockchain ecosystems with their own take on scalability have also materialized — Cosmos’ internet of blockchains, Polkadot and its parachains, Avalanche and its subnets, Solana and its native horizontal scaling, among others.

Try as they might, these new blockchain ecosystems have not managed to displace the Ethereum ecosystem. According to data from DefiLlama, Ethereum has over $27 billion in total value locked (TVL) while there are over $3.4 billion in TVL distributed amongst its rollups — making up for over 64% of all DeFi TVL. This shows that despite the emergence of alternative scaling solutions, the Ethereum ecosystem continues to dominate, with a healthily growing Layer 2 ecosystem as well.

This week, we dive into the new optimistic rollup on the block — Mantle Network. What sets Mantle Network apart in the already crowded field of L2 solutions such as Arbitrum and Optimism? Will its unique features and the largest DAO treasury in existence make Mantle Network a game-changer?

Let’s dive in!

What is Mantle Network?

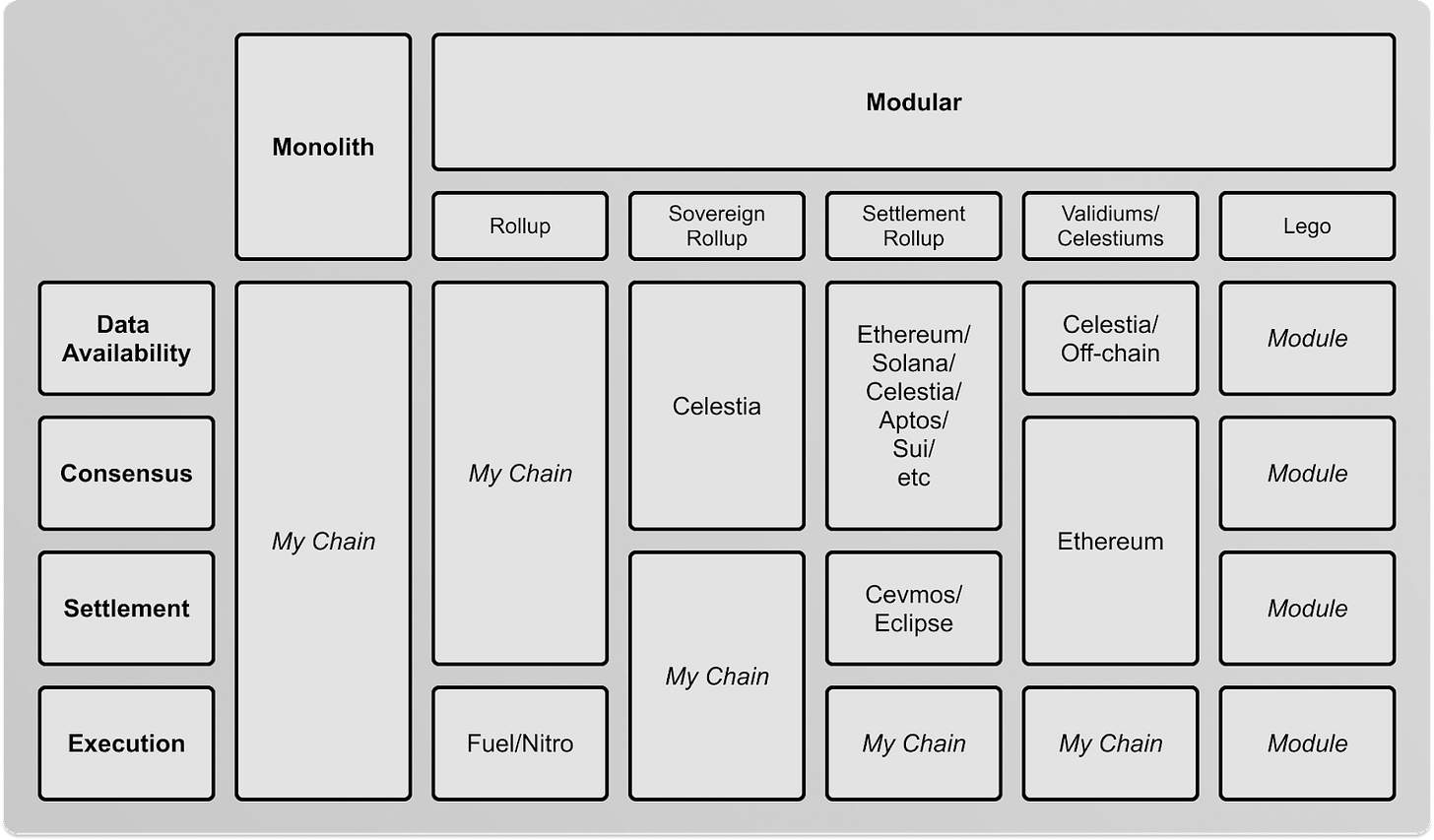

Mantle Network was envisioned as an iterative modular blockchain solution — ‘Iterative’ because it allows Mantle Network to be constantly developed and potentially integrate zero-knowledge (ZK) technology as it comes online; its 'modular' nature stems from its departure from traditional monolithic architecture. Monolithic architecture, in the simplest terms, is a unified model where the data availability, consensus, settlement, and execution layers are combined, making it less flexible and harder to scale — such as Layer 1 (L1) chains like Bitcoin and Ethereum.

Conversely, Mantle Network is taking the modular approach, which separates these layers, enabling greater scalability. This separation also paves the way for Mantle Network to experiment with diverse data availability solutions such as EigenDA — more about this later. This modular architecture allows Mantle Network to “hyperscale” throughput to hopefully achieve 1TB/s or more in order to support high-bandwidth applications such as gaming, social networks, etc.

Mantle Network Contributors

Mantle Network is backed by the newly rebranded Mantle, a result of the BitDAO-Mantle merger. Mantle Network development is being spearheaded by Windranger Labs, a Web3 accelerator and BitDAO contributor. Mantle Network development under Windranger was led by jacobc.eth, who has now transitioned to an advisor role. Jacob is also the Founder of HyperPlay, a Web3-native game launcher incubated by Game7 DAO of which Windranger is also a core contributor. Jacob has had extensive experience in Web3 — he was formerly Operations Lead at MetaMask where he played a role in growth and monetization strategies for both Consensys and MetaMask for almost 5 years. Prior to that, Jacob worked for over a decade in various roles in the tech industry and held two CTO positions.

Architecture

Recall the very first illustration of this article that showcased the different modular blockchain architectures compared to the monolithic blockchain. Mantle Network is a modular rollup — unlike a typical rollup which uses Ethereum for data availability, Mantle Network utilizes EigenLayer’s data availability product, EigenDA.

Data Availability

Imagine you have a library filled with all sorts of books — novels, textbooks, encyclopedias, comic books, everything. Data availability, in its most basic sense, is like making sure every book in the library can be found and read whenever someone wants it.

Now, just like a library needs to be organized so you can find a book when you want it, data also needs to be stored in a way that we can retrieve it when we need it. And it has to be reliable too, so it doesn't disappear or get damaged. That's essentially what data availability is all about — making sure the data is there when you need it.

Data availability in the context of blockchain networks refers to the capacity for all nodes to access transaction data within the network's blocks, enabling independent transaction verification and state calculation. It's crucial for a blockchain's decentralization, trustlessness, and security. However, data availability poses scalability and centralization challenges, due to redundancy and increasing storage needs. To address these, solutions like data availability layers (either on-chain or off-chain), sharding (splitting network into parallel sub-chains), and rollups (off-chain computation and storage) have been proposed, enhancing scalability while maintaining data accessibility.

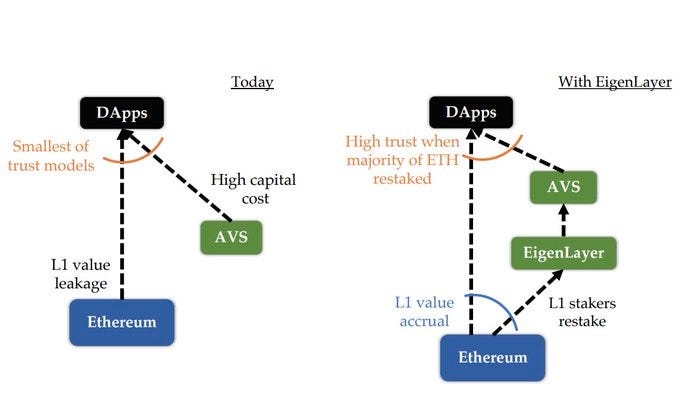

EigenLayer

EigenLayer is a protocol that allows for the permissionless addition of features to the Ethereum network that validators can choose to opt-in to support, earning fees in the process. Validators opt-in by re-staking their ETH in order to secure the new feature. By doing so, they take on additional slashing risk and the operation and facilitation of the new features. In short, this solves an important issue that new networks and protocols face, which is the high capital cost of bootstrapping the new network. By utilizing EigenLayer, new networks can rent pooled security provided by Ethereum validators for features such as consensus protocols, data availability layers, keeper networks, etc.

EigenDA

One such use case is EigenDA, a data availability layer secured by Ethereum that provides cheaper and higher bandwidth — up to 10MB/s. In contrast, Ethereum currently has a bandwidth of ~80 KB/s. EigenDA’s increased throughput is key for supporting gaming and social network dApps whilst reducing costs to the user, as they require a significant amount of bandwidth.

Optimistic Rollup (ORU)

The Typical ORU

Optimistic rollups (ORUs) typically rely on Ethereum for data availability, settlement, and execution. ORUs assume all transactions are valid (optimistic stance), and bundle transactions in batches before submitting on Ethereum. Any user can then challenge the outcome of an optimistic execution by submitting a fraud proof.

Fees on an ORU consists of gas fees for execution on the L2 network and rollup fees for settling on the Layer 1 (L1) network (Ethereum). Despite providing cheaper fees for users than if they were to directly interact with Ethereum, fees are still comparatively higher than if an ORU were to utilize a cheaper data availability provider.

Although ORUs have lower fees and higher throughput than the L1, one downside is that the withdrawal (L2 to L1 transaction) of funds from ORUs via the standard bridge takes a week due to the challenge period where fraud proofs are processed. This is because the ORU sequencer publishes state transitions to L1 before transaction data and state are audited. However, various protocols have built workarounds that allow users to instantly withdraw funds to Ethereum, such as via advanced bridging protocols for a higher fee, or directly sending funds to a centralized exchange (CEX).

Mantle Network ORU

Unlike a regular ORU, the Mantle Network ORU requires sequencers to execute and authorize transactions via a process called Multi-Party Computation (MPC) before publishing to L1. MPC ensures the security and credibility of transactions on L2 before it reaches L1, thus shortening the challenge period and providing quicker finality for users. While the maximum challenge period remains about seven days, the team has indicated that this improvement results in a wait time of just over a day. However, users will also be able to bypass the challenge period by using third-party bridging solutions or CEXs for instant withdrawals.

Another difference between a regular ORU and Mantle Network ORU is Mantle Network’s modular approach of using a separate data availability layer instead of Ethereum. This significantly reduces fees incurred by users due to the increased bandwidth availability, which consequently allows for high-bandwidth applications to run on Mantle Network.

Like other ORUs, Mantle Network will run a single sequencer operated by the core team before eventually decentralizing its sequencer operations. This allows anyone to run sequencers to produce blocks on the L2 network in a permissionless manner. This will be done via a leadership election mechanism, in which a scheduler appoints a leader from the sequencer set for each epoch. A decentralized sequencer set results in greater security by reducing a single-point-of-failure and allows for more ecosystem participation.

Fraud Proofs

As mentioned above, ORUs assume good behavior by considering all transactions are valid. To prevent bad actors from taking advantage of the optimistic nature of ORUs, fraud proofs are necessary to identify and challenge transactions with discrepancies. Imagine you're playing a game, and everyone playing is expected to follow the rules. But what if someone tries to cheat? We need a way to catch them, right? That's where fraud proofs come in; they're like a referee who checks if anyone's breaking the rules.

In the current implementation of fraud proofs, the on-chain verifier responsible for resolving disputes can only run commands in a more basic virtual machine, like MIPS or WASM. Back to the game analogy — its like having a referee who only speaks a different, simpler language (like MIPS or WASM). If the referee needs to check a rule in the main rulebook (Ethereum VM), they have to translate it into their simpler language first. This translation can cause some issues, like missing certain tricky rules or having to update the translation often. And most importantly, we can't be entirely sure if all the rules from the main rulebook are translated correctly. In the same way, the Ethereum Virtue Machine (EVM) has to recompile the fraud proof to be readable by the on-chain verifier, resulting in “a large trusted computing base (TCB), a lack of support for L2 client diversity, poor upgrade transparency and frequent upgrades” (Source: Specular). More importantly, the transpiling means that there is a blind spot because there is no way to guarantee that a fraud proof’s contents are from a compliant EVM client.

Mantle, on the other hand, works differently. It's like having a referee who speaks the same language as the main rulebook (Ethereum VM). This means the players (Ethereum client) can understand the referee without any translation needed. It's a similar system to what Mantle Network uses for their fraud proofs, which are implemented at the EVM-level, allowing all Ethereum clients to interact within a common proof system with on-chain verifiers, reducing the amount of trust assumptions between verifiers, clients, and compilers. This implementation is similar to that of Specular’s implementation of fraud proofs.

Tokenomics

Mantle has a somewhat unique origin which some have found confusing - in short, Mantle’s network token will be converted from the token of a DAO, BIT, that had direct ties to a centralized exchange, Bybit…

Let’s dive in.

MNT is the governance and gas token of the Mantle Network L2. As per BIP-22, BIT, the governance token of BitDAO will be converted to MNT tokens at a 1:1 ratio as a result of the BitDAO-Mantle merger proposed in BIP-21. The merger consolidates the BitDAO and Mantle brands into one entity – Mantle Network, in order to streamline messaging and avoid fragmentation of communities and mind-share.

BIT

Before we dive into the MNT token, let’s review the tokenomics of the BIT token.

BitDAO is a venture DAO that claims to drive “mass adoption of decentralized and token governed technologies”. With over $2.85B held in its treasury, BitDAO is the second largest DAO in crypto by onchain treasury value. However, over 75% of this value is in BIT, which currently trades ~$2-3M in daily volume - or 1/100th the value the treasury. Hence, the discounted value of the treasury in dollar terms should be significantly lower than $2.85B should the DAO decide to liquidate its holdings in real time.

The DAO has had close ties with Bybit as we will see below. BIT, the governance token for BitDAO, was launched on July 15, 2021 and began vesting on Oct. 15, 2021, with token allocations as below:

Private Sale: 5% — 3 months cliff, 12 months linear vesting.

Launch Partner Rewards: 5% — 100% released at launch.

BitDAO Treasury: 30% — 33.33% released at launch, 3 months cliff, 12 months linear vesting.

Bybit Flexible: 15% — 100% released at launch.

Bybit Locked: 45% — 12 months cliff, 24 months linear vesting.

Based on this, the BIT token release schedule is plotted out as shown below:

Tokens in the BitDAO Treasury are used for swaps, grants, milestone rewards, among others, and are administered by the DAO via governance. Bybit Flexible and Locked refers to tokens owned by Bybit, who in return pledged to contribute a portion of its revenues from its exchange business to the BitDAO treasury. As of Sept. 15, 2022, tokens allocated to the private sale and BitDAO treasury have completed vesting.

On Sept. 13, 2022, BIP-14 was passed, changing Bybit’s pledged contribution to BIT tokens from Bybit’s own holdings. Tokens were burned every month, contributing to the decentralization of BIT distribution and reduction of total supply. As of the time of writing, around 780 million tokens have been burned, as seen per the burn address’ balance.

On April 5, 2023, BIP-20 was passed, modifying the dynamic contribution structure into a fixed schedule as follows:

Year 1 – 120 million BIT per month for a total of 1.4 billion BIT

Year 2 – 60 million BIT per month for a total of 720 million BIT

Year 3 – 30 million BIT per month for a total of 360 million BIT

Year 4 – 15 million BIT per month for a total of 180 million BIT

In total, this meant the contribution of 2.7 billion BIT tokens from Bybit’s own holdings to BitDAO’s treasury over a period of 4 years. This would be later accelerated by BIP-21, which we will cover in detail below.

MNT

On May 19, 2023, BIP-21 was passed, which proposed the rebranding and optimization of BitDAO and BIT to the Mantle brand and introducing a revamp of its tokenomics. On June 7, BIP-22 passed to confirm the final details of the tokenomics revamp.

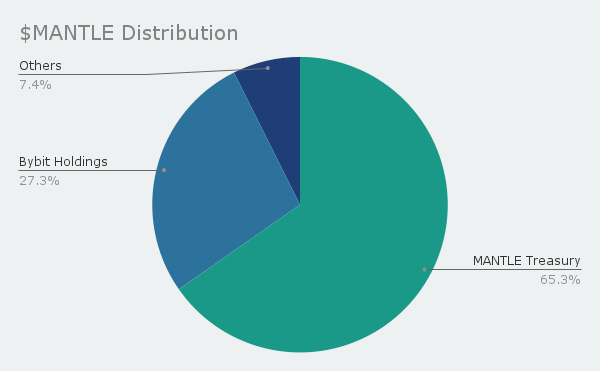

According to the proposal, MNT will have the same total supply of tokens as BIT, given a 1:1 conversion ratio from BIT and assuming all tokens have been converted. The MNT will be upgradeable and have a mint function, similar to both the ARB and OP tokens. Taking into consideration the 780 million burned tokens, the distribution of MNT can be estimated as follows:

Non-Circulating Tokens

Mantle Treasury: 6,019,959,337 (65.3%)

Circulating Tokens

Bybit Holdings: 2,519,316,795 (27.3%)

Other Circulating: 680,040,636 (7.4%)

There are two significant takeaways from the estimated distribution of MNT. The first is that the Mantle Treasury (from this point onwards the BitDAO treasury will be referred to as Mantle Treasury) will have a value of around $3.8 billion at launch – $2.9 billion (78.5%) in MNT, $515 million (13.6%) in ETH, and $230 million in stables (USDC and USDT).

As of the time of writing, Mantle Treasury is second only to the Arbitrum DAO in terms of total treasury value ($4.37 billion). However, excluding each DAO’s own tokens, Mantle Treasury is by far the largest DAO treasury in existence.

The second takeaway is this – Bybit’s holdings, while significantly reduced from the initial 60% of total supply to 27.3% of the total supply, will make up 78.7% of circulating supply.

MNT Utility

The MNT token has a number of use cases in Mantle Ecosystem. The core ones are:

Gas – MNT is used as the gas token for the L2 network.

Governance – MNT must be delegated to participate in network governance.

MPC Nodes – MPC node operators must stake a minimum of 2 million MNT to be eligible to run an MPC node.

Data Availability – L1 validators may stake MNT to participate in Mantle Network’s economic model

Token Burning – Tokens used for gas may be burned and tokens can also be burned (or minted) via governance.

Transaction Fees

Transaction fees on Mantle Network consist of the L2 execution fee, which is made up of gas fees based on computation and storage usage (just as on Ethereum), and the L1 data and security fee, which is incurred when transactions are published to Ethereum. The L2 execution fee is significantly lower than that of Ethereum, due to the vast availability of bandwidth on the L2 network resulting in lower gas prices. On the other hand, the L1 data fee is significantly higher, since the cost of gas on Ethereum is expensive. This is composed of:

The current gas price on Ethereum.

The gas cost to publish a transaction to Ethereum, which scales with transaction size.

Fixed overhead cost denominated in gas, currently set to 2100.

Dynamic overhead cost which scales the L1 fee by a fixed coefficient, currently set to 1.0.

Thus, because L2 execution fees are so low compared to L1 data fees, the total cost of a transaction on Mantle Network is determined by the L1 data fees. According to current available documentation, the process on Mantle Network could look like this:

Users pay for L2 gas fees and L1 data fees using MNT tokens.

MNT is bridged back to L1 to the Mantle Foundation.

Mantle Foundation pays for L1 gas fees in ETH.

While this is yet to be finalized, we could see a similar mechanism as EIP-1559, in which MNT tokens used for gas can be burned. The burn rate is dynamically adjusted based on network activity, which means that MNT token could gain added utility while increasing in scarcity as the ecosystem continues to grow, not unlike Ethereum.

Competitor Analysis

Technical Differences

Here’s a quick look at how Mantle Network compares with competitors Arbitrum and Optimism in terms of architecture.

Two characteristics in particular that may have a tangible difference from a user’s perspective:

Challenge Period – Mantle Network’s use of MPC, more commonly known as the Threshold Signature Scheme (TSS) effectively reduces the challenge period by improving the correctness of off-chain transaction execution results. This gives Mantle Network an advantage over both Arbitrum and Optimism, in terms of challenge period time. However, this advantage may not be significant, as most users utilize bridges and CEXs to bypass the waiting times anyway.

Data Availability – While both Arbitrum and Optimism post data for proof construction to Ethereum, Mantle Network will use EigenDA as its data availability layer. This gives Mantle Network a significant advantage as it allows for higher throughput.

Key Metrics

Based on market capitalization and fully diluted valuation, BIT appears undervalued compared to its peers, Arbitrum (ARB) and Optimism (OP). Despite Mantle Network only being in the testnet phase (as of the time of writing), this gap suggests potential for significant upside upon successful mainnet launch and growth of DeFi TVL and activity.

Moreover, the Mantle Treasury stands out — particularly the portion of assets excluding its own token, which amounts to around $821 million. This sizable treasury bodes well for ecosystem sustainability as it reduces dependency on token price fluctuations. When compared to OP's treasury (excl. its own token) which stands at $477.62 million, the Mantle Treasury is significantly larger, while ARB’s treasury consists only of its own tokens.

DeFi Ecosystem

An initial assessment of Mantle Network’s potential to stimulate substantial economic activity was not very positive. This was mainly due to its ecosystem composition, where, despite the extensive partnership network through Windranger Labs and Mirana, the majority of partnerships were in the GameFi space. A survey of Mantle Network’s ecosystem page at the time of writing proved as such, yielding 49 GameFi-related dApps while only three DeFi protocols are listed.

Whilst the merit of GameFi in accelerating Web3 adoption is undisputed, the sustainability of the sector remains to be seen. This is evident from the fact that only a handful of GameFi projects have achieved long-term success despite more than $6 billion of capital inflow into the sector following Axie Infinity’s entrance to the scene. However, recent developments suggest a strategic pivot in Mantle Network’s focus towards the DeFi space.

Key Hires

The first indicator was the recent onboarding of seasoned professionals from Spartan Labs. The addition of Defi_Maestro as the lead DeFi Architect, accompanied by 0xavarek and Gabe taking on ecosystem research roles, brings an influx of DeFi and infrastructure research experience. This suggests a deliberate shift to broaden Mantle Network’s focus, giving it a more balanced ecosystem, and enhancing its potential for future growth.

Liquid Staking Derivative (LSD)

The second key development was Mantle Network’s initiative to develop an ETH liquid staking derivative (LSD) product. LSDs have gained significant traction and attention due to their high composability, stemming from its underlying yield. LSDs serve as the building blocks for a variety of financial instruments, including borrowing and lending, leveraged products, and yield-generating assets.

As per data from Dune, “LSDFi” protocols have seen almost half a billion dollars of TVL as well as large inflows over the past month.

Another Dune dashboard shows over 9 million ETH staked in liquid staking protocols, accounting for approximately 42% of all staked ETH on the Ethereum network, which in turn accounts for only 16.1% of ETH supply. The upward trajectory of LSD TVL signals continued robust demand for these assets. Thus, developing an ETH LSD product offers Mantle Network great opportunity to not only establish its footprint in the liquid staking space, but to also attract liquidity and users from across the Ethereum ecosystem.

Catalysts

Mantle Network was unveiled on Nov. 30, 2022, and is estimated to launch its mainnet between July and August this year. Mantle Network is in the unique position of being built by a DAO with a vast ecosystem of partners.

Mantle Network has a couple of features that set it apart from existing ORUs. The use of TSS reduces its challenge period for withdrawals to L1 compared to existing ORUs, while its modular approach of using a separate data availability layer instead of Ethereum significantly reduces fees incurred by users (by up to 70%!).

The Mantle Treasury is unmatched in terms of size (more than $800 million excl. own tokens), which means ample runway to weather multiple cycles. It also has around $3 billion worth of MNT tokens, which provides a significant warchest to incentivize and bootstrap ecosystem growth. In fact, “multi-season achievements, quests, and airdrops” have already been confirmed.

The upcoming EIP-4484 (Proto-danksharding) will reduce gas fees on L2 rollups by orders of magnitude, which will make L2 networks significantly more profitable. The central feature of Proto-danksharding is the introduction of a new transaction type known as a blob-carrying transaction. These transactions resemble regular transactions but also carry an additional piece of data referred to as a blob. These blobs are quite large, approximately 125 kB, and are substantially more cost-effective compared to equivalent amounts of calldata. For perspective, Arbitrum is seeing profit margins of 30-40%, which will be expanded to 90-95% once EIP-4844 is rolled out (Source: James Ho).

Mantle Network will use MNT as its gas token. Its competitors Arbitrum and Optimism both use ETH. This results in an additional source of demand for MNT and could result in a deflationary token model should burn mechanisms be introduced.

Risks

Mantle Network’s launch comes during a bear market as TVL and total crypto market cap have decreased by ~65% and ~40% respectively since May 2022, while CEX spot trading volumes have reached three-year lows. This may result in muted enthusiasm from investors and retail users.

The initial launch will see Mantle Network use a single, centralized sequencer before transitioning to a decentralized sequencer. While unlikely, centralized sequencers have inherent risks such as censorship and MEV profiteering, among others. Single-sequencer setups also run the risk of not having fallback sequencers should the sequencer fail to process blocks for whatever reason. Most recently, Arbitrum’s single sequencer experienced a malfunction that halted the forwarding of transaction batches to the Ethereum mainnet, disrupting an automatic feature that replenished the node's wallet with ETH for transaction fees. This issue resulted in a backlog of transactions awaiting settlement for several hours.

At launch, Bybit is estimated to hold over 78% of circulating tokens. Considering their likely interest in preserving their stake in Mantle Network, this effectively renders these tokens non-circulating, resulting in significantly reduced token float which could result in volatile price action in either direction.

References

Huge thanks to the Mantle Network team for providing feedback and reviewing the technical portion of this report!

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about