Is Ore The Next Bitcoin… on Solana?

Guess who's back after breaking Solana?

This post was brought to you by the Aptos Foundation, an organization dedicated to supporting the growth and development of the Aptos protocol and developer ecosystem. Aptos is the secure, scalable, and feature-rich L1 blockchain of choice for both developers and users—delivering the best performance, the highest throughput, and lowest latency.

Bitcoin on Solana - that’s Ore for you. Reigning in a new era of experimentation on Solana, Ore explores the possibilities of deploying a Proof-of-Work (PoW) contract on Solana, a Proof-of-Stake (PoS) chain. This seemingly unique architecture took the industry by storm, with Ore’s popularity skyrocketing upon its launch in April, becoming the top-used Solana application in record time.

Ore isn’t just making waves, it’s causing tsunamis. And I mean that as the overwhelming mining activity on Ore caused Solana to face chain-wide congestion, with users facing a high volume of failed transactions (throwback to 2021 days). Eventually, Ore v1 had to be paused. But this was not the end, as Ore v2 is now back with improved mechanism designs, a $50,000 victory from the Solana Renaissance Hackathon, and a $3 million fund raise.

Despite the improvements in v2, Ore’s price has been on a downward trend as shown above. Is this the end of Ore? This article seeks to answer that by diving into the architecture of Ore, analyzing its traction, the potential use cases (a building block of PayFi, a critical piece to decentralized and efficient AI), and questions whether this is really the next Bitcoin or just bare metal.

The Origin of Ore

Ore was founded by a pseudonymous developer known as HardHat Chad (who distributed hard hats during Token2049 as merch - definitely unique). In an interview with Empire, HardHat chad shared that the idea stemmed while he was brainstorming around the possibilities of bringing Bitcoin onto Solana. Going back to Q1 and Q2 2024, the market saw an influx of new projects as well as significant price increases of projects within the Bitcoin ecosystem - primarily Runes and Ordinals, widely perceived as NFTs (non-fungible tokens) on Bitcoin.

Following this wave of attention that fell upon the Bitcoin ecosystem, multiple projects explored the potential of bringing Bitcoin assets onto either Etheruem or Solana. Some examples include Zeus Network and Pups. HardHat Chad on the other hand, employed a different approach from these ‘bridges’, and thought about re-writing Bitcoin as a smart contract to be deployed on Solana. Instead of bringing the Bitcoin over, build the Bitcoin. HardHat Chad also highlighted that the main aim of doing so was to reinvent the fair launch meta, with an aim to realize Bitcoin’s original vision of being a currency that everyone can mine and use for transactions.

The Team Behind Ore

HardHat Chad, alongside his co-founder and teammates are part of an entity known as Regolith Labs, which is in charge of maintaining Ore’s software. In addition to Ore, Regolilth Labs is also developing other software tools, with one recent example being Steel - a modular framework for building smart contracts on Solana.

With the traction it has received for Ore, Regolith Labs raised a $3 million round led by Foundation Capital, with significant support from Solana, with the round seeing participation from Colosseum (powers Solana’s online hackathons) and Solana Ventures. Nonetheless, HardHat Chad made sure to keep to his promise of creating a fair system for Ore, and no investors were allocated $ORE.

With an understanding of the origin of Ore, let’s transition into the mechanism of Ore - the realization of HardHat Chad’s ideation.

Ore’s Mechanism

At the heart of it, Ore utilizes a PoW mechanism, similar to Bitcoin where miners are required to solve computational puzzles to earn $BTC. The architecture is designed in a manner where Ore is able to leverage Solana’s consensus, and inherit the corresponding security.

In Ore, each miner is being assigned a custom computational challenge. As long as miners are able to provide a valid solution to the challenge issued to them within a minute, they are guaranteed a portion of the 1 $ORE that is being generated every minute. Miners that submit hashes more frequently than required will likely encounter errors and higher fees. This serves as a sybil disincentive to those that spam the network.

The chances of earning rewards are dependent on the hashpower, which refers to the computational power within the mining device. A higher hashpower indicates greater computational capabilities which increases the chances of miners finding a number of higher rarity, yielding them a higher reward.

With a high level understanding of the mining mechanism of Ore, let’s dive into the key architecture features, including it’s novel hash function, and sybil disincentives for upholding network integrity.

DrillX Hash Function

At the heart of Ore lies DrillX, an innovative hash function that builds upon the foundation of Equix, which was built to circumvent DOS (denial of service) attacks. Equix, in turn, is a variation of Equihash, an AISC-resistant algorithm that was previously used by the likes of Zcash.

DrillX helps fulfill HardHat Chad’s vision of democratic mining through an unique feature known as ‘memory hardness’. This feature allows Ore to be CPU-friendly, making it possible for everyone to mine from even a simple smartphone or laptop. This distinctive feature differentiates Ore from the traditional PoW assets, where large entities could utilize specialized hardware (e.g. ASICs) to maximize their mining earnings. In particular, DrillX is non-parallelizable, this means that even if an individual were to specialize a chip, or string together a series of strong GPUs / ASICs together, the improvement in hashpower will be meagre.

In addition to mining inclusivity, DrillX’s reliance on memory hardness over raw computational power (as with traditional PoW) significantly reduces the energy consumption of mining $ORE. This power efficiency is a breakthrough given Bitcoin’s infamous reputation when it comes to massive emissions generated from mining rigs.

Immutable contracts

In the initial phases of launch, the Ore smart contract will be kept upgradable. The goal is to eventually freeze the contract, and ensure that it becomes immutable, similar to Bitcoin. This ensures that all data within Ore is stored permanently, and cannot be tampered with. Nonetheless, there might be emergency situations in the early innings of the launch that may require a change in the smart contract, which explains the founder’s choice to keep it upgradable till mining dynamics have stabilized.

Some may argue that this is not in tandem with ‘Bitcoin’s vision of being immutable’. But it’s worth noticing that if the contracts were immutable to begin with, the Solana network might just have continued to be congested till this day, should Ore had no ability to amend the contract and change the mining mechanism to mitigate the congestion. Such can be thought of as ‘training wheels’, which are important to stress-test the system.

Phases of Development

Ore v1

On April 2nd, 2024, Ore was born - a PoW network implemented on top of Solana. The concept of Bitcoin on Solana quickly latched onto people’s heart, and the crowd mining Ore increased rapidly. Here are some statistics:

Ore program received 1.58 million transactions in 24 hours

Ranked 2nd in contributing to Solana transaction count within 48 hours

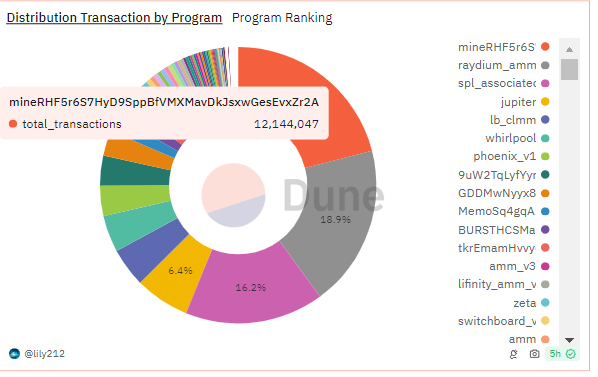

Became the most used program on Solana within a week from launch as shown below:

Holding true to the promises of a fair launch, there was no pre-mined supply or insider allocation for Ore. The Ore smart contract is also open source to ensure transparency and fairness.

Nonetheless, all these achievements came with their fair share of downsides.

Solana Congestion

This was a result of v1’s mining algorithm being too easily gameable. Participants were spamming Ore with a large number of transactions in hopes of landing a transaction, and eventually getting rewarded. Nonetheless, this spam resulted in Solana being congested, and an increase in failed transactions, as shown below.

$ORE’s Price Downfall

Mentioned in the beginning of this particle, the $ORE price has been decreasing since it’s launch. This is mainly due to the lack of utility of $ORE, which prompted miners to instantly sell. In addition, Ore v1 was launched with unlimited supply, which contributed to severe inflation and potentially contributed to the decrease in the ORE price.

As a result of the above issues, $ORE mining was paused shortly after its launch on April 16th, 2024. This was decided after a vote through Realms.

Ore v2

Following the network pause, the team worked on multiple mechanism improvements, and eventually resumed mining on August 6th, 2024, with the following new features:

DrillX Hash Function for Fairer Mining

This has been described in detail in the earlier section ‘Ore’s Mechanism’. At its core, DrillX aims to enhance the fair distribution of mining rewards by democratising mining, which can be carried out even on phones and laptops.

Supply Cap

A supply cap of 21 million $ORE was introduced. This created an element of scarcity for $ORE, which was supposedly meant to protect holders from dilution over the long term, and reduce selling pressure.

Keeping a rate of 1 $ORE distributed per minute, all ORE is slated to be mined by 2064.Staking Multiplier to Drive $ORE Utility

To tackle the selling pressure encountered with v1 (evident with an approximate 90% drawdown in price), v2 introduced $ORE staking. Users that stake $ORE will be able to boost their mining rewards through a staking multiplier. A multiplier creates a compounding reward curve, allowing stakers to scale their $ORE holdings much more rapidly. In addition, miners that stake will get prioritized access to leaders, increasing the chances of their hash submission being included. These new features create a demand sink that incentivizes people to hold onto $ORE.

Additional efforts have been put in to ensure that the staking rewards cannot be gamed. In particular, the multiplier is only available to miners that actively submit valid hashes consistently. An individual that takes a flash loan to mine and stake will not be eligible for the multiplier.

It was mentioned by HardHat Chad in an interview that the miner with the most stake will be receiving a 2x multiplier, while other miners will receive a multiplier between 1x to 2x, proportional to their stake amount. To this, I’ve got two main concerns:What is contributing to the multiplier? Is it going to be sustainable?

The multiplier might not be sufficient to encourage miners to stake $ORE. Miners, especially those with a smaller quantum of $ORE, will likely continue to sell to pocket the profit

Thus, it remains to be seen as to whether the staking multiplier will be able to mitigate selling pressure.

Following the launch of v2, all v1 $ORE will be upgraded to the new $ORE with the following details:

Optional, opt-in process that has to be initiated and signed by holders

v1 $ORE will be burnt to mint the new $ORE in a 1:1 exchange rate

1-way upgrade

Upgrade will be open for 3 months till November 2nd, 2024

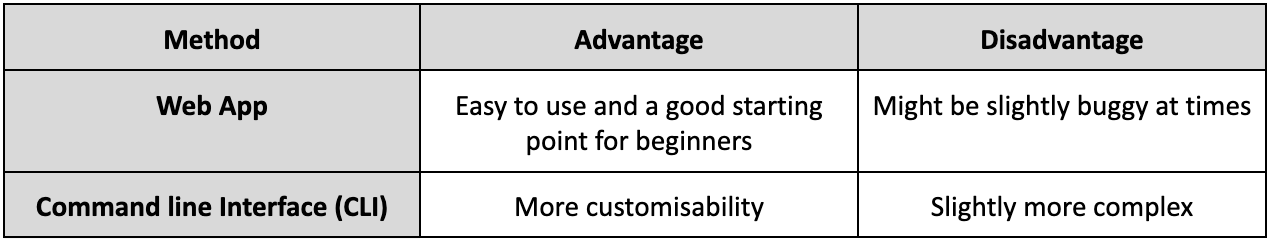

For folks that are looking to upgrade their tokens, they can do it through either of these methods:

Analyzing Ore from a Quantitative Perspective

From a high-level overview, the improvements made in v2 have been successful in reducing the spam on the Solana network, resulting in higher successful transaction rate. Nonetheless, it seems that efforts to encourage miners and promote the utility of $ORE have not been fruitful, with the network seeing a decrease in the number of unique active miners.

Failed Transaction Rate

As seen in the figure below, v1 saw a large proportion of failed mining transactions, where sometimes there are twice or more failed transactions than successful transactions. Even when transactions fail, they use up compute units, resulting in blocks being filled with failed transactions. This inefficiency was the cause of Solana’s congestion in April 2024 when Ore first launched.

With the mechanism improvements made in v2 to prevent spam, Ore saw a significant increase in successful mining transactions.

Number of Active Miners

Surprisingly enough, the number of unique miners per hour since has been decreasing drastically since v2’s launch, dropping by close to 93% in close to 2 months. This seems to inculcate that the mechanism improvements made to increase $ORE’s utility and improve the attractiveness of $ORE mining rewards might not have pulled off its intended effect.

Mining Difficulty & Mining Rewards

Since the launch of v2, the mining difficulty has been on the rise, seemingly reaching a plateau in the month of September. However, this is a slightly strange phenomenon, given that there are fewer unique miners per hour, as highlighted above, it would have been expected that the difficulty will decrease to allow successful mining, corresponding to Bitcoin’s ‘Difficulty Adjustment Algorithm.’

Yet, it seems like there’s an inverse relationship between number of unique miners and difficulty of $ORE mining. This could potentially indicate that the remaining miners own devices with higher hashpower, increasing the average hashpower present within the mining network. Thus, the average difficulty increases given the increase in capability of miners to search for hashes.

Ore Price: Up and Down

Within a short span of 5 months, $ORE has encountered its fair share of ups and downs. The price of $ORE increased significantly from $350 on April 9th by an approximate 70% to the highs of $1,200 on July 30th. But has since then come down from the highs, with prices decreasing by almost 95%.

The high selling pressure is evident from the steep drop in price and this raises concerns as to whether Ore’s efforts in enhancing yield (through staking multipliers) is a sufficiently strong enough strategy to incentivize holding $ORE.

The Value of Ore: Gold, Silver, or Just A Metal?

Is Ore just a gimmick, chasing the trends with Bitcoin on Solana, or is there merit in what HardHat Chad is trying to build? Below are two examples of how Ore could play a pivotal role in enhancing the usage of Solana.

Powering PayFi Solutions on Solana

In recent times, Solana has seen partnerships with financial giants including PayPal, Visa, and Huma Finance. The core concept of a PayFi (payment financing) network revolves around bringing dollars onchain, and leveraging blockchain to move these dollars in seconds, without having to suffer huge spreads or costs. The main element making this possible is stablecoins.

Presuming you are sending money overseas, instead of having to go to the remittance centre, pay a hefty cost and wait for 3 - 5 business days, you can do the following on the blockchain:Key in the wallet address of the recipient

Set transaction amount and send

Within seconds, the recipient receives the payment

For this above scenario to hold true and be widely adopted, it is important that Solana has sufficient blockspace at all times to handle the transaction load. In addition to the immense transaction load, it is important to ensure unwavering uptime for transactions to go through at all times. This is where Ore can potentially play a part. By mining blockspace on Solana, Ore is essentially creating a reservoir of transaction processing capacity that could be leveraged to support this financial activity. Ore could potentially be the backbone to support Solana’s burgeoning financial applications.Fundamental Piece to AI Use Cases

As artificial intelligence (AI) continues to evolve at rapid speeds, there is the potential that open-source AI models may face censorship in the future. It is of critical importance that a solution is built to verify AI inferences and models.

Imagine the followingYou want to find out whether there are pizzas with pineapples as a topping

You query an AI model that could be either close-source or open-source, but censored

As a matter of fact, there are pizzas with pineapples. But you don’t have insights as to how the model was trained, or the validity of the inference

You receive an answer that there are no pizzas on earth with pineapples - which is wrong

Ore’s PoW network can serve as the verification method for such scenarios. Its’ computational network can be integrated into the various protocols to run proofs to validate that the inferences were run in a censorship-resistance, accurate, and fair manner. In addition, people often claim AI models to be black boxes, as the training process is often unseen. Ore’s PoW network can also be used to prove that models have been trained accordingly based on accurate and legally-obtained data.

In addition, it’s worth noting that the AI vertical has been seeing increased attention in Small Language Models (SLMs), which are models that are trained for specialised tasks, and bring with them faster inference times. An important feature of SLMs are the lower level of compute required for it to run.

Ore has the potential to propel the onset of Edge AI, where SLMs are directly deployed on edge devices, with a simple example being, phones. This is how the computational power used in $ORE can potentially power such a paradigm:A phone is mining $ORE

$ORE is a proof of compute, which can be used to pay for computation in SLMs that are embedded within the phone

Natural language input can be processed real-time with or without internet given that the data is readily available in the phone

There are huge merits to such a system:

Data privacy given that it does not have to rely on cloud systems

Near-instant processing given SLM’s features and readily available compute

Users can get rewarded based on the data they contributed to the SLM, since it is clear that it comes from the user’s device

There has been experimentations similar to this by Microsoft and Exo Labs, which has managed to clinch wins at hackathons. This is an exciting realm that Ore has the potential to drive mass adoption.

Risks

As the founder calls it, Ore is an experiment. With it come certain risks.

Platform Risk

Despite the improvements made to the mechanism to prevent spam, it still does not entirely omit the potential of Solana being congested in the future by Ore mining activity. Given that the Equihash algorithm, which was utilized by Zcash to be ASIC-resistant for democratization of mining, eventually couldn’t hold it’s value proposition when ASICs evolved to bypass the resistance, DrillX may potentially run into the risk of being gamed in the future.

In addition, given that Ore anticipates a large number of miners to be mining using CPU devices, including mobile and laptops, the mining would be severely affected should there be an outage that affects mobiles and laptops. There are also questions around the reliability of mining using phones and laptops e.g. what happens when these devices run out of battery - will the miners be penalised for not submitting hashes actively?Integration Risk

The main question to be answered would be: how interoperable will $ORE be with other protocols on Solana. The market has seen the rise of applications being developed on Bitcoin, including liquid-staked tokens (LSTs), lending markets, decentralised exchanges (DEXs) and more.

Given that Solana already has a vibrant ecosystem, with strong liquid staking players like Sanctum, DEXs like Jupiter, lending markets like Kamino, how will $ORE be utilised within these protocols? This ultimately affects the ease of adoption of $ORE and its ‘worthiness’.Market Risk

For people to perceive $ORE as a valuable asset, alike to Bitcoin, is an uphill battle. Even with Bitcoin, it took time for people to understand it’s value proposition, and it was many years before corporations became willing to purchase Bitcoin as part of their treasury. Back in 2010, we even had a pizza man give up 10,000 Bitcoin.

It is evident from the previous section 'Analyzing Ore from a Quantitative Stance’ that mining activity has been decreasing. This is likely due to the lack of market interest, which is difficult to drive up. The lack of adoption is also apparent from the volume of the trading pair ORE-SOL on Meteora, which is merely $17,174 in the past 24 hours. Such illiquid markets make it slightly more difficult for folks to acquire $ORE from secondary markets with ease.

How to Mine Ore? Tip: It’s Simple

There are two ways to mine Ore:

A tip to increase mining rewards would be to mine using devices that have higher hashpower. You can check the hashpower of your device by visiting this website. In general, a device with more cores will be able to compute faster.

What’s Next on The Roadmap?

Mining Pools

The team has noticed the struggles of smaller miners with lower hashpower, as their proportion of $ORE earned from mining may at times be unable to cover transaction fees and mining costs.

The creation of mining pools is aimed at democratizing mining, where individual miners are able to collaborate and combine their hashpower. This collective then stands a chance of finding higher-difficulty hashes, which translates to a higher proportion of $ORE rewards, coupled with lowered transaction costs for individual miners as only a single hash is submitted.

$ORE rewards are then distributed back to individual miners based on their contribution of hashpower to the pool. This ensures that all miners, regardless of how small their contribution, stand a chance to earn.

Nonetheless, there are certain concerns with this model that have to be overseen. It is especially important to have a transparent mechanism that can ensure fair reward distribution to the miners involved in the pools.

MEV Bot Game

Not much detail has been shared with regards to this game that is being built.

The only details shared were:

It is going to be an easily and highly botted game (on purpose)

A territory game of sorts

Every move will incur a payment

The winner will earn half of the game pool, with the other half distributed to the rest of the players

The goal is to increase the pool size significantly to incentivize participation

It seems that this game is aimed at increasing the number of miners on the platform, with the incentivization being the prize pool. Definitely an interesting approach, but some of the areas that I would like clarification on include

Who contributes to the prize pool?

What happens to miners that do not have the knowledge to bot or participate in the game?

Ore: The Next Bitcoin or Just a Hype?

In many ways, Ore's journey echoes the early days of the meta ‘putting utility on Bitcoin’, reminiscent of the recent Runes and Ordinals phenomena that sent gas fees skyrocketing with the network being congested by the sheer number of participants.

Ore's ambitious vision to reinvent the fair launch meta on Solana's high-speed rails is an interesting experiment to keep a lookout for. Time will tell whether the market perceives $ORE as a store of value and whether people are open to using $ORE as a currency for peer-to-peer (p2p) transactions.

Should Ore achieve success, which could come from widespread integration of $ORE into protocols, or a surge in $ORE’s price reflecting its value, there is a high likelihood that we witness a domino network across other PoS chains looking to adopt the same experiment. It will be a curious case to see whether these chains will have the capacity to withstand the influx of activity.

Moreover, Ore's triumph at the Solana Renaissance hackathon tantalizes us with the possibility of a greater narrative at play - perhaps Solana sees in Ore a key to unlocking a new era of blockchain democratization. Or perhaps, even something more?

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website or social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about