Is Liquid Restaking 2024's Biggest Crypto Narrative?

A Comprehensive Deep Dive into Eigenlayer

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day. Disclaimer: author and Blockcrunch have no official personal exposure to Eigenlayer; editor is an angel investor in Eigenlayer

Since the dawn of finance, there has been an endless pursuit for more yield.

In traditional finance, banks may use customer securities, deposits or even US treasury bills as collateral to get more loans and use it to get additional yield. This is known as rehypothecation - the reusing of assets to generate additional yield.

In crypto, this is similar to liquid staking where tokens are staked in exchange for a liquid staked token (LSTs) that can be reused to generate additional yield. This concept is so popular that Lido, a liquid staking protocol (LSP) that launched in 2020, is now the largest DeFi protocol in TVL. This shows that the desire for more yield is one of the top demands.

Fast forward to today; Ethereum now has close to a million validators around the world. Validators are computers that can do all kinds of tasks, from networking to storage to computations, etc. This large network of validators have a lot of excess computing power that is not being used.

As crypto continues to advance quickly with ETFs, protocol upgrades, more projects becoming open-source, there will be even more applications being created that needs to be economically secured for the user’s safety.

So we have LSTs that are looking for more yield, and computational power that is looking for more work, and applications that are looking for more security. This is where EigenLayer comes in, creating a job marketplace that matches all of them together.

EigenLayer raised $50 million in their Series A round at a $500 million FDV, backed by prominent VCs such as Blockchain Capital, Coinbase Ventures, Polychain Capital and more.

EigenLayer is adding a new layer of utility and efficiency to the Ethereum ecosystem enabling liquid restaking and the creation of a new category of tokens called liquid restaked tokens (LRT). They have captured over $1.5 billion in TVL since it launched roughly half a year ago.

This week we will delve deeper into EigenLayer and will aim to cover the following:

What is EigenLayer and why it is important to Ethereum

The AVS Landscape

EigenLayer Token and Valuation Framework

What is Liquid Restaking and Liquid Restaking Protocols

Risks of EigenLayer

Quick Recap on Liquid Staking:

To understand restaking, you should first understand liquid staking. Skip this section if you are already familiar with it.

After Ethereum moved from Proof-of-Work to Proof-of-Stake, users that staked ETH received ETH yield. However, as their ETH is staked, it cannot be used with other dApps, and thus the concept of liquid staking tokens (LSTs) arose.

By staking ETH with liquid staking protocols like Lido Finance, users can receive a receipt token (like $wstETH) that passively accrues value from ETH staking rewards. In addition to that, it is also liquid meaning users can sell it into ETH without waiting for the redemption period, and it is also usable in DeFi to generate additional yield such as using it as collateral to borrow more, lending it out, or providing liquidity and earning liquidity provision rewards.

EigenLayer is taking this concept one step further.

What is EigenLayer?

EigenLayer is a protocol that acts as a marketplace between restakers who provide collateral, operators who provide trust-minimized computations, and applications that need cryptoeconomic security to operate securely and honestly.

EigenLayer was founded by Sreeram Kannan, an associate professor at University of Washington for of Computer Engineering with over 20 academic papers in the blockchain sector and also wrote a paper about data availability

Who participates in EigenLayer?

Restakers

The platform starts with restakers, which are users that pledged their staked ETH or ETH LSTs to EigenLayer or via a Liquid Restaking Protocol (LRPs).

LRPs allow users to restake their LSTs to earn more yield and receive a liquid restaked token that acts as a receipt token for their underlying LST.

As LSTs are already staked tokens, staking LSTs is called restaking.

Operators

Next, we have operators who are similar to validators on Ethereum. Operators use the restaked ETH or ETH LST and choose which AVS on EigenLayer to validate and support and run software for them.

Operators are able to validate for multiple AVSs simultaneously to generate more yield to their restakers. Operators also safeguard against malicious actors on EigenLayer by imposing slashing conditions (determined by the AVS) on operators’ actions, ensuring that they act honestly when securing AVS.

Slashing refers to confiscating an operator’s staked LST and redistributing to other operators in order to promote honesty and prevent malicious activities such as double signing.

Operators that got slashed not only lose credibility but their restakers lose a portion of their stake, resulting in lower yield for restakers which will be shown publicly. Thus restakers need to exercise diligence when delegating to operators and operators need to have good performance to remain attractive to restakers.

AVS

Lastly, we have AVS which are applications or services that require a specialized committee of distributed validators (aka operators) that perform verifications, come to consensus on the result, and output it for the network to operate smoothly. They also have preset slashing conditions to penalize malicious behavior which are carried out by operators.

Examples of AVS include oracles, sequencer networks, rollups, bridges, VMs, data availability layers, and even other networks. AVS on EigenLayer pay operators and restakers to help secure their security, which is where the yield to LRTs comes from.

Summary

To summarize, here’s how it works:

Restakers stake ETH LSTs with operators on EigenLayer

Operators, now backed with collateral, then performs tasks that helps secure AVSs

AVS rewards the restakers and operators if the job is done well

Operators and restakers get their collateral slashed if the job is done poorly

Here is a diagram from the EigenLayer docs to visualize this better.

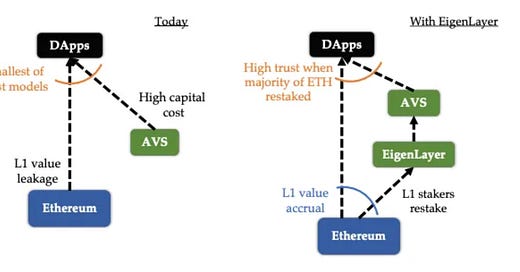

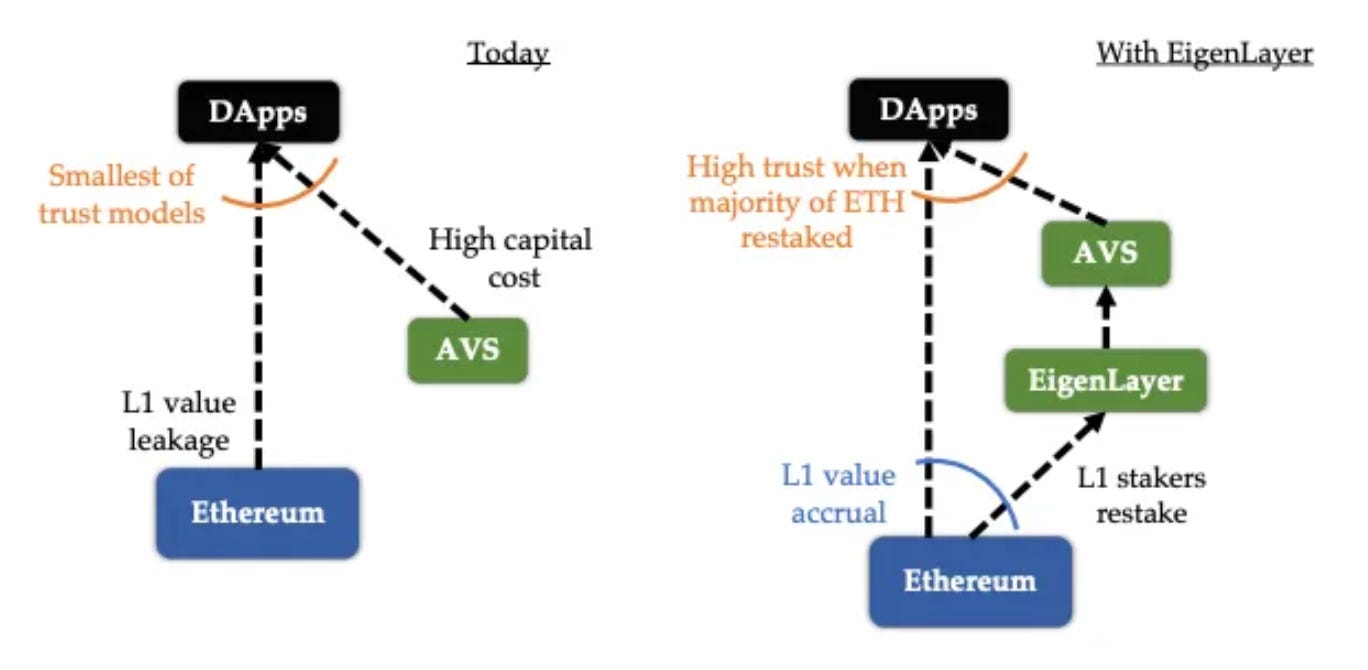

Why is EigenLayer needed?

EigenLayer helps AVSs to save cost and time while providing them with more security, making it cheaper for users, and bringing value back to Ethereum. Let’s understand how.

Current challenges faced by AVS

AVSs can be permissioned, however, if they are permissionless, they are usually secured by their own native token and validator set. This can present some challenges.

Bootstrapping a Validator Set: New AVS have to create a new validator set to establish a trust network for security which can be very complicated. They would have to design tokenomics, gather validators to support the network, and many other activities. EigenLayer simplifies this by providing an existing trust framework that they can quickly integrate with.

Expensive to Maintain a Validator Set: Validators securing AVSs face significant costs in the form of capital, operational, and opportunity costs as well as token price risks. Thus, to compensate validators, AVSs may introduce a high staking yield to reward them. However, this creates more selling pressure, reducing the token price drastically which can affect stakeholder confidence. EigenLayer addresses this by reducing the capital burden on validators through shared security models, allowing AVS to save cost as well.

By using EigenLayer, AVS save cost as it’s cheaper to provide rewards to users who restake their ETH to them, than to pay and maintain their validator set for security.

EigenLayer provides cryptoeconomic security

Cryptoeconomic security refers to the use of economic incentives and penalties as well as cryptography to ensure that an application is operating securely and honestly with the help of operators. It is crucial for AVSs, as low security makes them easier to be attacked.

An application’s security can be tied to the value staked with its validators and when economic security is weak, the service is more susceptible to takeover by malicious actors.

For instance, applications with low-market-cap governance tokens are easy targets for attackers to manipulate governance, leading to various attacks like fund theft or transaction processing manipulation. Below are more examples:

Roll-ups: Without EigenLayer, roll-ups may have low security due to the need to establish their own validator set which can be costly to maintain and not as secure as Ethereum. This makes them susceptible to attacks such as censorship and manipulation. EigenLayer’s integration enables them to use Ethereum's validators, enhancing security and user confidence.

Sequencer Networks: These networks, key to transaction ordering in roll-ups, can achieve increased security and reduced collusion risks by building on EigenLayer, and maintaining transaction integrity.

Bridges: Bridges often rely on validators for asset transfers between networks. A low barrier to becoming a validator increases the risk of control by attackers which in the worst-case scenario can perform unauthorized transactions of user’s approved funds. EigenLayer’s use of Ethereum validators for bridges makes attacks more difficult and costly.

Oracles: Typically run by independent validators, oversee the data that is fed into oracles which are used for smart contracts. If it is cheap to run a validator, malicious actors can manipulate an oracle data output for their own benefit. An AVS on EigenLayer ensures that oracles are backed by Ethereum’s security, minimizing risks of data manipulation and enhancing trustworthiness.

Data Availability Networks: Essential for the availability and verification of blockchain data, these networks benefit from the enhanced security and minimized data risks provided by EigenLayer, ensuring integrity in applications from decentralized finance to identity verification.

Vulnerable Dependencies: Nowadays dApps use a lot of other dApps. For example, a DeFi-focused roll-up may use an oracle application. Thus the cost to attack the roll-up, can be reduced to cost of attacking the oracle application it is using which can be substantiallyl ower. By securing as many AVS as possible, EigenLayer helps the entire dApp ecosystem become safer to use for users.

Ultimately, by raising the cost and difficulty of cryptoeconomic attacks, EigenLayer enhances security for the entire ecosystem. Additionally, EigenLayer validators are all over the world, allowing protocols to be secured in a geographically decentralized way.

EigenLayer adds more value to Ethereum stakers

Any application that needs to pay for its own security eventually passes these fees to users. By consolidating and sharing Ethereum’s security to AVS, EigenLayer achieves economies of scale for providing security to users. This ultimately makes it cheaper for users, all while Ethereum stakers capture some of this cost savings.

EigenLayer brings a lot of benefits to multiple stakeholders. Now that you have a better understanding of EigenLayer and restaking, let’s explore more on liquid restaking.

The AVS Landscape

The comprehensive list of AVSs building on EigenLayer can be found here. Currently, there are a total of 13 AVSs. We will talk about EigenDA, AltLayer, and Ethos as I find them interesting.

EigenDA

EigenDA is a data availability service on Ethereum using EigenLayer’s restaking. It is the first AVS on EigenLayer and was made by the EigenLabs team.

Data availability (DA) is the concept that data stored on a network needs to be easily accessible and retrievable by all network participants to help with network security and uptime. EigenDA help networks to have bigger L2 block sizes and cheaper DA costs.

EigenDA does not have a committee and instead relies on operators. Operators provide storage bandwidth to the EigenDA network based on their stake to keep them honest, allowing the system to remain trustless and decentralized.

As more operators join the network over time, EigenDA can support more data, scaling with the total bandwidth of the operator set, allowing EigenDA to be scalable.

EigenDA is on testnet and will be integrated with networks such as Celo, Mantle, and more.

AltLayer

AltLayer helps to launch native and restaked rollups with both optimistic and zk rollup stacks with enhanced security, decentralized sequencing, decentralized verification of rollup state, interoperability, and fast finality.

They also have a feature known as Flash Layer which allows anyone to use a UI dashboard to create a new rollup layer within minutes and destroy it at anytime, essentially a disposable layer. This is an interesting feature as it expands the execution layer to another chain for a certain event like an NFT mint or token sale while still being secure.

AltLayer will have a token called $ALT and is expected to go live in Q2-Q3 2024.

Ethos

Ethos is bringing ETH restaking to Cosmos app chains, allowing app chains to receive economic security from Ethereum.

To achieve this, they are both an AVS on EigenLayer as well as an appchain on Cosmos with IBC enabled. By using a security model called Mesh security, which was popularized by Osmosis, they will be able to share ETH security with any other IBC chain. It is currently still on testnet.

EigenLayer Valuation

Disclaimer: The valuations below are purely hypothetical and based on assumptions, and are not an indication of our view on price.

As the first of its kind, there are no clear valuation benchmarks, and the tokenomics and utility for EigenLayer token are not confirmed publicly, but we can create a mental valuation model with a few understanding and assumptions:

Supply Factors:

As users continue to seek yield, the amount of LSTs staked with EigenLayer will continue to increase, giving ample security that EigenLayer can supply to AVSs. In the future EigenLayer will also decentralize the platform and allow other non-ETH LSTs to be restaked to secure AVS.

Demand Factors:

Who will use EigenLayer? We shared a specific list of AVSs above, but essentially, any project that requires validators' consensus backed by economic security in the form of staked tokens can benefit from EigenLayer.

What would EigenLayer token’s utility be? Would it be similar to Liquid Staking Protocols like Rocket Pool which requires $RPL token as collateral? EigenLayer token may be required to be staked first in order to use the EigenLayer protocol.

Value-accrual:

As EigenLayer helps AVS to pay lesser fees for security by paying EigenLayer’s restakers and operators instead, EigenLayer would most likely take a portion of these fees. If it is similar to Lido Finance, this would be in the ratio of 90% to restakers, and the remaining split between node operators and EigenLayer. It is important to note that due to regulations, EigenLayer may not be able to give to EigenLayer token holders, similar to $LDO.

How much security do protocols need:

The market cap of PoS tokens can be viewed as a proxy to the economic security that is securing their TVL as they are used to stake with validators. If we look at the market cap to TVL ratio of the top few PoS protocols, we get an average ratio of 10:1. Thus we can assume that an AVS would similarly want to have around 10x more economic security compared to its TVL. That said, they may not need 10x more economic security if it now means paying for it, perhaps even 5x would suffice.

How much TVL would EigenLayer secure:

Instead of predicting how much TVL the new AVSs launching on EigenLayer would obtain, we are instead looking at existing applications as a proxy.

Looking at DeFiLlama’s TVL for popular AVS categories such as bridges, oracles, rollups, and data availability layer (just Celestia for now as a pure DA), we have a TVL of around $58 billion.

Although these are existing applications and are unlikely to move their security to EigenLayer, we will assume some of these TVL moves to AVSs that are secured by EigenLayer. Realistically only a fraction of this would happen as protocols with larger TVL are likely already well secured with their own token that is highly valued.

How much do protocols pay for security:

A protocol’s staking reward can be viewed as their security expense. As AVS on EigenLayer are just starting out, they would need more security and would provide more incentives. Looking at newer protocols, they have a staking reward of around 15% and go towards 3% as they mature. If we assume that building on EigenLayer is a cost-saving, then they should not pay lesser than 15%.

Bringing everything together:

Now let’s project what EigenLayer’s valuation would be after 1 year of traction.

As mentioned, we expect only a fraction of the TVL gets secured by EigenLayer, and we will use 7%, 5%, and 3% as our bull, base, and bear case respectively.

In terms of economic security to TVL multiplier, although the current average is 10x, it may not be so high if protocols have to directly pay for it, so we used a multiplier of 8x to 4x.

Next, we used a few percentages that are lower than 15% in terms of how much an AVS would pay for economic security.

For figuring out how much percent goes to EigenLayer, as Lido takes 5%, we will follow the same here. However it is not clear how much would go to token holders. In bullish case it would be 100%, however, in the bearish case it can be 80% or even lower.

For P/S ratio, we looked at Lido which has a P/S ratio of around 30x. We used a range between 50x to 30x as we expect EigenLayer’s P/S ratio to be higher than Lido after 1 year. This is because it is still a new primitive with strong growth potential, which can give it a speculative premium.

Thus, based on our assumptions and calculations, the valuation of EigenLayer after 1 year could be around $700 million to $10 billion.

What is Liquid Restaking?

EigenLayer allows users to deposit the following:

Native ETH

Liquid staked ETH (i.e. stETH)

LP tokens consisting of ETH LSTs e.g. stETH-ETH LP token (coming soon)

Here’s an overview of the mechanism:

1. Deposit Native ETH into LST protocols to get ETH LST, which generates staking yield.

2. Deposit ETH LSTs into LRT protocols integrated with EigenLayer to get ETH LRTs (you get EigenLayer and LRT protocol points for doing this now).

3. Deposit ETH LRTs into other DeFi protocols to earn more yield. At this current point, Ether.Fi is the only LRT protocol to offer this, where the LRT (eETH) can be used in DeFi protocols including Pendle, Curve, Balancer, Gravita, Maverick and Sommelier.

Note: Most LRT protocols allow you to deposit native ETH directly, which skips step 1, reducing the complexity of restaking.

Benefits of Liquid Restaking Tokens

There are 3 main benefits, capital efficiency, instant unbonding, and auto-compounding.

Capital Efficient:

LSTs are designed to be used in DeFi protocols while earning yield, and thus cannot simultaneously restake it through EigenLayer. This means users who are using LSTs in DeFi are missing out on potential yield. This is where Liquid Restaking Tokens (LRTs) come in.

Users can deposit their LSTs into Liquid Restaking Protocols (LRPs) and receive receipt tokens called Liquid Retsaked Tokens. These LRTs represent the LST deposited and thus continue to earn native yield, while the LST is also handled by the LRT to be restaked with AVS to earn additional yield.

These LRTs can then continue to be used in other DeFi dApps, such as being used as collateral or providing liquidity and earning LP rewards. LRTs increase the capital efficiency of users and help them generate even more yield.

Instant Unbonding:

EigenLayer has an unbonding period for LSTs based on the requirements of the AVS. The unbonding period is an issue with native staking which gave rise to liquid staking and LSTs.

Similarly, by introducing LRTs, users can now avoid the unbonding period by having liquidity for users to instantly swap LRTs into LSTs.

Auto-compounding:

There can be dozens of AVS who will want decentralized security from EigenLayer, and they can pay users in their own tokens, ETH, stablecoins, or any tokens they choose. Users have to manually claim these rewards, which can be costly due to the high gas fees of Ethereum.

LRT tokens will help to auto-compound these rewards back into the LRT, helping users to save time and money.

Projects Building on the LRT Narrative

Currently, users can accrue EigenLayer points which is speculated to be airdropped EigenLayer tokens in the future.

For every 1 ETH deposited into EigenLayer, it earns 1 point per hour or 24 points per day. There are no caps on the amount of EigenLayer points at the moment.

Various protocols are also building on EigenLayer. They allow users to stake in EigenLayer through them and distribute EigenLayer points to them. Let’s explore some of them.

Restake Finance

Restake Finance is the first LRT protocol to launch a native token $RSTK, which has seen its price increase by 469% since launch.

LRT: $rstETH

Collateral: $stETH

Mechanism: Rebase

Rewards: $ETH staking yield, EigenLayer restaked points

The protocol is distinct from other LRT protocols as it allows users to opt into specific sets of AVS based on the level of risk they are comfortable with. The type of AVSs that can be onboarded onto Restake Finance will be dependent on the governance, which brings us to the next point, the utility of $RSTK.

$RSTK has the following use cases:

Governance:

It is anticipated that there will be a large supply of AVS building on EigenLayer in the future. $RSTK holders have the opportunity to vote on the specific AVSs they would like to onboard onto Restake Finance, which will then give them the optionality to secure these AVSs.

Protocol Revenue Sharing:

Restake Finance generates revenue based on the TVL of the protocol. This is a reward-sharing mechanism with restakers as Restake Finance provides the service of managing the securing of AVSs. Users who stake their $RSTK, will receive $sRSTK, and be entitled to a portion of Restake Finance’s revenue.

Earn LP Fees:

Provide $RSTK liquidity in liquidity pools to earn LP fees.

Given that Restake Finance was the first to launch a token, but are only on testnet, it remains to be seen whether they will be able to sustain their price after protocols with greater TVL in their mainnet launch their native token.

Ether.Fi

Ether.Fi is the largest LRT protocol with a TVL of $235 mil and they have formed several partnerships with other DeFi protocols for their LRT.

With its feature-rich platform, Ether.Fi raised $5.3 million in February 2023, with notable funds being involved in the round, including North Island Ventures, Chapter One, Maelstrom and others.

LRT: $eETH and $weETH

Collateral: $ETH

Mechanism: Reward bearing and rebase

Rewards: $ETH staking yield, EigenLayer restaked points, Ether.Fi loyalty points

When users deposit $ETH into Ether.Fi, they receive $eETH. $eETH is an LST that utilizes a rebase mechanism, where the quantity of $eETH held by users increases as it accrues value. This $eETH can be wrapped into $weETH, which utilizes a reward-bearing mechanism, and the underlying value of the token reflects the accrued rewards.

The LST issued by Ether.Fi doubles up as an LRT token, as Ether.Fi has partnered with EigenLayer, where all $ETH staked with Ether.Fi will be restaked with EigenLayer. Thus, getting access to both $ETH staking yield and EigenLayer yield is simplified to 1 simple step with Ether.Fi.

Ether.Fi emphasizes decentralized liquid staking, by allowing anyone to run a node with ‘Operation Solo Staker’. There are 2 paths provided by Ether.Fi in engaging users for solo staking:

2 $ETH Bond Requirement:

Users will provide the hardware and internet connection required for running a node, alongside a 2 $ETH bond. Ether.Fi supplements this effort by providing the remaining 30 $ETH required.

No Bond Requirement:

By picking this path, users will only have to provide the hardware and internet connection and do not have to provide upfront capital (2 $ETH). However, it should be noted that should users wish to participate in this, they will have to be fully doxxed.

With Ether.Fi, the technical and financial entry barrier to participate in staking is significantly reduced, allowing many nodes to be onboarded, contributing to decentralization.

Currently, Ether.Fi is the only protocol that allows for the LRT $weETH to be used in other DeFi protocols. The list of integrated protocols can be found here. The use cases include being able to earn additional yields on $weETH by depositing into vaults, or earning fees by providing liquidity into liquidity pools on DEXs.

KelpDAO

KelpDAO is a LRT protocol launched in December 2023. They were started by the founders of Stader Labs, an existing LST protocol that ranks 7th in terms of market cap ($45 million as of this writing) that was launched in 2021 and were funded from prominent, top-tier funds, including Pantera Capital, Coinbase Ventures, Jump Capital, and many more.

KelpDAO was the second LRP to launch their mainnet on 12 December 2024 and currently ranks second with $188.76 mil in TVL (as of writing on 19 January 2024). The protocol garnered significant attention from the community with its Early Queue program, where users could deposit their LST into KelpDAO when EigenLayer’s caps were filled and automatically deposited the LSTs into EigenLayer when caps were lifted. This granted users a better opportunity to participate in EigenLayer, given that the caps were filled very quickly the previous times.

LRT: $rsETH

Collateral: $ETHx, $stETH

Mechanism: Reward bearing

Rewards: $ETH staking yield, EigenLayer restaked points, Kelp miles

Here’s a deeper dive into KelpDAO’s architecture and mechanism.

Users begin interacting with KelpDAO by depositing their choice of LST ($ETHx or $stETH) into the ‘Deposit Pool’. In return, users will receive $rsETH. Deposited LSTs are transferred to the ‘Node Delegator’ which will be in charge of delegating the LSTs to the respective ‘Operators’, that are securing different sets of AVS. ‘Operators’ will have to be whitelisted to be onboarded onto KelpDAO. Once rewards have been paid out by the AVS, ‘Operators’ and KelpDAO will take their respective share, and the remaining will be distributed back to the restakers in the form of an increased underlying value of $rsETH.

Renzo Protocol

Renzo Protocol is a LRT protocol and provides the additional feature of liquid restaking yield manager, which is aimed at maximizing the amount of yields users can receive from AVSs.

LRT: $ezETH

Collateral: $ETH, $rETH, $cbETH, $stETH

Mechanism: Reward bearing

Rewards: $ETH staking yield, EigenLayer restaked points, Renzo ezPoints

Renzo Protocol provides yield management strategies by allocating a certain weightage to each of the node operators that have been onboarded onto their platform. This weightage determines the amount of Renzo Protocol assets delegated to the node operators and is calculated based on the risk-adjusted reward ratio (RAR). RAR is a specific metric developed by Renzo Protocol to assess the risk and rewards associated with the AVS secured by the node operator and the node operator itself (e.g. inactivity etc.).

Puffer Finance

Puffer Finance sets out to decentralize Ethereum’s validator set, by making it more profitable to run at-home nodes while minimizing the risk.

LRT: $pufETH

Collateral: $ETH

Mechanism: Reward bearing

Rewards: $ETH staking yield, EigenLayer restaked points, Smoothing commitments

When users deposit $ETH into Puffer Finance, they receive $pufETH. Node Operators (NoOps) who would like to deploy a validator can put in a 1 $ETH bond collateral and pay an upfront smoothing commitment to borrow deposited $ETH from Puffer Finance to run a full validator. These NoOps will also opt into specific restaking modules offered by Puffer Finance, each of which secures different sets of AVS (giving different yields).

Holders of $pufETH, known as Puffers, will be able to earn native $ETH staking yield, EigenLayer rewards from securing the AVS, and also the smoothing commitments that are paid by the NoOps that benefit from a lowered financial barrier to operating a validator.

In addition to making it cheaper to deploy a full validator, Puffer Finance’s has a unique anti-slashing feature embedded into its architecture, which mitigates validator slashing from client bugs and user error. This is made possible by Secure-Signer and RAVe.

Anti-slashing is a highly novel implementation that has yet to be adopted by any of the protocols, and it will be interesting to see whether it will deliver lower slashing rates once the protocol has launched mainnet.

Swell Network

Swell Network began as a LST platform, and is currently ranked 6th amongst LST protocols in terms of market cap. The team has announced the upcoming integration with EigenLayer and launch of a native restaked token, $rswETH. This will allow users to stake native $ETH, and in return receive $rswETH to be used in other DeFi protocols.

LRT: $rswETH

Collateral: Native $ETH

Mechanism: Not yet announced

Rewards: $ETH staking yield, EigenLayer restaked points, Swell pearls

Contrary to Ether.Fi’s $eETH, which is automatically restaked with EigenLayer, Swell Network offers users the choice to either obtain $swETH (a LST) or $rswETH (a LRT). This offers users more optionality in terms of risk and reward, given that a LRT is subjected to a higher level of risk (increased potential of slashing given that they are securing multiple AVSs).

Rio Network

Rio Network is an LRT protocol that aims to provide users with risk-managed $ETH yield while retaining the liquidity of the underlying $ETH. In addition, Rio Network actively coordinates the selection and weightage of AVSs, helping to reduce AVSs’ cost of capital.

Rio Network raised a seed round co-led by Polychain Capital, Blockchain Capital, and Breyer Capital, with participation from more than 50 investors.

LRT: $reETH

Collateral: $ETH, $rETH, $cbETH, $stETH

Mechanism: Rebase

Rewards: No information yet

The team at Rio Network has already constructed their initial operator set, consisting of reputable operators including Chorus One, Figment, HashKey Cloud, Kiln, and Unit 410.

Despite Rio Network currently not having a testnet nor mainnet, it can be seen that the operator set is a highly reputable one with extremely experienced operators. This gives confidence to both users and AVSs in using Rio Network operators.

Liquid Restaking Protocol Comparison Table

Risks of EigenLayer

As with any new protocol, there are risks involved. Let’s explore some of the risks of using EigenLayer.

Lack of Demand:

Attacks happening due to an appplication’s poor economic security is not very common, hence they may prefer to pay more for smart contract security audits to protect against smart contract exploits which is far more common.

Also, if an AVS give yield to ETH restakers instead of their own token stakers, they could be reducing the utility and value of their own token, thereby reducing the appeal and demand of EigenLayer.

Although it is a hassle for an application to set up and manage their own validator set, it is not yet known how much time and money can be saved by using EigenLayer.

Accidental Slashing Risks:

Slashing is an act to reduce or confiscate a staker's tokens if they perform malicious activities that compromise the network's operation such as double-signing, censorship, etc. Similarly, EigenLayer stakers are exposed to slashing risks, which happens when a restaking validator acts maliciously and EigenLayer slashes them.

Right now this is done manually but in the future it will be automated, meaning it’s possible to be slashed accidentally. Additionally, if there are issues with the AVS smart contracts, there’s also a potential to be slashed accidentally.

Collusion Risk:

If a small group of EigenLayer operators are securing an AVSs, they could all collude together. This could be done by coordinating actions like double signing, censoring specific transactions, reporting wrong price feeds, etc, allowing them to profit off the AVS.

Centralization Risk:

As EigenLayer is the only restaking layer, if it becomes very large, it can result in centralization problems, which brings about problems that are not discovered.

One such problem is having a single point of failure. If EigenLayer were to have issues later when it is already securing many AVS, an exploit or attack on EigenLayer could lead to a cascading failure and bring forth untold economic damage.

Another problem is potentially having a conflict of interest. Similar to how Lido has amassed a lot of influence as the largest liquid staking provider, EigenLayer could achieve a similar status. This would potentially put them in a position where they could even sway decisions for the Ethereum ecosystem, such as upgrades, protocol changes, new features, etc.

Final Thoughts

Although restaking is new in crypto, the concept itself is not new. The global economy is already participating in restaking as well in a similar manner. For example, as USD is a strong currency with a stable governance and monetary policy (like ETH), entities such as financial institutions or even nations (similar to AVSs) buy US Treasury bills and receive yield. This makes US Treasury bills similar to liquid-staked USD (or ETH LSTs). This helps to create a constant demand for the USD, making it strong overseas, a type of benefit back to USD holders (ETH stakers).

These entities purchase these US Treasury bills to add backing to their economic security and economic confidence. In TradFi, they can show their reserves of US Treasury bills to secure uncollateralized loans from multiple lenders simultaneously to earn more yield while still earning treasury yield, similar to restaking. However unlike on EigenLayer, there are no operators to manage malicious behaviours, and their restaking is done in an opaque system which could cause systemic issues if handled poorly.

EigenLayer’s restaking and liquid staking are also similar as both help users to generate more yield with their native assets and both take a portion of the yield generated. However, the difference is that LST yields are generally fixed as they come natively from the Ethereum chain, while LRT yields can be infinite as there is currently no limit to the amount of AVS that can be secured by LRTs.

This reminds me of the movie ‘BlackBerry’ where AT&T moved away from selling minutes to selling data to users, as data sold have no caps, and went with distributing Apple phones.

Quote from the movie:

Jim: Stan, come on. You owe me. You've sold a lot of minutes because of us.

Stan Sigman: Yeah, but you know what the problem with selling minutes is?

Jim: What?

Stan Sigman: There's only one minute in a minute.

This makes it difficult to value EigenLayer by comparing with the valuations of existing Liquid Staking Protocols as they have fundamentally different dynamics. Liquid Staking Protocols only need to get more supply to be increasingly profitable, while EigenLayer requires both supply from ETH holders and demand from AVS building on EigenLayer.

This means in the beginning, EigenLayer’s value accrual may be slow as the demand for economic security is still nascent, and its multipliers is expected to be worse than LSPs.

However, EigenLayer has a huge potential as it helps to abstract away infrastructure and trust, allowing developers to focus on building the best innovation.

In the future, EigenLayer is also exploring to be a smart contract insurance platform. This means operators can help insure the smart contracts of AVSs with their ETH LSTs in exchange for more yield. As smart contract security is a far bigger concern, this feature will make crypto far safer for users.

Overall, I am bullish on EigenLayer as its new restaking primitive can create a new era of decentralized applications with better security and thereby functionality, which is bullish and exciting for crypto at large.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about