How to Bet on Stablecoin Collapse: Y2K Finance

A Unique DeFi Protocol on Arbitrum

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

One of the primary roles of the financial market is its ability to transfer risk and facilitate the efficient allocation of these risks. And yet, in the world of DeFi, there remains a massive void in users' capability to effectively hedge against de-pegging risks of stablecoins and pegged assets.

In this memo, we take a look at how Y2K Finance is seeking to fill this gap by serving as a marketplace of insurance buyers and sellers. By the end of the memo, we will illustrate why Y2K may be one of the best platforms for users to bet against the collapse of stablecoins, particularly in light of recent SEC actions against Paxos, the issuer behind BUSD.

Overview

Y2K Finance is a DeFi protocol on Arbitrum which provides a suite of products for the hedging and speculation of pegged asset risk, specifically in exotic peg derivatives. With Y2K, users have the ability to manage the potential deviation of stablecoins (USDT, FRAX, DAI, MIM), liquid staking derivatives (stETH, frxETH) or other wrapped assets (wBTC) from their expected market value.

Pegged assets dominate a large portion of the cryptocurrency market. The total value of the stablecoin market is over $140Bn, representing 14% of the entire cryptocurrency market cap. ETH LSDs on the other hand is a market worth over $10Bn. These pegged assets underpin the entire DeFi ecosystem.

Nonetheless, anyone who has been in crypto for a while right now should understand the stability of pegged assets cannot be taken at face value. From the TerraUSD collapse to accusations and concerns about Tether’s collateral backing, Fear, uncertainty and doubts about asset depegging waxes and wanes, but are never truly gone.

In this article, we will explore how Y2K Finance provides an avenue for users to hedge and speculate depeg risk:

Primer of catastrophe bonds in traditional finance

Explanation of Earthquake, Y2K’s main product

Usage and adoption of Y2K Finance

$Y2K tokenomics

Catalysts Ahead

Risks

Primer on catastrophe bonds (CAT bonds)

Y2K’s product will come intuitively to people who have an understanding of catastrophe bonds in traditional finance. A catastrophe bond, also known as a CAT bond, is a type of insurance-linked security that provides a financial payout in the event of a natural disaster, such as an earthquake or hurricane.

An insurer issues bonds via an investment bank, which are then sold to investors. The bonds have short maturities and are typically rated non-investment grade (high yield or junk bonds). If no catastrophe occurs, the insurer pays a coupon. However, if a catastrophe does occur, the principal is forgiven and the insurer uses the funds to pay claims.

Cat bonds transfer the financial risk of natural disasters from insurers to capital markets, allowing insurers to keep covering policyholders even in the wake of substantial losses. By financing disaster risk this way, cat bonds mitigate the effects of natural disasters on communities and economies and play a crucial role in a functional financial market as a means of risk transfer.

How does Earthquake work?

Y2K’s Earthquake vaults essentially build on the idea of a catastrophe bond and apply it to a de-peg event for stablecoins, liquid wrappers and other derivative products in DeFi. It is important to understand that Y2K Finance itself is not issuing any insurance products and does not directly underwrite them. Instead, it serves as a marketplace for users who have different views on the stability of pegged assets to buy or sell insurance on them. In other words, Y2K only serves as a facilitator, and does not take any directional bets.

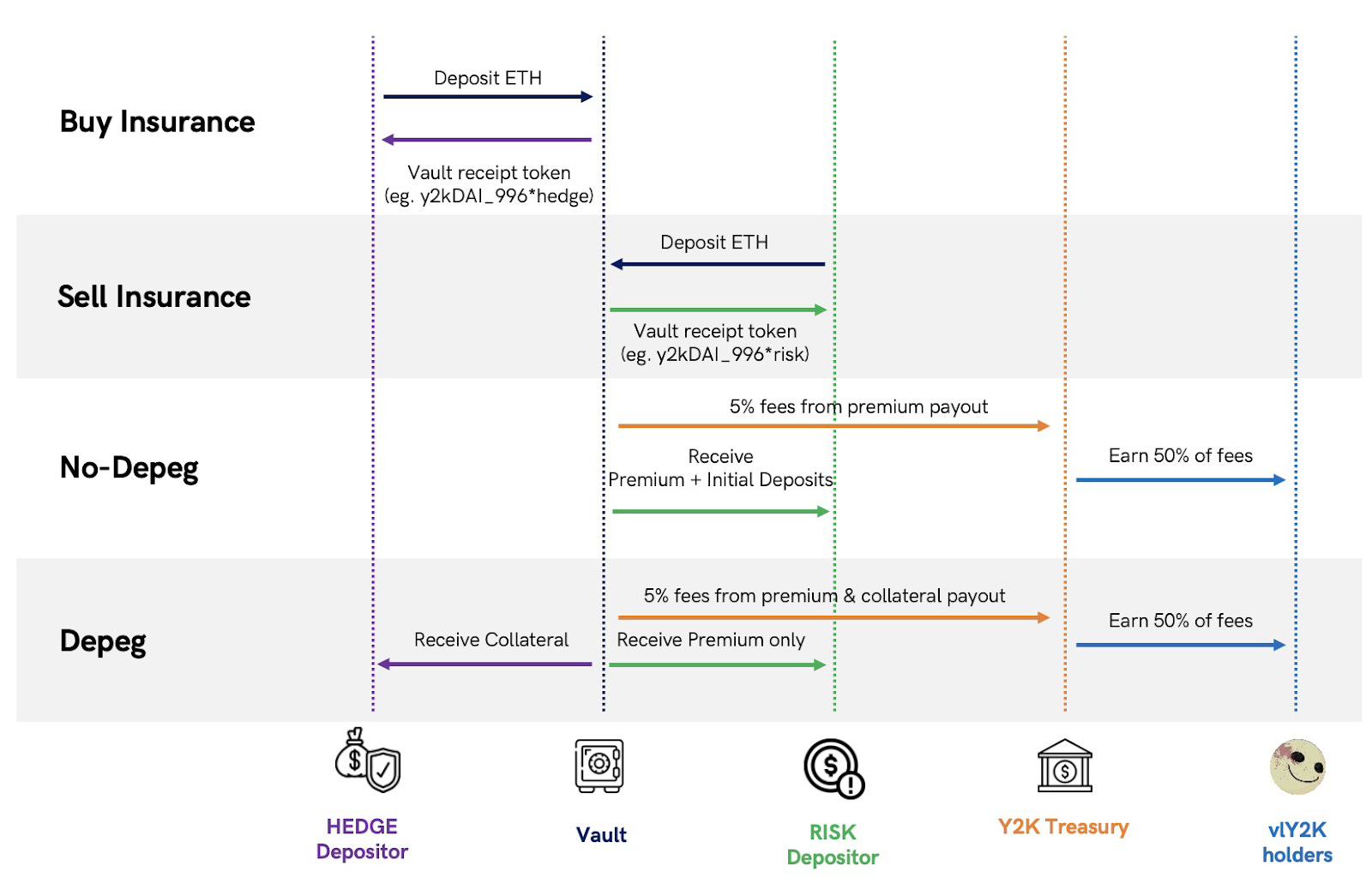

Hedge vs. Risk Vaults

Let’s start by explaining how users would use the ‘Earthquake’ Module. Insurance buyers and sellers can use the Hedge and Risk Vaults, respectively, to manage the risk of pegged assets deviating from their market value. ‘Hedgers’ can deposit ETH as insurance premiums, while ‘Riskoors’ can act as underwriters by depositing ETH in the Risk vault and receive a share of the premiums in return.

Why Hedge: The Hedge Vault in Y2K Finance allows insurance buyers to protect against volatility in pegged assets. By depositing ETH as an insurance premium, users are entitled to a share of the Risk Vault in the event of a depeg.

Why Risk: Sellers seeking to participate in the risk market can deposit into the Risk Vault to underwrite depeg insurance. They will receive a portion of the premiums from the Hedge Vault and in the case of a depeg, their deposits will help provide protection fr the Hedgers.

There are several components that determines the characteristic of each vault:

Target Asset: a pegged asset such as USDT, USDC, DAI, FRAX, MIM, USDD, wBTC, stETH

Stike price: the price that determines whether the asset has depegged (different values for each asset)

Epoch: the period and duration of the vault (1 week or 1 month)

Deposit: amount of ETH users would like to deposit

Let’s now walk through an example of what will happen to Hedger and Risk vaults repetitively in a depeg vs. no depeg situation.

If there’s no depeg event (price stayed above strike price):

Risk Vault depositors receive a pro-rated share of the premium from the Hedge Vault and their initial deposits if the strike price doesn't trigger during the weekly or monthly epoch.

Hedgers, or insurance buyers, receive nothing and lose their initial deposits (i.e. premium paid)

A 5% fee is charged on the payout to risk vault, with half going to protocol Treasury and half to $vlY2K holders (more on this later).

If there IS a depeg event (price dipped below strike price):

Risk Vaults depositors still receive a share of the premium but loses ALL their initial deposits (the collateral provided)

Hedge Vault depositors receive 95% the amount of collateral put up by the Risk depositors

A 5% fee is charged on both sides of the payout, including the premium paid to risk vaults and collateral paid to Hedgers. Similarly, half of that fee goes to the treasury and half goes to the $vlY2K holders.

For an overview of the protocol’s mechanism, you can refer to the illustration below.

After understanding the overall mechanism, another question naturally arises: how are the strike price for each asset determined? This is an important point as each stablecoin/pegged asset has different ‘tolerance’ of what is considered depegging. The question of determining the strike price for each asset is crucial as it determines how much each stablecoin or pegged asset can fluctuate before it is considered depegged. For example, people expect lower volatility for fiat-backed stablecoins like USDC and USDT compared to decentralized stablecoins like DAI or FRAX. During the Luna crash in May 2022, USDT briefly dipped to 0.996, causing a panic in the market, while FRAX has maintained a range of 0.98 to 1.01 over the past three months without being considered depegged. The calculation of the strike price is explained in more detail in the documentation. The rough idea is that:

Calculate the standard deviations for pegged assets

Calculate the daily deviations from the mean ($1), excluding all outliers

Calculate the frequency of breaking the variance threshold at various indicators

Determine strike prices with consideration of the incentives of all stakeholders

To address uncertainty when the vaults are empty, initial depositors are compensated with increased rewards through a bonding curve tracking each vault's total value locked (TVL). This helps to encourage early deposits and deals with the problem of having limited information about the number of funds on the opposite side of the trade or how much their position may be diluted as others join the same vault. The bonding curve ensures that the initial depositors receive fair compensation for their involvement in the vault.

Earthquake Vaults vs Insurance Protocols

One important point to make is that, instead of being a conventional insurance provider, Y2K operates more like a high-stakes casino, offering only one product: betting on asset depegging. Insurance, on the other hand, is about the collective pooling of capital and relying on the law of large numbers, which states that as the number of events insured increases, the average outcome will converge to the expected value, allowing for the calculation of risk and pricing of insurance policies. Traditional insurance protocols can often involve complicated and manual claim processes and demanding KYC requirements. But Y2K, with its singular focus on pegged assets, shirks these responsibilities and doesn't take on any solvency risk.

How does Wildfire work? (yet to be launched)

Deposits made in Earthquake vaults are locked for the duration of the epoch (i.e. the deposited funds cannot be withdrawn until the end of each epoch). This is necessary to provide stability and ensure that the vaults are able to meet the obligations of their insurance contracts. The Wildfire marketplace is built on top of Earthquakes tokenized vaults and provides a secondary market for users to trade positions in real-time through its order book.

Usage and adoption of Y2K

Despite its criticisms, Total Value Locked (TVL) remains the most commonly used metric in DeFi to gauge the adoption or traction of the protocol. At the time of writing, Y2K has a TVL of $2.7Mn, which can be considered ‘exceptionally unimpressive’.

TVL, however, is a static value measured at a specific time and is probably not appropriate to gauge Y2K’s adoption. This is because the assets in the vault cannot be locked indefinitely, but instead reset at the end of each epoch (either weekly or monthly). As a result, the TVL may fluctuate from one epoch to the next, making it a less reliable metric for measuring the success or growth of Y2K. A more appropriate measure here would be to look at its cumulative TVL since launch or the total value facilitated by its vaults.

Since launch in November last year, Y2K has facilitated about 51,000 ETH (~$80M at today’s price) in its Earthquake vaults, which is considerably more remarkable that its static $2.7Mn TVL. As you can see from the chart, 95% of the users deposit into the Risk vault, betting that the assets will not depeg. Below is a chart showing the value of deposits in each vault. We can see that the deposits were highest in November last year during the FTX collapse when the market was filled with uncertainty and volatility.

(Credits to @toubi for the Dune dashboard)

As mentioned, the protocol collects a 5% fees on the pay-outs at the end of each epoch. In three months’ time, the protocol has earned about $500K. Annualized that’s about $2 million per year.

The curious reader might have figured that Y2K’s fee-earning potential is the highest when there is in fact a depeg event so that they can earn 5% of Risk vaults’ collateral, which are much higher that Hedge vaults in general. So far, only three vaults have ever been triggered in a depeg event, which includes USDT and MIM in November last year amid the FTX turmoil and wBTC slight depeg last month (check out Digit’s DAO hedge on MIM which paid out handsomely).

$Y2K Tokenomics

The Y2K token is used for governing the Y2K ecosystem and setting key parameters. Currently, Y2K can only be traded in the Y2K: wETH Balancer Pool. As illustrated in the diagram previously, vlY2K (vote locked Y2K) holders are entitled to 50% of the fees generated.

To obtain vlY2K, one must provide liquidity to the Y2K Balancer pool. This LP token can then be locked for either 16 or 32 weeks and is non-transferable. Supplying liquidity in the Balancer pool and locking it for $vlY2K allows users to increase their share of governance power and receive a portion of the protocol's fee revenue. Put simply, vlY2K is essentially a locked 80Y2K:20wETH BPT (Balancer Pool Token).

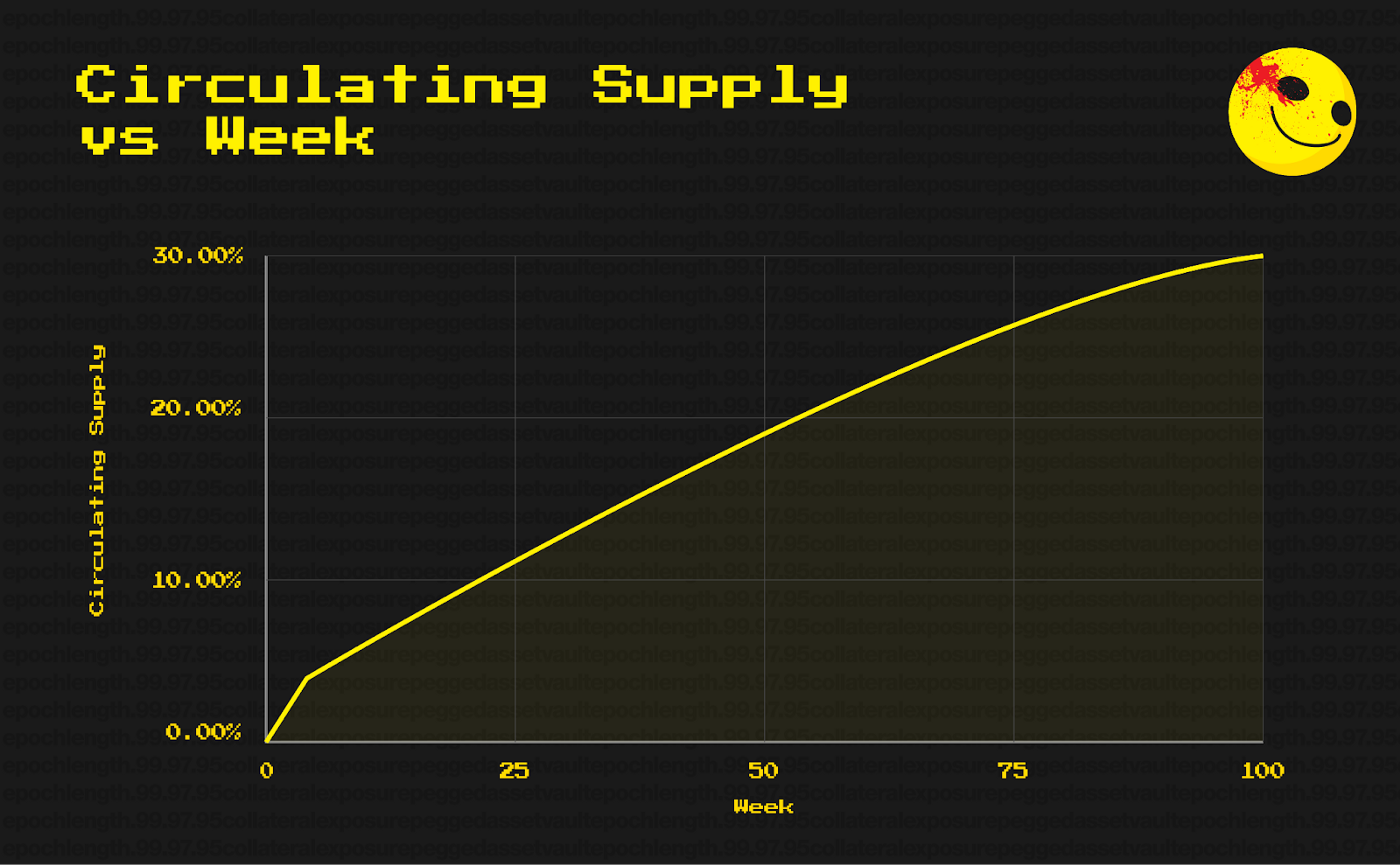

The total supply of $Y2K is 20,000,000 and its distribution is as follow:

30% towards Liquidity mining (linear emissions for 100 weeks)

35% towards the Treasury

15% towards the core team (24 month linear vest, 9-month cliff with a 10% unlock)

10% to New Order treasury, its Incubators

5% towards investors (24 month linear vest, 6-month cliff with a 10% unlock)

5% to the Initial Farming Offering.

Y2K Finance is a project incubated by New Order DAO, which is the venture DAO that is behind several projects such as Frogs Anonymous and Redacted Finance. The team members are anonymous and there are no other known VCs in its funding.

Liquidity Mining - To encourage adoption, Y2K has a liquidity mining program where users can farm $Y2K token emissions by locking their ERC-1155 Earthquake vault receipt tokens in the farms.

Governance - $Y2K tokens have 1 vote, $Y2K locked for 16 weeks have 5 votes, $Y2K locked for 32 weeks have 10 votes.

Gauge System on Liquidity Mining distributions – In the future, $vlY2K holders are not just getting a slice of the protocol fee, but they'll also have a hand in guiding liquidity mining emissions through a gauge system. The gauges keep tabs on Snapshot votes and determine where emissions go. Decentralizing the emissions process creates room for a "Bribe Market" to emerge, and $vlY2K holders can offer their voting rights on the "Hidden Hand" marketplace for rent.

Market statistics

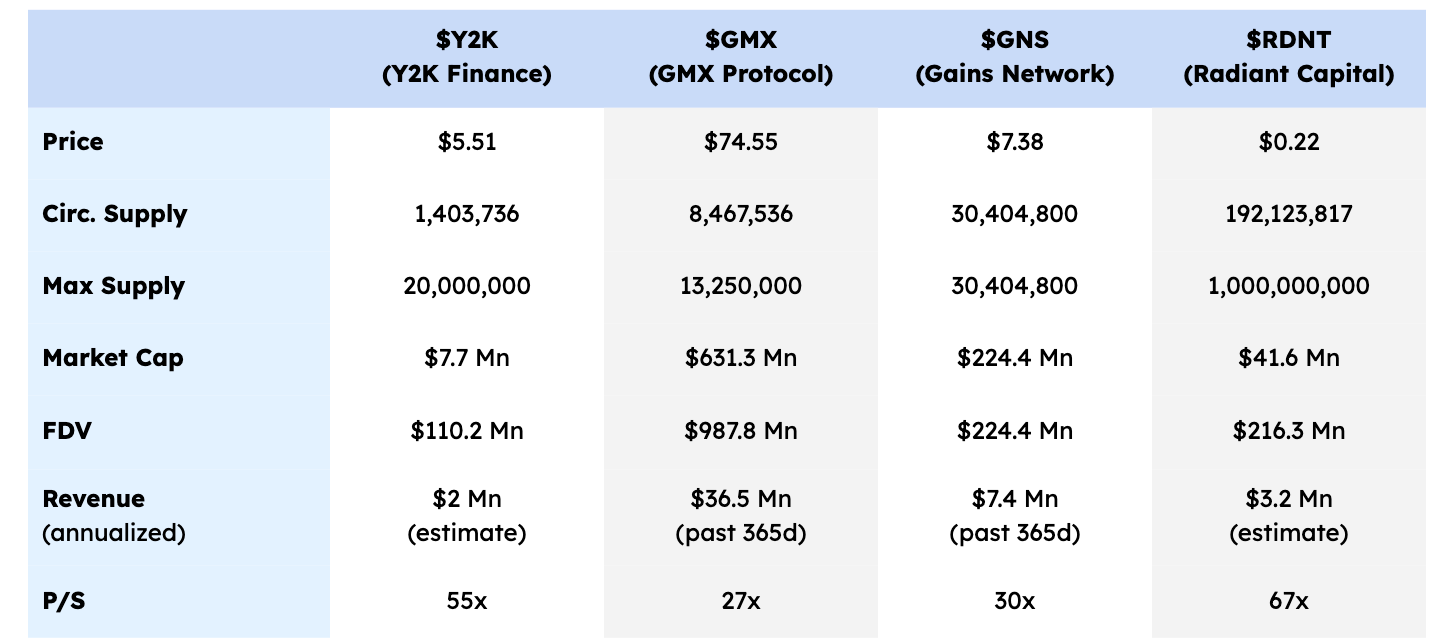

Currently $Y2K is trading at $5.51, which translates to an FDV of over $110M. Though its market cap only sits at $7.7Mn due to the low circulating supply thus far.

(Credits to @frijoles for the Dune dashboard)

Here is a quick comparison of Y2K tokens compared to other DeFi Protocols on Arbitrum. Please note that some of the revenue figures are only rough estimates based on the data available since protocol launch.

Catalysts Ahead

The risk of depegging is a constant presence in the crypto market, as evidenced by incidents such as the stETH depeg in June 2022, the USDD dip to 0.97 in December 2022, and the wBTC depeg FUD in November 2022.

The Y2K team has also been quick to respond to some of these narratives in the market, for example, they launched a stETH vault recently to ride on the hype around liquid staking derivatives. On Feb 10, when it is reported that stablecoin issuer Paxos, who operates Binance’s BUSD, is being investigated by New York Regulator, Y2K announced the launch of BUSD vault in the subsequent epoch.

The Luna crash caused a drop in confidence in decentralized stablecoins, leading to a surge in the popularity of centralized stablecoins like USDC, USDT, and BUSD that are backed by fiat currency. However, as the market moves past the aftermath of the Luna crash, we are seeing new decentralized stablecoins entering the market, like Aave’s GHO, Curve’s crvUSD, Platypus' USP, Vesta’s VST, Cosmo’s IST, among many more.

Y2K has the potential to play a crucial role in building trust and ensuring the stability of these new stablecoins by providing a mechanism for hedging against depegging risk. Protocols can demonstrate their confidence in the stability of their pegged assets by setting up a customized vault through Y2K finance service for a certain duration, allowing users to effectively hedge against the risk. This action can initiate a positive feedback loop of increased user trust and strengthened belief in the pegged assets.

Risks

The oracle used by Y2K is of great importance and can be a potential risk area. Currently, Y2K utilizes the Chainlink oracle to determine pricing. For large stablecoins and large market cap pegged LSDs, the risk is relatively low. However, for new projects and smaller caps, such as USP and VST stablecoins, there is a risk that a whale could manipulate the price of these tokens. For example, by dumping a microcap stablecoin while placing a hedge in the vault, they could cause a temporary depeg and gain from the risk vault.

In addition, the binary structure of Y2K's earthquake vaults means that a strike price is predetermined, and the only factor affecting the payout is whether the asset has depegged or not. This system can be problematic in extreme cases, such as with UST, as the hedge position may not be enough to protect users from capital loss. Therefore Y2K can be seen more as a betting protocol rather than an insurance provider.

References

https://drive.google.com/drive/folders/1dNURM0tKwcWyEU9C-y6LU5_NU91Mj1fu

https://tkxcapital.medium.com/y2k-a-playful-way-to-hedge-depeg-risk-tkx weekly-a5071e3baa89

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about