From Bitcoin Ordinals to Ethscriptions

Everything you need to know about Inscriptions, Ordinals, BRC-20, BRC-69, recursive inscriptions and Ethscriptions.

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Introduction

Since the Bitcoin whitepaper was published, its narrative has evolved in significant ways: from peer-to-peer payment system, to store of value and digital gold. Blockchains are immutable in a technical sense, but the social consensus formed around it can always override the technical. Case in point is the Ethereum hard fork from the 2016 DAO hack. Bitcoin itself has undergone multiple network upgrades, some more controversial than others.

One central debate about the Bitcoin network is regarding its role in serving as a programmable layer. Lighting network and Bitcoin “layer 2s” seek to leverage the network as a base layer where more complicated applications can be built on top. Some maintain this is the future of bitcoin while others are proponents of a more purist ideology where bitcoin should be untouched and that experimentation on it be kept to a minimum.

Earlier this year, inscriptions and ordinals have made a huge wave and caused a speculation frenzy on the potential of Bitcoin NFTs and programmability of the network. Moreover, the birth of BRC-20 tokens leverages the ordinal theory to create ‘fungible’ pieces of token representation, which ignited the imagination of the programmable Bitcoiners.

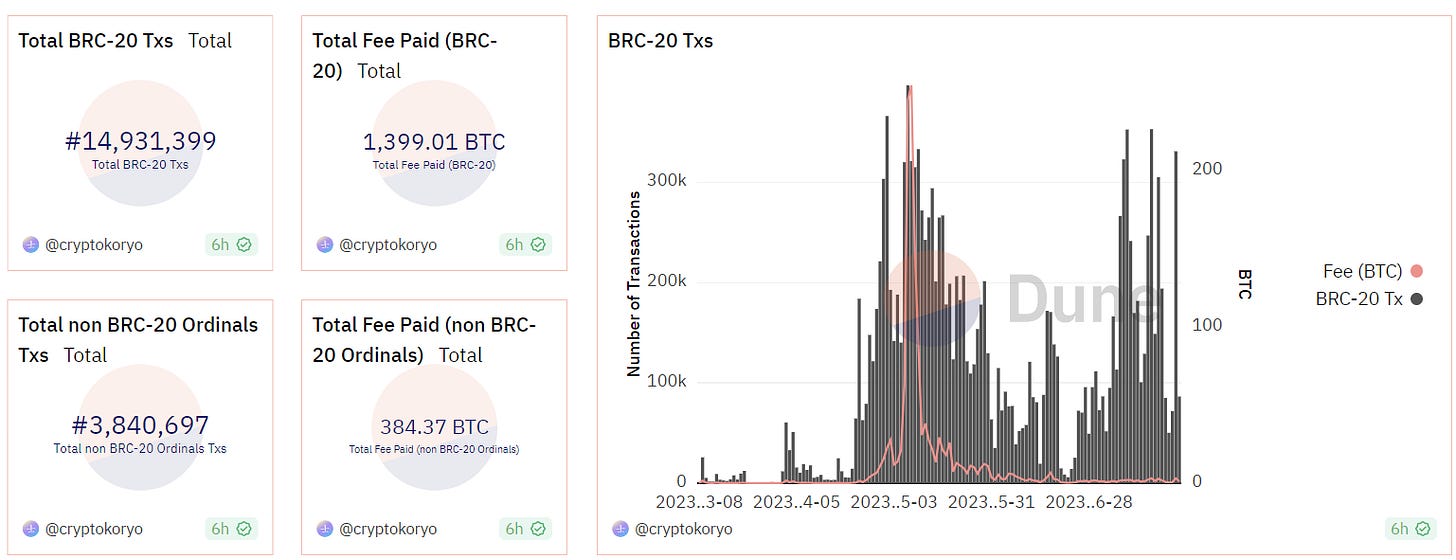

Vitalik also commented that the advent of Bitcoin Ordinals signals the “organic return of builder culture” to the network. “It feels like there's real pushback to the laser-eye movement, which is good.” While the initial hype has seemed to be quieting down, inscriptions and ordinals activity on-chain have stayed active. In fact, since April 2023, more than 40% of the all transactions on the bitcoin network are ordinals and BRC-20 related.

Are ordinals and inscriptions a fad that is due to become obsolete and forgotten? Or is this the most significant development of bitcoin since its inception that could shape its future over the long run? As we approach the next halving in 2024, do BRC-20 tokens offer any attractive investment opportunities? What are BRC-69 recursive inscriptions and Ethscriptions? These are the questions we will explore in this week’s post.

What are Inscriptions and Ordinals?

Let’s start by clarifying a few definitions.

Ordinal Theory is basically a way to give each satoshi (the smallest unit of bitcoin) a unique serial number and track them across transactions. This is done by attaching extra data to each satoshi, which is called "inscription."

The numbering scheme is based on the order in which satoshis were mined and transferred. The first satoshi in the first block has the ordinal number 0, and the second has the ordinal number 1, and so on. The ordinals protocol essentially allows users to make individual satoshis unique by attaching extra data to them.

Inscriptions here refer to the process of embedding arbitrary data onto the Bitcoin blockchain through the witness data portion of a transaction. Ordinals, in the context of ordinal theory, are the numbered sats that are tracked and transferred using the numbering scheme.

These ordinals can be seen as a way to serialize sats, effectively transforming a sat into a non-fungible token (NFT). The numbers assigned to ordinals can make them seem more valuable, similar to fiat currency notes with special serial numbers. Based on this characteristics, Ordinal Theory also further assigns a rarity for the satoshis:

Common: Any sat that is not the first sat of its block

Uncommon: The first sat of each block

Rare: The first sat of each difficulty adjustment period

Epic: The first sat of each halving epoch

Legendary: The first sat of each cycle

Mythic: The first sat of the genesis block

A key value proposition for Inscriptions and ordinals is that information is stored on-chain, providing verifiable proof of ownership that is immutable and transparent. The data stored in the inscriptions cannot be altered or deleted, ensuring the security and reliability.

The process of inscribing and assigning ordinals to satoshis is made possible by the Taproot upgrade to the Bitcoin protocol. Taproot introduced an easier way to store arbitrary witness data without strict limitations on how much it could contain. This created an opportunity for the utilization of ordinal NFTs, allowing associated data to be stored within Taproot script-path spend scripts.

Ordinals as Bitcoin NFTs

With an understanding of ordinal theory and inscriptions, we can see how these two elements combined allows for unique arbitrary data record on the network which gives ordinals similar characteristics as NFTs without the need for smart contract.

Ordinal theory can be imagined as a way of looking at the Bitcoin blockchain with special goggles on, allowing users to create, see, and track the extra information associated with each sat. Therefore when date data such as images, videos, and more are attached to an individual satoshi on the base Bitcoin blockchain, Ordinals can be seen as analogous to Bitcoin NFTs.

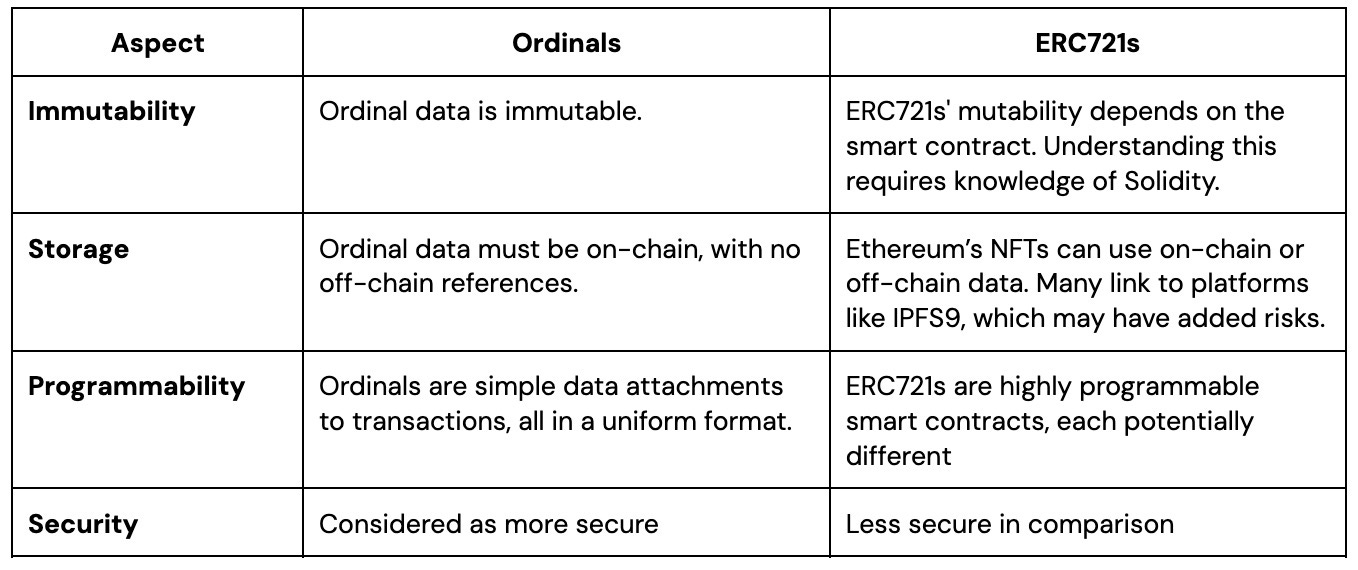

While both ordinals and traditional NFTs fall under the umbrella of digital assets, they exhibit significant differences.

First, Ordinals stand out for their immutability, meaning once created, they remain unaltered. In contrast, NFTs have the flexibility to undergo changes or updates. Second, ordinals are stored exclusively on-chain. NFTs however, could be stored on off-chain using other centralized or decentralized servers. Ordinals also have the capacity to house metadata directly on the blockchain. However, NFTs typically rely on off-chain solutions for metadata storage. Based on these features, the security of ordinals is considered to be higher than that of NFTs owing to their direct storage on the Bitcoin blockchain.

To sum up, ordinals present a more secure and unchangeable variation of NFTs. However, this comes with a limitation of less flexibility. Here is a table that summarizes the key differences between ordinals and NFTs:

Fungible Ordinals

What is BRC-20?

BRC-20 tokens are an experimental token standard that allows for the creation and transfer of “fungible” tokens on the Bitcoin network. They are named after the ERC-20 token standard and were introduced in March 2023 by an anonymous developer known as Domo.

Unlike ERC-20 tokens, BRC-20 tokens do not have smart contract functionality. They are limited to the functions of minting, deploying, and transferring tokens.

Creating and transferring BRC-20 tokens is also more complex than traditional transactions on smart contract platforms: After a BRC-20 token's minting is finished, transfers occur by minting again - a process of inscribing a “transfer” for a desired number of tokens. This transaction method is pretty inefficient, and BRC-20 transactions must be tracked off-chain to keep account balances updated.

Such a quality of BRC-20 is a key roadblock for NFT marketplaces or wallet apps to integrate them in a straightforward manner. For instance, transferring a token is essentially making a new inscription on-chain with the “transfer” function. It's like creating a new NFT to specify the balance change of the other NFT you owned. This system means that each transfer acts like a credit or debit to the balance. Wallets and other dApps can then calculate the users’ BRC-20 token balance based on the historical record of transfers and mints by netting the difference.

One way to think of BRC-20 is that it's a set of Ordinal NFTs minted to have exactly the same traits; This allows them to philosophically have the same fungibility as tokens. Another analogy here is that BRC-20 tokens are akin to ERC-1155 tokens, which can be thought of as NFTs that have the characteristics of fungibility.

On a more technical level, BRC-20 is a JSON text inscribed into an Ordinal that has instructions to make them unique. Each BRC-20 has to be have the below specification:

The ticker (must be 4 chars)

Max supply

Token limit per mint

Operation: Deploying, minting, and transferring function

Let’s use the largest BRC-20 Token ORDI as an example.

In the Deploy function:

"p" = protocol (BRC-20)

"op" = operation (deployment in this asse)

"tick" = 4 char ticker (ORDI)

"max" = max supply (21 million)

"lim" = mint limit (this determines the upper bound of “amt” in Mint function)

Once a BRC-20 token is deployed, anyone can mint it by inscribing the mint function There is no private sales or offering for these BRC-20 tokens, only mints, until the max supply has been reached. Looking at the current market, ORDI is the first BRC-20 token and commands the largest market cap at $155 million. Although at the current stage, the tokens are largely akin to meme coins with no attached utility.

What is BRC-20S

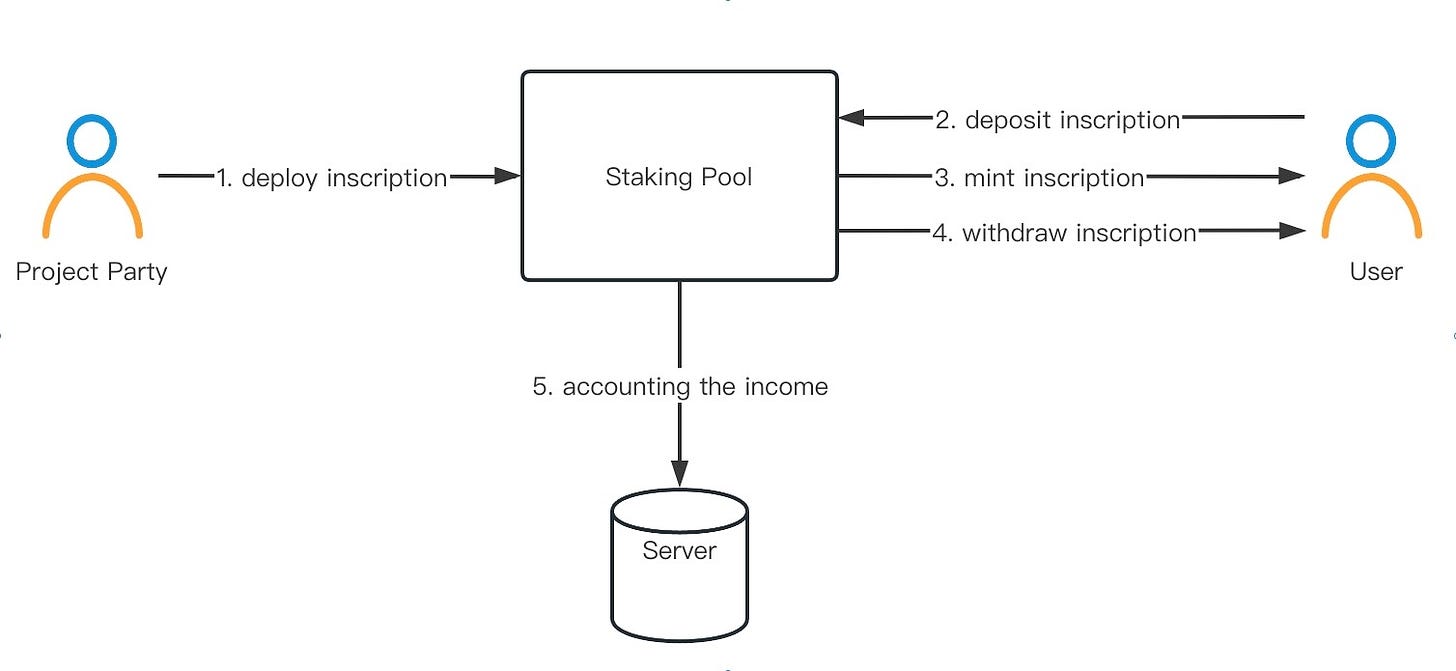

BRC-20S refers to the token standard introduced by OKX that enables Bitcoin and BRC-20 staking. This is an extended version of the BRC-20 proposal that introduces functionalities for staking operations such as depositing, minting, and withdrawing.

The motivation behind BRC20S is to provide BRC-20 token holders with additional opportunities to engage with their assets and earn rewards. By staking their BRC-20 tokens, users can earn rewards without having to sell or transfer their assets.

Some of the example use cases highlighted in the documentations resemble the mechanics yield farming. For example, the project team can issue their own BRC20-S tokens by creating a staking pool, gaining seed users. Users can stake BTC and earn other newly issued BRC20-S tokens. Or, users can stake one BRC-20 token and earn another BRC20-S like abcd (newly issued BRC20-S token).

The mechanism appears to grant BRC-20 token additional utility. Nonetheless at the current stage it does not appear to be anything more than “magical yield boxes” - essentially staking one artificial token to get more of another token created out of thin air.

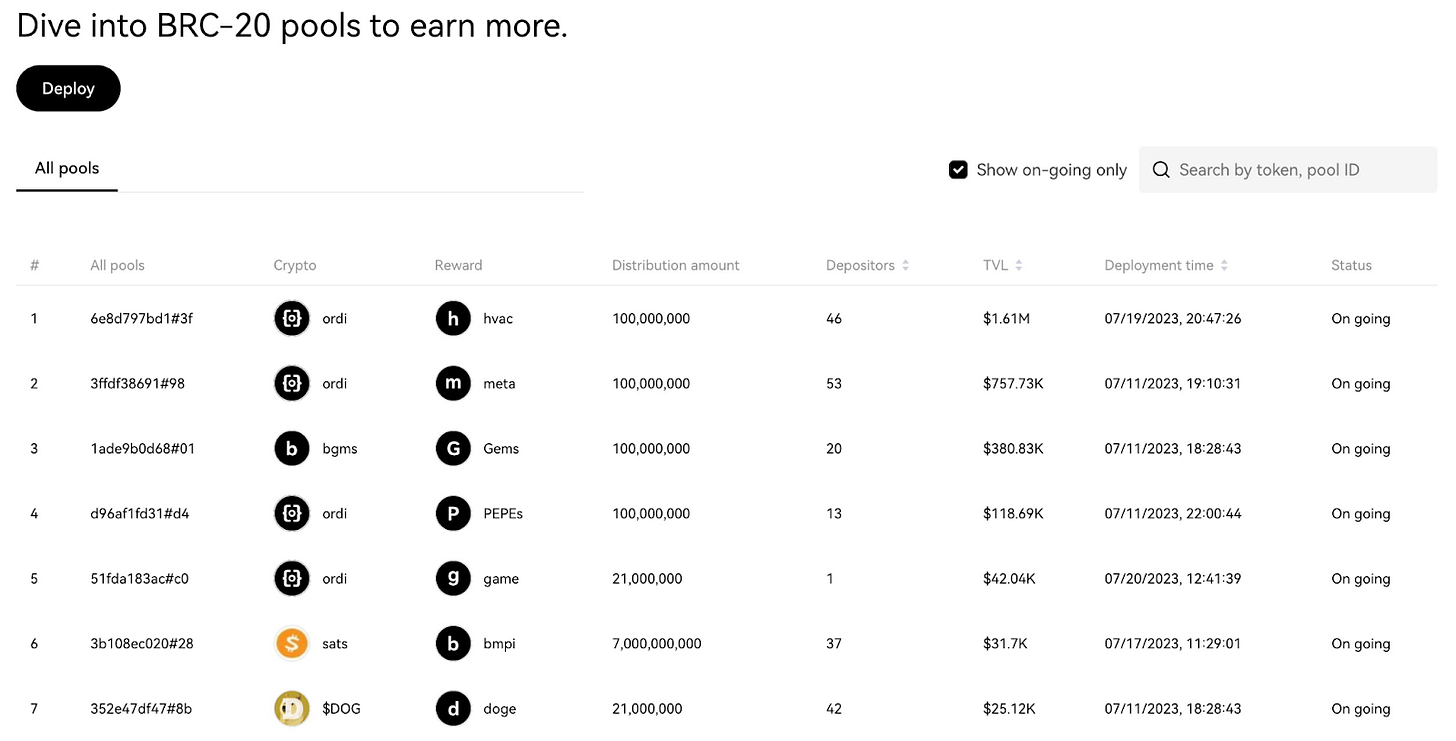

Current Adoption metrics

At time of writing, there were nearly 15 million BRC-20 transitions in total with about 1,400 BTC in total fees paid in relation to these transitions. Such volume has already surpassed the non-BRC20 Ordinals in both transaction counts and fees paid by about 4 times. The activity of BRC-20 has recently seen a revival about the initial hype in May. What’s more noticeable is that ordinals and BRC-20 transactions have taken up about 50% of all the BTC transactions since mid-April. Regardless of the price action of the Ordinals NFT or tokens, it looks like the they here to stay and will remain as a part of Bitcoin network activity.

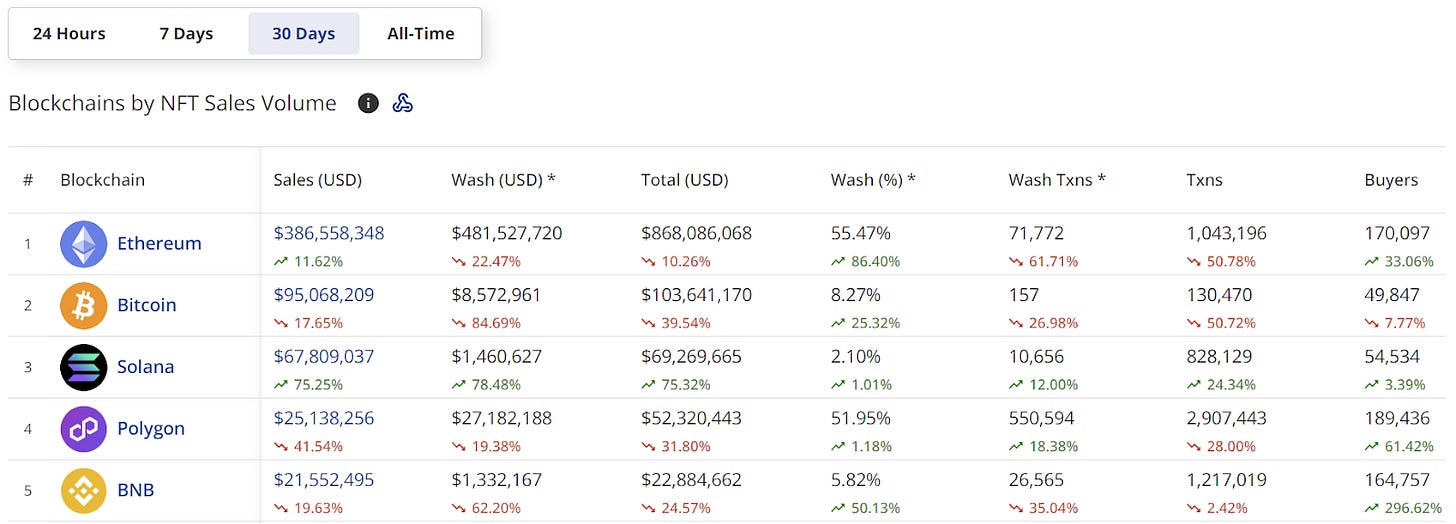

According to CryptoSlam, Bitcoin Ordinals also have a volume of $95 million in the past 30 days, which makes it the second most active NFT chain just behind Ethereum, ahead of Solana POlygon and BNB.

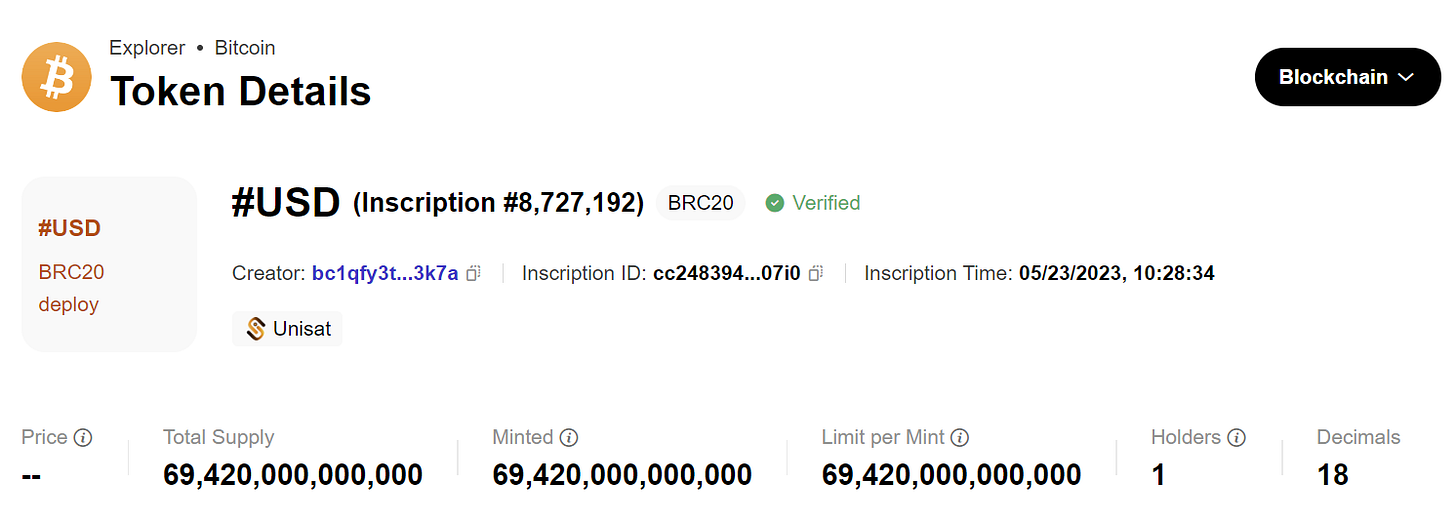

“#USD” - A BRC-20 based stablecoin?

So if fungible tokens can be created on the most economically secured blockchain, why not make a stablecoin on the Bitcoin network?

This is in fact exactly what Stably is trying to do with “#USD”. BRC-20 “#USD” by Stably is a US Dollar-backed stablecoin that is built on the Bitcoin ordinals protocol. It is designed to provide the Bitcoin community with a transparent and regulatory-compliant stablecoin.

The idea is the same as centralized fiat-backed stablecoin. Every #USD token is fully collateralized and redeemable 1-to-1 for USD held by a US-regulated custodian in a collateral account. The custodian, Prime Trust, holds the USD in FDIC-insured banks for the benefit of KYC-verified token holders. Monthly attestations are conducted by a third-party stablecoin attestor, The Network Firm, to verify the collateralization of the stablecoin.

Similar to Cricle’s USDC, To mint #USD, users need to go through a KYC process. Once verified, they can deposit USD into the collateral account at Prime Trust using payment methods such as Fedwire, SWIFT, USDC, and USDT. The deposited USD will then be converted into #USD and transferred to the user's personal wallet.

Stably proclaims that "#USD is designed to bring the benefits of tokenized fiat to the so called “BitFi” ecosystem. #USD seeks to bring tokenized fiat benefits to the BitFi ecosystem by streamlining fiat on and off-ramping for ordinals and BRC20 assets. #USD also provides a stable trading medium for ordinals and BRC20 assets on decentralized marketplaces, reducing crypto price volatility risk.

BRC-69 and Recursive Inscriptions

Recursive inscription refers to a concept that allows inscriptions on the blockchain to reference and utilize content from other inscriptions. It involves the repeated application of a rule or procedure to successive results, creating an interconnected network of data sources. This means that instead of each inscription existing in isolation, they can now be part of a larger whole, enabling greater flexibility and efficiency in storing and accessing information.

Recursive inscription allows for the recording of data, such as text, audio, images, videos, and applications, in a part of Bitcoin transactions called Witness. It enables multiple tokens to "work together" or be inserted into other tokens, thereby circumventing the 4 MB limitation of Bitcoin blocks. This feature is aimed at reducing transaction costs and optimizing the space used in Bitcoin blocks.

BRC-69, is a standard introduced by the Bitcoin Ordinals Launchpad platform, Luminex. It is an ordinal collection standard that aims to transform the Bitcoin NFT landscape by significantly reducing the costs of inscriptions and introducing an entirely on-chain pre-reveal process.

The mechanism of action of BRC69 involves a four-step process. Users first etch images of their NFT traits on-chain, then deploy the collection, compile it, and finally mint the assets. By leveraging recursive inscriptions, BRC-69 enables users to recycle data already inscribed on the blockchain, significantly reducing the time and cost required for making inscriptions. Instead of individually minting thousands of JPEG files onto the blockchain, users can reference content within existing inscriptions of the same collection and render it using minimal code.

BRC-69 allows NFT collections to leverage fully on-chain resources, enabling the disclosure of NFTs and the rendering of images on the Ordinals explorer without requiring additional actions. This not only enhances the efficiency of the inscription process but also reduces costs for both users and miners.

Furthermore, the introduction of BRC69 addresses concerns regarding blockchain congestion caused by Bitcoin NFTs. By reducing the size and complexity of inscriptions, BRC69 helps mitigate the strain on the Bitcoin network.

Overall, recursive inscription and BRC-69 represent significant advancements for the Ordinals ecosystem. These innovations enable more efficient and cost-effective inscription of data, opening up new possibilities for creators, developers and users.

Marketplace support and ecosystem

OKX Wallet is the first multichain wallet to support BRC-20 trading with the launch of the Ordinals Marketplace. The Ordinals Marketplace allows users to mint and trade Bitcoin Ordinals and BRC-20 tokens. The launch of the Ordinals Marketplace, along with the experiment with BRC20-S standard demonstrates OKX's commitment to supporting the ordinals ecosystem.

UniSat Wallet is a platform that provides support for Bitcoin Ordinals and BRC-20. Recently, UniSat Wallet announced the launch of a BRC20 native swap, a Ordinals native swap on bitcoin mainnet that is seeking to replicate the trading experience of Uniswap. UniSat Wallet provides open-source code, API access, and documentation to support developers in building their own Swap platforms based on BRC20. UniSat Wallet is also reportedly raising $50 million in financing, with interests from Binance Labs.

Magic Eden, a multi-chain NFT marketplace, has also supported Bitcoin BRC-20 tokens. This expansion leads the NFT marketplace into Bitcoin-based NFT creation, giving creators the ability to create new NFTs on the Bitcoin protocol. Magic Eden established itself as a leading venue for Bitcoin-based collectibles not long after its Ordinals marketplace debuted in March, moving early to support the NFT-like Ordinals amid growing hype and leveraging its established name in a nascent space.

Ethscriptions

What are Ethscriptions?

Ethscriptions is a protocol that allows users to create and share digital objects on the Ethereum blockchain. It was launched by Tom Lehman, the co-founder and former CEO of Genius.com. The protocol leverages Ethereum's transaction "calldata" to record non-financial data on the blockchain.

Unlike traditional NFTs , Ethscriptions are not issued as tokens on Ethereum's ERC-721 token standard through smart contracts. Instead, they are stored in transaction-level data. This unique approach sets Ethscriptions apart and opens up new possibilities for creating and managing digital assets on the blockchain.

The Ethscriptions protocol was introduced in June this year and has already gained some attention and adoption. To date, approximately 553K Ethscriptions have been created. However, the protocol recently encountered a setback when its main marketplace on Ethscriptions.com fell victim to a security breach. Hackers were able to steal a considerable number of listed Ethscriptions, causing disappointment for the community.

The emergence of Ethscriptions comes at a time when experimentation with Bitcoin is on the rise. The popularity of systems like Ordinals has sparked renewed interest in exploring unique use cases. By leveraging transaction "calldata," the protocol offers cost-saving benefits by limiting the use of smart contract storage.

Why Ethscriptions when we have ERC-721?

Ethscriptions and ERC-721 are both protocols used on the Ethereum blockchain, but they serve different purposes and have distinct advantages and disadvantages.

Ethscriptions are assets that leverage transaction "calldata" to record data on the Ethereum network. They allow users to embed fully on-chain arbitrary data, such as images or text, directly into the blockchain. ERC-721 is a token standard on the Ethereum network that is used for creating and managing non-fungible tokens (NFTs). NFTs are unique digital assets that can represent ownership of various item.

Advantages of Ethscriptions:

On-chain data storage: Ethscriptions store data directly on the Ethereum blockchain, eliminating the need for storage solutions. This ensures the immutability and permanence of the data.

Cost-saving benefits: Ethscriptions offer cost-saving benefits by limiting the use of smart contract storage.

Enhanced security: By leveraging the Ethereum blockchain's security features, Ethscriptions provide a secure environment for storing and accessing data. The decentralized nature of the blockchain makes it difficult for anyone to tamper with or manipulate the stored information.

Disadvantages of Ethscriptions:

Limited file size: Ethscriptions have a file size limitation of approximately 90KB. This restriction may be a disadvantage for users who need to store larger files.

Lack of interoperability: Ethscriptions are not compatible with the ERC-721 token standard or other NFT platforms. This means that Ethscriptions cannot be easily traded or interacted with on existing NFT marketplaces.

Limited functionality: Ethscriptions do not contain any smart contract logic, thus making them less integratable than conventional NFTs.

EIP-4444: The upcoming "Purge" upgrade in Ethereum includes a proposal, EIP-4444, to reduce transaction calldata, which might impact the durability of the Ethscriptions storage.

Future of inscriptions on Bitcoin and Ethereum

As the use of ordinals deviates from the conventional peer-to-peer electronic cash system, numerous criticisms have arisen from those who disapprove of them. Firstly, critics argue that storing arbitrary data on the Bitcoin network strays from the original intention Satoshi Nakamoto proposed in 2013. Secondly, the addition of extra data to the blockchain, known as 'blockchain bloat,' enlarges its size, complicating download processes and leading to concerns about blockchain clutter. Lastly, critics contend that inscribing a significant number of satoshis could compromise Bitcoin's fungibility, potentially impacting its primary role as digital currency.

Despite these criticisms, a report from Galaxy Digital suggests a rather bullish outlook for Bitcoin inscriptions. They estimate a market capitalization of $4.5 billion, with $1.6 billion in trading volume by 2025. This projection is based on various assumptions regarding the types and volumes of collections deployed and a top-down analysis of the global art market's trading volume.

In the bull case for Bitcoin Ordinals, minting NFTs on the Bitcoin blockchain turns these digital artifacts into a part of the most secure and likely-to-endure blockchain. Bitcoin miners have a strong incentive to support Bitcoin Ordinals due to the additional fees they generate, contributing to the network's security and stability. Moreover, the infrastructure underpinning Bitcoin Ordinals, such as marketplaces, is growing with continued interest in investment and funding.

However, the bear case should also be considered. Despite ordinals' ability to store arbitrary data, many BRC-20 tokens are largely meme-like and lack substantial utility. Another concern is the impact of Ordinals on transaction fees. Bitcoin transaction fees can surge due to Ordinals activity. Additionally, unlike Ethereum NFTs, Ordinals lack on-chain support for royalties, which may further detract from their appeal.

Conclusion

Blockchains are vessels for social consensus. They serve as shared, decentralized databases that operate based on a majority agreement among their community. There are those who adhere to the original vision of Bitcoin as a platform solely for secure financial transactions. They voice concerns that the inclusion of ordinals could unnecessarily increase transaction fees and fill the blockchain with irrelevant data.

In contrast, there are advocates of ordinal NFTs who value the cultural and memetic contribution they bring to Bitcoin. These proponents envision Bitcoin's growth beyond its financial roots, transforming it into an expansive, immutable, and database for more diverse applications.

It's not just the technical possibilities that determine the future of blockchain, but the shared beliefs, values, and perceptions of its user community. The question of whether Bitcoin will expand beyond its financial roots to host NFTs and other diverse applications will ultimately hinge on the agreement and discourse formed by its users and communities.

References

Bitcoin Inscriptions & Ordinals | Galaxy | BRC-20 (brc20 Ordinals) | Dune

Chain Research — What are Bitcoin Ordinals? | by Chain | Medium

Grayscale® - Market Byte: Can Ordinals Unlock New Potential for Bitcoin?

BRC-20 Tokens: A Primer | Binance Research A New Era for Bitcoin

The Definitive Guide to Bitcoin Ordinals | Coinmonks | May, 2023 | Medium

What are Ordinals? The new revolution on Bitcoin. | Rajan Sharma | Medium

What are Ethscriptions? Inscriptions on the Ethereum Blockchain, Explained

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about