Forget Fat Protocols: Who Makes Money in Modular Blockchains?

Assessing Value Accrual in the Future of Layer 1s

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

If someone told you a product that makes $260M in fees will be worth half of a product that generates $8.6M in fees, you might call them crazy.

In crypto, they’d make billions.

Fat Protocols is likely one of the most successful investment theses of all time. In the expanse of a few years, investors in multiple layer 1s generated returns upwards of 3,000x on multiple Layer 1 bets since 2017, prompting more capital to flow into infrastructural companies in crypto.

Even in the current bear market, one look at the rankings for cryptoassets tells you that Fat Protocols - the idea that the lower in the technical stack a project is the more value it captures - is alive and well. The most valuable networks today are virtually all Layer 1s (e.g. Ethereum ($150B), Polkdaot ($75B), Solana ($11.1B)) whereas even the most popular applications are valued at a fraction of that (e.g. Uniswap, at $5.2B).

The logic for Fat Protocols goes like this: everything that happens on a blockchain requires fees to be paid in its native token. Applications on a blockchain drive adoption of the blockchain’s token, which drives its price, increasing the value (and security) of the network, hence attracting more applications.

Recently, however, a wave of new protocols are launching that are splitting apart the functions performed by “monolithic” smart contract platforms like Ethereum into separate layers. These protocols might shift us from the “Fat Protocols” era into a new investing paradigm: Modular Blockchains.

This week, we’ll cover:

What is a Modular Blockchain? And Why You Should Care

Modular Blockchain Fee Model

MEV on Modular Blockchains

What is a Modular Blockchain?

The Fat Protocol thesis quickly ran into issues when real usage began to clog up blockcahins. Increased adoption of crypto applications equates to increased competition for block space, which increases costs for users.

As a somewhat recent example: it cost $1,000 to do Uniswap transactions during the Otherside NFT mint!

The “World Computer” vision where one blockchain handles every single application in Web 3 seemed increasingly ludicrous. As a response, layer-2 rollups and appchains began to emerge.

Enter the modular blockchain thesis, which goes something like this:

Blockchain transactions require different resources: primarily execution, settlement/consensus, and data availability

Specialized blockchains are better equipped to to provide these distinct resources (as opposed to one blockchain providing all of these resources)

Thus, we can construct smart contract platforms that utilize different blockchains for these distinct resources that will be more efficient and more performant, without meaningfully sacrificing decentralization and security

We have already seen some progress within the Ethereum ecosystem towards this vision: multiple rollups including Optimism, Arbitrum, and Starkware have been launched and are in use today; these platforms are primarily execution environments that use Ethereum as a settlement/consensus and data availability layer.

Assuming the modular blockchain vision makes sense (and there’s some valid critiques of the vision), an important question for an investor is: how will value accrue between these separate layers i.e. if a user pays $1 in fees for a transaction, which layer will capture most of those fees?

In other words, for an investor that is bullish on the growth of crypto applications, should she bet on the Layer 1 token (e.g. ETH), the Layer 2 token (e.g. OP), or the DA layer token (e.g. yet-to-launch Celestia)?

Where Does the Money Go in the Modular Stack?

In general, there are four sources of value generation for smart contract platforms:

Execution

Data availability

Settlement

MEV

Currently, users pay fees for the first three via a simple “gas fee”; the fourth is largely captured by validators on Ethereum, and MEV searchers on other networks. The two most successful rollups on Ethereum, Optimism and Arbitrum, provide us with some insight on how these fees might be split between different layers.

Currently, on Arbitrum and Optimism, execution fees are extremely low; this may change once sequencers need to be decentralized, but it is likely that they remain orders of magnitude lower than execution fees on Ethereum. User fees pay for three things:

Execution fees: negligible

Layer 1 settlement and DA fees: 70-80% of fees are used to pay this

“Revenue”/Margin: the remaining 20-30% is captured by rollup operators

However, it is not worth reading too much into these numbers for three reasons: a lack of experimentation in fee models, an extreme shift in the cost of data availability with EIP-4844 (and eventually the introduction of data availability sampling - more on this below), and the landscape of MEV extraction in rollups.

Below, I’ll talk a little bit about all three factors and ways they could impact value accrual, as well as some experiments and launches to keep an eye through the next year.

Fee Model Experimentation

At the moment, Optimism uses a model that charges a markup on layer-one fees; however, this markup is fixed. Starknet and Arbitrum employ similar models. This is a very simple fee model; some example of more interesting experimentation already exist:

ImmutableX, which is run as a StarkEx Validium, does not charge users gas fees at all! Instead, they charge a 2% fee on all NFT trading transactions that happen on the platform. Thus, layer-one fees are abstracted away from users completely. The IMX equity entity maintains a cash reserve on the balance sheet to pay for gas fees.

Taiko, a new type-1 zkEVM, plans to have decentralized permissionless access to both block proposing and proof generation. Their fee model allows the protocol to act as a coordination mechanism between block proposers and provers: users pay fees in ETH at the transaction level (nothing changes), block producers can create a block and collect all fees in the block (including MEV extraction), but need to pay a fee in TKO token when proposing a block (which is burnt). In turn, the protocol mints TKO token as a reward for provers who submit a succesful proof for a block that was accepted by the protocol. The key variable here (the Taiko team is still figuring out the formulas) is ensuring a “balance” between what prospers and provers earn; but this example is instructive of what fees might look like in a genuinely “decentralized” rollup.

I expect to see significantly more experimentation in this space over the next year, particularly for app-specific rollups. It’s also worth keeping an eye on a number of startups that allow users to outsource the work of setting up a roll-up e.g. Constellation sets up an Optimism style rollup for a team that needs it, while allowing flexibility on choice of execution, settlement and DA layers.

These startups will charge fees as well beyond the fees paid to the underlying blockchains: what do those margins look like in the long run?

The Dark Age of Data Availability

It’s important to remember that Ethereum was not originally designed with rollups in mind. Rollups currently use Ethereum for data availability by posting data as “calldata”; this procedure was deliberately made extremely expensive in terms of gas cost because the data is stored permanently on-chain, and reducing state bloat is a primary concern for Ethereum.

Recognizing this challenge, Ethereum is implementing EIP-4844 (proto-danksharding) - without delving into the technical details, this improvement creates a new feature within Ethereum that allows rollups to post “blobs” of data that are only posted to the consensus layer and can be pruned by nodes after ~2 weeks. This proposal will dramatically lower the costs of making data available on Ethereum, likely by an order of magnitude or more. This is a near-term improvement, expected in the next 6 months.

In the long term, data availability costs are expected to fall further via the use of data availability sampling, a technique that uses magic math to allow nodes to sample a small portion of block data to prove that all of the block data was made available instead of needing to download and verify full blocks. Data availability sampling is a key feature of both Ethereum’s long-term rollup centric roadmap and data availability focused blockchains, including Celestia and EigenDA.

This introduces two interesting questions:

What happens to Optimism’s “markup on L1 costs'' fee model when L1 DA fees fall dramatically? The expectation is that transactions on rollups should become an order of magnitude cheaper; will rollups pass on all these savings to users or should we expect revenue to increase?

How much value can a dedicated data availability layer capture? Optimism paid 800 ETH as DA fees for the month of November; however, if DA costs fall by multiple orders of magnitude, then it is likely the quantity of fees will also fall dramatically. Celestia mainnet likely goes live in 2023 and Fuel will likely launch a rollup that uses Celestia for blockchain; empirical evidence from this experiment will be a key data point to answer this question.

MEV on Modular Blockchains

MEV has become a key feature of value accrual for blockchains; the median validator on Ethereum can add 1.5-3 percentage points to their native yield by accepting payments for transaction ordering via mev-boost (we covered this for Blockcrunch VIPs in a previous post)

MEV extraction in modular blockchains and rollups is still in a very nascent stage; Optimism and Arbitrum both currently run centralized sequencers that process transactions on a first-come first-serve basis. However, there exist early conversations around auctioning the right to transaction ordering (or allowing the sequencer to reorder transactions to extract more MEV). Taiko’s proposed fee model above is an interesting example of what a rollup value extraction model looks like in a permissionless block building environment.

Flashbots also introduced plans for SUAVE: a blockchain that functions as a “sequencing” layer for multiple blockchains, with a focus on cross-domain MEV. Sei (more on next week’s memo!) and Skip within the Cosmos ecosystem are thinking of ways to structure mempools to allow the chain and validators greater control over what types of MEV can be extracted.

These moves are evidence that rollups and modular chains more broadly are going to be key battlegrounds for the MEV landscape over the next 2-3 years.

In the absence of specific plans from teams, it is challenging to make specific predictions about how these changes will affect value accrual for the modular blockchain stack; however, the decisions teams make about how to distribute and extract MEV could have dramatic effects on the value accrual landscape.

Summary

The era for Fat Protocols and a monolithic blockchain that handles every action in the crypto economy might be over. As we transition into a world with separate execution, settlement and data availability layers, we can expect to see a battle for control over fees.

Data availability costs are reducing dramatically: layer-2s are going to need to figure out a way to charge users that allows them to retain some value. Data availability focused chains (such as Celestia and EigenDA) are also going to have to find a way to monetize, which may prove challenging after DA becomes much cheaper on Ethereum.

Personally, I’m watching the MEV space most closely; Flashbots’ SUAVE, the work done by Skip with Osmosis, and the ATOM 2.0 proposal all build upon a key insight: the capture of MEV and cross-chain MEV can be a major source of revenue for chains, even in the absence of scarce blockspace.

Total MEV capture is still low relative to valuations of most chains; however, I expect that rollups and appchains that are able to gain adoption and grow transaction volume will find that auctioning off the right to transaction ordering is the key value capture mechanism.

Appendix: Digging into Optimism & Arbitrum Fees

Transactions on rollups are cheaper than base layer transactions for two reasons:

The cost of execution is significantly lower than the cost of execution on base layer (a single sequencer is responsible for execution vs all Ethereum nodes needing to process the transaction)

Settlement costs are driven down significantly by batching rollup transactions together prior to publishing data on the base layer. Fees on Optimism are designed to cover both the costs of execution and of settlement to the base layer.

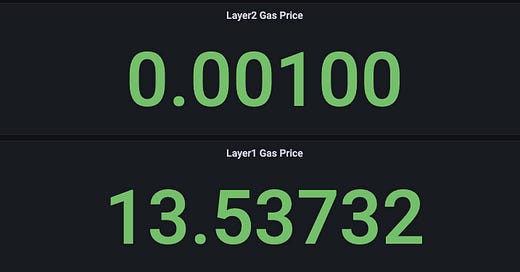

For the reasons stated above, execution fees are usually extremely low: gas fees are usually set to 0.001 gwei and increase during periods of high network usage (this has only happened twice in the last 90 days, as shown by the chart below). This is multiple orders of magnitude lower than what users pay for execution on the base layer chain (also illustrated in the chart below - check out the y axes for both charts). As noted above, execution fees and revenue will likely change once progress is made on decentralizing the sequencer and once there is a clear mechanism for MEV extraction.

The layer one fee, thus, forms the majority component of the fees; execution costs are basically insignificant (see chart 2 below). This can also be seen in the variation in the price of transactions; a Uniswap transaction currently costs $0.16 but has spiked to $2 during prices of high gas congestion on Ethereum.

Optimism is able to “earn revenue” in two different ways. The fees paid for execution to the sequencer (which are still extremely low) and a “markup” charged on L1 fees. Arbitrum’s fees work slightly differently, but the core concept is the same: users on L2 pay fees and the rollup pays some portion of those fees as gas fees to post data on Ethereum.

The tables below illustrate monthly L1 data availability costs, L2 transaction revenue, and margins earned in ETH terms by operators for both Optimism and Arbitrum.

Roughly, we find that rollups currently capture about 20-30% of the fees paid by users, with the rest going to Ethereum; i.e. at the moment, for every $1 of transaction fees paid by a user, $0.2-$0.3 is captured by the execution layer and the rest is captured by the settlement & DA layer.

Resources:

Proto-danksharding: https://notes.ethereum.org/@vbuterin/proto_danksharding_faq#What-is-proto-danksharding-aka-EIP-4844

The following resources are my go-tos for understanding this stuff better: i) Understanding rollup economics from first principles by Barnabé Monnot from the Ethereum Foundation ii) Wait, It's All Resource Pricing? by John Adler

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.