DOGE, SHIB, PEPE, WIF, BOME: The Memecoin Supercycle

Does Your Coin Have a Hat?

Blockcrunch VIP is a premium research newsletter on the most important crypto projects and trends, prepared by top crypto analysts twice a month. Subscribe to Blockcrunch VIP to receive in-depth project analysis from our research team - all for the price of a coffee ☕ a day.

Imagine a digital asset born out of internet culture, fueled by cult-like community enthusiasm and challenging traditional notions of value. Memecoins have captured the attention of specu-ahem, investors worldwide — from the retail newbie logging on to Coinbase for the first time, to hedge funds positioning themselves to capitalize on their influential and mindshare-permeating nature.

While memes offer a distinctive combination of cultural relevance and humor, memecoins add a speculative dimension to the mix.

One of the earliest memecoins to go viral was Dogecoin (DOGE). Based on the already popular meme of the same name, DOGE rocketed to just under $90 billion in market cap during the 2021 bull run. To put this in perspective, a well-established company like FedEx is currently trading at a market cap of approximately $63 billion, highlighting the staggering amount of speculative interest Dogecoin garnered from investors.

Today, memes and memecoins run almost parallel, with countless memecoins launching as soon as a new meme is created, resulting in near-instant tokenization of the attention economy and an avenue for traders to speculate on the virality of each meme. This has been made possible as gas fees on blockchains like Solana have decreased and the ease of launching tokens have increased via the development of no-code token deployers.

Is this the start of the “Memecoin Supercycle”?

The combined market cap of 14 popular memecoins as illustrated by memecoinrace.xyz as of the time of writing sits at just $57 billion — a far cry from Dogecoin’s peak market cap of $88 billion. With BTC reaching all time highs, surely memecoins make a comeback?

Are memecoins just a fleeting trend, or do they represent a new asset class as part of the future of finance? Let's find out.

Disclosure: The author holds positions in tokens that are mentioned in this article.

What Are Memes?

Memes are units of cultural information that spread virally among people, typically manifesting as images, videos, or text that humorously capture the state of current internet and pop culture. Usually characterized by their relatability, humor, and often, a reflection of societal sentiments, memes rapidly evolve and spread through online message boards, messaging apps, and social media platforms. In essence, meme culture represents a unique form of digital communication and are a collective consciousness of internet culture.

The trajectory of meme distribution has evolved alongside the internet itself. Early memes found traction on message boards such as 4chan and later on pioneering hybrid platforms like Reddit and 9gag, where text-based and image-based memes flourished. The emergence of social media giants — Facebook, Twitter, Instagram, TikTok — and the multifaceted platform Twitch has exponentially broadened the format, reach, and impact of memes, connecting diverse communities around shared humor and significant pop culture events. The launch of YouTube cannot be ignored, as it expanded the meme genre to include video-based meme formats that leveraged on the medium's expressive range.

What about memecoins?

Blockchains are but an extension of the internet and some go as far as to say, “Onchain is the new online”. This concept has certainly gained credibility through the emergence of memecoins, which illustrate how memes, integral to internet culture, have found a new expression onchain.

What is a Memecoin?

Dogecoin (DOGE), inspired by the "Doge" meme featuring a Shiba Inu dog, marked the inception of memecoins — cryptocurrencies that leverage the viral nature of memes to gain popularity and speculative interest. Following DOGE, other memecoins like Shiba Inu (SHIB) and SafeMoon emerged, each attempting to capitalize on the blend of humor and speculative frenzy that memecoins provide.

Memecoins not only embody the merger of online culture with blockchain technology but also affirm the growing influence of the blockchain as a medium reshaping digital experiences and providing avenues for speculation.

Recipe for Success

Like any investible asset, for example in the stocks or equities market — there are recipes and fundamental signals for what an undervalued or high-potential stock looks like.

But how do you value memecoins?

Drawing similarities to memes, and based on the historical performance of memecoins, we can observe several factors:

Community Support: Strong, enthusiastic community backing is crucial for spreading awareness and fostering a sense of belonging among holders. Everybody loves a cute dog or animal — the Doge meme, Dogecoin, and subsequent animal-related memecoins benefited from this universal appreciation.

Viral Potential: Memecoins generally capture or are associated with a meme that has widespread appeal and recognition. SafeMoon started as a memecoin but lacked the viral appeal that memecoins based on already viral memes had — lesson in there.

Timing: Successful memecoins have historically emerged either during phases of the cycle where the broader cryptocurrency market is receptive to speculative investments outside of Majors and Alts, or simply when a new meme emerges. PEPE, based on the already popular Pepe the Frog meme, emerged during a downcycle in June 2023, when BTC and ETH were trading sideways.

Attention: Arguably the most crucial factor to consider, with the age-old equation of “attention = time = money” being highly relevant. The key question is whether the meme or memecoin can capture and, more importantly, retain attention. In an era dominated by short-form content, capturing the fleeting attention spans of target audiences (in this case, traders) has become a vital. This principle is exemplified by Doge, a meme that has become a staple in internet culture. Its lasting appeal is mirrored in Dogecoin, which continues to lead as the top memecoin by market capitalization.

The Dark Side

The rapid rise of memecoins has also given rise to “rugs”. A rug refers to a scam where developers abruptly withdraw all funds from the project, leaving investors with worthless assets. Usually run by token factories — individuals or teams that do nothing but deploy tokens and add liquidity, before removing liquidity or upgrading the contract to prevent token holders from selling, thereby “rugging” buyers of the token.

On January 20, 2022, a paper on scam detection was published. It revealed that of the 27,588 tokens studied, as many as 97.7% were found to be rug pulls.

On August 27, 2023, X user tannishmango published a graph that plotted every single address that deployed a Uniswap pool on Ethereum. They found that out of more than 225k liquidity pools, nearly half were “rugged” by their deployers.

Perhaps the most well-known rug pull of late that crypto natives might recall would be the BALD token launched by an anonymous deployer, later revealed to be linked to anonymous X user Milkyway. The memecoin infamously reached almost $100m in market cap within days of launching on Base, an Ethereum Layer 2 network by Coinbase, before crashing when the deployer pulled liquidity — a full timeline of events can be found here.

Driving Blockchain Adoption

Memecoins have inadvertently played a role in driving the adoption and use of blockchains during bear markets and periods of low market activity.

Ethereum

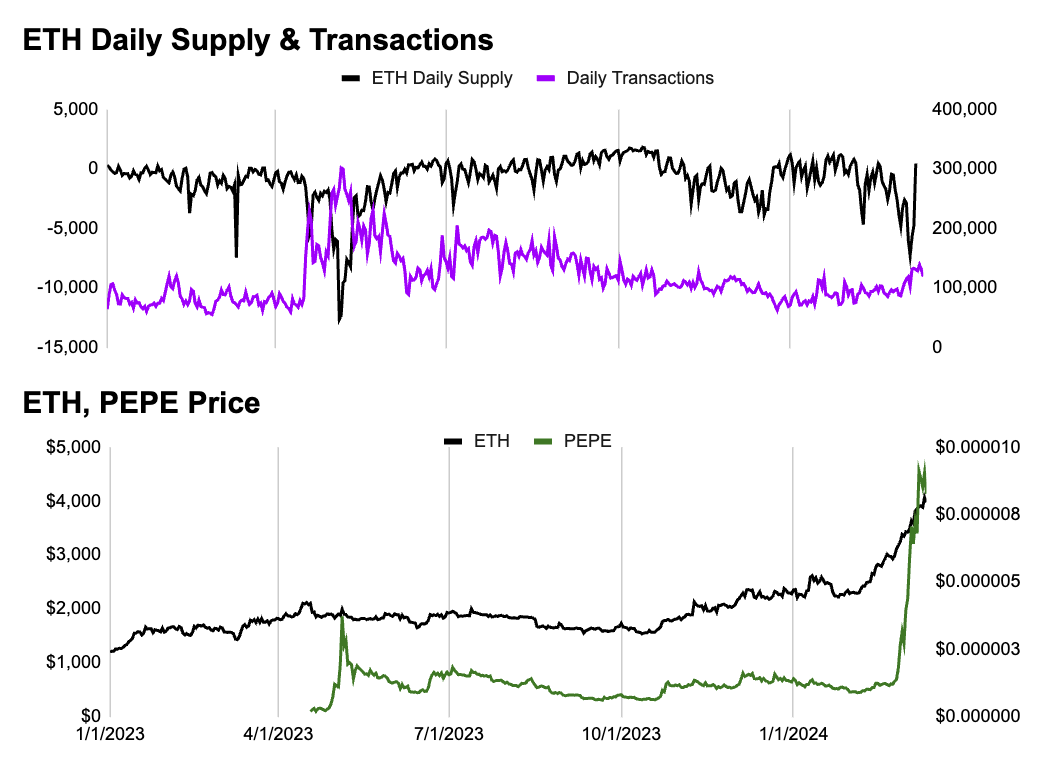

During the market downturn in 2023, the daily supply of Ethereum turned positive, indicating a shift back to inflationary conditions due to reduced on-chain activity. This reduction wasn't sufficient to offset the daily issuance of about 2,500 ETH — on the Ethereum mainnet, gas fees consist of a base fee, which is burned, and a priority fee, which is awarded to the block miner.

In May 2023, the memecoin PEPE captured widespread attention, triggering a memecoin bull market as speculators flocked to deploy and trade meme-themed tokens, particularly on the Ethereum network. This surge in activity led to increased gas fees and a substantial amount of ETH being burned.

However, despite PEPE's price reaching new all-time highs in the ongoing memecoin rally, trading activity on Ethereum has not returned to the levels observed in May 2023. The reasons for this discrepancy remain a topic of interest.

Enter Solana.

Solana

Solana saw an uptick in activity in Q4 of 2023, notably recovering from the aftermath of the FTX collapse. During this period, BONK, a memecoin created by contributors within the Solana ecosystem to revitalize the community following the late 2022 FTX crash, started gaining momentum alongside SOL's resurgence. The price of BONK surged 230 times to hit its all-time highs in January, igniting a new memecoin bull run.

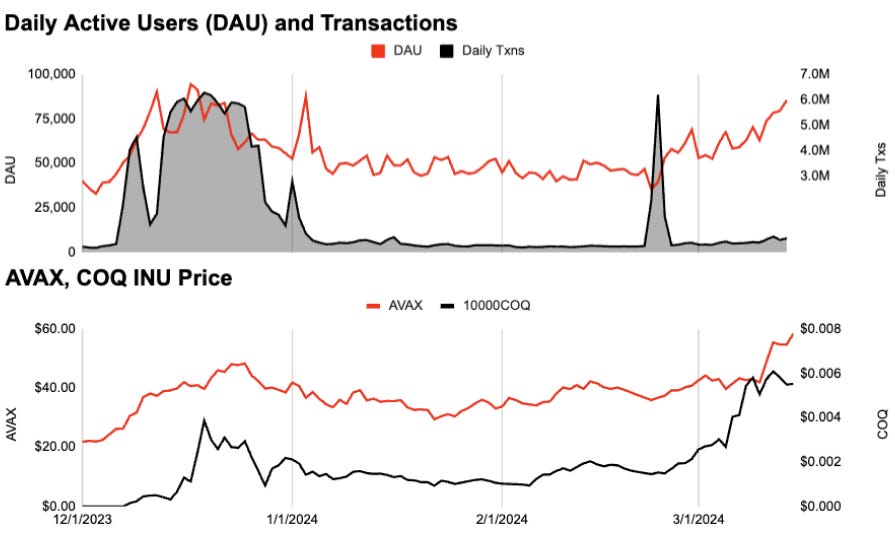

Buoyed by the performance of SOL and BONK, the launch and trading of memecoins on Solana increased significantly. This surge was reflected in the daily active users (DAU) and daily transaction metrics on Solana, which saw a dramatic rise, surpassing 1.3 million DAU at its peak and outperforming Ethereum after a period of subdued activity.

A glance at Dexscreener, a widely used token screener and charting platform, reveals that an overwhelming 96% (48 out of 50) of the trending tokens in the last 24 hours were on Solana, predominantly memecoins. Additionally, when looking at volume, Solana represented 32% (16 out of 50) of the top tokens traded across all blockchains in the last 24 hours.

These statistics highlight a significant shift in memecoin trading towards Solana, despite traditional memecoins like DOGE, SHIB, and PEPE experiencing notable comebacks at the time of writing.

In fact, Solana has remarkably secured an 87% market share of the $240 million in trading volume conducted through Telegram bots on March 15, 2024, previously an area dominated by Ethereum, adding further confluence to the substantial shift in trading venues that is happening.

After all, why would traders opt to spend hundreds of dollars on Ethereum gas fees when they can spend about $0.02 on Solana and invest the hundreds saved into their positions?

Memecoins as Marketing Tools

Seeing the success that memecoins brought to Solana, multiple Layer 1 and Layer 2 networks began to publicly support memecoins to attract traders to their chains. By doing this, they leveraged on the virality and community engagement aspects of memecoins to draw attention to their platforms. As Solana had shown, this method has proven to be a means of onboarding new users who had never wanted or needed to bridge to a new blockchain in the first place.

For instance, during the Alt L1 run that began in Q4 2023, the SEI token increased more than 3x in the month of December alone. While most of this rise can be attributed to traders on centralized exchanges (CEX), it also sparked an increase in DAU and daily transactions as users poured in to trade SEIYAN, a memecoin based on the name that the SEI team adopted for their community, and other memecoins. This caused an increased demand for SEI as users transacted and traded memecoins with SEI as the default token pair for liquidity.

A similar phenomena can be observed to have happened on the Injective and Avalanche blockchains around the same period (Avalanche charts below).

In fact, the Avalanche Foundation went as far as to announce that their previously launched Culture Catalyst, a fund aimed at bootstrapping creators on the Avalanche network, would also be used to purchase “select Avalanche-based meme coins to create a collection”.

Identifying Memecoin Runs

Identifying memecoin runs typically requires tracking trading volumes and social media activity. A notable increase in trading volume usually signals rising interest or organized buying efforts, often leading to significant price fluctuations.

The chart above showcases the 24-hour trading volumes of prominent memecoins, overlayed with Bitcoin's (BTC) price to indicate the market cycle's phase. Historically, peaks in the memecoin market have been marked by surges in trading volumes, hitting around the $50 billion range during the previous two cycle tops in 2021.

Further analysis reveals the source of these volumes. By comparing the 24-hour volume of leading memecoins against that of BTC and ETH (MEMES/MAJORS ratio), it's evident that in the last two memecoin surges between 2021 and 2022, this ratio escalated to 40-60%. The rally led by PEPE during the late 2022 bear market reached a 33% ratio.

Currently, as BTC breaks and retraces from all-time highs, memecoins such as DOGE, PEPE, dogwifhat (WIF), and new kid on the block Book of Meme (BOME) have been capturing significant attention and liquidity over the last fortnight. With the MEMES/MAJORS ratio at 38%, it suggests that the current cycle's peak might not yet have been reached.

Utility in Memecoins: A Bearish or Bullish Signal?

The addition of practical utility to memecoins, exemplified by Shiba Inu's venture into developing its own blockchain, raises a pivotal question: Does integrating real-world functionality affect the speculative dynamics of memecoins?

Dogecoin (DOGE) arguably possesses an element of real-world utility that fuels further speculation. Although not originally part of a formal roadmap, DOGE's widespread adoption by various merchants and payment platforms — most notably, Elon Musk's hints at accepting DOGE for Tesla purchases — showcases its growing utility.

SAFEMOON attempted to extend its utility by establishing a company that promised a cryptocurrency wallet, a debit card, and a proprietary exchange. However, the project faced a setback when its founders were charged with fraud by the U.S. Department of Justice.

On the other hand, successful memecoins like PEPE, BONK, and the more recent dogwifhat (WIF), have achieved market capitalizations exceeding $1 billion without promising specific utility, thriving solely on the strength of their meme appeal and community sentiment.

While some memecoins have enhanced their speculative appeal and market presence through added utility (whether by design or not), others have thrived without any promises of utility, leveraging the sheer force of community engagement and meme culture. This indicates that while utility can contribute to a memecoin's success, the ultimate determinant of its value and longevity seems to lie in the strength of its community.

The Memecoin Supercycle?

The thesis is simple — Attention.

In recent times, the pace of narrative cycles in the crypto market has accelerated significantly. January 2023 saw the artificial intelligence (AI) narrative take off, fueled by the viral launch of ChatGPT at the end of 2022. Shortly afterward, the liquid staking tokens (LST) narrative gained traction among traders, spurred by the increase in liquid staking on Ethereum following the Merge.

By February 2023, attention shifted to the "China narrative," with speculators rallying behind tokens from Chinese-based teams after Hong Kong announced it would permit crypto trading in June. March 2023 brought "Arbitrum season," succeeded by a memecoin surge led by PEPE in April 2023. Each of these narrative cycles lasted a mere one to two months, with tokens experiencing volatile price action and often retracing once a new narrative was “discovered”, evidencing a rapid compression of market trends.

Capturing the attention of traders and investors has thus been a challenge for project teams. It's become somewhat humorous that, to remain relevant through the bear cycle — when demand for riskier assets has faded — protocols feel compelled to incorporate buzzwords like AI, LSDs (Liquid Staking Derivatives), real-world assets (RWA), and others into their messaging and product.

But as a wise Spartan once said:

Now, as Bitcoin shatters all-time highs and the appetite for risk returns, particularly among retail investors, memecoins are poised to dominate the spotlight once again. This resurgence in risk tolerance positions memecoins at the forefront of discussions, and not just among retail. With their viral nature and the potential for significant gains, memecoins are expected to attract a substantial portion of investor attention, capitalizing on the current bullish sentiment and the widespread desire to leverage emerging opportunities in the cryptocurrency space

In an era where the attention economy is becoming increasingly sparse, will we see a Memecoin Supercycle?

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about