Aptos: The Premiere Chain for the Future of Finance and RWAs (50-Page Sponsored Report)

Explore how Aptos' innovative technology, growing ecosystem, and strategic partnerships position it as a leading blockchain platform in this 50-page report.

Thank you to Aptos Foundation for making this post free for all Blockcrunch VIP subscribers.

There’s plenty of hype and fleeting trends in crypto, but then there’s Aptos—a stable foundation built for the long term. While others chase buzz, Aptos is becoming the backbone of real-world asset tokenization and institutional finance solutions, offering the scalability and security needed for lasting impact.

The Aptos blockchain was launched in 2022 and captured attention quickly as it differentiated itself by using the Move programming language, which was developed at Meta. It's a game-changer that tackles the EVM's long-standing headaches of security and scalability. This technological foundation has allowed Aptos to achieve impressive performance metrics and attract a diverse ecosystem of developers and institutions in a short span.

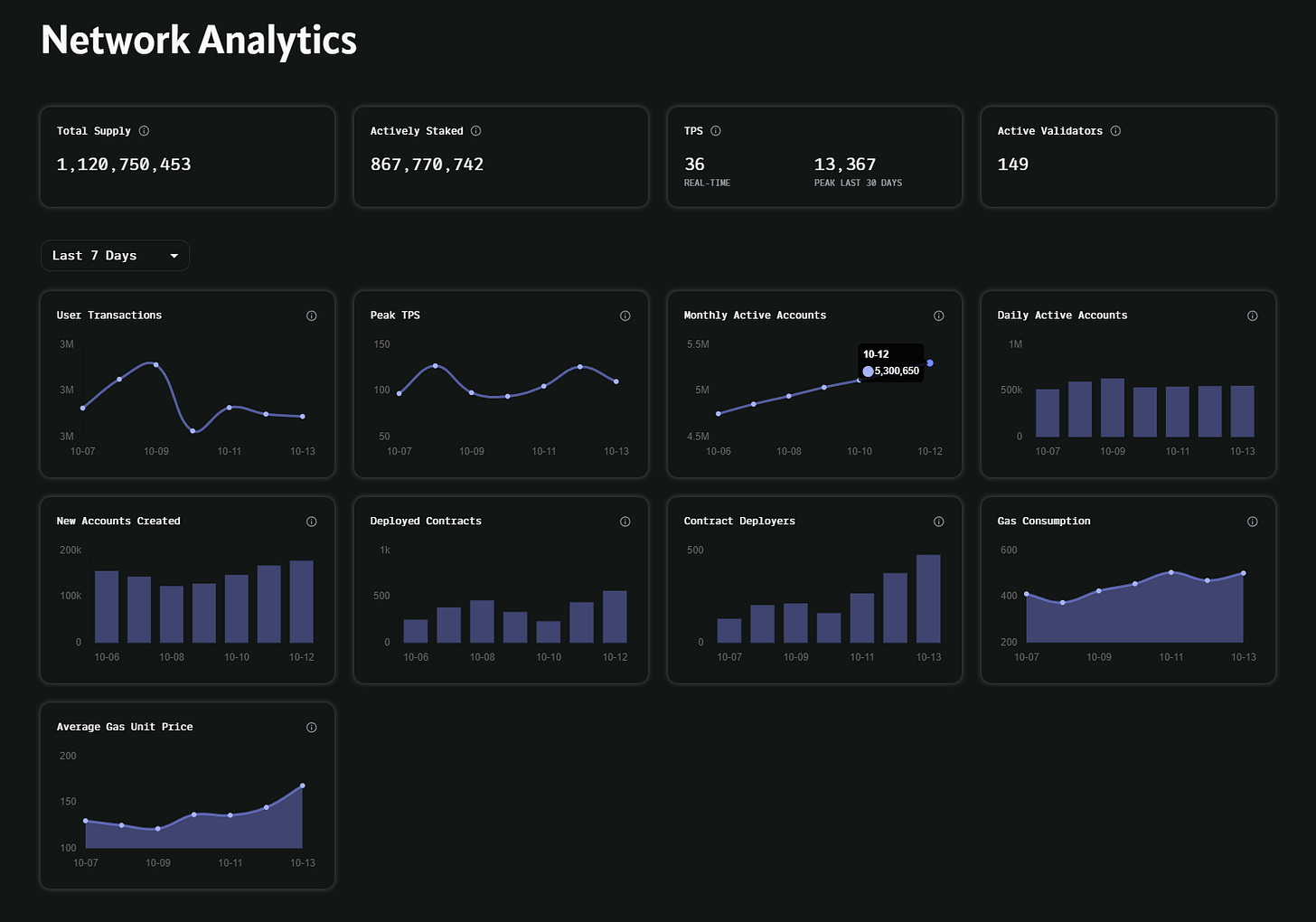

Some of Aptos' remarkable strides which establish it as one of the major networks include the following.

Massive User Adoption: Since launch, Aptos has onboarded an impressive 27 million unique users, showcasing its broad appeal and user-friendly approach. That's like onboarding the entire population of New York State!

Nearly 2 Billion Transaction Volume: With nearly 2 billion transactions processed, Aptos demonstrates its capacity to handle high-volume, real-world use cases.

Fast-growing TVL: The platform's TVL is over $700 million—6 times higher since the start of 2024—indicating growing confidence and investment in the Aptos ecosystem.

Fastest Layer 1: Aptos has recently emerged as the fastest Layer 1 blockchain, achieving sub-second transaction speeds without raising gas fees. With 99.99% uptime and gas fees up to 100 times lower than comparable L1 networks, Aptos combines exceptional performance with cost-efficiency, making it a standout in the blockchain space.

Advancing Global Financial Inclusion: Digital assets giant Tether recently announced plans to launch its leading stablecoin, USDT, on the Aptos network. This launch expands USDT's reach into emerging markets and represents a big step toward global financial inclusion. With unmatched transaction efficiency, low gas fees, and rapid processing, USDT on Aptos is poised to become the ideal choice for both micro-transactions and large-scale operations, reinforcing Aptos as a pivotal platform for digital finance.

These metrics paint a picture of a blockchain platform that is not just fundamentally sound but viable for large-scale adoption and ready for the future.

As we look to the future, Aptos is well-positioned to be utilized for the growing interest in RWAs and enterprise blockchain solutions. The numbers behind this revolution are staggering:

According to a 2022 BCG report, the market cap of tokenization of global illiquid assets is projected to reach $16 trillion by 2030, representing 10% of global GDP.

A more conservative 2024 McKinsey analysis projects the total tokenized market capitalization could reach around $2 trillion by 2030.

These projections and real-world examples underscore the massive potential of RWA tokenization. As this sector continues to grow, platforms that can provide the necessary infrastructure, security, and scalability will be positioned to capture significant use.

In this report, we will explore Aptos and its role in the RWA tokenization revolution and enterprise solution, covering the following key topics:

RWA and Enterprise Solutions: Use cases and partnerships

Exploring Aptos Ecosystem: Overview of Aptos dApp Verticals

Technical Infrastructure: Sub-second latency, 99.99% uptime, and 100x lower gas fees

Future Implications: Assessing Aptos’ potential impact on global finance

RWA Projects: Use cases and partnerships

Aptos is making significant strides in the real-world asset (RWA) tokenization space, with innovative projects like Ondo Finance and Propbase leading the charge. These initiatives demonstrate Aptos' capability to support complex, real-world use cases and its potential to revolutionize traditional industries.

Ondo Finance: Bridging Traditional Finance and DeFi on Aptos

Ondo Finance, a leading player in the tokenization of real-world assets (RWAs), has integrated with Aptos, marking a significant milestone in the RWA space. Aptos’ institutional-grade security, scalability, and flexibility provide the ideal foundation for handling complex financial instruments like tokenized US Treasuries.

This integration goes beyond technical implementation. Ondo's roots in traditional finance and its collaboration with BlackRock align perfectly with the growing institutional interest in RWAs, positioning Aptos as a prime destination for institutional-grade RWA solutions. By combining Ondo's financial expertise, BlackRock’s potential support, and Aptos' unique technology, this integration is poised to seamlessly bridge traditional finance and blockchain efficiency, unlocking new opportunities for on-chain and real-world asset integration.

Ondo’s integration with Aptos is a significant move towards advancing real-world asset tokenization on the blockchain. Key initiatives include:

USDY Integration: Ondo's tokenized US Treasuries product, USDY, is being natively integrated with Aptos.

Institutional Backing: Founded by Goldman Sachs Digital Assets team veterans, Ondo brings institutional-grade expertise to the Aptos ecosystem, working closely with established players like BlackRock.

Security and Efficiency: Aptos' Move programming language, with features like the Move Prover and pre-transaction transparency, provides the ideal foundation for Ondo's secure and efficient financial products.

Ecosystem Expansion: Ondo is also integrating with Thala, a DeFi protocol on Aptos, to enhance liquidity options and introduce USDY as collateral for CDPs.

By choosing Aptos, Ondo validates Aptos' potential in the RWA space and sets the stage for future innovations in tokenized assets and yield-generating products.

Propbase: Democratizing Real Estate Investment

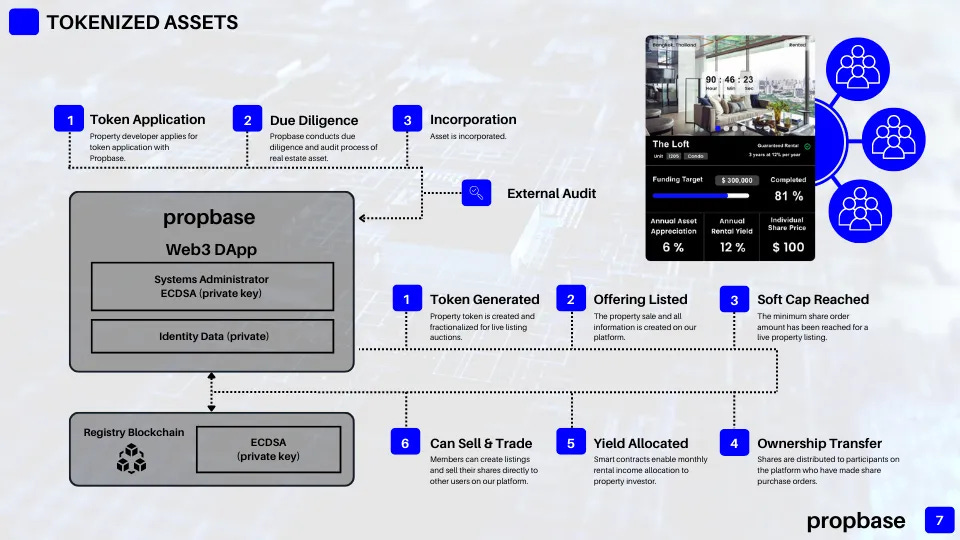

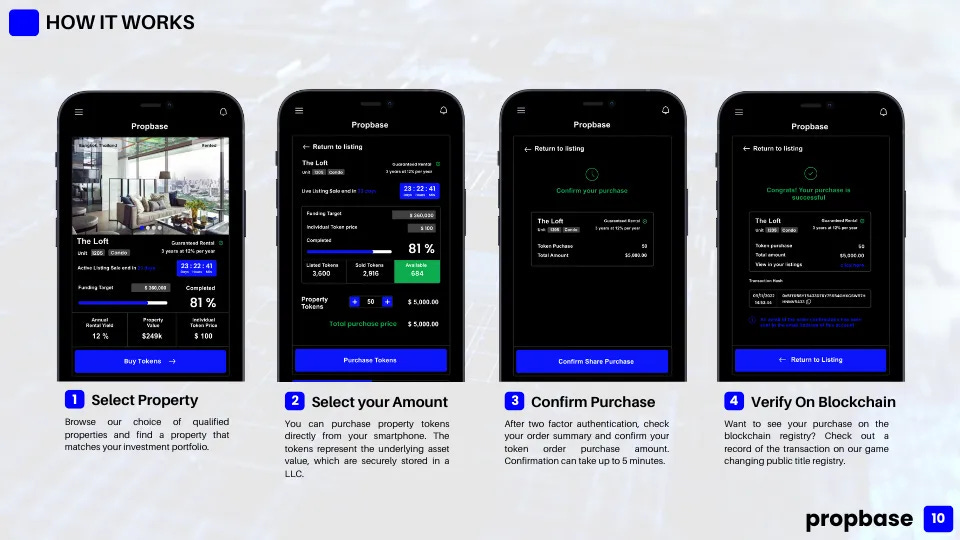

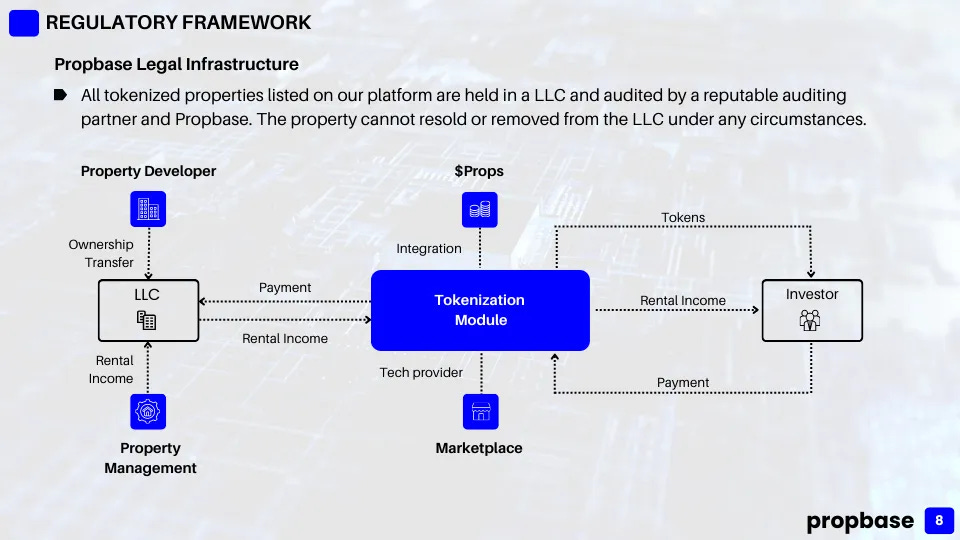

One of the standout RWA projects on Aptos is Propbase, a tokenized property transaction platform that's transforming real estate into a modern, liquid asset class. Propbase's tokenization process is a comprehensive, end-to-end solution that blends traditional real estate practices with blockchain technology.

The journey begins with a token application, where property developers submit their assets for tokenization. This is followed by a thorough due diligence phase and formal incorporation of the asset, ensuring all legal requirements are met coupled with an external audit to provide an additional layer of verification.

Once approved, the Propbase Web3 DApp, secured by a systems administrator using ECDSA private keys, generates the property token. This token is then listed on the platform, allowing investors to participate. Upon reaching the soft cap, ownership is transferred to successful bidders, and yields are allocated through smart contracts and the entire process is recorded on the registry blockchain, providing transparency and immutability.

What sets Propbase apart is the ability for token holders to sell and trade their assets directly on the platform, creating a liquid market for traditionally illiquid real estate assets. This sophisticated yet user-friendly system demonstrates how Aptos' blockchain infrastructure can support complex, real-world financial operations, potentially revolutionizing the real estate investment landscape.

Here's how Propbase is leveraging Aptos' blockchain to revolutionize property investment:

Instant Liquidity: Unlike traditional real estate investments, Propbase enables users to buy and sell property shares within minutes through its P2P marketplace.

Fractional Ownership: Propbase allows investors to purchase shares of properties for as little as $100, dramatically lowering the barrier to entry for real estate investment.

Global Access: The platform focuses on high-quality properties in Southeast Asia, with plans to expand to MENA, US, and EU regions, offering investors from all over the world global diversification opportunities after KYCing.

Smart Contract Integration: Propbase utilizes Aptos smart contract capabilities to automate processes like rental yield distribution, enhancing efficiency and transparency. It also uses the Aptos blockchain as its registry, recording an immutable history of every transaction for every property and minimizing administrative overhead as there is no need to update the registry when investors make transactions.

Regulatory Compliance: The project operates within legal and regulatory frameworks, with all properties securely stored in LLCs and ownership documents publicly available on the blockchain.

The Propbase tokenization model showcases how Aptos can support complex real-world applications, handling everything from property applications and audits to tokenization and marketplace listings. This end-to-end solution demonstrates Aptos' potential to transform traditionally illiquid assets into easily tradable digital tokens.

Libre: Bringing Blockchain-Based Funds On-Chain

Libre, a joint venture between Brevan Howard’s WebN group and Nomura's Laser Digital, has officially launched on the Aptos Network. Through this integration, institutional investors can trade tokenized real-world assets (RWAs) on the Aptos blockchain.

Through Aptos Ascend by Aptos Labs, institutional investors using the Libre Gateway gain the reliability and compliance of traditional financial systems, combined with the decentralization, scalability, and security of the Aptos blockchain. This enables seamless trading, collateralized lending, and secondary market activities on-chain, while ensuring institutional-grade efficiency and security. This integration underscores Aptos’s role as a leading platform in bridging TradFi and DeFi to bring the world of finance on-chain.

Franklin Templeton: Decentralizing Asset Management

Global asset management giant Franklin Templeton recently announced the launch of its onchain money market fund, FOBXX, on the Aptos network. Represented by the BENJI token on Aptos, Franklin Templeton’s FOBXX has surged past $20 million in subscriptions — signaling a rise in institutional blockchain adoption. The collaboration with the Aptos Foundation aims to increase the interoperability of real-world assets (RWAs) and treasury-backed assets across non-EVM blockchain environments, such as those utilizing Move.

Notably, Franklin Templeton is the second-largest tokenized fund by market cap and the first and only fund to leverage blockchain technology for transaction processing.

Enterprise Projects: Use Cases and Partnerships

Microsoft and Aptos Labs: Pioneering AI and Web3 Integration

Microsoft, a leader in AI technology, has formed a groundbreaking partnership with Aptos Labs, a team dedicated to developing products and applications on the Aptos blockchain. Microsoft's deep expertise in AI and cloud computing, combined with Aptos Labs' innovative approach to blockchain, creates a powerful synergy.

The partnership is uniquely positioned due to Aptos' high-throughput capabilities, which currently support up to 13,000 transactions per second with sub-second finality. This performance is crucial for AI-related applications that require rapid data processing and verification.

By leveraging Microsoft's AI prowess and Aptos' blockchain technology, the partnership seeks to enhance the trustworthiness of AI-generated content while simplifying web3 development for a broader audience.

The collaboration between Microsoft and Aptos Labs currently focuses on the following areas:

Financial Services Solutions: Exploration of use cases including asset tokenization, payments, and Central Bank Digital Currencies (CBDCs), showcasing the potential for AI and web3 integration in finance.

Enhanced Development Tools: Integration with GitHub Copilot to support Move programming language development, including contract development, unit testing, formatting, and prover specifications.

Blockchain Infrastructure: Improving tooling and support for validators to run efficiently on Azure cloud infrastructure, enhancing the security and reliability of the Aptos network.

AI Model Training and Verification: Utilizing Aptos blockchain data to enhance the reliability and trustworthiness of AI-generated content, addressing AI's perception problem through blockchain's transparency and security.

By partnering with Aptos Labs, Microsoft validates Aptos’ potential in the AI space and sets the stage for future innovations at the intersection of AI and web3. This collaboration represents a significant step towards creating a more transparent, efficient, and accessible digital ecosystem that combines the power of AI with the trust and security of blockchain technology.

As Rashmi Misra, General Manager of AI & Emerging Technologies at Microsoft, stated, "The intersection of AI and blockchain is one of the most interesting combinations of emerging technologies and can generate transformational use cases." This partnership aims to democratize blockchain use, enabling seamless onboarding to web3 and fostering innovation in decentralized applications using AI.

This collaboration between Microsoft and Aptos Labs is poised to redefine the landscape of digital experiences, making web3 more accessible and user-friendly while maintaining the highest standards of security and performance.

Aptos Ascend: Revolutionizing Institutional Finance

Earlier this year, Aptos Labs launched Aptos Ascend, a platform that simplifies the deployment of blockchain solutions for financial institutions to improve how they create, deploy, and administer financial products. This groundbreaking initiative leverages partnerships with industry giants including Microsoft Azure, Boston Consulting Group (BCG), Brevan Howard, and SK Telecom.

The collaboration between Aptos Labs and its partners through Aptos Ascend currently focuses on the following areas:

Advanced Digital Asset Controls: Enhancing security and compliance using zero-knowledge proofs, limiting transactions to pre-approved entities.

Sophisticated Network Controls: Offering fully permissioned networks with customizable features, allowing institutions to tailor governance and access controls.

High-Performance Infrastructure: Leveraging Aptos’ scalability to process millions of transactions daily, meeting the demands of modern finance.

Innovative Financial Products: Exploring use cases such as asset tokenization and pioneering new lending practices within regulated frameworks.

Strategic Partnerships: Combining BCG's network, Brevan Howard's investment expertise, and SK Telecom's regulatory-compliant Web3 technology to expand decentralized finance to institutional capital.

This initiative by Aptos Labs and its partners is poised to redefine the landscape of institutional finance, making blockchain technology more accessible and beneficial for traditional financial entities while maintaining the highest standards of security and regulatory compliance.

Aptos Ecosystem Overview

The Aptos blockchain has attracted a vibrant ecosystem, hosting a diverse array of decentralized applications (dApps) across various verticals. Let's dive into some of the key verticals that are flourishing on Aptos consisting of DeFi, Gaming, NFTs, and Social apps.

Decentralized Finance (DeFi) dApps

DeFi applications on Aptos are leveraging the blockchain's high throughput and low latency to offer financial services that rival traditional systems in speed and efficiency. Let’s explore some notable dApps within this category.

Aries Markets: Lending Market and More

https://ariesmarkets.xyz/

As the pioneer lending market on Aptos, Aries Markets has recently hit a milestone of 1 million users. By positioning itself as a comprehensive all-in-one DeFi solution, it tackles the fragmentation often seen in DeFi ecosystems. How? By combining borrowing, lending, and margin trading within a single platform.

Aries even have a unique feature called sub-accounts for risk isolation, aiming to provide a centralized exchange (CEX) experience within a decentralized framework.

Key features of Aries Markets:

Lending and Borrowing:

Over-collateralized lending and borrowing

Users can deposit assets to earn yield or borrow against collateral

Margin Trading:

Offers spot margin trading

Users can capitalize on asset movements using borrowed funds from a shared liquidity pool

Token Swaps:

Integrated with various Automated Market Maker (AMM) markets

Enables efficient token swaps within the platform

Risk Management:

Unique sub-account feature for risk isolation

Allows users to manage multiple trading strategies separately

Security and Reliability:

Leverages Move's security features and tooling

Utilizes coverage testing and formal verification for institutional-grade security

Market Position:

Total Value Locked (TVL): $618+ million

Recently achieved 1 million users

Technological Edge:

Built on Aptos, benefiting from its high throughput and low latency

Demonstrates how Aptos enables sophisticated DeFi applications that can compete with centralized alternatives

Aries Markets TVL of $250+ million shows' rapid growth and comprehensive offering showcase the potential of the Aptos ecosystem to support complex, user-friendly DeFi applications. Its success in attracting both liquidity and users highlights the increasing adoption of DeFi solutions built on high-performance blockchains like Aptos.

Thala: Liquid Staking Superapp

Thala Protocol stands out as a comprehensive DeFi ecosystem on Aptos, with a particular strength in liquid staking. While Thala offers multiple products, including a stablecoin (Move Dollar) and an AMM (Thala Swap), its liquid staking derivative (LSD) solution is a cornerstone of its offerings.

Key features of Thala's liquid staking:

Dual Token Model:

thAPT: A non-rebasing token pegged 1:1 with APT

sthAPT: A rebasing token that accrues staking yields

Enhanced Yield Distribution:

sthAPT receives 100% of its own validator rewards plus 80% of thAPT validator rewards

This model offers potentially higher yields compared to traditional LSD solutions

Flexible Staking Options:

Users can choose between immediate liquidity (thAPT) or maximized yields (sthAPT)

Incentive Structure:

20% of thAPT validator rewards incentivize the thAPT-APT liquidity pool on Thala Swap

This mechanism helps manage thAPT supply and maintain its peg

Fee Structure:

0.15% redemption fee (thAPT to APT)

0.01% stake fee (thAPT to sthAPT)

5% commission on staking rewards (12% total including validator commissions)

Integration with Broader DeFi Ecosystem:

Both thAPT and sthAPT can be used in other Thala products and across the Aptos DeFi landscape

Thala's TVL of $200+ million and its innovative approach to liquid staking demonstrate the growing sophistication of DeFi applications on Aptos. The protocol's ability to offer enhanced yields while maintaining liquidity highlights how Aptos' high-performance infrastructure enables complex financial products that can compete with traditional finance offerings.

Cellana: Ve(3,3) DEX & Launchpad

Cellana is a standout decentralized exchange (DEX), pioneering the implementation of the Ve(3,3) model in the Move language. Aiming to foster DeFi growth, this community-owned platform leverages a sustainable liquidity incentives model. Through these innovations, Cellana has positioned itself as a crucial liquidity pillar within the burgeoning Aptos ecosystem.

Key features of Cellana:

Ve(3,3) Model for Sustainability:

First Ve(3,3) DEX on Aptos, inspired by successful projects like Aerodrome

Balances incentives for LP and revenue for governance token holders

Addresses issues faced by traditional DEXes

Balances token emissions with long-term price stability

Community-Driven Governance:

Empowers the community to influence token emissions and incentives

Allows projects to add their own incentives to liquidity pools to attract LP

Innovative Fee Structure:

Trading fees are directed to voters (CELL token holders)

CELL emissions attract and reward liquidity providers

Launchpad for New Projects:

Offers a platform for emerging protocols to bootstrap liquidity

Supports established protocols with cost-effective liquidity stimulation

Ecosystem Integration:

Aims to become a DeFi leader on Aptos

Serves as a gateway for protocols seeking innovative liquidity solutions

Cellana’s TVL of $70+ million makes it the DEX with the highest TVL, showing that a successful implementation of the Ve(3,3) model makes it more advantageous compared to traditional DEXs. By addressing common challenges in liquidity provision and token economics, Cellana aims to create a more sustainable and efficient DeFi ecosystem on Aptos.

Merkle Trade: Gamified Derivatives

Merkle Trade stands out as a pioneering gamified perp platform. It offers a unique blend of high-leverage trading, gamification elements, and a user-friendly experience, aiming to make derivatives trading accessible and fun for users of all experience levels.

Key features of Merkle Trade:

Diverse Trading Options:

Offers crypto, forex, and commodities (gold and silver) trading

High leverage up to 1,000x (150x for crypto, up to 1000x for forex)

Advanced Trading Infrastructure:

Sub-second order execution with fair pricing and minimal slippage

Leveraging Aptos for low-latency performance

Decentralized, non-custodial trading without counterparty risk

Price feeds from Pyth Network for accurate and decentralized pricing

Charting solutions powered by TradingView

Gamified Trading Experience:

Bi-weekly Trading Seasons with unique themes and rewards

Level-up system with equipable items (NFTs) offering trading benefits

Weekly trading missions with varying difficulty levels and rewards

Loot box system with Merkle Gears and Shards as potential loot

Points system for seasonal trading incentives

Innovative Liquidity Provision:

Merkle LP acts as the counterparty to every trade

Synthetic trading model allows any asset with a reliable price feed to be listed

Soft and hard thresholds to prevent sudden liquidity draining

LP Circuit Breaker as an additional safety layer

Merkle Trade's implementation of gamified derivatives trading on Aptos showcases the blockchain's capacity to support complex financial products with high-performance requirements. By combining advanced trading features with engaging gamification elements, Merkle Trade aims to create a more accessible and enjoyable trading experience, potentially attracting a broader user base to decentralized derivatives trading on Aptos.

Echo: Pioneering Bitcoin Liquid Restaking, Bridging, and Lending on Aptos

Echo is a groundbreaking protocol that brings Bitcoin liquid restaking, bridging, and yield infrastructure to the Aptos ecosystem, marking a significant milestone in cross-chain interoperability and yield generation.

Key Features of Echo Protocol:

Secure Bitcoin Deposits:

Echo enables seamless bridging of Bitcoin assets (uBTC) to the Aptos ecosystem, expanding the utility of BTC within a high-performance blockchain environment

Echo addresses trusted bridge issues by restaking BTC through Hash-Timelock contracts on the Bitcoin Layer-1, ensuring high reliability. A decentralized, community-based relayer system further secures the bridging process

Liquid Restaking:

Users can stake their bridged Bitcoin assets to earn yield and receiving an LRT token, maintaining liquidity while participating in network security

Yield Infrastructure: Echo provides a comprehensive yield generation platform, allowing users to earn rewards through multiple avenues:

Bridging uBTC assets from Bitcoin to Echo (earning Echo and B2 points)

Depositing aBTC on Echo Lend for boosted APT yield up to 12%

Staking earned APT for additional Echo Points and 7% staking rewards

Echo currently has over 2,000 BTC of TVL worth over $160 million. Its integration with Aptos showcases the blockchain's ability to support complex cross-chain operations and innovative DeFi products. By bringing Bitcoin's massive market capitalization into the Aptos ecosystem, Echo opens up new opportunities for new groups of users, sustainable yield generation and capital efficient asset utilization.

This partnership not only enhances Aptos' DeFi offerings, it positions it as a key player in the broader blockchain interoperability landscape from BTC to EVM and non-EVM chains. As the crypto industry moves towards greater cross-chain collaboration, Aptos is proving itself to be at the forefront of this evolution, capable of supporting sophisticated protocols that bridge traditionally siloed blockchain networks.

Gaming, NFTs, and Social dApps on Aptos

Aptos has become a thriving ecosystem for gaming, NFT projects, and social dApps, leveraging the network's high performance and user-friendly features to create engaging experiences. Let's dive into some of the standout projects in this vertical.

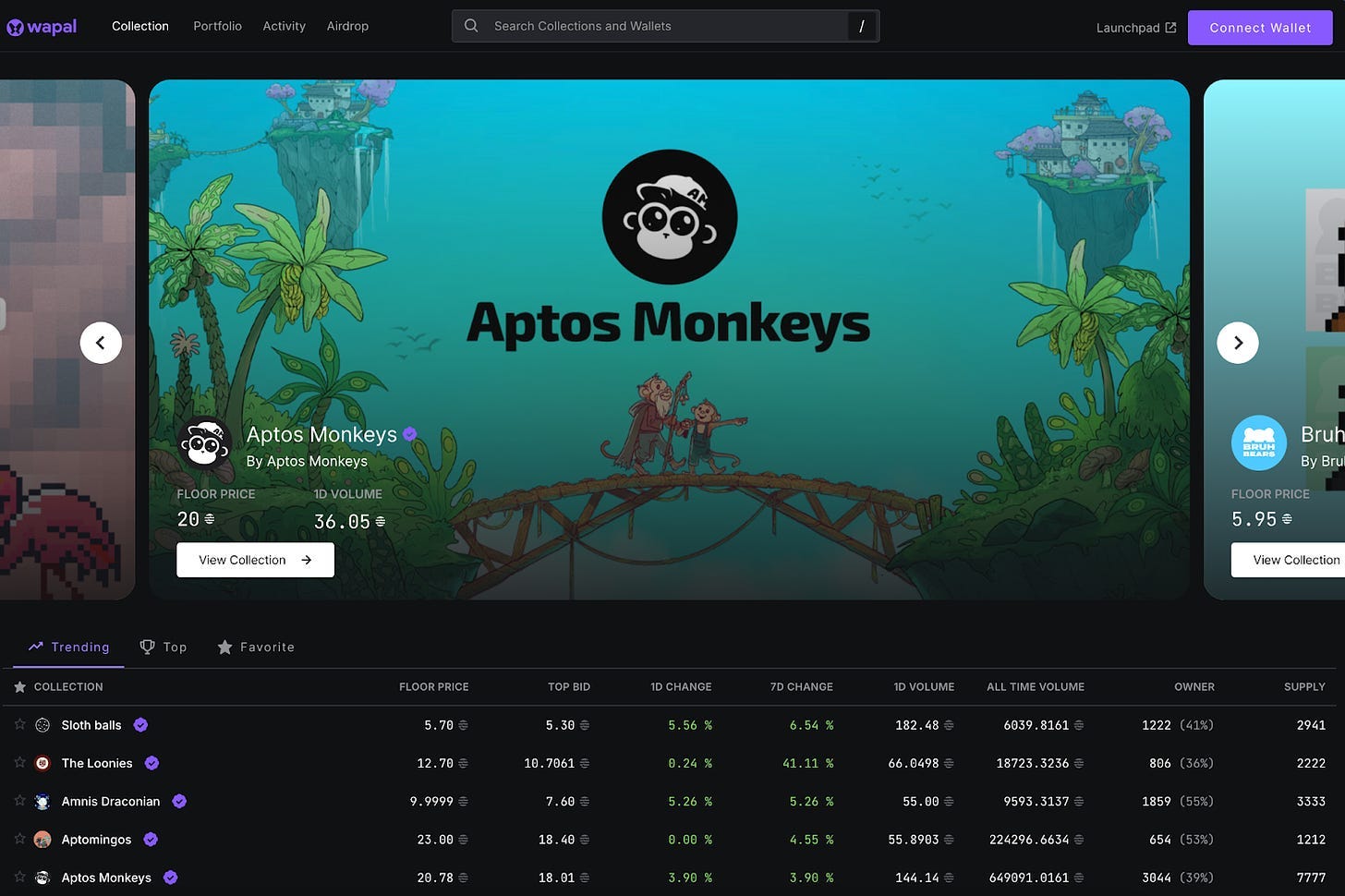

Aptos Monkeys: The most popular NFT collection on Aptos

Aptos Monkeys has quickly established itself as one of the most popular and influential NFT collections on Aptos. Launched in October 2022, this collection of 10,000 unique monkey avatars has captured the imagination of the Aptos community and beyond. With over 150 traits ensuring each monkey is one-of-a-kind, Aptos Monkeys has created a strong sense of community and exclusivity with an active Discord server of over 30,000 members.

The project's success is evident in its market performance, with a floor price hovering around 20 APT and a total trading volume of approximately 600,000 APT. This success showcases the potential for NFT projects on Aptos while demonstrating the blockchain's ability to efficiently handle high-volume transactions.

Wapal: Dominating the Aptos NFT landscape

Wapal has emerged as the largest NFT marketplace on Aptos, revolutionizing the way digital assets are bought, sold, and traded.

With a total trading volume of $2 million, the platform has become the go-to destination for NFT enthusiasts on Aptos. But it's not just about the volume – Wapal has fostered a thriving community of traders. The marketplace boasts 270,000 unique buyers and 200,000 unique sellers, a testament to its wide-reaching appeal and user-friendly interface. With 700,000 total trades executed and 260,000 unique NFTs listed, the platform showcases the Aptos blockchain's ability to handle high-volume, low-latency transactions easily.

This level of activity demonstrates the popularity of NFTs on Aptos and its technical prowess in managing such a high throughput.

Aptos Arena: Pioneering the future of Aptos gaming

Aptos Arena is shaking things up with its no-nonsense skill-based approach to mixing shooters with crypto rewards. Pay a small entry fee to spawn, and take on other players. If you kill them you get to pocket their entry fee straight into your wallet.

What's cool about Aptos Arena is how easy it is to jump in. No fancy gaming rig is needed - just fire up your browser on your phone, Mac, or PC, have some Aptos tokens in your wallet and you're good to go. No expensive NFT needed.

It’s not pay-to-win too. Whether you're a crypto whale or just dipping your toes in, everyone's got an equal shot at making some coin while they play.

Aptos Arena is showing off what the Aptos blockchain can really do. Fast-paced action, real-time rewards, all without breaking a sweat. It's setting the bar for what Web3 gaming can be - fun, fair, and potentially profitable.

Kade: Social Media Gets a Blockchain Makeover

Enter Kade, a social network built on Aptos that's reimagining how we interact online. Picture Instagram or Twitter, but with a blockchain twist: all the crucial elements are on-chain. This means that everything from posts to usernames (which, interestingly enough, are actually NFTs) is recorded on the blockchain. Moreover, even interactions like likes, follows, and DMs are permanently etched into the Aptos blockchain.

Kade is also building an off-chain indexer called ‘docks’ which takes on-chain data, processes the events, and persists them into a relational database with an API that makes it easy to query this data.

Kade is showing us what social media could look like in the Web3 world. It's taking the stuff we love about regular social apps and adding that extra layer of ownership and transparency that blockchain brings to the table. It's a glimpse into a future where you have more control over your online presence and your data isn't just floating around in some company's server.

So, if you're on Aptos and you're curious about what the future of social media might look like, Kade's worth keeping an eye on. Who knows? You might just end up preferring your social life on the blockchain.

Aptos Ecosystem Accelerator: Movementum Accelerator

Aptos Foundation is actively fostering innovation and growth within the Aptos ecosystem and has recently launched the Movementum Accelerator program and is focused on empowering Web3 innovators in the APAC region.

The Movementum Accelerator has a total grant pool of $1 million with finalists eligible for up to $150k in incentives and grants. Teams will receive customized mentorship training from experts in important topics such as product development, legal considerations, fundraising, and go-to-market strategies. They will also be introduced to over 200 VCs, communities, and partners, to ease the team’s funding and strategic partnership process.

The program targets projects across infrastructure, gaming, DeFi, CeFi, and other innovative blockchain applications.

Aptos Technical Infrastructure Explained

At the heart of Aptos' impressive performance lies its innovative use of the Move programming language and a unique blockchain architecture. This combination allows Aptos to achieve unparalleled speed, security, and cost-efficiency in the blockchain space.

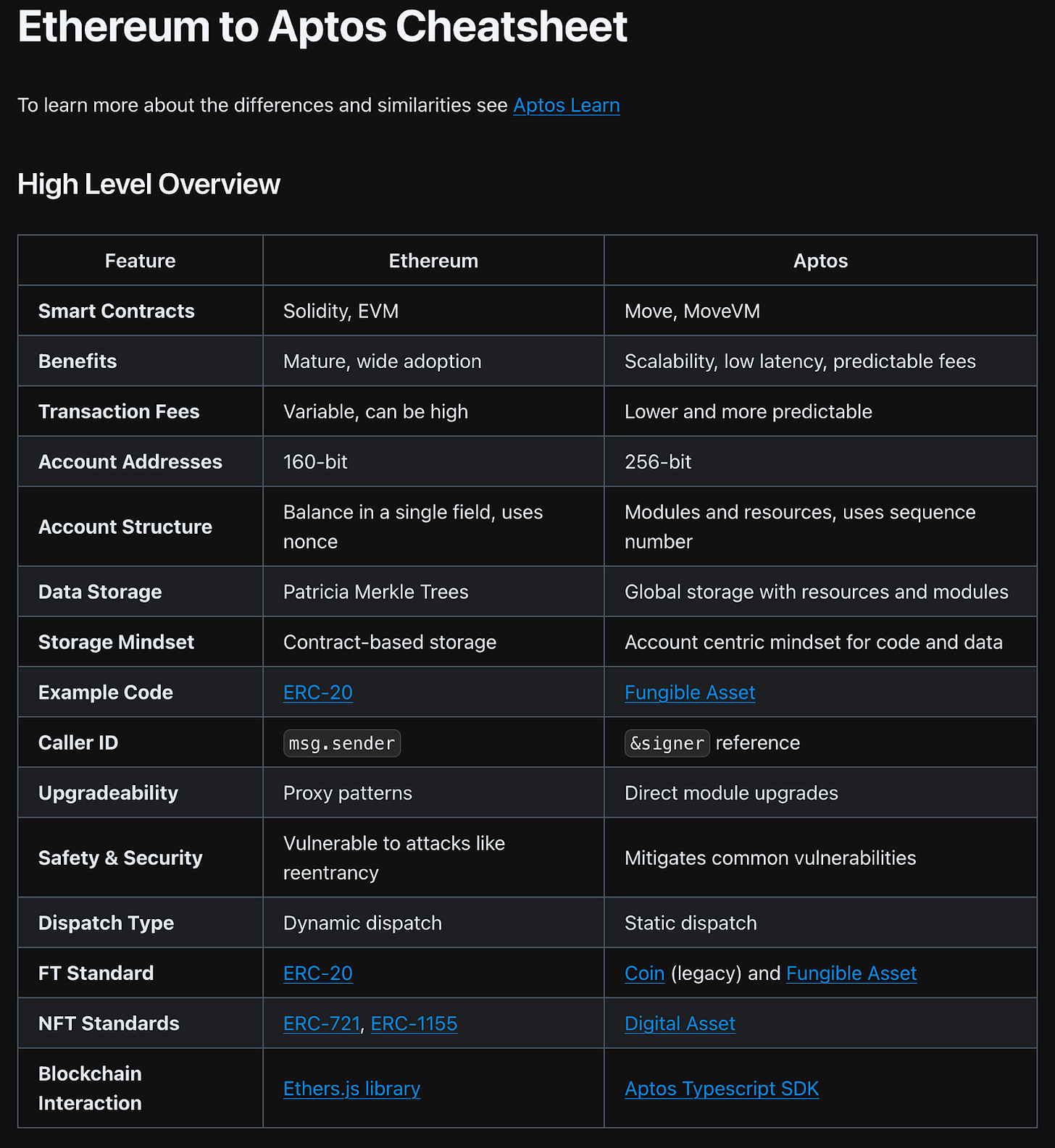

For readers coming from Ethereum, here’s a cheat sheet explaining the similarities and differences between Ethereum and Aptos.

The Move Programming Language

At the heart of Aptos' technical prowess lies Move, a programming language originally developed at Meta (formerly Facebook) for the Libra blockchain. As a statically-typed language, Move is designed with both safety and flexibility in mind, making it particularly well-suited for digital asset management.

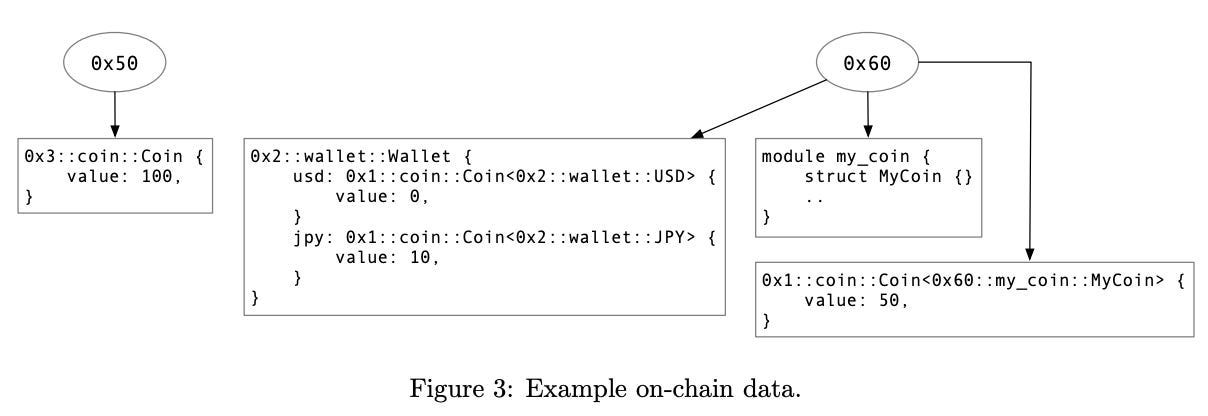

Resource-Oriented Programming in Move:

1. First-class citizens: In Move, resources (which represent digital assets like tokens or NFTs) are treated as fundamental data types, similar to how integers or strings are treated in other languages. This means they have full language support and can be used in all parts of the program.

2. Linear logic: Resources in Move can only be moved, not copied or implicitly discarded. This ensures that digital assets can't be duplicated or lost accidentally.

3. Explicit resource management: Programmers must explicitly create, transfer, or destroy resources, making asset flow clear and reducing errors.

4. Type safety: The Move compiler enforces strict rules about how resources can be used, preventing many common smart contract vulnerabilities at compile-time.

Practical implications:

Double-spending prevention: In Move, if a token is transferred, it's automatically removed from the sender's account. There's no way to accidentally or maliciously spend the same token twice.

Asset safety: Resources can't be accidentally lost or destroyed without explicit programming.

Intuitive asset representation: Developers can model complex digital assets more naturally, leading to clearer and potentially safer code.

Compile-time guarantees: Many errors that would be runtime issues in other languages are caught at compile-time in Move.

Comparing Move with other programming paradigms:

This resource-oriented approach in Move provides a more intuitive and safer way to handle digital assets, reducing the risk of many common blockchain vulnerabilities by design. Here is how Move compares with two popular blockchain languages, Solidity and Rust.

Smart contract languages (e.g., Solidity for Ethereum):

Similarity: Both are designed for blockchain environments and digital asset management.

Difference: Solidity relies more on developer discipline to prevent issues like double-spending, while Move enforces these rules at the language level.

Systems programming languages (e.g., Rust):

Similarity: Rust's ownership system is conceptually similar to Move's resource handling.

Difference: Move's resource system is more specialized for digital assets and blockchain use cases.

Aptos' Blockchain Architecture

Aptos leverages Move within a novel blockchain architecture. Let’s dig deeper to understand what makes Aptos unique and stand out from traditional blockchains.

Block-STM (Software Transactional Memory)

At the core of Aptos' blockchain architecture lies Block-STM, a component that enables parallel execution of transactions. This feature significantly boosts the network's throughput, setting Aptos apart from its competitors.

Key Features:

Parallel Execution: Unlike traditional blockchain systems that process transactions sequentially, Block-STM allows multiple transactions to be executed simultaneously. As modern computers have multiple cores, Block-STM takes advantage of this by using all available processing power instead of just a fraction. It's like having multiple cashiers in a store, each serving different customers at the same time.

Speculative Execution: Transactions are executed speculatively, assuming they will not conflict with other concurrent transactions. Imagine multiple cashiers in a store, each serving different customers simultaneously.

Conflict Resolution: If conflicts are detected during execution, Block-STM efficiently resolves them and re-executes only the necessary transactions. For example if two chefs are reaching for the same ingredient, Block-STM identifies this and only the conflicting transactions are re-executed, not the entire block.

Memory Access Tracking: The system tracks read and write sets of each transaction, using this information to detect and resolve conflicts.

How it Works:

Grouping: Transactions are bundled into blocks.

Assignment: Each transaction dynamically assigned to a different "worker" (think of these as individual processors) for optimal performance.

Parallel Processing: All workers process their transactions at the same time, keeping track of what data they're using.

Validation: Once processing is done, the system checks for any conflicts between transactions.

Conflict Resolution: If conflicts are found, only those specific transactions are redone.

Benefits:

High Throughput: Enables processing up to 160,000 transactions per second under optimal conditions.

Efficient Resource Utilization: Makes full use of multi-core processors.

Scalability: Performance scales with the number of available CPU cores.

Accessibility: Unlike static parallel execution, users do not need to specify any transaction information.

Recently, Aptos Labs unveiled Block-STM v2 which is set to change how Web3 thinks about parallel execution. v2 of the industry-leading parallel execution Block-STM is designed to scale efficiently across 256-core machines while improving parallel transaction processing and boosting throughput. This dynamic infrastructure allows Aptos to maintain low gas fees (~$0.00005/tx), even under massive network pressure. Already, Block-STM has set the standard for safe and simple parallel execution—in the Aptos ecosystem and beyond—with adoption from Polygon, Sei, Monad, Starknet, Flow and others that recognize this innovation for scalability and performance.

Optimistic Concurrency Control

Optimistic Concurrency Control (OCC) works hand in hand with Block-STM to enable Aptos' high-performance architecture.

Key Concepts:

Optimistic Execution: Transactions are executed assuming they will not conflict, without acquiring locks.

Version Control: Each data item has a version number, used to detect conflicts.

Validation Phase: After execution, transactions are checked for conflicts based on their read and write sets.

Commit or Abort: Transactions without conflicts are committed; conflicting ones are aborted and re-executed.

Advantages:

Reduced Locking Overhead: Improves performance in low-conflict scenarios.

Increased Parallelism: Allows for higher concurrency compared to pessimistic approaches.

Deadlock Prevention: Eliminates the possibility of deadlocks that can occur with lock-based systems.

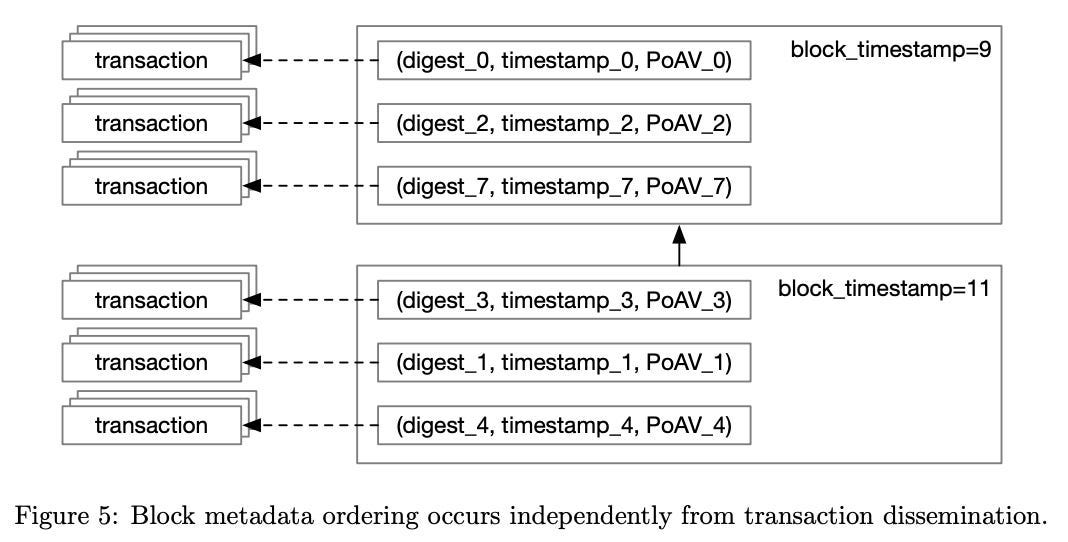

This diagram illustrates how multiple transactions are grouped into blocks, each with its own timestamp. Each transaction is associated with a digest (a unique identifier), timestamp, and Proof of Availability Vector (PoAV). This structure allows for efficient parallel processing and conflict resolution, key features of Aptos' high-performance architecture.

Modular Architecture

Aptos' modular architecture is like a well-oiled machine, with each part doing its own thing. By keeping consensus and execution in separate corners, this setup brings some serious perks to the table:

Components:

Consensus Layer: Responsible for ordering transactions and agreeing on the blockchain state.

Execution Layer: Handles the parallel execution of transactions using Block-STM.

Storage Layer: Manages the blockchain state and transaction history.

Benefits:

Flexibility: Allows for independent optimization and upgrading of each component.

Scalability: Enables future implementation of sharding for horizontal scalability.

Specialization: Each layer can be optimized for its specific function without affecting others.

Performance Synergy

The combination of Block-STM, Optimistic Concurrency Control, and modular architecture results in Aptos' impressive performance metrics:

Sub-second Finality: Transactions are confirmed in less than a second, rivaling traditional payment systems.

High Throughput: Aptos can process up to 160,000 transactions per second (TPS) in optimal conditions.

Low Gas Fees: Fees are up to 100 times lower than comparable L1 networks.

99.99% Uptime: Ensuring reliable operation for critical applications.

Comparison with Other Blockchain Architectures

Ethereum: Uses sequential execution, limiting throughput. Ethereum 2.0 aims to improve this with sharding, but still doesn't match Aptos' native parallelism.

Solana: Also uses parallel processing but with a different approach (Gulf Stream). Aptos' Block-STM potentially offers better conflict resolution.

Algorand: Focuses on fast consensus but doesn't have Aptos' level of parallel transaction execution.

Security Advantages for Aptos

In the Wild West of crypto, security isn't just important - it's make-or-break. We're talking about billions of dollars worth here, and hackers have already made off with a king's ransom through various exploits. Let’s understand how Aptos is solving the security challenges posed by other blockchains.

Resource Safety

Resource safety ensures that digital assets (like tokens or NFTs) can't be accidentally or maliciously duplicated or destroyed. This feature was already mentioned earlier when talking about the Move programming language.

Module Isolation

Module isolation restricts how different parts of the code can interact with each other, reducing the potential attack surface.

This is achieved by organizing code into modules with clear boundaries. Each module controls its own data and defines how other modules can interact with it. What’s important is that direct access to a module’s internal state is prohibited unless explicitly allowed.

This limits the spread of potential vulnerabilities, makes it easier to audit code, and allows for more modular and maintainable smart contracts

Formal Verification

Formal verification is a technique to mathematically prove that a program behaves correctly according to its specification.

Developers can write formal specifications for their smart contracts. Automated tools can then verify if the code meets these specifications. This process can catch subtle bugs that might be missed by traditional testing.

This dramatically increases confidence in critical smart contracts, and is particularly valuable for high-stakes financial applications, as it can catch complex, edge-case bugs before deployment.

Synergy of These Features

Together, these security features create a robust environment for blockchain development:

Resource safety ensures that assets are handled correctly.

Module isolation contains potential issues and simplifies auditing.

Formal verification provides mathematical certainty about contract behavior.

This combination addresses many of the vulnerabilities that have plagued other blockchain platforms, making Aptos an attractive option for enterprise and financial applications where security is paramount.

Comparison with Other Blockchain Platforms

Ethereum (Solidity): Lacks native resource safety and module isolation. Formal verification is possible but more challenging.

Cardano (Plutus): Offers similar security features but with a steeper learning curve.

Rust-based chains (e.g., Solana): Provide memory safety but lack Move's specific optimizations for blockchain use cases.

Move's security features in Aptos represent a significant advancement in blockchain security, addressing many of the vulnerabilities that have led to high-profile hacks and losses on other platforms.

Future Directions

Looking ahead, it's clear that the minds behind Aptos have their eyes firmly on the horizon. Their architecture isn't just built for today - it's primed for the future.

Here's what we might expect:

Sharding: The modular design allows for potential implementation of sharding for even greater scalability.

Hardware Optimizations: As hardware improves, Aptos can take advantage of increased cores and memory for better performance.

Adaptive Execution: Future versions might dynamically adjust execution strategies based on transaction patterns.

This architecture positions Aptos as a highly scalable and efficient blockchain platform, capable of handling the demands of enterprise-grade applications and large-scale DeFi operations.

Thesis: Aptos is Uniquely Positioned to be the Blockchain for RWAs and the Future of Finance

As we look towards the future of blockchain technology, Aptos stands out as a formidable contender in the race to become the premier platform for Real World Assets (RWAs) and institutional solutions. With its impressive technological foundation, growing ecosystem, and strategic integrations, Aptos is well-positioned to capture a significant share of the burgeoning RWA market, projected to reach trillions of dollars by 2030.

Aptos' achievements speak volumes:

A thriving user base of 22 million unique users

Sitting around $550 million in Total Value Locked (TVL), nearly quadrupling since the start of 2024

Processing of over 1 billion transactions, demonstrating robust network activity

These metrics underscore Aptos' rapid growth and adoption, setting the stage for its expansion into RWA tokenization and institutional blockchain solutions.

The blockchain's innovative use of the Move programming language, coupled with its high-performance architecture featuring Block-STM and Optimistic Concurrency Control, enables Aptos to deliver unparalleled speed, security, and cost-efficiency. With sub-second finality, 99.99% uptime, and gas fees up to 100 times lower than comparable L1 networks, Aptos is uniquely equipped to handle the demands of institutional-grade applications.

Strategic initiatives like Aptos Ascend, developed by Aptos Labs in collaboration with industry giants such as Microsoft, BCG, and Brevan Howard, position the blockchain as a bridge between traditional finance and the world of decentralized technologies. This institutional-ready financial suite exemplifies Aptos' commitment to meeting the complex needs of enterprise clients while maintaining the benefits of blockchain technology.

In the realm of RWAs, integrations with projects like Ondo Finance and Propbase showcase Aptos' potential to revolutionize asset tokenization, from US Treasuries to real estate. This not only validates Aptos' capabilities, it paves the way for broader adoption of blockchain technology in traditional finance.

As the blockchain landscape evolves, Aptos' combination of technological prowess, strategic partnerships, and a vibrant ecosystem spanning DeFi, gaming, NFTs, and social applications positions it at the forefront of the next wave of blockchain innovation. With its focus on scalability, security, and real-world utility, Aptos is not just participating in the future of finance – it's actively shaping it.

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about