Project Galaxy ($GAL) & The Emerging Web 3 Social Stack

Research memo for Blockcrunch VIPs

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribers may lock in their price forever and access all prior and future memos.

The Thesis: An Emerging Web 3 Social Stack

When I first came across Project Galaxy, I was admittedly a bit skeptical.

The idea was simple: Project Galaxy would help projects issue NFTs to their power users as onchain loyalty programs.

At first, I was skeptical about the value accrual of what I understood was a tokenized marketing platform for DAOs. Galaxy’s lead investor, Multicoin Capital, echoed the same lukewarm sentiment in their investment in the beginning. Galaxy was a moonshot, and neither of us knew how the “Web 3 social” thesis - which seemed more pie-in-the-sky relative to verticals with quantifiable traction like DeFi and NFTs - would play out.

Our only shared conviction was that if the space were to be big, the Galaxy team was likely the one to crack it.

Six months later, Project Galaxy now boasts 2.8M users and 3,655 campaigns held, with its native token trading at a $115M market cap ($654M fully diluted valuation). While by no means a mature project yet, Galaxy represents part of an emerging Web 3 social stack that warrants attention as it evolves into its own market category.

This week, we’ll examine what Galaxy does, its data credential network, whether its token can capture value over time, as well as upcoming catalysts.

Contents:

The Thesis: An Emerging Web 3 Social Stack

How Galaxy Works

Use Cases for Galaxy

Review of Traction and Performance

$GAL Token Model (Interactive)

Upcoming Catalysts

The Breakdown: How Galaxy Works

Supercharging Community Growth

Talk to any crypto founder and “fostering a vibrant community” is likely on the top 3 priorities for virtually all of them. However, without the ability to farm user data on social networks, projects often have no means of engaging their users in a sophisticated, targeted manner.

Enter Project Galaxy - which empowers brands to build better communities and products in Web3 by leveraging on and off-chain credentials to create growth campaigns. Campaigns range from requiring users to perform on-chain actions like depositing on the blockchain to off-chain activities like retweeting a tweet, becoming a Discord member or attending an AMA. Those who do the required activities can then mint an NFT as proof of their participation.

Project Galaxy has already been implemented across multiple well-known projects. Last August, decentralized exchange Hashflow had issues getting users on their platform as a new product.

The Hashflow team decided to partner with Galaxy to supercharge growth, and over a two-month campaign, 20,850 NFTs were minted, weekly active users grew over 3x, and monthly trading volume increased over 32x ($20 million to $673 million).

Still in its closed beta stage, Galaxy claims to have co-launched 3,800+ campaigns with 580+ ecosystem partners and a user base of 2.8 million Galaxy ID users ready to explore and contribute to Web 3 projects and communities. Today, Project Galaxy is live on 7 chains - Ethereum, Binance Smart Chain, Polygon, Arbitrum, Fantom, Avalanche and Solana.

Onchain Credentials: The Real Opportunity for Galaxy

In Web 3, on-chain credentials are records of actions performed on-chain that reveal specific traits of a user’s profile. For example, if a user has continually borrowed money from AAVE but never got liquidated, she is likely financially prudent and DeFi protocols may elect to offer her a lower interest rate based on this information.

In our view, marketing campaigns are only the go-to-market strategy for Galaxy’s credential solution. Project Galaxy aims to collect onchain user data from their campaigns and create an open network for user profiles. This allows Web 3 developers to leverage credential data to build better products and more engaging communities.

Project Galaxy’s Infrastructural Stack

Project Galaxy’s infrastructural stack has multiple layers, but can mostly be distinguished by the two main use cases it achieves:

Collecting/curating data on users, and

Allowing applications to use that data

Collecting the Data

Project Galaxy retrieves data from multiple sources:

For off-chain credentials, they have integrated with Snapshot.org, Discord, Twitter and Github to compile user data. For example, a user’s profile on Galaxy can factor in whether they have interacted with the Discord chat of a project before.

For on-chain credentials, blockchain data can be drawn from subgraph queries or static snapshots to verify if a user has performed certain on-chain actions. For example, a Galaxy profile can reflect whether a user has at least borrowed once from AAVE on Ethereum

Data on Galaxy requires manual curation from data curators, who are rewarded in Galaxy’s tokens for uploading data to Galaxy’s repository of data, also known as the data network.

Over time, projects could rely on data sets curated by them to filter for those who are eligible to use gated features, products and airdrops.

For a concrete example, Project Galaxy’s own campaign, “Galaxy ID Activation”, required a user to have interacted with at least 3 of Galaxy’s features (create an avatar, create a username and follow Galaxy on Twitter) before they are considered eligible to mint an exclusive NFT.

By assembling credentials for the data network, curators are rewarded with GAL tokens whenever the credentials are used by projects.

Using the Data

Projects who want to access Project Galaxy’s user data can use its Credential API endpoint to verify which addresses meet pre-set criteria.

For instance, developers can select addresses that have staked tokens on a certain protocol or have interacted with a specific contract within a specified date range, and reward said addresses with either NFT airdrops or access to NFT mints. Galaxy has created a lightweight NFT standard, called OAT (On-Chain Achievement Token), which enables users to mint in a gasless fashion as well.

Use Cases for Galaxy

Over the past year, Galaxy claims to have co-launched 3,800+ campaigns with 580+ ecosystem partners and amassed a massive user base of 2.8 million Galaxy ID users ready to explore and contribute to Web 3 projects and communities.

A prominent example of a successful campaign was SOL COOL 2022 - a growth campaign launched with 27 different protocols on the Solana blockchain such as Raydium, STEPN and Orca. Overall, the campaign had 33,400 participants, with each unique user trying out an average of 5 protocols on Solana.

On top of distributing NFTs as proof of a user’s participation, projects could also distribute NFTs with utilities to bootstrap users and platform usage via Galaxy.

Zk.Link, a multi-chain L2 network secured by zero-knowledge technology, wanted to incentivize their community to experience their new product and celebrate the release of zk.Link Testnet 2.0. They launched a loyalty campaign where users could mint an NFT that would grant them access to yield-farm in exclusive liquidity pools with much higher yields in a $5m giveaway program. In total, 53,813 NFTs were minted - 28,421 on BSC, 20,848 on Polygon and 4,544 on Ethereum

Besides exclusive access, projects have also issued NFTs to retroactively reward specific types of users. Last August, Project Galaxy launched a “Shadowy Super Coder” NFT Pack with $300 million worth of perks to 110,294 Ethereum addresses that deployed at least 1 contract on the Ethereum mainnet and had at least 2 different addresses that interacted with the contract.

Apart from getting greater perks with the tier-1 Shadowy Super Coder NFT, the NFT also serves as proof of the developer’s contribution and achievement, which can be used in other use-cases like job-hunting and recruitment. For example, recruiters head-hunting for developers could potentially reach out to all of the wallet addresses with this particular NFT.

Performance and Traction

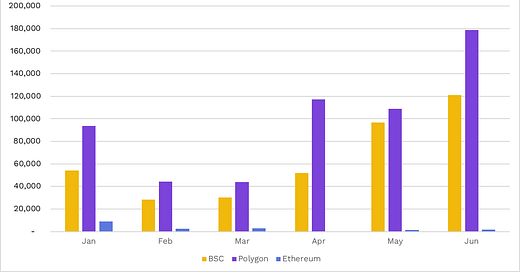

Monthly Unique Users

Galaxy has achieved 300k monthly active users in June - nearly a 100% growth compared to the start of the year. Being able to achieve consistent growth in user activity is impressive, given that on-chain activity has generally decreased amid the bear market. Also, do note that these figures only cover 3 of the 7 chains that Project Galaxy is on, so actual monthly active users are higher.

We also noted that amongst the 3 chains, Polygon is performing the best, with Ethereum performing the worst (only 1.51% of Polygon’s). A potential reason for Ethereum’s underperformance is because Galaxy provides a gas-less minting experience on Polygon. This reduces the participants’ barrier to entry and translates to higher participation, which is the goal of most campaigns and hence their chain of choice.

Currently, the option for projects to cover user’s gas fees i.e gas-less minting, is only available on the Polygon network and will expand to other chains in the future. We anticipate that once gas-less minting is live on other chains, the number of unique addresses will increase.

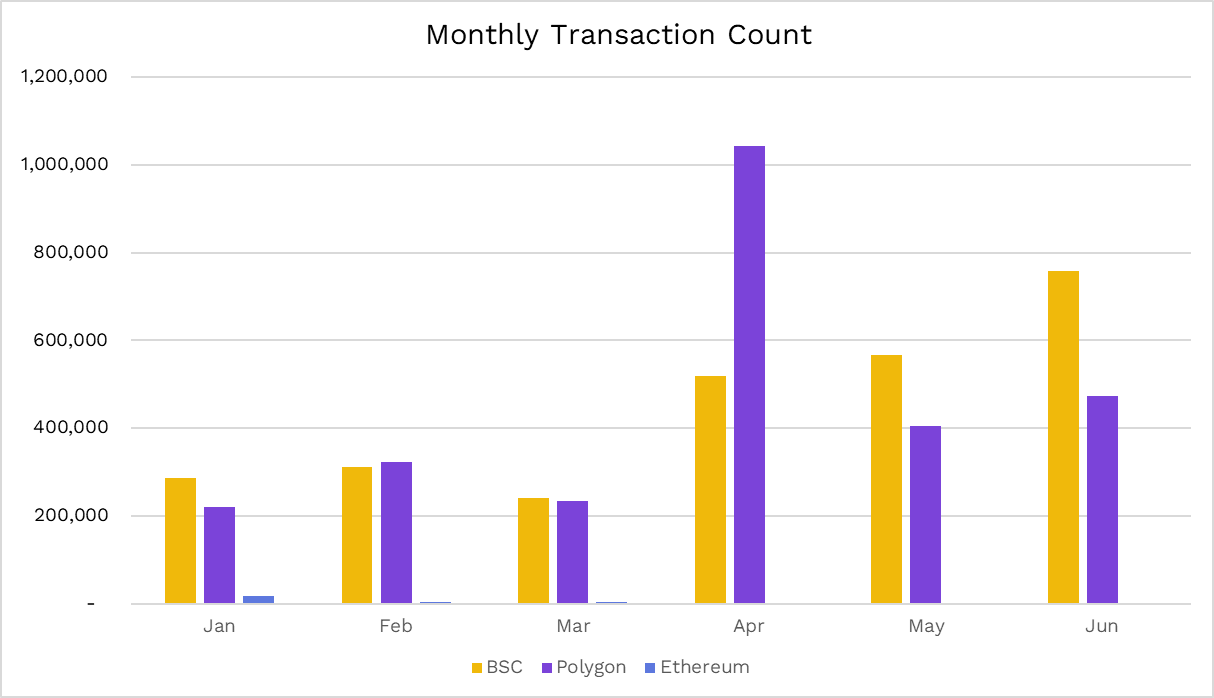

Transactions

Project Galaxy also has displayed healthy growth in user activity - they started the year with approximately 523k and now averages above 1 million monthly transactions.

We also noted that while Polygon has more unique users than BSC, BSC typically has more monthly transactions (except for February and April). From January, users had an average of 7.74 transactions on BSC vs 5.04 on Polygon - this means that users were more participative on BSC than on Polygon.

The higher number of transactions on BSC is important to Project Galaxy because they are launching their sidechain, GAL Chain, as a BNB Application Sidechain. More details on this are in the following segments.

$GAL Token Model

Utility

GAL is an essential component of Project Galaxy’s credential data network as it functions as the governance token, incentivizes user participation and is the primary payment token in the ecosystem. The utilities of GAL include:

While the token mechanism is not live yet, Galaxy intends to make GAL crucial to its data curation. Data curators will purchase and stake GAL tokens to reflect their conviction in the value of a credential data set. The stake, in turn, will be used to determine the share of the revenue generated by the data set in a pro-rata fashion. Each credential dataset will contain its own bonding curve.

For instance, let’s say there is a data set that contains a list of wallets that have interacted with a DeFi protocol in the past 30 days. Alice, a data curator, is able to verify this data and has high confidence that this data set is valid. As such, she purchases $10,000 worth of GAL and stakes it on the dataset’s bonding curve. Other curators have staked a total of $10,000 to signal for the validity of the dataset as well.

Over time, more projects query the dataset for various purposes, and over the course of a year pay ~$100,000 in aggregate fees to curators of the data set. This means Alice will earn 50% of the aggregate fees, or $50,000, over the year, assuming she maintains her stake.

Despite the obvious positive feedback loop (and the future intended additional sink for using GAL as a stake token for Galaxy’s own side chain), it is important to remember that complicated token models sometimes backfire. For example, oracle project Band Protocol has implemented a similar model for datasets token in 2019, but the team has since scrapped the idea due to its complexity and lack of uptake from users.

Token Inflation

Project Galaxy’s token, GAL, has a total supply of 200,000,000 tokens and had its token-generation event on 5th May 2022. According to Coingecko, GAL’s current circulating supply is at 35.2 million tokens or 17.5% of max supply.

Based on our calculations, 8.4 million GAL or 4.20% of the total GAL supply will be released every quarter post-token-generation event i.e August, November, February and May. GAL investors should be privy to the months that GAL will be unlocked as it may cause short-term price volatility.

$GAL Token Valuation

Disclaimer: The following segment does not constitute financial advice nor inducement to purchase any assets. Blockcrunch is not licensed to provide financial advice, and the following model is presented purely for educational purposes.

Since actual details of how much Galaxy would charge for its services are unknown and not live at this moment, any attempt at valuing GAL will introduce a high degree of false precision. Instead, we can try to ascertain a rough valuation framework by ascertaining a variety of scenarios.

Currently, the dollar value ascribed to an individual user’s data varies widely - with some sources estimating less than a dollar and others estimating $100 for a Facebook user. To put it in perspective, Meta generated $40.70 of revenue per user in 2021, while YouTube generated roughly $10.90 in revenue per user in the same fiscal year.

Given the nascency of the crypto market and the relatively unproven nature of Galaxy’s business model (all current datasets are query-able are free of charge currently), we can expect the average cost ascribed to a user to be lower than in Web 2 where advertising conversion is a proven business model.

In addition, we also expect the willingness to pay for data varies widely across different types of protocols. For instance, a lending protocol that targets whales may be willing to pay more for user-targeting data than a game that generally targets smaller account retails.

Below, we present an interactive model for $GAL tokens for our readers to test their multiple assumptions here. Under our liberal assumptions, we think it’s not unreasonable to see Galaxy generating ~$230M in annualized revenue from the current mix of DeFi dapps.

While we consider multiples-based valuation on limited comp set to be of low utility in cryptoassets as of today, for reference, the only public comp in the social vertical on Token Terminal ($ENS) holds a 18x P/S multiple as of the time of this writing.

Roadmap and Potential Catalysts

Launching GAL Chain

As mentioned above, Project Galaxy is launching its own GAL chain as a BNB Application Sidechain (BAS), powered by NodeReal’s Semita. Previously, Project Galaxy stored its credential data in 2 places - their own centralized database and across 7 different chains.

With GAL chain being the aggregated layer of credential data on a singular chain, developers can better query and leverage credential data. On top of the functional benefits, we think Project Galaxy starting its own chain (as a BAS) is a good decision that exemplifies the capabilities of Project Galaxy’s team. This is because:

BSC has shown to be the chain with the most transactions. Launching as a BAS means that there would be a lesser barrier of entry since users are already used to transacting on the BSC network

Running its own chain means that Project Galaxy could potentially control/adjust the gas fees according to network usage. In the future if on-chain activity returns and various stakeholders compete for blockspace, gas fees on other chains (especially Ethereum) could be expensive for projects or users to transact and deter participation. Being able to adjust gas prices or subsidize it via earnings would allow for more usage.

There’s minimal information released about GAL chain currently but we will be monitoring closely for its future developments.

Summary

Galaxy straddles DeFi and arguably one of the most nascent verticals - Web 3 social. While adoption across social protocols (e.g Peepeth, Bitclout), credit scores (e.g. ArcX) and credential systems (e.g. Civic) have been minimal, Galaxy has found a wedge into the market by focusing on immediately identifiable commercial goals - i.e. driving usage to specific protocols.

While we have reservations around the complexity of the dataset bonding curve model and the relatively unproven model of charging for open source (albeit curated) data, we remain optimistic on the team’s ability to execute.

Resources

If you’re a project/developer

Creating your own Galaxy Space (follow through to Step 5)

If you’re a user

General

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

solid