Maple Finance ($MPL) and the Future of DeFi

Is CeDeFi the Next Big Thing in Crypto?

This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a week!

They were considered geniuses of their time.

At the peak of their success, they were considered untouchable, and the riches they made led to much attention (and jealousy) from other investors in the space. But the market is a tempestuous mistress: it giveth and it taketh. When the tide rolled back, they were revealed for what they were: over-leveraged speculators who flew too close to the sun.

If you are a “crypto native”, you would be forgiven for thinking that the above is referring to Three Arrows Capital - the multi-billion dollar crypto hedge fund whose appetite for leverage led to bankruptcies and hundreds of millions lost from multiple lending desks, as well as a broader market implosion.

But those who remember the infamous LTCM saga will tell you it’s the same story, told over and over again in the history of financial markets: the story of greed, leverage and the systemic risks they cause in opaque markets.

Given the recent events, discussions are now surfacing about whether DeFi is the answer to an opaque credit market rife with moral hazard. The poster child for this discussion is Maple Finance: the largest under-collateralized lending protocol in DeFi facilitating institutional lending.

As a follow-up to our interview with Maple co-founder Sidney Powell (available on YouTube, Spotify and Apple), we will examine Maple Finance’s performance, market opportunity as well as the utility of $MPL, its native token below.

(As a disclaimer, Jason has a small exposure to $MPL from providing liquidity on the platform as a lender).

Contents:

Maple Finance Team

How Maple Works

Competitive Landscape

$MPL Tokenomics

Interactive $MPL Model

Risks to Maple Finance

Catalysts and Roadmap

Maple Finance’s value proposition is simple: it allows lenders to earn a fixed income by pooling capital via smart contracts, which is then borrowed by reputable crypto investment firms to at an under-collateralized manner.

In other words, Maple is a capital markets protocol for institutions. In theory, the model can be expanded to far more than just crypto investment firms, but any type of entity that requires leverage (e.g. miners, businesses etc.)!

Since going live in May of 2021, they have:

Facilitated over $1.6 billion in loans, currently denominated in ETH and USDC to institutions like Amber Group, Orthogonal Trading and Alameda Research

Helped depositors and crypto lending businesses earn $37 million in interest

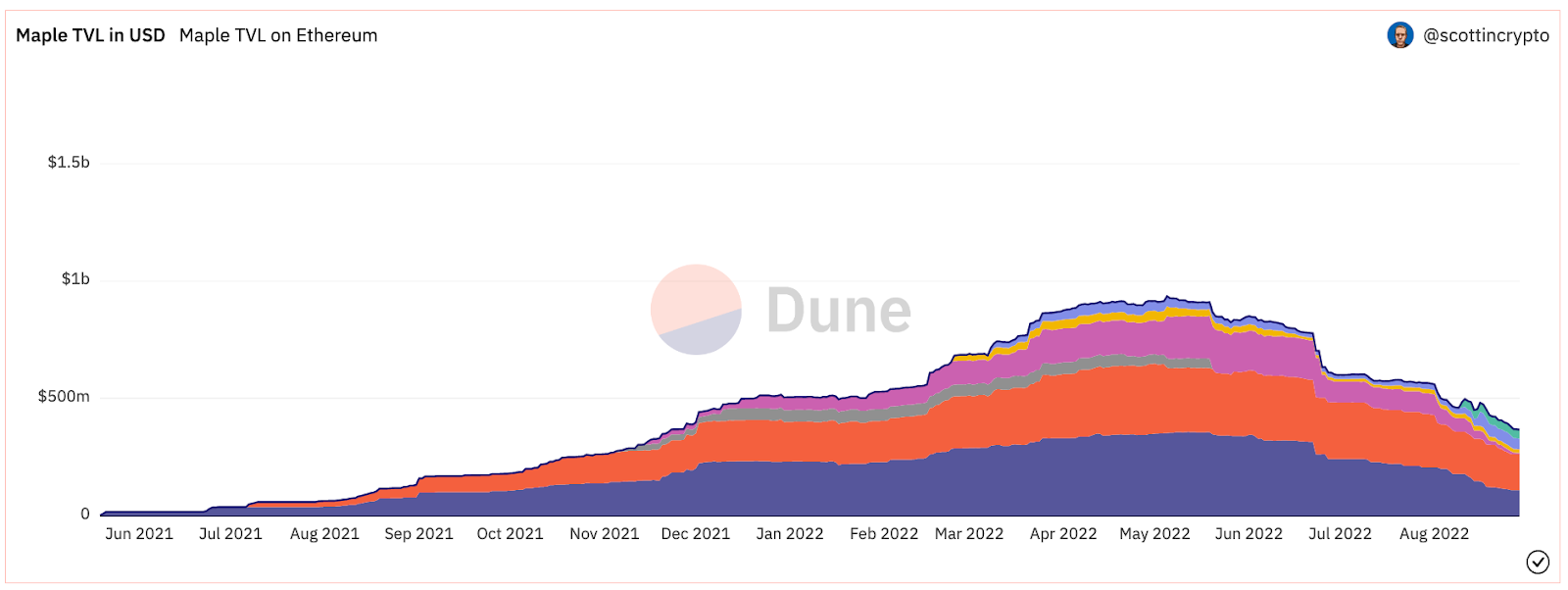

At its peak, Maple had over $1B in total deposits (including both Ethereum and Solana markets)

The Maple Team

Maple Finance was founded by co-founder and CEO Sidney Powell and co-founder Joe Flanagan in October 2020. Both co-founders have extensive experience in loans and corporate financing:

Before Maple, Sidney worked for 2 years as a Treasurer for Angle Finance, a non-bank asset finance company. He also worked as a Senior Associate specializing in the securitization of corporate and capital financing in the National Australia Bank for 3.5 years.

Joe served as the Managing Director for 3 year at Clover Advisory, a firm providing advisory services in capital management, accounting and growth strategies for retail consumers. He also served as the Chief Financial Officer for Axsesstoday, an Australian FinTech company specializing in financing small to medium enterprises for 2.5 years.

Today, the Maple team is 35 people strong with teammates hailing from Abra, Goldman Sachs, Ernst & Young and Kraken Exchange.

How Maple Works

Maple can be considered a “CeDeFi” protocol that leverages both onchain and offchain features.

Lenders deposit capital into smart contracts, which are managed by appointed pool managers who manage interest payouts, risk parameters, and loan utilization completely onchain. At the same time, pool managers conduct all risk assessment and credit underwriting on borrowers offchain and hence do not require any onchain credit-scores.

Like centralized lending desks, Maple offers under-collateralized loans, currently only available to institutional borrowers. The loans are also subjected to a credit assessor’s approval and therefore lack the fully permissionless nature of decentralized platforms like Compound and Aave.

However, like decentralized platforms, by managing all capital onchain, Maple offers more transparency than its centralized counterparts. This lowers the risk for systemic contagion should borrowers be at risk of being insolvent.

Below we understand how loans on Maple work by going through the stakeholders involved:

Borrowers

Borrowers first have to go through an application process with Maple before they are allowed to request loans. Approved borrowers can log into Maple’s web app and submit loan requests on-chain, with details such as loan amount, token borrowed, collateral and interest rates. The loans are then subjected to the approval of credit assessors known as Pool Delegates (more later).

Once a Pool Delegate agrees to undertake the loan and funds the loan contract with lenders’ capital, the loan is considered finalized. The borrower’s collateral is locked up in the loan contract and the borrower can now draw from the borrowed funds. There are 2 fees a borrower has to pay for the loans:

a one-time establishment fee on the loan amount (currently set at 0.99%)

ongoing interest paid as a fixed yield to lenders

Currently, borrowers are crypto-native asset managers, market makers, and exchanges such as Amber Group, Folkvang and Alameda Research.

Pool Delegates

Pool Delegates manage the lending pools (smart contracts that contain the liquidity deposited by lenders on Maple) and are the de facto credit accessors and risk underwriters of the platform.

Since lenders are not protected by the over-collateralized nature of most DeFi loans, Pool Delegates are responsible for conducting due diligence on behalf of the liquidity providers (lenders) and determining the creditworthiness of borrowers to minimize the risk of defaults.

Pool Delegates are required to put up an insurance fee - a minimum of $100,000 - that is used to pay lenders first in the event of loan default. An ingenious decision made by Maple is requiring that the fee be put up in the form of Balancer Position Tokens (BPT) - not just USDC, ETH or MPL.

In other words, Pool Delegates do the following:

Deposit both MPL and USDC into a liquidity pool on Balancer, thus providing exit liquidity for MPL sellers and entry liquidity for MPL buyers on balancer

Get issued BPT (a ERC20 representation of their MPL:USDC stake in the Balancer pool) automatically by Balancer

Stake the BPT on Maple’s insurance pool (also known as pool cover), which will be liquidated and used as first loss coverage should defaults occur

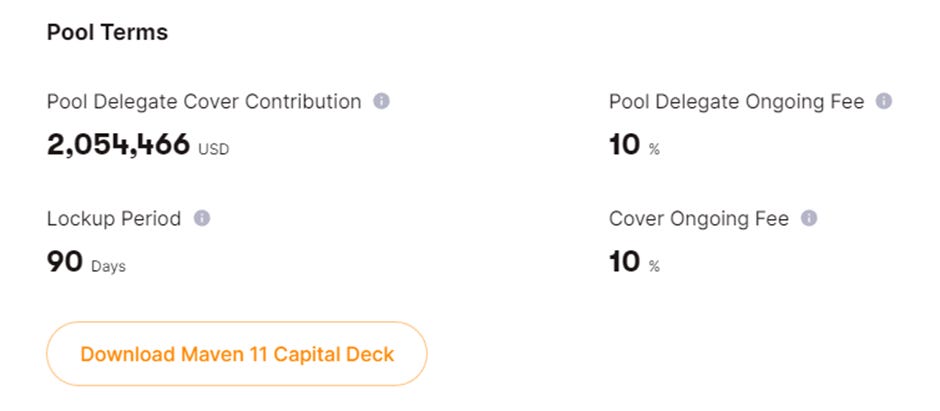

However, this will be done away with soon in a future update (more later). For their service, Pool Delegates are paid a third of the loan establishment fee (0.33% of the 0.99%), and a percentage of the interest yield paid out by the borrowers. For example, Maven 11 (a Pool Delegate on Maple) charges a 10% fee on the interest for managing the lending pool.

Pool Delegates are mostly crypto-native asset managers, market makers, and exchanges such as Maven 11, Orthogonal Trading and Alameda Research. Recently, Maple also onboarded Genesis, the largest cryptocurrency lending desk currently in crypto as well.

Lenders

Lenders are the users providing liquidity to the lending pool, and earn interest from the fees paid by the borrowers and any associated MPL lending rewards.

Compared to lending to centralized lending desks like Celsius and BlockFi, users enjoy higher flexibility and transparency. For example, they can select which pool they would to fund after considering the pool delegate’s strategy, fees involved, past and current loan performances.

Lenders currently earn 4% to 10% interest on their deposits (inclusive of inflationary MPL token rewards). Those looking for higher returns and are fine with undertaking greater risks can provide liquidity to the insurance pool as well by staking MPL:USDC Balancer Position Tokens. For taking on the first-loss risk, the pool cover providers earn 10% on the interest paid by borrowers on top of MPL rewards, which adds up to a higher yield than regular liquidity provision. For example, in the Orthogonal Trading – USDC01 pool, liquidity providers for the lending pool earn 8.51% APY while pool cover providers earn 18.6%.

If borrowers fail to make timely repayment, they are granted a 5-day grace period to make the payment or inform the Pool Delegate of any temporary cashflow issue. If they are unable to make payment within the grace period or come to a new arrangement, their collateral can be liquidated at the discretion of the Pool Delegate.

On top of the collateral loss, the defaulted borrower incurs hefty reputational damage since the default is recorded on-chain, and lenders may seek legal recourse from borrowers since they have entered a Master Loan Agreement during onboarding. Lenders are also entitled to compensation from the pool cover – the pool tokens will be redeemed for stablecoins and distributed to the Lending Pool to cover liquidity lost.

Competitive Landscape

While Maple Finance offers significantly higher transparency than centralized lending desks, its traction is still very much a fraction of incumbents like Genesis. In Q2 2022, Genesis did $40.4 billion in loan volume, whereas Maple did $414 million, which is only 1% of Genesis’ volume.

We believe the 1) existing institutional relationships between Genesis and its counterparties as well as 2) perceived higher risk of storing assets in smart contracts is likely the primary factor for weaker liquidity and, consequently, lower lending volume.

However, we would like to point out that Maple, as a loan facilitation platform, is the only project live today that has successfully captured meaningful loan volumes from the larger centralized lending desks. In addition, Genesis onboarding with Maple in June and lending out $75 million from its own balance sheet is also a promising sign for institutional acceptance.

For the purposes of our comparison, we will only look at CeDeFi (DeFi protocols with centralized credit origination processes) platforms live today: namely Clearpool, TrueFi and GoldFinch. Below we break down their main differences:

Amongst the decentralized under-collateralized lending protocols, Maple is the best performing one with the highest average loans originated per month, and most loans originated in the recent quarter. This is likely due to Maple’s extremely crypto-native go-to-market strategy, which consists primarily of onboarding institutions that are already familiar with interacting with cryptoassets. While Clearpool has a similar GTM strategy, Maple has a clear first-mover advantage, being the first to market and leading Clearpool by almost a year.

In addition, Maple offers lenders and borrowers an experience akin to centralized lending desks, wherein lenders’ liquidity are managed by a professional credit assessor which functions as a de facto counterparty.

On the other hand, there are no pool managers on ClearPool, and TrueFi is community-managed, which may be less familiar to lenders and borrowers alike.

GoldFinch is the least performant of all, with less than 10% of the loans originated than that of Maple, even though they had been live for the same duration. This is mostly due to:

While Goldfinch does attempt to target crypto-native firms on the lending side, the borrower side is primarily consisting of credit businesses targeting emerging markets, a notoriously difficult market to break into

The longer sales cycles and smaller per-borrower size for emerging market loans versus the institutional loans serviced by Maple

Extremely low liquidity on GFI (Goldfinch’s native token) makes earning token rewards less attractive than other platforms

The long lockup associated with loans on Goldfinch

To put in context how the above protocols are performing relative to how they are priced in the market by their native tokens, we present the following multiples table:

It is worth noting that while Maple’s token has a comparatively healthier circulating supply and better price performance, its value accrual is significantly weaker than its peers. On Maple, approximately 1% of fees paid by borrowers are earned by MPL token holders, whereas TrueFi and GoldFinch holders receive 10% of fees paid – a 9x difference.

Maple Tokenomics

Maple Finance’s token, MPL, is the utility and governance token of Maple Protocol . It is an ERC-20 token with a maximum supply of 10,000,000 and is distributed as an incentive for liquidity providers. Currently MPL is used as follows:

In May, Maple redesigned and increased the utility of the MPL token where holders can stake MPL and receive a representative token, xMPL. Holders of xMPL can use xMPL to:

Participate in governance

Provide pool cover and earn fees (currently set at 10% of interest yield + MPL rewards), instead of using Balancer Position Tokens

Receive share of loan establishment fee (currently set at 50% of the 0.66% annualized establishment fee)

Receive a rebate on their interest paid (if xMPL held is greater than a certain balance of their requested loan)

Currently, of the 7 million circulating supply of MPL tokens (out of 10 million), 2.75 million have been staked for xMPL (39.6% of circulating MPL tokens). Since staking went live, the percentage of xMPL staked remains relatively constant at 40%, despite the volatility in token price and increase in circulating supply from emissions.

MPL Token Model

Disclaimer: The following segment does not constitute financial advice nor inducement to purchase any assets. Blockcrunch is not licensed to provide financial advice, and the following model is presented purely for educational purposes and does not represent Blockcrunch’s investment view.

Value accrual to the MPL token is primarily via MPL buyback using a portion of Maple’s treasury revenue, which is its share of the loan establishment fee. Currently, the buyback is structured as follows:

50% of the Treasury Revenue

Treasury Revenue is 1/3 of the Loan Establishment Fee

Loan Establishment is an annualized fee of 0.99% on the loan amount

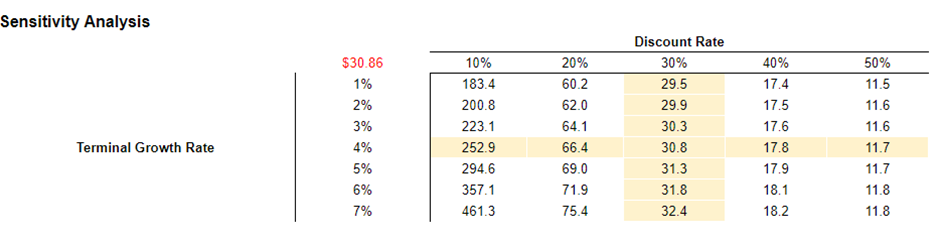

Essentially, value accrual to MPL token is a function of the volume of loans originated. We created an interactive model for $MPL tokens that our readers can tinker with under different assumptions here.

Our model is meant as a template for readers to make their own subjective assumptions concerning the growth of Maple’s underlying lending business, but it not intended to be reflective of our subjective view.

We include a sensitivity analysis table to arrive at a theoretical value captured by each MPL token under varying assumptions, but this is not meant to be a price target for MPL.

Risks

With the recent blow-up of centralized lending desks, more transparent counterparts like Maple stand to capture more market share as liquidity providers look for more transparency. In addition, as expected returns and variable yields continue to compress globally, Maple’s fixed yield opportunity may represent fruitful

However, we anticipate the following to be headwinds for Maple’s core lending business and token:

Credit contraction

Maple primarily serves crypto-native institutions where demand for loan volume is affected by market liquidity and volume. The uncertainty of the global markets, further exacerbated by the recent death spiral of LUNA and blow-up of 3AC has led to a noticeable deleveraging across the entire crypto sector. In June, crypto trading volume dropped to its lowest ever since December 2020. We are seeing signs of loans slowing down, as loan volume contracted by 35% from Q1 to Q2 on Maple this year as well.

One possible mitigant is the increased of investor cash positions as majority of funds derisk. Investors may choose to park some of the dry powder in fixed rate opportunities such as Maple. Perhaps coincidentally, Maple has remained relatively resilient throughout the challenging market conditions in Q2 this year as:

Maple’s Total Active Liquidity contracted by only 12% when the industry shrank by 67%

Number of lenders increased by 25%

41 new borrowers onboarded the platform

Liquidity Loss and Increased Volatility to MPL

As Maple intends to phase out its requirement for pool covers to utilize MPL:USDC Balancer Position Tokens, delegates and cover providers may opt for the easier alternative of staking MPL instead.

Currently, Balancer controls almost ~30% of MPL global volume, likely higher once wash trading on lower tier exchanges are factored out. On a marginal basis, the removal of the BPT requirement reduces liquidity in the MPL:USDC pool and as such may contribute to higher volatility.

Risk of regulation

Due to the recent blow-up of crypto lending desks like Celsius and BlockFi, which accepts deposits from investors, regulators may impose stricter requirements for one to be an eligible depositor.

For example, regulators may require liquidity providers to undergo KYC and AML checks or even qualify as accredited investors before they can provide liquidity for loans. We foresee these restrictions impeding the growth of Maple’s loan liquidity and, consequently, loan volume.

We note that these are industry-wide regulations and may not be enacted in the near future, nor be as big of an issue as Genesis is still the largest cryptocurrency lending desk with more than 100x the loan volume of Maple in 2021, despite it only accepting deposits greater than $2 million from customers with more than $10 million in asset value.

Competition from other decentralized undercollateralized loan platforms

Competitors are a huge risk because lenders, borrowers and pool managers are likely platform agnostic and utilize multiple platforms to diversify risk and extend reach. This is especially true if they offer similar value propositions.

Furthermore, Maple currently has a minimum lock-up period for lenders when other platforms do not. It also has a weaker value accrual mechanism to its token (lower fee split to token holders) than its peers. But we recognize that these are protocol-level settings that may be changed in the future.

Roadmap and Catalysts

The long-term goal for Maple is to establish Maple as the dominant institutional crypto-capital network by building a robust, intuitive, composable lending infrastructure. Below we note several important catalysts Maple has planned in their recent announcement.

Platform Focus

Maple will work on expanding its user base and use cases such as:

Extending borrower base to crypto miners and even other verticals such as FinTech and SaaS businesses

Integrations with 3rd-party applications such as exchanges, custodians and yield aggregators to increase accessibility

Enabling fiat deposits to allow institutions and users that do not want to interact with crypto to also participate on Maple’s platform as lenders or borrowers

Product Overhaul

Maple announced that it will overhaul its current smart contract infrastructure and launch Maple 2.0 which will correct its present flaws and enable scalability of the platform. Some notable changes include:

Increased flexibility in pool settings, which will allow broader range of pool strategies and borrower sets. They also mentioned changing the withdrawal mechanism (which we noted above as a risk) to enable shorter term liquidity options for lenders

Redesigning pool cover mechanism and allowing single-side deposits. This solves the current impermanent loss issue and incentivizes more deposits and decreases lenders’ risk in loan defaults; however, as noted above this may affect MPL liquidity

Interoperability with other platforms such as other DeFi protocols. The increased utility and unlocking of liquidity could incentivize more lending.

Building out Maple on Solana blockchain

In just 2 months of operations, Maple Solana managed to grow from 0 to $115 million loans originated. The goal is not to extend Maple Ethereum onto Solana, but rather to build a differentiated product with its own users and use-cases such as:

New pools catering to financing Solana infrastructure initiatives such as node operators, SaaS companies and startups

Open-term loans without a predefined end-date and possibly active collateral management features where new collateral can be posted or withdrawn while the loan is active

Its separate token called SYRUP so that it will not dilute MPL tokens while still accruing value to it

Summary

Maple Finance represents an exciting new vertical in DeFi that straddles both the trusted processes in CeFi and the transparency in DeFi.

Even if the lending market in crypto remain unchanged, we still a possible 10-50x (based on loan volume) market opportunity for Maple. Should Maple be able to extend to businesses beyond crypto lending desks, that should significantly increase their total addressable market.

Overall, the execution ability of Maple Finance’s team has been nothing short of impressive, and we applaud the team for making many sharp decisions on both product (e.g. requiring insurance cover to be staked in the form of BPT tokens to encourage MPL liquidity) and commercial (e.g. going after crypto-native capital first) fronts.

For the sake of objectivity, we also find the weaker value accrual to MPL token a challenge, as well as increasing competition a potential threat. Given the cyclicality of crypto markets, we also view Maple’s core business as being highly correlated with crypto and as such faces significant headwinds in the short to medium term.

Resources

Maple

Others

DISCLAIMER

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

Would be cool if you could trade your position as a lender like a bond; a secondary market that revolves around the lock-up period vis a vis default risk.

Hi Jason & Javier, hope you're well. Would be incredibly awesome if you could drop an updated MPL valuation model given new tokenomics. All good regardless -- Keep up the great work.