This research memo is for educational purposes only and not an inducement to invest in any asset. Subscribe to Blockcrunch VIP to receive in-depth project analysis, interactive token models and exclusive AMAs from our research team - all for the price of a coffee ☕ a day.

Elon Musk banning journalists on Twitter was not on our 2022 Bingo card (and trust me, we had a lot of weird stuff on there).

While Musk is not the first to silence his critics (Peter Thiel famously helped bankrupt popular lowbrow tech blog, Gawker), and the New York Times is not exactly known for its objectivity when it comes to big tech personalities, Musks’ antics did have people begin to ponder: should future social media platforms be controlled by its users, rather than one person?

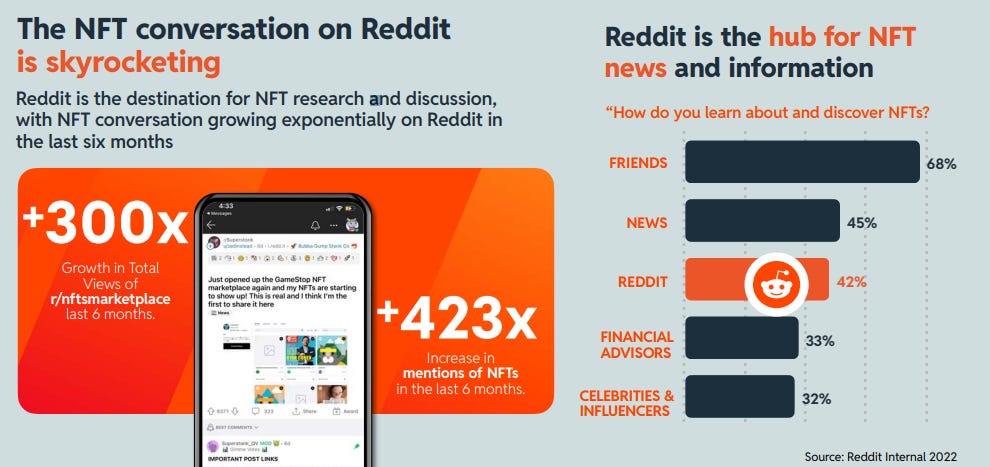

Recently, VCs have been buzzing about the potential for Web 3 social platforms (e.g. Lens Protocol) in disrupting Web 2 incumbents, and the latter are beginning to place bets in a technology that could one day displace their bottom line as well.

A few example of Big Tech dipping their toes into crypto:

Twitter launched an official verification mechanism for NFT profile pictures and allowed users to buy and sell NFTs through tweets in January

Meta allowed users on Facebook and Instagram to create, sell and post NFTs on the Ethereum and Solana blockchain in May

Snapchat allowed users to sell and use NFTs as Augmented Reality filters in July

Amongst the popular social platforms, Reddit is the furthest along in blockchain adoption and recently made headlines as their recent NFT launch managed to onboard more than 3 million users and did over $10 million in secondary sales volume.

To put this in context, that was 62% of Polygon NFT trading volume on Opensea for October!

Unbeknownst to many, Reddit actually has had a crypto strategy dating back to 2020, with multiple developments that are often overlooked by crypto natives. As one of the world’s most prominent social sites, Reddit’s strategy to crypto may inform what other companies may pursue, and bear important lessons for those bullish on the emerging “Web 3 Social” narrative.

In this article, we go through:

Reddit’s blockchain strategy: NFTs, social tokens and a digital wallet

Assessing the success of Reddit’s crypto strategy

Social media platforms’ approach to crypto and why it matters

Relevant verticals and projects

Subreddits Are Proto-DAOs

If you break Reddit down into its core functions, it shares more in common with DAOs than with entrenched social networks like Facebook/ Twitter.

Reddit is a network of communities where people can dive into different interests and hobbies. In the different communities known as subreddits, members post and share content, interact with comments, and socially curate the posts via voting. Their history of engagement on various forums is public, and users accrue “Karma” and “Community Points” for their participation.

To put it in more obvious terms, Reddit is made up of: self-organizing digital communities that are mostly pseudonymous, aligned in interests, governed by votes, and whose members have a publicly viewable history of engagement and credentials.

All that’s missing is a token, and you got yourselves a DAO.

Like DAOs, subreddits span a wide variety of topics; unlike DAOs, they already have a material impact beyond their niche communities. Even non-Redditors have likely heard of the infamous subreddit known as WallStreeBets, which was used to coordinate the short squeeze on GameStop’s stock that sent it flying 1700% back in early 2021. Subreddits span from asking for advice to jokes and horror stories - there are more than 2.8 million subreddits, and there’s likely a subreddit for whatever topic you’re thinking of.

Today, Reddit has more than 1.5 billion registered users, hosts 50 million daily active users, and is the world’s 15th most popular social media site.

So what does a behemoth like Reddit need from crypto - where the daily active users for the entire industry barely stands up to Reddit’s?

Reddit’s Crypto Strategy

Like most social sites, Reddit’s primary business model, which brings in $350M a year, revolves mostly around advertising. Unlike other social sites, however, most of your interactions on Reddit are likely with strangers who happen to share the same interests.

Crypto, by injecting shared financial interests directly into communities, fills the hole otherwise filled by familiarity on social sites where “real” friends and acquaintances dominate your social graph.

Throughout the past few years, Reddit has been quietly experimenting with ways to do just this.

Most might have only heard of Reddit’s NFTs - which they deemed “Collectible Avatars” - because of their recent media spotlight. Unbeknownst to many, Reddit’s roots in crypto actually date back to May 2020 with the launch of their own digital wallet! Reddit has even launched its first NFT collection on Ethereum in July 2021 to not much fanfare, before its much more recent and successful sequel.

Today, Reddit’s broader crypto strategy revolves around three main offerings:

NFT collections, with enhanced interactivity

Social tokens native to subreddits, called Community Points

An EVM-compatible, non-custodial digital wallet, called Vault

Below, we’ll cover each of them and how they are used to increase engagement for Reddit.

Reddit’s “Not NFTs” NFT Strategy

Reddit’s official foray into NFTs began with the NFT collection, CryptoSnoos in 2021.

The CryptoSnoos collection consisted of only 4 1/1 NFTs of Reddit’s mascot and was individually auctioned off to the highest payer, with the highest being sold for 175 ETH, or $398k then (note that this predates the NFT mania of 2021. A Bored Ape Yacht Club, which trades at 69ETH even in the current market, only fetched an average of 4 ETH then!)

Following its first NFT launch, Reddit didn’t capitalize on the eight-month NFT craze from August 2021 to April 2022 but instead studied the dos and don’ts when launching an NFT collection. They packaged their findings and released a 42-page report titled “The ABCs of NFTs” in June 2022. Many of their key insights would lead to astute business decisions later when they launched their new NFT collection in July 2022.

In mid-2022, Reddit finally collaborated with 29 creators to launch collections with varying supplies and made several improvements to their first NFT outing in line with their findings. These insights are:

NFTs have a PR problem: noting the mainstream aversion to NFTs (based on their speculative connotation and tenuous ties to climate change), Reddit rebranded NFTs as Collectibles Avatars backed by the blockchain. This was a simple trick that seemed to have changed the perception of Reddit’s NFTs completely amongst retails

Retail users don’t like high gas fees: Reddit launched on Polygon rather than Ethereum as Polygon offers lower gas fees, while tapping into the large contingent of EVM-native wallet users (Metamask boasts 21M MAU, whereas Solana’s non-EVM compatible wallet Phantom has 3M) who can quickly trade the NFTs on marketplaces such as Opensea

Mainstream retails don’t like to handle wallet keys: Reddit created its own EVM-compatible digital wallet called Vault, rather than requiring users to create an external non-custodial wallet like Metamask on their own (more on this in a later segment). Note that users can still buy/sell Reddits’ NFTs with Metamask on Opensea

Not everyone who wants NFTs wants crypto: Perhaps borrowing from NBA TopShot, which was widely speculated on by non-crypto natives, Reddit allowed its users to purchase collectibles with fiat via credit card (just like other online or in-game purchases) rather than cryptocurrency. Collectibles ranged from $9.99 to $99.99

Forgoing (some of) Web 2’s predatory take rates: While it is unusual for a Web 2 platform to forgo a high take rate, Reddit allowed its creators keep all of the revenue from primary sales (less payment processing and minting fee) and earn 50% of the 5% royalty fee on secondary sales in order to encourage creator uptake

Reddit also put significant thought into differentiating its collections with your typical NFT profile picture collection. Instead of having their own unique design, a Collectible may have the same exact same design as another Collectible, and is differentiated only by its serial number. That’s because instead of being assigned static JPEGs to use, users may mix and match the different traits from their Collectibles owned to form their unique profile picture.

Despite its retail-friendly and utility-enhanced approach, as the launch took place after the Terra collapse, collections reportedly took weeks to sell out. Reddit’s insightful go-to-market, however, would pay off in its second collection (its third outing in NFTs since CryptoSnoos), which launched in Q4 of 2022.

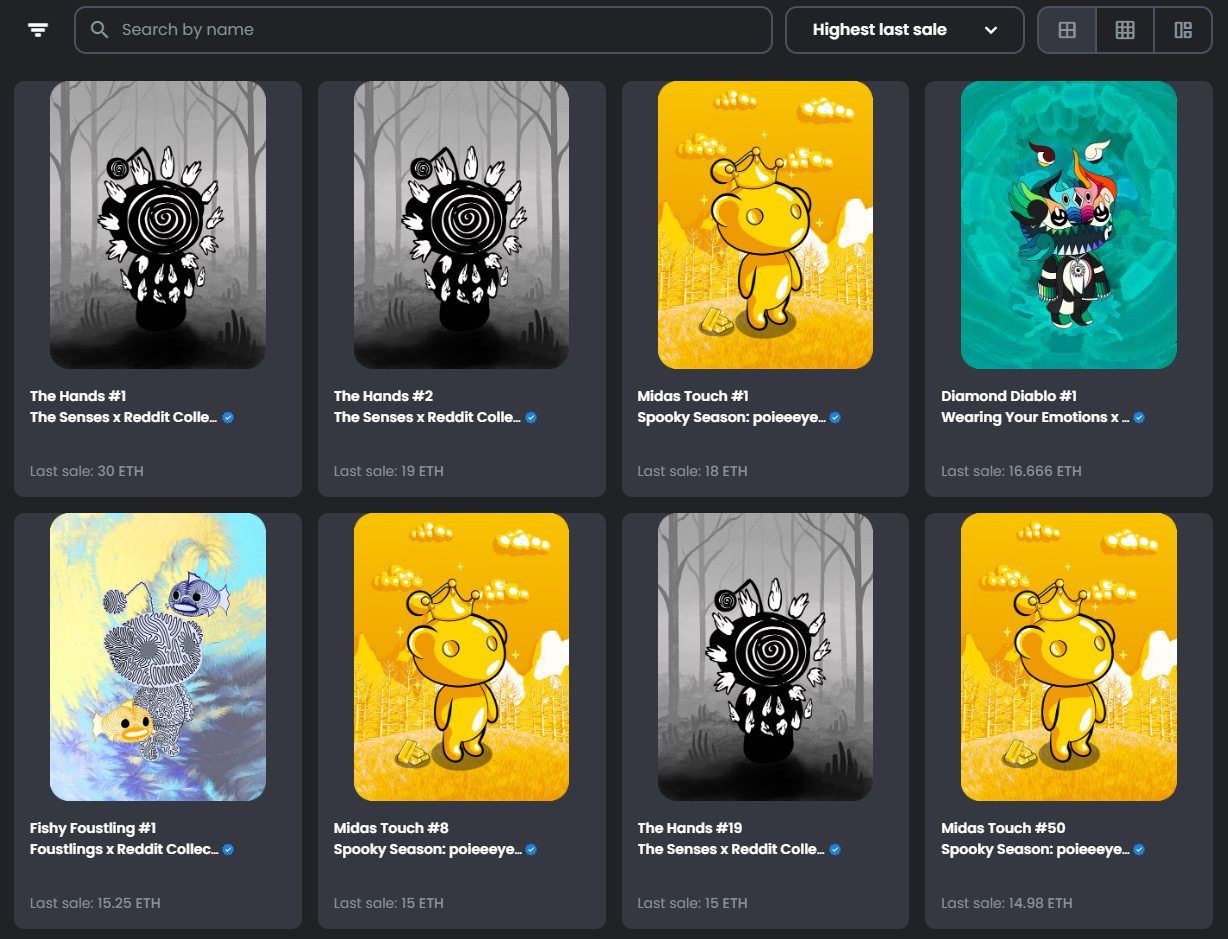

Launched in time for Halloween, the second generation of Collectible Avatars launched on 21st October and sold out in less than 24 hours. The launch of the 2nd generation kickstarted an influx of demand for Collectible Avatars from both generations and made a few headlines:

One of The Hands, which the artist sold for $74.99, was resold for 30 ETH or approximately $45k – a 600x increase

Collectible Avatars accounted for 72% of OpenSea’s trading volume on Polygon over the 2 week period since the launch

Another headline that roused the attention of many NFT collectors (and presumably caused the short-term FOMO) was that 3 million Reddit users created Vaults (Reddit’s native crypto wallet) to purchase the Collectible Avatars. However, the majority of the wallets were created to claim the free Collectible Avatars that Reddit gave away during August to eligible Redditors that contributed to their communities. There are approximately 2.863 million free Collectible Avatars given away, representing 98% of the total Collectible Avatar holders - i.e. only 2% or 33k users created a Vault/bought a Collectible Avatar without receiving a free one.

Despite organic penetration being relatively lower than what the general public may perceive, Reddit made two key decisions that contributed to its modest success, namely:

Rebrand its collectibles to distance itself from NFTs, which its core non-crypto native user group may find less appealing;

seamlessly integrate an easy-to-setup wallet (Vault) while maintaining EVM compatibility to tap into existing NFT infrastructure (e.g. OpenSea)

Community Points: the OG Social Tokens

Beyond Collectible Avatars, Reddit has its own version of social tokens known as Community Points, which was mostly overlooked by the broader crypto community. In fact, Reddit’s Community Points was launched on Ethereum as early as May 2020 – even earlier than the famed DeFi summer.

Due to scalability issues, Community Points were launched on Rinkeby testnet but have since migrated to mainnet on Arbitrum Nova, a Layer 2 roll-up powered by the same developers of Arbitrum on 9th August 2022.

Each subreddit (sub-communities) will have its own version of Community Points, which are distributed monthly to reward users for their activity and contributions to that particular subreddit. Similar to Collectible Avatars, Community Points are stored in users’ Vaults. Apart from signalling one’s contribution and reputation, users can use the points to unlock features like Special Memberships, which allow for special emotes and custom flair for their usernames, vote in weighted polls (like with DAOs), tip other Redditors, or reward creators and developers for their work in that subreddit.

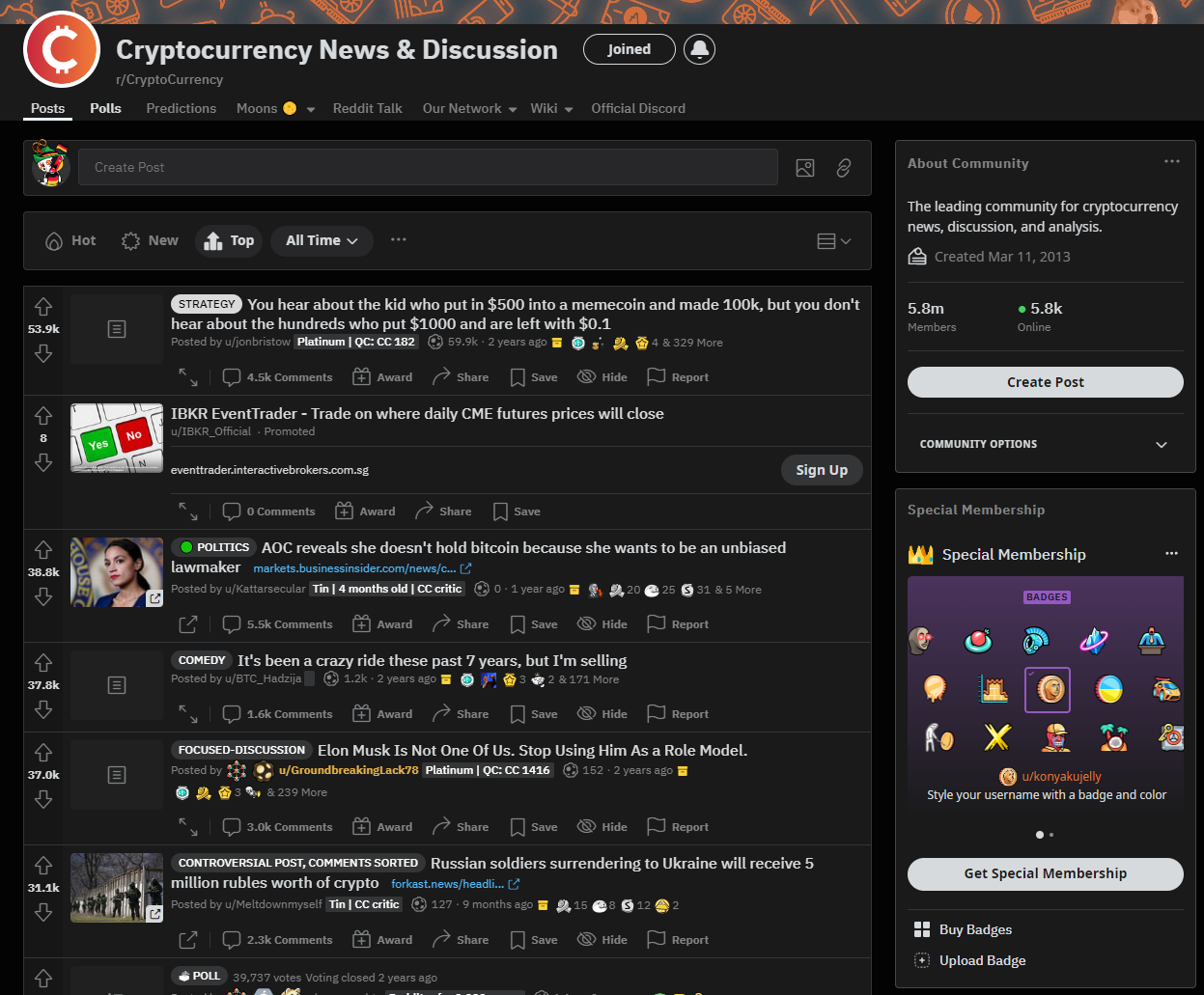

An example of Community Points is Moons, which belongs to the subreddit CryptoCurrency. Moons launched on May 2020 with an initial supply of 50 million and are distributed monthly with a predetermined schedule that decreases by 2.5% monthly, starting with 5 million Moons. Since then, there have been approximately 106 million Moons in circulation, with close to 183,000 holders representing only 3.2% of the total number of members in the CryptoCurrency subreddit.

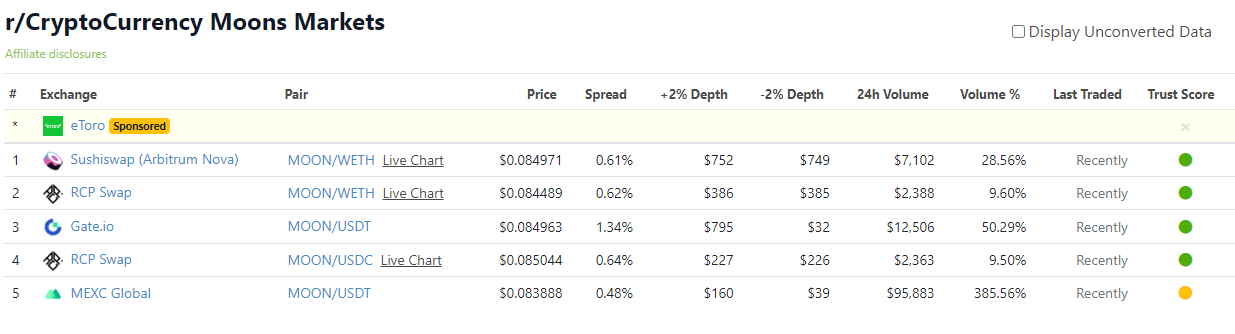

Each Moon is currently trading at $0.10 (as of 7th Nov), which implies a market cap of $10.6 million. As an ERC-20 token on Arbitrum Nova, Community Points and Moons are decentralized tokens, and not owned nor controlled by Reddit. Moons are available for trading on Sushiswap (on Arbitrum Nova), a community-built DEX called RCPSwap and even on centralized exchanges like MEXC and Gate.io.

The ability to sell Moons presents an interesting opportunity for Redditors – not only can Moons be used for social signaling on Reddit, users can be rewarded financially in the real world if they choose to sell their Moons earned

According to CCMoons, a community-built site that tracks all things Moons, the largest Moon holder nanooverbtc holds 1.26 million Moons that is worth $126,000 at current prices. Further research shows that nanooverbtc is a moderator of the CryptoCurrency subreddit. Assuming that they have been a moderator since Moon’s inception (or about 30 months ago), this translates to $4,200 income per month for moderating the subreddit!

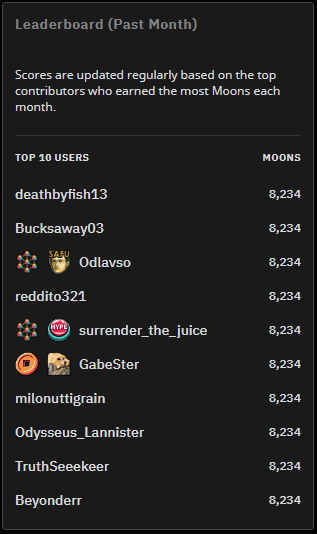

Also, the top earners of October’s distribution each earned 8,234 Moons, which is approximately $823 if they were to sell all of it – imagine you could make $800 for posting threads (or memes) on Twitter.

On the other hand, there also have been criticisms that such reward mechanisms have the adverse impact of diluting content quality as users are also incentivized to post more in quantity to “farm” for such rewards.

Beyond use on Reddit, Reddit also has bigger plans for Community Points. Since these points are ERC-20 tokens on a public blockchain, reputation (represented by tokens) becomes portable and composable. Users can display their reputation anywhere on the Internet, on and off of Reddit. For example, communities can add bots to show balances in the chat apps they use, and external forums can restrict access to users who have earned a minimum number of Points across Reddit communities.

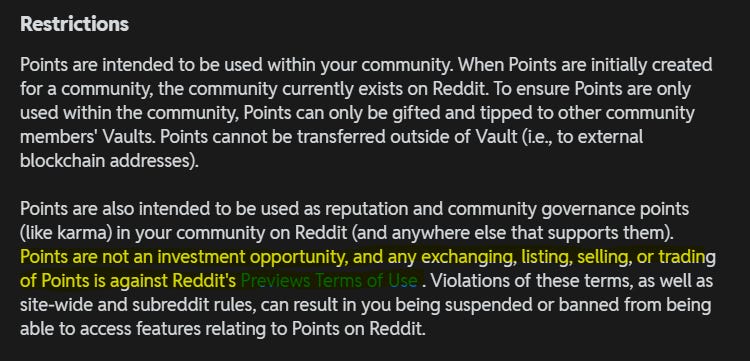

However, using these points as a sign of reputation and being able to buy them results in a conundrum – how would users know who rightfully earned their reputation? Reddit likely recognizes this as an issue, which is why their terms and conditions prohibit the selling or trading of Community Points.

A community proposal by the CryptoCurrency subreddit 7 months ago further clarifies the rules for trading Moons. In order to incentivize holding and disincentivize selling, the community decided that:

At each monthly snapshot, users with at least 75% of their earned Moons in their Vaults will not be penalized. Those that fall below the threshold will earn a reduced rate of Moons

The community implemented the 75% threshold such that tipping is not discouraged. But this also opens up the possibility of selling up to 25% of your Moons.

While you can buy Moons and have a higher perceived reputation in the community, only Moons earned and still in the user’s vault count towards governance votes. This is to prevent whales from manipulating community proposals by buying Moons

These rules apply to CryptoCurrency’s Moons, and other subreddits may have different laws concerning trading their Community Points. While users are still actively selling their Moons, it is unclear if Reddit will eventually intervene with users selling Moons e.g blacklisting their Vaults.

Admittedly, the concept of earning points for contributing is not new, and community reputation systems and governing can be done without using blockchains. However, the breakthrough here is the composability of reputation unlocked by the blockchain, allowing for exciting use cases such as interoperability between different platforms.

This represents a paradigm shift, wherein users own their digital identity represented by data instead of silo-ed companies owning user data causing fragmentation in a user’s digital identity.

Reddit’s Vault Wallet

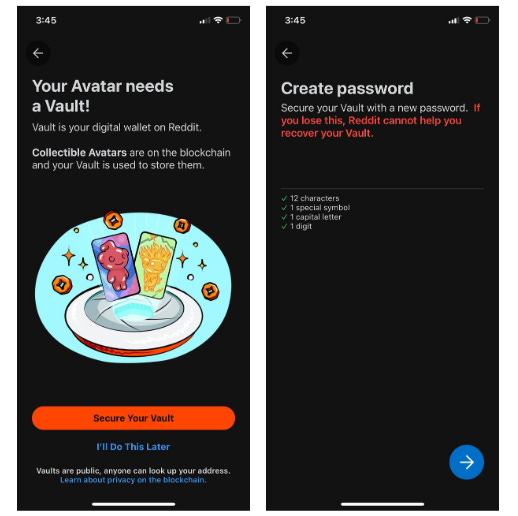

Vault is Reddit’s non-custodial, unhosted wallet available since May 2020. Vault allows users to self-custody their digital goods on Ethereum-compatible blockchains and, in Reddit’s case, used to hold Collectible Avatars and Community Points they’ve earned. To date, over 3 million Vaults have been created, which is more than the number of registered users on OpenSea.

While the Vault functions largely like any other non-custodial wallet on Ethereum, the critical difference is how Reddit minimized the frictions and made interacting with the blockchain simple for non-crypto native users.

First, the guided Vault creation process. Instead of requiring users to create and be familiar with Metamask or equivalent beforehand, Reddit guides its users through the wallet creation process in their mobile application. To create a Vault, users only had to set up a Vault password – a single-step process that takes less than 20 seconds to begin interacting with the blockchain.

Secondly, the possibility of wallet recovery using the Vault password. Typically, the responsibility of safekeeping the seed phrases falls on the users, and if the user loses their seed phrases, they lose their assets permanently with no recovery options. For the non-crypto native, the possibility of total asset loss is likely a considerable barrier to entry because they are used to multiple recovery options that Web 2 sites offer (email, mobile phone, secret questions). Reddit removes this barrier and allows users to recover a lost Vault by storing an encrypted version of the private keys on the Reddit servers, which the users can decrypt using their unique Vault password and recover their Vault. Those more crypto-native may also opt to safe-keep the 12-word seed phrase themselves to recover their Vaults.

Thirdly, ease of interacting with blockchains. When interacting with different Ethereum-compatible blockchains, users are typically required to switch between networks. With Vaults, however, users need not bother themselves with switching networks despite Collectible Avatars being on Polygon and Community Points being on Arbitrum Nova. Reddit packages the blockchain interactions as if they are just another regular function on Reddit and abstracts the blockchain aspects from the front end – users need not know they are interacting with the blockchain.

Furthermore, users need not fuss about gas costs since Reddit even covers the gas required to redeem Collectible Avatars and spend Community Points. However, there are 2 scenarios where users will need some level of crypto-nativity. As Reddit does not cover the gas costs for gifting Community Points, users must load their Vaults with ETH when tipping other users. This will require them to send ETH (on Arbitrum Nova) to their Vault address or have an account with FTX to purchase ETH through the in-app process (an alternative exchange is likely to take over post-FTX’s blowup). Secondly, as Reddit does not have a secondary marketplace for its Collectible Avatars, users who wish to trade their Collectibles would have to use OpenSea. Interacting with OpenSea requires them to either port over their Vault account to Metamask (or equivalent) or purchase the Collectible Avatar with a non-Vault wallet and send the Collectible to their Vault address (so that they can use the avatar on Reddit).

Towards Mainstream Adoption

Admittedly, most of the blockchain features on Web 2 social platforms are still considered experimental. Even Reddit, who’s the furthest in blockchain adoption, has only managed to onboard a relatively small group of users. As of 10th November, there are approximately 3 million Reddit users with a Vault, representing only 6% of Reddit’s 50 million daily active users and 0.70% of the 430 million monthly active users.

However, the bigger picture to note here is that these social media giants adopting blockchain are an opportunity to onboard 4 billion social media users who are non-crypto native into the world of blockchain - which is more than 10x the number of blockchain users from where we are now.

Reddit’s strategy to seamlessly onboard its users onto the blockchain is definitely one for the books. Specifically, its strategy to camouflage blockchain elements by 1. renaming NFTs to digital collectibles backed by the blockchain, 2. allowing only fiat purchases instead of cryptocurrency payment, 3. making wallet creation similar to regular account creation (guided process + possibility of social recovery).

While some aspects of Reddit’s crypto strategy are still not fully congruent with crypto’s cypherpunk vision (e.g. Vault wallets, while non-custodial, are not trustless as keys are encrypted and stored on Reddit’s servers), it represents an exciting first step on Web 2’s push towards Web 3.

Appendix: Relevant Consumer Verticals to Watch Out For

Account Abstraction and Smart Contract Wallets

When users lose their password or access to a Web 2 account, there are likely no repercussions apart from mild inconvenience as they can simply go through the self-guided recovery process or even contact customer support for help. In fact, users are hugely reliant on password recovery - a study in 2019 found that 78% of the respondents required a password reset within the last 90 days.

Conversely, the loss of private keys or seed phrases when managing cryptocurrencies is extremely unforgiving as the loss of private keys or seed phrases results in the TOTAL LOSS of one’s assets with no chance of recovery. The unforgiving nature is likely a deterrent for non-crypto natives to step into the world of blockchain.

To achieve worldwide blockchain adoption, social recovery has to be made available for users as it would make self-custody of cryptocurrency assets less daunting - Vitalik wrote an article on why we need wide adoption of social recovery wallets back in 2021 and recently echoed this sentiment again on Twitter.

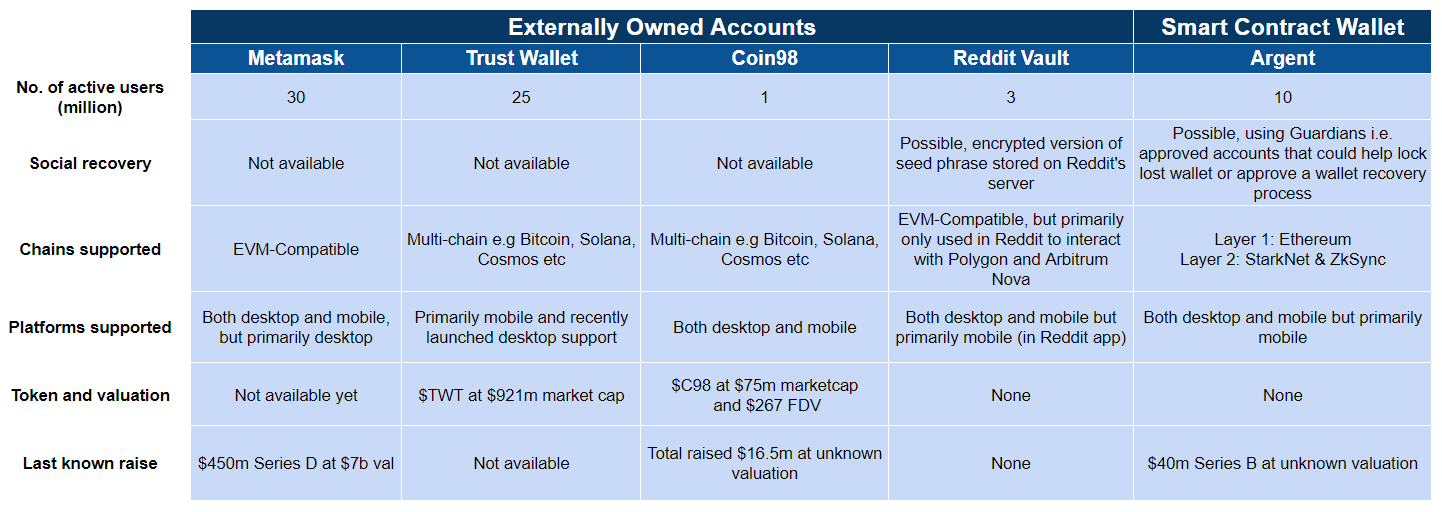

Most of the wallet platforms today focus more on scaling (acquiring more users via mobile or multi-chain support) and do not provide social recovery for their users. This is because most of the wallets today are Externally Owned Accounts. While basic recovery of encrypted private keys is possible (like Reddit’s Vault), this is not secure enough. Secure on-chain social recovery is difficult with EOAs since they do not allow programmable logic to be coded to the account, and there is a tight coupling between private keys and the account.

On the other hand, smart contract wallets, which decouple private keys and the account and also allow programmable logic such as on-chain social recovery, provides an interesting alternative. For example, when a user loses their private key, they could whitelist trusted wallets (perhaps of a family member) to help approve a transaction that replaces the lost private key with a newly generated one - adding whitelisted wallets to the account on a smart contract level and replacing private key are both impossible with EOAs.

Lately, developments in Account Abstraction, the forefront of wallet technology, promises additional features that smart contract wallets supports - namely social recovery, multi-signature security, rate-limiting, whitelisting of addresses, gasless meta-transactions etc. - without the need to incur fluctuating gas price. A good summary of the latest EIPs targeting Account Abstractions can be found here.

In sum, smart contract wallets make owning cryptocurrency more accessible for users. The most developed and popular smart contract wallet on Ethereum right now is Argent, which is primarily mobile-based, and some other efforts in this space include Soul Wallet, UniPass and StackUp, with likely many more on the way as Account Abstraction matures.

Blockchain Security

Over $4 billion of assets have been lost to hackers over the past 2 years - this further accentuates crypto’s stigma of being the wild wild west which does not help with onboarding users into the space.

It is imperative that the crypto space becomes safer for users, namely by preventing loss of assets through 1. security breaches and loss of private keys, 2. smart-contract bugs and exploits and 3. signing fraudulent transactions

Smart-contract bugs and exploits have been a significant issue in Web 3, with the bulk of lost user assets being lost in this manner - $3.6 billion has been lost to vulnerabilities on cross-chain bridges, DeFi lending hacks and decentralized exchange exploits over the past 2 years. Such hacks make it difficult to convince users to adopt decentralized alternatives over centralized ones since the decentralized and open-sourced nature is what makes them more vulnerable in the first place.

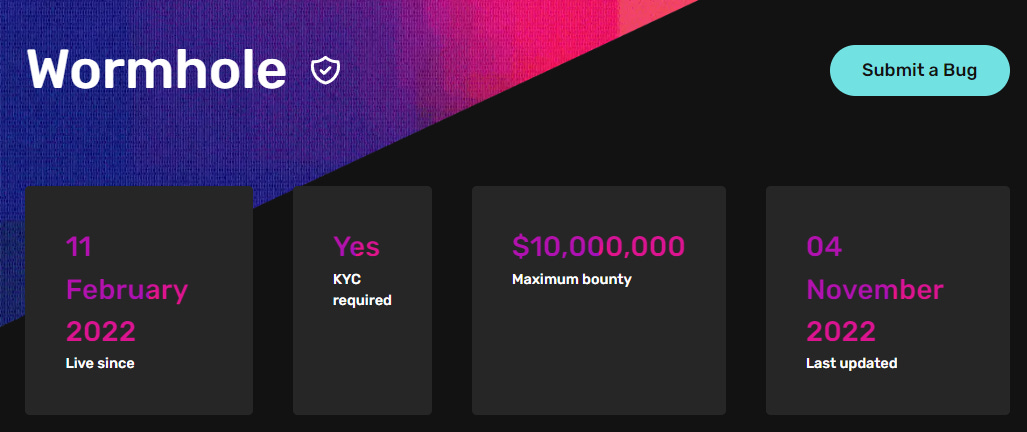

Given that such hacks are non-reversible and funds are typically non-recoverable, smart contract bugs and exploits can’t be tolerated and smart contracts must be secure for use once on the mainnet. Apart from security audit companies like Certik, there are other projects that help ensure the security of smart contracts.

ImmuneFi is a bug bounty and security services platform where blockchain projects can employ white hat hackers to help review their smart contracts - so far, they have paid out $62 million in bounties and averted more than $25 billion in hack damage.

PwnedNoMore is a white hat hackers’ DAO (disclaimer: Jason is an angel investor) that seeks to improve the efficiency and scalability of smart contract audits. They developed an automated bug-hunting engine that seamlessly integrates into projects’ development process and automatically searches for potential vulnerabilities in their codebase and dependencies. To date, they protected more than $650 million in funds at risk and reported 17 critical bugs on the Ethereum Network.

Lastly, while the above 2 security measures prevent involuntary loss of assets, they do not prevent loss of assets through “voluntary” signing of fraudulent transactions. Notable examples of this include the collective loss of 150 Bored Ape Yacht Club NFTs worth approximately $14 million through fraudulent links and when $500k was lost when Curve’s front-end was hacked. Various projects are working on preventing the loss of assets in this manner.

For example, Fire claims that 98% of Web 3 users do not read and can’t recognize malicious smart contracts. Therefore, Fire built a free web extension that simulates transactions before users sign in with their wallets to help them understand the effects of the contracts they are interacting with, which prevents users from signing away assets to bad actors. Other examples working on similar features include Stelo Labs

What if the transaction has already been sent? Well, there is still hope for recourse as long as the transaction has not been confirmed on the blockchain. Harpie is an on-chain firewall that allows users to create a trusted network of applications and addresses for their wallets and monitors the user’s pending transactions for potential attacks. If Harpie identifies malicious transactions i.e. transactions outside of the user’s trusted network, Harpie frontruns the transaction by transferring the user’s assets to a safe vault. Harpie’s prevention of asset transfer to malicious actors is similar to smart contract wallet capabilities, except that it works with EOAs and is more convenient to use.

How about not using the wallet with important assets to interact with the blockchain altogether? Sismo (disclaimer: Jason is an angel investor) allows users to mint representative NFTs known as zero-knowledge badges, which users can use to prove their ownership of assets (e.g NFTs) or reputation (e.g top ETH participant) even with a secondary wallet. Users can still access token-gated services such as merchandize drops or Discord channels without connecting their primary wallet, thus keeping it safe.

Resources

Collectible Avatars: Info, Performance, Collection Data

Community Points: Info, r/CryptoCurrency’s Moons and Moon’s data

Vaults: Info

Interesting projects

Wallets: Argent, Soul Wallet, UniPass and StackUp

Preventing signing of fraudulent transactions: Fire, Stelo Labs and Harpie

Minting of zero-knowledge badges: Sismo

Physical-backed tokens: Info

Others

Disclaimer

The Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to. Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

thank you